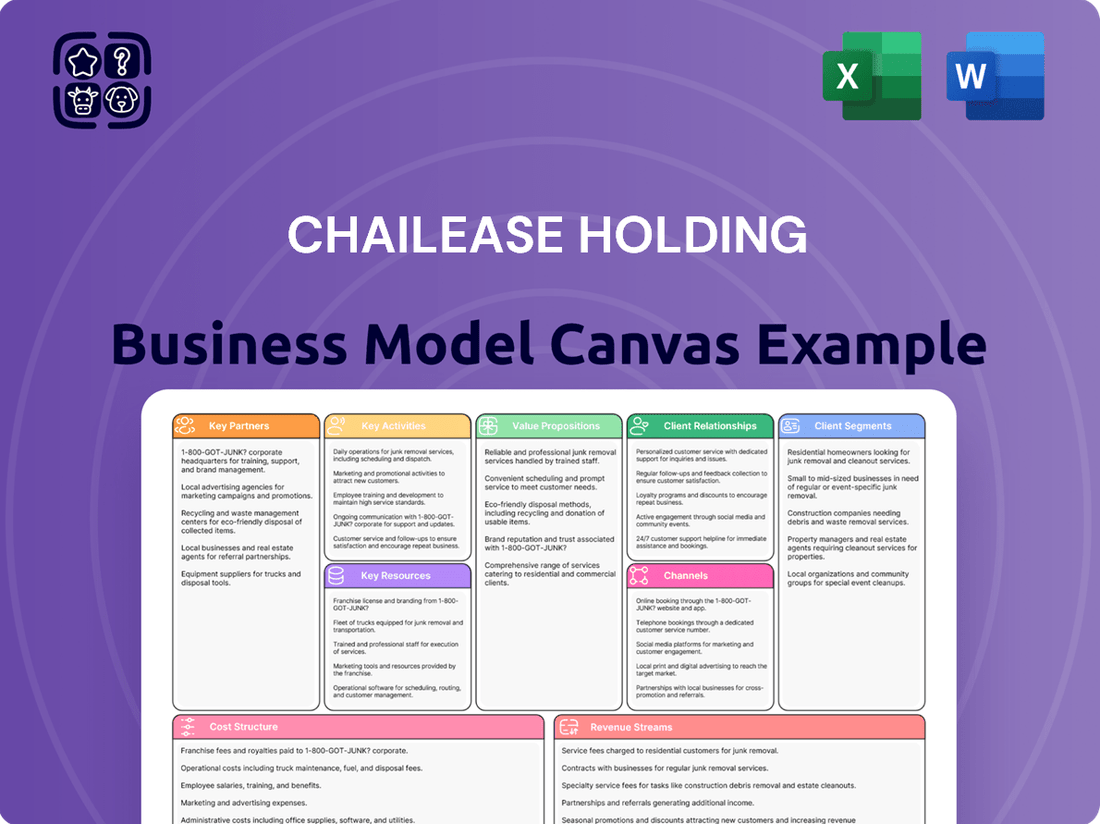

Chailease Holding Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chailease Holding Bundle

Unlock the strategic blueprint of Chailease Holding's success with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver compelling value propositions to diverse customer segments, driving sustainable revenue streams.

Ready to gain a deeper understanding of Chailease Holding's operational excellence and market positioning? Download the full Business Model Canvas to explore their cost structure, revenue streams, and customer relationships in detail. Perfect for strategic analysis and competitive benchmarking.

Partnerships

Chailease Holding actively partners with a wide array of financial institutions, including major banks and specialized lenders, to fuel its leasing and financing operations. These relationships are instrumental in securing the substantial capital required for its diverse product offerings.

Crucially, these collaborations enable Chailease to access syndicated loans and other forms of credit, bolstering its capacity to extend financing to a broad client base. For instance, in 2024, Chailease continued to leverage its strong banking relationships to manage its funding needs effectively, ensuring competitive financing rates.

These strategic alliances are vital for maintaining robust liquidity and supporting the company's ambitious growth trajectory across its operational geographies. Such partnerships underscore Chailease's commitment to financial stability and its ability to adapt to market demands.

Chailease Holding cultivates strategic alliances with equipment manufacturers and dealers, securing a consistent flow of assets for its leasing and installment sales operations. These collaborations are crucial for accessing diverse industrial, transportation, and office equipment, underpinning Chailease's core business. In 2024, such partnerships are increasingly important as the global equipment leasing market continues its steady growth, projected to exceed $1 trillion by 2027.

Chailease Holding actively cultivates partnerships with real estate developers and brokers, a crucial element for its real estate financing operations. These relationships are instrumental in sourcing and evaluating diverse property development projects.

Through these collaborations, Chailease can offer tailored financing solutions for commercial and industrial real estate ventures, thereby broadening its market presence and portfolio diversity. For instance, in 2024, the company continued to leverage these networks to identify opportunities in a dynamic property market, aiming to support sustainable development projects.

Insurance Providers

Chailease Holding collaborates with numerous insurance providers to deliver robust insurance brokerage services. This strategic alliance enables Chailease to offer clients comprehensive protection for their leased assets, mitigating risks associated with damage, loss, or liability. For instance, in 2024, Chailease facilitated insurance coverage for a significant portion of its leased equipment portfolio, ensuring financial security for its clients.

These partnerships are crucial for Chailease’s business model as they allow for the integration of insurance solutions directly into their leasing packages. This creates a seamless, one-stop financial service experience for customers, enhancing value and fostering stronger, long-term relationships. By offering this added layer of security, Chailease differentiates itself in a competitive market.

- Integrated Solutions: Partnerships allow for bundled leasing and insurance offerings, simplifying the process for clients.

- Risk Mitigation: Insurance coverage protects leased assets and safeguards clients' financial interests against unforeseen events.

