CompuGroup Medical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CompuGroup Medical Bundle

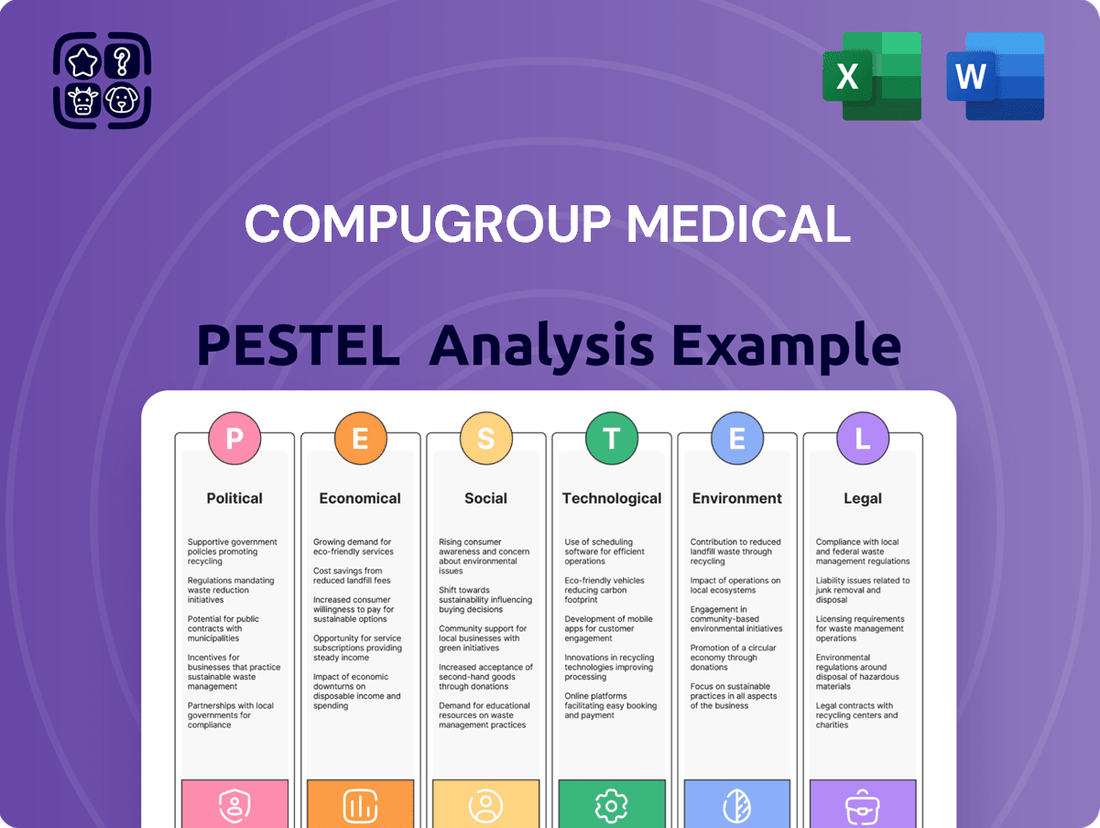

Gain a critical understanding of the external forces shaping CompuGroup Medical's future with our comprehensive PESTLE analysis. Explore how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are impacting the company's operations and strategic direction. This in-depth analysis provides actionable intelligence to identify opportunities and mitigate risks. Download the full version now and equip yourself with the insights needed to navigate the complex healthcare IT landscape.

Political factors

Governments worldwide are strongly encouraging the digitization of healthcare services, a trend that directly benefits e-health providers like CompuGroup Medical. These efforts often include mandates and incentives for electronic health records (EHRs), digital prescriptions, and secure patient data sharing, fostering a supportive regulatory landscape and boosting demand for their software solutions.

A prime example is the European Health Data Space (EHDS) Regulation, which became effective in March 2025. This landmark regulation establishes a unified framework for accessing and utilizing health data across all EU Member States, significantly shaping CompuGroup Medical's operational environment and market opportunities within Europe.

CompuGroup Medical's financial performance is directly tied to government healthcare funding and reimbursement policies. Changes in national budgets for healthcare, especially those impacting digital health services, can significantly alter revenue streams. For instance, policies that encourage healthcare providers to adopt digital tools often lead to increased market penetration for companies like CompuGroup Medical.

Conversely, budget constraints or less favorable reimbursement rates for digital solutions can impede growth. The ongoing implementation of Germany's Hospital Future Act (KHZG) is a prime example, creating a strong demand for hospitals to upgrade outdated systems, which directly benefits CompuGroup Medical by driving the need for their solutions.

Growing political tensions and a heightened focus on national data sovereignty are significantly impacting CompuGroup Medical's global operations. These concerns often translate into more stringent regulations governing how data can move across borders. This makes it harder for the company to offer truly integrated international solutions, as data localization requirements can fragment their service offerings.

