Chailease Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chailease Holding Bundle

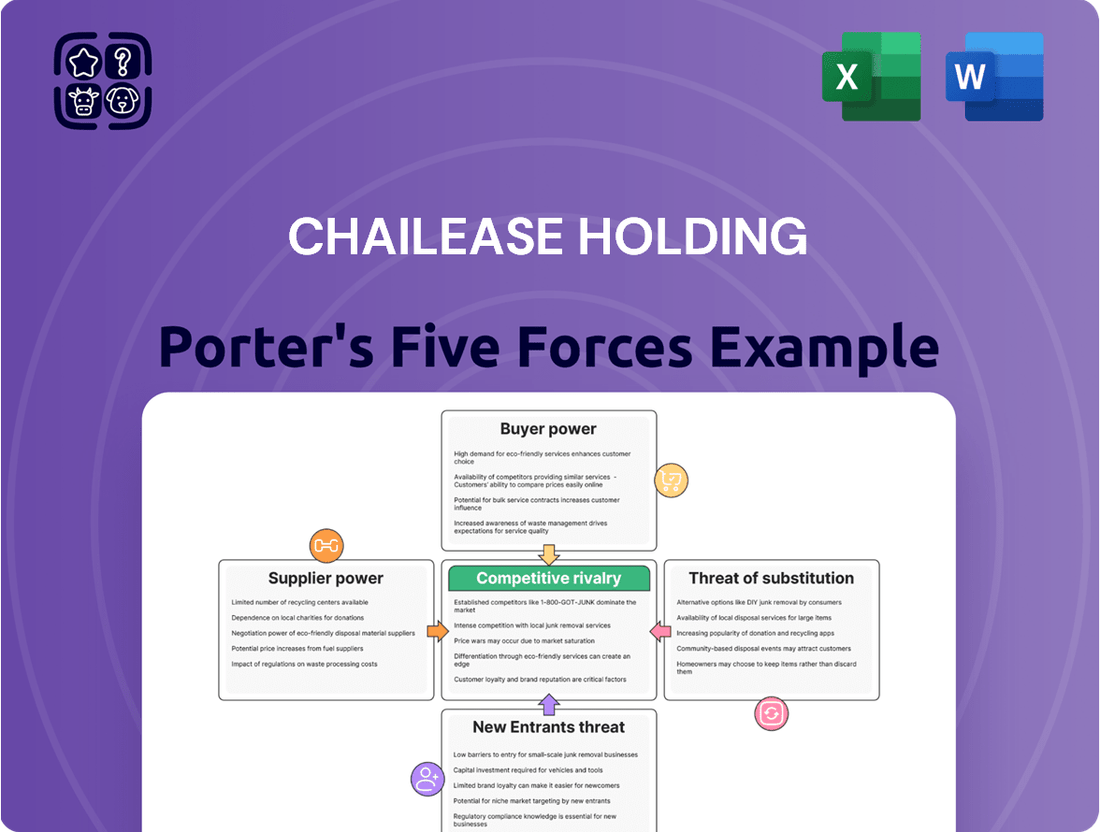

Chailease Holding navigates a competitive landscape shaped by moderate buyer power and the looming threat of substitutes. Understanding these pressures is crucial for any stakeholder looking to grasp the company's strategic positioning.

The full analysis reveals the strength and intensity of each market force affecting Chailease Holding, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Chailease Holding, as a financial services firm, depends on a range of funding channels, including banks and institutional investors. In 2024, the global financial sector saw continued reliance on these traditional sources, with a significant portion of lending still originating from major banking institutions. A concentrated funding landscape means these institutions can wield considerable influence, potentially dictating terms and interest rates, thereby affecting Chailease's operational costs and overall profitability.

The prevailing interest rate environment significantly impacts the bargaining power of Chailease's financial suppliers. When interest rates are on the rise, lenders gain more leverage, commanding higher returns on their capital and thus increasing Chailease's borrowing expenses. For instance, if benchmark rates like the LIBOR or SOFR increase by 100 basis points, the cost of funds for Chailease could rise substantially, directly affecting its profitability and negotiating position with these suppliers.

