Chailease Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chailease Holding Bundle

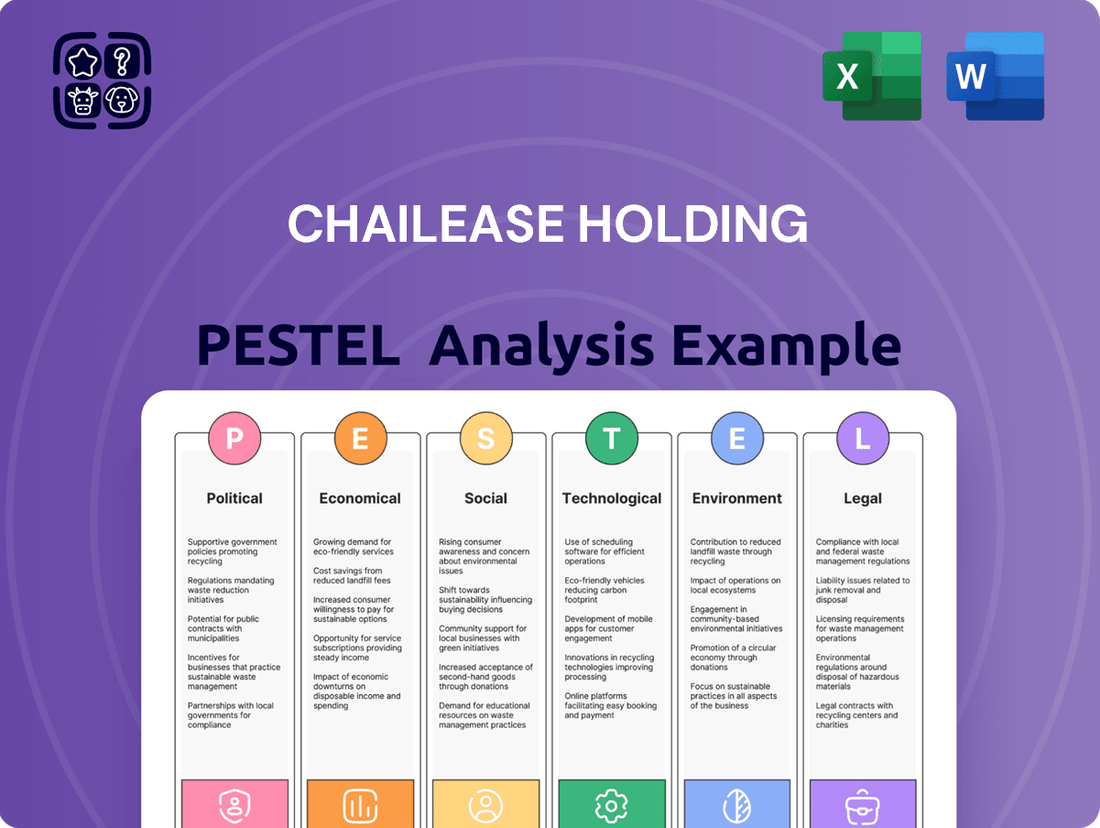

Navigate the complex external forces shaping Chailease Holding's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategic planning and investment decisions.

Gain a critical competitive edge by diving deep into the PESTLE factors impacting Chailease Holding. Our expertly crafted analysis provides the crucial insights you need to anticipate market shifts and capitalize on emerging trends. Download the full version now and unlock the strategic advantage.

Political factors

Governments globally, including key markets for Chailease Holding, continue to prioritize Small and Medium-sized Enterprises (SMEs) through various support mechanisms. For instance, in 2024, many nations are enhancing tax incentives and offering expanded credit guarantee schemes to encourage lending to this vital sector, directly broadening Chailease's potential client base and reducing its risk exposure.

These proactive governmental policies are critical; a stable political climate and predictable regulatory frameworks are essential for Chailease to confidently invest in and develop long-term financing solutions for SMEs. The ongoing commitment to SME growth, as seen in initiatives like the European Union's SME Strategy for sustainable and digital growth, signals a favorable operating environment for leasing companies like Chailease.

The stability and evolving direction of financial regulations are critical for Chailease Holding. For instance, changes in capital adequacy rules for non-bank financial institutions, as seen with potential adjustments in Basel III finalization impacting regional banks in 2024, can directly affect Chailease's leverage capacity and operational costs.

