Ceres Global Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ceres Global Bundle

Ceres Global navigates a landscape where buyer power is moderate, influenced by the availability of alternative transportation solutions. The threat of new entrants is also a key consideration, as the capital-intensive nature of the industry presents some barriers but doesn't entirely deter potential competitors. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Ceres Global’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ceres Global Ag Corp. sources its primary inputs, grains and oilseeds, from a widely dispersed base of individual farmers. This fragmentation is a key factor in limiting the bargaining power of any single agricultural producer. In 2024, the agricultural sector continues to be characterized by a vast number of small to medium-sized operations, meaning no single farmer can exert significant leverage over Ceres' purchasing decisions or pricing structures.

The core agricultural commodities Ceres Global deals with, such as grains and oilseeds, are largely undifferentiated. This means they are standardized products with numerous suppliers available, making them commodities.

This commoditization significantly limits the bargaining power of individual farmers or even regional farming groups. Ceres can easily shift between suppliers based on cost, quality, and logistical efficiency, as long as local supply conditions permit such flexibility.

While global agricultural markets contribute to this, local supply dynamics remain a critical factor in Ceres's sourcing decisions. For instance, in 2024, global wheat prices saw considerable fluctuation, impacting the cost of sourcing for companies like Ceres.

Farmers, though individually small, can wield significant collective power when weather events or poor harvests limit the availability of essential commodities. This scarcity can inflate prices, giving these suppliers greater leverage over agricultural companies such as Ceres Global Ag Corp. For instance, the 2023 U.S. corn harvest was estimated to be down 6% from the previous year, impacting supply chains.

Specialized Input Providers

Ceres Global Ag Corp. might encounter suppliers with significant bargaining power when acquiring specialized inputs like patented fertilizers or proprietary seeds. This power stems from factors such as exclusive product rights, strong brand loyalty among farmers, or a limited number of competitors offering these crucial agricultural products. Consequently, these suppliers can often dictate higher prices or enforce less favorable contract terms, particularly when demand for their specialized offerings is robust.

Ceres' strategic alliances within the seed retail and processing sectors are vital for mitigating this supplier leverage. These partnerships can provide more favorable access to essential inputs and potentially secure better pricing, thereby strengthening Ceres' position in the agricultural supply chain.

- Supplier Concentration: In 2024, the global fertilizer market, a key input for Ceres, saw continued consolidation among major producers, potentially increasing supplier bargaining power in certain regions.

- Patented Technology: The agricultural technology sector, particularly for advanced seed varieties, is characterized by significant R&D investment and patent protection, granting holders considerable pricing influence.

- Brand Equity: Established agricultural input brands often command a premium due to proven performance and farmer trust, giving them an edge in price negotiations.

Transportation and Logistics Providers

Transportation and logistics providers hold substantial bargaining power over Ceres Global Ag Corp. because of the company's reliance on moving commodities. In 2024, freight costs, particularly for rail and trucking, continued to be a significant operational expense for agricultural companies like Ceres. Any disruption or limited availability of these services, especially in key agricultural regions, can lead to increased rates and impact Ceres' ability to deliver products efficiently.

Ceres' strategic investments in transportation infrastructure, such as its ownership interests in railways and participation in joint ventures, are designed to mitigate this supplier power. These investments provide greater control over a critical part of their supply chain, potentially reducing dependence on third-party logistics providers and their associated pricing pressures.

- Key Transportation Modes: Rail, truck, and barge are essential for Ceres' commodity movement.

- Impact of Bottlenecks: Limited transport options can increase freight rates and reduce service, directly affecting Ceres' costs.

- Mitigation Strategy: Ceres' investments in railways and joint ventures aim to enhance control over logistics.

The bargaining power of suppliers for Ceres Global Ag Corp. is generally low due to the fragmented nature of its primary input providers, individual farmers, and the commoditized status of grains and oilseeds. However, this can shift when specific inputs are patented or when widespread weather events limit supply.

In 2024, while individual farmers have limited leverage, collective action or severe weather impacting harvests can significantly increase input costs. For example, a 6% drop in the 2023 U.S. corn harvest highlighted how supply scarcity can empower farmers. Specialized inputs like patented seeds or fertilizers, however, present a higher supplier bargaining power due to intellectual property and fewer alternatives.