The regulatory environment significantly influences the bargaining power of funding suppliers. For instance, in 2024, stricter capital adequacy ratios imposed on financial institutions by bodies like the Basel Committee on Banking Supervision can limit their ability to access certain types of funding, making it harder to negotiate favorable terms.

When regulations tighten, such as increased liquidity coverage ratios, financial entities may find fewer institutions willing or able to provide the necessary capital. This scarcity can empower the remaining, compliant funding sources, allowing them to demand higher interest rates or more stringent collateral, thereby increasing their bargaining leverage over companies like Chailease Holding.

Supplier Switching Costs

Supplier switching costs significantly influence the bargaining power of funding suppliers for Chailease Holding. If Chailease faces substantial costs or difficulties in moving from one financing provider to another, such as penalties for early termination of agreements or the significant effort required to build new banking relationships, then existing suppliers gain more leverage.

The ease with which Chailease can shift between different sources of capital is a key determinant of supplier power. For instance, if Chailease has to incur considerable expenses or legal hurdles to exit current loan agreements or establish new credit lines, its current lenders are in a stronger position to dictate terms.

Chailease's operational model, which often involves securing syndicated loans from a diverse range of financial institutions, indicates a degree of flexibility in its funding sourcing. However, the company’s reliance on established, long-term relationships with key lenders for its substantial capital needs means that these suppliers can exert considerable influence.

For example, in 2023, Chailease Holding reported total borrowings of approximately TWD 370 billion. The process of refinancing or securing new, large-scale credit facilities can involve substantial transaction costs and due diligence, reinforcing the bargaining power of established banking partners who are familiar with Chailease’s credit profile and business operations.

- High Switching Costs: Breaking existing loan covenants or early repayment penalties can make it expensive for Chailease to switch funding sources.

- Relationship Dependence: Long-standing relationships with major banks reduce the ease of switching and can increase supplier leverage.

- Syndicated Loan Flexibility: Chailease's ability to access syndicated loans from multiple banks provides some diversification, mitigating the absolute power of any single supplier.

- Transaction Costs: The administrative and legal costs associated with establishing new credit facilities can be significant, acting as a barrier to easy supplier switching.

Availability of Alternative Funding

The availability of alternative funding sources significantly impacts the bargaining power of traditional bank lenders. When companies like Chailease can tap into bond markets or securitization, they lessen their reliance on banks, thereby reducing the lenders' leverage. For instance, Chailease has actively pursued syndicated loans and issued corporate bonds, demonstrating a strategic move to diversify its financing base and gain more favorable terms.

In 2023, Chailease Holding successfully issued unsecured corporate bonds totaling NT$10 billion, with maturities ranging from 3 to 7 years. This issuance provided a substantial alternative to traditional bank financing, allowing the company to manage its capital costs more effectively. By accessing capital markets, Chailease can secure funding at potentially lower interest rates compared to solely relying on bank loans, thus diminishing the bargaining power of individual banks.

- Diversified Funding Channels: Chailease's proactive engagement with bond markets and syndicated loans reduces dependence on any single funding source.

- Cost of Capital Management: Access to alternative funding allows for potentially more competitive interest rates, directly impacting profitability.

- Market Access in 2024: Chailease continues to explore international financing options, further strengthening its position against traditional lenders.

Chailease Holding's suppliers, primarily financial institutions, hold moderate bargaining power. This is influenced by the concentration of major lenders and the costs associated with switching, which can be substantial. However, Chailease's access to diverse funding channels, like syndicated loans and corporate bonds, helps to dilute this power.

