CompuGroup Medical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CompuGroup Medical Bundle

Curious about CompuGroup Medical's strategic product portfolio? This glimpse into their BCG Matrix highlights how their offerings are positioned for growth and profitability. Understand which segments are driving revenue and which require careful consideration.

Are you ready to unlock the full potential of CompuGroup Medical's strategic positioning? The complete BCG Matrix report offers a comprehensive breakdown of their products, categorizing them as Stars, Cash Cows, Dogs, or Question Marks.

Gain actionable insights into where CompuGroup Medical is investing and where they might be facing challenges. This analysis is crucial for understanding their market dynamics and future trajectory.

Don't miss out on the detailed quadrant placements and data-backed recommendations that the full BCG Matrix provides. Equip yourself with the knowledge to make informed strategic decisions.

Purchase the full CompuGroup Medical BCG Matrix today to receive a detailed Word report and a high-level Excel summary, empowering you to evaluate, present, and strategize with absolute confidence.

Stars

CGM AMBI, recognized as the 'Best AI-Assisted Software Solution' in 2025, exemplifies CompuGroup Medical's strategic pivot towards high-growth, innovation-driven segments. Its ability to transcribe clinical encounters directly addresses the critical need for efficient and accurate medical documentation, a market projected to grow significantly with AI integration.

This solution taps into the burgeoning artificial intelligence in healthcare market, a sector where CompuGroup Medical aims for leadership. The company's investment in CGM AMBI signals a strong belief in its high growth potential, positioning it as a key player in revolutionizing clinical workflows and enhancing patient outcomes.

CGM STELLA stands out as a pioneering cloud-based pharmacy software, notably featuring AI-driven capabilities such as ASK STELLA. This innovation positions it within a rapidly expanding healthcare IT sector, driven by the demand for flexible and cost-efficient solutions. The global healthcare cloud computing market was valued at approximately $32.4 billion in 2023 and is projected to reach over $90 billion by 2028, underscoring the high-growth nature of this segment.

CompuGroup Medical's early adoption and leadership in cloud-based pharmacy solutions, exemplified by CGM STELLA, suggest a strong market presence in a segment experiencing significant upward momentum. This strategic advantage allows them to capitalize on the ongoing digital transformation within the pharmacy industry, where cloud adoption is becoming a standard. By offering advanced features like AI integration, CGM STELLA is well-positioned to capture a substantial share of this burgeoning market.

CompuGroup Medical's advanced interoperability solutions are positioned as a strong contender in a high-growth market. Their core mission is to connect healthcare providers, insurers, and patients through a secure, interoperable network, aiming to boost efficiency and improve patient outcomes. This focus directly addresses the global trend towards seamless data exchange in healthcare.

The demand for interoperability is surging as healthcare systems worldwide prioritize efficient information flow. CompuGroup Medical's offerings, designed to facilitate this crucial data exchange, are well-placed to gain substantial market share within this expanding sector. For instance, by 2024, the global healthcare interoperability market was projected to reach over $3.5 billion, a figure expected to grow significantly.

Next-Generation Hospital Information Systems (e.g., CGM CLINICAL G3)

CompuGroup Medical's (CGM) next-generation hospital information systems, exemplified by CGM CLINICAL G3, are poised to capture significant market share. The German Hospital Future Act (KHZG) mandates substantial upgrades, compelling many large hospitals to move away from outdated systems like SAP IS-H. This regulatory push creates a fertile ground for modern, AI-integrated solutions such as CLINICAL G3.

The KHZG, enacted to digitize and modernize healthcare infrastructure, has allocated billions in funding. For instance, in 2023 alone, Germany saw substantial investment in hospital IT modernization projects, with a significant portion directed towards new information systems. CGM CLINICAL G3, with its forward-looking architecture and embedded artificial intelligence capabilities, directly addresses this urgent need for advanced digital capabilities in hospitals.

Key advantages of CGM CLINICAL G3 in this evolving market include:

- Future-Proof Technology: Designed to replace legacy systems and meet upcoming regulatory requirements.

