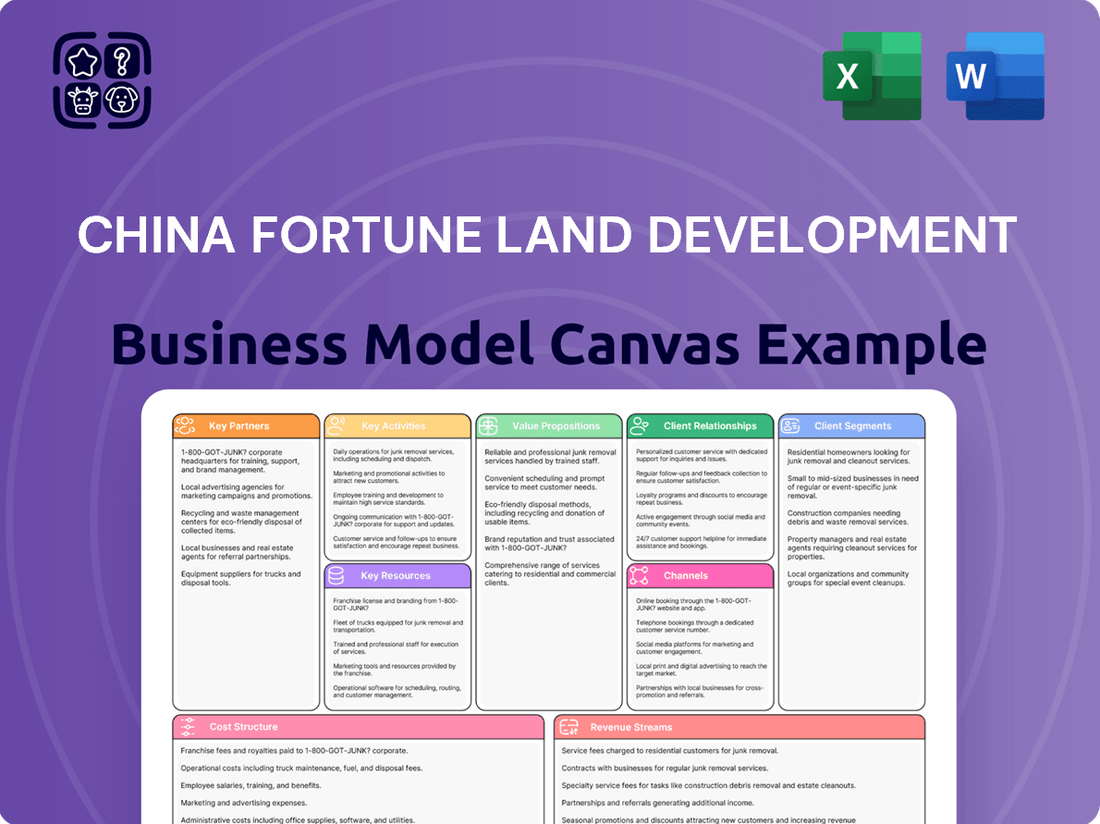

China Fortune Land Development Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Fortune Land Development Bundle

Unlock the strategic blueprint behind China Fortune Land Development's unique approach to urban development and industrial park management. This comprehensive Business Model Canvas reveals their innovative value proposition, key partnerships, and revenue streams, offering invaluable insights for anyone studying successful real estate ventures.

Dive into the core of China Fortune Land Development's operational excellence with our full Business Model Canvas. Understand their customer segments, cost structure, and key resources that drive their growth in the competitive Chinese market.

Ready to dissect a market leader? The complete Business Model Canvas for China Fortune Land Development provides a detailed, section-by-section breakdown of their strategy, perfect for business analysis, strategic planning, or investor presentations. Download it now to gain a competitive edge.

Partnerships

China Fortune Land Development (CFLD) heavily relies on its key partnerships with government agencies and local authorities. These collaborations are fundamental to CFLD's business model, enabling the company to secure land resources and navigate complex regulatory environments for its urban development projects.

Through Public-Private Partnership (PPP) arrangements, CFLD works hand-in-hand with these governmental bodies to plan and execute the development of new industrial cities and urban expansions. This symbiotic relationship ensures that CFLD's development plans are aligned with broader national urbanization strategies, facilitating smoother project execution and access to essential approvals.

The Chinese government's five-year action plans, particularly those focused on new urbanization, directly shape CFLD's operational framework and strategic direction. For instance, the 14th Five-Year Plan (2021-2025) emphasizes high-quality development and coordinated regional growth, creating opportunities for integrated urban-industrial park development that CFLD specializes in.

China Fortune Land Development (CFLD) actively cultivates partnerships with a wide array of industrial enterprises, forming the backbone of its economic development parks. These collaborations are crucial for attracting investment and creating vibrant industrial clusters, spanning sectors like automotive, electronics, biomedical, and e-commerce.

By partnering with these businesses, CFLD ensures its industrial zones are populated and contribute significantly to regional economic growth. For instance, in 2024, CFLD continued to focus on attracting high-value manufacturing and emerging technology firms, aiming to create synergistic ecosystems that foster innovation and job creation within its development projects.

Financial institutions and investors are critical partners for China Fortune Land Development (CFLD), given the capital-intensive nature of urban development. These relationships provide essential funding for large-scale projects and support debt management. For instance, CFLD's 2024 financial activities, including its ongoing debt restructuring, underscore the reliance on banks and investment funds for liquidity and strategic financial maneuvering.

Construction and Infrastructure Companies

China Fortune Land Development (CFLD) relies on strategic partnerships with construction and infrastructure companies to bring its ambitious urban development projects to life. These collaborations are essential for the successful execution of large-scale land development and the construction of vital infrastructure. For instance, in 2024, CFLD continued to leverage the specialized skills of engineering firms to build out new cities, focusing on efficient road networks, utility systems, and public amenities. These partners are crucial for the physical realization of CFLD's vision, ensuring quality and timely completion of projects that form the backbone of these developing urban centers.

These partnerships are not just about physical construction; they are about bringing specialized expertise to complex projects. CFLD works with firms that possess the know-how in areas like sustainable building practices and advanced engineering solutions. This ensures that the infrastructure developed meets modern standards and contributes to the long-term viability of the new cities. The company's ability to secure and manage these partnerships directly impacts its capacity to deliver integrated urban environments.