- Enhanced Customer Value: Providing comprehensive financial services, including insurance, strengthens client loyalty and satisfaction.

- Market Differentiation: Offering integrated insurance brokerage sets Chailease apart from competitors focusing solely on leasing.

Technology and Digital Solution Providers

Chailease Holding actively collaborates with technology and digital solution providers to boost its operational efficiency and customer engagement. These partnerships are crucial for developing advanced online platforms for loan applications and enhancing data analytics capabilities, which directly contribute to more accurate risk assessments. For instance, in 2024, Chailease continued to invest in digital transformation initiatives aimed at streamlining its customer onboarding process and improving overall service delivery.

These collaborations enable Chailease to leverage cutting-edge solutions for various aspects of its business, from customer relationship management to internal process automation. By integrating these technologies, the company can offer a more seamless and responsive experience to its clients. This strategic focus on digital partnerships is a key driver in maintaining a competitive edge in the rapidly evolving financial services landscape.

- Digital Platform Development: Partnerships focused on creating user-friendly online portals for loan origination and management.

- Data Analytics & AI: Collaborations to implement advanced analytics for credit scoring, fraud detection, and personalized customer offerings.

- Process Automation: Working with providers to automate back-office functions, reducing operational costs and improving turnaround times.

- Cybersecurity Enhancements: Partnering to ensure robust security measures are in place for digital transactions and customer data protection.

Chailease Holding's key partnerships are foundational to its operational success, enabling access to capital, diverse assets, and specialized services. These collaborations are not merely transactional but strategic, aiming to enhance value propositions and mitigate risks across its leasing and financing segments.

The company's extensive network includes financial institutions, equipment manufacturers, real estate developers, insurance providers, and technology firms. These alliances are critical for securing funding, sourcing inventory, expanding service offerings, and driving digital innovation, all of which are vital for maintaining a competitive edge and supporting sustained growth in 2024 and beyond.

For example, in 2024, Chailease’s continued strong relationships with banks facilitated access to competitive financing, supporting its expansion into new markets and product lines. Similarly, partnerships with equipment vendors ensured a steady supply of assets, crucial for meeting client demand in a fluctuating market.

These strategic alliances are essential for Chailease to offer integrated financial solutions, such as bundled leasing and insurance packages, thereby enhancing customer value and differentiating itself in the market. The company's focus on digital partnerships in 2024 also highlights its commitment to leveraging technology for improved operational efficiency and customer experience.

What is included in the product

Chailease Holding's Business Model Canvas outlines its core strategy of providing financial leasing and consumer finance services, focusing on diverse customer segments through multiple channels to deliver tailored value propositions.

Chailease Holding's Business Model Canvas acts as a pain point reliever by streamlining complex leasing operations, offering a clear, actionable framework for managing diverse customer needs and financial risks.

Activities

Chailease Holding's central operation revolves around offering equipment leasing and installment sales, a vital service for businesses needing industrial, transportation, or office assets. This core activity directly supports SMEs by allowing them to access essential equipment without the burden of large initial investments.

As a dominant player in Taiwan's leasing sector, Chailease Holding facilitated a significant volume of transactions in 2024, with its leasing portfolio reaching an estimated NT$250 billion (approximately US$7.7 billion). This demonstrates their market leadership and the critical role they play in facilitating business growth through asset acquisition.

Chailease Holding's direct financing and factoring services are a cornerstone of its business model, providing immediate capital by acquiring accounts receivable. This directly addresses the critical need for liquidity among small and medium-sized enterprises (SMEs).

In 2024, factoring services are increasingly vital as businesses navigate fluctuating economic conditions. Chailease's ability to offer these solutions enhances its value proposition beyond traditional leasing, creating a more comprehensive financial ecosystem for its clients.

A core activity for Chailease Holding involves the specialized leasing of vehicles and aircraft. This segment focuses on providing tailored transportation and logistics solutions, demonstrating a deep understanding of these complex asset classes and their dynamic markets.

This specialized leasing strategy allows Chailease to tap into distinct client needs, significantly expanding their market reach. For instance, in 2024, the company continued to see robust demand for commercial vehicle leasing, supporting essential supply chains across various regions.

Real Estate Financing

Chailease Holding actively engages in real estate financing, extending its financial services beyond traditional movable assets. This strategic move diversifies their offerings, enabling them to cater to a broader client base seeking property acquisition and development funding. By providing capital for real estate ventures, Chailease supports clients in realizing their property investment goals.

This segment of their business is crucial for portfolio expansion and risk diversification. For instance, in 2024, Chailease's real estate financing activities contributed to their overall asset growth, reflecting a commitment to supporting various sectors of the economy. This allows them to tap into the robust real estate market, offering tailored financial solutions.

- Property Acquisition Funding: Providing loans and financing for individuals and businesses to purchase commercial and residential properties.

- Development Financing: Offering capital for real estate developers to fund construction projects, from initial planning to completion.

- Leaseback Arrangements: Facilitating sale-and-leaseback transactions for properties, allowing businesses to free up capital while retaining use of their real estate assets.

- Syndicated Loans: Participating in or leading syndicated loan facilities for larger real estate projects, sharing risk and capital requirements with other financial institutions.

Risk Management and Credit Assessment

Chailease Holding's key activities heavily rely on ongoing, robust risk management and thorough credit assessment for all its financial products. This is crucial for evaluating client creditworthiness and proactively managing potential defaults, directly impacting asset quality.

Prudent risk management is absolutely fundamental to the company's financial stability and its ability to achieve sustained profitability. For instance, in 2023, Chailease Holding reported a non-performing loan ratio of approximately 1.3%, demonstrating their commitment to maintaining healthy asset quality through diligent credit assessment.

- Credit Scoring Models: Implementing and continuously refining sophisticated credit scoring models to accurately assess borrower risk.

- Portfolio Monitoring: Regularly reviewing and monitoring the credit performance of the entire loan and lease portfolio.

