CFO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CFO Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting CFO's strategic direction. Our comprehensive PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a competitive advantage and make informed, forward-thinking decisions.

Political factors

Government funding for vocational training in Portugal is a critical political factor influencing centers like CFOS. In 2024, the Portuguese government allocated €250 million towards active employment policies, a significant portion of which supports vocational training initiatives aimed at improving workforce skills and employability.

These budgetary allocations, including subsidies and grants, directly impact CFOS's capacity to offer accessible and affordable training programs. For instance, a 10% increase in government funding for vocational training in 2025 could enable CFOS to expand its course offerings by 15%, reaching an additional 500 students.

Conversely, a reduction in public funding could necessitate higher tuition fees or a scaled-back curriculum, potentially limiting access for a broader segment of the population. The stability and predictability of these funding streams are therefore paramount for strategic planning and sustainable growth within the vocational education sector.

The Portuguese government is actively promoting workforce development through various policy initiatives. For instance, the Skills for the Future program, launched in 2023, aims to retrain workers for emerging sectors, with an initial budget of €50 million. CFOs should monitor these government-led programs, as alignment can unlock access to funding and ensure training aligns with national economic objectives, such as advancing the digital economy.

Changes in labor market regulations, such as updates to minimum wage laws or new requirements for worker benefits, can significantly impact a company's operational costs and talent acquisition strategies. For instance, a potential increase in the federal minimum wage to $15 per hour, a topic of ongoing discussion in 2024, would necessitate adjustments in budgeting for entry-level positions across many sectors.

Evolving employment regulations, including those related to remote work policies or independent contractor classifications, also demand CFO attention. Companies must ensure compliance with these evolving rules to avoid penalties and maintain a stable workforce, as seen with the increasing scrutiny of gig economy worker status in 2024.

Furthermore, shifts in professional qualification requirements, like new licensing or certification mandates for certain roles, directly influence hiring practices and the need for internal upskilling programs. CFOs must factor in the cost and feasibility of ensuring their workforce meets these updated professional standards, which can affect project timelines and team capabilities.

EU structural funds allocation

Portugal, as an EU member, is set to receive substantial European Union structural funds, with a significant portion earmarked for education, training, and employment. For instance, under the Portugal 2030 framework, the European Regional Development Fund (ERDF) and the European Social Fund Plus (ESF+) are key instruments. These funds are crucial for CFOs looking to finance specific projects, upgrade infrastructure, or develop new programs that align with EU priorities.

The allocation and focus of these funds act as a critical political-economic driver, influencing investment decisions and strategic planning within various sectors. CFOs should monitor the specific calls for proposals and the thematic objectives set by the EU and Portuguese authorities for 2024 and 2025 to identify opportunities for co-financing.

- Portugal 2030: This is the current operational program guiding EU fund allocation in Portugal, with a strong emphasis on innovation, competitiveness, and social inclusion.

- ERDF and ESF+ Focus: These funds are expected to channel significant resources into digital transition, green economy initiatives, and enhancing the skills of the workforce.

- Project Eligibility: CFOs need to ensure their proposed projects align with the specific eligibility criteria and strategic goals outlined in the Portugal 2030 program to secure funding.

- Economic Impact: The successful absorption and utilization of these structural funds can lead to increased investment, job creation, and overall economic growth, directly impacting business performance.

Political stability and long-term planning

Portugal's political stability is a cornerstone for long-term strategic planning within the vocational training sector. A predictable policy environment allows Chief Financial Officers (CFOs) to confidently forecast investments in new programs, technology upgrades, and infrastructure development. For instance, the continuity of government support for skills development, as evidenced by the €2.4 billion allocated to the European Social Fund Plus (ESF+) for Portugal in the 2021-2027 period, directly impacts the sector's financial outlook.

Conversely, rapid shifts in government or frequent policy reversals introduce significant uncertainty. This makes it difficult for vocational training institutions to commit to long-term capital expenditures or to establish stable partnerships, as future funding streams and regulatory landscapes become unpredictable. Such instability can deter both institutional investment and the confidence of trainees seeking to upskill for a stable career path.

- Political Stability: Contributes to a predictable investment climate for vocational training infrastructure and program development.

- Policy Continuity: Essential for long-term financial planning and securing funding for training initiatives.

- Government Support: Portugal's commitment to vocational training, supported by EU funds, underpins sector growth.

- Risk Mitigation: Stable political conditions reduce financial risks associated with unforeseen policy changes for institutions and investors.