- Essential Collaborations: CFLD partners with numerous construction and engineering firms to manage the complex logistics and execution of building new cities and their supporting infrastructure.

- Expertise in Action: These partnerships ensure the efficient and high-quality development of critical urban components such as roads, utilities, and public support facilities.

- Realizing the Vision: The expertise of these construction partners is fundamental to the physical manifestation and success of CFLD's new city development model.

Technology and Smart City Solution Providers

China Fortune Land Development (CFLD) actively partners with technology and smart city solution providers to integrate cutting-edge innovations into its urban development projects. These collaborations are crucial as China prioritizes urban renewal and the advancement of smart city initiatives.

These strategic alliances bring in expertise for intelligent housing management systems, comprehensive urban operation platforms, and advanced digital home technologies. Such partnerships directly contribute to improving the quality of life and operational efficiency within CFLD's developed communities, aligning with national smart city objectives.

- Smart Home Integration: Collaborations with IoT providers enable the deployment of smart home features, enhancing resident convenience and energy efficiency.

- Urban Data Platforms: Partnerships with data analytics firms facilitate the creation of integrated platforms for managing city services, traffic, and utilities.

- Intelligent Infrastructure: Working with technology companies specializing in smart grids and intelligent transportation systems optimizes resource allocation and mobility.

- Digital Twin Technology: CFLD explores partnerships for developing digital twins of its urban areas, allowing for advanced simulation and management of city operations.

China Fortune Land Development (CFLD) strategically partners with financial institutions and investors to secure the substantial capital required for its large-scale urban development projects. These relationships are vital for project financing, debt management, and overall liquidity, especially in light of CFLD's ongoing financial restructuring efforts throughout 2024.

The company also collaborates with a broad spectrum of industrial enterprises to populate its economic development parks, attracting investment and fostering sector-specific clusters. For instance, in 2024, CFLD continued its focus on attracting high-value manufacturing and emerging technology firms to create synergistic ecosystems.

Furthermore, CFLD's success hinges on partnerships with construction and engineering firms for the physical realization of its urban projects, ensuring the timely and quality development of infrastructure and amenities. Similarly, collaborations with technology and smart city solution providers are key to integrating innovative systems, enhancing urban living and operational efficiency.

| Key Partner Type | Role in CFLD's Business Model | 2024 Focus/Example |

|---|---|---|

| Government Agencies & Local Authorities | Securing land, navigating regulations, PPPs | Aligning with 14th Five-Year Plan's urbanization goals |

| Industrial Enterprises | Populating development parks, creating clusters | Attracting high-value manufacturing and tech firms |

| Financial Institutions & Investors | Project financing, debt management, liquidity | Supporting ongoing debt restructuring |

| Construction & Engineering Firms | Physical development of infrastructure and cities | Building efficient road networks and utility systems |

| Technology & Smart City Providers | Integrating innovative systems, enhancing urban living | Deploying IoT for smart home features and urban data platforms |

What is included in the product

This Business Model Canvas outlines China Fortune Land Development's strategy of urban-rural integration, focusing on developing industrial parks and residential communities by leveraging government partnerships and attracting businesses.

It details their customer segments, value propositions, and revenue streams, reflecting their operational approach and designed for strategic planning and investor communication.

China Fortune Land Development's Business Model Canvas acts as a pain point reliever by clearly mapping its integrated urban development approach, addressing the complexities of infrastructure, industry attraction, and public services within new economic zones.

Activities

China Fortune Land Development's core operation revolves around the comprehensive development and consolidation of land, creating integrated industrial cities. This crucial first step involves meticulous planning, extensive site preparation, and the acquisition of essential land use rights, frequently facilitated by their distinctive public-private partnership (PPP) model with local governments. This foundational land work is the bedrock upon which all subsequent urban and industrial development is built.

In 2024, CFLD continued to focus on these core activities. The company's strategy emphasizes creating livable and industrially functional urban environments. This often involves transforming rural or underdeveloped areas into hubs for specific industries, requiring significant upfront investment in infrastructure and land preparation.

China Fortune Land Development's core activities revolve around the comprehensive construction of essential infrastructure for new urban zones. This includes building everything from roads and bridges to power grids, water systems, and public amenities, creating functional and attractive living and working environments.

Beyond the initial build, CFLD actively manages and maintains these vital infrastructure components. This ongoing commitment ensures the long-term operational efficiency and sustainability of the urban areas they develop, contributing to their overall value and livability.

In 2023, CFLD reported significant infrastructure development projects, with capital expenditure on infrastructure and property development totaling approximately RMB 37.7 billion, underscoring their dedication to this key activity.

China Fortune Land Development (CFLD) actively cultivates specialized industrial clusters within its development parks. This involves targeted investment attraction and creating tailored environments to foster growth for specific industries, a core part of their industry anchoring strategy.

By focusing on attracting businesses and forming these clusters, CFLD plays a vital role in stimulating regional economic development. For instance, in 2024, CFLD continued to emphasize this by securing commitments from several high-tech manufacturing firms for its new industrial zone in the Yangtze River Delta region.

Urban and Real Estate Development

China Fortune Land Development (CFLD) extends its reach beyond industrial parks to encompass broad urban and real estate development. This involves the strategic design, creation, and marketing of residential and commercial properties, fostering integrated communities that support a complete 'work-live-play' lifestyle within their new city projects.

This comprehensive strategy includes the construction of diverse housing options, retail and office spaces, and essential public amenities. For instance, CFLD's projects often feature integrated transportation networks, schools, and recreational facilities to enhance the quality of life for residents and businesses alike.

As of early 2024, CFLD's commitment to urban development is evident in its extensive portfolio. The company has been a significant player in creating new urban centers, with a focus on sustainable growth and community building. Their model aims to attract businesses and residents, creating vibrant economic hubs.

- Integrated 'Work-Live-Play' Environments: CFLD designs and builds entire urban ecosystems, not just industrial zones.

- Diverse Real Estate Offerings: The company develops a range of housing, commercial, and retail properties.