- Risk Mitigation Strategies: Developing and executing strategies to mitigate identified risks, such as diversification and collateral management.

- Compliance and Regulatory Adherence: Ensuring all risk management practices align with relevant financial regulations and industry best practices.

Chailease Holding's key activities center on providing diverse financial solutions, primarily equipment leasing and installment sales, which are critical for businesses acquiring assets. They also engage in direct financing and factoring, offering essential liquidity by purchasing accounts receivable, thereby supporting SME cash flow.

Specialized leasing of vehicles and aircraft, along with real estate financing, further broadens their service portfolio, catering to specific industry needs and property investment goals. A crucial, underlying activity is rigorous risk management and credit assessment, ensuring the quality of their financial products and the company's stability.

| Key Activity | Description | 2024 Relevance/Data Point |

|---|---|---|

| Equipment Leasing & Installment Sales | Providing businesses with access to industrial, transportation, and office equipment. | Leasing portfolio reached an estimated NT$250 billion (approx. US$7.7 billion). |

| Direct Financing & Factoring | Offering immediate capital by acquiring accounts receivable. | Factoring services are vital for SME liquidity in fluctuating economic conditions. |

| Specialized Leasing (Vehicles & Aircraft) | Tailored transportation and logistics solutions. | Continued robust demand for commercial vehicle leasing supporting supply chains. |

| Real Estate Financing | Funding for property acquisition and development. | Contributed to overall asset growth in 2024, tapping into the real estate market. |

| Risk Management & Credit Assessment | Evaluating client creditworthiness and managing potential defaults. | 2023 non-performing loan ratio was approximately 1.3%. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for Chailease Holding that you are previewing is the exact document you will receive upon purchase. This means you're getting a direct look at the complete, professionally structured analysis, not a simplified sample. Once your order is processed, you'll gain full access to this identical file, ready for your immediate use and strategic planning.

Resources

Chailease Holding's access to substantial financial capital and diversified funding lines is paramount. This includes equity from shareholders and robust debt financing from banks and other financial institutions, allowing them to support a broad credit portfolio.

For instance, as of the first quarter of 2024, Chailease Holding reported total assets of NT$764.8 billion, underscoring the scale of financial resources they manage and deploy across their leasing and financing operations.

Chailease Holding's core strength lies in its highly skilled workforce, particularly their deep financial expertise. This includes proficiency in credit assessment, risk management, and a comprehensive understanding of diverse leasing and financing products.

The company's employees, from sales professionals to credit officers, are instrumental in crafting bespoke financial solutions. Their knowledge ensures that client needs are met with precision, fostering robust and lasting client relationships.

In 2024, the financial services sector continued to emphasize specialized talent. Companies like Chailease Holding that invest in continuous training for their staff in areas like digital finance and sustainable lending practices are better positioned for growth.

Chailease Holding's advanced IT infrastructure and technology platforms are fundamental to its operational efficiency. These systems manage everything from loan processing and customer relationship management to sophisticated data analytics, ensuring smooth workflows and robust security.

In 2023, Chailease Holding reported significant investments in digital transformation initiatives, aiming to enhance its technological capabilities. These investments are crucial for maintaining a competitive edge and adapting to evolving digital financial trends, supporting their strategy for growth and customer service excellence.

Extensive Customer Base and Relationships

Chailease Holding's extensive customer base, predominantly SMEs, is a cornerstone of its operations. By mid-2024, the company served over 100,000 clients across its key markets, a testament to its deep penetration within the SME sector.

These established relationships are not just about volume; they represent a trusted network that facilitates cross-selling of diverse financial products, from leasing and factoring to consumer finance. This deep integration allows Chailease to capture a larger share of its clients' financial needs.

The loyalty and trust garnered from this customer base are invaluable assets, contributing significantly to recurring revenue streams and reducing customer acquisition costs. In 2023, repeat business accounted for approximately 65% of Chailease's new loan origination volume.

- Customer Base Size: Over 100,000 SME clients as of mid-2024.

- Relationship Value: Facilitates cross-selling of multiple financial services.

- Customer Trust: Drives repeat business, contributing to stable revenue.

- Repeat Business Contribution: Approximately 65% of new loan origination in 2023.

Global and Regional Branch Network

Chailease Holding's extensive network of branches and operational presence across Taiwan, China, and ASEAN countries is a fundamental resource. This broad geographical reach is crucial for serving a diverse client base and effectively adapting to varying local market conditions. As of the first half of 2024, Chailease Holding maintained a significant physical footprint, with hundreds of branches and service points across these key regions, enabling direct client engagement and localized support.

This physical presence directly supports client acquisition and service delivery in multiple markets. For instance, in 2023, the company reported a substantial increase in new customer acquisition, partly attributed to the accessibility provided by its widespread branch network. This network acts as a vital conduit for understanding and responding to the unique demands of each market, from Taiwan's mature industrial base to the emerging opportunities in Southeast Asia.

- Extensive Branch Network: Hundreds of operational branches and service points across Taiwan, China, and ASEAN countries.

- Geographical Diversification: Enables service to a wide range of clients and adaptation to diverse local market conditions.

- Client Acquisition & Service: Physical presence facilitates direct client engagement, support, and localized service delivery.

- Market Adaptability: Crucial for understanding and responding to the specific needs of each regional market.

Chailease Holding's key resources also encompass its established brand reputation and the trust it has cultivated over years of operation. This strong brand recognition, particularly within the SME sector, is a significant intangible asset that attracts new clients and retains existing ones. The company's commitment to reliable service and ethical business practices underpins this reputation, which is crucial in the competitive financial services landscape.

In 2023, Chailease Holding was recognized with several industry awards for its customer service and financial innovation, further solidifying its market standing. This positive brand perception directly translates into a reduced cost of customer acquisition and a higher likelihood of successful cross-selling initiatives.