In 2023, Chailease Holding's total borrowings were approximately TWD 370 billion, highlighting its significant reliance on external funding. The company's successful issuance of NT$10 billion in corporate bonds in the same year demonstrates its ability to tap into capital markets, thereby reducing its dependence on traditional banks and mitigating their leverage.

| Factor | Impact on Supplier Bargaining Power | Chailease Holding's Position (2023-2024) |

|---|---|---|

| Concentration of Lenders | High concentration increases supplier power. | Moderate; reliance on major banks but diversified relationships. |

| Switching Costs | High costs empower existing suppliers. | Significant; due to loan covenants and relationship building. |

| Availability of Alternatives | Access to alternatives reduces supplier power. | Strengthened; via syndicated loans and corporate bond issuance. |

| Interest Rate Environment | Rising rates empower lenders. | Impacts borrowing costs; managed through diversified funding. |

What is included in the product

This analysis dissects the competitive forces impacting Chailease Holding, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly gauge competitive intensity and identify strategic vulnerabilities with a dynamic Chailease Holding Porter's Five Forces analysis.

Easily adapt the analysis to changing industry dynamics, empowering proactive strategy adjustments for Chailease Holding.

Customers Bargaining Power

Chailease Holding's customer base is largely composed of small and medium-sized enterprises (SMEs), which are spread out across various industries. This fragmentation means that no single SME customer holds enough sway to significantly impact Chailease's pricing or terms on their own. For instance, in 2024, the average lease size for SMEs in many of the markets Chailease operates in remained relatively modest, underscoring the dispersed nature of their client portfolio.

While individual SMEs have limited bargaining power due to their small contribution to Chailease's overall revenue, there's a potential for collective influence. If industry associations or groups of SMEs were to band together, they could potentially exert more pressure. However, the current market structure, with a vast number of independent businesses, dilutes this possibility, keeping individual customer power at a low level.

Small and medium-sized enterprises (SMEs) now have a wider selection of financing avenues beyond traditional banks. These include fintech lenders, peer-to-peer platforms, and various non-bank financial institutions.

The rise of digital lending platforms, particularly in Southeast Asia where Chailease Holding is active, is a significant factor. For instance, by mid-2024, the digital lending market in Southeast Asia was projected to reach over $100 billion, offering businesses more choices and thus increasing their bargaining power.

Customer switching costs for Chailease Holding are generally moderate. While securing new financing requires some administrative steps, customers can readily compare leasing and financing options across various providers, particularly with the increasing prevalence of online comparison tools. This ease of comparison limits the lock-in effect for customers.

Price Sensitivity of SMEs

The price sensitivity of Small and Medium-sized Enterprises (SMEs) significantly influences their bargaining power with financing providers like Chailease. SMEs, often operating with tighter profit margins, are particularly attuned to the cost of capital. This means they actively seek out the most favorable financing terms and interest rates. In 2023, for instance, many SMEs reported that financing costs were a primary concern, with a significant portion indicating they would switch providers for even a modest reduction in fees or interest rates.

This inherent price sensitivity compels Chailease to maintain competitive pricing strategies to attract and retain its SME clientele. If Chailease's financing costs are perceived as too high, SMEs have the leverage to look elsewhere, putting pressure on Chailease to offer attractive rates. This dynamic is crucial for Chailease's market position, especially considering the substantial number of SMEs seeking financing solutions.

- SME Financing Cost Sensitivity: SMEs are highly aware of financing costs, impacting their decision-making.

- Competitive Rate Seeking: This sensitivity drives SMEs to actively search for the best available financing rates and terms.

- Pressure on Chailease Pricing: SMEs’ pursuit of competitive rates forces Chailease to maintain aggressive and attractive pricing to remain viable.

- Market Impact: The collective bargaining power of price-sensitive SMEs can shape the overall pricing landscape in the SME financing sector.

Information Asymmetry

As financial literacy grows among Small and Medium-sized Enterprises (SMEs), the gap in information between Chailease and its clients shrinks. This improved understanding allows customers to more readily compare rates and services across the market, directly impacting their bargaining power.

For instance, by mid-2024, a significant portion of surveyed SMEs reported actively using online comparison tools to evaluate leasing options, a trend that has accelerated in recent years. This increased access to data empowers them to negotiate more favorable terms, potentially reducing the profit margins for less competitive lessors.

- Decreasing Information Asymmetry: SMEs are becoming more informed about market leasing rates and service providers.

- Enhanced Negotiation Position: Better-informed customers can leverage their knowledge to secure better deals.

- Market Rate Awareness: The proliferation of financial education resources and online platforms aids this shift.

