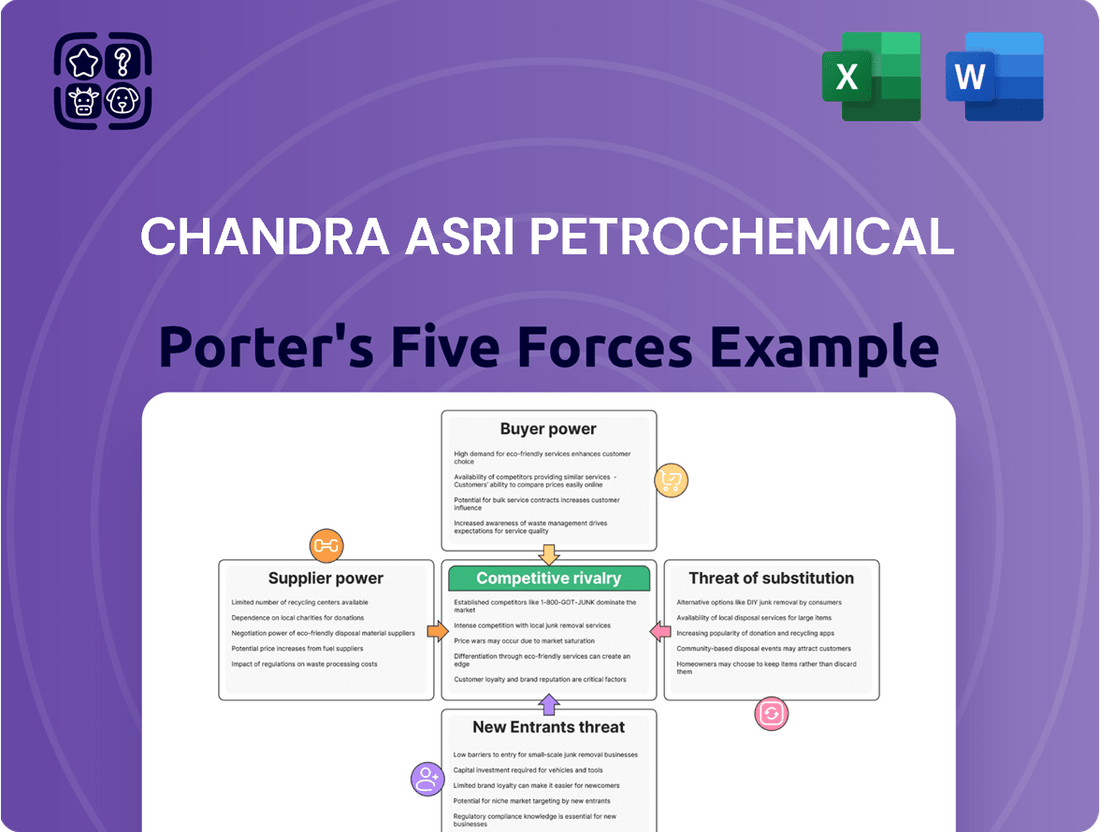

Chandra Asri Petrochemical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chandra Asri Petrochemical Bundle

Chandra Asri Petrochemical navigates a complex landscape shaped by intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding the influence of powerful suppliers and the barriers to entry for new players is crucial for their sustained success. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Chandra Asri Petrochemical’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts Chandra Asri Petrochemical's bargaining power. The availability and cost of key feedstocks, such as naphtha, are heavily influenced by the number of suppliers in the market. If a few dominant suppliers control these essential raw materials, they can exert considerable leverage over Chandra Asri by dictating prices and terms.

Chandra Asri's reliance on international markets for its naphtha supply means global supply and demand dynamics play a crucial role. In 2024, the price of naphtha, a primary feedstock for petrochemicals, saw volatility due to geopolitical tensions and refinery operational adjustments in major producing regions. This global market structure can empower suppliers, especially during periods of tight supply, allowing them to command higher prices.