Government policies and regulations significantly shape the operational landscape for vocational training centers. Portugal's commitment to workforce development, backed by substantial EU funding under the Portugal 2030 framework, offers considerable opportunities for institutions like CFOS. For example, the €2.4 billion allocated to the European Social Fund Plus (ESF+) for Portugal in the 2021-2027 period directly supports skills enhancement and employment initiatives, providing a stable financial outlook for strategic investments.

Changes in labor laws and professional qualification requirements necessitate proactive adaptation by CFOs. Staying abreast of evolving employment regulations, such as potential minimum wage adjustments in 2024 or new certification mandates, is crucial for maintaining compliance and ensuring workforce readiness, thereby mitigating operational risks and supporting long-term growth strategies.

Political stability is a key determinant for long-term financial planning in the vocational training sector. A consistent policy environment allows for confident investment in new programs and technology, as demonstrated by the continued government focus on skills development, which is further bolstered by EU structural funds aimed at digital transition and green economy initiatives.

| Factor | Impact on CFOS | 2024/2025 Data/Trend |

|---|---|---|

| Government Funding & Support | Enables program expansion and accessibility. | €250 million allocated to active employment policies in Portugal (2024); Portugal 2030 framework channeling ESF+ funds. |

| Labor Market Regulations | Affects operational costs and talent strategy. | Ongoing discussions on minimum wage increases; increased scrutiny of gig economy worker status (2024). |

| EU Funding & Policy Alignment | Provides opportunities for project financing and infrastructure upgrades. | Portugal 2030 focuses on digital transition and green economy skills; ERDF and ESF+ are key instruments. |

| Political Stability & Policy Continuity | Ensures predictable investment climate and reduces financial risk. | Continuity of government support for skills development is critical for strategic planning. |

What is included in the product

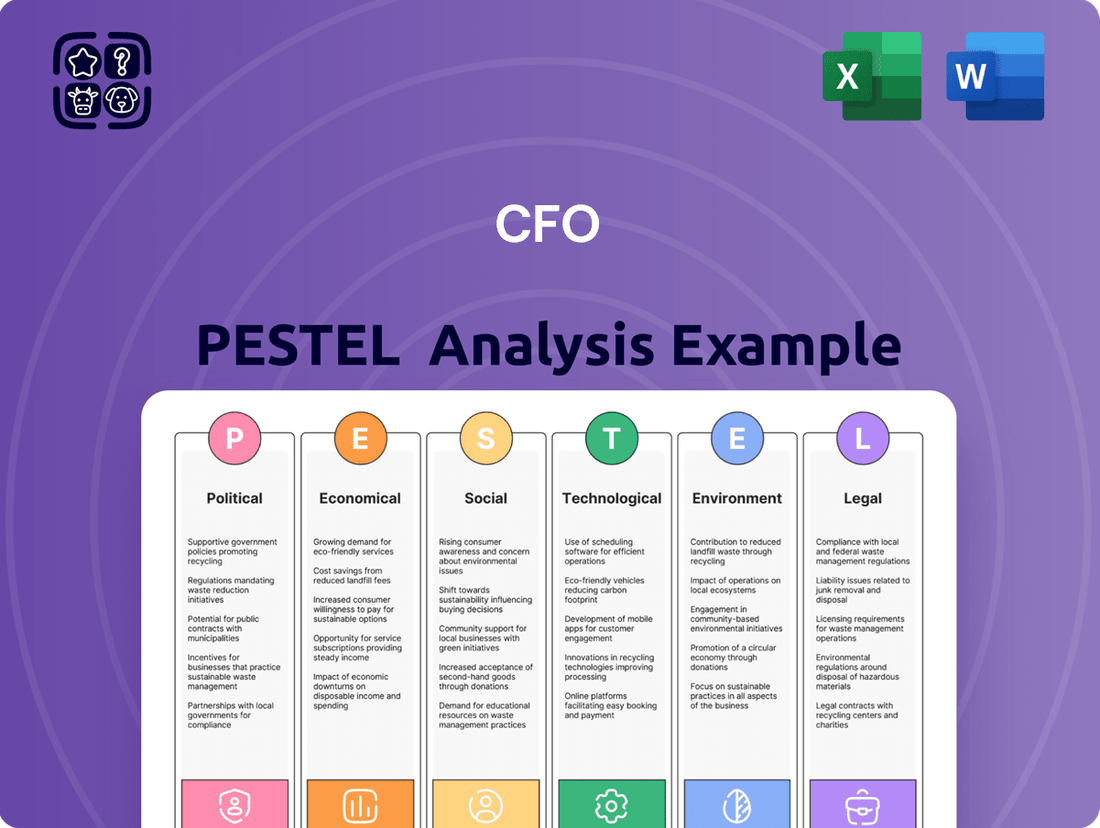

This analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors that impact a Chief Financial Officer's decision-making and strategic planning.