- Impact on Lessors: This trend pressures lessors like Chailease to maintain competitive pricing and transparent offerings.

Chailease Holding's customers, primarily Small and Medium-sized Enterprises (SMEs), exhibit significant bargaining power due to their price sensitivity and increasing access to alternative financing options. By mid-2024, the digital lending market in Southeast Asia was projected to exceed $100 billion, offering SMEs more choices and thus strengthening their negotiating position against traditional lessors.

| Factor | Impact on Bargaining Power | Evidence/Data Point (2024) |

| Customer Concentration | Low (fragmented customer base) | Average lease size for SMEs remains modest, indicating dispersed client portfolio. |

| Availability of Alternatives | High (fintech, P2P, non-bank lenders) | Digital lending market in Southeast Asia projected to surpass $100 billion. |

| Switching Costs | Moderate (ease of comparison) | Increased prevalence of online comparison tools facilitates easy evaluation of leasing options. |

| Price Sensitivity | High (focus on financing costs) | SMEs actively seek favorable terms; financing costs are a primary concern, driving provider switching. |

| Information Asymmetry | Decreasing (financial literacy, online tools) | Significant portion of SMEs actively use online comparison tools to evaluate leasing options. |

Preview Before You Purchase

Chailease Holding Porter's Five Forces Analysis

This preview shows the exact Chailease Holding Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It thoroughly details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You're looking at the actual document, ready for download and use the moment you buy.

Rivalry Among Competitors

The financial services sector, particularly leasing and installment sales, presents a crowded field. Chailease contends with a broad spectrum of players, from established commercial banks with extensive resources to niche leasing specialists and agile fintech startups. This diversity means competition can come from multiple angles, each with different strengths and strategies.

Chailease's operational footprint across Taiwan, mainland China, and various ASEAN countries exposes it to distinct competitive pressures in each market. For instance, in Taiwan, it might face intense rivalry from local banks and established leasing firms, while in emerging ASEAN markets, competition could be more fragmented and driven by local players adapting to rapid economic growth.

As of early 2024, the Asian leasing market, a key area for Chailease, continues to see significant activity. While specific competitor market share data for every niche is proprietary, reports indicate that the top five leasing companies in regions like Southeast Asia hold a substantial, though not dominant, portion of the market, highlighting the presence of numerous smaller, specialized competitors.

The financial leasing and SME financing markets are experiencing varied growth rates, which directly impacts how fiercely companies compete. While the overall global financial leasing services market is expected to expand, a more moderate growth pace in certain areas or for particular types of financing can really heat up the competition as firms vie for a larger piece of the pie.

Chailease Holding distinguishes itself through specialized financing solutions tailored to diverse industries, including heavy vehicles and solar power plants. This focus on niche markets, rather than broad commodity-like offerings, inherently reduces direct price competition.

The company's investment in digital services, exemplified by 'zingala' for consumer finance, further enhances its competitive edge by offering accessible and convenient financial products. This digital innovation allows Chailease to extend its customer reach and build loyalty beyond traditional financing models.

By concentrating on these differentiated offerings and customer extension strategies, Chailease can effectively counter the intense rivalry that often characterizes the leasing and financing sector, moving the competitive landscape away from pure price wars.

Exit Barriers

High exit barriers in the financial services sector, including substantial capital outlays for technology and compliance, alongside deeply entrenched customer relationships, can trap less profitable firms. This situation prolongs competition, as these entities may continue operating despite weak performance, thus intensifying the rivalry among existing players. For instance, the financial services industry often requires significant investments in IT infrastructure and cybersecurity, making it costly to divest or shut down operations. In 2024, regulatory compliance costs alone represented a substantial portion of operating expenses for many financial institutions.

These exit barriers mean that even underperforming companies in the leasing sector, like those Chailease Holding might encounter, are less likely to exit quickly. This can lead to a prolonged period of heightened competition, as these firms continue to vie for market share. The long-term nature of many financial contracts and the need to maintain regulatory approval further complicate an exit strategy.

- Significant Capital Investments: Financial institutions often have substantial fixed assets and technology investments that are difficult to liquidate.