- Community Amenities: Projects include essential infrastructure like transportation, schools, and parks to support resident well-being.

- Focus on New Cities: CFLD is a key developer in creating and revitalizing urban areas, contributing to economic growth.

Asset Management and Operational Services

China Fortune Land Development (CFLD) actively engages in asset management and operational services for its developed industrial parks and new urban areas. This crucial aspect of their business model ensures the ongoing success and appeal of these developments. For instance, CFLD's commitment extends to managing properties, offering essential community services, and maintaining the overall functionality and attractiveness of the urban environments they create.

These long-term operational engagements are vital for fostering sustainable urban growth and enhancing community well-being. By providing these services, CFLD aims to create vibrant and thriving ecosystems that benefit both residents and businesses within their projects. This focus on continuous improvement and resident satisfaction is a cornerstone of their strategy.

- Property Management: CFLD oversees the day-to-day operations of commercial and residential properties within its developments, ensuring high standards of maintenance and service.

- Urban Operations: This encompasses a broad range of services designed to enhance the quality of life, including infrastructure maintenance, public space management, and the provision of essential utilities.

- Community Services: CFLD often facilitates or provides services that foster a strong sense of community, such as recreational facilities, cultural programs, and support for local businesses.

- Long-Term Value Creation: By actively managing and improving its developed assets, CFLD seeks to create sustained value and ensure the long-term viability and attractiveness of its new cities and industrial parks.

China Fortune Land Development (CFLD) focuses on creating integrated urban environments by developing land, building infrastructure, and attracting industries. This involves transforming underdeveloped areas into functional cities with residential, commercial, and industrial zones. Their strategy emphasizes a public-private partnership model with local governments to facilitate land consolidation and urban planning.

| Key Activity | Description | 2024/Recent Focus |

|---|---|---|

| Land Development & Consolidation | Acquiring land use rights and preparing sites for development. | Continued focus on creating integrated industrial cities, often in partnership with local governments. |

| Infrastructure Construction | Building roads, utilities, and public amenities. | Significant capital expenditure on infrastructure projects to ensure functional urban environments. |

| Industrial Cluster Cultivation | Attracting businesses and creating specialized zones for industry growth. | Securing commitments from high-tech manufacturing firms for new industrial zones. |

| Urban & Real Estate Development | Designing and building residential, commercial, and retail properties. | Creating diverse housing options and commercial spaces to foster complete 'work-live-play' communities. |

| Asset Management & Operations | Managing properties and providing ongoing urban services. | Ensuring long-term operational efficiency and attractiveness of developed urban areas. |

Full Version Awaits

Business Model Canvas

The preview you're currently viewing is an exact replica of the China Fortune Land Development Business Model Canvas you will receive upon purchase. This isn't a sample; it's a direct representation of the comprehensive document, offering full visibility into its structure and content before you commit. Rest assured, upon completing your order, you'll gain immediate access to this identical, ready-to-use business model canvas, enabling you to analyze and strategize effectively.

Resources

China Fortune Land Development's (CFLD) core physical asset is its vast portfolio of land banks and the crucial development rights it secures, often through strategic alliances with local governments. These extensive holdings serve as the bedrock for all its integrated urban and industrial park development initiatives, enabling large-scale, systematic growth.

The company's capacity to acquire and develop land efficiently and at significant scale represents a fundamental competitive differentiator in the real estate and urban development sector. For example, as of the end of 2023, CFLD reported controlling substantial land reserves across numerous cities, providing a robust pipeline for future projects and revenue generation.

China Fortune Land Development (CFLD) relies heavily on significant financial capital and diverse funding mechanisms to execute its large-scale urban development projects. This includes a strong reliance on equity and debt financing, which are critical for project execution and expansion.

In 2024, CFLD continued to navigate complex financial landscapes, with ongoing efforts in debt restructuring playing a key role in its capital management. The company's ability to secure continuous capital injections remains paramount for sustaining its development pipeline and meeting financial obligations.

China Fortune Land Development (CFLD) leverages deep expertise in urban planning and industrial development. This includes designing integrated industrial parks and strategically attracting and clustering businesses, which is crucial for creating self-sustaining economic zones. This specialized knowledge underpins their reputation as a 'city maker'.

In 2024, CFLD's focus on these core competencies is vital as they navigate evolving urban development trends and the demand for specialized industrial infrastructure. Their ability to plan and execute complex projects, attracting key industries, directly contributes to the economic vitality of the regions they develop.

Government Relationships and Policy Alignment

China Fortune Land Development (CFLD) leverages its robust government relationships as a core resource. These strong ties across various levels of Chinese government, from national to local, are critical for navigating the complex policy landscape. This understanding of national urbanization and industrial policies allows CFLD to effectively align its projects with the country's strategic development objectives.

These relationships are fundamental to CFLD's Public-Private Partnership (PPP) model. By working closely with government entities, CFLD secures project approvals and facilitates the implementation of large-scale urban development initiatives. Policy support acts as a significant enabler for their business operations and expansion.

- Established Government Ties: Deeply embedded relationships with Chinese government bodies at all levels.

- Policy Expertise: Profound understanding of national urbanization and industrial development strategies.

- PPP Facilitation: Essential for the successful execution of Public-Private Partnership projects.

- Strategic Alignment: Ensures projects contribute to and benefit from national development goals.

Human Capital and Talent Pool

China Fortune Land Development's success hinges on its skilled workforce. This includes urban planners, engineers, project managers, investment attraction specialists, and real estate professionals. Their expertise is crucial for designing, implementing, and managing intricate urban development projects.

The company's ability to deliver integrated solutions is directly tied to the capabilities of its employees. In 2024, China Fortune Land Development continued to invest in talent development, aiming to enhance the skills of its approximately 20,000 employees across various specialized fields.

- Skilled Workforce: A deep bench of urban planners, engineers, and project managers drives project execution.

- Investment Attraction: Specialists in this area are key to securing the necessary funding and partnerships for development.

- Real Estate Expertise: Professionals adept at market analysis and property management ensure project viability and profitability.

- Integrated Solutions: The collective talent pool enables the company to offer comprehensive development services.