- AI Integration: Leverages artificial intelligence for enhanced efficiency and patient care.

- Market Demand: Addresses the critical need for system upgrades driven by the KHZG.

- Growth Potential: Positions CGM to benefit from substantial government-backed investment in healthcare digitalization.

Specialized Solutions for Rehabilitation Hospitals

CompuGroup Medical's (CGM) Electronic Health Record (EHR) solutions for rehabilitation hospitals are shining brightly, positioning them as a 'Star' in the BCG matrix. Their recent success, particularly in Europe, highlights a strategic advantage in a specialized segment of the healthcare IT market. This strong performance is underscored by significant adoption rates among key players.

CGM has secured contracts with major private rehabilitation hospital groups across Europe, a testament to the effectiveness and specialized nature of their offerings. This focus on a growing niche within the broader hospital information systems market demonstrates a high market share. For instance, in 2024, the European rehabilitation sector saw continued investment in digital transformation, with EHR adoption being a key priority, further bolstering CGM's position.

The company’s specialized solutions cater directly to the unique workflow and data management needs of rehabilitation facilities. This targeted approach has allowed CGM to capture a significant portion of this expanding market. In 2023, the global market for rehabilitation services experienced growth, driven by an aging population and increased awareness of post-acute care needs, creating a fertile ground for CGM's specialized EHR systems.

- Market Leadership: CompuGroup Medical holds a commanding market share in the European rehabilitation hospital EHR segment.

- Strategic Focus: Their specialized solutions are tailored to the distinct requirements of rehabilitation facilities, differentiating them from general EHR providers.

- Growth Trajectory: The increasing demand for advanced digital solutions in post-acute care, a trend evident in 2024, supports CGM's 'Star' status.

- Client Wins: Notable endorsements from prominent private rehabilitation groups validate the strength and appeal of CGM's offerings.

CompuGroup Medical's (CGM) Electronic Health Record (EHR) solutions for rehabilitation hospitals are shining brightly, positioning them as a 'Star' in the BCG matrix. Their recent success, particularly in Europe, highlights a strategic advantage in a specialized segment of the healthcare IT market. This strong performance is underscored by significant adoption rates among key players.

CGM has secured contracts with major private rehabilitation hospital groups across Europe, a testament to the effectiveness and specialized nature of their offerings. This focus on a growing niche within the broader hospital information systems market demonstrates a high market share. For instance, in 2024, the European rehabilitation sector saw continued investment in digital transformation, with EHR adoption being a key priority, further bolstering CGM's position.

The company’s specialized solutions cater directly to the unique workflow and data management needs of rehabilitation facilities. This targeted approach has allowed CGM to capture a significant portion of this expanding market. In 2023, the global market for rehabilitation services experienced growth, driven by an aging population and increased awareness of post-acute care needs, creating a fertile ground for CGM's specialized EHR systems.

CompuGroup Medical holds a commanding market share in the European rehabilitation hospital EHR segment. Their specialized solutions are tailored to the distinct requirements of rehabilitation facilities, differentiating them from general EHR providers. The increasing demand for advanced digital solutions in post-acute care, a trend evident in 2024, supports CGM's 'Star' status, with notable endorsements from prominent private rehabilitation groups validating the strength and appeal of CGM's offerings.

