CompuGroup Medical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CompuGroup Medical Bundle

CompuGroup Medical operates in a dynamic healthcare IT landscape, where intense rivalry and the threat of new entrants significantly shape its competitive environment. Understanding the power of buyers and the availability of substitutes are crucial for navigating this market. Supplier power also plays a role in CompuGroup Medical's operational costs and strategic flexibility.

The complete report reveals the real forces shaping CompuGroup Medical’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CompuGroup Medical's reliance on specialized software components means suppliers of unique or proprietary modules can wield considerable bargaining power. If these components are critical to CGM's core offerings and difficult to replace, suppliers can command higher prices or more favorable terms. For instance, a supplier of a highly specialized medical imaging processing library, deeply embedded in CGM's diagnostic software, would possess significant leverage.

As CompuGroup Medical (CGM) deepens its commitment to cloud-based solutions and artificial intelligence, the bargaining power of major cloud infrastructure providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud is significant. These providers, controlling a vast majority of the cloud market, can exert influence due to the high switching costs and technical complexities involved in migrating large-scale, customized cloud deployments.

In 2024, the global cloud computing market continued its robust growth, with major providers like AWS, Azure, and Google Cloud dominating the landscape. AWS, for instance, maintained its leading market share, estimated to be around 31% in early 2024. This concentration of market power means that for companies like CGM, relying on these platforms for critical infrastructure, the providers hold considerable leverage, particularly when negotiating terms for specialized services or when significant data volumes are involved.

The bargaining power of hardware manufacturers for CompuGroup Medical (CGM) is influenced by the standardization and availability of components like servers and networking equipment. If CGM relies on highly specialized or customized hardware, the power of these suppliers can be significant.

For instance, in 2024, the global semiconductor shortage continued to impact the availability and pricing of certain critical hardware components, potentially strengthening the hand of manufacturers who could secure supply. This situation could force CGM to accept less favorable terms if specific, in-demand chips are required for their medical solutions.

Data and Content Providers

CompuGroup Medical's reliance on specialized data means suppliers of curated medical information and regulatory updates can hold a degree of influence. If this data is critical for compliance or for enhancing the functionality of CGM's software, particularly in niche areas like laboratory diagnostics or pharmacy management, these suppliers might exert moderate bargaining power. For instance, a provider of continuously updated drug interaction databases or specific diagnostic coding standards could command better terms.

- Data Dependency: CGM's software solutions, particularly those for pharmacies and laboratories, require accurate and up-to-date medical data, including drug information, billing codes, and treatment guidelines.

- Specialized Suppliers: Suppliers offering unique, highly curated, or proprietary datasets that are difficult to replicate can wield more influence.

- Regulatory Impact: The healthcare industry's stringent regulatory environment means that data compliant with evolving standards (e.g., e-prescribing, interoperability mandates) is essential, potentially increasing supplier leverage.

- Moderate Power: Overall, the bargaining power of data and content providers is likely moderate, as CGM can potentially source similar data from multiple providers, but the cost and effort of switching specialized data can be significant.

Highly Skilled IT and Healthcare Domain Talent

The availability of highly skilled professionals in areas like software development, cybersecurity, and AI/machine learning is paramount for CompuGroup Medical (CGM). While not direct suppliers in the traditional sense, a scarcity of specialized IT and healthcare domain talent can significantly inflate recruitment and retention costs, effectively granting these professionals considerable bargaining power. CGM's substantial investment of EUR 255 million in research and development during 2024 underscores its deep reliance on securing and retaining this critical human capital.

- Talent as a Cost Driver: Shortages in specialized IT and healthcare skills elevate the cost of acquiring and retaining key personnel for CGM.

- R&D Investment: The EUR 255 million R&D expenditure in 2024 highlights CGM's dependence on skilled professionals to drive innovation.

- Domain Expertise: Expertise in healthcare IT, combined with technical skills, gives these professionals leverage in the job market.