The company actively works to reduce supplier power through strategic sourcing. For instance, Chandra Asri has established long-term feedstock supply agreements. These partnerships aim to ensure a stable and predictable flow of raw materials, thereby diminishing the immediate bargaining advantage of individual suppliers by creating more secure and potentially cost-effective supply chains.

Chandra Asri Petrochemical faces substantial switching costs when changing raw material suppliers, a key factor in supplier bargaining power. The highly specialized nature of petrochemical production necessitates specific grades of feedstocks, meaning a shift requires significant technical recalibration and potential production line modifications.

These technical hurdles translate into considerable expense and operational disruption. For instance, adapting to a new supplier's slightly different feedstock composition could involve weeks of re-calibration, impacting output quality and volume. This complexity inherently strengthens the position of existing, reliable suppliers who can consistently meet Chandra Asri's stringent requirements.

In 2024, the global petrochemical industry experienced price volatility for key feedstocks like naphtha and propane, driven by geopolitical factors and supply chain disruptions. This environment makes securing stable, high-quality feedstock crucial for Chandra Asri, further limiting its flexibility and increasing reliance on established suppliers.

The availability of substitute inputs for primary petrochemical feedstocks, such as naphtha, is currently quite limited, which inherently boosts the bargaining power of suppliers. While there's a global trend exploring bio-based raw materials, these alternatives are still in their nascent stages and haven't yet reached a point where they can offer cost-effective substitutes on the massive scale needed for major petrochemical operations.

This scarcity of readily accessible alternatives keeps companies like Chandra Asri Petrochemical heavily reliant on conventional fossil fuel-based inputs. For instance, as of early 2024, the global market for bio-naphtha, while growing, still represents a tiny fraction of the overall naphtha supply, making it difficult for large-scale producers to transition away from traditional sources without significant cost increases or supply chain disruptions.

Supplier's Product Differentiation

For commodity chemicals, supplier product differentiation is usually low, which tends to reduce supplier power. However, when suppliers offer specialized catalysts or crucial equipment, their power increases because of unique products or protected technologies. Chandra Asri's unique status as Indonesia's sole naphtha cracker operator grants its primary raw material suppliers a certain level of inherent power.

Chandra Asri Petrochemical procures various raw materials, including naphtha and condensate. The bargaining power of suppliers is influenced by the availability and uniqueness of these inputs. In 2023, the global naphtha market experienced price volatility, impacting feedstock costs for cracker operators. For instance, Brent crude oil prices, a key driver of naphtha costs, fluctuated significantly throughout the year, averaging around $82 per barrel.

- Naphtha Sourcing: Chandra Asri relies on a mix of imported and domestically sourced naphtha, with the global market dynamics directly influencing its procurement costs.

- Proprietary Catalysts: While specific details on catalyst suppliers are not publicly disclosed, the petrochemical industry often relies on specialized catalysts that can represent a significant source of supplier power due to proprietary technology.

- Equipment Suppliers: For critical machinery and plant components, suppliers with specialized manufacturing capabilities or exclusive rights to certain technologies can command higher prices and favorable terms.

Threat of Forward Integration by Suppliers

The threat of forward integration by Chandra Asri Petrochemical's raw material suppliers is a consideration, though less pronounced in the capital-intensive petrochemical sector. Major oil and gas companies, supplying essential feedstocks, possess the theoretical capability to expand downstream into petrochemical manufacturing.

However, the substantial capital outlay and specialized technical knowledge needed for complex petrochemical operations present considerable hurdles, effectively mitigating this particular threat. For instance, establishing a new ethylene cracker, a fundamental petrochemical unit, can easily cost billions of dollars.

Despite this, suppliers may exert influence through strategic partnerships or by prioritizing supply to competitors who offer more favorable terms, indirectly leveraging their position.

While direct forward integration by feedstock suppliers into large-scale petrochemical production is infrequent, smaller-scale downstream activities or joint ventures remain plausible.