It provides a comprehensive overview of the external landscape, enabling CFOs to identify potential risks and opportunities for their organization.

A PESTLE analysis for the CFO provides a structured framework to anticipate and mitigate external threats, transforming potential market disruptions into manageable challenges for strategic financial planning.

Economic factors

Portugal's national unemployment rate stood at 6.5% in the first quarter of 2024, a slight decrease from the previous year. This figure is crucial for vocational training providers, as it directly impacts the pool of individuals seeking new skills or career changes. A higher unemployment rate typically correlates with increased demand for retraining programs aimed at re-entering the job market.

Conversely, as the economy strengthens and unemployment falls, demand may shift towards specialized upskilling courses designed to enhance existing career paths or fill specific industry skill gaps. CFOs must analyze these shifts to strategically allocate resources for training development and marketing efforts, ensuring alignment with evolving labor market needs.

Portugal's economic growth significantly influences investment in employee training. A robust economy, like the projected 2.0% GDP growth for 2024 and an estimated 2.2% for 2025, generally boosts business confidence, leading to increased spending on upskilling and reskilling initiatives to meet rising labor demands.

Conversely, economic slowdowns can curtail corporate training budgets and individual capacity to invest in professional development. For instance, if economic growth falters, companies might postpone or reduce training programs, impacting vocational training centers that rely on this demand.

The positive growth outlook for Portugal in 2024-2025 suggests a favorable environment for training providers. Increased demand for skilled workers, driven by economic expansion, can translate into higher enrollment and revenue for institutions offering relevant vocational and specialized courses.

In Portugal, the average disposable income significantly influences an individual's capacity to invest in vocational training, particularly for programs that aren't entirely subsidized. For instance, the average net adjusted disposable income per household in Portugal was estimated to be around €20,500 in 2023, a figure that directly impacts how much individuals can allocate to personal development.

CFOs must therefore develop flexible pricing models and explore scholarship initiatives to ensure these training opportunities are accessible to a broader economic spectrum. Understanding the economic pressures faced by households is crucial, as these can directly correlate with enrollment figures for training programs.

Inflation and operational costs

Inflationary pressures in Portugal are significantly impacting operational costs for CFOs. For instance, the Harmonised Index of Consumer Prices (HICP) in Portugal saw an annual rate of 2.4% in May 2024, a slight decrease from 2.6% in April 2024, but still indicative of sustained cost increases across utilities, raw materials, and labor. These rising expenses directly affect profitability and necessitate careful consideration for program pricing strategies.

Managing these escalating costs while aiming to keep course fees competitive presents a substantial economic hurdle. For educational institutions, this means scrutinizing every budget line item, from energy consumption to the procurement of educational materials and the compensation of faculty and staff. The challenge lies in absorbing as much of these cost increases internally as possible without compromising the quality or accessibility of educational programs.

Prudent financial management is therefore paramount for CFOs to effectively navigate this economic landscape. This involves implementing cost-saving measures, exploring bulk purchasing agreements for supplies, optimizing energy usage, and potentially renegotiating supplier contracts. A proactive approach to financial planning and a keen eye on market trends are essential to mitigate the adverse effects of inflation on the organization's financial health.

- Rising Utility Costs: Energy prices, a key component of operational expenses, have seen volatility. For example, electricity prices for households in Portugal increased significantly in recent years, impacting institutional energy bills.

- Material Procurement: The cost of educational materials, from textbooks to specialized equipment, is subject to global supply chain dynamics and inflationary pressures, leading to higher acquisition costs.

- Wage Pressures: To attract and retain talent in a competitive market, institutions may face pressure to increase staff salaries, adding to the wage bill.

- Pricing Dilemma: Balancing the need to cover increased operational costs with the imperative to maintain affordable course fees requires strategic pricing models and a focus on operational efficiency.

Availability of public and private funding

The availability of both public and private funding is a cornerstone for CFOs aiming for financial sustainability. In 2024, for instance, the US government allocated significant funds through initiatives like the CHIPS and Science Act, supporting domestic semiconductor manufacturing, demonstrating the impact of public funding. Simultaneously, private sector investment, particularly venture capital, continued to flow into technology and green energy sectors, with global VC funding reaching approximately $250 billion in the first three quarters of 2024, according to PitchBook data. This mix allows for strategic diversification.

Diversifying funding sources is paramount for resilience. Relying solely on government grants, which can be subject to political shifts and budget cuts, or private equity, which often comes with stringent return expectations, can create vulnerabilities. For example, a company heavily dependent on a single government grant might face severe financial strain if that grant is reduced or eliminated, as seen in some non-profit sectors experiencing funding recalibrations in the post-pandemic economic climate. A balanced approach mitigates these risks.