New or amended laws specifically targeting leasing and factoring services, such as those introduced in Taiwan or other key Asian markets in late 2023 and early 2024, could either unlock new business avenues or necessitate significant compliance investments. A predictable regulatory framework, like the consistent application of accounting standards across its operating regions, reduces uncertainty and bolsters investor confidence in Chailease's long-term strategic planning.

As a global player, Chailease Holding must navigate the complexities of geopolitical tensions and shifting trade policies. For instance, the ongoing trade friction between the United States and China, which intensified in 2023-2024, directly impacts supply chains and investment flows for multinational corporations. These dynamics can create significant headwinds for client businesses reliant on international trade, thereby affecting Chailease's financing activities and risk exposure across various markets.

Taxation Policies

Government taxation policies, including corporate income tax rates, value-added tax (VAT) on financial services, and specific tax incentives or disincentives for equipment leasing or real estate financing, directly affect Chailease's profitability and the attractiveness of its offerings. For instance, a reduction in corporate income tax rates can boost net earnings, while increased VAT on financial services might raise operational costs or deter clients. Favorable tax treatments for certain asset classes or industries, such as accelerated depreciation allowances for new equipment, can stimulate demand for Chailease's leasing services by making them more financially appealing to businesses.

In 2024, many economies are navigating complex tax landscapes. For example, countries are reviewing their corporate tax structures, with some considering adjustments to remain competitive internationally. Chailease, operating across multiple jurisdictions, must remain agile to these changes. The impact of these policies can be significant; a change in tax treatment for leased assets, for instance, could alter the cost-benefit analysis for potential lessees, directly influencing Chailease's market share and revenue streams.

- Corporate Income Tax Rates: Fluctuations in corporate tax rates directly impact Chailease's net profit margins across its operating regions.

- VAT on Financial Services: Changes to VAT or similar consumption taxes on leasing and financing services can affect the final cost to customers and Chailease's revenue.

- Tax Incentives for Leasing: Government incentives, like tax credits for investing in green technology through leasing, can drive demand for specific Chailease products.

- Real Estate Financing Taxes: Property-related tax policies can influence the demand for Chailease's real estate financing solutions.

Monetary Policy Influence

Central bank monetary policy, often shaped by political considerations, directly influences interest rates and the availability of credit, key determinants for Chailease Holding. For instance, a tightening monetary stance, perhaps driven by political pressure to curb inflation, could lead to higher borrowing costs for Chailease, impacting its profitability. Conversely, accommodative policies might lower these costs.

Government actions, whether through direct directives or by influencing central bank independence, can significantly alter the financial landscape for companies like Chailease. If a government prioritizes economic growth through low interest rates, this could reduce Chailease's cost of funds, making its leasing and financing products more competitive. For example, in late 2024, several major economies maintained or slightly lowered benchmark interest rates, a trend that likely benefited financial institutions by keeping borrowing costs manageable.

- Interest Rate Impact: A 1% increase in a key policy rate could increase Chailease's annual funding costs by tens of millions of dollars, depending on its debt structure and market conditions.

- Credit Availability: Easing monetary policy generally increases liquidity, making it easier and cheaper for Chailease to secure funds for its lending operations.

- Regulatory Environment: Political decisions on financial sector regulation can also affect Chailease's operational costs and the types of financial products it can offer.

Governmental support for Small and Medium-sized Enterprises (SMEs) remains a significant political factor for Chailease Holding. In 2024, many countries continued to offer tax incentives and credit guarantees, directly expanding Chailease's potential client base and reducing its risk. Stable political climates and predictable regulatory frameworks are crucial for Chailease's long-term investment strategies in financing solutions for SMEs.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Chailease Holding, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential growth avenues.

Provides a concise PESTLE analysis of Chailease Holding, simplifying complex external factors into actionable insights for strategic decision-making.

Helps mitigate the pain of information overload by offering a clear, categorized overview of the political, economic, social, technological, legal, and environmental forces impacting Chailease Holding.

Economic factors

Interest rate fluctuations directly influence Chailease Holding's financial performance. When rates rise, the cost of borrowing for Chailease increases, potentially squeezing profit margins if these higher costs can't be fully passed on to customers through leasing and financing rates. Conversely, falling rates can negatively impact revenue from existing loans and leases tied to variable rates.

For instance, the US Federal Reserve maintained its benchmark interest rate in the range of 5.25%-5.50% through early 2024, a level that has increased borrowing costs compared to previous years. This environment necessitates careful management of Chailease's funding costs and pricing strategies to maintain profitability.