The bargaining power of CompuGroup Medical's suppliers is influenced by factors like component specialization and market concentration. For critical, hard-to-replace software modules or specialized hardware, suppliers can command higher prices. The significant reliance on major cloud providers like AWS, which held approximately 31% of the market share in early 2024, grants them substantial leverage due to high switching costs.

| Supplier Type | Influence Level | Key Factors |

|---|---|---|

| Specialized Software Components | High | Uniqueness, difficulty to substitute |

| Cloud Infrastructure Providers (e.g., AWS) | High | Market dominance, high switching costs |

| Hardware Manufacturers | Moderate to High | Component standardization, availability (e.g., 2024 semiconductor shortages) |

| Data & Content Providers | Moderate | Data specificity, regulatory compliance needs |

What is included in the product

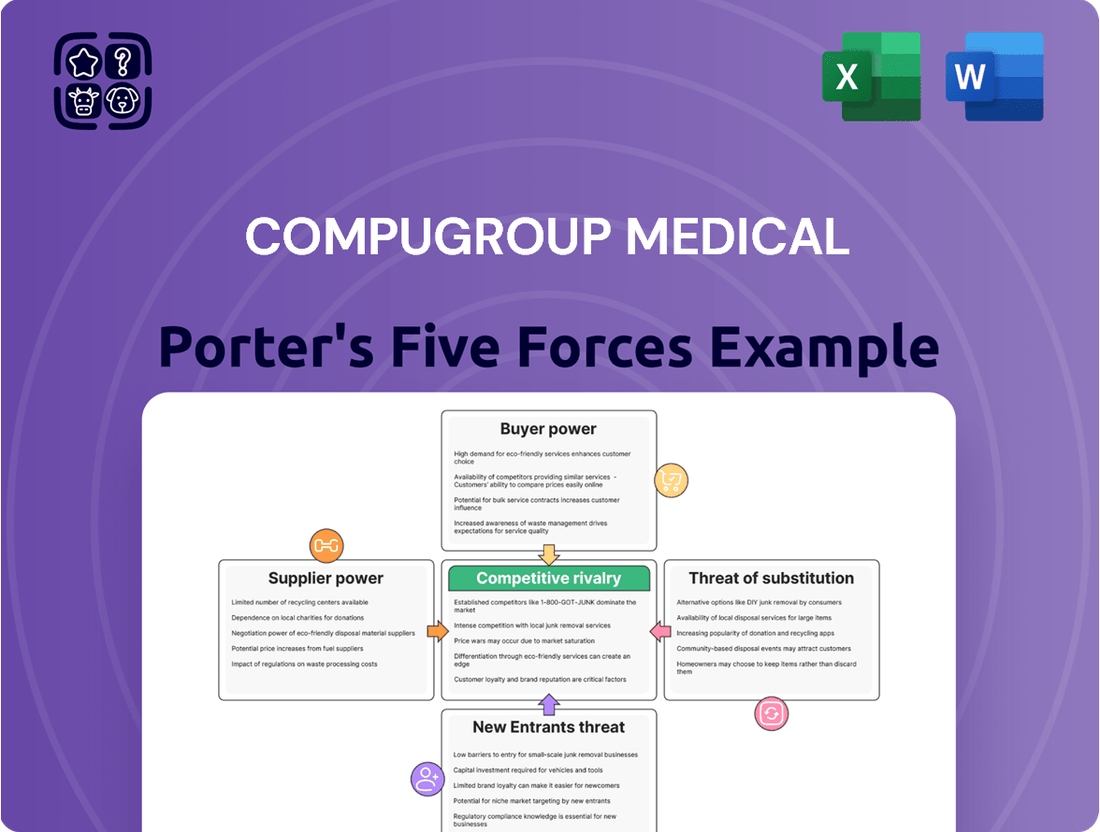

CompuGroup Medical's Five Forces Analysis reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its market position.

A dynamic, interactive model to visualize and quantify the impact of each Porter's Five Forces on CompuGroup Medical's strategic positioning.

