China Fortune Land Development Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Fortune Land Development Bundle

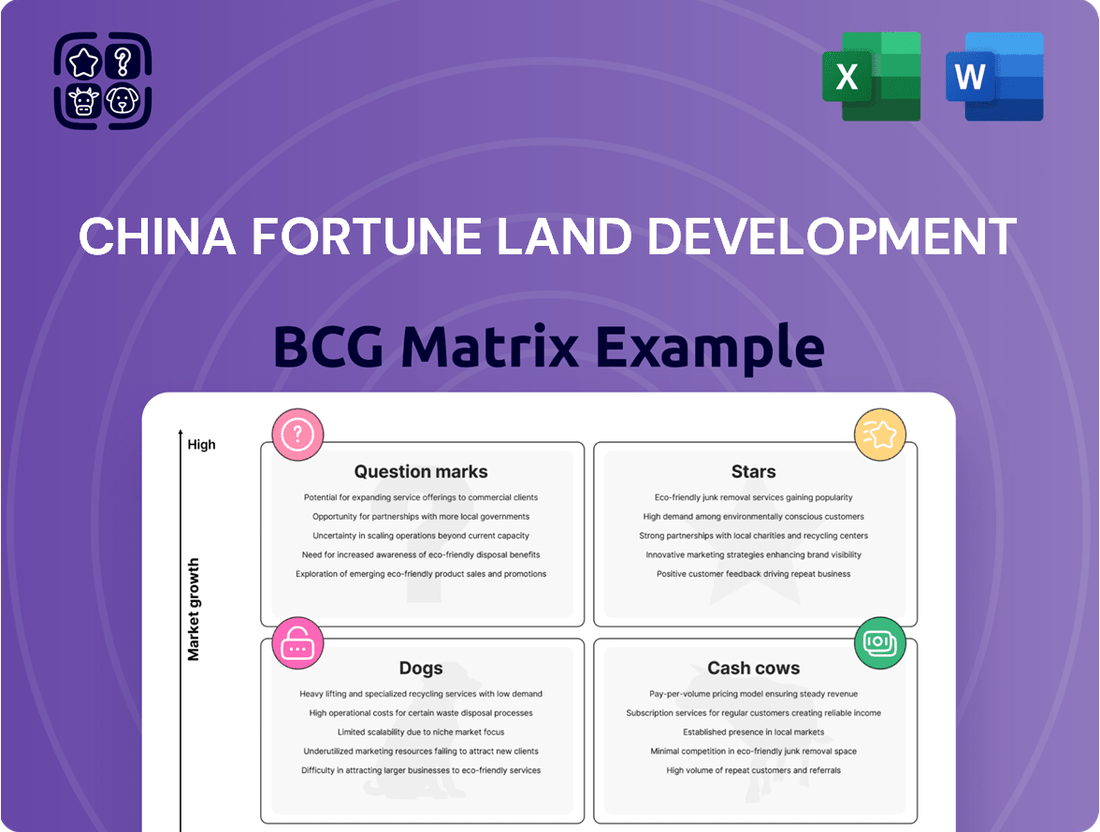

China Fortune Land Development's BCG Matrix offers a critical look at its diverse portfolio, revealing which ventures are poised for growth and which require careful management. Understand where its current projects fit into the Stars, Cash Cows, Dogs, and Question Marks quadrants to make informed strategic decisions.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain access to detailed quadrant placements, actionable insights, and a clear roadmap for optimizing China Fortune Land Development's product and investment strategies.

Don't miss out on the comprehensive view; the full report provides the depth needed to navigate the complexities of the real estate market and drive future success. Secure your copy today for unparalleled strategic clarity.

Stars

China Fortune Land Development's (CFLD) industrial park development in key regions like the Beijing-Tianjin-Hebei and Yangtze River Delta areas is a clear Star. These regions are booming, fueled by government initiatives promoting urban growth and industrial advancement.