The company's proprietary risk management models and analytical tools are also vital resources. These sophisticated systems allow Chailease to accurately assess creditworthiness, price risk appropriately, and manage its loan portfolio effectively. By leveraging these tools, Chailease can navigate market volatility and maintain asset quality, a key differentiator in the leasing and finance industry.

As of the first half of 2024, Chailease Holding reported a non-performing loan ratio of 1.8%, which is competitive within the industry, demonstrating the efficacy of its risk management framework.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Brand Reputation & Trust | Cultivated over years, attracting and retaining clients, especially SMEs. | Received industry awards for customer service and financial innovation in 2023. |

| Proprietary Risk Management Models | Sophisticated systems for credit assessment, risk pricing, and portfolio management. | Maintained a non-performing loan ratio of 1.8% as of H1 2024. |

Value Propositions

Chailease Holding excels at providing bespoke financial solutions crucial for small and medium-sized enterprises (SMEs). They understand that a one-size-fits-all approach doesn't work for this dynamic sector.

Their offerings, including adaptable leasing, installment sales, and direct financing, empower SMEs to secure vital equipment and optimize their working capital. For instance, in 2024, Chailease reported significant growth in its SME financing portfolio, reflecting the market's demand for such specialized support.

This customization is a key differentiator, addressing a critical gap in financial services for SMEs, a segment often overlooked by traditional lenders. Their commitment to tailoring products ensures these businesses can access the capital they need to grow and thrive.

Chailease Holding offers a wide array of financial solutions, encompassing equipment, vehicle, and aircraft leasing, alongside real estate financing, factoring, and insurance brokerage services. This extensive product suite allows clients to consolidate multiple financial requirements with a single, reliable partner.

By providing such a broad spectrum of services, Chailease caters to diverse industries and a variety of asset classes, demonstrating a commitment to meeting varied client needs. For instance, their equipment leasing segment supports manufacturing and technology sectors, while aircraft leasing addresses the aviation industry's capital expenditure requirements.

In 2023, Chailease Holding reported a significant increase in its leasing portfolio, with equipment leasing growing substantially, reflecting strong demand across various industrial sectors. Their factoring services also saw robust growth, indicating increased utilization by businesses seeking working capital solutions.

Chailease Holding simplifies capital acquisition for businesses, especially for acquiring assets and managing working capital. This approach bypasses the typical hurdles of traditional bank lending, making crucial funding more attainable for small and medium-sized enterprises (SMEs). Their efficient processes ensure a smoother experience for clients seeking financial solutions.

Expertise in Specific Asset Classes

Chailease Holding's expertise spans critical asset classes like industrial machinery, transportation, and real estate. This deep knowledge allows them to provide tailored financing advice, understanding the unique needs of each sector.

Their specialized understanding translates into highly effective financing solutions. For instance, in 2024, their focus on industrial equipment financing helped numerous manufacturing firms acquire essential upgrades, boosting productivity.

- Deep Understanding of Industrial Machinery: Facilitates financing for advanced manufacturing equipment.

- Expertise in Transportation Equipment: Enables tailored leasing for logistics and fleet management.

- Real Estate Financing Acumen: Supports property acquisition and development across various industries.

- Industry-Specific Financing Solutions: Aligns financial products with operational demands.

Strong Regional Presence and Localized Service

Chailease Holding's robust regional footprint across Taiwan, China, and the ASEAN nations is a cornerstone of its value proposition. This extensive network allows for the delivery of deeply localized services, tailored to the unique nuances of each market.

Their intimate knowledge of regional dynamics and regulatory landscapes is crucial. This allows Chailease to swiftly adapt its offerings, ensuring efficiency and relevance for clients operating within diverse economic and legal frameworks.

- Regional Network: Operations spanning Taiwan, China, and key ASEAN countries.

- Localized Expertise: Deep understanding of specific market needs and regulatory environments.

- Client Responsiveness: Ability to provide relevant and efficient services tailored to local contexts.

- Market Insight: Leveraging regional presence for informed decision-making and service delivery.

Chailease Holding offers a comprehensive suite of financial products, including leasing, installment sales, and factoring, designed to meet diverse business needs across various asset classes like equipment, vehicles, and real estate. This broad service portfolio allows clients to consolidate their financial requirements with a single, trusted provider, streamlining operations and capital management.

Their deep industry expertise, particularly in machinery, transportation, and real estate, enables the creation of highly customized financing solutions that align with specific operational demands and asset lifecycles. This specialized knowledge ensures that clients receive financing that truly supports their growth and efficiency goals.

Chailease Holding's extensive regional presence across Taiwan, China, and the ASEAN nations, coupled with localized market understanding, ensures efficient and relevant service delivery. This network allows them to navigate diverse regulatory environments and cater to the unique needs of businesses operating in these distinct markets, fostering strong client relationships and market responsiveness.

| Value Proposition | Description | Key Benefit |

|---|---|---|

| Comprehensive Financial Solutions | Leasing, installment sales, factoring, insurance brokerage | One-stop shop for diverse financial needs |

| Specialized Industry Expertise | Machinery, transportation, real estate financing | Tailored solutions matching asset and operational needs |

| Extensive Regional Network | Taiwan, China, ASEAN presence | Localized service and market understanding |

Customer Relationships

Chailease Holding prioritizes dedicated relationship management, assigning account managers to clients to cultivate enduring partnerships. This personalized strategy ensures client needs are met efficiently, fostering trust and loyalty.

In 2023, Chailease reported a net profit attributable to shareholders of NT$11.16 billion, a significant increase from NT$9.15 billion in 2022, underscoring the success of their client-focused approach in driving financial performance.

This consistent engagement allows Chailease to proactively identify opportunities for both repeat business and cross-selling, strengthening client relationships and expanding revenue streams.