Customers Bargaining Power

Hospitals, clinics, and pharmacies face significant hurdles when considering a change from existing Electronic Health Record (EHR) or practice management systems, such as those offered by CompuGroup Medical. These challenges include the complex and costly process of data migration, extensive staff retraining to adapt to new software, and the inherent risk of operational disruptions during the transition. These substantial switching costs serve to dampen the bargaining power of customers.

CompuGroup Medical (CGM) serves a wide array of customers, from individual physicians and dentists to large hospital networks and pharmacies in 56 countries. This broad reach means the bargaining power of its customers isn't uniform. For instance, in 2023, large hospital systems, representing significant contract volumes, likely held more sway than smaller, independent clinics.

The fragmentation of CGM's customer base, with many individual practitioners, generally dilutes overall customer bargaining power. However, the presence of large, consolidated entities like major hospital groups or national pharmacy chains can exert considerable pressure on pricing and contract terms due to their purchasing volume. This creates a dynamic where some customer segments have more leverage than others.

Evolving regulatory landscapes significantly impact customer bargaining power. For instance, mandates promoting interoperability, such as the widespread adoption of FHIR standards in healthcare, empower customers by simplifying the integration of systems from various vendors. This ease of integration means customers can more readily switch providers or demand greater functionality, thereby increasing their leverage.

The push for seamless data exchange, driven by regulations like the 21st Century Cures Act in the US, directly influences customer expectations. In 2023, a significant portion of healthcare providers expressed increased demand for interoperable solutions, with over 70% indicating that data exchange capabilities were a key factor in their purchasing decisions. This pressure forces vendors like CompuGroup Medical to offer more open and integrated platforms, enhancing customer choice and bargaining power.

Customer's Focus on Efficiency and Patient Outcomes

Healthcare providers are placing a significant emphasis on operational efficiency and enhancing patient outcomes, directly aligning with the core value proposition of CompuGroup Medical (CGM) solutions. When CGM's software effectively demonstrates tangible improvements in these critical areas, it reinforces the company's attractiveness to customers. This focus on demonstrable benefits can shift the customer's bargaining power away from a purely price-driven negotiation towards a value-based assessment.

For example, in 2024, numerous studies highlighted that healthcare organizations investing in integrated digital health platforms saw an average reduction in administrative overhead by up to 15% and an improvement in patient wait times by 10-20%. If CGM can clearly articulate and quantify these types of gains for its clients, the ability of customers to demand lower prices solely based on cost considerations diminishes.

- Efficiency Gains: Providers seeking to streamline workflows and reduce operational costs are drawn to solutions promising improved efficiency.

- Patient Outcome Focus: The drive to achieve better patient results, through enhanced data access and care coordination, empowers software that facilitates this.

- Value Proposition: Demonstrating clear ROI through improved patient care and cost savings strengthens CGM's position against price-sensitive buyers.

- Reduced Price Sensitivity: When software directly contributes to core strategic goals like better patient outcomes, customers may be less inclined to switch solely on price differentials.

Access to Alternative Solutions and In-house Development

While CompuGroup Medical (CGM) benefits from high switching costs for many of its healthcare IT solutions, the bargaining power of customers is nonetheless influenced by the availability of alternatives. For instance, large hospital systems might explore developing proprietary in-house solutions, especially if they perceive existing market offerings as inadequate or too expensive. This potential for self-sufficiency, even if rarely realized, serves as a significant lever in negotiations.

The perceived effectiveness and cost of these alternative solutions, whether from direct competitors or internal development, directly impact customer leverage. For example, if a competitor offers a more integrated or user-friendly system at a comparable price point, CGM’s pricing power could be diminished. In 2024, the healthcare IT market continued to see innovation, with many vendors enhancing interoperability and AI capabilities, thereby increasing the viable alternatives available to large healthcare providers.

- Alternative Solutions: Competitors offer a range of Electronic Health Record (EHR) and practice management systems that provide varying levels of functionality and integration.

- In-house Development Potential: Large, sophisticated healthcare organizations possess the IT infrastructure and expertise to consider custom software development, creating a credible threat to external vendors.

- Impact on Bargaining Power: The existence and perceived viability of these alternatives empower customers to negotiate better terms, pricing, and service level agreements with CGM.