Securing strategic partnerships with industries offers direct economic advantages and enhances operational relevance. These collaborations can lead to joint ventures, shared research and development costs, and access to new markets. For example, automotive manufacturers partnering with battery technology firms in 2024 are not only securing supply chains but also gaining expertise, driving innovation and cost efficiencies. These symbiotic relationships are vital for long-term growth and competitive positioning.

- Government Grants: Crucial for R&D, infrastructure, and public services, but subject to policy changes.

- Private Sector Investment: Includes venture capital, private equity, and corporate partnerships, often driven by ROI.

- Self-Funding: Retained earnings and internal cash flow provide autonomy but may limit growth scale.

- Industry Partnerships: Offer co-investment, shared risk, and market access, boosting economic benefits.

Portugal's economic trajectory, marked by projected GDP growth of 2.0% in 2024 and 2.2% in 2025, directly influences investment in employee training and development. A robust economy generally translates to increased corporate confidence and spending on upskilling initiatives to meet growing labor demands.

The average disposable income, estimated around €20,500 per household in 2023, impacts individuals' capacity to invest in vocational training, necessitating flexible pricing and scholarship options from training providers.

Inflationary pressures, with the HICP at 2.4% in May 2024, increase operational costs for CFOs, affecting everything from utilities to materials and wages, creating a pricing dilemma for educational institutions.

The interplay of government grants and private sector investment, with global VC funding around $250 billion in Q1-Q3 2024, alongside industry partnerships, shapes financial sustainability and growth opportunities for organizations.

| Economic Factor | 2023 Data/Estimate | 2024 Projection | 2025 Projection | Impact on Training Sector |

| GDP Growth | (N/A - 2023 actual) | 2.0% | 2.2% | Increased demand for skilled workers, higher enrollment |

| Unemployment Rate | (N/A - Q1 2024: 6.5%) | Decreasing trend | Decreasing trend | Shift towards upskilling, potential decrease in entry-level retraining |

| Average Disposable Income (Household) | €20,500 | (Likely increasing with GDP) | (Likely increasing with GDP) | Affects individual investment capacity, need for accessible pricing |

| Inflation (HICP) | (N/A - May 2024: 2.4%) | Stabilizing/Slightly Decreasing | (Monitoring trend) | Increased operational costs, pricing challenges for institutions |

| Global VC Funding | (N/A - Q1-Q3 2024: ~$250bn) | (Continued activity) | (Continued activity) | Potential for investment in education technology and training platforms |

Preview Before You Purchase

CFO PESTLE Analysis

The preview shown here is the exact CFO PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, offering a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting financial leadership.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing actionable insights for your strategic financial planning.

Sociological factors

Portugal's population is indeed aging, with the average age increasing. This demographic trend directly affects the workforce, creating a need for CFOs to focus on reskilling and upskilling programs for experienced employees. For instance, as of 2023, Portugal's median age was around 46.8 years, one of the highest in Europe, indicating a significant proportion of older workers.

This aging workforce presents both challenges and opportunities. CFOs must consider investing in training that bridges generational skill gaps and supports career transitions for older individuals. Simultaneously, attracting younger talent into critical sectors, particularly vocational fields that may be facing shortages due to retirements, becomes paramount for long-term business sustainability.

The labor market is shifting, with a growing need for digital skills and adaptability. For instance, a 2024 LinkedIn report highlighted that skills like AI proficiency and data analysis saw significant year-over-year growth in demand. This means companies, like those a CFO oversees, need to invest in training or hire individuals with these in-demand capabilities to remain competitive.

Beyond technical skills, soft skills such as critical thinking, communication, and problem-solving are becoming increasingly crucial. A 2025 survey by the World Economic Forum indicated that these "human skills" are expected to be among the most vital for future job success. CFOs need to ensure their workforce possesses these attributes to navigate complex business environments.

The societal value and prestige placed on vocational training compared to traditional university degrees significantly impact enrollment and career decisions. A positive public perception of vocational training, emphasizing its practical skills and strong employability, directly benefits organizations like CFO. Highlighting successful graduate outcomes through marketing campaigns can further elevate this perception.

Increased demand for lifelong learning

The shift towards less predictable career trajectories fuels a societal demand for continuous professional development. This means individuals are actively seeking ways to upskill and reskill throughout their working lives, creating a larger pool of potential learners. For example, LinkedIn Learning reported a 50% increase in course enrollments in 2024 compared to the previous year, highlighting this growing trend.