Transportation and logistics providers also hold significant power, as evidenced by continued high freight costs in 2024. Ceres' investments in transportation infrastructure are crucial for mitigating these pressures.

| Input Type | Supplier Concentration | Commoditization | Potential Bargaining Power |

|---|---|---|---|

| Grains & Oilseeds (Farmers) | Very Low (Fragmented) | High | Low (individually) |

| Specialized Inputs (Seeds, Fertilizers) | Variable (Can be High for Patented Products) | Low (Differentiated) | Moderate to High |

| Transportation & Logistics | Moderate to High (Industry Consolidation) | N/A | High |

What is included in the product

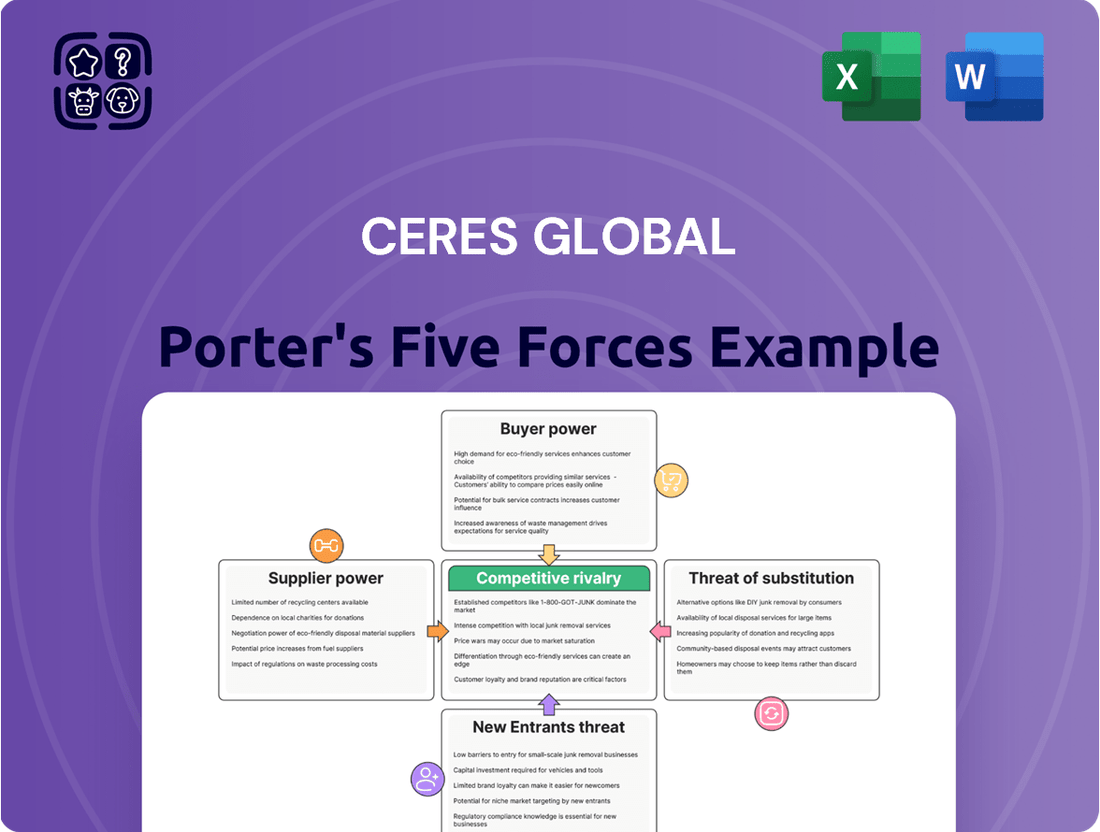

This analysis delves into the competitive forces impacting Ceres Global, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Effortlessly identify and quantify competitive threats, alleviating the pain of strategic uncertainty.

Customers Bargaining Power

Ceres Global Ag Corp.'s large industrial customers, like major food processors and millers, wield significant bargaining power. Their substantial purchase volumes, often in the tens of thousands of tons for commodities, allow them to negotiate aggressively on price and terms. For example, if Ceres Global Ag's pricing or quality doesn't align with a major buyer's expectations, that buyer can easily switch to another supplier, putting pressure on Ceres to remain competitive.

