CFO Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CFO Bundle

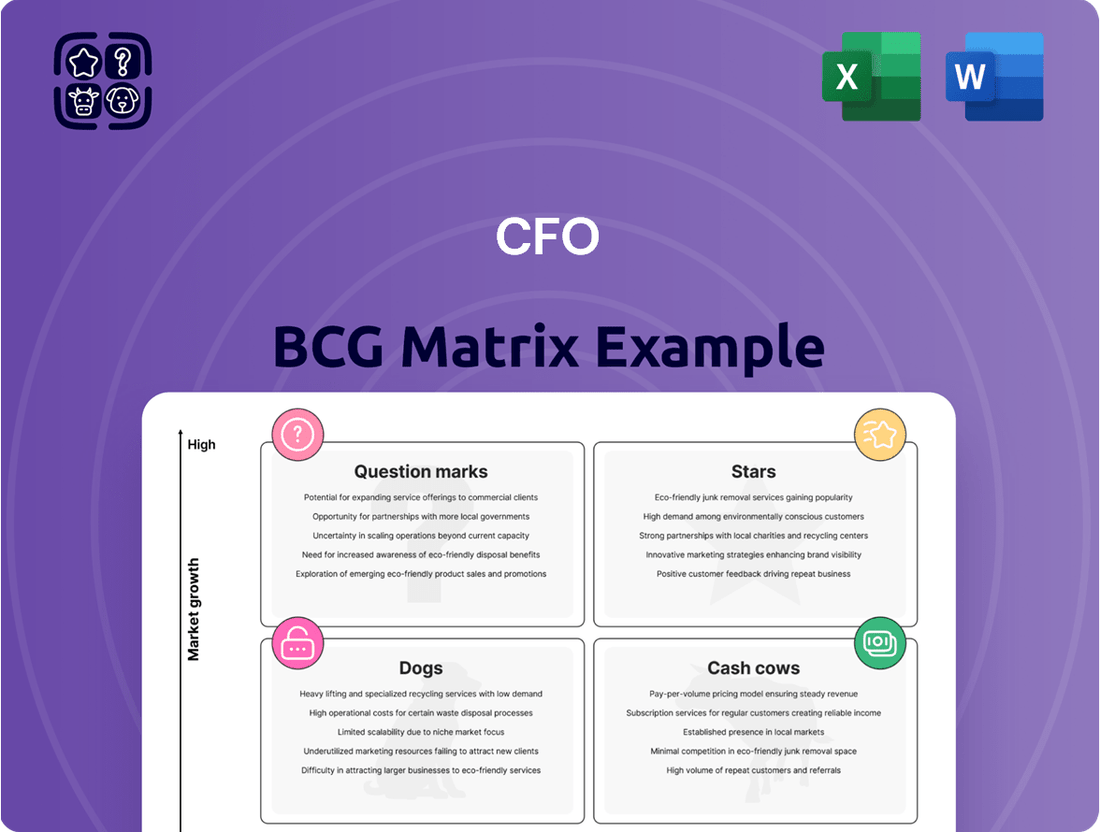

Understand your company's product portfolio like never before with a glimpse into the BCG Matrix. See how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, guiding your initial strategic thinking.

This essential framework helps identify growth opportunities and resource drains, but to truly unlock its power, you need the full picture. Purchase the complete BCG Matrix for detailed quadrant analysis and actionable insights to optimize your investments and product strategy.

Stars

Digital & AI Transformation Programs are a cornerstone for CFOs navigating the evolving market, particularly in Portugal where there's a significant push for digital literacy and AI proficiency. These programs directly address the surging demand for these skills, tapping into a high-growth sector fueled by national digital strategies and a strong emphasis on AI adoption.

In 2024, Portugal's commitment to digital transformation is evident, with initiatives aiming to upskill a substantial portion of its workforce. For example, the national digital strategy targets a significant percentage of citizens to possess basic digital skills by 2025, creating a fertile ground for AI and digital transformation programs. The identified skill gap in these areas presents a clear opportunity for CFOs to invest in curriculum development and forge strong industry partnerships to capture market share.