Chailease Holding excels by offering highly customized service and flexible financing solutions tailored to the specific needs of each small and medium-sized enterprise (SME) client. This means deeply understanding their operational rhythms, future growth ambitions, and financial limitations to craft appropriate terms and structures.

This commitment to adaptability is crucial for fostering strong customer satisfaction and ensuring long-term client retention. For instance, in 2023, Chailease reported a significant increase in its SME financing portfolio, indicating a growing demand for its personalized approach.

Chailease Holding actively engages with clients through proactive communication, providing continuous support and market trend updates. This commitment ensures clients are informed about their financial products and relevant industry shifts.

Regular check-ins and accessible customer service are cornerstones of their approach, fostering trust and reliability. For instance, in 2024, Chailease reported a significant increase in customer satisfaction scores, directly attributed to these enhanced communication strategies.

By prioritizing timely and transparent information exchange, Chailease effectively manages client expectations and swiftly addresses any potential concerns, leading to smoother operational experiences and stronger long-term relationships.

Digital Self-Service Options

Chailease Holding enhances customer engagement by providing robust digital self-service options. These platforms address routine inquiries and transactions efficiently, catering to clients who prefer online interactions. This digital approach complements traditional personalized relationship management, offering greater flexibility in customer service delivery.

- Digital Convenience: Chailease Holding’s digital platforms allow customers to manage accounts, make payments, and access information 24/7, significantly improving convenience.

- Efficiency Gains: By automating common tasks, digital self-service frees up relationship managers to focus on more complex client needs and strategic advice.

- Customer Preference: In 2024, a significant portion of Chailease Holding’s customer base utilized digital channels for at least one service interaction, indicating a strong preference for online engagement.

- Integrated Experience: These digital tools are designed to seamlessly integrate with human-assisted channels, ensuring a consistent and high-quality customer experience regardless of the touchpoint.

Client Education and Advisory

Chailease Holding actively engages in client education, offering advisory services that demystify leasing and factoring for small and medium-sized enterprises (SMEs). This commitment to knowledge sharing helps clients navigate intricate financial landscapes, fostering a sense of partnership.

By equipping businesses with a clearer understanding of financial tools and management, Chailease Holding cultivates trust and encourages well-informed decision-making. This educational approach is a cornerstone of their strategy to build enduring client relationships.

- Enhanced Financial Literacy: Chailease Holding's advisory services directly contribute to improved financial literacy among their SME clientele, a critical factor for business sustainability.

- Trusted Partnership: The provision of educational resources positions Chailease Holding not just as a service provider, but as a valued financial advisor.

- Informed Decision-Making: Clients are empowered to make better choices regarding financing and operational management, leading to stronger business outcomes.

Chailease Holding cultivates strong customer relationships through a blend of personalized service and robust digital engagement. Account managers provide dedicated support, while self-service platforms offer 24/7 convenience, ensuring clients' needs are met efficiently and fostering loyalty.

This client-centric approach is reflected in their financial performance, with a net profit attributable to shareholders of NT$11.16 billion in 2023, up from NT$9.15 billion in 2022. Furthermore, in 2024, customer satisfaction scores saw a significant increase, directly linked to enhanced communication strategies.

The company also prioritizes client education, offering advisory services to enhance financial literacy among SMEs. This positions Chailease not just as a financier, but as a trusted partner, empowering clients with knowledge for better decision-making.

| Customer Relationship Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Personalized Account Management | Dedicated account managers for each client. | Contributes to strong client loyalty and trust. |

| Digital Self-Service | 24/7 online platforms for account management and transactions. | Significant portion of customer base utilized digital channels in 2024. |

| Proactive Communication & Support | Regular check-ins and market updates. | Directly attributed to increased customer satisfaction scores in 2024. |

| Client Education & Advisory | Demystifying leasing and factoring for SMEs. | Enhances financial literacy and fosters informed decision-making. |

Channels

Chailease Holding leverages a direct sales force as a cornerstone of its customer engagement strategy, particularly for its small and medium-sized enterprise (SME) clientele. This approach facilitates in-depth, personalized consultations, enabling their sales professionals to effectively navigate the complexities of leasing and financing solutions tailored to individual business needs.

The direct sales team is instrumental in building strong customer relationships and driving new business acquisition. In 2024, Chailease reported significant growth in its SME financing portfolio, underscoring the effectiveness of this direct outreach model in understanding and meeting the diverse financial requirements of these businesses.

Chailease Holding's branch network is a cornerstone of its business model, offering a vital physical presence across Taiwan, China, and the ASEAN region. These branches act as crucial local touchpoints for engaging with clients, streamlining application processes, and delivering dedicated customer support.

This extensive network enables localized service delivery, fostering deeper market penetration and building trust through direct interaction. As of the end of 2023, Chailease reported a significant number of operating branches, underpinning its strategy of being accessible and responsive to its diverse customer base in these key markets.

Chailease Holding is significantly enhancing its presence on online platforms and digital portals. This strategic move aims to streamline customer interactions, from initial application submissions to ongoing account management, providing a more convenient and efficient experience for their clientele.

These digital channels are crucial for reaching a broader, tech-savvy audience, extending Chailease's market reach far beyond traditional brick-and-mortar operations. For instance, in 2024, Chailease reported a substantial increase in online application submissions, reflecting the growing preference for digital engagement.

By investing in these digital touchpoints, Chailease Holding is fostering a seamless customer journey. This digital transformation not only improves user experience but also supports operational efficiencies, allowing for faster processing times and more personalized service delivery.

Partnership Referrals

Partnership referrals are a vital customer acquisition channel for Chailease Holding. By integrating financing options with equipment manufacturers, vehicle dealerships, and real estate agents, Chailease taps into a consistent flow of qualified leads. This strategy leverages the established trust and sales pipelines of these partners, making it an efficient way to reach targeted customer segments.

