China Fortune Land Development Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Fortune Land Development Bundle

China Fortune Land Development (CFLD) faces a dynamic competitive landscape, with moderate bargaining power from suppliers and buyers. The threat of new entrants is present, though significant capital requirements create a barrier. Substitutes, while not direct, can emerge from alternative investment vehicles or government policy shifts impacting urban development.

The complete report reveals the real forces shaping China Fortune Land Development’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Fortune Land Development (CFLD) is deeply reliant on securing land for its development projects. The bargaining power of land owners, particularly local governments in China, is substantial because they control the availability of land and the rights to develop it.

Government policies significantly shape the land market. For instance, China's ongoing urbanization drive and rural land reforms directly affect how much land is accessible and at what price. In 2024, policies encouraging urban expansion and consolidation continued to influence land acquisition strategies for developers like CFLD, impacting their operational costs and the viability of new projects.

Construction material suppliers, such as those providing steel and cement, exert moderate bargaining power over China Fortune Land Development (CFLD). In 2024, global commodity prices for steel and cement experienced volatility, with steel rebar prices in China fluctuating around an average of ¥4,000-¥4,500 per ton. This directly impacts CFLD's project costs.

Supply chain disruptions, a recurring theme in recent years, can also empower these suppliers by limiting availability and potentially driving up prices. However, CFLD's substantial project pipeline and bulk purchasing capabilities likely provide some counter-leverage, allowing for negotiated discounts and more favorable terms compared to smaller developers.

Infrastructure and utility providers, such as those supplying electricity and telecommunications, hold a moderate to high degree of bargaining power over China Fortune Land Development (CFLD). These services are absolutely essential for CFLD to develop and operate its industrial parks and new cities, making their provision non-negotiable. The cost and reliability of these critical inputs directly impact CFLD's operational expenses and the overall appeal of its development projects.

Financiers and Lenders

Financiers and lenders possess significant bargaining power over China Fortune Land Development (CFLD) due to the capital-intensive nature of urban development. CFLD's reliance on external funding means that the terms offered by banks and other financial institutions directly impact its profitability and project viability. For instance, in 2023, the average interest rate on corporate loans in China hovered around 4.1%, a figure CFLD would negotiate for its substantial borrowing needs.

The ability of CFLD to secure favorable financing terms, such as lower interest rates and less restrictive loan covenants, is directly tied to the lenders' assessment of its financial health and the overall stability of the real estate market. In 2024, with ongoing adjustments in China's property sector, lenders are likely to be more cautious, potentially increasing their leverage in negotiations.

- Interest Rate Sensitivity: CFLD's profitability is highly sensitive to interest rate fluctuations. Higher borrowing costs directly reduce net income and can impact the feasibility of new projects.

- Loan Covenants: Lenders can impose covenants that restrict CFLD's financial activities, such as debt-to-equity ratios or dividend payouts, giving them considerable influence over operational decisions.

- Market Conditions: Broader economic conditions and government policies affecting the real estate and lending sectors in China significantly influence the bargaining power of financiers. For example, tighter credit conditions can empower lenders.

Specialized Service Providers

Specialized service providers, like those offering urban planning, design, environmental consulting, and smart city technologies, hold moderate bargaining power over China Fortune Land Development (CFLD). CFLD's commitment to developing comprehensive and sustainable urban environments necessitates access to these high-quality, innovative services.

- Supplier Concentration: The market for highly specialized urban development services may have a limited number of providers, potentially increasing their leverage.

- Uniqueness of Service: The distinctiveness of the expertise offered by these specialized firms can make it difficult for CFLD to find readily available substitutes.

- Switching Costs: The effort and expense involved in switching from one specialized service provider to another can be substantial for CFLD, reinforcing supplier power.

- Importance to CFLD: For projects requiring cutting-edge smart city solutions or intricate environmental planning, the reliance on these specialized suppliers is significant.

The bargaining power of suppliers for China Fortune Land Development (CFLD) is multifaceted, ranging from land owners to material providers and specialized service firms. Local governments, as primary land controllers, wield significant power, influencing land availability and pricing through policy. In 2024, China's continued urbanization efforts meant that access to prime land remained a critical negotiation point for CFLD, with land acquisition costs being a major factor in project feasibility.