- Regulatory Obligations: Stringent regulations govern the closure or sale of financial firms, adding complexity and cost to exiting the market.

- Long-Term Customer Relationships: Established trust and ongoing service contracts make it challenging to sever ties with customers without incurring penalties or reputational damage.

- Specialized Assets: Assets like specialized leasing equipment or proprietary trading platforms may have limited resale value outside the industry.

Strategic Objectives of Competitors

Competitors in the leasing industry often pursue aggressive market share expansion, which intensifies rivalry. For instance, in 2024, several regional leasing firms announced significant capital injections aimed at broadening their customer base and service offerings, directly challenging established players like Chailease.

The strategic objectives of these rivals, whether prioritizing rapid growth or focusing on profitability through tighter credit controls, dictate the competitive landscape. A competitor's decision to expand into new digital leasing platforms, for example, forces Chailease to consider similar innovations to remain competitive.

Chailease must continually monitor and adapt to these evolving competitor strategies. For example, if a major competitor, such as Sumitomo Mitsui Finance and Leasing, increases its investment in ESG-focused leasing solutions, Chailease will need to evaluate its own sustainability initiatives to maintain its market position.

- Aggressive Market Share Expansion: Many competitors aim to grow their footprint, leading to price competition and increased marketing efforts.

- Profitability Focus: Some rivals prioritize higher margins, which can involve stricter lending criteria or focusing on higher-yield segments.

- Niche Market Dominance: Certain competitors concentrate on specific industries or customer types, carving out specialized expertise.

- Digital Transformation: The push towards digital platforms and online services is a key strategic objective for many, requiring significant investment and adaptation.

Competitive rivalry within the financial leasing sector, where Chailease operates, is robust due to a diverse range of competitors. These include large commercial banks, specialized leasing firms, and emerging fintech companies, each vying for market share across Taiwan, mainland China, and ASEAN nations.

The intensity of competition is further shaped by varying market growth rates and strategic objectives of rivals, such as aggressive expansion or a focus on niche markets. For instance, in 2024, several regional leasing firms secured substantial capital to expand their offerings, directly challenging established players.

Chailease aims to mitigate direct price wars by focusing on specialized financing solutions and digital innovation, like its consumer finance platform zingala. This differentiation strategy helps it navigate a landscape where high exit barriers, including significant capital investments and regulatory compliance costs, can prolong competition from even underperforming entities.

| Key Competitor Strategies | Impact on Rivalry | Chailease's Counter-Strategy |

| Aggressive Market Share Expansion | Intensified price competition and marketing efforts. | Focus on specialized solutions and customer loyalty. |

| Niche Market Dominance | Reduced direct competition in specific segments. | Differentiated offerings in heavy vehicles and solar power. |

| Digital Transformation | Need for investment in online platforms and services. | Development of digital services like zingala. |

| Profitability Focus (stricter lending) | Can lead to market segmentation and higher yields for some. | Tailored financing solutions for diverse industries. |

SSubstitutes Threaten

Traditional bank loans represent a significant substitute for Chailease's core offerings, particularly for established small and medium-sized enterprises (SMEs) with robust credit profiles. The availability and pricing of these loans directly impact the competitive landscape, as businesses can opt for conventional financing instead of leasing or installment plans.

In 2024, interest rates on business loans from major banks in many Asian markets remained competitive, hovering in the range of 4-7% for well-qualified borrowers, making them a direct alternative to the financing costs associated with leasing. This accessibility to capital through traditional channels can reduce the perceived value of Chailease's services if bank terms are more favorable.

Larger corporations or those with robust internal cash reserves might bypass leasing companies entirely. They can access capital markets directly by issuing bonds, for instance. In 2024, corporate bond issuance remained a significant source of funding for many established businesses, offering competitive rates that can make leasing less attractive.

Internal funding, generated from retained earnings, is another powerful substitute. Companies with strong profitability can self-finance asset acquisition, eliminating the costs and complexities associated with leasing agreements. This strategy is particularly prevalent among established, cash-rich enterprises.

