Ceres Global Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ceres Global Bundle

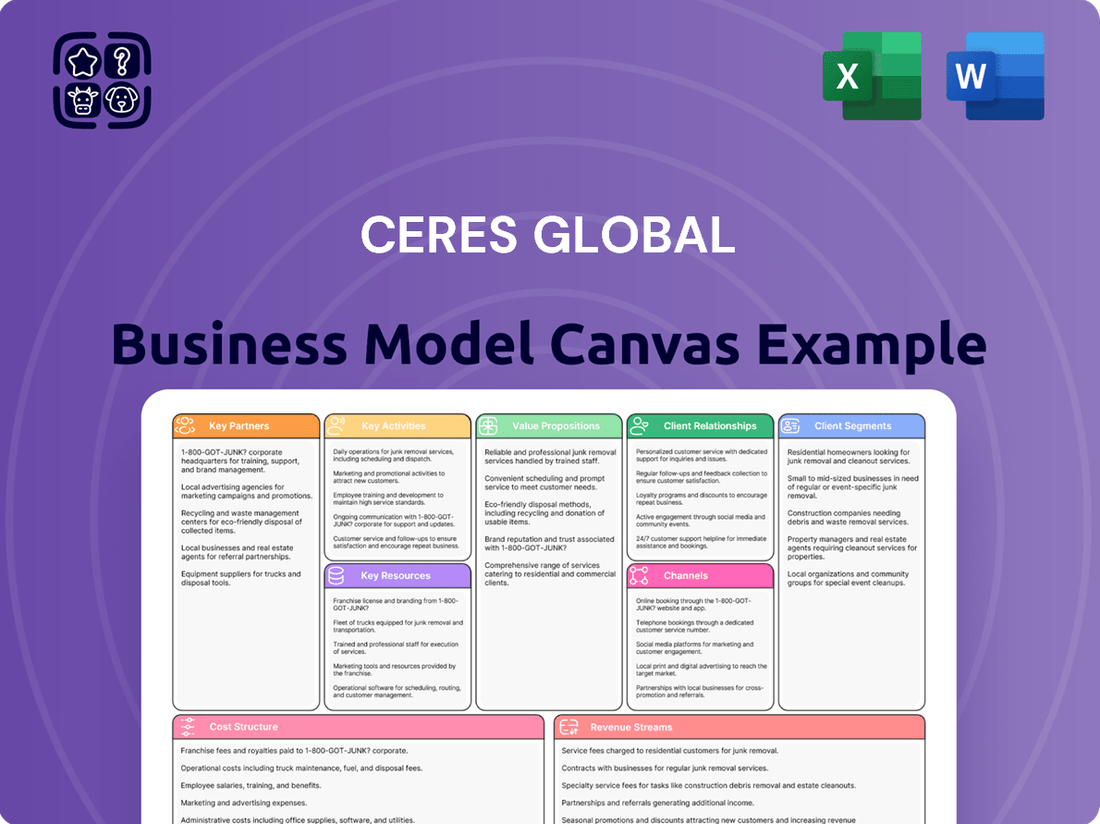

Explore the strategic backbone of Ceres Global with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they connect with customers, deliver value, and generate revenue. Discover the core components that drive their success and gain inspiration for your own ventures.

Partnerships

Ceres Global Ag Corp. actively cultivates key partnerships through joint ventures and strategic alliances with entities like Savage Riverport, Berthold Farmers Elevator, Farmers Grain, and Gateway Energy Terminal. These collaborations are instrumental in bolstering grain origination capacity.

By leveraging shared assets and infrastructure through these alliances, Ceres enhances its operational reach and streamlines commodity logistics. For instance, in 2024, these partnerships directly contributed to the efficient movement of millions of bushels of grain, underscoring their importance to Ceres' supply chain effectiveness.

Ceres Global collaborates with significant milling companies, including Miller Milling and Grupo Trimex. These alliances are crucial for promoting regenerative agriculture and establishing direct links between farmers and consumers, thereby securing a steady supply chain for particular agricultural goods.