- Market Dynamics: Increased investment in healthcare technology in 2024, with a focus on cloud-based solutions and data analytics, expanded the competitive landscape and customer options.

The bargaining power of customers for CompuGroup Medical (CGM) is tempered by high switching costs, including data migration and retraining, which can deter frequent changes. However, this power is amplified by regulatory mandates pushing for interoperability, such as FHIR standards, making it easier for providers to switch or demand more from vendors. For instance, in 2023, over 70% of US healthcare providers cited data exchange capabilities as a key purchasing factor, increasing their leverage.

While CGM's diverse customer base, spanning individual practices to large hospital networks, means bargaining power varies, larger clients like hospital systems in 2023 held more sway due to volume. The availability of competitive alternatives and the potential for in-house development by large organizations also act as significant negotiation levers. The healthcare IT market in 2024, with its focus on cloud and AI, presented more options, further bolstering customer influence.

Full Version Awaits

CompuGroup Medical Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive analysis of CompuGroup Medical's position within the healthcare IT market, as detailed by Porter's Five Forces, offers a thorough examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products. Understand the strategic landscape and key industry dynamics affecting CompuGroup Medical with this exact, ready-to-use report.

Rivalry Among Competitors

The e-health and healthcare IT market is intensely competitive, featuring a wide array of global giants and specialized regional players. Companies like Oracle Cerner, Epic Systems, and McKesson Corporation operate on a large scale, while numerous smaller, regional providers also vie for market share. This crowded field significantly amplifies competitive rivalry.

CompuGroup Medical (CGM) faces this dynamic head-on. In a market with 630 active competitors, CGM holds a notable position, ranking fourth. This ranking underscores the significant presence of other established and emerging companies that directly challenge CGM's market penetration and growth strategies.

Developing and maintaining advanced e-health software demands substantial upfront investment in research and development, along with continuous support and infrastructure expenses. CompuGroup Medical's commitment is evident, with EUR 255 million allocated to R&D in 2024 alone. These considerable fixed costs often fuel fierce price competition as firms aim to capture market share and recoup their investments.

In the competitive landscape of healthcare IT, CompuGroup Medical (CGM) distinguishes itself through specialized product offerings and a commitment to integrated solutions. While numerous vendors provide Electronic Health Record (EHR) and practice management systems, CGM's strategic focus on areas like AI-powered clinical decision support and cloud-based pharmacy management software carves out a unique market position.

CGM's emphasis on cybersecurity and the proactive integration of artificial intelligence (AI) are key differentiators, aiming to enhance data security and streamline clinical workflows for healthcare providers. This strategic approach is vital for maintaining a competitive edge in a market where advanced features and robust security are increasingly demanded by customers.

Market Growth Rate and Strategic Focus

The e-health market's robust expansion, projected to grow at a compound annual growth rate (CAGR) of 16.02% between 2025 and 2030, significantly influences competitive rivalry. This substantial market growth creates opportunities for numerous participants, potentially diluting the intensity of competition as the overall pie expands. CompuGroup Medical (CGM) itself is anticipating a rebound, forecasting a return to growth in 2025 with organic revenue increasing in the low to mid-single digit percentage range, indicating their strategic positioning within this dynamic sector.

- Market Expansion: The e-health sector is set for considerable growth, with an anticipated CAGR of 16.02% from 2025 to 2030.

- Rivalry Dynamics: Ample market opportunities stemming from this growth can alleviate competitive pressures, allowing multiple players to thrive.

- CGM's Outlook: CompuGroup Medical expects to see organic revenue growth in the low to mid-single digit percentages starting in 2025.

Mergers, Acquisitions, and Strategic Partnerships

The healthcare IT sector, including companies like CompuGroup Medical (CGM), is characterized by significant consolidation through mergers and acquisitions. A prime example is Oracle's acquisition of Cerner, a deal valued at approximately $28.3 billion in 2022, which dramatically altered the competitive landscape by integrating a major EHR provider into a technology giant's ecosystem.