The bargaining power of suppliers for Chandra Asri Petrochemical is significant, particularly concerning critical feedstocks like naphtha. Global market conditions, supplier concentration, and the limited availability of substitutes for these essential raw materials empower suppliers to influence pricing and terms. For example, in 2024, naphtha prices remained a key concern due to ongoing geopolitical instability, with Brent crude oil averaging approximately $83 per barrel in the first half of the year, directly impacting feedstock costs for petrochemical producers.

Chandra Asri's reliance on specialized equipment and catalysts, often protected by proprietary technology, further amplifies supplier leverage. The high costs and technical complexities associated with switching suppliers for these critical components mean established relationships with reliable providers offer considerable stability, albeit at a premium. This reliance is underscored by the capital-intensive nature of petrochemical operations, where feedstock consistency is paramount for efficient production.

| Factor | Impact on Chandra Asri | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration grants suppliers significant pricing power. | Limited number of global naphtha producers can dictate terms. |

| Feedstock Availability | Scarcity of key inputs like naphtha strengthens supplier leverage. | Geopolitical events in 2024 continued to affect global naphtha supply chains. |

| Switching Costs | High technical and financial costs to change suppliers. | Ensures continued reliance on existing, specialized feedstock providers. |

| Substitute Inputs | Limited viable alternatives to conventional petrochemical feedstocks. | Bio-naphtha market in early 2024 represented a small fraction of total supply. |

What is included in the product

This analysis delves into the competitive forces impacting Chandra Asri Petrochemical, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the petrochemical industry.

Instantly identify and address key competitive pressures within the petrochemical industry, simplifying strategic planning for Chandra Asri Petrochemical.

Customers Bargaining Power

Chandra Asri Petrochemical's customer base is quite varied, spanning sectors like packaging, automotive, construction, and agriculture. This broad reach typically means that no single customer holds a dominant position, thus lessening their individual bargaining power. For instance, while the packaging sector might represent a significant portion of demand, it's still composed of numerous smaller players.

However, the scenario shifts when dealing with large industrial clients who procure substantial volumes of specific products, such as polyethylene or polypropylene. These high-volume purchasers can leverage their scale to negotiate more favorable terms, potentially impacting Chandra Asri's pricing and margins. This is a common dynamic in the petrochemical industry where bulk orders carry weight.

The company's strategic focus on the Indonesian domestic market is a key factor. Indonesia's status as a net importer of petrochemicals creates a robust demand environment for Chandra Asri. In 2023, Indonesia's petrochemical imports were substantial, underscoring the domestic need for these products and indirectly strengthening Chandra Asri's position by ensuring consistent demand, which can counterbalance some customer leverage.

Customers generally face moderate to high switching costs when looking to change petrochemical suppliers. This is because petrochemicals are often fundamental building blocks for their own manufacturing operations, meaning a change isn't a simple swap. For instance, in 2024, a plastics manufacturer relying on Chandra Asri's polypropylene would need to invest significant resources in re-qualifying a new supplier's material to ensure it meets exact specifications.

The process of switching can involve extensive testing, potential adjustments to existing production machinery, and rigorous quality control checks to guarantee a consistent supply. These are not trivial undertakings and can represent a considerable time and financial investment, reinforcing customer loyalty to established suppliers like Chandra Asri.

While Chandra Asri Petrochemical's core products are essential building blocks, the availability of substitutes for their customers' end products can indeed shift bargaining power. For example, in the vast packaging sector, consumers might opt for glass, metal, or paper containers instead of plastic. This broadens the choices for the final consumer, indirectly impacting the demand for virgin polymers produced by Chandra Asri. In 2023, the global market for sustainable packaging solutions, including paper and metal, experienced significant growth, indicating a tangible shift in consumer preferences away from traditional plastics.

Customer's Price Sensitivity

Customer price sensitivity for petrochemical products, often viewed as commodities, can be quite significant. This is because price frequently plays a crucial role in purchasing decisions for these essential materials.

Downstream industries that rely on these petrochemicals are frequently under pressure to manage costs, particularly when operating in highly competitive market environments. This cost-consciousness directly translates to pressure on petrochemical suppliers like Chandra Asri.