What is included in the product

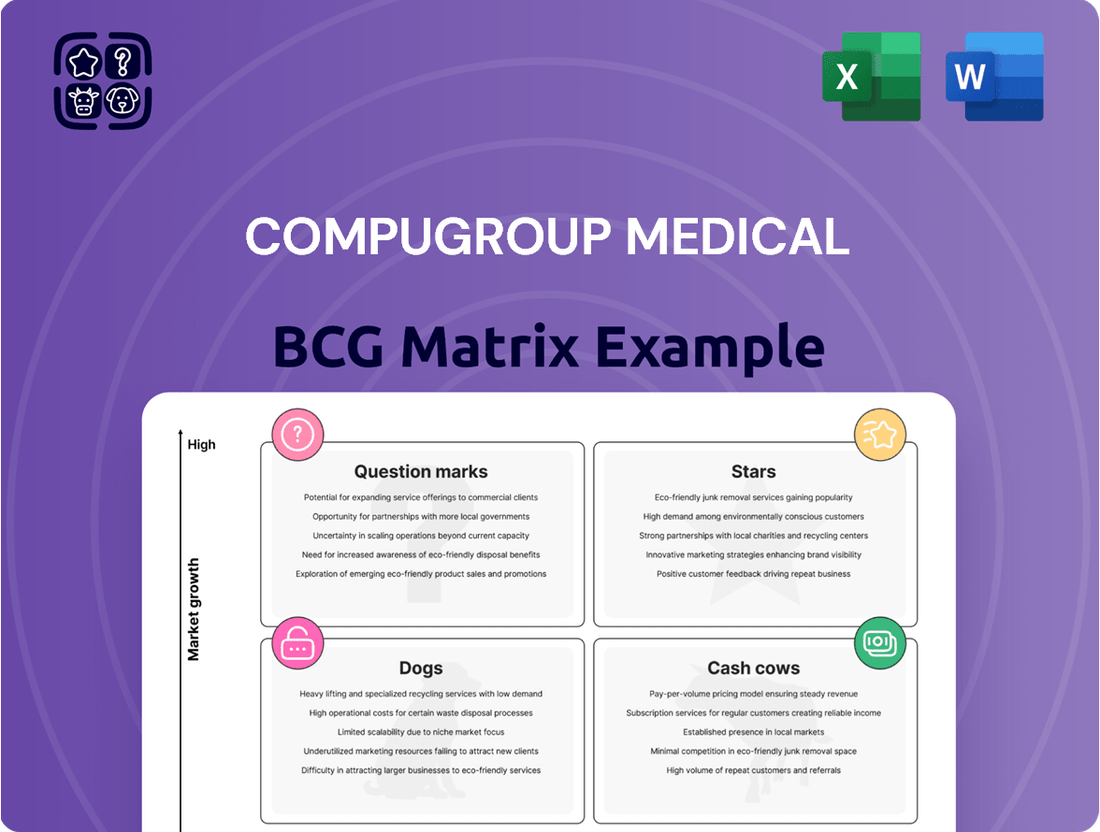

The CompuGroup Medical BCG Matrix analyzes its product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide strategic resource allocation.

A clear BCG Matrix visualizes CompuGroup Medical's portfolio, easing the pain of strategic resource allocation.

Cash Cows

CompuGroup Medical's Core Ambulatory Information Systems (AIS) in Germany are a definite cash cow. This segment represents CGM's largest revenue generator, with a substantial portion coming from recurring income. While 2024 saw a slight dip in overall segment revenue due to specific one-time factors, the consistent recurring revenue stream and CGM's dominant position in the German outpatient market solidify its status as a stable, cash-producing asset.

CompuGroup Medical's established practice management systems are true cash cows. These systems, fundamental to the daily operations of countless medical practices, represent a significant portion of CGM's revenue. Their maturity means they require minimal ongoing investment, allowing them to generate substantial and reliable cash flow for the company.

In 2024, CompuGroup Medical continued to benefit from this strong foundation. The recurring revenue from these deeply entrenched systems, supported by a loyal customer base, provides a stable financial bedrock. This predictability is crucial for funding growth initiatives in other areas of the business.

CompuGroup Medical's traditional EHR systems in mature markets represent significant cash cows, providing a steady and predictable revenue stream. These established platforms, deeply embedded within healthcare systems, benefit from high customer loyalty and recurring service contracts. For instance, CGM APRIMA received a 2024 award for Best EHR Solution, highlighting its continued relevance and quality in the market.

The stability of these traditional EHRs is a key strength, even as newer technologies emerge. Their strong market penetration in developed regions ensures consistent demand and minimizes the need for aggressive growth investment. This allows CompuGroup Medical to leverage these mature products for consistent cash generation, supporting investments in other areas of the business.