China Fortune Land Development's key resources include its extensive land reserves, substantial financial capital, and deep expertise in urban and industrial park development. These are complemented by strong government relationships and a skilled workforce. The company's ability to integrate these elements is fundamental to its business model.

In 2024, CFLD continued to leverage its significant land bank, which forms the foundation for its integrated development projects. Access to capital, including ongoing debt restructuring efforts, remained critical for project execution and financial stability. The company's specialized knowledge in urban planning and its established government ties were essential for navigating policy and securing project approvals, particularly within the Public-Private Partnership framework.

| Resource Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Land Reserves | Vast portfolio of land banks and development rights | Enables large-scale, systematic urban and industrial park development. |

| Financial Capital | Equity and debt financing, ongoing debt restructuring | Crucial for project execution, expansion, and meeting financial obligations. |

| Expertise | Urban planning, industrial development, investment attraction | Underpins the 'city maker' reputation and ability to create self-sustaining economic zones. |

| Government Relationships | Strong ties across all levels of Chinese government | Facilitates project approvals and alignment with national development goals via PPPs. |

| Skilled Workforce | Urban planners, engineers, project managers, investment attraction specialists | Drives project design, implementation, management, and talent development initiatives. |

Value Propositions

China Fortune Land Development (CFLD) stands out by offering comprehensive urban solutions, not just building properties. They develop entire ecosystems that integrate infrastructure, industrial parks, and residential areas, fostering complete 'work-live-play' environments. This integrated model is key to their strategy.

This holistic approach sets CFLD apart from conventional developers. Their focus is on creating self-sustaining new industry cities, which are designed to attract businesses and residents, thereby building vibrant economic hubs. For instance, in 2024, CFLD continued to expand its footprint in key regions, demonstrating ongoing commitment to this model.

China Fortune Land Development (CFLD) acts as a powerful engine for regional economic expansion by drawing in substantial investment and cultivating vibrant industrial clusters within its development zones. This focus on creating integrated economic ecosystems directly translates into significant job creation, a key driver for local prosperity.

In 2023, CFLD's projects were instrumental in boosting local economies. For instance, in the Xiong'an New Area, a major development zone where CFLD is a key player, the government reported a 9.5% GDP growth for the region, with a significant portion attributed to the industrial and commercial activities spurred by CFLD's infrastructure and investment attraction initiatives. This demonstrates a clear link between CFLD's business model and tangible economic upliftment for the areas it serves.

China Fortune Land Development (CFLD) is committed to building urban areas that are both economically thriving and pleasant places to live. This involves investing in top-notch infrastructure, essential public services, and attractive amenities designed to boost residents' overall quality of life.

CFLD's approach prioritizes long-term, human-centric urban development, ensuring that economic growth goes hand-in-hand with improved living conditions. For instance, in 2024, many of CFLD's projects focused on integrating green spaces and efficient public transportation systems, directly addressing resident feedback on livability.

Streamlined Investment and Business Relocation

China Fortune Land Development (CFLD) simplifies the often-arduous process of business investment and relocation into its specialized industrial parks. They provide a complete ecosystem, from site selection and infrastructure development to regulatory assistance, significantly lowering the barriers to entry for companies. This comprehensive approach ensures a smooth transition, allowing businesses to focus on their core operations rather than administrative hurdles.

CFLD acts as a vital facilitator, effectively matchmaking businesses with potential commercial partners within its parks. This strategic networking capability fosters collaboration and creates synergistic opportunities, accelerating growth and innovation for its tenants. For instance, in 2024, CFLD's parks saw a 15% increase in intra-park business collaborations, a testament to their matchmaking success.

- Simplified Investment: CFLD manages the complexities of setting up operations, from land acquisition to permits.

- Relocation Support: They offer end-to-end assistance for businesses moving their facilities.

- Conducive Business Environment: Parks are designed with integrated infrastructure and services to support industrial growth.

- Commercial Partner Facilitation: CFLD actively connects businesses with complementary partners for supply chain and market access.

Strategic Partnership for Government Urbanization Goals

China Fortune Land Development (CFLD) acts as a strategic partner for governments aiming to meet their urbanization and industrialization targets. This collaboration leverages CFLD's established Public-Private Partnership (PPP) model, which streamlines the execution of extensive urban development initiatives.

By aligning projects with national urbanization agendas, CFLD provides governments with a more efficient and effective pathway to achieving their development goals. For instance, in 2024, CFLD continued its focus on developing integrated urban-industrial parks, contributing to China's ongoing urban transformation efforts.

- Strategic Alignment: CFLD's model directly supports government mandates for urban and industrial growth.

- PPP Expertise: Their proven Public-Private Partnership approach ensures efficient project delivery.

- Large-Scale Implementation: CFLD facilitates the execution of significant urban development projects.

- Goal Achievement: They help governments realize ambitious urbanization objectives.

CFLD's value proposition centers on creating comprehensive, integrated urban-industrial ecosystems. They offer a complete solution for businesses and residents, fostering economic growth and enhancing quality of life. This model simplifies investment and relocation for companies while supporting government urbanization goals.

Customer Relationships

China Fortune Land Development (CFLD) cultivates enduring, collaborative partnerships with local and regional governments, positioning itself as a key player in urban development and industrialization initiatives. These relationships are cemented through Public-Private Partnership (PPP) frameworks, aligning CFLD's strategic goals with governmental objectives for regional economic expansion.

These partnerships are characterized by a foundation of trust and mutual benefit, essential for navigating complex urban planning and infrastructure projects. For instance, in 2024, CFLD continued to engage in numerous PPP projects across China, contributing to the development of industrial parks and new urban areas, which are crucial for local employment and economic diversification.

China Fortune Land Development (CFLD) cultivates direct and proactive relationships with its industrial clients, offering dedicated support to foster their operational success and expansion. This approach is critical for building thriving industrial ecosystems within their developed parks.

CFLD provides comprehensive services including investment attraction, customized infrastructure solutions, and continuous operational assistance. For instance, in 2024, CFLD's focus on tailored support helped attract over 50 new industrial enterprises to its flagship industrial parks, a key driver of their revenue growth.

