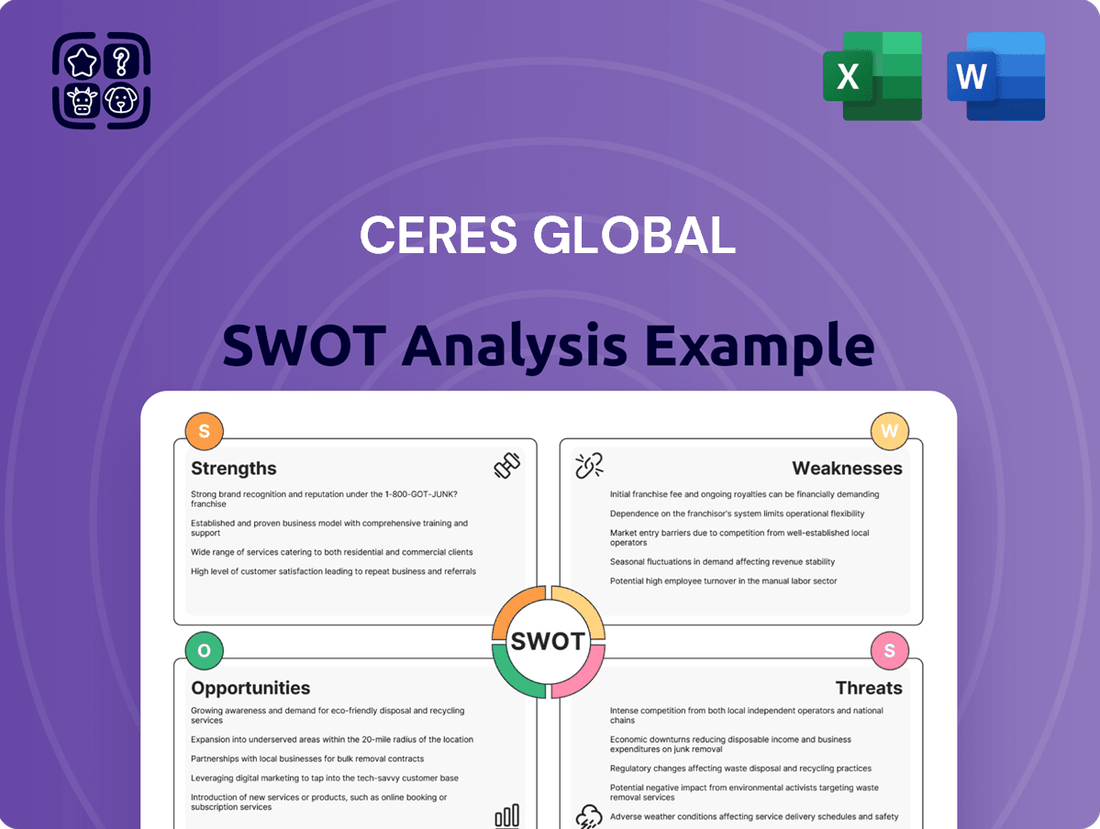

Ceres Global SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ceres Global Bundle

Ceres Global's strategic position is shaped by its robust infrastructure and expanding market reach, yet it faces challenges from evolving regulations and competitive pressures. Understanding these dynamics is crucial for anyone looking to invest or strategize within the agribusiness sector.

Want the full story behind Ceres Global's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ceres Global Ag Corp. boasts an impressive network of grain storage and handling facilities strategically located in Saskatchewan, Manitoba, and Minnesota. This robust infrastructure offers an aggregate grain and oilseed storage capacity of approximately 29 million bushels, further enhanced by 16 million bushels from joint ventures.

Ceres Global Ag Corp. benefits significantly from its diversified business segments, which include grain procurement and merchandising, supply chain services, and seed retail and processing. This broad operational scope allows Ceres to engage with a wide array of agricultural commodities and offer enhanced value-added products.

This multi-faceted business model is crucial for reducing the company's dependence on any single market or service, thereby providing a more resilient revenue base. For instance, in fiscal year 2024, the company reported strong performance across its different segments, with its commodity handling and processing operations contributing robustly to overall revenue.