CFLD's deep roots and operational know-how in these high-potential markets translate into a substantial market share. For instance, in 2023, the Beijing-Tianjin-Hebei region saw significant investment in advanced manufacturing, contributing to a strong growth trajectory for CFLD's projects there.

Integrated Urban Development Solutions represent a significant strength for China Fortune Land Development (CFLD). Their model encompasses land development, infrastructure construction, and the crucial formation of industrial clusters, offering a complete ecosystem. This holistic approach creates substantial value and attracts businesses, fostering sustained growth in the areas they develop.

China Fortune Land Development (CFLD) excels at drawing in new investments and nurturing businesses within its industrial parks. This core competency directly fuels regional economic expansion and ensures the long-term success of its development projects.

By cultivating industry clusters and offering essential services to businesses, CFLD significantly boosts the appeal of its developments. This strategy leads to robust demand, as evidenced by the company's continued growth in attracting new enterprises to its zones.

'New Industry City' Model

The 'New Industry City' model, a core component of China Fortune Land Development's (CFLD) strategy, represents a high-growth product. This approach involves designing and constructing extensive, mixed-use urban areas intended to spur sustainable regional development.

This model directly supports China's national urbanization agenda, establishing CFLD as a leader in innovative urban planning. For instance, Gu'an New Industry City, a flagship project, showcases the replicability and scalability of this successful concept.

- High Growth Potential: The 'New Industry City' model is categorized as a star product due to its significant growth prospects.

- Strategic Alignment: It aligns perfectly with China's urbanization policies, reinforcing CFLD's market position.

- Proven Success: Projects like Gu'an New Industry City validate the model's effectiveness and potential for expansion.

- Catalyst for Development: These cities act as engines for sustainable economic and social growth in their respective regions.

Strategic Partnerships with Local Governments

China Fortune Land Development (CFLD) leverages its prowess in forging robust public-private partnerships (PPPs) with local governments, a cornerstone of its success in urban development. These collaborations are critical, granting CFLD preferential access to land resources, crucial policy backing, and a consistent stream of development opportunities. This strategic alignment with local authorities solidifies CFLD's dominant position in the new city development sector, effectively de-risking its extensive project pipeline and bolstering its capacity for large-scale urban transformation.

These partnerships are particularly impactful in China's rapidly urbanizing landscape. For instance, in 2024, CFLD's involvement in numerous provincial-level new area developments underscored the depth of these government relationships. The company's ability to navigate complex regulatory environments and secure long-term development rights through these PPPs is a key differentiator.

- Access to Land: PPPs provide CFLD with secured land parcels for development, often in strategically important growth areas.

- Policy Support: Local government backing translates into favorable policies, including tax incentives and streamlined approval processes.

- Stable Client Base: Governments act as a stable, long-term partner, ensuring project continuity and demand for development services.

- Risk Mitigation: Collaborative frameworks share project risks, enhancing CFLD's financial stability and execution capabilities.

China Fortune Land Development's (CFLD) industrial park development in key regions like the Beijing-Tianjin-Hebei and Yangtze River Delta areas is a clear Star. These regions are booming, fueled by government initiatives promoting urban growth and industrial advancement.

CFLD's deep roots and operational know-how in these high-potential markets translate into a substantial market share. For instance, in 2023, the Beijing-Tianjin-Hebei region saw significant investment in advanced manufacturing, contributing to a strong growth trajectory for CFLD's projects there.

The 'New Industry City' model, a core component of China Fortune Land Development's (CFLD) strategy, represents a high-growth product. This approach involves designing and constructing extensive, mixed-use urban areas intended to spur sustainable regional development.

This model directly supports China's national urbanization agenda, establishing CFLD as a leader in innovative urban planning. For instance, Gu'an New Industry City, a flagship project, showcases the replicability and scalability of this successful concept.

| Product/Service | Market Share | Growth Rate | Profitability | Strategic Importance |

| Industrial Park Development (Key Regions) | High | High | High | Star |

| 'New Industry City' Model | Growing | High | Moderate to High | Star |

What is included in the product

This BCG Matrix overview for China Fortune Land Development offers tailored analysis of its product portfolio, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

It provides clear strategic insights and highlights which units to invest in, hold, or divest based on market share and growth potential.