CFOs can capitalize on this by offering flexible learning formats such as short-term certifications and modular courses. These cater directly to professionals needing to adapt their skillsets quickly. The global e-learning market is projected to reach $400 billion by 2026, demonstrating the significant financial opportunity in addressing this need.

- Growing demand for upskilling: Professionals are investing more in personal development to remain competitive.

- Flexible learning solutions: Modular courses and certifications are key to meeting learner needs.

- Expanded market reach: The need for lifelong learning broadens the potential customer base for educational providers.

- Industry adaptation: Educational institutions must evolve their offerings to align with evolving workforce requirements.

Cultural attitudes towards career development

Cultural norms significantly shape how individuals view and pursue career development, impacting the appeal of institutions like CFOS. In Portugal, there's a noticeable shift towards valuing practical skills and vocational training, which directly benefits institutions offering such programs. This evolving perspective means more individuals are likely to see the tangible benefits of skill-based employment and thus consider vocational pathways.

This cultural appreciation for practical expertise is reflected in employment trends. For instance, in 2024, the demand for skilled trades and vocational professionals in Portugal remained robust, with certain sectors experiencing shortages. Understanding these cultural leanings allows CFOS to better align its offerings with market needs and individual aspirations.

- Shifting Perceptions: A growing segment of the Portuguese population now views vocational education as a direct route to stable and well-compensated employment, moving away from older stigmas.

- Skill Demand: Data from late 2024 indicated a continued high demand for technicians and skilled workers across industries like construction, manufacturing, and technology.

- Program Alignment: CFOS can leverage this by highlighting how its curriculum directly addresses these in-demand skills, making its programs more attractive to prospective students seeking practical career advancement.

- Economic Impact: The emphasis on practical skills aligns with national economic goals to boost productivity and reduce unemployment among younger demographics.

Societal attitudes towards education and career paths are evolving, with a growing emphasis on lifelong learning and adaptability. This trend is fueled by rapid technological advancements and changing economic landscapes, as seen in the 2024 surge in demand for AI and data analysis skills. Consequently, CFOs must recognize this shift and invest in continuous training programs to keep their workforce relevant.

The increasing acceptance and prestige of vocational training over traditional academic routes directly impact talent acquisition and development strategies. As of early 2025, surveys indicated a significant rise in enrollment for practical, skill-based courses, reflecting a societal preference for tangible career outcomes. This necessitates CFOs to potentially partner with or develop vocational training initiatives to secure a skilled workforce.

Workforce demographics, particularly an aging population, necessitate proactive strategies for knowledge transfer and talent management. With Portugal's median age nearing 47 in 2024, CFOs need to focus on retaining experienced workers and facilitating intergenerational skill sharing to mitigate potential labor shortages. This demographic reality underscores the importance of adaptable HR policies.

| Sociological Factor | 2024/2025 Data Point | Impact on CFO Strategy |

|---|---|---|

| Lifelong Learning Trend | 50% increase in online course enrollments (LinkedIn Learning, 2024) | Invest in flexible, continuous professional development programs. |

| Vocational Training Perception | High demand for skilled trades; shortages in key sectors (Portugal, 2024) | Align training with in-demand vocational skills; explore partnerships. |

| Aging Workforce | Median age in Portugal ~46.8 years (2023/2024 estimates) | Implement knowledge transfer programs and reskilling for older workers. |

| Soft Skills Demand | Human skills ranked vital for future job success (WEF Survey, 2025) | Integrate critical thinking and communication training into development plans. |

Technological factors

The increasing adoption of e-learning and blended learning models, fueled by technological advancements, presents a significant opportunity for CFOs. These digital approaches offer unparalleled flexibility and accessibility to employee training, breaking down geographical barriers and enabling a wider reach. For instance, by mid-2024, over 70% of companies reported using some form of online learning for professional development, a trend expected to continue growing.

CFOs must strategically invest in robust e-learning platforms and integrate advanced digital tools to foster a culture of continuous learning and maintain a competitive edge. This digital transformation in learning not only caters to diverse employee learning preferences but also allows for more cost-effective and scalable training solutions, with many organizations seeing a 20-30% reduction in training costs through e-learning adoption by early 2025.

Artificial intelligence and automation are rapidly reshaping the job market, creating a demand for new skill sets. For example, a 2024 report indicated that 70% of new jobs created in the next decade will require digital skills, with AI and data analytics being paramount.

CFOs must proactively integrate training on AI tools, advanced data analytics, and automation technologies into their educational programs. This strategic move ensures graduates are equipped for emerging roles, such as AI ethics officers or automation specialists, which are projected to see significant growth.

By staying ahead of these technological shifts, institutions can maintain a cutting-edge curriculum that directly aligns with industry needs. This proactive approach is crucial for preparing students for the evolving professional landscape and ensuring their long-term employability.