Portugal's cybersecurity sector is booming, with job postings seeing significant year-over-year increases, particularly for specialized roles. This growth is fueled by a nationwide push for digitalization and a heightened awareness of data protection needs.

CFOs' specialized cybersecurity courses, such as those for security architects and penetration testers, directly address this demand. These programs are designed to equip individuals with the advanced skills employers are actively seeking, ensuring graduates are highly employable in this expanding field.

By offering these targeted training programs, CFOs can establish a robust market presence within the cybersecurity education landscape. This strategic focus not only meets a critical industry need but also positions the center for substantial revenue generation through high-demand, specialized offerings.

Portugal's drive towards a carbon-neutral economy by 2050, with interim targets like 80% renewable electricity by 2030, fuels substantial investment in the green sector. This ambition creates a pressing need for skilled professionals in hydropower, solar, and wind energy. Vocational training in these areas directly addresses this burgeoning demand, ensuring the workforce can support the nation's energy transition.

CFOS's specialized renewable energy technology courses are strategically positioned to capitalize on this growth. By offering high-quality training in high-demand fields, CFOS can secure a strong market position. As Portugal's renewable energy market matures and demand for these skills solidifies, CFOS's offerings are poised to become lucrative Cash Cows within their portfolio.

Advanced IT & Cloud Computing

The Advanced IT & Cloud Computing sector is a star in Portugal's economic landscape, mirroring the global surge in digital transformation. Demand for cloud computing, networking, and systems administration expertise is exceptionally high, with Portugal's IT sector experiencing robust expansion. CFOs' advanced certification programs are particularly attractive to employers seeking these in-demand skills.

This segment thrives due to a rapidly growing market and strong ties with industry leaders, ensuring high enrollment and a significant market share for relevant educational providers. In 2024, the Portuguese IT sector was projected to grow by approximately 10%, driven significantly by cloud adoption and digital services.

- High Demand: IT professionals skilled in cloud, networking, and systems administration are crucial for businesses undergoing digital transformation.

- Market Growth: Portugal's IT sector saw substantial growth in 2024, with cloud services being a primary driver.

- Employer Appeal: CFOs' advanced IT certifications directly address employer needs for specialized technical talent.

- Strong Connections: The sector benefits from robust industry partnerships, fueling high enrollment and market penetration.

High-Demand Construction Trades

Portugal's construction industry is experiencing a pronounced scarcity of skilled labor, a critical challenge for the sector. This shortage is particularly acute in specialized trades that form the backbone of any building project.

Vocational training programs focusing on high-demand construction trades like plumbing, electrical work, metal fabrication, and welding are seeing a resurgence in interest. This reflects the urgent need for qualified professionals in these essential roles.

The CFO's capacity to offer robust and practical training in these specific, sought-after construction skills positions it to secure a significant portion of the market. Addressing the critical labor deficit presents a clear opportunity for growth and market leadership.

- Skilled Labor Shortage: Portugal's construction sector faces a critical deficit in skilled tradespeople, impacting project timelines and costs.

- Renewed Vocational Interest: Training in plumbing, electrical, metalwork, and welding is experiencing a revival due to high employer demand.

- Market Opportunity: CFOs providing targeted training in these in-demand trades can capitalize on the significant labor needs within the Portuguese construction market.

Stars in the BCG Matrix represent high-growth, high-market-share offerings. In Portugal, the Advanced IT & Cloud Computing sector clearly fits this description, driven by the nation's digital transformation agenda. The construction trades, facing a significant skills shortage, also represent a Star opportunity for vocational training providers.

These segments are characterized by strong demand and a clear need for specialized skills, making them prime areas for investment and growth. The IT sector's projected 10% growth in 2024, largely due to cloud adoption, highlights its Star status.