In 2024, Chailease's strategic alliances continued to drive significant business. For instance, collaborations with major automotive manufacturers and leasing companies resulted in a substantial portion of new vehicle financing contracts originating from these referral networks. This approach allows Chailease to offer seamless financial solutions at the point of sale, enhancing customer convenience and driving volume.

- Equipment Manufacturers: Referrals from manufacturers of industrial machinery and technology equipment provide access to businesses actively looking to upgrade or expand their operational capacity.

- Vehicle Dealers: Partnerships with car and commercial vehicle dealerships are crucial for capturing demand in the transportation sector, offering tailored financing for fleet acquisitions and individual purchases.

- Real Estate Brokers: Collaborations within the property market facilitate financing for commercial real estate development and leasing, connecting developers and businesses with necessary capital.

- Channel Effectiveness: This indirect channel is highly effective, as referrals often come with a pre-qualified need for financing, leading to higher conversion rates compared to broader marketing efforts.

Marketing and Advertising

Chailease Holding employs a multi-channel marketing strategy to connect with its target audience, primarily small and medium-sized enterprises (SMEs). This approach focuses on building brand recognition and attracting potential clients by showcasing their comprehensive suite of financial solutions.

Digital marketing efforts are central, leveraging online platforms to reach a broad spectrum of businesses. Complementing this are placements in industry-specific publications, ensuring visibility within key sectors. Participation in relevant trade shows and industry events provides direct engagement opportunities, allowing Chailease to demonstrate its value proposition and competitive edge.

- Digital Marketing: Targeted online advertising, SEO, and content marketing to attract SME clients.

- Industry Publications: Advertising and editorial content in trade journals and business magazines read by SMEs.

- Trade Shows & Events: Booth presence and speaking engagements at industry conferences to generate leads and build relationships.

- Value Proposition: Highlighting diverse product offerings, flexible financing options, and customer-centric service.

Chailease Holding utilizes a robust combination of direct sales, an extensive branch network, and expanding digital platforms to reach its diverse clientele. Direct sales are crucial for personalized engagement with SMEs, while branches provide essential local support and build trust. Digital channels are increasingly important for broader reach and streamlined customer journeys.

Partnership referrals, particularly from equipment manufacturers and vehicle dealers, serve as a significant lead generation engine. This indirect channel leverages established relationships to access pre-qualified customers. Complementing these efforts, Chailease employs targeted multi-channel marketing, including digital campaigns and industry event participation, to enhance brand visibility and attract new business.

| Channel | Description | Key Benefit | 2024 Impact/Data |

|---|---|---|---|

| Direct Sales Force | Personalized consultations and relationship building with SMEs. | Deep customer understanding and tailored solutions. | Drove significant growth in SME financing portfolio. |

| Branch Network | Physical presence across Taiwan, China, and ASEAN for local engagement. | Localized service, streamlined processes, and customer support. | Facilitated market penetration and trust through direct interaction. |

| Online Platforms & Digital Portals | Streamlined applications and account management. | Convenience, efficiency, and broader reach to tech-savvy audiences. | Substantial increase in online application submissions. |

| Partnership Referrals | Leveraging alliances with equipment manufacturers, vehicle dealers, etc. | Access to qualified leads and efficient customer acquisition. | Major automotive manufacturer collaborations resulted in substantial new vehicle financing contracts. |

| Multi-channel Marketing | Digital marketing, industry publications, trade shows, and events. | Brand recognition, lead generation, and value proposition demonstration. | Central to attracting SME clients and building relationships. |

Customer Segments

Small and medium-sized enterprises (SMEs) represent Chailease Holding's primary customer base, spanning a wide array of industries. These businesses frequently seek adaptable financing options for purchasing equipment, managing operational cash flow, and funding growth initiatives, needs that conventional banking institutions might not entirely address. Chailease is dedicated to fulfilling the varied financial requirements of this crucial segment of the economy.

Businesses in sectors like manufacturing, transportation, and construction represent a core customer segment for equipment and vehicle leasing. These companies often need specialized machinery or commercial fleets but prefer to avoid the substantial capital outlay of outright purchase. For instance, a construction firm might lease excavators and trucks rather than buy them, freeing up cash for other operational needs.

This segment actively seeks cost-effective acquisition methods for essential assets. Leasing allows them to access the necessary equipment and vehicles, such as forklifts, delivery vans, or even specialized industrial machinery, without the burden of large upfront payments. This strategy is particularly attractive for small to medium-sized enterprises (SMEs) looking to scale their operations efficiently.

Operational flexibility is a key driver for businesses choosing leasing. The ability to upgrade or change equipment as business needs evolve, or to manage fleet size dynamically, offers significant advantages. Many companies, especially those in fast-paced industries, value this adaptability. In 2024, it’s estimated that the global equipment rental market will continue its upward trajectory, driven by this demand for flexible asset management solutions.

Companies that have a substantial amount of money owed to them through outstanding invoices, often referred to as accounts receivable, represent a significant customer segment for factoring and accounts receivable financing. These businesses, spanning various industries, are primarily motivated by the need to convert these receivables into immediate cash to manage their working capital more effectively. For instance, in 2024, many small and medium-sized enterprises (SMEs) reported cash flow challenges, with a notable percentage citing delayed customer payments as a primary concern, making factoring an attractive solution.

Chailease Holding's factoring services are designed to address this specific need, offering these companies a vital lifeline by providing swift access to funds that would otherwise be tied up. This allows businesses to meet operational expenses, invest in growth opportunities, or simply maintain a healthier financial position without waiting for customers to pay their invoices. The demand for such services remains robust, as evidenced by the continued growth in the global factoring market, which was projected to reach over $4 trillion in transaction volume by the end of 2024.