Chandra Asri Petrochemical's financial results highlight this sensitivity. For instance, the company reported a net loss in 2024. This loss was primarily driven by a decline in revenue, underscoring how shifts in market pricing and overall demand directly impact its profitability.

- High Price Sensitivity: Petrochemical products are often treated as commodities, making price a primary driver for buyers.

- Cost-Conscious Downstream Industries: Sectors using these materials operate in competitive markets, demanding cost efficiency.

- Impact on Profitability: Chandra Asri's 2024 net loss, linked to revenue decline, demonstrates the effect of market pricing on financial performance.

Threat of Backward Integration by Customers

The threat of backward integration by Chandra Asri Petrochemical's customers is typically low. Establishing petrochemical production, especially for core products like olefins, requires massive capital investment, estimated in the billions of dollars, and advanced technical know-how. For instance, building a naphtha cracker alone demands significant upfront costs and ongoing operational expertise, making it a prohibitive step for most buyers.

While very large industrial consumers might theoretically explore producing their own feedstock, the sheer scale and integrated nature of Chandra Asri's operations present formidable barriers. The complexity of managing a complete petrochemical value chain, from cracking naphtha to producing various polymers, is a substantial undertaking. This inherent difficulty significantly dampens the likelihood of customers attempting to vertically integrate and produce their own raw materials.

- High Capital Requirements: Petrochemical plant construction can cost billions, a substantial hurdle for most customers.

- Technical Expertise Needed: Operating facilities like naphtha crackers requires specialized knowledge and skilled personnel.

- Economies of Scale: Chandra Asri benefits from large-scale production, which is difficult for individual customers to replicate efficiently.

- Complexity of Operations: Managing a fully integrated petrochemical complex is a significant operational challenge.

Chandra Asri Petrochemical's customers generally face moderate to high switching costs. This is due to the need for extensive re-qualification of materials and potential adjustments to manufacturing processes, as seen in 2024 when a plastics manufacturer would need to re-qualify polypropylene for specification consistency. These efforts represent a significant time and financial investment, reinforcing customer loyalty.

| Factor | Impact on Bargaining Power | Relevance to Chandra Asri |

| Switching Costs | Moderate to High | Customers face significant hurdles in changing suppliers due to re-qualification and process adjustments. |

| Price Sensitivity | High | As petrochemicals are often commodities, price is a critical purchasing factor for cost-conscious downstream industries. |

| Customer Concentration | Low to Moderate | While there are large industrial clients, the overall customer base is diverse, limiting individual leverage. |

Preview Before You Purchase

Chandra Asri Petrochemical Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for Chandra Asri Petrochemical, detailing the competitive landscape within the petrochemical industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry, all presented in a professionally formatted and ready-to-use document. The document you see here is exactly what you’ll be able to download after payment, providing a comprehensive understanding of the strategic forces shaping Chandra Asri Petrochemical's market position.

Rivalry Among Competitors

Chandra Asri Petrochemical operates in a dynamic market with a significant number of both domestic and international competitors. While it holds a unique position as Indonesia's largest integrated petrochemical firm and the only one with a naphtha cracker, it doesn't operate in a vacuum.

Regional petrochemical powerhouses such as Lotte Chemical, Lanxess, and Clariant represent formidable competitive forces. These companies possess substantial scale and technological capabilities, often serving similar markets and product needs as Chandra Asri.

Beyond these regional giants, Chandra Asri also contends with a spectrum of other Indonesian chemical producers. This diversity in the competitive landscape means Chandra Asri faces rivals ranging from large, integrated players with broad product portfolios to more specialized companies focusing on niche chemical segments.

The Indonesian petrochemical market is a hotbed of activity, driven by robust domestic demand and ambitious government targets to become Southeast Asia's petrochemical powerhouse by 2027. This expansion, however, is met with a growing competitive landscape.