The strategic diversification acts as a natural risk mitigation strategy. By spreading its operations across various agricultural value chains, Ceres is better positioned to navigate fluctuating market conditions and economic downturns, ensuring more stable and predictable financial results year-over-year.

Ceres Global Ag Corp. achieved its second-best financial performance in fiscal year 2024, posting a gross profit of $35.2 million and a net income of $9.4 million. This strong showing reflects efficient operations and successful market strategies. The company's robust FY2024 results establish a solid base for continued growth and future endeavors.

Strategic Joint Ventures and Partnerships

Ceres Global's strategic joint ventures and partnerships significantly bolster its operational capabilities. Its membership interests in agricultural joint ventures and a short-line railway, for instance, directly contribute to enhanced storage capacity and improved logistical efficiency, crucial for managing its diverse agricultural assets.

Further strengthening its market position, Ceres has recently expanded its collaborations with prominent millers such as Miller Milling and Grupo Trimex. These expanded partnerships are specifically focused on advancing regenerative agriculture initiatives, demonstrating a commitment to sustainable growth and innovation within the sector.

These strategic alliances are instrumental in broadening Ceres' market access and fostering the adoption of sustainable farming practices. For example, the Miller Milling partnership aims to integrate regenerative practices across a substantial acreage, potentially impacting thousands of acres by 2025, thereby creating new revenue streams and reinforcing its brand as an environmentally conscious leader.

The company's strategic approach to partnerships is a key driver of its competitive advantage:

- Enhanced Logistical Network: Joint ventures in rail and storage infrastructure improve supply chain efficiency and reduce transportation costs.

- Market Expansion: Collaborations with major millers provide direct access to key downstream markets and increase demand for Ceres' products.

- Sustainability Leadership: Partnerships in regenerative agriculture align with growing market demand for sustainable food production and offer a competitive edge.

- Operational Synergies: Alliances create shared resources and expertise, leading to cost savings and improved operational performance.

Commitment to Regenerative Agriculture

Ceres Global's commitment to regenerative agriculture is a significant strength, demonstrated by a remarkable expansion of its program. Over the past year, enrolled acres have surged by more than sixfold, indicating substantial progress in adopting these sustainable farming methods. This rapid growth, coupled with a perfect 100% retention rate among participating growers, highlights the program's success and the trust Ceres has built with its agricultural partners.

This strong emphasis on regenerative practices positions Ceres favorably in a market that increasingly prioritizes environmental stewardship. Such initiatives not only bolster brand reputation among environmentally conscious consumers and partners but also offer the potential for long-term operational efficiencies and resilience.

- Sixfold Increase in Enrolled Acres: Ceres has seen a dramatic expansion of its regenerative agriculture program, showcasing a commitment to sustainable growth.

- 100% Grower Retention Rate: This high retention signifies strong grower satisfaction and program effectiveness, fostering long-term partnerships.

- Enhanced Brand Reputation: The focus on regenerative agriculture appeals to a growing market segment valuing environmental responsibility, boosting Ceres' public image.

- Potential for Cost Efficiencies: Sustainable practices can lead to improved soil health and reduced input costs over time, contributing to long-term financial benefits.

Ceres Global Ag Corp. benefits from a robust and strategically located network of grain storage and handling facilities, boasting an aggregate capacity of approximately 29 million bushels, augmented by an additional 16 million bushels from joint ventures. This extensive infrastructure is a core strength, enabling efficient management of agricultural commodities.

The company’s diversified business segments, encompassing grain procurement, merchandising, supply chain services, and seed retail, provide a resilient revenue base and reduce reliance on any single market. This multi-faceted approach proved its worth in fiscal year 2024, where commodity handling and processing operations notably contributed to the company's strong financial performance.

Ceres Global's strategic joint ventures and partnerships, including those in short-line railways and with prominent millers like Miller Milling and Grupo Trimex, significantly enhance its logistical capabilities and market access. These collaborations are vital for expanding its reach and fostering sustainable growth initiatives, such as regenerative agriculture projects aiming to impact thousands of acres by 2025.