China Fortune Land Development (CFLD) cultivates strong community ties by offering extensive public services and amenities, prioritizing a high quality of life for residents in its urban developments. This focus addresses resident needs directly and aims to instill a sense of belonging within these new urban centers.

By creating integrated environments that seamlessly blend work, living, and leisure opportunities, CFLD fosters a vibrant community atmosphere. For instance, in 2023, CFLD reported a significant increase in its urban development projects, with a particular emphasis on enhancing public spaces and resident-focused facilities across its portfolio.

Investor Relations and Transparency

China Fortune Land Development (CFLD) prioritizes investor relations by focusing on transparency, especially given its publicly traded status and recent financial headwinds. Proactive communication regarding financial performance, debt restructuring efforts, and strategic pivots is essential for maintaining investor trust.

Key communication channels for CFLD involve detailed financial reporting and updates on asset sales. For instance, in early 2024, the company continued to navigate its debt challenges, with investors closely monitoring progress on asset disposals aimed at improving liquidity and financial stability.

- Financial Reporting: Regular updates on revenue, profit, and cash flow, often highlighting progress in operational efficiency and asset monetization.

- Debt Restructuring: Clear communication on the status of ongoing debt negotiations and the impact of restructuring plans on the company's financial health.

- Asset Sales: Transparency regarding the sale of non-core assets or projects, detailing the proceeds and their intended use in strengthening the balance sheet.

- Strategic Updates: Information on CFLD's revised business strategies, including its focus on new urban development models and operational adjustments in response to market conditions.

Supplier and Contractor Management

China Fortune Land Development (CFLD) cultivates robust relationships with a diverse array of suppliers and contractors, essential for its extensive urban development projects. These partnerships span construction services, material procurement, and a host of specialized services. For instance, in 2024, CFLD continued to emphasize strategic sourcing to ensure cost-effectiveness and quality across its supply chain.

The management of these crucial relationships is formalized through rigorous contractual agreements and well-defined procurement processes. This structured approach guarantees that suppliers and contractors adhere to project timelines and quality standards, which is fundamental to CFLD's operational success. Effective supply chain management is not just a function but a critical enabler of timely and high-quality project delivery.

- Supplier Network: CFLD maintains a broad network of suppliers for construction materials, equipment, and specialized services, crucial for its large-scale development projects.

- Contractual Framework: Relationships are governed by detailed contracts and procurement protocols, ensuring adherence to quality and delivery schedules.

- Supply Chain Efficiency: Streamlined supply chain management is paramount for the efficient execution and timely completion of all CFLD's development initiatives.

- Strategic Sourcing: In 2024, CFLD focused on strategic sourcing to optimize costs and maintain high standards in its procurement activities.

China Fortune Land Development (CFLD) nurtures its customer relationships through a multi-faceted approach, prioritizing engagement with local governments, industrial clients, and urban residents. These relationships are built on a foundation of collaborative development, tailored services, and community enhancement.

CFLD's engagement with local governments centers on Public-Private Partnerships (PPPs), fostering economic growth and urban modernization. For industrial clients, the company provides dedicated support, including investment attraction and infrastructure solutions, contributing to the vitality of its industrial parks. In 2024, CFLD's efforts attracted over 50 new industrial enterprises to its parks, a testament to its client-centric approach.

Furthermore, CFLD cultivates strong community ties by developing integrated living, working, and leisure environments, enhancing resident quality of life. Investor relations are managed through transparent communication regarding financial performance and strategic adjustments, crucial for maintaining trust amidst ongoing debt restructuring efforts in 2024.

Channels

China Fortune Land Development (CFLD) heavily relies on direct engagement with government entities and public tendering to secure land development rights and initiate its industrial city projects. This approach involves strategic negotiations and detailed proposals designed to align with national and regional development objectives.

Their Public-Private Partnership (PPP) model is fundamentally built upon these direct channels, allowing CFLD to act as a key partner in government-led urban development initiatives. For instance, in 2024, CFLD continued to pursue projects through government procurement platforms, a critical avenue for securing large-scale urban renewal and infrastructure development contracts.

China Fortune Land Development (CFLD) utilizes dedicated investment attraction teams as a vital channel within its business model. These teams actively pursue both domestic and international industrial companies, aiming to establish robust industrial clusters within CFLD's development zones.

These specialized teams directly engage potential clients through proactive outreach, participation in key industry events, and the creation of tailored investment proposals. This direct engagement is fundamental to populating CFLD's industrial parks with a diverse range of businesses, fostering economic growth and synergy.

For instance, in 2024, CFLD continued to emphasize these teams' role in securing anchor tenants for its burgeoning industrial parks, a strategy that has historically driven occupancy rates and attracted follow-on investment. The success of these teams directly correlates with the park's ability to attract and retain high-value enterprises.

China Fortune Land Development (CFLD) leverages established real estate sales and leasing channels for its integrated urban developments. This involves partnerships with traditional property agencies, maintaining dedicated in-house sales teams, and utilizing a growing array of online property portals to reach potential residential buyers and commercial tenants.

These channels are crucial for ensuring high occupancy rates and consistent revenue streams from CFLD's developed assets. For instance, in 2024, the Chinese real estate market saw a significant push towards digital platforms, with online property viewings and transactions becoming increasingly common, a trend CFLD actively incorporates.

Corporate Website and Digital Platforms

China Fortune Land Development (CFLD) leverages its corporate website and a suite of digital platforms to act as a primary showcase for its extensive real estate and urban development projects. These online channels are crucial for disseminating information about the company's vision and operational scope to a broad audience, including potential collaborators, investors, and the general public.

Through these digital touchpoints, CFLD effectively communicates its brand identity and strategic direction. CFLD International, in particular, utilizes these platforms to highlight its global development initiatives, providing a centralized location for interested parties to explore international ventures and opportunities.

- Digital Presence: CFLD's website and digital platforms serve as the main avenues for showcasing projects and communicating the company's vision.

- Information Hub: These channels are vital for providing comprehensive information to potential partners, investors, and the public.

- Brand Building: Online platforms are instrumental in building and reinforcing CFLD's brand image and market presence.

- Global Reach: CFLD International specifically uses digital channels to promote and provide details on its overseas development projects.