Complying with a patchwork of diverse national data residency rules adds considerable complexity and expense to CompuGroup Medical's IT infrastructure. Each country may have unique stipulations about where health data must be stored and processed, necessitating localized data centers and specialized compliance measures.

For example, in April 2025, the U.S. Department of Justice (DOJ) enacted a new rule that either prohibits or severely restricts certain bulk data transactions involving foreign entities in specific countries deemed as areas of concern. This regulation directly affects the transfer of sensitive personal health data, posing a direct challenge to CompuGroup Medical's ability to leverage global data pools for innovation and service delivery.

Political Stability and Geopolitical Risks

Political instability and geopolitical shifts are significant considerations for CompuGroup Medical, a global player. For instance, heightened tensions in Eastern Europe in early 2024 could indirectly impact supply chain logistics or currency exchange rates relevant to European operations. The company's reliance on international markets means that trade disputes or the imposition of sanctions in key regions, like those seen with certain trade barriers in 2023, could affect its ability to freely distribute and support its healthcare IT solutions.

CompuGroup Medical must remain agile in navigating the evolving global political climate. A company statement from late 2023 highlighted the importance of risk management in response to emerging geopolitical events. This involves closely tracking:

- Impact of regional conflicts on healthcare infrastructure investment.

- Changes in data localization laws driven by national security concerns.

- Potential disruptions to cross-border data flow and software updates.

Public Health Policies and Emergency Preparedness

Government responses to public health crises, particularly pandemics, directly impact the demand and investment in digital health infrastructure. CompuGroup Medical, as a provider of health information systems, is well-positioned to benefit from increased funding for rapid data sharing, remote care solutions, and efficient vaccine management systems. The COVID-19 pandemic significantly accelerated the adoption of telehealth, a sector where CompuGroup Medical offers services, with projections indicating continued robust growth.

The global telehealth market, valued at approximately $20.4 billion in 2023, is expected to reach $128.9 billion by 2030, demonstrating a compound annual growth rate of 30.1% during this period. This surge is driven by government initiatives promoting digital health and the increasing need for resilient healthcare systems. CompuGroup Medical's existing portfolio of electronic health records and practice management software can be integrated with telehealth platforms to offer comprehensive solutions.

- Increased demand for digital health infrastructure: Governments are prioritizing investments in technologies that enable rapid data sharing and remote patient monitoring following public health emergencies.

- Telehealth market expansion: The global telehealth market is projected for substantial growth, presenting significant opportunities for companies like CompuGroup Medical.

- Focus on health system resilience: Public health policies increasingly emphasize preparedness, creating demand for integrated digital solutions that enhance healthcare system responsiveness.

- Government funding for digital health: Emergency preparedness funding often includes allocations for the development and deployment of digital health tools.

Governments worldwide are driving the digitization of healthcare, a trend that directly benefits CompuGroup Medical through mandates for electronic health records and digital prescriptions. The European Health Data Space Regulation, effective March 2025, exemplifies this by creating a unified framework for health data access across the EU, shaping CompuGroup Medical's market opportunities.

Political stability and data sovereignty concerns significantly impact CompuGroup Medical's global operations, leading to stricter cross-border data regulations and fragmentation of international solutions. For instance, a U.S. DOJ rule enacted in April 2025 restricts certain data transactions with foreign entities in countries of concern, directly affecting the transfer of sensitive health data.

Government funding and reimbursement policies are critical to CompuGroup Medical's financial performance; for example, Germany's Hospital Future Act (KHZG) implementation is creating strong demand for system upgrades, benefiting the company.

Public health crises, like pandemics, accelerate demand for digital health infrastructure, benefiting CompuGroup Medical. The telehealth market, valued at $20.4 billion in 2023, is projected to grow significantly, with governments investing in technologies for rapid data sharing and remote care.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting CompuGroup Medical, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights into how these forces create both challenges and strategic advantages for the company.

Provides a concise version of CompuGroup Medical's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, unmanageable reports.

Economic factors

The growth trajectory of healthcare expenditure is a significant driver for companies like CompuGroup Medical. As governments, insurers, and individuals allocate more resources to healthcare, the potential budget for health IT solutions expands, creating a more favorable market environment.

A notable trend is the increasing investment in digital transformation within the healthcare sector. This shift directly benefits CompuGroup Medical by increasing demand for its digital health products and services.

Looking ahead, the global digital health market is anticipated to reach approximately USD 1,093.65 billion by 2034. This impressive growth, projected at a compound annual growth rate of 11.68% starting from 2025, underscores a robust and expanding market for health technology solutions.

Rising inflation in 2024 and 2025 presents significant cost pressures for CompuGroup Medical. Increased expenses for essential inputs like IT talent, hardware, and energy directly impact operational budgets, potentially squeezing profit margins.

To counter these rising costs, CompuGroup Medical may need to implement price adjustments for its software and services. However, such moves carry the risk of affecting market competitiveness, especially in a price-sensitive healthcare IT sector.