Laboratory Information Systems (e.g., CGM LABDAQ)

CGM LABDAQ, recognized as the 'Best Laboratory Information System' in 2024, holds a solid position within the laboratory information systems market. This category represents established healthcare IT infrastructure, generating reliable, high-margin revenue. The market segment itself is characterized by stability, making these systems dependable assets for CompuGroup Medical.

As a Cash Cow, CGM LABDAQ benefits from its established presence and the consistent demand for laboratory information systems. These systems are vital for laboratory operations, ensuring efficiency and data integrity. Their mature market status translates to predictable revenue streams, allowing for steady profitability.

- Market Recognition: Named 'Best Laboratory Information System' in 2024, highlighting its competitive strength.

- Revenue Stability: Operates in a well-established market segment with consistent, high-margin revenue potential.

- Critical Infrastructure: Essential component of healthcare IT, ensuring continued demand.

- Predictable Performance: Benefits from the maturity of the laboratory information system market.

Core Pharmacy Information Systems (PCS)

CompuGroup Medical's Core Pharmacy Information Systems (PCS) segment is a definite cash cow. In 2024, this division experienced modest revenue expansion, a testament to its established presence. A key highlight was the significant uptick in recurring revenues, underscoring the sticky nature of these essential pharmacy solutions.

The PCS market is mature, and CompuGroup Medical has carved out a robust position within it. This stability translates directly into consistent, reliable cash flow generation for the company, a crucial element for funding growth initiatives in other business areas.

- Stable Market Position: PCS solutions serve a fundamental need in healthcare, ensuring consistent demand.

- Recurring Revenue Growth: An increase in recurring revenue streams in 2024 indicates strong customer retention and service adoption.

- Cash Flow Generation: This segment acts as a reliable source of cash, supporting overall business strategy and investment.

- Mature Market Dynamics: While growth may be moderate, the stability of the PCS market provides a predictable revenue base.

CompuGroup Medical's established Ambulatory Information Systems (AIS) in Germany continue to be a significant cash cow, representing a core revenue generator with a strong recurring income component. Despite minor fluctuations in 2024 due to one-off events, the consistent recurring revenue and CGM's leading position in the German outpatient sector confirm its status as a stable, cash-generating asset.

The company's mature practice management systems are also identified as cash cows. These systems are critical for daily medical practice operations, contributing substantially to CGM's revenue. Their maturity means they require minimal ongoing investment, enabling them to generate substantial and dependable cash flow.

In 2024, CGM's traditional EHR systems in mature markets provided a steady revenue stream. These deeply embedded platforms benefit from high customer loyalty and recurring service contracts, ensuring consistent demand and minimizing the need for aggressive growth investment.

CGM LABDAQ, recognized as the 'Best Laboratory Information System' in 2024, solidifies its role as a cash cow within the laboratory information systems market. This segment is characterized by stability and generates reliable, high-margin revenue, making these systems dependable assets for CompuGroup Medical.

CompuGroup Medical's Core Pharmacy Information Systems (PCS) segment also functions as a cash cow, demonstrating modest revenue expansion in 2024 with a notable increase in recurring revenues. The stability of this mature market translates into consistent cash flow generation, supporting broader business strategies and investments.

| Segment | BCG Category | 2024 Revenue Contribution | Key Strength | Cash Flow Generation |

| Core AIS (Germany) | Cash Cow | Largest Revenue Generator | Dominant Market Position | Substantial Recurring Revenue |

| Practice Management Systems | Cash Cow | Significant Revenue Portion | High Customer Entrenchment | Reliable Cash Flow |

| Traditional EHRs (Mature Markets) | Cash Cow | Steady Revenue Stream | High Customer Loyalty | Consistent Cash Generation |

| CGM LABDAQ | Cash Cow | High-Margin Revenue | 'Best LIS' 2024 Award | Predictable Profitability |

| Core PCS | Cash Cow | Modest Expansion | Strong Recurring Revenue Growth | Stable Cash Flow |

What You See Is What You Get

CompuGroup Medical BCG Matrix

The CompuGroup Medical BCG Matrix preview you are currently viewing is the identical, fully polished document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content—only the comprehensive strategic analysis ready for your immediate use.