The commoditized nature of grains and oilseeds means Ceres Global's customers have numerous suppliers to choose from. This abundance of alternatives significantly strengthens their bargaining power.

Customers face low switching costs when sourcing raw materials, and readily available market data on commodity prices allows them to easily compare offers. This empowers buyers to seek the most competitive pricing, pressuring Ceres to maintain competitive pricing and service standards.

For instance, in 2024, the global average price for wheat saw fluctuations, with major benchmarks like the Chicago Board of Trade (CBOT) wheat futures trading within a range that allowed buyers to leverage price differences between suppliers. This market dynamism underscores the need for Ceres to focus on efficiency and supply chain partnerships to secure customer loyalty.

In today's agricultural landscape, customers, from individual farmers to large food processors, possess unprecedented access to information. They can readily compare prices for grains, oilseeds, and other commodities, analyze supply and demand forecasts, and scrutinize competitor pricing strategies. This high degree of price transparency significantly diminishes information asymmetry, tipping the scales in favor of the buyer.

This enhanced customer knowledge directly impacts Ceres Global's ability to command premium pricing. Without clearly demonstrable value-added services or unique product differentiators, Ceres faces pressure to align its pricing with market benchmarks. For instance, in 2024, global grain prices have shown increased volatility, making it imperative for Ceres to offer competitive rates or specialized risk management solutions to retain its customer base.

Low Switching Costs for Commodities

For basic grain and oilseed purchases, the cost for a customer to switch from Ceres Global to another supplier is minimal. This typically involves straightforward administrative adjustments rather than substantial operational changes, making it easy for buyers to move if they find better pricing or service elsewhere.

This low switching cost significantly amplifies customer bargaining power. It means Ceres must consistently deliver on reliability and service quality to retain its customer base, as price and convenience are easily comparable across the market.

- Low Switching Costs: Customers can easily shift between grain suppliers with minimal disruption.

- Customer Power: This ease of switching empowers customers to demand better terms.

- Competitive Landscape: Ceres faces pressure to differentiate through reliability and service, not just price.

- Market Dynamics: In 2024, the agricultural commodity market continues to see price sensitivity among buyers, reinforcing the impact of low switching costs.

Value-Added Services and Differentiation

While Ceres Global Ag Corp.'s commodity sales are subject to significant customer bargaining power, the company also provides value-added services such as fertilizer and seed distribution, alongside specialized supply chain solutions. These differentiated offerings can mitigate customer power if Ceres delivers unique advantages or integrated solutions that are difficult for rivals to match, fostering customer loyalty and raising switching costs.

The financial performance of Ceres' Supply Chain Services and Seed Retail segments is a key indicator of its success in leveraging these value-added services. For instance, in the fiscal year ending June 30, 2024, Ceres reported that its Seed & Crop Solutions segment, which includes seed distribution, saw revenue growth, indicating a positive reception to its specialized offerings.

- Differentiated Offerings: Ceres' value-added services in fertilizer, seed distribution, and supply chain solutions aim to reduce customer reliance on price alone.

- Customer Loyalty: By providing integrated solutions and unique benefits, Ceres seeks to increase customer switching costs and build loyalty, thereby lessening direct bargaining power.

- Segment Performance: The financial results of the Seed Retail and Supply Chain Services segments are crucial for assessing the effectiveness of these strategies in counteracting customer bargaining power.

- Market Dynamics: In 2024, the agricultural sector continued to see demand for efficiency and specialized inputs, creating opportunities for companies like Ceres to add value beyond basic commodity trading.

Ceres Global Ag Corp. faces substantial customer bargaining power due to the commoditized nature of its core products and low switching costs. Major industrial buyers, with their significant purchase volumes, can easily leverage multiple suppliers and readily available market data to negotiate favorable pricing and terms, as seen in 2024's volatile grain markets.

Customers' access to transparent pricing information for grains and oilseeds in 2024 allows them to readily compare offers, diminishing information asymmetry and empowering them to seek the best deals. This necessitates that Ceres Global maintain competitive pricing and demonstrate clear value beyond basic commodity supply.

The minimal costs associated with switching suppliers for raw agricultural materials significantly amplify customer leverage. This means Ceres must consistently deliver reliable service and quality to retain its client base, as price and convenience are easily matched by competitors.