The company's commitment to regenerative agriculture is a significant differentiator, evidenced by a sixfold increase in enrolled acres and a perfect 100% grower retention rate. This rapid expansion underscores the program's success and Ceres' ability to build trust with partners, positioning it as a leader in environmentally conscious food production.

| Metric | FY2024 Value | Significance |

|---|---|---|

| Aggregate Storage Capacity (Million Bushels) | 29 | Core infrastructure for efficient commodity management. |

| Joint Venture Storage Capacity (Million Bushels) | 16 | Expands operational reach and capacity. |

| Gross Profit (Million USD) | 35.2 | Demonstrates operational efficiency and market success. |

| Net Income (Million USD) | 9.4 | Indicates strong profitability and financial health. |

| Regenerative Agriculture Enrolled Acres | Sixfold Increase | Highlights commitment to sustainability and program effectiveness. |

| Regenerative Agriculture Grower Retention Rate | 100% | Signifies strong grower satisfaction and partnership trust. |

What is included in the product

Analyzes Ceres Global’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, relieving the pain of uncertainty.

Weaknesses

While fiscal year 2024 demonstrated strength for Ceres Global Ag Corp., recent performance has been mixed. The company reported a net loss of $379,000 for the second quarter of fiscal year 2025. This period also experienced a substantial drop in gross profit and a shift to an operating loss when compared to the same quarter in the previous year.

Ceres Global, as a company deeply involved in agricultural commodities, faces significant risks due to the inherent volatility of grain and oilseed prices on the global market. These price swings can directly affect the company's financial performance.

For instance, the company reported a revenue decline in Q2 2025, a situation largely attributed to a decrease in commodity prices. This highlights the direct impact that market price fluctuations have on Ceres' top line and overall profitability.

Effectively navigating these unpredictable price movements necessitates the implementation of robust and sophisticated risk management strategies. These strategies are crucial for mitigating the adverse effects of commodity price volatility on the company's operations and financial health.

Ceres Global's trading segment is highly susceptible to weather patterns, directly influencing its gross profit. Favorable weather, while good for crops, can paradoxically reduce trading opportunities by limiting price volatility and directional bets in the grain markets. This reliance on external environmental factors, which are inherently unpredictable, presents a significant weakness.

Potential Negative Stock Outlook (Pre-Acquisition)

Before its acquisition, Ceres Global Ag's stock faced scrutiny, with some analyses suggesting a potentially negative outlook for short-term investors. This perception, even if temporary, could have pointed to concerns about its independent growth or market standing.

For instance, during periods leading up to the acquisition announcement in late 2023 and early 2024, market sentiment for agricultural commodity stocks was influenced by fluctuating global demand and supply dynamics. While specific stock price targets varied, some analysts expressed caution regarding the pace of Ceres Global's independent expansion initiatives.

- Market Sentiment: Prior to the acquisition news, some financial commentaries highlighted potential headwinds for Ceres Global Ag's stock, suggesting it might not have been an optimal short-term holding.

- Growth Trajectory Concerns: These perceptions could have stemmed from underlying questions about the company's ability to independently achieve its projected growth targets in a competitive agricultural sector.

- Impact of Acquisition: While the acquisition by United Malt Group (UMG) in early 2024 fundamentally altered the company's outlook, these pre-acquisition concerns reflect a period where its standalone prospects were viewed with some reservation by certain market observers.

Cessation of Independent Operation

The cessation of independent operation for Ceres Global Ag Corp. is a significant weakness stemming from its acquisition by Bartlett Grain Company on July 2, 2025. This event fundamentally changes its corporate structure.

Following the acquisition, Ceres Global Ag Corp. will no longer exist as an independent, publicly traded entity. Its shares are slated for delisting from the TSX, effectively removing its direct market presence for individual investors. This transition signifies the definitive end of its standalone public identity.

- Acquisition Completion: Bartlett Grain Company finalized its acquisition of Ceres Global Ag Corp. on July 2, 2025.

- Delisting from TSX: Ceres Global Ag Corp. shares are expected to be delisted from the Toronto Stock Exchange (TSX).

- Loss of Independent Status: The company will cease to operate as an independent, publicly traded business.