The company's financial performance reflects these pressures; CompuGroup Medical's adjusted EBITDA saw a decline in 2024, a trend partially attributed to increased investments in research and development alongside heightened operational expenditures.

The general economic stability significantly shapes the investment decisions of healthcare providers in new IT infrastructure and software. A robust economy usually encourages increased spending on technology upgrades, while economic slowdowns can lead to postponed or scaled-back investments in these areas.

CompuGroup Medical's financial performance reflects this dynamic. The company reported revenues of EUR 1,154.0 million in 2024, demonstrating resilience. Furthermore, its expectation to return to growth in 2025 suggests a positive outlook for the healthcare IT sector, indicating that providers are likely to continue investing.

Reimbursement Models and Payor Landscape

The healthcare industry's shift towards value-based care and outcome-based reimbursement models directly impacts the demand for sophisticated IT solutions. CompuGroup Medical's offerings, particularly its practice management and electronic health record (EHR) systems, are vital for healthcare providers adapting to these new payment structures. These systems facilitate the crucial tasks of data analytics and patient outcome tracking, essential for demonstrating value and securing reimbursement under evolving policies.

CompuGroup Medical's financial performance reflects the stability and growth potential within this evolving landscape. The company's recurring revenue share climbed to a robust 74% by the end of 2024, underscoring the sticky nature of its software solutions and its ability to generate consistent income. This strong recurring revenue base provides a solid foundation for continued investment in innovation and market expansion.

Key factors influencing CompuGroup Medical's position within the payor landscape include:

- Shift to Value-Based Care: Increasing adoption of payment models that reward quality and outcomes over volume, driving demand for data-driven healthcare IT.

- Demand for Analytics and Tracking: Providers need solutions that can analyze patient data, track outcomes, and report on quality metrics to meet payor requirements.

- EHR and Practice Management Integration: CompuGroup Medical's core offerings are essential for streamlining workflows and managing patient populations under new reimbursement frameworks.

- Recurring Revenue Stability: The company's 74% recurring revenue in 2024 highlights customer stickiness and a resilient business model amidst healthcare system changes.

Currency Exchange Rate Fluctuations

CompuGroup Medical's extensive global presence across 56 countries means it's significantly exposed to currency exchange rate shifts. These fluctuations directly impact its reported revenues and costs when earnings from foreign operations are translated back into its reporting currency, the Euro. For instance, a strengthening Euro could reduce the value of profits earned in weaker currencies, affecting overall profitability. This volatility necessitates careful financial management and robust hedging strategies to mitigate potential losses and ensure financial stability.

The unpredictable nature of currency markets can also complicate strategic planning and forecasting for CompuGroup Medical. Changes in exchange rates can alter the competitive landscape, influencing pricing strategies for its software and services in different regions. For example, if the Euro strengthens significantly against the US Dollar, CompuGroup Medical's products might become more expensive for American customers, potentially impacting sales volume. Conversely, a weaker Euro could make its offerings more attractive internationally but increase the cost of imported components or services.

To illustrate the potential impact, consider the financial year 2023 for CompuGroup Medical. While specific figures on currency impact are often embedded within broader financial reports, the company's reliance on international markets makes it susceptible. For example, a 10% adverse movement in a major currency pair like EUR/USD could have a material effect on reported earnings per share. The company's financial statements often include disclosures about its foreign currency exposure and the methods used to manage this risk, such as forward contracts and currency options.

- Global Operations Exposure: CompuGroup Medical operates in 56 countries, leading to substantial exposure to currency exchange rate fluctuations.

- Impact on Financials: Fluctuations affect international revenues, costs, and profitability when converting foreign earnings to Euros.

- Strategic Planning Challenges: Currency volatility complicates financial reporting and the development of long-term strategic plans.

- Competitive Landscape Shifts: Exchange rate movements can alter the pricing competitiveness of CompuGroup Medical's products and services in various markets.

Economic stability is a crucial factor for CompuGroup Medical, as healthcare providers' IT spending decisions are heavily influenced by the overall economic climate. A strong economy typically encourages investments in new technology, while downturns can lead to delayed or reduced spending.

CompuGroup Medical reported revenues of EUR 1,154.0 million in 2024, demonstrating resilience amidst economic uncertainties. The company anticipates a return to growth in 2025, suggesting that healthcare providers are likely to maintain or increase their technology investments.

Rising inflation in 2024 and 2025 presents cost pressures for CompuGroup Medical, impacting operational budgets due to increased expenses for IT talent, hardware, and energy. This could necessitate price adjustments for its software and services, potentially affecting market competitiveness.

The global digital health market is projected to reach approximately USD 1,093.65 billion by 2034, growing at a compound annual growth rate of 11.68% from 2025. This expansion highlights a robust and growing market for health technology solutions.