The demand for digital skills training is soaring, as basic computer literacy and proficiency in advanced software are now essential across nearly every profession. Chief Financial Officers must prioritize embedding robust digital skills development programs, covering everything from foundational computer use to specialized application knowledge pertinent to specific roles, to ensure workforce readiness and enhance employability in today's economy.

Cybersecurity concerns for online platforms

As educational institutions lean more heavily on digital platforms for everything from course delivery to managing student records, cybersecurity has become a top priority for CFOs. The increasing volume of sensitive data handled online necessitates strong defenses to prevent breaches and maintain operational continuity. A significant rise in cyberattacks targeting educational institutions in recent years underscores this urgency. For instance, reports indicate a substantial increase in ransomware attacks against universities, with some incidents leading to millions in ransom demands and significant data loss.

Protecting student data and ensuring the integrity of online learning environments are not just technical challenges but also critical for maintaining trust with students, parents, and regulatory bodies. Non-compliance with data protection regulations, such as GDPR or FERPA, can result in hefty fines. The average cost of a data breach in the education sector reached an estimated $4.47 million in 2023, highlighting the financial implications of inadequate security measures.

Consequently, investing in robust cybersecurity infrastructure, including advanced threat detection systems and regular security audits, is no longer optional but a fundamental business requirement. Furthermore, ongoing training for staff on best practices for data security and phishing awareness is essential to build a resilient defense against evolving cyber threats.

- Increased Ransomware Attacks: Educational institutions experienced a 72% rise in ransomware attacks between 2021 and 2023.

- High Data Breach Costs: The average cost of a data breach in education in 2023 was $4.47 million.

- Regulatory Compliance: Non-compliance with data privacy laws can lead to significant financial penalties.

- Investment in Security: Cybersecurity spending in the education sector is projected to grow by 15% annually through 2025.

Emergence of new industry technologies

The relentless pace of technological evolution is a constant force reshaping industries and spawning entirely new sectors, directly influencing the demand for specialized skills. For instance, the burgeoning field of artificial intelligence (AI) is creating a significant need for AI specialists, with the global AI market projected to reach over $1.8 trillion by 2030, according to some forecasts. CFOs must therefore stay ahead of these technological waves, anticipating the skills required for emerging areas such as quantum computing or advanced biotechnology.

Proactive identification of these technological shifts allows CFOs to strategically invest in workforce development and infrastructure. Consider the rapid advancements in electric vehicle (EV) technology; by 2024, global EV sales were expected to surpass 14 million units, highlighting a clear demand for expertise in battery technology, charging infrastructure, and EV maintenance. Companies that fail to adapt their training programs risk falling behind competitors who are equipping their workforce with these critical, future-oriented skills.

- Renewable Energy Tech: Growth in solar and wind power necessitates expertise in installation, maintenance, and grid integration. The International Energy Agency reported that renewable energy capacity additions set a new record in 2023, underscoring this trend.

- Advanced Manufacturing: Automation, robotics, and 3D printing are transforming production, creating demand for skilled technicians and engineers proficient in these technologies.

- Cybersecurity: As digital transformation accelerates, the need for robust cybersecurity measures is paramount, driving demand for cybersecurity analysts and specialists. The global cybersecurity market was valued at over $200 billion in 2023 and is expected to grow significantly.

- Biotechnology and Genomics: Breakthroughs in genetic sequencing and personalized medicine are creating new opportunities and requiring specialized scientific and technical talent.

Technological advancements are fundamentally altering the skills landscape, necessitating continuous adaptation in workforce training. The increasing integration of AI and automation, for example, means that by 2025, over 70% of new job roles will demand advanced digital competencies. CFOs must prioritize upskilling programs focused on these areas to ensure their organizations remain competitive and their employees are future-ready.

Legal factors

As a CFO, understanding Portugal's national education and vocational training laws is crucial. These laws dictate everything from curriculum development to the qualifications required for instructors, ensuring a baseline standard for educational institutions. For example, the recent updates to the National Qualifications Framework (NQF) in 2024 emphasize digital skills, requiring centers to adapt their programs accordingly.

Compliance with these regulations is not optional; it's a fundamental requirement for operation. Failure to adhere to standards concerning student rights, data protection, or program accreditation can lead to significant penalties. In 2023, several vocational training centers faced sanctions for not meeting updated safety protocols, highlighting the importance of staying current.

Changes in these legislative areas directly influence the CFO's financial planning and strategic decisions. For instance, a new government initiative announced in late 2024 to subsidize specific vocational training programs in green technologies could present both opportunities for expansion and require adjustments to budget allocations for program development and marketing.