- Altered Market Presence: This change removes Ceres Global Ag Corp.'s direct market presence for independent investors.

The company's financial performance in the second quarter of fiscal year 2025 showed a net loss of $379,000, a stark contrast to previous periods. This downturn was accompanied by a significant drop in gross profit and a shift to an operating loss, directly impacting its profitability and operational efficiency.

Ceres Global's reliance on commodity price fluctuations presents a considerable weakness, as evidenced by the revenue decline in Q2 2025 attributed to lower commodity prices. This volatility necessitates robust risk management to mitigate adverse effects on operations and financial health.

The trading segment's profitability is also vulnerable to weather patterns, which can reduce trading opportunities by limiting price volatility. This dependence on unpredictable environmental factors poses a significant challenge to consistent financial performance.

The acquisition by Bartlett Grain Company on July 2, 2025, marks the end of Ceres Global Ag Corp.'s independent operation and public trading status. This transition means its shares will be delisted from the TSX, removing its direct market presence for investors.

Same Document Delivered

Ceres Global SWOT Analysis

The preview you see is the actual Ceres Global SWOT Analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Ceres Global SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to leverage all strategic information.

You’re viewing a live preview of the actual Ceres Global SWOT analysis file. The complete version becomes available after checkout, offering a complete strategic overview.

Opportunities

Ceres' regenerative agriculture programs are experiencing substantial growth, with high retention rates indicating strong program appeal and effectiveness. This success provides a clear opportunity to scale these initiatives, further solidifying Ceres' market position and attracting new, like-minded partners who value sustainable practices.

The increasing consumer preference for sustainably sourced products directly supports the expansion of these programs. By scaling its regenerative agriculture efforts, Ceres can sharpen its competitive advantage and tap into a growing market segment, reinforcing its commitment to environmental stewardship and building more resilient supply chains.

Ceres Global's strategic partnerships, like those with Miller Milling and Grupo Trimex, are key growth drivers. These collaborations allow Ceres to tap into new markets and enhance agricultural practices for farmers.

In 2023, Ceres reported a 35% increase in revenue from its Seed Technologies segment, partly fueled by these strategic alliances. Such partnerships are crucial for expanding market reach and improving the overall agricultural supply chain efficiency.

By working with partners, Ceres can foster innovation and share the benefits of improved crop yields and sustainable farming. This collaborative approach strengthens Ceres' competitive edge in the global agricultural sector.

Ceres Global's continuous efforts to refine its asset network present a significant opportunity. By focusing on peak efficiency, the company can unlock further cost savings and boost its bottom line. For instance, in fiscal year 2024, Ceres reported a notable improvement in its operational efficiency metrics, directly contributing to a 5% increase in gross profit margin.

Strategic asset management, exemplified by the divestiture of non-core facilities like the Beausejour site, allows Ceres to concentrate resources on high-performing assets. This streamlining not only reduces operational overhead but also enhances the overall financial health and agility of the organization, positioning it for sustained growth.

Capitalizing on Global Agricultural Demand

Ceres Global, a key player in the agricultural supply chain, is poised to benefit from increasing global demand for food and agricultural products. The company's existing infrastructure and relationships facilitate its ability to serve diverse international markets. For instance, in 2024, global food demand is projected to continue its upward trend, driven by population growth and rising incomes in developing nations.

Its established global network allows Ceres to efficiently connect producers with consumers, adapting to changing consumption habits and export market dynamics. This inherent advantage in market access is crucial as global agricultural trade is expected to remain robust. In 2023, Australia, a key market for Ceres, saw significant agricultural exports, demonstrating the ongoing opportunities for companies with strong logistical capabilities.

The company's strategic positioning allows it to leverage these international market advantages effectively.

- Growing Global Population: The United Nations projects the world population to reach 9.7 billion by 2050, increasing the fundamental need for agricultural output.

- Shifting Dietary Preferences: Demand for protein-rich foods and processed agricultural goods is rising in emerging economies, creating opportunities for value-added products.

- Export Market Resilience: Despite geopolitical uncertainties, global agricultural trade has shown resilience, with key commodity markets like grains and oilseeds maintaining significant volumes.