Construction material suppliers, while numerous, can exert moderate power, especially when commodity prices surge. For instance, steel rebar prices in China in early 2024 averaged around ¥4,200 per ton, a figure that directly impacts CFLD's cost structure. However, CFLD's scale allows for some negotiation leverage. Similarly, infrastructure and utility providers are essential, giving them moderate to high power due to the non-negotiable nature of their services for urban development projects.

Financiers and lenders hold substantial bargaining power, particularly given the capital-intensive nature of CFLD's business. In 2023, average corporate loan interest rates in China were around 4.1%, a benchmark for CFLD's borrowing costs. Lenders' caution in 2024, due to property sector adjustments, likely amplified their influence, leading to stricter loan covenants and terms.

Specialized service providers in areas like urban planning and smart city technology also possess moderate bargaining power. The uniqueness of their expertise and the high switching costs for CFLD can create dependence, especially for projects requiring innovative solutions. The concentration of such specialized firms in the market further bolsters their negotiating position.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power | 2024 Impact/Data Point |

|---|---|---|---|

| Land Owners (Local Governments) | High | Control over land supply, zoning regulations, government policies | Urbanization drive continued to shape land availability and pricing. |

| Construction Material Suppliers | Moderate | Commodity price volatility, supply chain disruptions, CFLD's purchasing volume | Steel rebar prices averaged ¥4,000-¥4,500/ton in China. |

| Infrastructure & Utility Providers | Moderate to High | Essential nature of services, reliance of development projects | Reliability and cost directly impact operational expenses. |

| Financiers & Lenders | High | Capital intensity of projects, CFLD's financial health, market conditions | Average corporate loan rates around 4.1% (2023); increased lender caution in 2024. |

| Specialized Service Providers | Moderate | Uniqueness of expertise, supplier concentration, switching costs | Crucial for smart city and environmental planning components. |