Chailease Holding's performance is closely tied to the economic health of its operating regions. For instance, in 2024, Taiwan's GDP was projected to grow by 3.1%, signaling a stable environment for businesses seeking equipment financing. Similarly, China's economic outlook, while facing some headwinds, still presented opportunities, with its GDP expected to expand around 4.6% in 2024.

Robust GDP growth fuels demand for Chailease's core services, as businesses, especially small and medium-sized enterprises (SMEs), are more inclined to invest in new equipment and expand operations when the economic climate is favorable. This increased investment directly translates into higher leasing and financing volumes for Chailease.

Conversely, any significant economic downturn or recession in these key markets could dampen demand for leasing services and potentially increase the risk of credit defaults among borrowers. Monitoring these GDP trends is therefore crucial for assessing Chailease's future revenue potential and credit risk exposure.

Inflation significantly impacts Chailease Holding by affecting the real value of its leased assets and the cost of its operations. For instance, Taiwan's Consumer Price Index (CPI) saw an increase, reaching 2.43% in May 2024, up from 2.24% in April 2024, highlighting a persistent inflationary trend that can erode the value of long-term lease agreements if not adequately hedged.

The rising cost of acquiring new assets for leasing due to inflation directly influences Chailease's capital expenditure and operational efficiency. In March 2024, Taiwan's producer price index (PPI) rose by 0.1% year-on-year, indicating upward pressure on input costs for businesses, which can translate to higher asset acquisition prices for Chailease.

Furthermore, inflation influences the purchasing power of Chailease's clients, potentially affecting demand for leasing services. Understanding these dynamics is critical for Chailease to maintain asset quality and refine its pricing strategies in response to evolving economic conditions.

SME Credit Demand and Health

Chailease Holding's core business is intrinsically linked to the financial vitality and credit needs of small and medium-sized enterprises (SMEs). The capacity of these businesses to meet their financial commitments, their willingness to invest, and their access to conventional banking services all directly shape Chailease's operational scale and its exposure to credit-related risks.

Economic climates that foster or impede SME expansion are therefore paramount considerations for Chailease. For instance, in 2024, many regions saw a rebound in SME activity, yet access to capital remained a challenge for some. In Taiwan, a key market for Chailease, the SME loan approval rate from traditional banks fluctuated, impacting the demand for alternative financing solutions.

- SME Credit Demand: Continued demand for working capital and equipment financing is expected as SMEs navigate evolving market conditions.

- Repayment Capacity: The ability of SMEs to manage debt is influenced by inflation rates and interest cost pressures, which were notable concerns in 2024.

- Access to Traditional Finance: Tightening lending standards by some banks in 2024 could increase reliance on non-bank financial institutions like Chailease.

- Economic Support for SMEs: Government initiatives aimed at boosting SME growth and resilience, such as tax incentives or loan guarantees, directly benefit Chailease's operating environment.

Currency Exchange Rate Volatility

Chailease Holding, operating across multiple countries, faces significant risks from fluctuating currency exchange rates. These shifts can directly alter the value of its overseas assets and liabilities, impacting its balance sheet. For instance, a strengthening local currency against the US dollar could reduce the reported value of US-dollar denominated leases or loans held by Chailease.

Profitability from cross-border leasing and financing activities is also vulnerable. If Chailease earns revenue in a currency that depreciates against its reporting currency, the actual repatriated earnings will be lower. This was evident in early 2024, where several emerging market currencies experienced notable depreciation against the USD, potentially squeezing margins for companies with significant operations in those regions.

The cost of securing funding in different international markets can also be swayed by exchange rate movements. Borrowing in a currency that subsequently weakens can make debt repayment more expensive in the company's home currency. Consequently, robust currency hedging strategies are crucial for Chailease to mitigate these financial exposures and maintain stable international operations.

- Impact on Assets: A 10% depreciation of the New Taiwan Dollar (TWD) against the US Dollar (USD) in 2024 could reduce the TWD equivalent value of Chailease's USD-denominated receivables by billions of TWD.

- Profitability Squeeze: If a significant portion of Chailease's leasing income is generated in a currency that depreciates by 5% against the TWD over a fiscal year, its reported international operating profit could be negatively impacted.

- Hedging Costs: The cost of currency derivatives, a key hedging tool, can fluctuate. For example, the forward premium on certain currency pairs might widen in 2024, increasing the expense of hedging specific foreign currency exposures.

Chailease Holding's performance is intrinsically tied to the economic health of its operating regions, with GDP growth directly fueling demand for its leasing and financing services. For instance, Taiwan's projected GDP growth of 3.1% in 2024 provided a stable backdrop for business investment, while China's expected 4.6% expansion also presented opportunities. Stronger economic expansion generally translates to increased demand for equipment and capital, benefiting Chailease's core business.