While growth is strong, increased self-sufficiency in mainland China has introduced downward pressure on margins, intensifying rivalry. Companies are actively competing for market share in this expanding but increasingly challenging environment.

For Chandra Asri Petrochemical's key products such as olefins and polyolefins, which are essentially commodity chemicals, differentiating one product from another is quite difficult. This means that the competition often boils down to who can offer the best price, maintain high quality, and ensure a dependable supply chain.

Despite Chandra Asri's strong presence in the Indonesian market, holding substantial shares like 50% in Olefins and 40% in Polyethylene, and 32% in Polypropylene, the ease with which customers can switch between similar commodity chemical suppliers can really ramp up the competitive pressure.

Exit Barriers

Chandra Asri Petrochemical operates in an industry with exceptionally high exit barriers. The substantial investments in specialized fixed assets like crackers and polymer plants, coupled with dedicated logistics infrastructure, create significant sunk costs. These assets are not easily repurposed, making divestment or closure financially prohibitive.

The specialized nature of petrochemical facilities means they have very limited alternative uses outside the industry. This lack of redeployability locks companies into operations, even when market conditions are unfavorable. For instance, a cracker designed for specific feedstock cannot simply be converted into a food processing plant.

High exit barriers can intensify competitive rivalry. Companies may continue to operate and compete aggressively, even at low profit margins, to avoid the substantial losses associated with exiting. This can put pressure on profitability for all players in the market.

- Massive Fixed Asset Investment: Petrochemical plants represent billions of dollars in capital expenditure, creating substantial financial commitment.

- Specialized Infrastructure: Assets like ethylene crackers and polyethylene plants are highly specific to the industry, with little to no resale value or alternative use.

- Operational Continuity Pressure: The inability to easily exit forces companies to maintain operations, potentially leading to price wars or oversupply during downturns.

- Limited Salvage Value: In the event of an exit, the specialized equipment often has a very low salvage value compared to its original cost.

Industry Structure and Strategic Alliances

Chandra Asri Petrochemical is actively transforming its business model, moving towards becoming a comprehensive solutions provider across energy, chemicals, and infrastructure. This strategic shift is significantly influenced by its alliances with major shareholders, including the Barito Pacific Group and the Siam Cement Group, as well as strategic investments from entities like Thai Oil. These partnerships are crucial in bolstering Chandra Asri's competitive standing within the industry.

The company's engagement in National Strategic Projects, such as the development of the Chandra Asri Chlor-Alkali and Ethylene Dichloride (CA-EDC) plant, highlights its integral role in Indonesia's economic development. This deepens government support and solidifies Chandra Asri's position, directly impacting the competitive landscape by creating a more stable, albeit potentially more consolidated, environment for key players.

- Strategic Alliances: Partnerships with Barito Pacific Group and Siam Cement Group enhance operational synergies and market access.

- Investor Confidence: Thai Oil's investment signals strong external validation of Chandra Asri's growth strategy.

- National Project Integration: Involvement in projects like CA-EDC strengthens government backing and market influence.

- Industry Consolidation: Such strategic moves can lead to a more concentrated competitive environment, favoring integrated players.

Chandra Asri Petrochemical faces intense competition, particularly in commodity chemicals like olefins and polyolefins, where price, quality, and supply reliability are key differentiators. Despite holding significant market shares in Indonesia, such as 50% in Olefins and 40% in Polyethylene, the ease of customer switching amplifies competitive pressure.

The Indonesian petrochemical market is expanding rapidly, with ambitious government goals to become a Southeast Asian hub by 2027, attracting both domestic and international players. However, increased self-sufficiency in China is creating downward margin pressure, intensifying the rivalry for market share.

Major regional competitors like Lotte Chemical, Lanxess, and Clariant bring substantial scale and technological capabilities, directly challenging Chandra Asri. Furthermore, a variety of specialized Indonesian chemical producers also contribute to a diverse and competitive landscape.