While customer bargaining power is high for basic commodities, Ceres Global can mitigate this by offering value-added services like specialized supply chain solutions and seed distribution. The positive revenue growth in its Seed & Crop Solutions segment in fiscal year 2024 indicates customer receptiveness to these differentiated offerings, which can increase switching costs.

| Factor | Impact on Ceres Global Ag Corp. | 2024 Market Context |

|---|---|---|

| Purchase Volume of Large Customers | High; enables aggressive price negotiation. | Major food processors' needs remain substantial, driving price sensitivity. |

| Availability of Alternative Suppliers | High; strengthens customer choice and bargaining power. | Global grain markets offer numerous sourcing options for buyers. |

| Customer Switching Costs | Low; facilitates easy movement between suppliers. | Administrative ease of changing grain suppliers persists. |

| Price Transparency | High; empowers customers to seek best pricing. | Real-time commodity price data is widely accessible in 2024. |

| Value-Added Services | Potential to reduce bargaining power by increasing differentiation. | Demand for specialized inputs and supply chain efficiency is growing. |

What You See Is What You Get

Ceres Global Porter's Five Forces Analysis

This preview showcases the complete Ceres Global Porter's Five Forces Analysis, providing an in-depth examination of industry competition and profitability. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The agricultural merchant and supply chain sector is highly fragmented, featuring a mix of large multinational corporations, regional cooperatives, and smaller local businesses. This wide array of competitors, operating on a global scale, fuels intense price competition, especially since many agricultural commodities are seen as similar products. Ceres Global manages this by utilizing its extensive network of assets and strategic alliances.

Grains and oilseeds, the core of Ceres Global's business, are largely commoditized. This means their market value hinges on factors like price, quality, and sheer availability, rather than any proprietary differentiation. Consequently, the marketplace is characterized by intense price-based competition, where buyers naturally gravitate towards the most cost-effective suppliers.

In 2024, global grain prices experienced significant volatility. For instance, wheat prices fluctuated, with benchmark futures contracts seeing considerable swings due to geopolitical events and weather patterns impacting supply chains. This environment necessitates that Ceres Global maintains peak operational efficiency and employs astute trading strategies to secure a competitive edge and navigate the price-sensitive nature of the market.

The grain handling and processing industry, including companies like Ceres Global Ag Corp., demands substantial upfront investment in assets like storage silos, processing plants, and logistics networks. These significant capital expenditures translate directly into high fixed costs for all players in the sector.

To offset these substantial fixed costs and achieve operational efficiency, companies must maintain high levels of capacity utilization. For Ceres Global, this means maximizing the throughput of its facilities to spread the fixed costs over a larger volume of grain.

This drive for high utilization often fuels intense price competition. When the industry faces overcapacity or a slowdown in demand, companies are incentivized to offer lower prices to secure sufficient volumes, putting pressure on profit margins across the board.

Slow Industry Growth

The agricultural commodity market, including areas where Ceres Global operates, often sees slower growth rates compared to rapidly evolving tech sectors, especially in developed economies. This can make market share gains the primary driver of expansion.

In these slower-growth environments, competition can become quite fierce. Companies might engage in aggressive tactics like price reductions to capture customers from competitors, or they may focus on securing exclusive deals with suppliers and buyers to solidify their positions.

Ceres Global's strategy of forming strategic partnerships is a key response to this dynamic. For instance, their partnerships in 2024 aim to unlock new markets and enhance their product offerings, directly addressing the need for growth beyond organic expansion in a mature market.

- Slow Growth Environment: Mature agricultural markets can limit organic expansion opportunities.

- Intensified Competition: Companies often battle for market share through aggressive pricing and exclusive contracts.

- Strategic Partnerships: Ceres Global utilizes alliances to drive growth and differentiate its offerings.

Strategic Partnerships and Joint Ventures

Ceres Global Ag Corp. actively pursues strategic partnerships and joint ventures to bolster its competitive standing. A prime example is its collaboration with Berthold Farmers Elevator, which significantly enhances its grain origination capabilities and refines its asset network utilization.

These alliances are a direct countermeasure to intense industry competition. By pooling resources, expanding market reach, and improving operational efficiencies, Ceres strengthens its position against rivals who are also seeking to optimize their supply chains and customer access.

- Strategic Alliances: Ceres Global Ag Corp. forms partnerships, like the one with Berthold Farmers Elevator, to boost its origination capacity.