What You See Is What You Get

CompuGroup Medical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This CompuGroup Medical PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers a comprehensive overview of the external forces shaping its strategic landscape. You'll gain actionable insights into market dynamics and potential challenges.

Sociological factors

The world's population is getting older, and with that comes more chronic illnesses. By 2050, the UN projects that over 1.5 billion people will be 65 or older. This trend directly boosts the demand for advanced healthcare solutions, including digital tools for managing patient care and remote monitoring, areas where CompuGroup Medical excels.

The rising rates of chronic conditions, such as diabetes and heart disease, are a major catalyst for the digital health sector. For instance, the World Health Organization reported in 2023 that chronic diseases cause an estimated 41 million deaths annually, underscoring the critical need for efficient, digitally-enabled healthcare management systems.

CompuGroup Medical's offerings are well-positioned to address these societal shifts. Their software and services support healthcare providers in managing complex patient needs and implementing preventative care strategies, ultimately aiming to reduce the strain on healthcare systems.

Patients now expect digital convenience in healthcare, similar to other industries. This includes booking appointments online, having virtual doctor visits, and easily accessing their medical history. This growing demand for e-health solutions naturally boosts companies like CompuGroup Medical, whose products facilitate these digital interactions.

CompuGroup Medical's own data reflects this trend, with their patient portal being a frequently used and appreciated feature by users. This indicates a strong alignment between patient desires and the company's existing digital service portfolio. In 2023, for instance, a significant percentage of CompuGroup Medical’s revenue growth was attributed to their digital service offerings, underscoring the market’s embrace of these technologies.

The public's understanding of health information and their comfort with new technology are crucial for e-health success. In 2023, a Pew Research Center study found that 77% of U.S. adults reported using the internet to find health information, indicating a strong baseline for digital health engagement.

When both patients and healthcare providers are digitally savvy, adopting new e-health systems, like those offered by CompuGroup Medical, becomes much easier and more beneficial. This increased digital fluency translates to better utilization of electronic health records and telehealth platforms.

The surge in telehealth use, particularly following the COVID-19 pandemic, has significantly boosted digital health adoption. By the end of 2024, it's projected that over 40% of healthcare appointments will be conducted virtually, underscoring this trend's impact.

Workforce Shortages in Healthcare

The persistent global shortage of skilled healthcare professionals, projected to reach 10 million by 2030 according to the World Health Organization, directly fuels the demand for IT solutions that boost efficiency and reduce administrative burdens. CompuGroup Medical's offerings, such as their practice management software and AI-driven tools, are designed to alleviate these strains. For instance, the company's AI-based telephone assistant, introduced in October 2024, aims to automate patient communication and appointment scheduling, freeing up valuable staff time. This addresses the critical need for technology to support healthcare providers facing increased patient loads with fewer personnel.

These workforce challenges create a significant opportunity for companies like CompuGroup Medical to provide solutions that optimize operations. The strain on existing staff necessitates tools that can automate routine tasks and improve patient flow. By offering these capabilities, CompuGroup Medical positions itself to be a key enabler of more sustainable healthcare delivery models in an environment of constrained human resources.

- Global healthcare worker shortage: Expected to reach 10 million by 2030, impacting operational capacity.

- IT solution demand: Driven by the need to improve efficiency and automate administrative tasks in healthcare settings.

- CompuGroup Medical's AI assistant: Launched October 2024 to enhance practice efficiency and patient communication.

- Operational impact: Solutions aim to mitigate the effects of staff shortages by streamlining workflows.

Societal Acceptance of Data Sharing and Privacy Concerns

Societal attitudes towards sharing health data are complex, with a strong desire for the benefits of digital health solutions, like those offered by CompuGroup Medical, counterbalanced by escalating concerns about privacy and data security. This creates a delicate balance for companies in the health tech sector.

To foster the adoption of its interoperable network and digital health services, CompuGroup Medical is compelled to proactively build and maintain public trust. This involves clearly demonstrating rigorous data protection measures and maintaining transparent practices regarding how patient information is handled.

The company's commitment to compliance is underscored by its systems being noted as HIPAA-compliant, a crucial factor in reassuring individuals about the security of their sensitive health information. In 2024, consumer trust in digital health platforms is heavily influenced by perceived data security, with studies indicating a significant portion of the population hesitating to use services that do not clearly outline their privacy protocols.

- Growing Demand for Digital Health: Patients increasingly expect convenient access to health information and services through digital channels.

- Escalating Privacy Concerns: Public awareness of data breaches and misuse fuels apprehension regarding the sharing of personal health data.

- HIPAA Compliance: CompuGroup Medical's adherence to HIPAA standards is a foundational element for building trust in the US market.

- Trust as a Differentiator: Companies that transparently showcase robust data security are more likely to gain user adoption in the competitive digital health landscape.

Societal expectations are shifting towards greater convenience and accessibility in healthcare, mirroring trends in other consumer sectors. This includes a strong preference for digital platforms for appointment scheduling, accessing medical records, and engaging in telehealth, all areas where CompuGroup Medical is actively expanding its services.