Chandra Asri's strategic alliances and involvement in National Strategic Projects, such as the CA-EDC plant, bolster its competitive position and government support. These moves, supported by investments from entities like Thai Oil and partnerships with groups like Siam Cement, aim to create operational synergies and enhance market access, potentially leading to industry consolidation.

| Market Share (Indonesia) | Olefins | Polyethylene | Polypropylene |

| Chandra Asri | 50% | 40% | 32% |

SSubstitutes Threaten

The threat of substitute products for Chandra Asri Petrochemical's offerings is a significant consideration, particularly within its downstream markets. For example, in the packaging sector, traditional plastics such as polyethylene and polypropylene face substitution from materials like glass, metal, paper, and increasingly, biodegradable alternatives. This shift is influenced by evolving consumer preferences leaning towards sustainability and growing regulatory pressures aimed at reducing plastic waste.

The attractiveness of substitutes for petrochemicals hinges significantly on their price-performance trade-off. Currently, while some eco-friendly alternatives might exist, they often struggle to match the cost-effectiveness, durability, and versatility that petrochemical-derived products offer. For instance, while bio-plastics are gaining traction, their production costs can be higher, impacting their widespread adoption against traditional plastics in many applications.

However, this dynamic is not static. Ongoing advancements in material science and a growing global emphasis on sustainability are actively closing this gap. Research and development into novel materials, coupled with potential policy shifts favoring greener options, could accelerate the adoption of substitutes, presenting a more substantial long-term threat to established petrochemical markets. By 2024, the market for sustainable plastics, for example, is projected to see significant growth, indicating a shift in consumer and industrial preferences.

Growing global awareness of plastic waste is reshaping consumer choices, pushing demand towards recycled content and bio-based alternatives. This environmental consciousness directly impacts the petrochemical industry, potentially diverting demand from virgin materials.

In 2024, the global market for bioplastics, a key substitute, is projected to reach over $60 billion, signaling a significant shift away from traditional plastics. This trend presents a substantial threat to companies like Chandra Asri that rely heavily on virgin petrochemical production.

Chandra Asri is proactively addressing this by investing in plastic waste management and exploring sustainable material innovations. These efforts aim to mitigate the threat by aligning with evolving consumer preferences and regulatory pressures towards a circular economy.

Technological Advancements in Bio-based Materials

Technological advancements in bio-based materials are presenting a growing threat of substitution for petrochemical products. As research in sustainable chemistry accelerates, bio-polymers and other bio-derived chemicals are becoming more competitive. For instance, the global bio-based chemicals market was valued at approximately $100 billion in 2023 and is projected to reach over $200 billion by 2030, indicating significant growth potential for these alternatives.

These emerging bio-based alternatives could eventually offer viable, large-scale substitutes for traditional petrochemicals. This evolving landscape necessitates that companies like Chandra Asri Petrochemical adapt their product portfolios and production methods. The development of more efficient and cost-effective processes for producing bio-plastics, for example, could directly challenge the market share of conventional plastics derived from petroleum.

Chandra Asri must monitor these technological shifts closely. The potential for bio-based materials to disrupt the market is substantial, impacting demand for their core petrochemical offerings. Strategic adaptation might involve diversifying into bio-based product lines or investing in research and development to enhance the sustainability of their existing processes.

- Growing Market Share: The increasing investment in and adoption of bio-based materials across various industries signal a long-term trend that could erode demand for petrochemicals.

- Cost Competitiveness: As production technologies for bio-based alternatives mature, their cost-competitiveness with traditional petrochemicals is expected to improve.

- Regulatory Support: Many governments are implementing policies and offering incentives to promote the use of sustainable and bio-based products, further encouraging their adoption.

Regulatory and Policy Support for Substitutes

Government policies and regulations often play a significant role in shaping the competitive landscape, especially when it comes to promoting sustainability and environmental responsibility. In Indonesia, for example, there's a growing emphasis on cleaner fuel standards and ambitious net-zero emissions targets, which can indirectly bolster the appeal and viability of alternative materials and technologies. This regulatory push creates a more fertile ground for substitutes to emerge and capture market share.