What is included in the product

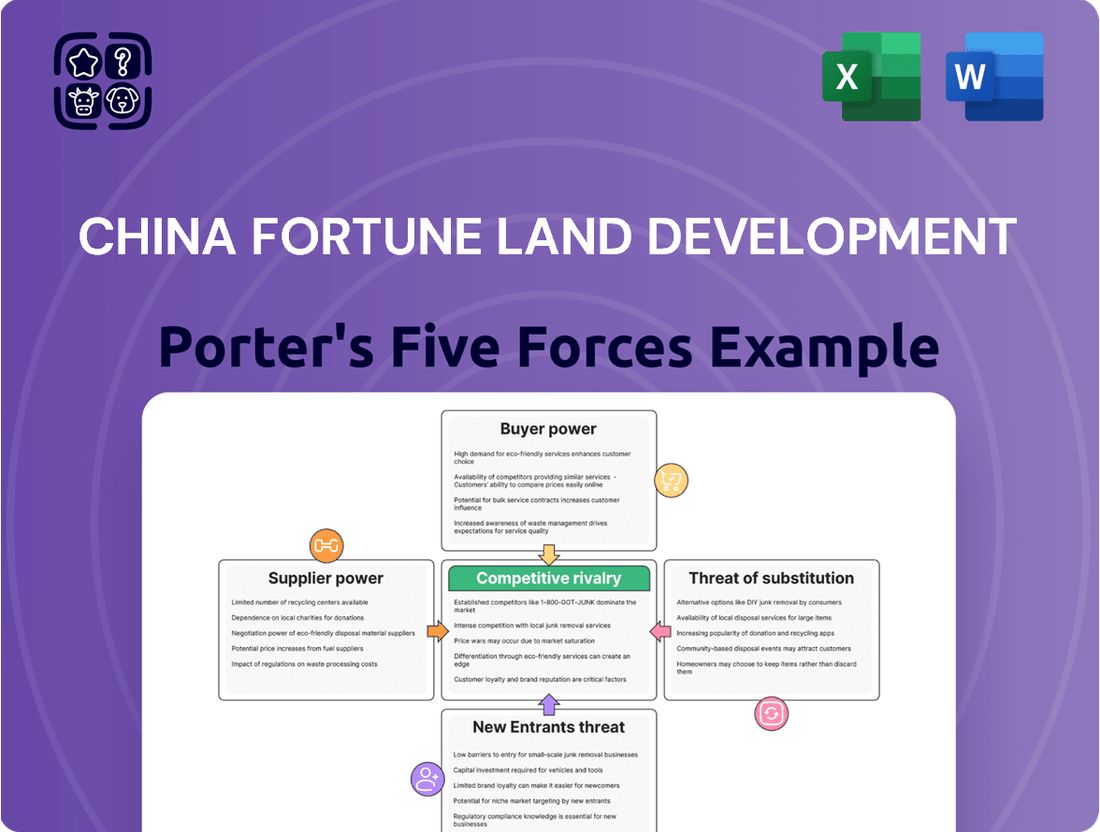

This Porter's Five Forces analysis for China Fortune Land Development assesses the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the real estate development sector.

Understand the competitive landscape for China Fortune Land Development by dissecting each of the five forces, providing clarity on where strategic focus is most needed.

Customers Bargaining Power

Industrial park tenants, or the businesses looking to set up shop, generally hold moderate bargaining power when dealing with China Fortune Land Development (CFLD). While CFLD's parks provide a comprehensive package of services and a supportive business environment, companies can still explore other industrial parks or different geographical locations. This means tenants aren't entirely dependent on CFLD, giving them some leverage in negotiations.

The strength of this tenant bargaining power is further shaped by broader economic conditions. During economic downturns, when demand for industrial space might be lower, tenants could find themselves with more negotiating room. Conversely, in a booming economy with high demand for industrial facilities, CFLD might have less pressure to concede on terms. The availability of comparable alternatives and any special incentives CFLD might offer to attract or retain tenants also play a crucial role in determining how much sway businesses have.

Residential property buyers, both individuals and corporations, wield considerable influence over China Fortune Land Development (CFLD). This is particularly true in areas where CFLD has developed new cities, as these markets can sometimes face oversupply and price pressures. For instance, in 2024, reports indicated that certain segments of China's property market experienced price corrections, giving buyers more leverage.

The bargaining power of these buyers is further amplified by broader market dynamics, including government housing policies and the sheer availability of alternative residential options. When buyers have more choices and face a less restrictive regulatory environment, their ability to negotiate terms and prices with developers like CFLD naturally increases.

Local governments act as significant customers for China Fortune Land Development (CFLD), particularly in their role as partners in urban development. These governments wield substantial bargaining power because they are actively seeking investment to drive economic growth and fulfill specific development objectives. For instance, in 2023, many local governments were actively competing to attract foreign direct investment, often offering incentives that could influence project terms.

Investors in Industrial Clusters

Investors in industrial clusters developed by China Fortune Land Development (CFLD) hold significant bargaining power. They scrutinize CFLD's project viability, potential returns, and associated risks, often comparing these opportunities against broader market alternatives. For instance, in 2024, with global infrastructure investment seeing increased scrutiny, investors are demanding clearer risk-mitigation strategies and more predictable revenue streams from developers like CFLD.

Their ability to allocate capital directly impacts CFLD's ability to finance and expand its industrial cluster projects. A strong investor appetite can lower CFLD's cost of capital, while a hesitant investor base can force the company to offer more favorable terms or seek alternative, potentially more expensive, funding sources.

- Investor Scrutiny: Investors assess CFLD's cluster projects against global investment benchmarks, demanding robust financial projections and risk management frameworks.

- Capital Allocation Influence: Investor decisions directly affect CFLD's access to funding, influencing project timelines and development scale.

- 2024 Market Conditions: In 2024, a heightened focus on sustainable and predictable returns means investors are more likely to negotiate terms that ensure their capital is protected and yields are competitive.

Businesses Attracted for Industrial Clusters

The bargaining power of customers, particularly the large industrial enterprises CFLD seeks to attract for its industrial clusters, is significant. These businesses can leverage their unique industry requirements and the incentives they demand, such as tax breaks or specialized infrastructure, to negotiate favorable terms. Furthermore, the competitive landscape, with other regions and developers vying for these key anchor tenants, amplifies this power.