The increasing reliance on digital tools by both patients and healthcare providers is a significant driver for CompuGroup Medical's business. As more individuals become comfortable with online interactions and data sharing for health purposes, the demand for integrated digital health solutions naturally grows, positively impacting companies like CompuGroup Medical.

CompuGroup Medical's digital offerings, such as their patient portals and telehealth solutions, directly address these evolving societal preferences. The company's continued investment in user-friendly interfaces and secure digital infrastructure aligns with the public's growing demand for seamless and efficient healthcare experiences.

The aging global population, projected to see individuals over 65 exceed 1.5 billion by 2050, coupled with a rise in chronic diseases, necessitates more efficient healthcare management. CompuGroup Medical's digital solutions are crucial for supporting healthcare providers in managing these increasing demands and improving patient outcomes.

Technological factors

Technological advancements in Artificial Intelligence (AI) and Machine Learning (ML) are profoundly reshaping healthcare IT. These technologies are driving innovations in predictive analytics for disease outbreaks, enhancing diagnostic accuracy, automating burdensome administrative tasks, and paving the way for truly personalized medicine.

CompuGroup Medical is at the forefront of this transformation, actively embedding AI into its product suite. For instance, the CGM ONE telephone assistant leverages AI for more intuitive patient interactions, while its cloud-based pharmacy software, CGM STELLA, features an AI-assisted module designed to boost operational efficiency and improve patient care outcomes.

The move to cloud computing significantly boosts CompuGroup Medical's ability to scale its healthcare IT systems. This allows them to efficiently handle growing data volumes and user needs, a critical factor as healthcare digitalizes. For instance, by 2024, the global healthcare cloud computing market was projected to reach over $60 billion, underscoring the widespread adoption and CompuGroup Medical's strategic positioning within this trend.

Cybersecurity threats are a growing concern for healthcare IT companies like CompuGroup Medical. The increasing sophistication of these attacks means CompuGroup Medical must constantly invest in robust security measures to safeguard sensitive patient data. Failure to do so could lead to breaches, reputational damage, and regulatory penalties.

CompuGroup Medical's commitment to security is evident in its C5 attestation (Type 1) for cloud services in Germany. This certification signifies adherence to rigorous security standards, crucial for protecting the confidential information handled by their software solutions.

Interoperability and Data Exchange Standards

The increasing demand for healthcare systems to communicate seamlessly across providers, devices, and patient portals highlights the critical importance of interoperability and data exchange standards. CompuGroup Medical's strategic focus on building a connected network for healthcare professionals, insurers, and patients directly addresses this technological imperative. For instance, the push for standardized data formats like FHIR (Fast Healthcare Interoperability Resources) is a key enabler, with significant adoption expected to accelerate in the coming years, potentially impacting how CompuGroup Medical's platforms integrate with the broader healthcare ecosystem.

Policies mandating interoperability are a major catalyst in the health IT sector, directly influencing CompuGroup Medical's operational strategy and market positioning. The company's commitment to facilitating secure and efficient data exchange is a competitive advantage in a landscape where seamless information flow is becoming non-negotiable. By 2025, it's projected that a substantial portion of healthcare organizations will be prioritizing interoperability solutions to improve patient care coordination and operational efficiency.

Key aspects of interoperability impacting CompuGroup Medical include:

- Standardized Data Formats: Adoption of standards like FHIR and HL7 ensures that data can be understood and processed by different systems.

- API Development: CompuGroup Medical's investment in robust Application Programming Interfaces (APIs) allows for easier integration with third-party applications and devices.

- Security Protocols: Ensuring secure data exchange through encryption and access controls is paramount for maintaining patient trust and regulatory compliance.

- Cross-Platform Compatibility: The ability of CompuGroup Medical's solutions to work across various operating systems and hardware is essential for widespread adoption.

Emerging Technologies (e.g., IoT, Blockchain, Virtual Care)

The digital health sector is rapidly evolving, with emerging technologies like the Internet of Things (IoT), blockchain, and virtual care platforms at the forefront. CompuGroup Medical must actively integrate these innovations to maintain its competitive edge and broaden its service portfolio. For instance, the global IoT healthcare market was valued at approximately USD 28.1 billion in 2023 and is projected to reach USD 107.8 billion by 2028, demonstrating a significant growth trajectory driven by advancements in connected medical devices and remote patient monitoring.

These technological shifts are fundamentally altering how healthcare is delivered and managed. The adoption of IoT enables sophisticated remote patient monitoring, allowing for continuous data collection and proactive health interventions. Blockchain technology offers robust solutions for data security and integrity, crucial for sensitive patient information. Virtual care, or telehealth, continues to expand, providing accessible and convenient healthcare services, a trend amplified by increasing patient demand for digital health solutions.