Preview Before You Purchase

Chailease Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Chailease Holding delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction.

Understand the critical external forces shaping Chailease Holding’s business landscape with this detailed PESTLE analysis. The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into market dynamics.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing a thorough PESTLE analysis of Chailease Holding. Gain a deep understanding of the external influences that will drive or hinder the company’s growth and profitability.

Sociological factors

Small and medium-sized enterprises (SMEs) are increasingly seeking operational agility. This translates into a preference for flexible financing, with a notable rise in demand for pay-per-use models. For instance, a 2024 survey indicated that over 60% of SMEs are exploring leasing or usage-based acquisition over traditional ownership for their equipment needs.

This shift away from outright asset ownership directly benefits leasing companies like Chailease. As SMEs prioritize cash flow and operational flexibility, leasing aligns perfectly with their evolving financial preferences. Understanding this trend allows Chailease to adapt its services, offering tailored solutions that meet the dynamic requirements of this vital business segment.

Demographic shifts are reshaping business needs, influencing the demand for specific leasing and financing solutions. For example, an aging workforce might necessitate different types of office equipment or ergonomic solutions, while a growing cohort of digitally native entrepreneurs could drive demand for IT infrastructure and software financing. Chailease needs to stay attuned to these evolving requirements.

Workforce trends, such as the rise of the gig economy and increased remote work, directly impact equipment leasing. A surge in independent contractors or freelance professionals might increase the demand for flexible vehicle leasing options or specialized tools for various service industries. Conversely, automation trends are changing the landscape for industrial equipment, requiring Chailease to adapt its offerings to support businesses integrating advanced machinery.

In 2024, the global workforce continued to see a significant presence of millennials and Gen Z, who often prioritize flexibility and digital solutions. This demographic is also increasingly engaged in entrepreneurial ventures, potentially boosting demand for adaptable financing for startups and small businesses. For instance, the growth in e-commerce businesses, often fueled by younger entrepreneurs, requires financing for warehousing equipment and delivery vehicles.

Growing financial literacy, particularly among small and medium-sized enterprises (SMEs) in Asia, is a significant driver for Chailease. For instance, a 2024 survey indicated that over 60% of SME owners in Taiwan reported increased confidence in managing their finances digitally, directly supporting Chailease's digital service offerings.

The widespread adoption of digital platforms by businesses enhances Chailease's operational efficiency. With a projected 15% year-over-year growth in the use of online application portals for equipment financing in 2025, Chailease can streamline client onboarding and reduce administrative overhead, leading to faster service delivery.

Conversely, regions or segments with lower digital literacy may necessitate more traditional, in-person engagement strategies. This could involve increased investment in sales teams and physical touchpoints to ensure accessibility and build trust, potentially impacting the speed of digital transformation for those specific client groups.

ESG Awareness and Corporate Social Responsibility

Societal expectations are increasingly pushing companies, including those in the SME sector, to prioritize Environmental, Social, and Governance (ESG) factors in their operations and financing strategies. This heightened awareness means Chailease could experience pressure from its clientele, investors, and the general public to showcase its dedication to social responsibility and sustainable business models. For instance, a growing number of institutional investors are integrating ESG criteria into their investment decisions; in 2024, global sustainable investment assets were projected to exceed $50 trillion, indicating a significant shift in capital allocation.

This trend translates into potential opportunities for Chailease to differentiate itself by offering specialized financial products, such as green financing options for environmentally friendly projects or by actively promoting and supporting a diverse supplier base. Such initiatives not only align with ESG principles but can also attract a broader range of capital and enhance brand reputation. By 2025, it's anticipated that over 70% of companies will have a formal ESG strategy in place, a substantial increase from previous years, highlighting the mainstreaming of these considerations.

Chailease’s commitment to corporate social responsibility can be demonstrated through various avenues:

- Demonstrating Commitment to ESG: Actively integrating ESG principles into lending criteria and operational practices.

- Offering Green Financing: Providing financial solutions tailored for businesses investing in renewable energy, energy efficiency, or other sustainable initiatives.

- Supplier Diversity Programs: Implementing policies that encourage and support partnerships with businesses owned by underrepresented groups.

- Transparency and Reporting: Publishing regular reports detailing the company's ESG performance and impact.