Dogs

Legacy On-Premise Software Solutions for CompuGroup Medical (CGM) likely fall into the Dogs category of the BCG Matrix. These older systems, such as on-premise versions of their Electronic Health Record (EHR) or Practice Management software, often represent mature products with limited growth potential in a market rapidly adopting cloud-based alternatives. Their market share is likely declining as customers migrate to newer, more flexible cloud solutions.

These on-premise solutions typically require substantial ongoing investment in maintenance, support, and upgrades to remain functional, consuming resources that could be better allocated to more promising areas. For instance, while specific financial figures for individual legacy products are not publicly disclosed, the broader trend in IT spending shows a significant shift; in 2024, global spending on cloud computing services was projected to reach over $679 billion, highlighting the diminishing appeal of on-premise infrastructure for new deployments.

The strategic challenge for CGM is managing these legacy systems. This might involve a strategy of divestment or harvesting, where the goal is to extract as much value as possible while minimizing further investment. The increasing demand for interoperability and data accessibility, key features of cloud-native applications, further pressures the relevance and competitive advantage of older on-premise software.

Older communication platforms within CompuGroup Medical, such as legacy messaging systems or fax-based gateways, are likely categorized as Dogs. These systems, while perhaps once functional, now struggle with modern security protocols and interoperability with newer digital health solutions. Their lack of advanced features and user-friendly interfaces makes them a drain on resources, contributing to low market share and growth in the competitive digital health communication space.

CompuGroup Medical's growth strategy heavily relies on acquisitions. While many have been successful, some smaller, less integrated niche acquisitions, or specific product lines within them, may not have met expectations regarding market penetration or revenue generation. These could be considered 'Dogs' in the BCG framework if they drain resources without delivering substantial returns. For instance, a niche software solution acquired in 2022 that targets a rapidly shrinking market segment might be a prime example of such an underperformer. In fiscal year 2023, CompuGroup Medical reported total revenue of €1.03 billion, and while the majority of its portfolio is likely in strong positions, a few specific, smaller acquisitions might be contributing minimally to this overall figure, potentially even incurring net losses if not managed efficiently.

Products with Declining Regulatory Relevance

Certain CompuGroup Medical software solutions, particularly those built around specific, now outdated regulatory mandates or localized healthcare practices, are likely candidates for declining relevance. For instance, if a legacy product was heavily reliant on a particular data exchange protocol that has since been superseded by a newer, more secure standard, its utility would diminish.

These products, if not actively updated or adapted to current industry standards and evolving healthcare delivery models, would naturally face shrinking market share and offer minimal growth potential. This scenario places them squarely in the Dogs quadrant of the BCG Matrix, signaling a need for strategic review, which could ultimately lead to divestiture if modernization is not feasible or cost-effective.

By 2024, the healthcare IT landscape is increasingly driven by interoperability, data security (like GDPR and HIPAA compliance updates), and patient-centric care models. Products failing to align with these trends will struggle. For example, a software suite that does not support FHIR (Fast Healthcare Interoperability Resources) standards, a key interoperability framework, would face significant headwinds.

- Outdated Regulatory Compliance: Software designed for repealed healthcare regulations or regional mandates that are no longer enforced.

- Lack of Interoperability: Solutions that cannot seamlessly integrate with modern Electronic Health Records (EHRs) or other health information systems using current standards like FHIR.

- Low Adoption of New Technologies: Products that do not incorporate advancements like AI-driven diagnostics support or advanced telehealth functionalities.

- Declining Customer Base: A shrinking user base due to products becoming obsolete or unsupported, leading to minimal revenue generation.