- Network Optimization: These joint ventures help Ceres streamline its asset network, making operations more efficient.

- Competitive Response: Such collaborations are a strategic move to combat competitive pressures in the agricultural sector.

- Enhanced Reach and Efficiency: Partnerships allow Ceres to leverage shared resources for broader market access and improved operational performance.

The agricultural sector, where Ceres Global operates, is characterized by a fragmented landscape with numerous players, leading to intense price competition due to the commoditized nature of grains and oilseeds. In 2024, global grain prices saw considerable volatility, driven by geopolitical factors and weather, underscoring the need for Ceres Global to maintain operational efficiency and employ smart trading strategies to remain competitive.

The industry's high capital requirements create substantial fixed costs, pushing companies towards maximizing capacity utilization to spread these costs, which in turn fuels price competition. In slower-growth markets, companies often vie for market share through aggressive pricing and exclusive deals, making strategic partnerships, like Ceres Global's 2024 collaborations, crucial for growth and differentiation.

Ceres Global Ag Corp. actively uses strategic alliances, such as its partnership with Berthold Farmers Elevator, to enhance grain origination and optimize its asset network, directly addressing competitive pressures by improving efficiency and market access.

SSubstitutes Threaten

A significant substitute threat emerges from large agricultural producers bypassing intermediaries like Ceres, selling directly to food processors or millers. This trend is amplified by advancements in logistics and information technology, which streamline direct transactions and diminish reliance on traditional merchant services. For instance, in 2024, the adoption of blockchain technology in agricultural supply chains has seen a notable increase, enabling greater transparency and direct farmer-to-buyer connections.

The food industry is experiencing a surge in innovation, particularly with alternative proteins like plant-based and lab-grown options. These advancements could potentially decrease the demand for traditional grains and oilseeds, impacting companies like Ceres. For example, the global plant-based food market was valued at approximately $29.4 billion in 2023 and is projected to grow significantly.

While these are considered long-term shifts, a rapid change in consumer tastes or a major technological leap could lead to these alternatives substituting products derived from Ceres' main commodities. This indirect competition could affect the demand for their services. By 2025, it's estimated that alternative proteins could capture a substantial share of the protein market.

Ceres' focus on regenerative agriculture programs might be a strategic move to address these evolving market demands and maintain relevance. Such programs aim to improve soil health and sustainability, potentially appealing to a growing segment of environmentally conscious consumers.

Large food processors and livestock operations might consider bringing grain storage and handling in-house. This vertical integration would allow them to bypass third-party providers like Ceres, directly impacting Ceres' customer base and revenue. For instance, a major meat producer could invest in its own grain silos to secure feed supply, reducing the need for Ceres' services.

Changes in Agricultural Practices

Innovations in agricultural practices pose a threat of substitutes by potentially disrupting established supply chains. For example, the rise of precision agriculture, which optimizes resource use and output, and the growing local food movement, emphasizing shorter distribution channels, could lessen reliance on large-scale, long-distance logistics. This shift might reduce the demand for services provided by companies like Ceres, which specialize in managing extensive transportation and storage networks.

However, Ceres Global's diversified operational model, encompassing facilities across various regions, provides a degree of resilience against these evolving agricultural practices. This adaptability allows Ceres to cater to different farming methods and distribution preferences, mitigating the direct impact of substitute solutions that emerge from localized processing and distribution networks.

The threat is amplified by changing consumer preferences and technological advancements. For instance, by 2024, the global market for precision agriculture technology was projected to reach over $10 billion, indicating a significant shift towards more efficient and localized farming. This growth suggests a potential for reduced reliance on traditional, centralized agricultural infrastructure.

- Innovations in precision agriculture could lead to more efficient on-farm processing, reducing the need for external logistics.

- The local food movement fosters shorter supply chains, bypassing large-scale storage and transportation providers.

- Ceres' advantage lies in its ability to adapt its infrastructure to accommodate diverse regional agricultural practices and distribution models.

- Market growth in precision agriculture signals a trend towards decentralized and optimized farming operations.

Substitution of Specific Grains/Oilseeds

The threat of substitution for specific grains and oilseeds is a persistent factor in the agricultural industry. Price fluctuations, shifts in availability, and evolving end-use demands can easily lead customers to switch between commodities. For instance, if corn prices surge, feed producers might increase their use of sorghum or barley.