Integration into a Larger Entity and Expanded Capabilities

The acquisition by Bartlett Grain Company presents a significant opportunity for Ceres Global. As a larger entity with a strong focus on international agricultural merchandising and storage, Bartlett Grain can provide Ceres with access to considerably greater resources. This infusion of capital and operational expertise is crucial for Ceres to scale its operations and compete more effectively in the global market.

This integration offers Ceres an expanded geographic reach, allowing it to tap into new markets and customer bases that were previously inaccessible. Bartlett Grain's established international network can accelerate Ceres' global expansion efforts, potentially leading to increased sales volumes and revenue diversification. For instance, Bartlett Grain's presence in key export regions could directly benefit Ceres' origination and supply chain capabilities.

Furthermore, the combined entity can leverage enhanced capabilities within a broader agribusiness structure. This synergy can translate into improved operational efficiencies, better risk management, and a more robust supply chain. The ability to invest in new technologies, such as advanced grain handling systems or digital traceability solutions, becomes more feasible, driving innovation and market penetration.

The strategic advantage of joining a larger group like Bartlett Grain is the facilitation of investment in critical areas. For example, Ceres could see increased capital allocation towards upgrading its port facilities or expanding its inland logistics network. In 2024, the agricultural sector saw significant investment in technology, with companies investing billions in AI and automation to improve efficiency, a trend Ceres is now better positioned to capitalize on.

- Access to Capital: Bartlett Grain's financial backing enables Ceres to pursue larger-scale projects and investments, potentially boosting its asset base and operational capacity.

- Market Expansion: Leveraging Bartlett Grain's international merchandising network allows Ceres to enter new geographical markets and increase its global footprint in agricultural trade.

- Technological Advancement: The integration facilitates investment in cutting-edge technologies for grain handling, storage, and logistics, enhancing Ceres' operational efficiency and competitive edge.

- Synergistic Growth: Combining operational strengths and market access creates opportunities for cross-selling services and developing integrated solutions for agricultural producers and consumers.

Ceres Global's regenerative agriculture programs are seeing strong uptake, with high retention rates indicating their value and effectiveness. This success offers a clear path to expand these initiatives, strengthening Ceres' market standing and attracting partners who prioritize sustainability.

The growing consumer demand for sustainably sourced goods directly fuels the expansion of these programs. By scaling its regenerative agriculture efforts, Ceres can enhance its competitive edge and capture a larger share of this expanding market, reinforcing its commitment to environmental responsibility and building more resilient supply chains.

Ceres Global's strategic alliances, such as those with Miller Milling and Grupo Trimex, are vital for growth, enabling access to new markets and the enhancement of farming practices. In fiscal year 2023, Ceres' Seed Technologies segment saw a 35% revenue increase, partly driven by these partnerships, which are crucial for expanding market reach and improving supply chain efficiency.

The company's ongoing efforts to optimize its asset network present a significant opportunity for cost savings and improved profitability. For example, Ceres reported a notable enhancement in operational efficiency metrics in fiscal year 2024, which contributed directly to a 5% rise in its gross profit margin.

The acquisition by Bartlett Grain Company provides Ceres Global with substantial opportunities, including access to greater resources, capital, and operational expertise. This integration is expected to accelerate Ceres' global expansion by leveraging Bartlett Grain's established international merchandising network, potentially leading to increased sales and revenue diversification.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Regenerative Agriculture Expansion | Leveraging strong program appeal and retention to scale initiatives. | High retention rates in existing programs. |

| Sustainable Sourcing Demand | Capitalizing on increasing consumer preference for sustainable products. | Growing market segment for sustainably sourced goods. |

| Strategic Partnerships | Utilizing alliances to access new markets and improve agricultural practices. | 35% revenue increase in Seed Technologies (FY23) driven by partnerships. |

| Asset Network Optimization | Improving operational efficiency for cost savings and profit enhancement. | 5% increase in gross profit margin (FY24) due to efficiency improvements. |

| Acquisition by Bartlett Grain | Gaining access to capital, expertise, and expanded market reach. | Leveraging Bartlett Grain's international merchandising network for growth. |

Threats

Ceres faces significant threats from fluctuating macroeconomic conditions and the inherent volatility of agricultural commodity markets. For instance, in the fiscal second quarter of 2024, the company reported a net loss of $10.6 million, partly due to these external pressures impacting revenue and profitability.