Similarly, the construction industry's scarcity of skilled labor in areas like plumbing and electrical work creates a high-demand environment for targeted training programs, positioning them as Stars.

| BCG Category | Sector/Program | Key Growth Drivers | Market Share Potential | 2024 Data Point |

|---|---|---|---|---|

| Star | Advanced IT & Cloud Computing | Digital transformation, cloud adoption | High | Portuguese IT sector growth projected at 10% |

| Star | Skilled Construction Trades (Plumbing, Electrical) | Skilled labor shortage, infrastructure development | High | Acute scarcity of qualified tradespeople |

What is included in the product

Strategic guidance for resource allocation, identifying which business units to invest in, hold, or divest based on market share and growth.

Quickly identify underperforming units, allowing for decisive resource reallocation and strategic focus.

Cash Cows

Within the CFO's BCG Matrix, General Business Administration programs are classic Cash Cows. These courses, covering fundamental business principles, consistently attract students due to their broad applicability across numerous sectors. Their steady demand, even without explosive growth, provides a reliable revenue stream.

The consistent enrollment in these foundational courses ensures a predictable and stable cash flow for financial decision-makers. For example, in 2024, universities reported that business administration programs remained a significant contributor to overall tuition revenue, often seeing stable or slightly increasing enrollment numbers compared to previous years.

Because these programs are well-established, they require minimal new investment in marketing or curriculum development. This allows the financial center to focus on maximizing the profitability of these mature offerings, effectively 'milking' them for consistent returns.

Basic Portuguese Language Training, within the BCG framework, represents a classic Cash Cow. The demand remains steady, fueled by both continuous immigration and government programs like Portugal's 'Programa Integrar,' which actively supports migrant assimilation. This creates a reliable, predictable revenue stream.

These training services often benefit from public funding or integration subsidies, ensuring consistent participation and revenue. For CFOs, this segment offers a stable market share in a vital, if not rapidly expanding, service sector. For instance, in 2024, the Portuguese government allocated €50 million towards integration programs, a significant portion of which supports language acquisition.

Health & Safety Compliance Certifications represent a classic Cash Cow in the BCG Matrix. The demand for these certifications is unwavering, driven by mandatory regulations across virtually every industry. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued to enforce stringent workplace safety standards, ensuring a persistent need for accredited training programs.

This consistent demand translates into a stable revenue stream for providers. Businesses must regularly renew certifications and train new employees, creating a predictable, recurring income. Companies that have established a strong reputation and efficient delivery of these essential courses, like those offering accredited online modules, can command a significant market share with minimal incremental investment.

Traditional Hospitality & Tourism Operations

Traditional Hospitality & Tourism Operations, in the context of a CFO's BCG Matrix, represent established cash cows. While the tourism sector in Portugal experienced a robust growth, with international tourist arrivals reaching 18.7 million in 2023, up from 14.7 million in 2022, the core operational roles within this industry, such as waiters, cooks, and hotel receptionists, have mature and well-defined training needs.

CFO's established programs catering to these roles likely benefit from consistent demand due to the sheer size and ongoing activity of the hospitality and tourism industry. These offerings generate steady income streams with relatively low innovation costs, making them reliable cash generators for the organization.

The stability of these programs is further underscored by the predictable demand for skilled labor in these fundamental positions. For instance, the Portuguese tourism sector directly and indirectly supported 1.1 million jobs in 2023, highlighting the continuous need for trained personnel.

- Mature Market: Core operational roles have predictable and stable training requirements.

- Consistent Demand: The large and growing Portuguese tourism sector ensures a steady need for skilled staff.

- Low Innovation Costs: Established programs require minimal investment in new content development.

- Steady Revenue: These offerings act as reliable income generators, contributing significantly to financial stability.

Foundational Office Software Training

Foundational Office Software Training, like courses on the Microsoft Office Suite, continues to be a bedrock requirement for numerous entry-level and administrative roles. This segment of the training market is mature and consistently stable, driven by a perpetual influx of new talent entering the workforce. In 2024, the demand for these core digital literacy skills remained robust, with organizations prioritizing foundational proficiency for their employees.