CFLD's strategy hinges on its ability to create a compelling ecosystem that goes beyond mere land provision. This includes offering integrated services, access to talent, and a supportive business environment. For instance, by 2024, China's manufacturing sector continued to be a major global player, with significant investment flowing into advanced manufacturing hubs, underscoring the demand for well-developed industrial zones.

- Customer Leverage: Industrial clients can demand specific infrastructure and financial incentives due to their substantial investment and job creation potential.

- Competitive Environment: The presence of alternative development zones and competing regions globally means CFLD must offer superior value propositions to attract and retain anchor tenants.

- Ecosystem Value: CFLD's success in mitigating customer bargaining power relies on building a comprehensive industrial ecosystem that provides tangible benefits beyond basic land.

The bargaining power of customers for China Fortune Land Development (CFLD) is multifaceted, with industrial park tenants and residential buyers holding significant sway. Industrial clients can negotiate terms based on their investment scale and job creation potential, especially given the competitive landscape for attracting anchor tenants. Residential buyers, particularly in 2024, benefited from market conditions that saw price corrections in some areas, increasing their leverage.

Local governments, as key partners in urban development, also exert considerable bargaining power, often competing to attract investment through incentives. Investors, scrutinizing project viability and returns, demand clear risk mitigation and predictable revenue streams, influencing CFLD's financing and expansion strategies. This collective customer power necessitates CFLD's focus on creating compelling, value-added ecosystems.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | 2024 Market Context |

|---|---|---|---|

| Industrial Park Tenants | Moderate to High | Investment scale, job creation, industry-specific needs, availability of alternatives | Demand for advanced manufacturing hubs |

| Residential Buyers | Moderate to High | Market oversupply, price sensitivity, government policies, alternative options | Price corrections in certain property segments |

| Local Governments | High | Economic growth objectives, investment attraction competition, incentive offerings | Active competition for foreign direct investment |

| Investors | High | Project viability, risk assessment, return expectations, global investment benchmarks | Increased scrutiny on infrastructure investments, demand for predictable returns |

Preview the Actual Deliverable

China Fortune Land Development Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for China Fortune Land Development, detailing the competitive landscape including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into the company's strategic positioning.

Rivalry Among Competitors

China Fortune Land Development (CFLD) operates in a fiercely competitive landscape within China's urban development and industrial park sector. The market is populated by a multitude of domestic companies, many of which are large state-owned enterprises, alongside a growing number of international developers seeking to capitalize on China's urbanization trends.

This intense rivalry means CFLD contends with various types of competitors. These include other comprehensive urban developers offering integrated city-building solutions, established traditional real estate firms diversifying into industrial and new urban areas, and specialized operators focusing solely on industrial park management and services. This diversity intensifies competition for prime land acquisition, securing development projects, and attracting high-quality tenants to their parks.

China's urbanization remains a driving force, yet its real estate sector is experiencing increasing maturity and facing headwinds. This shift means the market growth rate is slowing down in many segments. For instance, in 2023, property investment in China saw a decline of 9.6% year-on-year, indicating a more challenging environment.

A slower market growth rate naturally intensifies competitive rivalry. Companies like China Fortune Land Development must increasingly vie for a larger portion of the existing customer base rather than benefiting from broad market expansion. This dynamic forces businesses to differentiate more effectively and potentially engage in more aggressive pricing strategies to capture market share.

China Fortune Land Development (CFLD) distinguishes itself with its unique 'industrial new cities' model, providing a complete ecosystem for businesses and residents. This integrated approach offers a compelling value proposition beyond just real estate development.

However, the competitive landscape is intense. Rivals may counter CFLD's offering by specializing in niche industries, investing heavily in cutting-edge technology infrastructure, or leveraging robust government support, intensifying rivalry on the basis of differentiation.

Exit Barriers

China Fortune Land Development (CFLD) faces significant exit barriers in the urban development sector. High fixed costs associated with land acquisition, infrastructure development, and long project timelines mean that exiting a project before completion can result in substantial financial penalties and unrecouped investments. For example, in 2023, the real estate development sector in China saw an average project completion time of 24-36 months, with significant capital tied up in each phase.