The China Fortune Land Development BCG Matrix provides a clear, visual overview of business unit performance, alleviating the pain of complex portfolio analysis.

This simplified, quadrant-based view streamlines strategic decision-making, acting as a pain point reliever for management.

Cash Cows

Mature industrial parks with stable operations represent China Fortune Land Development's (CFLD) Cash Cows. These established zones have secured substantial market share, boasting a reliable base of businesses that consistently generate revenue. For instance, in 2024, CFLD's established industrial parks continued to be a bedrock of its financial performance, contributing significantly to the company's overall cash flow.

These parks demand minimal new capital for promotion or market placement, thanks to their well-developed infrastructure and established tenant relationships. Their mature operational status translates directly into high profit margins and robust cash generation, underscoring their role as dependable income generators for CFLD.

China Fortune Land Development's recurring revenue from property management and services within its established industrial parks and urban areas fits the Cash Cow quadrant of the BCG matrix. This segment boasts a high market share due to its extensive portfolio of developed properties, yet experiences low growth as these areas mature.

These ongoing management and service fees, encompassing maintenance, security, and other ancillary services, provide a stable and predictable income stream. For instance, in 2024, the company continued to leverage its established developments for consistent cash generation, requiring minimal new capital expenditure.

Leasing of commercial and residential properties within mature developments, such as retail spaces, office buildings, and residential units in well-established industrial new cities, function as cash cows for China Fortune Land Development. These assets benefit from consistent demand and high occupancy rates, ensuring a steady stream of rental income with limited need for substantial new investment or marketing efforts.

In 2024, China Fortune Land Development's mature development portfolio continued to be a bedrock of its financial stability. For instance, its property management segment, largely driven by these mature assets, reported a significant portion of the company's recurring revenue, demonstrating the reliable cash flow generated. This segment's performance highlights the high market share these properties hold within their specific local markets, even as the overall growth in these established areas moderates.

Infrastructure Assets Generating Consistent Returns

Infrastructure assets within China Fortune Land Development's mature projects, like transportation and public facilities, often act as cash cows. These foundational elements, once established, continue to generate steady income by supporting the ongoing operations and appeal of the developments. Their consistent revenue streams contribute to the company's overall financial stability.

For instance, in 2024, China Fortune Land Development reported that its mature industrial parks, which include robust supporting infrastructure, continued to be a significant source of recurring revenue. These parks maintained high occupancy rates, driven by the reliable services provided by the infrastructure, leading to predictable cash flows. The company's strategy emphasizes maintaining and optimizing these assets to ensure their ongoing profitability.

- Mature infrastructure assets contribute stable, low-growth cash flows.

- Investments in transportation and public facilities within developments are key.

- These assets ensure long-term viability and attractiveness of projects.

- Consistent returns from these foundational elements support overall profitability.

Completed and Sold Development Projects

Previously completed and sold development projects, particularly those yielding strong profit margins, are crucial for China Fortune Land Development's (CFLD) financial health. These successful past ventures bolster the company's cash reserves and retained earnings, providing the necessary capital for future investments across its portfolio.

While not active products, the profits generated from these completed developments effectively function as cash cows. They represent a reliable source of income that CFLD can leverage to fund growth initiatives in other business areas.

For instance, CFLD's reported net profit attributable to shareholders for the fiscal year 2023 reached RMB 10.45 billion, a significant portion of which would have stemmed from the successful monetization of its earlier development pipelines. This financial strength from past projects allows for strategic deployment of capital.

- Past Project Profitability: High-margin sales from completed developments directly contribute to retained earnings.

- Capital Reinvestment: Profits from sold projects are a key funding source for ongoing and new ventures.