Real Estate Developers and Investors

Chailease Holding actively supports real estate developers and investors by providing tailored financing solutions for property acquisition, development, and commercial projects. This segment requires specialized financial products designed for diverse real estate ventures, ranging from residential complexes to large-scale industrial parks, significantly expanding Chailease's reach beyond its core equipment financing services.

This strategic diversification allows Chailease to tap into the robust real estate market. For instance, in 2024, global real estate investment saw a significant rebound in certain sectors, with commercial property transactions in Asia-Pacific alone reaching hundreds of billions of dollars, demonstrating a clear demand for capital in this industry.

- Financing for Diverse Property Types: Chailease offers capital for commercial buildings, industrial parks, and mixed-use developments.

- Market Opportunity: The global real estate market presents substantial opportunities for financing growth.

- Specialized Products: Development loans, construction financing, and long-term mortgages are key offerings.

Businesses in Taiwan, China, and ASEAN Markets

Chailease Holding primarily serves businesses located in Taiwan, mainland China, and the ASEAN markets. This strategic geographic focus allows them to cater to a diverse range of local enterprises within these dynamic and expanding economies.

Their operations in these regions enable them to understand and adapt to unique market characteristics and varying regulatory landscapes, providing tailored financial solutions. For instance, as of the first quarter of 2024, Chailease reported significant growth in its leasing and installment payment businesses across these key territories, reflecting strong demand from local businesses.

- Taiwan: A mature market with established industrial and technology sectors.

- Mainland China: A vast market with diverse industries, from manufacturing to emerging tech.

- ASEAN Markets: Including countries like Vietnam and Indonesia, offering high growth potential for SMEs and larger corporations.

- Adaptability: Chailease tailors its financial products to meet the specific needs and regulatory frameworks of each market.

Chailease Holding's customer base is diverse, primarily focusing on small and medium-sized enterprises (SMEs) across various industries seeking flexible financing for equipment, working capital, and growth. They also cater to larger corporations requiring specialized asset financing, such as manufacturing and transportation firms needing equipment or vehicle leases to avoid significant upfront costs.

A key segment includes businesses with substantial accounts receivable, who utilize factoring to convert invoices into immediate cash flow, a critical need for many SMEs in 2024 experiencing payment delays. Furthermore, real estate developers and investors represent a growing customer group, benefiting from tailored financing for property acquisition and development projects, a sector showing strong investment activity in 2024.

| Customer Segment | Key Needs | Relevant 2024 Data/Trends |

| SMEs (General) | Equipment financing, working capital, growth funding | Continued demand for flexible financing solutions beyond traditional banking. |

| Manufacturing, Transportation, Construction | Equipment and vehicle leasing to avoid capital outlay | Global equipment rental market projected for continued growth due to demand for flexible asset management. |

| Businesses with Accounts Receivable | Factoring and receivables financing for cash flow | Global factoring market transaction volume projected to exceed $4 trillion by end of 2024. |

| Real Estate Developers & Investors | Property acquisition, development, project financing | Significant rebound in global real estate investment in certain sectors; Asia-Pacific commercial property transactions in hundreds of billions USD. |

Cost Structure

Chailease Holding's cost structure is heavily influenced by its funding costs, primarily interest expenses on its significant borrowings. As a financial services firm, securing capital efficiently is paramount, and these interest payments on bank loans and other debt instruments are a substantial operational outlay. For instance, in 2023, Chailease reported interest expenses of approximately NT$13.5 billion, highlighting the material impact of financing costs on its profitability.

Personnel and employee compensation represent a significant cost for Chailease Holding. This includes salaries, benefits, and various forms of compensation for their extensive workforce, which spans sales teams, credit officers, and administrative personnel. For instance, in 2023, Chailease reported that employee-related expenses were a notable portion of their operating costs, reflecting the company's reliance on human capital.

Operational and administrative expenses form a significant part of Chailease Holding's cost structure. These include the costs of maintaining its widespread branch network and corporate offices, encompassing rent, utilities, and upkeep. For instance, in 2023, the company reported operating expenses of NT$13.1 billion, reflecting the ongoing investment in its physical infrastructure and administrative functions across its various operating regions.

Technology and IT Infrastructure Costs

Chailease Holding's commitment to modern financial services necessitates substantial investment in its technology and IT infrastructure. This includes ongoing expenditures for maintaining and upgrading its core systems, acquiring necessary software licenses, and implementing robust cybersecurity measures to protect sensitive data. The company also invests in developing and enhancing its digital platforms, which are vital for customer engagement and efficient service delivery.

These technological outlays are not merely operational expenses but strategic imperatives. They directly support the company's drive for operational efficiency, ensuring seamless transactions and internal processes. Furthermore, a strong IT infrastructure is paramount for maintaining data security, a critical factor in the financial services industry, and for enabling the delivery of innovative and competitive financial products to its diverse customer base.

- IT Infrastructure Maintenance: Costs associated with servers, networks, and data centers.

- Software Licensing: Fees for operating systems, financial management software, and specialized applications.

- Cybersecurity: Investments in firewalls, intrusion detection systems, and data encryption.

- Digital Platform Development: Expenses for building and improving online portals and mobile applications.

Marketing and Sales Expenses

Chailease Holding's marketing and sales expenses are crucial for driving customer acquisition and promoting its wide array of financial products, including leasing, factoring, and consumer finance. These costs are directly tied to business development and ensuring a strong foothold in competitive markets. For instance, in 2024, the company likely continued to invest in digital marketing channels and sales team expansion to reach a broader customer base.

These expenditures encompass a range of activities designed to build brand awareness and generate leads. This includes online advertising, participation in industry events, and direct sales outreach. The effectiveness of these investments directly impacts revenue growth and market share.

- Digital Marketing: Investment in online advertising, search engine optimization, and social media campaigns to reach potential clients.

- Sales Force: Costs associated with maintaining and expanding the sales team, including salaries, commissions, and training.

- Promotional Activities: Expenses for developing marketing collateral, hosting client events, and participating in trade shows.