These substantial capital investments and the protracted nature of urban development projects discourage companies from leaving the market, even when facing economic headwinds. This can lead to intensified competition as firms are compelled to remain operational, potentially driving down prices and profit margins. CFLD’s own financial reports from 2023 indicated that a significant portion of its assets were tied to ongoing development projects, highlighting the illiquid nature of its investments.

The difficulty in divesting partially completed projects or land holdings means that companies like CFLD are often locked into their market positions. This lack of flexibility can exacerbate competitive pressures during periods of slower demand or regulatory changes. In 2024, the urban development market in China continued to be characterized by these high sunk costs, making strategic exits a complex and costly undertaking for all players.

- High Fixed Costs: Significant upfront capital is required for land, infrastructure, and construction, making it difficult to recoup these investments if a company exits early.

- Long Development Cycles: Urban development projects can take several years to complete, tying up capital and making it challenging to pivot or exit quickly.

- Capital Investments: The sheer scale of investment needed for large-scale urban projects creates substantial sunk costs, acting as a strong deterrent to exiting.

- Intensified Competition: High exit barriers force companies to stay in the market, potentially leading to increased competition and pressure on profitability, especially during economic downturns.

Government Policies and Support

Government policies, such as land supply regulations and investment incentives, directly shape the competitive landscape for China Fortune Land Development (CFLD). Changes in these policies can significantly alter the ease of market entry and the cost of operations for all players.

Companies that effectively align with national strategic initiatives, like the Xiong’an New Area development, can secure preferential treatment and access to crucial resources. This alignment can create a notable competitive advantage, particularly for those with established government relationships.

- Land Supply Control: Government decisions on land allocation and zoning directly impact the availability and cost of development sites, influencing rivalry.

- Investment Incentives: Tax breaks, subsidies, and financing support offered by the government can attract new entrants and bolster existing players, intensifying competition.

- Regional Development Plans: National and provincial development strategies often prioritize certain areas or industries, creating opportunities and challenges that affect CFLD's competitive position.

- Regulatory Environment: Evolving regulations concerning urban planning, environmental standards, and property development can create barriers to entry or shift competitive advantages.

Competitive rivalry within China's urban development sector is exceptionally high, with numerous domestic and international players vying for market share. This intense competition is fueled by a large number of developers, including state-owned enterprises and specialized firms, all seeking prime land and tenants. The market's increasing maturity, evidenced by a 9.6% year-on-year decline in property investment in 2023, forces companies to differentiate and potentially engage in aggressive pricing.

China Fortune Land Development (CFLD) faces a crowded field of competitors, ranging from comprehensive urban developers to specialized industrial park operators. These rivals often possess strong government backing or focus on niche markets, intensifying the battle for resources and customers. CFLD's integrated 'industrial new cities' model offers a unique value proposition, but competitors can counter with technological advancements or specialized services.

The sheer number of participants and the slowing growth rate in China's real estate market, which saw property investment fall by 9.6% in 2023, mean that companies must fight harder for market share. This dynamic leads to increased pressure on pricing and a greater need for effective differentiation strategies to stand out in a crowded marketplace.

Companies like CFLD are locked into long-term, capital-intensive projects, with exit barriers being substantial due to high fixed costs and lengthy development cycles. This immobility means that even during market downturns, firms remain operational, contributing to sustained, and often heightened, competitive pressures throughout the sector.

SSubstitutes Threaten

The primary threat of substitutes for China Fortune Land Development's (CFLD) integrated new city model comes from traditional, fragmented urban development. In this approach, separate entities handle residential, commercial, and industrial zones, offering greater individual choice but lacking the cohesive synergy CFLD aims to create.

While these traditional models might appear less integrated, they can offer cost advantages for specific components, as developers can focus on optimizing individual land parcels rather than managing a comprehensive ecosystem. For instance, a standalone industrial park might attract tenants with lower upfront costs than a fully integrated new city.

The flexibility of independent development allows businesses and residents to select locations based solely on their immediate needs, bypassing the broader, long-term vision of an integrated new city. This can be particularly appealing in 2024 as economic conditions necessitate agile operational decisions.