These supportive policies can manifest in several ways, directly impacting industries that rely on traditional petrochemical products. For instance, incentives for recycling and the adoption of eco-friendly materials can make these alternatives more cost-competitive and accessible to consumers and businesses alike. This trend is observable globally, with many nations actively pursuing policies that favor a circular economy and reduce reliance on virgin fossil fuel-based products.

- Government Initiatives: Policies encouraging recycling and the use of bio-based or recycled plastics can directly increase the threat of substitutes for virgin petrochemicals.

- Sustainability Goals: Indonesia's commitment to net-zero emissions by 2060, and potentially sooner with enhanced efforts, incentivizes sectors to explore and adopt lower-carbon alternatives.

- Regulatory Support: Favorable regulations for renewable energy and sustainable materials can lower the barrier to entry for substitute products, making them more competitive.

- Market Perception: Increased consumer and corporate demand for sustainable products, often driven by awareness campaigns and regulatory frameworks, further fuels the adoption of substitutes.

The threat of substitutes for Chandra Asri Petrochemical's products, particularly in packaging, is growing. While traditional plastics like polyethylene and polypropylene are widely used, materials such as glass, metal, paper, and increasingly, biodegradable plastics, pose a significant alternative. This shift is driven by heightened consumer demand for sustainable options and stricter regulations targeting plastic waste reduction.

The viability of these substitutes is increasingly linked to their price-performance ratio. While some eco-friendly alternatives are emerging, they often fall short of the cost-effectiveness and versatility of petrochemical-based products. However, advancements in material science are narrowing this gap, with bio-plastics, for example, becoming more competitive. By 2024, the global bioplastics market is anticipated to exceed $60 billion, reflecting a notable trend away from conventional plastics.

Technological progress in bio-based materials presents a substantial threat. The global bio-based chemicals market, valued around $100 billion in 2023, is projected to surpass $200 billion by 2030. This expansion suggests that bio-polymers and other bio-derived chemicals could become viable, large-scale substitutes for traditional petrochemicals, necessitating strategic adaptation by companies like Chandra Asri.

| Substitute Material | Key Drivers | 2024 Market Projection (USD Billion) | Chandra Asri Impact |

|---|---|---|---|

| Bioplastics | Sustainability demand, Regulatory push | > 60 | Potential demand erosion for virgin plastics |

| Recycled Plastics | Circular economy initiatives, Cost savings | N/A (integrated into plastic market) | Reduced demand for primary production |

| Paper & Cardboard | Environmental concerns, Biodegradability | N/A (part of packaging market) | Substitution in specific packaging applications |

| Glass & Metal | Durability, Reusability | N/A (established materials) | Competition in specific high-value packaging |

Entrants Threaten

The petrochemical industry demands massive upfront capital. Establishing new production facilities, like the naphtha crackers and polymer plants Chandra Asri Petrochemical operates, necessitates investments often in the billions of dollars. This financial barrier significantly restricts the number of companies that can realistically enter the market.

For instance, building a world-scale integrated petrochemical complex, similar to Chandra Asri's operations, can easily exceed several billion US dollars. This substantial financial commitment acts as a powerful deterrent, effectively limiting the pool of potential new competitors and thus reducing the threat of new entrants.

Chandra Asri Petrochemical, as the operator of Southeast Asia's largest integrated petrochemical complex, enjoys substantial economies of scale. This massive operational footprint translates to lower per-unit production costs, a significant barrier for any potential new competitor aiming to enter the market.

For a new entrant to challenge Chandra Asri on price, they would need to replicate this enormous scale, which demands a colossal initial capital outlay. For context, the petrochemical industry generally requires billions of dollars in investment for a new, competitive facility.

This inherent cost advantage means that newcomers would struggle to match Chandra Asri's pricing without first achieving a comparable level of production volume and efficiency. The sheer magnitude of investment required to achieve such scale effectively deters many potential entrants.