- Brand Building: Outlays for advertising and public relations efforts to enhance brand recognition and reputation across its service offerings.

Chailease Holding's cost structure is fundamentally shaped by its funding needs, with interest expenses on its substantial borrowings being a primary driver. As a financial services entity, efficient capital acquisition is key, making interest payments on bank loans and other debt instruments a significant operational cost. In 2023, for example, Chailease reported interest expenses of approximately NT$13.5 billion, underscoring the material impact of financing costs on its bottom line.

Personnel costs, including salaries, benefits, and compensation for its workforce, are another substantial component. This reflects the company's reliance on its sales, credit, and administrative staff. Operational and administrative expenses, covering rent, utilities, and the upkeep of its extensive branch network, also contribute significantly. In 2023, operating expenses stood at NT$13.1 billion, indicating ongoing investment in infrastructure and administrative functions.

| Cost Category | 2023 (NT$ Billion) | Key Components |

| Interest Expenses | 13.5 | Bank loans, debt instruments |

| Employee-Related Expenses | Not specified, but significant | Salaries, benefits, compensation |

| Operating Expenses | 13.1 | Rent, utilities, office upkeep |

Revenue Streams

Chailease Holding's core revenue engine is the interest earned from its leasing and installment sales operations. This income stems from financing a diverse portfolio of assets, from heavy industrial machinery to everyday vehicles and office equipment.

Interest income constitutes the lion's share of Chailease's earnings. For instance, in the first quarter of 2024, the company reported significant interest income contributing to its overall financial performance, reflecting the substantial volume of financing agreements it manages.

Chailease Holding generates revenue through factoring services, essentially buying a company's outstanding invoices at a discount. This provides immediate cash flow for the seller. The fees charged cover the risk and the administrative effort of managing and collecting these receivables.

In 2024, factoring services remain a significant contributor to Chailease's income. For instance, in the first quarter of 2024, the company reported that its factoring and leasing segments collectively contributed substantially to its overall financial performance, demonstrating the ongoing demand for these liquidity solutions.

Chailease Holding generates substantial revenue through direct financing and interest earned on various loan products provided to small and medium-sized enterprises (SMEs). This core revenue stream is built on the interest accrued over the lifespan of these loans, which are often structured to support SME working capital needs or specific business projects.

In 2024, the company continued to see strong performance in its lending operations. For instance, its leasing and financing segments, which include direct loans, consistently contribute a significant portion of its overall income. While specific figures for direct loan interest are often embedded within broader segment reporting, the company’s overall financial health in 2024 indicated robust activity in these areas, reflecting ongoing demand for SME financing.

Real Estate Financing Income

Chailease Holding generates income through its real estate financing operations. This includes earning interest and various fees from providing loans and leases specifically for commercial and industrial properties. This segment contributes to the company's diversified revenue base.

This strategic expansion into real estate financing bolsters Chailease Holding's overall financial health. It allows the company to tap into the property market's potential for generating consistent returns. For instance, in 2023, the company's leasing and financing segments, which encompass real estate, demonstrated robust performance, contributing significantly to its profitability.

- Interest Income: Earned on capital provided for real estate transactions.

- Lease Income: Revenue generated from leasing commercial and industrial properties.

- Fee Income: Includes arrangement fees, processing fees, and other charges associated with real estate financing.

Insurance Brokerage Commissions

Chailease Holding generates revenue through insurance brokerage commissions, adding another layer to its income. This involves arranging insurance for the assets it leases and other financial products it offers to clients.

This diversification strategy allows Chailease to tap into income streams beyond its core lending and leasing operations, enhancing financial stability. For instance, in 2023, the company's total revenue reached NT$47.5 billion, with a significant portion attributable to its diverse financial service offerings.

- Insurance brokerage commissions are earned by facilitating insurance coverage for leased assets and other financial products.

- This revenue stream diversifies Chailease's income beyond traditional lending and leasing activities.

- In 2023, Chailease Holding reported total revenues of NT$47.5 billion, demonstrating the scale of its operations across various financial services.

Chailease Holding's primary revenue streams are built upon the interest generated from its extensive leasing and installment sales activities. This core business involves financing a wide array of assets, from heavy machinery to vehicles, with interest income forming the largest portion of its earnings. For example, in the first quarter of 2024, the company reported substantial interest income, underscoring the volume of its financing agreements.

The company also generates income through factoring services, where it purchases outstanding invoices at a discount, providing immediate liquidity to businesses. Additionally, direct financing and interest from loans offered to small and medium-sized enterprises (SMEs) are significant revenue contributors. Chailease's operations in 2024 showed robust activity in these lending segments, reflecting consistent demand for SME financing solutions.

Further diversification comes from real estate financing, where interest and fees are earned on loans and leases for commercial properties. Insurance brokerage commissions, earned by arranging coverage for leased assets and other financial products, also add to Chailease's diverse income base. In 2023, the company achieved total revenues of NT$47.5 billion, showcasing the breadth of its financial service offerings.

| Revenue Stream | Description | 2023 Performance Indicator |

| Interest Income (Leasing & Installment Sales) | Earnings from financing diverse assets. | Largest contributor to overall revenue. |

| Factoring Services | Income from purchasing invoices at a discount. | Significant contributor to income. |

| Direct Financing (SMEs) | Interest earned on loans to SMEs. | Robust activity in 2024. |

| Real Estate Financing | Interest and fees from property financing. | Contributes to diversified revenue. |

| Insurance Brokerage Commissions | Commissions from facilitating insurance. | Diversifies income beyond core operations. |

Business Model Canvas Data Sources

The Chailease Holding Business Model Canvas is constructed using a blend of internal financial statements, comprehensive market research reports, and strategic insights derived from industry analysis. These diverse data sources ensure each component of the canvas accurately reflects the company's operational realities and market positioning.