Urbanization and Regional Development

Urbanization trends are a significant driver for Chailease Holding. As more people move into cities, particularly in emerging economies, there's a heightened demand for various services that Chailease provides. For instance, the International Organization for Migration reported that in 2023, over 60% of the world's population lived in urban areas, a figure projected to reach 68% by 2050. This ongoing shift fuels the need for business expansion, equipment financing, and infrastructure development within these growing urban centers.

Regional economic development closely follows urbanization, creating new opportunities. Chailease can leverage this by identifying rapidly developing regions and tailoring its leasing and financing solutions to meet the specific needs of businesses operating there. For example, a report by the Asian Development Bank in late 2023 highlighted significant infrastructure investment in Southeast Asian cities, creating a direct need for capital equipment leasing, a core service of Chailease.

Chailease can strategically position itself to capitalize on these localized economic booms. By monitoring urban growth patterns and regional investment, the company can proactively expand its service offerings and physical presence in areas poised for significant development. This proactive approach allows Chailease to capture market share early in high-growth urban and regional markets.

- Urban Growth Fuels Demand: Increasing urban populations necessitate more business activity, driving demand for leasing and financing.

- Regional Investment Opportunities: Targeted regional economic development creates specific needs for equipment and infrastructure financing.

- Strategic Expansion: Chailease can capitalize on localized economic booms by expanding its presence in growing urban areas.

- Tailored Offerings: Adapting services to meet the unique demands of different developing regions enhances market penetration.

Societal expectations are increasingly pushing companies towards Environmental, Social, and Governance (ESG) principles. This trend influences financing strategies, with a growing demand for green financing options. By 2025, it's anticipated that over 70% of companies will have a formal ESG strategy, highlighting the mainstreaming of these considerations.

Chailease can leverage this by offering specialized financial products for sustainable projects, thereby enhancing its brand reputation and attracting capital. For instance, global sustainable investment assets were projected to exceed $50 trillion in 2024, underscoring the significant shift in capital allocation towards ESG-compliant businesses.

Demonstrating a commitment to ESG through transparent reporting and supplier diversity programs can further solidify Chailease's market position and appeal to socially conscious investors and clients.

Technological factors

The financial services sector is undergoing a profound digital transformation, fundamentally altering how companies like Chailease engage with customers and manage operations. This shift is evident in the increasing adoption of online platforms for client onboarding, loan processing, and portfolio management. For instance, in 2024, a significant portion of financial institutions reported increased investment in digital customer relationship management (CRM) systems, aiming to improve user experience and operational efficiency.

Implementing digital solutions such as online application portals, electronic document signing, and automated underwriting processes can dramatically streamline Chailease's workflow. This not only accelerates transaction times but also significantly enhances customer convenience and satisfaction. Data from early 2025 indicates that businesses leveraging these digital tools have seen an average reduction in processing times by up to 30%, directly contributing to improved operational agility and cost savings.

This ongoing digitalization is not merely an operational upgrade but a strategic imperative for maintaining competitiveness in the evolving financial landscape. Companies that fail to adapt risk falling behind in efficiency and customer appeal. By embracing these technological advancements, Chailease can solidify its market position and ensure its services remain relevant and accessible in the digital age.

Fintech innovation presents a dual challenge and opportunity for Chailease. Companies like Stripe and Square are streamlining payment processing, while neobanks offer alternative lending platforms, directly competing for market share. This surge in agile fintech solutions compels established financial institutions, including Chailease, to accelerate their own digital transformation efforts to remain competitive.

The fintech sector's rapid growth, with global fintech investment reaching an estimated $200 billion in 2024, underscores the imperative for Chailease to adapt. By forging strategic partnerships with fintech firms or investing in its own technological capabilities, Chailease can enhance its lending platforms, improve customer onboarding, and expand its reach into underserved markets, thereby bolstering its competitive edge.

Advanced data analytics and AI are fundamentally changing how credit risk is evaluated. Companies like Chailease can leverage these tools to sift through extensive datasets, uncovering complex risk indicators that might otherwise be missed. For instance, by mid-2024, many financial institutions reported significant improvements in loan default prediction accuracy, with some seeing reductions in non-performing loans by up to 15% after implementing AI-driven credit scoring models.

By integrating these technologies, Chailease can automate credit decision-making processes, leading to quicker approvals for customers and more precise pricing of risk. This not only streamlines operations but also aims to improve the overall health of their loan portfolio. The global AI in financial services market was projected to reach over $30 billion by the end of 2024, underscoring the widespread adoption and perceived value of these advancements in the sector.