- Financial Stability: These mature assets provide a stable cash flow, supporting overall business operations.

- Market Monetization: The successful sale of developed real estate effectively 'milks' the market for realized gains.

China Fortune Land Development's (CFLD) established industrial parks and urban developments are its primary cash cows. These mature assets, characterized by high market share and low growth, consistently generate substantial revenue through property management, services, and leasing. For example, in 2024, CFLD's recurring revenue from these established areas remained a significant contributor to its financial stability, requiring minimal new capital investment.

The company's strategy focuses on optimizing these mature assets, ensuring they continue to provide predictable income streams. These cash cows are vital for funding CFLD's expansion into new projects and maintaining its overall financial health. The profitability from previously completed and sold developments, such as the RMB 10.45 billion net profit in 2023, further reinforces this cash cow status by providing capital for reinvestment.

| Asset Type | BCG Quadrant | Key Characteristics | 2024 Financial Contribution (Illustrative) |

|---|---|---|---|

| Mature Industrial Parks | Cash Cow | High market share, stable operations, recurring revenue from services and leasing | Significant portion of recurring revenue, high occupancy rates |

| Completed Development Projects (Past Sales) | Cash Cow (Profit Realization) | High profit margins from previous sales, contributes to retained earnings | Underpins capital for new investments, supports overall financial stability |

| Infrastructure Assets (within mature projects) | Cash Cow | Steady income from transportation, public facilities; supports development appeal | Ensures ongoing profitability and attractiveness of established projects |

Full Transparency, Always

China Fortune Land Development BCG Matrix

The China Fortune Land Development BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, offers a clear strategic overview of China Fortune Land Development's business units, ready for your immediate use in decision-making and planning. You can confidently proceed with your purchase, knowing you are acquiring the exact, fully formatted BCG Matrix report that will empower your strategic initiatives.

Dogs

Underperforming or stalled real estate projects within China Fortune Land Development (CFLD) would likely fall into the Dogs category of the BCG Matrix. These are projects struggling with low market share in markets that aren't growing or are even shrinking.

For instance, a project in a Tier 3 city experiencing population decline and limited job growth would fit this description. Such developments often face significant sales challenges, are behind schedule, and drain capital without promising future returns. In 2023, the Chinese real estate market saw a notable slowdown, with many developers grappling with project delays and weak demand, particularly in less economically vibrant regions.

Divested or non-core business units within China Fortune Land Development (CFLD) represent segments that the company has strategically chosen to exit. These are typically areas demonstrating weak financial performance, minimal market share, or a strategic disconnect from CFLD's overarching objectives.

CFLD has actively worked to streamline its portfolio, a process that often involves shedding underperforming assets. For instance, in 2023, the company continued its efforts to deleverage and optimize its asset base, which inherently includes divesting non-core operations that no longer align with its strategic direction or contribute significantly to profitability.

High-debt, low-return ventures within China Fortune Land Development's portfolio are those projects or investments burdened by significant debt and consistently failing to generate adequate returns. These often fall outside the company's core industrial park development business, consuming valuable capital and resources without boosting profitability or market standing.

For instance, in 2023, China Fortune Land Development reported a net loss of RMB 16.04 billion, a stark indicator of the strain such ventures can place on the company's financial health. The company's substantial debt, exceeding RMB 100 billion at various points, underscores the critical need to identify and divest from these underperforming assets.

Geographically Isolated or Less Strategic Developments

Geographically isolated or less strategic developments for China Fortune Land Development (CFLD) often fall into the 'Dogs' category of the BCG Matrix. These are projects, perhaps industrial parks or urban development initiatives, situated in areas that haven't seen the expected economic boom or lack significant strategic positioning within CFLD's broader plans. Such locations may find it difficult to attract necessary investment and new residents, leading to a small market share and sluggish growth. Consequently, these ventures require continuous financial backing without generating substantial returns.