CompuGroup Medical's strategic response to these technological factors is critical for its future success. The company should focus on:

- Leveraging IoT for enhanced patient data acquisition and remote care delivery. In 2024, over 70% of healthcare organizations were expected to be using or piloting IoT devices for patient monitoring.

- Implementing blockchain for secure and transparent health data management. This can improve interoperability and patient data privacy, addressing a key concern in digital health.

- Expanding virtual care offerings to meet growing patient and provider demand. Telehealth utilization saw a significant surge, with some studies indicating a 40-fold increase compared to pre-pandemic levels, and this trend continues into 2024/2025.

- Investing in research and development to stay ahead of technological advancements in areas like AI-driven diagnostics and personalized medicine. The global AI in healthcare market is anticipated to grow substantially, reaching over USD 100 billion by 2028.

Technological advancements are a primary driver for CompuGroup Medical (CGM), with AI and Machine Learning integrated into solutions like the CGM ONE telephone assistant to enhance patient interaction and CGM STELLA pharmacy software for operational efficiency. The widespread adoption of cloud computing, projected to exceed $60 billion globally in healthcare by 2024, allows CGM to scale effectively as healthcare digitalization accelerates. Cybersecurity remains a critical focus, with CGM's German C5 attestation underscoring their commitment to protecting sensitive patient data.

Interoperability is a key technological factor, with CGM focusing on seamless data exchange across providers and systems, supported by standards like FHIR, which is seeing increasing adoption. Emerging technologies such as IoT, blockchain, and virtual care platforms present significant growth opportunities. The global IoT healthcare market was valued at approximately USD 28.1 billion in 2023 and is expected to reach USD 107.8 billion by 2028, indicating strong potential for CGM's integration of connected medical devices and remote monitoring.

CompuGroup Medical's strategic investments in these areas are crucial. For instance, over 70% of healthcare organizations were expected to be using or piloting IoT devices for patient monitoring in 2024. The company's expansion of virtual care offerings aligns with the continued demand for telehealth, which saw a significant surge, with some indications of a 40-fold increase compared to pre-pandemic levels, a trend continuing into 2024/2025.

| Technology Area | Key Developments/Trends | CompuGroup Medical Relevance | Market Projections (2024/2025 Focus) |

|---|---|---|---|

| Artificial Intelligence (AI) / Machine Learning (ML) | Predictive analytics, enhanced diagnostics, administrative automation, personalized medicine | Integration into CGM ONE, CGM STELLA; AI-driven diagnostics R&D | Global AI in healthcare market projected to exceed $100 billion by 2028 |

| Cloud Computing | Scalability, data handling, accessibility | Cloud-based pharmacy software (CGM STELLA); efficient data management | Global healthcare cloud computing market projected to exceed $60 billion by 2024 |

| Cybersecurity | Protecting sensitive patient data, preventing breaches | C5 attestation (Type 1) in Germany; robust security measures | Ongoing investment essential due to increasing threat sophistication |

| Interoperability | Seamless data exchange, standardized formats (FHIR, HL7), API development | Building connected networks for healthcare professionals, insurers, patients | Substantial portion of healthcare organizations prioritizing interoperability by 2025 |

| Emerging Technologies (IoT, Blockchain, Virtual Care) | Remote patient monitoring, secure data management, accessible healthcare services | Leveraging IoT for data acquisition, blockchain for data integrity, expanding virtual care | IoT healthcare market: USD 28.1 billion (2023) to USD 107.8 billion (2028); Telehealth utilization remains high |

Legal factors

CompuGroup Medical operates under a complex web of global and regional data privacy laws, notably the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States. These regulations dictate the precise methods for handling sensitive healthcare data, covering its collection, storage, processing, and sharing.

Ensuring adherence to these evolving legal frameworks is paramount for CompuGroup Medical, requiring continuous adaptation. For instance, the company must factor in potential updates, such as proposed amendments to the HIPAA Security Rule anticipated around 2025, to maintain full compliance across its diverse operational territories.

CompuGroup Medical's healthcare IT solutions must navigate a complex web of national and international compliance standards and certifications. These are crucial for ensuring product safety, effectiveness, and the ability for different systems to work together. Failure to meet these requirements can prevent market access and hinder operations.

The regulatory landscape is constantly evolving, impacting companies like CompuGroup Medical. For instance, the European Parliament specifically requested urgent reviews of the Medical Devices Regulation (MDR) and the In Vitro Diagnostic Medical Devices Regulation (IVDR) in October 2024. This signals that CompuGroup Medical must remain agile and adapt to new or revised legal frameworks to maintain compliance.

CompuGroup Medical's ability to protect its intellectual property, including patents, copyrights, and trademarks, is fundamental to safeguarding its innovative software solutions and competitive edge. Navigating the intricate landscape of software licensing agreements and avoiding potential infringement claims are ongoing legal necessities for the company.