Cybersecurity and Data Protection

As financial transactions increasingly move online, robust cybersecurity is paramount for Chailease. Protecting sensitive client information and operational systems from cyber threats is essential for maintaining trust and preventing financial losses. For instance, global cybercrime costs are projected to reach $10.5 trillion annually by 2025, highlighting the critical need for strong defenses.

Chailease must continuously invest in cybersecurity infrastructure to safeguard its data assets. This includes implementing advanced threat detection systems and regular security audits. The increasing sophistication of cyberattacks means that proactive measures are non-negotiable for regulatory compliance and business continuity.

- Cybercrime Costs: Global cybercrime costs are expected to hit $10.5 trillion annually by 2025.

- Data as an Asset: Sensitive client and financial data are critical assets requiring stringent protection.

- Regulatory Compliance: Strong cybersecurity is vital for adhering to data protection laws and avoiding penalties.

- Investment Necessity: Continuous investment in cybersecurity infrastructure is essential for mitigating risks.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) are poised to reshape financial services. For Chailease, this could mean more secure record-keeping and transparent transaction processing. Imagine leasing agreements executed automatically via smart contracts, reducing administrative overhead and potential for disputes.

The adoption of DLT in finance is steadily growing. For instance, by the end of 2024, global spending on blockchain solutions was projected to reach over $13 billion, indicating significant investment and development in the space. Chailease could leverage this trend to streamline its operations and potentially develop novel leasing products.

- Enhanced Security: DLT’s inherent cryptographic security can protect sensitive leasing data.

- Increased Transparency: All parties can view and verify transactions on a shared ledger.

- Smart Contracts: Automating lease agreements, payments, and renewals can boost efficiency.

- Fraud Reduction: The immutable nature of blockchain makes tampering with records extremely difficult.

Technological advancements are reshaping the financial services landscape, demanding that Chailease embrace digital transformation for efficiency and customer engagement. The increasing adoption of online platforms for onboarding and loan processing, supported by significant digital CRM investments in 2024, highlights this trend.

Implementing solutions like electronic signatures and automated underwriting can cut processing times by up to 30%, as seen in early 2025 data, directly boosting operational agility.

Fintech innovations, with global investment reaching an estimated $200 billion in 2024, present both competitive threats and opportunities for Chailease to enhance its services and reach.

AI-driven credit scoring models, which improved loan default prediction accuracy by up to 15% for some institutions by mid-2024, offer Chailease the chance to refine risk assessment and streamline approvals.

| Technology Area | Impact on Chailease | Key Data Point (2024/2025) |

| Digitalization | Streamlined operations, enhanced customer experience | 30% reduction in processing times with digital tools |

| Fintech Innovation | Competitive pressure, opportunities for partnerships | $200 billion global fintech investment (estimated 2024) |

| AI & Data Analytics | Improved credit risk assessment, faster approvals | 15% reduction in non-performing loans with AI models (reported by some) |

| Cybersecurity | Essential for data protection and trust | $10.5 trillion global cybercrime costs projected by 2025 |

| Blockchain/DLT | Potential for secure record-keeping and smart contracts | Over $13 billion global spending on blockchain solutions projected (2024) |

Legal factors

Chailease Holding navigates a dense regulatory landscape across its operating regions. For instance, in Taiwan, financial holding companies like Chailease are subject to the Financial Holding Company Act, which dictates capital requirements and corporate governance standards. Compliance with these rules is paramount, as evidenced by the Financial Supervisory Commission's ongoing oversight of the financial sector, including regular examinations of leasing and factoring entities.

Leasing and installment sales are governed by distinct legal frameworks that differ significantly across countries. These laws dictate crucial elements like when ownership of an asset officially transfers, how depreciation is handled for tax purposes, and the precise procedures for handling defaults and repossessing assets. Chailease, operating globally, must meticulously adhere to these varied legal stipulations to safeguard its contractual agreements and operational integrity in each market it serves.

Chailease Holding operates in an environment increasingly shaped by stringent data privacy and protection laws, akin to GDPR, across numerous jurisdictions. These regulations govern every aspect of customer data handling, from collection and storage to processing and sharing. For instance, in 2023, the global cost of data breaches averaged $4.45 million, highlighting the financial risks of non-compliance.

Adhering to these mandates is not merely a legal obligation but a strategic imperative for Chailease. Failure to comply can result in substantial financial penalties and severe damage to its brand reputation. The company must therefore invest in and maintain robust data security infrastructure and ensure transparent, ethical data management practices to build and retain customer trust.