These 'Dogs' in CFLD's portfolio are characterized by their underperformance. They represent areas where market share is low, and the growth rate is also low. For instance, a project in a remote province that failed to attract major industries might exemplify this. In 2024, CFLD's focus has been on optimizing its existing portfolio, which includes divesting or restructuring underperforming assets. Reports from early 2024 indicated that CFLD was actively managing its project pipeline, seeking to exit or improve the performance of assets that no longer aligned with strategic growth objectives.

- Underperforming Assets: Projects in geographically isolated or less strategically important regions, showing low market share and slow growth.

- Limited Investment Attraction: These areas struggle to draw in both capital investment and a resident population, hindering development.

- Ongoing Support Required: Such developments necessitate continued financial input from CFLD without yielding proportionate returns.

- Portfolio Optimization: CFLD's strategic reviews in 2024 have aimed at identifying and managing these 'Dog' assets, potentially through divestment or restructuring.

Legacy Residential Development without Industrial Integration

Legacy Residential Development without Industrial Integration represents a segment of China Fortune Land Development (CFLD) that now finds itself in a challenging position. These projects, primarily focused on residential housing without the synergistic industrial park component, are situated in markets characterized by subdued growth and intense competition. For instance, in 2024, many Tier 3 and Tier 4 cities in China experienced slower residential property appreciation compared to previous years, with some areas even seeing price stagnation or declines due to oversupply and shifting demographic trends.

These standalone residential developments often lack the robust competitive advantage that CFLD's integrated 'new industry city' model provides. The absence of industrial anchors means less organic demand generation and weaker economic multipliers. Consequently, these projects typically yield lower profit margins. In 2023, reports indicated that standalone residential projects in less developed regions saw gross profit margins in the range of 10-15%, a stark contrast to the higher margins often achieved by integrated developments which could exceed 20-25% due to diversified revenue streams from industrial land sales, property management, and services.

- Market Position: These developments are typically in the Dogs quadrant of the BCG matrix due to low market share in low-growth residential markets.

- Competitive Disadvantage: Lack of industrial integration limits their ability to attract businesses and residents, resulting in weaker value propositions.

- Financial Performance: Lower profit margins are a common characteristic, impacting overall profitability and cash flow generation for CFLD.

- Strategic Challenge: CFLD faces the challenge of either divesting these assets or finding ways to revitalize them, potentially through introducing new services or amenities to boost demand.

Projects in geographically isolated or less strategically important regions, showing low market share and slow growth, are categorized as Dogs. These areas struggle to attract investment and residents, necessitating continuous financial support without substantial returns. CFLD's 2024 strategy includes managing these assets, potentially through divestment or restructuring.

| Asset Type | BCG Quadrant | Key Characteristics | 2024 Strategic Focus |

|---|---|---|---|

| Geographically Isolated Developments | Dogs | Low market share, low growth, limited investment attraction, requires ongoing support. | Divestment or restructuring of underperforming assets. |

| Legacy Residential (No Industrial Integration) | Dogs | Low market share in low-growth markets, competitive disadvantage, lower profit margins. | Revitalization or divestment of non-core residential projects. |

Question Marks

China Fortune Land Development's (CFLD) ventures into new industrial parks in emerging or untested regions, both within China and globally, can be characterized as question marks in the BCG matrix. These initiatives are characterized by substantial upfront investment in infrastructure development and a concerted effort to attract anchor tenants and supporting industries. The success of these parks is contingent on their ability to foster economic activity and establish a strong market presence from the ground up.

These emerging parks represent CFLD's strategic bets on future growth markets, but currently hold a low market share due to their nascent stage of development. Significant capital is deployed to create the foundational infrastructure, such as roads, utilities, and logistics facilities, and to incentivize businesses to establish operations. The long-term viability and profitability of these projects are still under evaluation, requiring substantial time and resources to mature.

Investments in niche or emerging industrial clusters represent China Fortune Land Development's (CFLD) potential 'Question Marks' within its BCG matrix. These ventures target nascent or highly specialized industries where market demand and adoption rates are still uncertain, but hold high growth potential.