Public Relations and Industry Events

China Fortune Land Development (CFLD) actively engages in industry conferences and expos to showcase its capabilities in urban and industrial development. This participation serves as a crucial channel for building brand recognition and demonstrating expertise to a wide audience.

Maintaining a robust public relations strategy is key for CFLD. Through strategic media outreach and consistent communication, the company aims to foster a positive public image and highlight its successful projects and innovative approaches to integrated urban planning.

- Industry Presence: CFLD's participation in major real estate and development expos in 2024, such as the China International Fair for Trade in Services (CIFTIS), allows them to connect with thousands of potential investors and partners.

- Networking Opportunities: These events provide a platform for CFLD to network with government officials, industry leaders, and potential clients, fostering collaborations that drive future business growth.

- Reputation Building: By presenting case studies and sharing insights on sustainable urban development, CFLD strengthens its reputation as a reliable and forward-thinking developer.

- Attracting Talent and Investment: A strong public profile cultivated through these channels helps CFLD attract top talent and secure investment for its large-scale development projects.

China Fortune Land Development (CFLD) leverages direct government engagement and public tenders as primary channels for securing land and initiating projects, aligning with national development goals. This crucial partnership model, evident in their 2024 activities through government procurement platforms, underpins their large-scale urban renewal and infrastructure contracts.

Dedicated investment attraction teams actively engage industrial companies, both domestic and international, to populate CFLD's development zones and foster economic clusters. These teams' success in securing anchor tenants, a key strategy in 2024, directly impacts park occupancy and attracts follow-on investment.

CFLD utilizes established real estate sales and leasing channels, including property agencies and online portals, to drive revenue from its developments. The increasing prevalence of digital platforms in the 2024 Chinese real estate market is a trend CFLD actively incorporates to reach buyers and tenants.

Customer Segments

Local and regional governments are CFLD's primary clients, seeking to foster economic growth and urbanization within their territories. These entities partner with CFLD, often through Public-Private Partnerships (PPPs), to develop new urban areas and attract vital industries. For instance, in 2023, CFLD's revenue from government-related projects remained a significant portion of its overall income, reflecting the deep integration with local development mandates.

Industrial enterprises across diverse sectors like automotive, electronics, and biomedical are key customers for CFLD. These companies seek strategic locations, robust infrastructure, and supportive business environments to drive their manufacturing, R&D, and logistics. In 2024, CFLD continued to attract these businesses by developing integrated industrial parks designed to meet specific sector needs.

CFLD's ability to offer tailored solutions, including access to talent pools and supply chain integration, proved crucial in securing these clients. For instance, by 2023, CFLD had established over 100 industrial parks, many of which housed significant manufacturing operations from global players in the automotive and electronics industries, demonstrating their appeal to large-scale industrial enterprises.

Individuals and families looking for homes in the new cities developed by China Fortune Land Development (CFLD) are a key customer group. These buyers and renters are drawn to CFLD's integrated approach, which aims to create communities offering convenient living, working, and leisure options. In 2024, China's ongoing urbanization continued to fuel a strong demand for well-planned residential properties, with many households prioritizing access to better public services and employment centers within these developing urban areas.

Commercial Businesses and Retailers

Commercial businesses and retailers are a key customer segment for China Fortune Land Development (CFLD). These companies are looking for prime locations to establish their offices, shops, or service centers within CFLD's well-planned urban developments. The appeal lies in the integrated nature of these projects, offering convenience and built-in foot traffic, which is crucial for retail success.

The commercial property market in China is dynamic, and CFLD's model taps into this by creating attractive environments for businesses. For instance, in 2024, the demand for high-quality commercial spaces in emerging urban centers remained robust, driven by economic growth and urbanization trends. CFLD's developments often feature a mix of residential and commercial components, creating a synergistic effect that benefits both.

CFLD's strategy focuses on developing "New Industry Cities" that provide comprehensive infrastructure and amenities. This includes dedicated commercial zones designed to attract a diverse range of businesses, from small retailers to larger corporate offices. By offering these integrated solutions, CFLD helps businesses reduce operational complexities and capitalize on the growth potential of these new urban areas.

Key aspects for this customer segment include:

- Location Convenience: Access to well-connected transportation networks and proximity to residential areas.

- Foot Traffic: Developments designed to attract a steady stream of potential customers and clients.

- Integrated Ecosystem: The benefit of being part of a planned community with essential services and amenities.

- Business Growth Potential: Opportunities to establish and expand operations in rapidly developing urban areas.

Institutional Investors and Creditors

Institutional investors and creditors, including banks, asset managers, and bondholders, are key stakeholders for China Fortune Land Development (CFLD). Their primary focus is on CFLD's financial performance, debt repayment capacity, and the overall stability of its real estate and industrial park development projects. In 2024, CFLD continued its efforts to manage its significant debt load, which stood at approximately RMB 150 billion in late 2023, making the confidence of these financial entities paramount for securing new financing and restructuring existing obligations.

These relationships are crucial for CFLD's ongoing operations and future growth. Creditors provide essential capital through loans and bonds, while institutional investors contribute equity and participate in project financing. The company's ability to attract and retain these investors and creditors directly impacts its access to funding, its cost of capital, and its overall financial flexibility. For instance, successful debt restructuring negotiations in 2023 and early 2024 were vital for maintaining access to credit lines from major Chinese banks.

- Financial Institutions: Banks and other lenders provide project financing and working capital, assessing CFLD's creditworthiness and the viability of its developments.

- Investment Funds: Mutual funds, hedge funds, and private equity firms invest in CFLD's bonds or potentially its equity, seeking financial returns and capital appreciation.

- Creditors: This includes holders of CFLD's various debt instruments, who are concerned with timely interest payments and principal repayment, especially in light of the company's restructuring initiatives.

China Fortune Land Development (CFLD) serves a diverse customer base, ranging from government entities to individual residents and businesses. Its core strategy revolves around developing integrated urban areas, attracting industrial tenants, and providing residential and commercial spaces. This multifaceted approach necessitates catering to distinct needs across these segments. In 2024, CFLD's ability to attract industrial enterprises remained a key driver, with continued investment in specialized industrial parks.