The proliferation of alternative financing avenues like peer-to-peer (P2P) lending and crowdfunding poses a significant threat of substitution for Chailease Holding. These platforms provide accessible capital, especially for small and medium-sized enterprises (SMEs) and even micro-businesses that may struggle with conventional banking requirements. For instance, the global crowdfunding market was valued at approximately $20 billion in 2023 and is projected to grow substantially, indicating a strong preference for these more agile funding methods.

These digital platforms often streamline the application and disbursement processes, offering a speed and flexibility that traditional financial institutions may not match. This can be particularly attractive to businesses needing quick access to funds for short-term projects or working capital needs, directly competing with the services Chailease provides.

Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later (BNPL) services present a growing threat to traditional installment sales, particularly for smaller purchases where immediate access to goods is prioritized. These services, which include options like Chailease's own 'zingala,' allow consumers to defer payments, effectively substituting for longer-term financing arrangements. The convenience and accessibility of BNPL can draw customers away from established installment plans, especially in competitive retail environments.

The increasing adoption of BNPL underscores its role as a substitute. For instance, in 2023, the global BNPL market was valued at approximately $121.4 billion, with projections indicating substantial growth. This expansion directly impacts sectors where installment credit is a common offering, as consumers may opt for the simpler, often interest-free, BNPL solutions. This shift necessitates that companies like Chailease adapt their offerings or risk losing market share to these agile payment alternatives.

- BNPL as a substitute for traditional installment sales: Offers immediate gratification with deferred payment options, appealing to consumers seeking quick access to goods.

- Market growth of BNPL: The global BNPL market reached an estimated $121.4 billion in 2023, signaling a significant shift in consumer payment preferences.

- Impact on Chailease: Services like 'zingala' compete directly with Chailease's traditional installment offerings, potentially diverting customers.

- Consumer behavior shift: Consumers may favor the perceived simplicity and accessibility of BNPL over more complex installment plans.

Equity Financing

The threat of substitutes for Chailease Holding's leasing services is present, particularly from equity financing. For businesses, especially startups and those in high-growth phases, equity financing through venture capital, private equity, or angel investors can serve as an alternative to traditional leasing or debt-based financing. This is especially true when companies wish to avoid taking on debt obligations.

Equity financing allows companies to raise capital by selling ownership stakes, which can be attractive for those prioritizing flexibility and avoiding interest payments. For instance, in 2024, global venture capital funding reached over $250 billion, indicating a robust alternative for businesses seeking growth capital without the encumbrance of debt.

- Equity financing offers an alternative to debt-based leasing.

- Startups and high-growth firms may prefer equity to avoid debt.

- Global VC funding in 2024 exceeded $250 billion, highlighting this alternative.

While Chailease offers specialized leasing and installment plans, traditional bank loans and direct capital market access remain significant substitutes. For many established businesses, especially SMEs in 2024, competitive interest rates on bank loans, often ranging from 4-7% in key Asian markets, present a direct alternative to leasing financing costs.

Furthermore, larger corporations with strong creditworthiness can bypass leasing companies altogether by issuing corporate bonds, a funding avenue that remained robust in 2024, offering attractive rates that can make leasing less appealing.

Internal funding through retained earnings is another powerful substitute, allowing profitable companies to self-finance asset acquisition, thereby avoiding the costs and complexities associated with leasing agreements.

| Substitute Type | Description | 2024 Relevance/Data Point |

|---|---|---|

| Traditional Bank Loans | Direct financing for businesses with good credit. | Interest rates for qualified borrowers in Asia often between 4-7%. |

| Capital Markets (e.g., Bonds) | Access to funding by issuing debt, suitable for larger corporations. | Corporate bond issuance remained a significant funding source for established businesses. |

| Internal Funding (Retained Earnings) | Self-financing asset acquisition using company profits. | Prevalent for established, cash-rich enterprises prioritizing flexibility. |

Entrants Threaten

The financial services sector, especially in lending and leasing, demands immense capital. This high barrier to entry naturally deters many potential newcomers. Chailease Holding, with its significant asset base and robust funding mechanisms, exemplifies this substantial hurdle for new competitors.