Ceres Global's strategy of maintaining a diversified portfolio across multiple grains and oilseeds, such as oats, barley, rye, wheat, and canola, effectively mitigates this risk. This diversification means that a significant price increase or supply disruption for one commodity is less likely to cripple the company, as demand can be met by other products within their offerings.

In 2024, global grain markets experienced notable volatility. For example, wheat prices saw considerable swings due to geopolitical events impacting key exporting regions, while canola prices remained sensitive to weather patterns in major producing countries like Canada and Australia. Ceres' ability to offer alternatives across its product lines provides a competitive advantage in such dynamic market conditions.

- Diversified Portfolio: Ceres Global's range of oats, barley, rye, wheat, and canola reduces reliance on any single commodity.

- Price Sensitivity: Customers can switch to alternative grains or oilseeds if one becomes economically unviable.

- Market Volatility (2024): Fluctuations in wheat and canola prices highlight the ongoing threat of substitution.

- Risk Mitigation: Diversification allows Ceres to absorb impacts from individual commodity price shocks or supply issues.

The threat of substitutes for Ceres Global stems from direct sales by large agricultural producers to food processors, bypassing intermediaries. Advancements in logistics and technology, such as blockchain adoption in 2024, facilitate these direct connections, reducing dependence on traditional merchant services.

Innovations in alternative proteins, like plant-based and lab-grown options, also pose a significant substitute threat. The global plant-based food market, valued at approximately $29.4 billion in 2023, highlights this growing trend, potentially impacting demand for traditional grains and oilseeds.

Furthermore, vertical integration by large food processors and livestock operations, bringing grain storage and handling in-house, directly threatens Ceres' customer base. Innovations in precision agriculture, with a market projected to exceed $10 billion by 2024, also promote localized processing and shorter supply chains, potentially lessening reliance on extensive logistics networks.

| Threat of Substitutes | Description | Impact on Ceres | Mitigation Strategy | Relevant Data/Trend |

| Direct Sales by Producers | Large farms selling directly to buyers. | Reduced customer base for Ceres. | Focus on value-added services. | Increased use of blockchain in 2024 for supply chain transparency. |

| Alternative Proteins | Plant-based and lab-grown protein sources. | Decreased demand for traditional grains. | Diversified commodity portfolio. | Global plant-based market valued at $29.4B in 2023. |

| Vertical Integration | Processors handling their own storage/handling. | Loss of intermediary business. | Adapt infrastructure to diverse needs. | Major meat producers investing in own grain silos. |

| Precision Agriculture & Local Food | Optimized on-farm processing and shorter supply chains. | Reduced need for large-scale logistics. | Adaptability to regional practices. | Precision agriculture market projected over $10B by 2024. |

Entrants Threaten

High capital requirements act as a significant deterrent for new players looking to enter the agricultural merchant and supply chain sector. Establishing the necessary infrastructure, such as grain storage facilities, handling equipment, and transportation assets, demands a considerable upfront investment. For instance, building a modern grain elevator can cost tens of millions of dollars, a sum that many potential entrants cannot readily mobilize.

The cost of acquiring or building a robust network of commodity logistics centers and ensuring efficient supply chain operations creates a substantial financial hurdle. This barrier is amplified by the need for advanced technology to manage inventory, track shipments, and ensure quality control. Ceres Global, for example, operates an extensive network of these facilities across North America, representing a significant capital commitment that new competitors would struggle to match.

Existing players in the agricultural commodities sector, such as Ceres Global Ag Corp., leverage substantial economies of scale. This advantage is particularly evident in their ability to secure lower per-unit costs through bulk procurement of grains and oilseeds, efficient storage solutions, and optimized transportation networks. For instance, in 2024, Ceres Global's integrated supply chain, spanning from origination to processing and distribution, allowed for significant cost savings compared to smaller, less integrated operations.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the established volume and infrastructure, newcomers would find it difficult to achieve comparable per-unit cost advantages, placing them at a distinct competitive disadvantage from the outset. This barrier is amplified by the experience curve; incumbents have honed their operational expertise over years, particularly in navigating the complexities of global agricultural supply chains, which is not easily replicated by new market participants.