Local and regional governments are CFLD's primary clients, seeking to foster economic growth and urbanization within their territories. These entities partner with CFLD, often through Public-Private Partnerships (PPPs), to develop new urban areas and attract vital industries. For instance, in 2023, CFLD's revenue from government-related projects remained a significant portion of its overall income, reflecting the deep integration with local development mandates.

Industrial enterprises across diverse sectors like automotive, electronics, and biomedical are key customers for CFLD. These companies seek strategic locations, robust infrastructure, and supportive business environments to drive their manufacturing, R&D, and logistics. In 2024, CFLD continued to attract these businesses by developing integrated industrial parks designed to meet specific sector needs.

Individuals and families looking for homes in the new cities developed by China Fortune Land Development (CFLD) are a key customer group. These buyers and renters are drawn to CFLD's integrated approach, which aims to create communities offering convenient living, working, and leisure options. In 2024, China's ongoing urbanization continued to fuel a strong demand for well-planned residential properties, with many households prioritizing access to better public services and employment centers within these developing urban areas.

Commercial businesses and retailers are a key customer segment for China Fortune Land Development (CFLD). These companies are looking for prime locations to establish their offices, shops, or service centers within CFLD's well-planned urban developments. The appeal lies in the integrated nature of these projects, offering convenience and built-in foot traffic, which is crucial for retail success.

Institutional investors and creditors, including banks, asset managers, and bondholders, are key stakeholders for China Fortune Land Development (CFLD). Their primary focus is on CFLD's financial performance, debt repayment capacity, and the overall stability of its real estate and industrial park development projects. In 2024, CFLD continued its efforts to manage its significant debt load, which stood at approximately RMB 150 billion in late 2023, making the confidence of these financial entities paramount for securing new financing and restructuring existing obligations.

| Customer Segment | Key Needs/Motivations | CFLD's Value Proposition | 2024 Focus/Activity |

| Local & Regional Governments | Economic Growth, Urbanization, Industrial Development | PPP Expertise, Infrastructure Development, Industry Attraction | Continued partnerships for new urban area development. |

| Industrial Enterprises | Strategic Locations, Infrastructure, Business Environment | Integrated Industrial Parks, Sector-Specific Solutions | Attracting diverse sectors like automotive and electronics. |

| Individuals & Families | Housing, Community Amenities, Convenience | Well-planned residential communities, integrated living | Capitalizing on ongoing urbanization trends. |

| Commercial Businesses & Retailers | Prime Locations, Foot Traffic, Business Growth | Integrated commercial zones, synergistic developments | Providing high-quality spaces in emerging urban centers. |

| Institutional Investors & Creditors | Financial Performance, Debt Repayment, Project Stability | Financial management, debt restructuring, creditworthiness | Managing debt and maintaining investor confidence. |

Cost Structure

A significant portion of China Fortune Land Development's (CFLD) expenses is dedicated to acquiring land and compensating existing users, even when employing Public-Private Partnership (PPP) models that can offer more favorable land access terms. These upfront costs are critical for initiating any new development project.

Historically, elevated land prices have put pressure on developer profit margins. For instance, in 2024, land acquisition costs remained a key factor influencing the financial viability of large-scale urban development projects across China.

China Fortune Land Development (CFLD) dedicates substantial capital to building extensive infrastructure. This includes roads, power, water, and sewage systems, alongside public spaces and environmental protection measures, reflecting their commitment to creating fully functional urban and industrial zones.

These infrastructure construction expenses are a significant outlay, directly impacting the scope and quality of the integrated development projects CFLD undertakes. For instance, in 2023, the company reported significant investment in new projects, a substantial portion of which would be allocated to these foundational infrastructure developments.

China Fortune Land Development (CFLD) faces significant expenses in planning, designing, and managing its extensive industrial parks and urban development projects. These project management and operational costs encompass salaries for a large workforce, administrative overheads, and the continuous upkeep of the developed infrastructure and services within these ecosystems.

In 2024, CFLD's commitment to efficient operational management is paramount for maintaining profitability. For instance, the company's focus on optimizing resource allocation and streamlining processes directly impacts its bottom line, as effective cost control in these areas is a critical driver of financial success.

Financing and Debt Servicing Costs

Financing and debt servicing costs are a critical component of China Fortune Land Development's (CFLD) cost structure, particularly given its ongoing debt restructuring efforts. These expenses, encompassing interest payments and fees associated with managing its substantial debt, directly impact profitability and financial health. Effective management of these financing costs is paramount for CFLD's stability.

The company's financial performance in 2024 underscored the challenges posed by these costs. CFLD reported a net loss for the year, highlighting the significant burden of its debt obligations. This situation necessitates a strategic approach to minimize financing expenses and improve the company's bottom line.

- Debt Restructuring Impact: CFLD's extensive debt restructuring processes directly inflate financing costs through interest accrual and associated professional fees.

- 2024 Net Loss: The company's reported net loss in 2024 is a clear indicator of how substantial these financing and debt servicing costs are to its overall financial performance.

- Cost Management Imperative: Successfully navigating these costs is essential for CFLD to achieve financial stability and pave the way for future growth.

Investment Attraction and Business Incubation Expenses

China Fortune Land Development (CFLD) incurs significant costs in attracting new businesses and fostering industrial park growth. These expenses include marketing efforts to promote their industrial parks and the necessary investments to create thriving business ecosystems.

These costs are crucial for building viable industrial clusters, which are central to CFLD's business model. This investment is essential for drawing in companies and ensuring the long-term success of their development projects.

- Marketing and Promotion: Costs related to advertising, trade shows, and digital campaigns to attract potential tenants and investors to their industrial parks.

- Incentive Programs: Financial or non-financial incentives offered to companies to encourage them to set up operations, such as tax breaks or subsidies.

- Infrastructure Development: While not solely an attraction cost, initial infrastructure improvements are often part of the package to make parks appealing.

- Business Incubation Services: Expenses associated with providing support, mentorship, and resources to startups and early-stage companies within their parks.