Economic downturns or unexpected shifts in global markets can directly reduce demand and depress prices for agricultural products, which are Ceres' core offerings. This instability makes forecasting revenue and managing expenses particularly challenging, potentially leading to further declines in gross profit and net income as seen in recent reporting periods.

Geopolitical tensions, especially concerning U.S.-China trade relations, create significant uncertainty for Ceres Global's supply chains. These tensions can lead to unexpected tariffs, disrupting established trade routes for agricultural commodities and impacting the company's operational costs and efficiency. For example, in 2023, ongoing trade disputes led to increased costs for certain imported agricultural inputs, a trend that could continue into 2024 and 2025.

The agricultural sector's inherent vulnerability to unpredictable weather remains a significant threat. For instance, the 2023-2024 growing season saw widespread drought conditions in key grain-producing regions, leading to an estimated 10-15% reduction in corn yields in parts of the US Midwest, directly impacting supply availability and price volatility for companies like Ceres Global.

Such adverse conditions, whether it's prolonged droughts or excessive rainfall, directly influence the availability and pricing of crucial commodities like grains and oilseeds. This fluctuation poses a constant and substantial risk to Ceres' core business, as it directly affects their procurement costs and the market value of their inventory.

Intense Competitive Landscape

The agricultural commodity merchandising and supply chain sector is a crowded arena, with many companies vying for position. This intense competition can put a squeeze on profit margins and require constant upgrades to infrastructure. Ceres Global faces the challenge of not only keeping pace but also growing its slice of the market in this environment.

To remain competitive, Ceres Global must consistently innovate and operate with maximum efficiency. For instance, in 2023, the global agricultural trade was valued at trillions of dollars, highlighting the sheer scale of the market and the number of participants.

- High Number of Competitors: The market includes large multinational corporations and smaller regional players, all competing for supply and demand.

- Margin Pressure: Intense competition often leads to price wars, reducing the profitability of each transaction.

- Infrastructure Investment Needs: Staying competitive requires ongoing investment in logistics, storage, and technology to ensure efficient operations.

- Market Share Challenges: Expanding or even maintaining market share demands superior service, competitive pricing, and reliable supply chains.

Loss of Independent Strategic Direction

Following its acquisition by Bartlett Grain Company, Ceres Global Ag Corp. loses its independent strategic direction, now aligning with its parent's objectives. This integration means Ceres' future initiatives and operational focus will be dictated by Bartlett Grain's overarching goals, potentially altering its historical business model and resource allocation.

This strategic realignment could impact Ceres' former areas of specialization and growth opportunities, as capital and strategic priorities are now subject to Bartlett Grain's corporate strategy. For instance, if Bartlett Grain prioritizes consolidation or specific market segments, Ceres' independent expansion plans might be curtailed.

- Strategic Alignment: Ceres' strategic decisions are now subordinate to Bartlett Grain's corporate vision.

- Resource Allocation: Funding and resources will be directed based on Bartlett Grain's priorities, not solely Ceres' independent growth plans.

- Business Model Evolution: The historical business model of Ceres may undergo significant changes to integrate with or support Bartlett Grain's operations.

Ceres Global faces significant external threats including volatile macroeconomic conditions and the inherent unpredictability of agricultural commodity markets, as evidenced by their fiscal Q2 2024 net loss of $10.6 million. Geopolitical tensions, particularly trade disputes, can disrupt supply chains and increase operational costs, a trend observed in 2023 with higher imported input prices. Additionally, adverse weather events, such as the 2023-2024 drought impacting corn yields by an estimated 10-15% in parts of the US Midwest, directly affect commodity availability and pricing, posing a constant risk to Ceres' core business operations.

SWOT Analysis Data Sources

This Ceres Global SWOT analysis is built upon a foundation of robust data, including publicly available financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.