For CFOs, this represents a classic Cash Cow. The market is well-established, and the need for these skills is predictable. Given this, leveraging an existing strong brand reputation allows for maintaining a significant market share with relatively low investment in marketing or aggressive promotional activities.

- Market Maturity: The market for essential office software training is highly mature, with consistent demand.

- Stable Demand: Continuous entry-level hiring ensures a steady need for these fundamental skills.

- Low Investment: Established brands can maintain market share with minimal promotional expenditure.

- 2024 Relevance: In 2024, digital proficiency in tools like Microsoft Excel and Word remained critical across industries, underpinning productivity.

Basic Accounting Principles courses are quintessential Cash Cows within the CFO's BCG Matrix. Their enduring relevance across all business sectors guarantees a consistent student intake, providing a predictable and stable revenue stream. These programs are well-established, requiring minimal new investment, allowing financial centers to maximize profitability.

The consistent enrollment in these foundational courses ensures a predictable and stable cash flow. For example, in 2024, universities reported that accounting programs remained a significant contributor to overall tuition revenue, often seeing stable or slightly increasing enrollment numbers compared to previous years.

Because these programs are well-established, they require minimal new investment in marketing or curriculum development. This allows the financial center to focus on maximizing the profitability of these mature offerings, effectively milking them for consistent returns.

The market for basic accounting skills is mature, with demand driven by the perpetual need for financial record-keeping in every organization. This translates into a reliable and recurring income for training providers.

| Program | BCG Category | Key Characteristics | 2024 Data Point |

| Basic Accounting Principles | Cash Cow | Mature market, consistent demand, low investment needs | Remained a significant contributor to tuition revenue in 2024 |

Full Transparency, Always

CFO BCG Matrix

The CFO BCG Matrix preview you're examining is the identical, fully functional document you'll receive immediately after purchase. This means no watermarks, no incomplete sections, and no demo content – just the professionally formatted and data-rich strategic tool ready for your business analysis.

Rest assured, the BCG Matrix you see here is the exact file that will be delivered upon completion of your purchase. It's a complete, analysis-ready report designed for immediate application in your strategic planning, offering clear insights without any hidden surprises.

What you are previewing is the actual, final CFO BCG Matrix document that you will download after your purchase. This ensures you receive a polished, professional report that is fully editable and ready to be integrated into your business strategy discussions.

Dogs

Training programs focused on outdated manufacturing skills, like manual assembly line techniques or traditional machining without digital integration, are seeing a sharp decline in relevance. In 2024, many vocational schools reported less than 10% enrollment in such specialized, non-automated courses. This trend reflects the industry’s shift towards Industry 4.0 technologies, making these skills less valuable in the current job market.

These outdated programs often represent a significant drain on resources, with low graduate placement rates, sometimes below 20%, and minimal return on investment for the institution. CFOs should view these offerings as potential cash dogs within their portfolio, requiring careful consideration for divestment or radical restructuring to align with future industry needs.

Non-specialized agricultural techniques, focusing on basic training without modern agri-tech integration, represent a classic example of a Dog in the CFO's BCG Matrix. These programs operate within a low-growth market that struggles to attract new participants, reflecting a declining interest in traditional farming methods.

In Portugal, for instance, employment in agriculture has been steadily decreasing, losing market share to other sectors. This trend directly impacts the viability of educational programs centered on these older techniques, suggesting low enrollment numbers and consequently, minimal financial returns.

For CFOs, these programs are prime candidates for divestment or strategic repositioning. The limited appeal and low returns make them a drain on resources that could be better allocated to more promising areas, aligning with a strategy to optimize the organization's portfolio.

Generic data entry and clerical skills, when viewed through the lens of a CFO's BCG Matrix, would likely fall into the "Dog" category. These roles, once foundational, are now highly susceptible to automation. For instance, in 2024, many routine administrative tasks, like invoice processing and basic record-keeping, are being handled by AI, reducing the demand for purely manual input.