Established urban centers with robust infrastructure, deep talent pools, and mature business ecosystems present a significant threat of substitution for China Fortune Land Development's (CFLD) new city projects. Businesses may opt for these developed areas, especially if the advantages of locating in a new, emerging industrial city do not clearly surpass the benefits of an established one. For example, in 2024, major Chinese cities like Shanghai and Shenzhen continued to attract significant foreign direct investment, with Shanghai alone seeing a 5.4% year-on-year increase in FDI in the first quarter of 2024, highlighting the persistent draw of established hubs.

The increasing adoption of digital and remote work solutions poses a significant threat to traditional urban development models, including those China Fortune Land Development (CFLD) engages in. As more companies embrace distributed workforces, the demand for large-scale, centralized office spaces and even industrial parks could diminish. This trend, accelerated by events like the COVID-19 pandemic, suggests a long-term shift where physical proximity becomes less critical for many businesses.

By 2024, the global remote workforce has expanded considerably, with studies indicating that a significant percentage of companies intend to maintain hybrid or fully remote structures. This directly impacts the need for extensive physical infrastructure, potentially reducing CFLD's core market for developing and managing such spaces. The cost-effectiveness and flexibility offered by these digital alternatives present a compelling substitute for the physical real estate CFLD traditionally provides.

Relocation to Other Countries/Regions

For multinational corporations and export-focused businesses, the option to shift operations to other countries or regions presents a significant threat of substitution for engaging with China's industrial parks. Factors such as more favorable economic climates, reduced operating expenses, or diminished geopolitical uncertainties in alternative locations can make these other countries a more attractive alternative to investing in or expanding within China.

This threat is amplified by global economic shifts and evolving trade policies. For instance, in 2024, several Southeast Asian nations continued to attract significant foreign direct investment due to their competitive labor costs and growing domestic markets, offering a viable alternative to China for manufacturing and assembly operations. Companies are increasingly evaluating these diversified location strategies to mitigate risks.

- Relocation Advantage: Businesses can seek locations with lower production costs, potentially offering higher profit margins than those achievable in China's industrial parks.

- Geopolitical Risk Mitigation: Moving operations can serve as a hedge against potential trade disputes or political instability, ensuring business continuity.

- Market Access: Some alternative regions provide direct access to burgeoning consumer markets that might be difficult to penetrate from China.

Brownfield Redevelopment and Urban Renewal

The threat of substitutes for China Fortune Land Development (CFLD) in its core business of developing new towns is significant, particularly from brownfield redevelopment and urban renewal initiatives. Instead of opting for new greenfield developments, businesses and residents increasingly consider revitalizing existing urban areas. This trend is driven by the inherent advantages of leveraging established infrastructure and proximity to existing markets and labor pools.

In 2024, urban renewal projects are gaining momentum globally and within China. For instance, many Tier 1 and Tier 2 cities in China are actively promoting brownfield regeneration. These projects often benefit from existing utility networks, transportation links, and a readily available workforce, reducing the upfront investment and time-to-market compared to greenfield sites. This makes them a compelling alternative for developers and end-users alike.

- Leveraging Existing Infrastructure: Brownfield sites already possess access to power, water, and sewage systems, lowering development costs and timelines.

- Proximity to Markets and Labor: Urban renewal projects are typically located within or near established population centers, offering immediate access to consumers and a skilled workforce.

- Government Incentives: Many local governments offer tax breaks and streamlined permitting processes for brownfield redevelopment to revitalize urban cores.

- Sustainability Focus: The environmental benefits of reusing existing land and reducing urban sprawl are increasingly attractive to both developers and the public.

The threat of substitutes for China Fortune Land Development's (CFLD) integrated new city model is substantial, primarily stemming from the appeal of established urban centers and the increasing viability of remote work. Businesses may find the existing infrastructure, talent pools, and mature ecosystems of major cities like Shanghai more attractive than developing in a new, emerging industrial city. For example, Shanghai saw a 5.4% year-on-year increase in FDI in Q1 2024, underscoring the persistent draw of established hubs.

Furthermore, the rise of distributed workforces, accelerated by global events, diminishes the demand for large-scale physical spaces. By 2024, a significant portion of companies maintain hybrid or fully remote structures, making physical proximity less critical and presenting a cost-effective alternative to CFLD's traditional real estate offerings.