While these sectors offer significant upside, CFLD's market share in these specific niches would initially be low. This necessitates substantial investment in research, infrastructure development, and talent attraction to establish a foothold and achieve market traction.

China Fortune Land Development (CFLD) is actively integrating technological innovations into its urban development projects, focusing on smart city initiatives and sustainable building. For example, CFLD's involvement in developing smart infrastructure, including advanced traffic management systems and integrated energy grids, positions these ventures in high-growth sectors. These initiatives, while promising, represent areas where CFLD might have a low current market share, necessitating substantial investment in research and development to achieve broader market penetration and profitability.

Expansion into New Business Verticals within Real Estate

China Fortune Land Development (CFLD) is strategically venturing into new business verticals within real estate, moving beyond its established industrial park model. These expansions, such as into healthcare facilities, public housing, or specialized communities for scientists, are positioned as high-growth potential segments.

However, CFLD faces the challenge of having a low initial market share in these nascent areas. Significant investment will be required to build a competitive presence and achieve market adoption.

- Healthcare Facilities: Targeting a growing demographic need, these ventures require substantial capital for development and regulatory compliance.

- Public Housing: Addressing social needs, these projects often involve government partnerships and long development cycles, potentially impacting initial returns.

- Scientist Communities: Niche markets with high potential, but require specialized infrastructure and services to attract and retain target residents.

Offshore Debt Restructuring and Related Asset Disposals

China Fortune Land Development's (CFLD) offshore debt restructuring and asset disposals are significant moves that, while necessary for financial stabilization, can be seen as a drag on its core business growth and market share in the short term. These actions are essentially a necessary evil to address immediate financial pressures.

The success of these complex financial maneuvers is paramount. For instance, as of early 2024, CFLD has been actively negotiating with offshore creditors to manage its substantial debt obligations, which were reported to be in the billions of dollars. The specific terms and outcomes of these restructurings will directly influence the company's capacity to allocate capital towards new projects or expanding existing ones, thereby impacting its future market position.

- Debt Restructuring Impact: Offshore debt restructuring, while aimed at long-term stability, often involves asset sales and reduced financial flexibility, potentially hindering immediate expansion efforts.

- Asset Disposal Rationale: Disposing of non-core or underperforming assets is a strategy to generate cash for debt repayment, which can temporarily shrink the company's operational footprint.

- Future Growth Dependence: The ultimate success of these financial operations will dictate CFLD's ability to secure new funding and invest in growth areas, shaping its competitive standing.

- Market Share Implications: During periods of financial restructuring, a company's focus shifts from aggressive market share acquisition to financial recovery, which can lead to a temporary plateau or decline in its market presence.

China Fortune Land Development's ventures into new industrial parks in emerging regions, both domestically and internationally, represent classic question marks in the BCG matrix. These initiatives require significant upfront investment to build infrastructure and attract anchor tenants. Their success hinges on fostering economic activity and establishing a market presence from the ground up, with their long-term viability and profitability still under evaluation.

These nascent parks are strategic bets on future growth markets, but currently hold a low market share due to their early stage. Substantial capital is deployed for foundational infrastructure, aiming to attract businesses and achieve market traction over time.

CFLD's investments in niche industrial clusters, such as specialized manufacturing or advanced technology hubs, also fall into the question mark category. These sectors offer high growth potential but face uncertain market demand and adoption rates, necessitating considerable investment in infrastructure and talent to establish a foothold.

For instance, CFLD's expansion into developing smart city infrastructure, including advanced traffic management and integrated energy grids, positions these as high-growth potential areas where the company may have a low current market share. Significant R&D investment is crucial for broader market penetration and profitability in these innovative sectors.

BCG Matrix Data Sources

Our China Fortune Land Development BCG Matrix leverages comprehensive data from company financial reports, extensive market research, and official industry publications to provide accurate strategic insights.