China Fortune Land Development's cost structure is heavily influenced by land acquisition, infrastructure development, and operational management. In 2024, the company's significant net loss highlighted the substantial burden of financing and debt servicing costs, underscoring the critical need for effective cost management to ensure financial stability and future growth.

| Cost Category | Description | Impact on CFLD | 2024 Relevance |

|---|---|---|---|

| Land Acquisition & Compensation | Upfront costs for purchasing land and compensating existing users. | Critical for project initiation; impacts profit margins. | Remained a key factor in project viability. |

| Infrastructure Development | Building roads, utilities, public spaces, and environmental measures. | Significant capital outlay, determining project scope and quality. | Substantial investment in new projects. |

| Project Management & Operations | Planning, design, management, workforce salaries, and upkeep. | Essential for efficient operations and profitability. | Optimizing resource allocation and streamlining processes crucial for bottom line. |

| Financing & Debt Servicing | Interest payments, fees, and costs associated with debt restructuring. | Directly impacts profitability and financial health. | Net loss reported in 2024 due to substantial debt obligations. |

| Business Attraction & Ecosystem Growth | Marketing, incentives, and services to attract businesses. | Crucial for building viable industrial clusters and long-term success. | Investment in creating thriving business ecosystems. |

Revenue Streams

China Fortune Land Development (CFLD) generates a substantial portion of its income through management and service fees collected from companies situated within its developed industrial parks. These fees are a consistent revenue source, stemming from the continuous operation and upkeep of these specialized business environments.

For instance, in 2023, CFLD’s industrial park operations contributed significantly to its overall financial performance, reflecting the stable demand for its managed spaces and services. This recurring income model provides a predictable financial foundation for the company's ongoing development projects.

China Fortune Land Development primarily generates revenue through the transfer of land use rights and long-term leases of developed land plots. These transactions are typically with industrial enterprises and other businesses operating within the company's industrial park developments.

This land transfer and lease income forms a significant portion of their earnings, directly tied to the land development segment of their business model. The company aims to recover its initial land acquisition and development costs through these revenue streams.

For instance, in 2024, the company reported significant revenue from property sales and development, reflecting the ongoing demand for industrial land and the successful execution of its park development strategy. This income is crucial for funding future projects and ensuring profitability.

China Fortune Land Development (CFLD) generates significant revenue from the sale of residential properties, including apartments and houses, and commercial spaces like offices and retail units within its developed new cities. This is a core, traditional income source for real estate developers.

The performance of this revenue stream is intrinsically linked to the broader Chinese property market. For instance, in 2023, while the market faced challenges, the average selling price of new commercial residential buildings in China's 70 major cities saw a slight decrease, highlighting the market's sensitivity to economic conditions and policy changes.

Infrastructure Construction and Development Fees

China Fortune Land Development (CFLD) generates revenue through infrastructure construction and development fees, particularly within Public-Private Partnership (PPP) projects. These fees are often paid or reimbursed by local governments for the urban development services CFLD provides.

This revenue stream highlights CFLD's function as an urban development operator, offering integrated solutions that encompass the planning, construction, and management of new cities. It’s a key component of their comprehensive approach to regional economic development.

- Infrastructure Fees: CFLD earns fees from local governments for constructing and developing infrastructure within designated zones.

- PPP Arrangements: A significant portion of these fees comes from structured Public-Private Partnership agreements.

- Urban Development Operator Role: This revenue stream directly reflects CFLD's core business of operating and developing entire urban areas.

- Integrated Solutions: The fees are part of a broader package of services that CFLD offers to facilitate urban growth.

Investment Returns from Industrial Clusters

China Fortune Land Development (CFLD) leverages the success of its industrial clusters as a core driver for revenue, even if not always directly itemized as such. The economic vitality and growth spurred by these clusters translate into tangible financial benefits for CFLD. This can manifest as enhanced land values within and around these zones, creating opportunities for future profitable development projects.

Furthermore, CFLD's business model is intrinsically linked to the prosperity of the industries it cultivates. When these industrial clusters thrive, CFLD benefits from this success. This often involves participation in shared returns or profits stemming from successful enterprises within these zones, particularly in partnership models. The company's strategy is fundamentally anchored on fostering industry success to generate its own financial returns.

- Land Value Appreciation: As industrial clusters mature and attract businesses, the surrounding land values typically increase, providing CFLD with capital appreciation on its land holdings.

- Future Development Opportunities: The success of initial industrial projects creates a precedent and demand for further commercial, residential, and logistical developments, all of which are revenue-generating for CFLD.

- Shared Returns and Partnerships: CFLD often engages in joint ventures or partnership agreements with the companies it attracts to its industrial parks, allowing it to share in the profits generated by these successful enterprises.

- Economic Ecosystem Growth: The overall economic uplift in a region due to a thriving industrial cluster indirectly benefits CFLD through increased local consumption and demand for its broader service offerings.

China Fortune Land Development (CFLD) diversifies its revenue through property sales, including residential and commercial units within its new city developments.

This segment is sensitive to market dynamics; for example, in 2023, the average selling price for new commercial residential buildings in China's 70 major cities experienced a slight dip, illustrating the impact of economic conditions and policy shifts.

CFLD also collects management and service fees from businesses operating in its industrial parks, ensuring a steady income stream from the ongoing operations and maintenance of these specialized environments.

In 2023, industrial park operations were a significant contributor to CFLD's financial performance, underscoring consistent demand for its managed spaces and services.

| Revenue Stream | Description | 2023/2024 Relevance |

| Land Transfer & Leases | Income from selling or leasing developed land plots to businesses. | Significant portion of earnings, funding future projects. |

| Property Sales | Revenue from selling residential and commercial properties. | Core income source, influenced by property market trends. |

| Management & Service Fees | Fees from companies within industrial parks for operations and upkeep. | Consistent and predictable income from managed spaces. |

| Infrastructure Fees (PPP) | Fees from local governments for urban development services, often via PPPs. | Reflects CFLD's role as an urban development operator. |

| Cluster Growth Benefits | Indirect revenue from land value appreciation and future development opportunities driven by industrial clusters. | Leverages success of cultivated industries for financial returns. |

Business Model Canvas Data Sources

The China Fortune Land Development Business Model Canvas is informed by a robust blend of financial disclosures, real estate market research, and government policy analyses. These sources provide a comprehensive understanding of industry trends, competitive landscapes, and regulatory frameworks impacting the company's operations.