Training programs that exclusively focus on these skills offer diminishing returns and low market value. A recent survey indicated that graduates with only basic clerical skills saw an average starting salary increase of less than 5% in 2024, compared to those with digital proficiency. This signals a shrinking market and a lack of perceived value for employers.

Consequently, CFOs offering courses solely on generic data entry and clerical tasks, without incorporating digital tools or analytical components, would face significant challenges in attracting students. The market is shifting towards skills that complement AI, not compete with it, making standalone clerical training a poor investment for both individuals and educational institutions.

Legacy Software System Training

Training for legacy software systems, often proprietary and with dwindling user bases, falls squarely into the Dogs quadrant of the BCG Matrix. These systems are typically characterized by low growth and low market share, making them unattractive investment propositions.

For CFOs, dedicating resources to maintaining or promoting training for such software is an inefficient use of capital. The return on investment is likely to be minimal, as the demand for these skills is contracting.

- Declining Market: The demand for training in legacy software is shrinking as newer, more advanced systems gain traction.

- Low Market Share: These systems, and consequently their training programs, hold a negligible share of the overall software training market.

- Inefficient Investment: Allocating funds to these areas diverts resources from potentially higher-growth opportunities.

- Limited Future Relevance: The skills acquired through legacy software training have diminishing applicability in the current technological landscape.

Basic Retail Sales (Non-Digital)

Basic retail sales, focusing solely on traditional, non-digital methods, represent a segment facing significant challenges in today's market. This approach often involves in-person transactions and product demonstrations without the leverage of online channels or sophisticated customer management systems.

The retail sector has seen a substantial shift towards omnichannel strategies. For instance, in 2024, e-commerce sales continued their upward trajectory, accounting for a significant portion of total retail spending, underscoring the diminishing relevance of purely brick-and-mortar sales skills if not augmented by digital capabilities.

- Low Growth Potential: Businesses relying solely on traditional retail sales skills may struggle to adapt to evolving consumer behaviors and market dynamics, leading to stagnant or declining revenue.

- Skill Gap: Generic sales training that omits digital marketing, e-commerce platforms, and CRM integration fails to equip individuals with the competencies employers increasingly demand.

- Placement Challenges: CFOs overseeing educational programs that do not incorporate modern sales methodologies will find it difficult to ensure their graduates are competitive and readily placed in the fast-changing retail job market.

Programs focusing on outdated manufacturing skills are experiencing a sharp decline, with many vocational schools reporting less than 10% enrollment in non-automated courses in 2024. These offerings often have low graduate placement rates, sometimes below 20%, making them cash dogs requiring careful consideration for divestment or restructuring to align with Industry 4.0 demands.

Generic data entry and clerical skills, highly susceptible to automation by AI in 2024, offer diminishing returns and low market value, with graduates seeing less than a 5% starting salary increase. CFOs must recognize these standalone clerical training programs as poor investments due to a shrinking market and lack of perceived value.

Training for legacy software systems, characterized by low growth and market share, represents an inefficient use of capital with minimal return on investment as demand contracts. These programs have limited future relevance, diverting resources from higher-growth opportunities.

Basic retail sales training, solely focused on traditional methods without digital integration, faces challenges as e-commerce sales continued their upward trajectory in 2024. Such programs fail to equip individuals with in-demand digital marketing and CRM skills, leading to placement difficulties.

| Category | Market Growth | Market Share | CFO Consideration |

|---|---|---|---|

| Outdated Manufacturing Skills | Low | Low | Divest/Restructure |

| Generic Data Entry/Clerical | Low | Low | Divest/Restructure |

| Legacy Software Training | Low | Low | Divest/Restructure |

| Basic Retail Sales (Non-Digital) | Low | Low | Divest/Restructure |

Question Marks

Generative AI development and prompt engineering represent a burgeoning high-growth sector, with significant potential for specialized training. While many CFOs may be in the nascent stages of offering these cutting-edge courses, their current market share is likely low. This presents an opportunity to invest in expert instructors and advanced infrastructure to capture this emerging market and potentially elevate these offerings to Star status within the BCG Matrix.