New entrants into the financial leasing sector, where Chailease operates, often encounter significant regulatory complexities and licensing demands across its key markets like Taiwan, China, and ASEAN nations. These stringent requirements are in place to safeguard financial stability and protect consumers, acting as a substantial barrier to entry.

Established players like Chailease Holding benefit from strong brand recognition and customer trust, which are crucial in the leasing industry. For instance, Chailease Holding has cultivated a reputation for reliability, particularly among small and medium-sized enterprises (SMEs) who often prioritize dependable financial partners.

New entrants face a significant hurdle in replicating this level of trust and brand loyalty. Building a comparable reputation requires substantial time and considerable investment in marketing and customer service, making it a formidable barrier to entry.

Economies of Scale and Experience

Chailease benefits significantly from economies of scale in its core operations, encompassing credit assessment, sophisticated risk management, and a broad spectrum of financial product offerings. This scale allows for greater efficiency and lower per-unit costs.

New entrants would find it challenging to replicate Chailease's cost efficiencies. They would need substantial investment to build comparable infrastructure and expertise, especially in specialized or niche markets where Chailease has cultivated deep experience.

- Economies of Scale: Chailease's large operational footprint enables cost reductions in areas like loan processing and administrative overhead.

- Experience Curve: Years of operation have allowed Chailease to refine its risk assessment models and operational processes, creating a competitive advantage.

- Diversified Offerings: A wide range of financial products, from equipment leasing to consumer finance, spreads risk and leverages operational synergies, making it harder for a new entrant to compete across the board.

- Market Penetration: Chailease's established presence in key markets, potentially evidenced by its market share in specific segments, presents a barrier to entry for newcomers aiming for rapid adoption. For instance, in 2023, Chailease reported total assets exceeding NT$1.1 trillion, demonstrating its substantial scale.

Access to Distribution Channels and Customer Networks

Existing financial institutions, like major banks and established leasing companies, have spent years building robust distribution networks and cultivating strong relationships with a broad customer base. This makes it difficult for new entrants to gain traction.

For instance, in 2024, the top five diversified financial services groups in Taiwan by assets under management controlled a significant portion of the market, making it challenging for newcomers to access comparable reach without substantial capital outlay.

New entrants face a considerable hurdle in replicating these established channels and customer loyalty. The cost and time required to build a comparable infrastructure and brand recognition are substantial, acting as a significant barrier to entry in the leasing sector.

- Established players possess extensive branch networks and digital platforms, offering immediate customer access.

- New entrants must invest heavily in marketing and sales to build brand awareness and acquire customers.

- Customer inertia and existing relationships with financial institutions further solidify the advantage of incumbents.

The threat of new entrants for Chailease Holding is generally considered moderate to low. The financial leasing industry requires substantial capital investment to establish operations, acquire assets, and navigate complex regulatory frameworks across its operating regions. For example, in 2023, Chailease Holding reported total assets of NT$1.1 trillion, underscoring the significant scale required to compete effectively.

Newcomers must also overcome established brand loyalty and the extensive distribution networks of incumbents. Building trust and market presence, especially among SMEs that rely on dependable financial partners, takes considerable time and resources. This is further compounded by economies of scale that established players like Chailease leverage, leading to lower operational costs and a more competitive pricing structure.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High initial investment needed for operations and asset acquisition. | Significant deterrent due to substantial financial outlay. |

| Regulatory Hurdles | Complex licensing and compliance across Taiwan, China, and ASEAN. | Time-consuming and costly to navigate, slowing market entry. |

| Brand Loyalty & Trust | Established reputation and customer relationships are critical. | Difficult and expensive for new entrants to replicate. |

| Economies of Scale | Cost advantages from large-scale operations and efficient processes. | New entrants struggle to match cost efficiencies and pricing. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Chailease Holding is built upon a foundation of comprehensive data, including Chailease's annual reports, industry-specific market research from firms like IBISWorld, and financial data from Bloomberg.

We also incorporate insights from regulatory filings, competitor financial statements, and macroeconomic indicators to provide a robust assessment of the competitive landscape impacting Chailease Holding.