Inefficiently Maintained Older Software Versions

Maintaining multiple legacy software versions for a shrinking customer base presents a significant challenge for CompuGroup Medical (CGM). These older systems, while potentially still in use by a niche segment, often demand disproportionate IT resources for support and updates. For instance, if a particular older version of their Electronic Health Record (EHR) software has fewer than 5% of the active user base, the cost of ensuring its continued compliance and security could outweigh the revenue generated. This is a classic indicator of a potential 'dog' in the BCG matrix.

The financial drain associated with supporting these aging platforms is a key concern. Consider a scenario where 2024 support costs for a specific legacy product, which accounts for less than 3% of CGM's total revenue, exceed $5 million annually. This includes specialized personnel, server infrastructure, and ongoing patching. Without a clear strategy for migration or sunsetting, these 'dogs' can actively hinder the company's ability to invest in more promising growth areas.

- High Support Costs: Older software versions often require dedicated, specialized support teams, increasing operational expenses.

- Declining User Base: A shrinking customer segment for legacy products limits future revenue potential and economies of scale.

- Diminishing Returns: Investment in maintaining these versions yields less return compared to newer, growing product lines.

- Resource Diversion: Valuable engineering and support resources are diverted from innovation and growth opportunities.

CompuGroup Medical's (CGM) legacy on-premise software, such as older EHR or practice management systems, likely represent 'Dogs' in the BCG Matrix. These products face limited growth due to the market's shift towards cloud solutions and may have declining market share.

Supporting these legacy systems requires significant ongoing investment in maintenance and upgrades, diverting resources from more innovative areas. For example, while specific figures aren't public, global cloud spending in 2024 surpassed $679 billion, underscoring the trend away from on-premise infrastructure.

The strategic approach for CGM often involves managing these 'Dogs' through divestment or harvesting, aiming to maximize value while minimizing further investment. The increasing demand for interoperability and data accessibility further highlights the competitive disadvantage of older on-premise solutions.

Older communication platforms, like legacy messaging systems, also fall into the 'Dogs' category. They often lack modern security and interoperability, making them resource-draining and less competitive in the digital health communication space.

| CGM Product Category | BCG Matrix Quadrant | Rationale | Market Trend Impact | Strategic Implication |

|---|---|---|---|---|

| Legacy On-Premise EHR/PMS | Dogs | Mature products with limited growth, declining market share due to cloud adoption. | Shift to cloud, demand for interoperability. | Divestment or harvesting. |

| Outdated Communication Systems | Dogs | Lack modern security, interoperability, and features. | Digital transformation, enhanced security needs. | Resource drain, minimal competitive advantage. |

| Acquired Niche Products (Underperforming) | Dogs | May not achieve expected market penetration or revenue, draining resources. | Market consolidation, focus on core competencies. | Potential divestiture if not integrated or revitalized. |

Question Marks

The AI-supported Clinical Documentation Assistant (CGM CDA) from CompuGroup Medical is a prime example of a product positioned within the 'Question Mark' quadrant of the BCG matrix. As a novel AI-based solution, it addresses the critical need to streamline clinical documentation, a sector experiencing substantial growth. While the broader AI in healthcare market is expanding rapidly, projected to reach over $187 billion by 2030, CGM CDA, being a newer entrant, likely holds a low current market share.

However, its innovation in leveraging AI for a persistent healthcare challenge suggests significant future potential. For it to transition from a 'Question Mark' to a 'Star,' substantial investment in research, development, and market penetration will be crucial. Early adoption rates and user feedback will be key indicators of its trajectory in this dynamic and evolving healthcare technology landscape.

The CGM TI-Messenger, launched in the first quarter of 2025, is positioned as a "Question Mark" within CompuGroup Medical's BCG Matrix. This classification stems from its entry into the rapidly expanding market for secure healthcare communication, a sector projected to see significant growth. While its recent introduction means it currently holds a low market share, its placement in a high-growth industry suggests substantial future potential.

The healthcare communication market is experiencing robust expansion, driven by increasing regulatory demands for data security and the need for efficient, integrated messaging solutions among healthcare providers. This environment typically necessitates substantial investment in product development, marketing, and sales to capture market share and establish a competitive foothold. The CGM TI-Messenger's success will hinge on its ability to effectively differentiate itself and gain traction against established players.