Strategic partnerships also play a crucial role in reshaping competition. CGM's own delisting and subsequent partnership with private equity firm CVC Capital Partners in 2023, valuing the company at around €3.5 billion, exemplifies this trend. Such moves can inject capital for expansion or R&D, and often lead to a more focused, albeit potentially more aggressive, competitive stance from the involved entities.

These corporate actions directly influence industry dynamics.

- Consolidation: Oracle's Cerner acquisition brought together two substantial players, potentially reducing the number of major independent competitors.

- New Entrants/Strengthened Players: Private equity involvement, as seen with CVC and CGM, can lead to significant investment and strategic shifts, creating stronger or more agile competitors.

- Market Share Shifts: M&A activity regularly reallocates market share, impacting the competitive positioning of all industry participants.

- Innovation Focus: Partnerships and acquisitions can drive innovation by combining resources or providing access to new technologies and markets.

The e-health sector is incredibly crowded, with hundreds of companies competing for market share, including large global players and smaller regional specialists. CompuGroup Medical (CGM) ranks fourth among 630 active competitors, highlighting the intense rivalry it faces. Significant R&D investments, such as CGM's EUR 255 million in 2024, create high fixed costs that often lead to aggressive pricing strategies as companies strive to gain or maintain their position.

Mergers and acquisitions are actively reshaping the competitive landscape, as seen with Oracle's $28.3 billion acquisition of Cerner in 2022, consolidating major players. CGM's own delisting and partnership with CVC Capital Partners in 2023, valued at approximately €3.5 billion, also signifies a trend towards strategic realignments that can intensify competition through increased investment and focus.

| Major Competitor Actions | Impact on Rivalry | CGM's Strategic Response |

| Oracle's acquisition of Cerner ($28.3 billion, 2022) | Consolidation of major EHR providers, potential reduction in independent competitors. | Focus on specialized offerings and integration to differentiate. |

| CGM's delisting and CVC partnership (€3.5 billion valuation, 2023) | Potential for increased investment, strategic agility, and more aggressive market positioning. | Leveraging private equity backing for R&D and market expansion. |

| High R&D Expenditure (CGM: €255 million in 2024) | Drives innovation and necessitates market share pursuit to recoup investment, often leading to price competition. | Emphasis on AI and cybersecurity as key differentiators. |

SSubstitutes Threaten

Some smaller healthcare providers may still rely on generic IT solutions or even manual processes for certain tasks. This is often a response to the perceived high cost or complexity of specialized e-health software. However, the increasing regulatory push towards digitalization, such as mandates for electronic health records (EHRs) and data interoperability, makes these manual or generic approaches less viable and riskier in the long run. For instance, by 2024, a significant portion of healthcare data is expected to be digital, making manual systems a bottleneck.

While CompuGroup Medical (CGM) operates in a digital-first environment, the persistent use of paper-based records and legacy systems in certain markets acts as a subtle substitute. These older methods, though inefficient, can deter some healthcare providers from adopting new e-health solutions immediately. However, the global trend is a clear shift away from paper; for instance, by the end of 2024, the healthcare industry's investment in digital transformation is projected to reach significant figures, reflecting a strong market preference for modern, integrated systems over outdated paper-based alternatives.

The growing prevalence of direct-to-consumer digital health apps and wearables presents a tangible threat of substitutes for certain functionalities within CompuGroup Medical's offerings. These technologies, including remote monitoring devices and smartwatches, empower individuals to track vital signs, manage chronic conditions, and even perform basic diagnostics independently. For example, the global digital health market was valued at approximately $300 billion in 2023 and is projected to grow significantly, indicating increasing patient adoption of these alternative health management tools.

While these consumer-facing solutions may not replace the entirety of a comprehensive Electronic Health Record (EHR) system, they can diminish the perceived need for specific features. Patients might rely on a wearable's integrated glucose monitoring to inform their diabetes management, thereby reducing their dependence on a physician's EHR for routine data. This shift means CompuGroup Medical must continually innovate to offer integrated solutions that leverage, rather than compete with, these evolving patient-centric technologies.