Another significant substitute is brownfield redevelopment and urban renewal initiatives. These projects leverage existing infrastructure and proximity to markets, reducing development costs and time-to-market compared to greenfield sites. Many Chinese cities in 2024 actively promoted brownfield regeneration, offering a compelling alternative for businesses seeking immediate access to consumers and skilled workforces.

Entrants Threaten

The urban development and industrial park sector, where China Fortune Land Development (CFLD) operates, demands immense capital. Think land acquisition, building roads, utilities, and actual structures – it all adds up. For instance, in 2024, major infrastructure projects in China often require billions of dollars in upfront investment, making it difficult for smaller players to even get started.

The Chinese government's stringent regulations on land use, urban planning, and real estate development act as a significant barrier to entry. New companies must navigate a complex web of licensing, permits, and approvals, a process that can be both time-consuming and costly.

In 2024, the real estate sector in China experienced continued regulatory scrutiny, particularly concerning land acquisition and development rights. For instance, policies aimed at curbing speculative land hoarding and ensuring sustainable urban growth directly impact the ease with which new developers can enter the market. This regulatory environment inherently favors established players like China Fortune Land Development who possess the expertise and relationships to manage these processes efficiently.

Established players like China Fortune Land Development (CFLD) leverage significant economies of scale in land acquisition, construction, and marketing, making it difficult for new entrants to compete on cost. For instance, CFLD's extensive project pipeline in 2024 likely allowed for bulk purchasing discounts and optimized construction processes, reducing per-unit costs.

Furthermore, CFLD's decades of experience in developing integrated urban communities provide invaluable know-how in navigating complex regulations, securing financing, and managing large-scale projects efficiently. This accumulated expertise translates into a lower risk profile and faster project execution compared to newcomers who would face a steep learning curve.

Access to Land and Strategic Locations

Securing desirable land in strategic locations is paramount for urban development projects. China Fortune Land Development (CFLD) benefits from its established presence and deep understanding of the land acquisition landscape.

Existing players like CFLD often possess strong, long-standing relationships with local governments, which can streamline the process of acquiring prime real estate. This established network and familiarity with land bidding procedures create a significant barrier for newcomers attempting to secure competitive sites.

For instance, in 2024, the average land auction price for commercial and residential development in major Chinese Tier 1 cities saw a notable increase, making the upfront capital requirement for new entrants even more substantial. CFLD’s historical success in securing land parcels in these high-demand areas underscores this advantage.

The threat of new entrants is therefore moderated by the significant hurdles in accessing and securing land in strategic locations:

- Established Government Relationships: CFLD's existing ties with local authorities facilitate smoother land acquisition.

- Land Acquisition Expertise: A deeper understanding of complex land bidding processes provides a competitive edge.

- High Capital Requirements: The increasing cost of prime land, exemplified by rising auction prices in 2024, deters new competitors.

- Limited Availability of Prime Sites: Desirable locations are often already secured by incumbent developers.

Brand Reputation and Relationship Networks

China Fortune Land Development's (CFLD) strong brand reputation and extensive relationship networks present a significant barrier to new entrants. Building comparable trust with businesses, investors, and government bodies requires substantial, long-term investment.

Newcomers would struggle to replicate CFLD's established connections, which are crucial for securing land, financing, and government approvals in China's complex development landscape. For instance, in 2024, navigating local government partnerships remains a key differentiator for established players.

- Brand Loyalty: CFLD benefits from a reputation built over years, fostering loyalty among its existing business park tenants and residential buyers.

- Government Relations: Established relationships with local and provincial governments are vital for project approvals and favorable policies, a hurdle for new firms.

- Investor Confidence: CFLD's track record instills confidence in investors, making it easier to raise capital compared to unproven entrants.

The threat of new entrants for China Fortune Land Development (CFLD) is significantly mitigated by the immense capital required for land acquisition and infrastructure development. New companies face steep upfront investment costs, especially with rising land auction prices in major Chinese cities in 2024, which can exceed billions of dollars. Navigating China's intricate regulatory environment, including land use and urban planning permits, further deters potential competitors by demanding considerable time and financial resources.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Fortune Land Development is built upon a foundation of verified data from annual reports, industry-specific research from firms like IBISWorld, and regulatory filings to ensure comprehensive competitive insights.