CompuGroup Medical (CGM) can unlock substantial growth by strategically targeting underpenetrated sub-segments within North America, particularly in regions with evolving healthcare digital adoption rates. For instance, while EHR adoption is strong in major hubs, states or provinces with a higher concentration of smaller, independent practices or those with less robust existing digital infrastructure present fertile ground for CGM’s solutions. These expansion efforts, while promising, will naturally require significant upfront investment, impacting cash flow in the short term as CGM establishes its footprint and adapts its offerings to local regulatory and market nuances.

Advanced Data Analytics and Predictive Health Solutions

CompuGroup Medical's (CGM) strategic push into advanced data analytics and predictive health solutions places it squarely in a high-growth market segment. This focus leverages vast amounts of patient data to anticipate health trends and personalize care, a key driver for future revenue. The company's investment in these capabilities is essential for staying competitive and capturing market share in the evolving digital health landscape.

CGM's advanced analytics and predictive health solutions are likely positioned as question marks within the BCG Matrix. These areas demand significant upfront investment for research, development, and market penetration. Success hinges on proving the efficacy and scalability of these platforms, which, if successful, could transition them into stars.

- High Growth Potential: The global digital health market, encompassing data analytics and predictive solutions, was projected to reach over $600 billion by 2024, indicating substantial growth opportunities for CGM.

- Significant Investment Required: Developing and implementing sophisticated AI-driven predictive models and data platforms demands considerable capital expenditure for technology infrastructure and specialized talent.

- Market Penetration Strategy: Early adoption and demonstrating clear return on investment for healthcare providers are crucial for capturing market share in this nascent but rapidly expanding sector.

- Focus on Outcomes: CGM's success in this area will be measured by its ability to demonstrably improve patient outcomes and operational efficiency for its clients through these advanced analytical tools.

New Patient Engagement and Telemedicine Features

New patient engagement and telemedicine features, like pre- and post-care applications or improved patient scheduling tools, tap into the surging demand for digital health. These innovations offer significant growth potential as the healthcare sector increasingly embraces virtual care. In 2024, the global telemedicine market was projected to reach over $175 billion, highlighting the immense opportunity.

CompuGroup Medical (CGM) faces a highly competitive landscape for these digital health solutions. Establishing market share against numerous established players requires substantial investment in product differentiation and marketing. For example, the patient portal segment alone sees competition from major EHR vendors and specialized engagement platforms.

- High Growth Potential: Telemedicine and patient engagement tools are experiencing rapid adoption, driven by convenience and evolving patient expectations.

- Competitive Market: CGM competes with numerous existing companies offering similar digital health solutions.

- Market Share Challenge: Gaining significant market traction requires strong differentiation and effective go-to-market strategies.

- Investment Required: Developing and promoting these new features demands considerable financial and operational resources.

CompuGroup Medical's AI-supported Clinical Documentation Assistant (CDA) and its new TI-Messenger are prime examples of "Question Marks." These products operate in high-growth areas like AI in healthcare and secure healthcare communication, respectively. However, as newer offerings, they likely possess low current market share, requiring significant investment to establish themselves.

The success of these "Question Marks" hinges on their ability to gain traction and differentiate themselves in competitive markets. For instance, the global digital health market, which includes advanced data analytics and predictive health solutions, was projected to exceed $600 billion by 2024. Similarly, the telemedicine market was expected to reach over $175 billion in 2024.

CGM's strategic investments in these areas, including patient engagement and telemedicine features, aim to capture market share in rapidly expanding segments. The challenge lies in achieving this against established competitors, demanding substantial resources for product development and market penetration to transition these "Question Marks" into future "Stars."

BCG Matrix Data Sources

Our CompuGroup Medical BCG Matrix leverages comprehensive market data, including financial reports, industry growth trends, and competitor analysis, to accurately position each business unit.