In-house Developed Solutions (for large institutions)

Very large hospital systems, particularly those with substantial IT budgets and specialized development teams, can create their own software. This capability represents a significant, albeit infrequent, threat of substitution for external vendors like CompuGroup Medical.

These bespoke in-house solutions can be tailored precisely to an organization's unique workflows and data management needs, potentially offering a level of integration and customization that off-the-shelf products struggle to match. For instance, a healthcare system investing heavily in proprietary AI for diagnostics might develop integrated patient management software to support it.

While the upfront investment and ongoing maintenance are considerable, successful in-house development can reduce long-term reliance on third-party vendors and associated licensing fees. This strategy is more feasible for organizations with millions in annual IT spending, allowing them to reallocate capital strategically.

- Customization: Solutions are built to exact institutional specifications.

- Integration: Seamlessly links with existing proprietary systems.

- Cost Control: Potential for long-term savings by eliminating vendor fees.

- Independence: Reduced reliance on external software providers.

Alternative Telehealth Platforms

The rise of alternative telehealth platforms presents a significant threat of substitution for certain functionalities offered by CompuGroup Medical (CGM). While CGM provides integrated communication solutions within its broader healthcare IT ecosystem, standalone virtual care platforms are increasingly offering specialized or superior user experiences for specific needs like remote patient monitoring or virtual consultations. For instance, by mid-2024, the global telehealth market was projected to reach over $200 billion, indicating a substantial and growing segment of the healthcare technology landscape where direct competitors can emerge.

These specialized platforms can attract users seeking niche features or a more streamlined interface for particular telehealth services, potentially diverting demand away from CGM's more general communication tools. This is particularly relevant as many new entrants focus on user-friendliness and innovative virtual care delivery models. By late 2023, several prominent telehealth providers had reported significant user growth, with some experiencing year-over-year increases exceeding 30% in patient engagement for virtual visits.

- Increased Competition: Standalone telehealth platforms offer focused solutions that can replace specific communication or consultation aspects of CGM's offerings.

- User Experience Advantage: Some alternative platforms may provide a more intuitive or feature-rich user experience for specialized virtual care needs.

- Market Growth: The booming telehealth market, projected to exceed $200 billion by mid-2024, signifies ample room for substitute providers to gain traction.

- User Engagement Data: Reports indicated over 30% year-over-year growth in patient engagement for certain telehealth platforms by late 2023, highlighting their increasing appeal.

The threat of substitutes for CompuGroup Medical (CGM) primarily stems from alternative ways healthcare providers and patients can manage health information and interactions. While CGM offers integrated digital solutions, simpler or more specialized alternatives can emerge.

These substitutes range from continued reliance on manual processes and paper records, particularly in less digitized regions, to the rise of consumer-facing health apps and wearables. Large healthcare systems also pose a threat by developing their own in-house software. The increasing adoption of standalone telehealth platforms also offers a direct substitute for certain communication and consultation functionalities.

The market is rapidly evolving, with digital transformation in healthcare accelerating. By 2024, a significant majority of healthcare data is expected to be digital, making outdated systems less viable. The global digital health market's valuation, estimated around $300 billion in 2023, underscores the growth of these alternative digital solutions.

For instance, while CGM provides comprehensive EHRs, a patient using a wearable device for continuous glucose monitoring might reduce their need for specific data entry within the EHR itself. Similarly, the telehealth market, projected to exceed $200 billion by mid-2024, shows a strong demand for virtual care that specialized platforms can fulfill, potentially bypassing broader IT providers like CGM for specific service delivery.

Entrants Threaten

Entering the e-health software market demands significant upfront capital. Developing sophisticated software like CompuGroup Medical's (CGM) requires extensive research and development, robust IT infrastructure, and substantial investment in sales and marketing efforts. For example, CGM reported EUR 255 million in R&D expenses in 2024, highlighting the scale of investment needed to innovate and compete effectively.