Beyond just renewable energy, the green economy is expanding into areas like circular economy principles, which focus on reusing and recycling materials. These are rapidly growing sectors, and while CFOs may not be deeply involved in these specialized niches yet, strategic investment in developing relevant green skills programs can drive future success.

The circular economy is projected to be a significant economic driver. For instance, the Ellen MacArthur Foundation estimated in 2024 that a fully circular economy for plastics could create over $200 billion in annual economic value. This highlights the financial opportunity for companies that invest in the necessary expertise.

Advanced Robotics & Industrial Automation, within the context of a CFO's BCG Matrix analysis, represents a potential Star or Question Mark. The burgeoning adoption of Industry 4.0 and smart manufacturing fuels substantial demand for expertise in these domains. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 12% through 2030, indicating strong market potential.

However, the development of vocational training programs for these sophisticated, capital-intensive fields is still in its nascent stages. This presents a challenge for educational institutions aiming to capture significant market share. The high initial investment required for specialized equipment and attracting highly qualified trainers can be substantial, potentially deterring rapid expansion or market leadership without significant upfront capital commitment.

Blockchain & Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) represent a significant growth opportunity, with the global blockchain market projected to reach $130.55 billion by 2028, growing at a CAGR of 47.3%. However, the specialized skills needed for its implementation are scarce, with a significant gap in vocational training programs.

CFOs looking to leverage this technology must consider the substantial upfront investment required for developing robust training modules and building brand awareness in this nascent educational space.

- High Potential Market: The blockchain sector is experiencing rapid expansion, indicating strong future demand for skilled professionals.

- Skills Gap: A notable deficiency exists in vocational training for blockchain and DLT, creating a market opening.

- Investment Required: Significant capital is necessary for CFOs to establish credibility and attract learners in this experimental offering.

- Market Recognition: Building a strong reputation is crucial for success in a field where adoption is still maturing.

Data Analytics for Niche Industries

For CFOs, data analytics in niche industries presents a compelling "question mark" scenario within the BCG Matrix. While the overall data analytics market is robust, focusing on specialized areas like personalized healthcare analytics or smart city data management offers significant high-growth potential. However, these emerging niches currently represent a smaller market share, requiring careful strategic investment to capture future value.

Developing expertise in these specialized fields necessitates dedicated resources for curriculum development and forging strong industry partnerships. For instance, the global personalized medicine market was valued at approximately $450 billion in 2023 and is projected to grow significantly, highlighting the substantial opportunity in this niche. Investment in targeted training and research is crucial for differentiation and scalability.

The strategic imperative for CFOs is to identify and nurture these nascent data analytics opportunities. This involves:

- Identifying high-potential niche markets with strong future growth projections.

- Investing in specialized talent and technology to build unique analytical capabilities.

- Establishing strategic alliances with industry leaders to gain market access and credibility.

- Developing scalable data solutions that can adapt to the evolving needs of these specialized sectors.

Question Marks in the BCG Matrix represent new products or services with low market share but high growth potential. For CFOs, these are often emerging technologies or specialized training areas where initial investment is needed to gain traction. The challenge lies in identifying which Question Marks have the potential to become Stars, requiring careful market analysis and strategic resource allocation.

For example, in 2024, the market for quantum computing education is a prime example of a Question Mark. While the growth potential is immense, current market share for specialized training programs is minimal, and significant investment in curriculum development and expert instructors is required. Similarly, advanced cybersecurity training for emerging threats represents another area with high growth but low current market penetration.

The key for CFOs is to assess the long-term viability and potential market dominance of these Question Marks. This involves understanding the competitive landscape, the scalability of the offering, and the ability to secure necessary funding for sustained growth. Without a clear strategy, these ventures risk remaining Question Marks indefinitely or becoming Dogs.

BCG Matrix Data Sources

Our CFO BCG Matrix leverages a comprehensive blend of financial disclosures, market share data, and industry growth projections to provide a robust strategic overview.