The agricultural commodity sector thrives on deeply entrenched relationships. Ceres Global, for instance, has cultivated decades-long partnerships with farmers, logistics firms, and industrial buyers, a network built on trust and consistent performance. For a new entrant, replicating this intricate web of connections and gaining the necessary credibility to secure consistent supply and demand would be a formidable hurdle.

Regulatory Hurdles and Compliance

The agricultural sector, where Ceres Global operates, is heavily regulated. New entrants face significant challenges due to stringent rules governing everything from product quality and safety to transportation and environmental impact. For instance, in 2024, the European Union continued to enforce its Farm to Fork Strategy, introducing stricter pesticide regulations and sustainability requirements that necessitate substantial investment and expertise to comply with.

Navigating this intricate web of regulations and securing the required licenses and permits represents a substantial barrier to entry. This process is not only time-consuming but also financially demanding, often requiring specialized legal and technical knowledge. Ceres Global's established experience in meeting these complex compliance standards gives it a distinct advantage over potential newcomers who lack this proven track record.

- Regulatory Complexity: Agricultural businesses must adhere to a multitude of national and international regulations.

- Compliance Costs: Meeting quality, safety, transportation, and environmental standards incurs significant operational expenses for new entrants.

- Licensing and Permits: Obtaining necessary approvals can be a lengthy and resource-intensive process.

- Ceres' Advantage: Existing operational experience and established compliance frameworks provide a competitive edge.

Access to Supply Chain Infrastructure and Expertise

Ceres Global Ag Corp. benefits from significant barriers to entry related to its established supply chain infrastructure. The company operates a network of grain elevators and boasts crucial rail access, facilitating efficient commodity movement. In 2023, Ceres handled approximately 12.7 million tonnes of grain and oilseeds, highlighting the scale of its operations.

Replicating Ceres' integrated infrastructure and deep expertise in merchandising and logistics presents a substantial challenge for new entrants. This specialized knowledge is vital for navigating the complexities of sourcing, storing, transporting, and marketing agricultural products effectively. The capital investment required to build a comparable network of assets and acquire such expertise would be considerable.

- Established Infrastructure: Ceres Global Ag Corp. owns and operates a network of grain elevators and rail infrastructure, providing a significant advantage.

- Logistical Expertise: The company possesses deep knowledge in merchandising and logistics, crucial for efficient agricultural commodity handling.

- Capital Investment: New entrants face high capital requirements to replicate Ceres' physical assets and operational know-how.

- Market Access: Ceres' existing relationships and established pathways to market further deter new competition.

The threat of new entrants in the agricultural merchant and supply chain sector, where Ceres Global operates, is significantly mitigated by substantial barriers. High capital requirements for infrastructure like grain elevators, which can cost tens of millions of dollars, and the need for advanced technology create formidable financial hurdles. For example, building a modern grain elevator in 2024 represents a significant investment that many potential competitors cannot easily overcome.

Deeply entrenched relationships with farmers, logistics providers, and industrial buyers, cultivated over decades, are another major deterrent. Ceres Global's established network, built on trust and consistent performance, is difficult for newcomers to replicate. Furthermore, the sector's complex regulatory landscape, encompassing product quality, safety, and environmental standards, demands significant investment and expertise to navigate, as evidenced by ongoing regulations like the EU's Farm to Fork Strategy in 2024.

| Barrier | Description | Impact on New Entrants | Ceres Global's Advantage |

|---|---|---|---|

| Capital Requirements | High costs for infrastructure (e.g., grain elevators) and technology. | Significant financial hurdle. | Established asset base reduces per-unit costs. |

| Economies of Scale | Lower per-unit costs through bulk purchasing and efficient operations. | Difficulty matching cost efficiencies. | Achieves cost savings via integrated supply chain. |

| Established Relationships | Long-term partnerships with suppliers and buyers. | Formidable challenge to gain credibility and secure supply/demand. | Decades of cultivated trust and consistent performance. |

| Regulatory Complexity | Navigating stringent quality, safety, and environmental rules. | Time-consuming and costly compliance process. | Proven track record in meeting complex compliance standards. |

Porter's Five Forces Analysis Data Sources

Our Ceres Global Porter's Five Forces analysis is built on a foundation of diverse data, incorporating annual reports, industry-specific market research, and regulatory filings. This blend ensures a comprehensive understanding of competitive dynamics.