The company's significant investment in research and development, evidenced by EUR 255 million in R&D expenses during 2024, underscores the importance of robust IP protection strategies. These investments fuel the creation of proprietary technologies that require legal safeguards.

Cybersecurity Laws and Breach Notification Requirements

Cybersecurity laws are constantly changing, and companies like CompuGroup Medical must stay ahead of new regulations and mandatory data breach notification rules. These legal shifts demand strong security measures and quick plans for dealing with any security incidents. Failing to comply can result in hefty fines, damage to the company's image, and significant legal trouble, making this a key legal consideration.

The healthcare industry, in particular, has seen a significant rise in data breach notifications. For instance, in 2023, the U.S. Department of Health and Human Services reported hundreds of breaches affecting millions of individuals. This trend highlights the critical need for CompuGroup Medical to maintain rigorous data protection standards to avoid legal repercussions and maintain patient trust.

- Increased Regulatory Scrutiny: Evolving laws such as the GDPR and various state-level data privacy acts impose strict obligations on data handling.

- Mandatory Breach Notifications: Companies are legally required to report data breaches to authorities and affected individuals within specific timeframes, often as short as 72 hours.

- Financial Penalties: Non-compliance can lead to substantial fines, with GDPR penalties reaching up to 4% of annual global revenue or €20 million, whichever is higher.

- Reputational Risk: Data breaches can severely damage customer trust and brand reputation, impacting future business prospects.

Anti-Trust and Competition Law

CompuGroup Medical (CGM), as a significant entity in the global e-health sector, is subject to stringent anti-trust and competition regulations across numerous markets. These laws are designed to prevent monopolistic practices and ensure a level playing field for all participants. CGM's operations, particularly its expansion through mergers and acquisitions, face close examination from regulatory bodies to prevent undue market concentration.

The company's pricing strategies and market share are continuously monitored to uphold fair competition principles. Recent regulatory scrutiny, for instance, surrounded CGM's 2023 voluntary public takeover offer for a majority stake in the company by CVC Capital Partners, which required thorough review and approval from competition authorities in key regions before proceeding with the planned delisting.

Navigating these legal frameworks is crucial for CGM's sustained growth and market access. Failure to comply can result in significant fines and operational restrictions. For example, in 2024, several large technology companies faced substantial penalties from the European Commission for alleged anti-competitive practices, underscoring the importance of diligent compliance for all players in the digital health space.

Key areas of focus for CGM's legal compliance include:

- Merger Control: Scrutiny of acquisitions to prevent excessive market power.

- Pricing Practices: Ensuring fair pricing that doesn't stifle competition.

- Abuse of Dominance: Preventing the misuse of significant market share.

- Data Handling: Compliance with regulations concerning the use and sharing of sensitive health data.

CompuGroup Medical's legal environment is shaped by stringent data privacy mandates like GDPR and HIPAA, requiring meticulous handling of sensitive health information. The company must adapt to evolving regulations, such as potential HIPAA Security Rule amendments anticipated around 2025, to ensure ongoing compliance.

Navigating a complex web of global and regional compliance standards, including those for medical device regulations like the MDR and IVDR, is critical for CompuGroup Medical's product market access and operational integrity.

The company's substantial investment in R&D, exemplified by EUR 255 million in 2024, necessitates robust intellectual property protection to safeguard its innovative software and maintain its competitive edge.

CompuGroup Medical faces significant legal obligations regarding cybersecurity, including mandatory data breach notifications and the implementation of strong security measures to avoid hefty fines and reputational damage, especially in light of rising data breaches in the healthcare sector, such as those reported by the U.S. HHS impacting millions in 2023.

Environmental factors

Growing environmental consciousness and stricter regulations are pushing businesses toward sustainability, particularly in IT. This means a greater need for 'green IT' solutions focused on reducing energy use and electronic waste. CompuGroup Medical can gain an edge by embracing environmentally sound data centers and championing sustainable software practices.

CompuGroup Medical is actively pursuing carbon neutrality, with a clear objective to cut its Scope 1 and Scope 2 emissions. This commitment reflects a broader industry trend where environmental responsibility is becoming a key differentiator.

Climate change presents significant physical risks to healthcare infrastructure. Extreme weather events like floods and heatwaves, which are projected to become more frequent and intense, can damage hospitals, clinics, and the supply chains for medical equipment. For instance, a 2023 report highlighted that over 70% of healthcare facilities in coastal regions are at risk of flooding by 2050 due to rising sea levels. This necessitates a move towards more resilient buildings and operational models.

These physical disruptions mean healthcare providers need robust, digitally-enabled systems that can support remote operations and ensure data recovery during emergencies. CompuGroup Medical's focus on digital health solutions, such as telemedicine platforms and cloud-based electronic health records (EHRs), positions them to address this growing need. The company's investments in cybersecurity and data redundancy are crucial for maintaining continuity of care when physical infrastructure is compromised.