Accreditation and certification are paramount for CFO programs to ensure quality and global recognition. For instance, many accounting bodies, like the AICPA for the CPA designation, require specific educational prerequisites and ongoing professional development, influencing curriculum design and program validity. Failure to meet these evolving standards, which often involve regular audits and updates, can directly impact a CFO program's appeal to prospective students and the employability of its graduates in 2024 and beyond.

Portuguese labor laws establish clear guidelines for trainees, internships, and the employment of instructors and support staff in vocational training centers. CFOs must meticulously ensure compliance with regulations covering work hours, minimum wages, social security payments, and crucial workplace safety standards.

For instance, as of early 2024, the Portuguese minimum wage was €820 per month, a figure that training centers must respect for any paid trainee positions or instructor salaries. Failure to adhere to these labor statutes, including those related to contract types and termination procedures, poses significant legal and financial risks, potentially leading to substantial fines and reputational damage.

Data protection and privacy regulations (GDPR)

As an educational institution, CFOs must navigate a complex landscape of data protection and privacy regulations, with the General Data Protection Regulation (GDPR) being a prime example. This means ensuring secure storage, transparent processing, and obtaining explicit consent for all personal data handled for students and staff. Failure to comply can result in substantial financial penalties, with GDPR fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher, as seen in various enforcement actions across sectors.

The implications for CFOs are significant. Robust data governance frameworks are not just a legal requirement but a strategic imperative to avoid severe financial repercussions and protect the institution's reputation. For instance, in 2023, numerous organizations faced investigations and fines for data breaches or non-compliance with privacy laws, highlighting the ongoing enforcement and the need for proactive measures. This necessitates ongoing investment in cybersecurity and privacy training for all personnel.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- Reputational Risk: Data breaches erode trust and can significantly damage an institution's standing.

- Compliance Costs: Investment in secure systems, staff training, and legal counsel is essential.

- Data Governance: Implementing strict policies for data collection, storage, processing, and deletion is legally mandated.

Health and safety regulations for facilities

Vocational training centers, particularly those with hands-on workshops and labs, face stringent health and safety regulations. These rules are designed to protect students and staff from workplace hazards, ensuring a secure learning environment. For example, in the UK, the Health and Safety at Work etc. Act 1974 places a general duty on employers to ensure the health, safety, and welfare of all employees and others affected by their undertaking.

Compliance often involves regular facility inspections, rigorous maintenance schedules for machinery and equipment, and strict adherence to fire safety codes and emergency preparedness plans. A failure to meet these standards can result in significant fines and operational disruptions. For instance, a vocational school in California was fined $50,000 in 2023 for inadequate machine guarding in its automotive workshop, leading to a student injury.

These legal obligations are critical for fostering a safe learning and working space. They not only prevent accidents but also contribute to the reputation and operational continuity of the institution.

- Regular safety audits are mandated by law to identify and mitigate risks in practical training environments.

- Equipment maintenance logs are legally required, demonstrating due diligence in preventing mechanical failures.

- Emergency response plans, including fire drills and first aid provisions, must be in place and regularly reviewed.

- Compliance with specific industry safety standards, such as those from OSHA in the US, is often a legal prerequisite for operating vocational programs.

Legal factors significantly shape a CFO's operational landscape, demanding strict adherence to a myriad of regulations. These include labor laws, data protection statutes like GDPR, and health and safety mandates, all of which carry substantial financial and reputational consequences for non-compliance. For instance, GDPR fines can reach up to 4% of global annual turnover, a stark reminder of the need for robust data governance.

Staying abreast of legislative changes is paramount, as new initiatives or updated safety protocols can necessitate immediate budget adjustments and strategic realignments. The Portuguese minimum wage, set at €820 per month as of early 2024, directly impacts staffing costs for any vocational training center.

Furthermore, accreditation and certification requirements, often involving regular audits, influence curriculum design and program viability, directly impacting student recruitment and graduate employability. Failure to meet evolving standards can lead to significant penalties and operational disruptions, as evidenced by a $50,000 fine levied in 2023 for inadequate machine guarding in a vocational workshop.

Environmental factors

The global push towards sustainability is creating a significant demand for green skills. This translates to more job opportunities in sectors like renewable energy, waste management, and sustainable agriculture, with many governments actively investing in these areas. For instance, the International Renewable Energy Agency (IRENA) projected in 2024 that the renewable energy sector could employ over 43 million people globally by 2030.

CFOs can leverage this trend by investing in and promoting training programs focused on these in-demand green skills. This not only addresses a critical workforce need but also positions companies to capitalize on the growing green economy, aligning with both future economic growth and environmental imperatives. The World Economic Forum's "Future of Jobs Report 2023" highlighted analytical thinking and creative thinking as top skills, with sustainability and environmental awareness also rising in importance.