The petrochemical industry is heavily reliant on intricate, proprietary technologies and highly specialized operational know-how. Developing or obtaining these advanced technologies, coupled with the need for a skilled workforce capable of managing sophisticated plants, creates a significant hurdle for potential newcomers.

Chandra Asri Petrochemical's extensive operational history and its investment in state-of-the-art facilities highlight the profound technical expertise essential for successful competition in this sector.

Access to Raw Materials and Distribution Channels

Securing consistent and affordable access to key raw materials, such as naphtha, presents a significant hurdle for potential new entrants into the petrochemical industry. Chandra Asri Petrochemical benefits from established long-term supply agreements, providing a stable foundation for its operations. For instance, in 2023, naphtha prices saw considerable fluctuation, impacting production costs across the sector, a challenge new players would need to navigate without existing advantageous contracts.

Furthermore, the development of a robust and efficient domestic distribution network is crucial for reaching end-users. Chandra Asri has already invested heavily in building out its extensive infrastructure, enabling it to serve the Indonesian market effectively. New companies would need to replicate this considerable investment and time, facing difficulties in establishing a comparable logistical reach and customer base. This existing network provides Chandra Asri with a competitive edge in terms of delivery speed and cost efficiency.

- Raw Material Sourcing: New entrants struggle to secure competitive feedstock prices, unlike Chandra Asri's long-term supply agreements.

- Distribution Network: Building an extensive domestic distribution infrastructure requires substantial capital and time, a barrier for new players.

- Logistical Efficiency: Chandra Asri's established network allows for more efficient and potentially lower-cost delivery to customers compared to a newcomer.

- Market Penetration: Overcoming the established presence and reach of Chandra Asri's distribution channels is a significant challenge for new entrants.

Government Policy and Regulatory Environment

Government policies and the regulatory landscape in Indonesia significantly influence the threat of new entrants into the petrochemical sector. Policies can either ease or complicate market entry for new players. For instance, the Indonesian government has identified the petrochemical industry as strategically vital, evidenced by the designation of projects like Chandra Asri's CAP2 (formerly referred to as CA-EDC) as National Strategic Projects. This strategic focus suggests a government intent to foster domestic production capabilities.

However, existing regulations and the unique status of incumbent facilities can present substantial barriers. Chandra Asri Petrochemical's facilities, for example, have been granted Vital National Object status. This designation implies enhanced security and potentially preferential treatment or regulatory considerations that could favor established operators over newcomers. Such measures, while aimed at protecting national assets, inherently create an advantageous position for incumbents by increasing the complexity and cost of entry for potential new competitors.

- National Strategic Project Status: Chandra Asri's CAP2 project is a National Strategic Project, highlighting government support for domestic petrochemical expansion.

- Vital National Object Status: This status for Chandra Asri's existing facilities can create regulatory advantages for the incumbent.

- Policy Impact: Government regulations can either facilitate or hinder new entrants, directly impacting the competitive landscape.

- Incumbent Advantage: Existing regulatory frameworks and asset status often benefit established companies, raising the barrier to entry.

The threat of new entrants for Chandra Asri Petrochemical is moderate, primarily due to significant capital requirements and established operational advantages. Building a new, integrated petrochemical facility comparable to Chandra Asri's operations demands billions of dollars in investment, a substantial financial barrier. Furthermore, Chandra Asri benefits from economies of scale, proprietary technology, and strong raw material sourcing agreements, all of which are difficult for newcomers to replicate.

| Factor | Impact on New Entrants | Chandra Asri's Position |

|---|---|---|

| Capital Investment | Extremely High (Billions USD) | Established, large-scale operations |

| Economies of Scale | Challenging to achieve | Significant cost advantage |

| Technology & Know-how | Requires substantial R&D or licensing | Proprietary and advanced |

| Raw Material Access | Difficult to secure competitive pricing | Long-term, advantageous agreements |

| Distribution Network | Costly and time-consuming to build | Extensive and efficient domestic reach |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Chandra Asri Petrochemical leverages data from official company filings, Bloomberg terminal insights, and industry-specific market research reports to capture the competitive landscape.