The healthcare sector's intricate web of regulations presents a formidable barrier for potential new entrants into CompuGroup Medical's market. These rules, covering everything from data privacy like HIPAA to patient safety and system interoperability, demand substantial investment in compliance infrastructure and expertise. For instance, the Health Insurance Portability and Accountability Act (HIPAA) in the US alone necessitates robust security measures and stringent data handling protocols, a costly undertaking for any newcomer.

The healthcare sector, where CompuGroup Medical (CGM) operates, places immense value on established customer relationships and trust. Providers are hesitant to switch vendors for critical systems managing patient data, prioritizing reliability and a proven track record. This creates a significant barrier for new entrants, as cultivating this level of confidence is a lengthy and resource-intensive process.

CGM itself has built a substantial foundation of trust, serving approximately 1.6 million users across 56 countries. This extensive network and long-standing presence mean that potential new competitors must not only offer superior technology but also overcome the deeply ingrained preference for established, trusted partners. The sheer scale of CGM's user base underscores the difficulty new entrants face in replicating the necessary trust and relationships within a reasonable timeframe.

Technological Expertise and Specialization

The development of sophisticated e-health solutions, such as those offered by CompuGroup Medical, necessitates significant technological expertise. This includes specialized knowledge in cloud infrastructure, artificial intelligence for data analysis, robust cybersecurity measures, and adherence to complex interoperability standards vital for seamless data exchange. General software developers often lack this deep, sector-specific know-how, creating a substantial barrier to entry.

This technological specialization acts as a significant deterrent to new entrants. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially. Companies looking to compete in this space must invest heavily in acquiring or developing these niche skills, which takes considerable time and resources. CompuGroup Medical's established proficiency in these areas provides a strong competitive advantage.

Key areas of technological expertise that create barriers include:

- Cloud Computing: Managing secure and scalable health data requires advanced cloud architecture.

- Artificial Intelligence (AI): AI is increasingly used for diagnostics, personalized medicine, and operational efficiency in healthcare.

- Cybersecurity: Protecting sensitive patient data is paramount and requires cutting-edge security protocols.

- Interoperability Standards: Implementing systems that can communicate with diverse healthcare IT infrastructures is complex.

Network Effects and Ecosystem Lock-in

Existing e-health platforms, like those offered by CompuGroup Medical, thrive on powerful network effects. This means the more doctors, patients, and healthcare providers who use a platform, the more valuable it becomes for everyone involved through enhanced data sharing and interoperability. For example, a larger user base attracts more third-party integrations, such as with labs or insurance providers, further solidifying the platform's utility.

New entrants face a significant hurdle in replicating these established ecosystems. Building a comparable network from scratch requires substantial investment and time to achieve critical mass. Without an existing network of users and integrated partners, new platforms struggle to offer the same level of convenience and comprehensive functionality that users have come to expect from incumbents, leading to high switching costs for customers.

Consider the challenge: a new e-health system needs to persuade users to abandon a system that is already deeply integrated into their daily workflows and connected to a vast network of other healthcare entities. In 2024, the continued consolidation within the healthcare IT sector means that established players like CompuGroup Medical are even more entrenched, making it harder for smaller, less connected new entrants to gain traction.

- Network Effects: Value increases with user and partner adoption, creating a self-reinforcing cycle.

- Ecosystem Lock-in: High switching costs for users due to integrated workflows and data.

- Barriers to Entry: New entrants must overcome inertia and build a comparable network and functionality.

- Incumbent Advantage: Established players benefit from existing user bases and extensive partner integrations.

The threat of new entrants into CompuGroup Medical's (CGM) market is generally low due to substantial capital requirements, stringent regulatory environments, and the need for specialized technological expertise. CGM's significant R&D investment of EUR 255 million in 2024 underscores the financial commitment needed to remain competitive. Navigating complex regulations like HIPAA also necessitates considerable investment in compliance, acting as a deterrent for newcomers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CompuGroup Medical is built upon a foundation of diverse and reliable data sources. This includes CompuGroup Medical's official annual reports and investor relations materials, alongside industry-specific research from reputable market analysis firms and publications. We also incorporate data from regulatory filings and relevant government databases to ensure a comprehensive understanding of the competitive landscape.