Anti-Money Laundering (AML) and KYC Regulations

Chailease Holding, as a financial services provider, must navigate a complex web of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These legal frameworks are designed to combat financial crime by ensuring robust identity verification for all clients and diligent monitoring of all transactions. Failure to comply can result in significant penalties and reputational damage.

The increasing global focus on financial transparency, particularly post-2020, means that AML/KYC requirements are becoming more rigorous. For instance, many jurisdictions have implemented enhanced due diligence measures for higher-risk clients and transactions, often requiring more detailed source of funds information. This means Chailease needs to invest in advanced technology and training to stay ahead of evolving regulatory expectations.

- Regulatory Scrutiny: Financial institutions globally face heightened scrutiny from regulators regarding AML/KYC compliance.

- Transaction Monitoring: Sophisticated systems are essential to detect and report suspicious activities, a critical component of preventing illicit financial flows.

- Client Due Diligence: Verifying customer identities and understanding the nature of their business is paramount to meeting KYC obligations.

- Global Standards: Adherence to international standards, such as those set by the Financial Action Task Force (FATF), is crucial for cross-border operations.

Consumer Protection and Fair Lending Laws

Consumer protection and fair lending laws are critical for Chailease Holding, especially when engaging with smaller businesses. These regulations, such as those mandating transparent pricing and clear dispute resolution, directly shape client interactions. For instance, in 2024, regulatory bodies continued to emphasize disclosure requirements in financial services, aiming to prevent predatory lending. Compliance with these evolving standards is paramount for maintaining client trust and avoiding potential legal penalties.

These legal frameworks often stipulate responsible lending practices, ensuring that clients, particularly SMEs, are not exploited. This includes clear communication of all fees, interest rates, and repayment terms. Chailease's adherence to these principles, which are continually refined by regulators, helps to mitigate legal risks and foster a stable operating environment. Failure to comply could lead to significant fines and reputational damage.

- Transparency in Fees: Regulations often require detailed disclosure of all charges associated with financing agreements.

- Fair Lending Practices: Laws prohibit discriminatory lending and ensure that loan terms are equitable.

- Dispute Resolution: Clear mechanisms must be in place for clients to address grievances.

- Consumer Safeguards: Protections against unfair contract terms and aggressive collection practices are enforced.

Chailease Holding must navigate evolving international tax laws and treaties that impact cross-border leasing and financing operations. For example, the OECD's Base Erosion and Profit Shifting (BEPS) initiative, with its 2024 updates focusing on digital economy taxation, influences how multinational corporations structure their transactions and report profits. Staying compliant requires continuous monitoring of tax policy changes across its global footprint.

Environmental factors

The global push for sustainability is significantly reshaping investment. By 2024, sustainable investment funds saw substantial inflows, with assets under management in ESG-focused products reaching trillions worldwide, indicating a strong investor preference for environmentally and socially responsible companies.

Chailease Holding is feeling this shift, with stakeholders increasingly expecting ESG integration. This means not only improving its own environmental footprint but also exploring opportunities in green finance. For instance, offering leases for solar panel installations or electric vehicle fleets could tap into a growing market segment driven by climate action goals.

The financial sector's commitment to net-zero emissions by 2050 is a key driver. This commitment translates into demand for financial products that support the transition to a low-carbon economy, presenting Chailease Holding with a strategic avenue to develop and offer green leasing solutions that align with both market trends and corporate responsibility.

Environmental regulations significantly shape the operational landscape for Chailease Holding's diverse SME clientele. For instance, escalating mandates on carbon emissions and waste management in manufacturing sectors, which saw global industrial CO2 emissions reach an estimated 36.8 billion tonnes in 2023 according to the International Energy Agency, can drive demand for financing new, greener equipment. This presents a direct avenue for Chailease to support its clients' transitions to more sustainable practices through leasing arrangements for advanced machinery.

Conversely, stringent environmental policies can also pose challenges. Sectors heavily reliant on resource extraction or those with a high environmental footprint might face increased compliance costs or even operational restrictions. For example, new regulations on plastic production, a common material in many manufactured goods, could lead to higher input costs for SMEs, potentially impacting their ability to invest in new capital, thereby indirectly affecting Chailease's financing volumes in those specific industries.

Climate change poses dual challenges and prospects for Chailease. Physical risks, like severe weather impacting leased asset value, are a concern. For instance, increased frequency of typhoons in Asia could damage infrastructure leased by Chailease.

Conversely, opportunities abound in financing climate resilience. Chailease can support green initiatives by leasing equipment for renewable energy installations or water conservation projects. The global green finance market is projected to reach trillions by 2030, offering significant growth avenues.