The increasing demand for resilient healthcare infrastructure will likely influence the design and deployment of CompuGroup Medical's software and services. Expect a greater emphasis on solutions that facilitate decentralized care, enable remote patient monitoring, and offer secure, off-site data backup. This trend aligns with the global push for healthcare systems that can withstand environmental shocks and maintain service delivery.

Data centers, the backbone of CompuGroup Medical's cloud-based healthcare IT, are significant energy consumers, directly impacting carbon emissions. In 2024, the global data center market consumed an estimated 1.5% of the world's electricity, a figure projected to rise. This substantial energy demand places pressure on CompuGroup Medical to actively mitigate its environmental footprint.

CompuGroup Medical is responding to this challenge by prioritizing investments in energy-efficient technologies and exploring renewable energy sources for its operational needs. This strategic shift aims to not only reduce environmental impact but also to align with increasing regulatory and stakeholder expectations for sustainability in the tech sector.

Waste Management and Electronic Waste (e-waste)

The lifecycle of hardware components within CompuGroup Medical's healthcare IT systems inherently generates electronic waste (e-waste). This poses a significant environmental challenge, as the rapid obsolescence of technology means old equipment must be disposed of responsibly. For instance, the global e-waste generation reached an estimated 62 million metric tons in 2020 and is projected to increase significantly by 2025, underscoring the scale of the issue.

CompuGroup Medical must actively embrace responsible waste management practices. This involves not only proper disposal but also prioritizing the refurbishment, repair, and recycling of its hardware and equipment. Promoting circular economy principles, where materials are kept in use for as long as possible, can reduce the environmental footprint and potentially create cost savings.

To mitigate these environmental impacts, CompuGroup Medical should consider:

- Implementing take-back programs for old hardware.

- Partnering with certified e-waste recyclers.

- Designing products with longevity and repairability in mind.

- Exploring leasing models to encourage hardware upgrades and responsible end-of-life management.

Corporate Social Responsibility (CSR) and ESG Reporting

Growing investor and public demand for transparency in Environmental, Social, and Governance (ESG) performance means CompuGroup Medical must embed environmental responsibility into its core business strategy and actively report on its initiatives. This scrutiny is driving a shift towards more comprehensive ESG disclosures, influencing how companies are valued and perceived.

CompuGroup Medical acknowledges this trend by publishing non-financial reports, including its 2024 report, which outlines the company's commitment to and progress on various ESG fronts. These reports are crucial for stakeholders seeking to understand the company's broader impact beyond financial metrics.

- ESG Integration: CompuGroup Medical is increasingly integrating ESG factors into its decision-making processes, recognizing their impact on long-term sustainability and value creation.

- Transparent Reporting: The company provides detailed non-financial reports, such as its 2024 ESG report, to offer stakeholders clear insights into its environmental, social, and governance performance.

- Stakeholder Expectations: Investor and public pressure is a key driver for enhanced ESG reporting, pushing companies like CompuGroup Medical to demonstrate tangible progress in sustainability.

- Environmental Focus: While specific environmental data from the 2024 report is still emerging, the commitment to reporting signifies a focus on areas like carbon footprint reduction and resource management.

Environmental regulations are becoming more stringent, pushing IT companies like CompuGroup Medical towards sustainable practices, often termed 'green IT'. This includes a focus on reducing energy consumption and managing electronic waste effectively.

CompuGroup Medical is committed to carbon neutrality, actively working to reduce its Scope 1 and Scope 2 emissions, a move that aligns with industry-wide sustainability trends and enhances its market position.

The company's digital health solutions, such as telemedicine and cloud-based EHRs, are vital for healthcare resilience against climate change impacts like extreme weather events, which can disrupt physical facilities.

Addressing the significant energy demands of data centers, which consumed an estimated 1.5% of global electricity in 2024, CompuGroup Medical is investing in energy-efficient technologies and renewable energy sources.

| Environmental Factor | Impact on CompuGroup Medical | Action/Mitigation |

| Climate Change & Extreme Weather | Risk to healthcare infrastructure, need for resilient digital systems. | Focus on digital health, telemedicine, cloud EHRs, data redundancy. |

| Energy Consumption (Data Centers) | High electricity usage, carbon emissions. | Investment in energy-efficient tech, renewable energy sources. |

| Electronic Waste (E-waste) | Environmental challenge from hardware obsolescence. | Responsible disposal, refurbishment, recycling, circular economy principles. |

| ESG Reporting & Stakeholder Pressure | Demand for transparency and sustainability performance. | Publishing non-financial/ESG reports (e.g., 2024 report), integrating ESG into strategy. |

PESTLE Analysis Data Sources

Our CompuGroup Medical PESTLE Analysis is built on a robust foundation of data from reputable sources including government health and economic reports, industry-specific market research, and global technology trend analyses. We integrate insights from regulatory bodies and legislative updates to ensure a comprehensive understanding of the macro-environment.