Portuguese businesses, including those led by CFOs, are navigating a landscape of escalating environmental regulations aimed at boosting sustainability and curbing carbon emissions. This translates to a direct need to evaluate operational footprints, from energy usage to waste disposal, ensuring adherence to evolving national and EU standards.

For instance, the European Union's Green Deal, with its ambitious climate targets, directly impacts Portugal. CFOs must consider how investments in energy efficiency, renewable energy sources, and circular economy principles can mitigate compliance risks and potentially unlock new market opportunities by 2025.

Societal expectations for environmental responsibility are increasingly influencing business operations, extending beyond mere legal requirements. For instance, a 2024 survey indicated that 78% of consumers consider a company's environmental impact when making purchasing decisions.

CFOs can leverage this trend by integrating sustainable practices, such as investing in energy-efficient technologies or implementing robust waste reduction programs. These initiatives not only bolster corporate social responsibility but also can lead to cost savings; for example, many companies are seeing a 10-15% reduction in utility costs through targeted energy efficiency upgrades.

Adopting eco-friendly operational practices enhances a company's reputation, making it more attractive to environmentally conscious investors and customers alike. This can translate into tangible financial benefits, with studies showing that companies with strong ESG (Environmental, Social, and Governance) performance often outperform their peers in the long run.

Impact of climate change on specific industries

Climate change presents significant environmental challenges that directly affect industries crucial for CFO training, such as agriculture and construction. For instance, extreme weather events, like prolonged droughts or intense rainfall, can devastate crop yields, impacting agricultural businesses and supply chains. In 2024, the agricultural sector faced an estimated loss of billions due to climate-related disruptions globally.

CFOs need to consider how these shifts necessitate new adaptive practices and investments in resilience. For example, the construction industry may see increased demand for climate-resilient infrastructure, but also face higher insurance costs and material sourcing challenges due to climate impacts. Integrating climate resilience and adaptation strategies into vocational programs is paramount to prepare future professionals for these evolving operational conditions and future challenges in affected sectors.

- Agriculture: Increased frequency of extreme weather events (droughts, floods) impacting crop yields and livestock, potentially leading to higher food prices and supply chain volatility. For example, the 2024 European heatwaves significantly reduced cereal production.

- Construction: Demand for climate-resilient building materials and infrastructure, coupled with potential disruptions to project timelines and increased insurance premiums due to rising climate risks.

- Tourism: Impacts on natural attractions like coral reefs or ski resorts due to rising temperatures and sea levels, affecting destination viability and revenue.

- Energy: Shifts in demand patterns and the need for investment in renewable energy sources to mitigate carbon emissions, alongside potential impacts on fossil fuel infrastructure from extreme weather.

Corporate social responsibility expectations

Stakeholders, from students to employees and business partners, are increasingly prioritizing organizations that show a strong commitment to corporate social responsibility (CSR), with environmental stewardship being a key component. This growing expectation means that a company's environmental performance is no longer just a feel-good initiative, but a critical factor in stakeholder engagement and brand perception.

Chief Financial Officers (CFOs) can strategically leverage a demonstrated commitment to environmental sustainability. This can translate into tangible marketing advantages and stronger partnerships, attracting individuals and businesses that align with eco-conscious values. For instance, in 2024, companies with robust sustainability reports often see higher investor interest and better access to capital. A 2025 survey indicated that 70% of consumers consider a company's environmental impact when making purchasing decisions.

- Stakeholder Expectations: Growing demand from students, employees, and partners for demonstrable CSR, especially in environmental areas.

- Brand Enhancement: Leveraging environmental commitments to attract eco-conscious talent and customers, boosting brand image.

- Partnership Opportunities: Building alliances with like-minded organizations, creating synergistic growth and shared environmental goals.

- Market Differentiation: Standing out in a crowded marketplace by showcasing a genuine commitment to sustainability, leading to competitive advantage.

Environmental factors are increasingly shaping business strategy and financial planning. The global shift towards sustainability, driven by consumer demand and regulatory pressures, necessitates a focus on green skills and eco-friendly operations. For instance, a 2025 survey revealed that 70% of consumers consider a company's environmental impact when purchasing. This trend means CFOs must integrate environmental considerations into their financial models to ensure long-term viability and capitalize on emerging green economy opportunities.

PESTLE Analysis Data Sources

Our CFO PESTLE Analysis is meticulously constructed using data from reputable financial institutions like the IMF and World Bank, alongside government economic reports and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, fact-based data.