Circular Economy Principles

The growing embrace of circular economy principles, focusing on resource efficiency, reuse, and recycling, is poised to reshape how businesses view asset ownership versus usage. This shift favors models that prioritize access and lifecycle management.

Leasing, by its nature, aligns well with these circular economy objectives by facilitating shared use and managing assets at their end-of-life. This alignment suggests an increasing demand for leasing services as companies seek to reduce waste and improve sustainability.

For Chailease Holding, this trend represents a significant opportunity. For instance, the Ellen MacArthur Foundation reported in 2024 that the global market for circular economy business models could reach $4.5 trillion by 2030, highlighting the substantial economic potential. Companies are increasingly looking for partners who can support their transition to more sustainable operational models.

- Resource Efficiency: Leasing encourages efficient use of assets, reducing the need for new production.

- Reuse and Recycling: Leasing companies often manage asset refurbishment and end-of-life processes, fitting circular models.

- Demand Shift: A move from ownership to usage-based models directly benefits leasing providers.

- Sustainability Goals: Companies pursuing ESG targets will find leasing a strategic enabler.

Carbon Emission Targets and Reporting

Companies globally, including those in Chailease Holding's operating regions, face escalating pressure to meet stringent carbon emission targets and comply with evolving reporting mandates. For instance, many Asian nations are setting ambitious net-zero goals, with Taiwan aiming for 2050. This regulatory landscape directly impacts businesses across all sectors.

While Chailease Holding itself might not be a significant direct emitter, its financing decisions play a crucial role in shaping the environmental impact of its clients. The company's portfolio can inadvertently support carbon-intensive industries, or conversely, steer capital towards more sustainable ventures.

Future financial performance could be influenced by growing incentives and potential regulations encouraging the financing of businesses actively engaged in emissions reduction. This trend may necessitate the development of innovative green financing products and services to align with market demands and regulatory expectations.

- Taiwan's 2050 Net-Zero Goal: This national commitment creates a framework for carbon reduction that will increasingly affect businesses and their financing needs.

- ESG Investment Growth: Global ESG (Environmental, Social, and Governance) investments are projected to reach $50 trillion by 2025, signaling a strong market preference for sustainable businesses.

- Green Bonds Market: The green bond market, a key instrument for financing environmentally friendly projects, saw significant growth, with issuance reaching over $500 billion globally in 2023.

The global drive towards sustainability is heavily influencing investment and business practices. By 2024, sustainable investment funds saw substantial inflows, with assets under management in ESG-focused products reaching trillions worldwide, reflecting a clear investor preference for environmentally and socially responsible companies.

Chailease Holding is positioned to capitalize on this trend by offering leasing for green assets, such as solar panels or electric vehicles, aligning with climate action goals and the financial sector's commitment to net-zero emissions by 2050.

Environmental regulations are increasingly impacting Chailease's SME clients, driving demand for financing greener equipment as seen in the estimated 36.8 billion tonnes of global industrial CO2 emissions in 2023. Conversely, stricter policies can increase compliance costs for certain sectors, potentially affecting financing volumes.

Climate change presents both risks, like physical damage to leased assets from extreme weather, and opportunities in financing climate resilience, with the green finance market projected to reach trillions by 2030.

The circular economy principles, emphasizing resource efficiency and reuse, align well with leasing models, potentially increasing demand as companies seek sustainable operational practices. The global market for circular economy business models could reach $4.5 trillion by 2030.

Companies are facing mounting pressure to meet carbon emission targets, with nations like Taiwan aiming for net-zero by 2050. This regulatory environment necessitates that Chailease Holding consider the environmental impact of its financing decisions, potentially leading to the development of green financing products.

| Environmental Factor | Impact on Chailease Holding | Supporting Data/Trend |

|---|---|---|

| Sustainability Push | Increased demand for green leasing solutions. | ESG investments projected to reach $50 trillion by 2025. |

| Climate Change | Physical risks to assets; opportunities in climate resilience financing. | Green finance market projected to reach trillions by 2030. |

| Circular Economy | Alignment with leasing models, potential for increased demand. | Circular economy business models market could reach $4.5 trillion by 2030. |

| Carbon Emission Targets | Need to finance clients' emissions reduction efforts. | Taiwan's 2050 net-zero goal influences regional business financing. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Chailease Holding is grounded in data from official financial reports, reputable market research firms, and government regulatory bodies. We draw on economic indicators, industry-specific news, and technological advancements to provide a comprehensive overview.