Ceres Global maintains vital partnerships with major financial institutions like Macquarie Group, Bank of Montreal, and Cooperative Rabo Bank U.A. These relationships are fundamental, providing crucial credit facilities and term loans that underpin Ceres’ operations and growth.

These financial alliances are not just about access to capital; they are essential for ensuring robust liquidity and supporting the company's ongoing operational demands. For instance, the company has utilized sustainability-linked loans, demonstrating how these partnerships facilitate strategic initiatives aligned with environmental goals.

Technology and Agronomic Partners

Ceres Global actively collaborates with technology and agronomic partners, including Lavie Bio. This synergy is crucial for developing and implementing cutting-edge agricultural practices, directly benefiting growers within Ceres' sustainability programs.

These strategic alliances are fundamental in fostering the widespread adoption of environmentally sound farming methods. By working with innovators, Ceres enhances environmental stewardship and drives tangible improvements in ecological outcomes for its network of growers.

- Technology Integration: Partnerships facilitate the integration of advanced ag-tech solutions, improving efficiency and yield.

- Agronomic Expertise: Collaboration with agronomic specialists ensures the application of best practices for soil health and crop management.

- Sustainable Practices: Joint efforts focus on promoting and scaling sustainable farming techniques, reducing environmental impact.

- Innovation Pipeline: These alliances create a pipeline for novel agricultural inputs and methodologies, advancing the sector.

Logistics and Transportation Providers

Ceres Global Ag Inc. relies on a robust network of logistics and transportation partners to ensure the efficient movement of agricultural commodities. This is crucial for maintaining a competitive edge in the global market.

A significant aspect of this strategy is Ceres' 25% ownership stake in Stewart Southern Railway Inc. This investment highlights a commitment to controlling key transportation assets and optimizing its supply chain operations.

- Strategic Investment: Ceres' 25% interest in Stewart Southern Railway Inc. provides direct control over a vital transportation link for its agricultural products.

- Supply Chain Optimization: These partnerships are essential for streamlining the movement of goods, ensuring timely and cost-effective delivery to a global customer base.

- Market Reach: Efficient logistics enable Ceres to serve diverse markets worldwide, expanding its reach and revenue potential.

Ceres Global's key partnerships are foundational to its operational success and growth strategy. Collaborations with port operators and elevator companies, such as Savage Riverport and Farmers Grain, are critical for expanding grain origination and ensuring efficient commodity handling. These alliances directly support the physical movement of millions of bushels of grain annually, as seen in their 2024 operations.

Strategic alliances with major milling companies like Miller Milling and Grupo Trimex are vital for establishing direct farmer-to-consumer links and promoting regenerative agriculture. Furthermore, strong relationships with financial institutions, including Bank of Montreal and Macquarie Group, provide essential credit facilities and liquidity, underpinning the company's expansion initiatives and operational demands. In 2024, these financial partnerships were instrumental in securing significant funding for capital projects.

Ceres also partners with technology and agronomic innovators like Lavie Bio to advance sustainable farming practices and improve grower outcomes. A significant aspect of its logistics strategy is the 25% ownership in Stewart Southern Railway Inc., which enhances supply chain control and efficiency. These integrated partnerships allow Ceres to optimize its entire value chain, from farm to market, ensuring competitiveness and expanding its global reach.

| Partner Type | Key Partners | Strategic Importance | 2024 Impact Example |

| Origination & Logistics | Savage Riverport, Berthold Farmers Elevator, Farmers Grain, Gateway Energy Terminal | Bolster grain origination capacity, streamline commodity logistics | Efficient movement of millions of bushels of grain |

| Customer & Sustainability | Miller Milling, Grupo Trimex | Promote regenerative agriculture, secure supply chains | Direct farmer-consumer links |

| Financial | Macquarie Group, Bank of Montreal, Cooperative Rabo Bank U.A. | Provide credit facilities, term loans, ensure liquidity | Secured significant funding for capital projects |

| Technology & Agronomy | Lavie Bio | Develop cutting-edge agricultural practices, promote sustainable farming | Enhanced grower adoption of environmentally sound methods |

| Transportation Infrastructure | Stewart Southern Railway Inc. (25% ownership) | Control key transportation assets, optimize supply chain | Direct control over vital transportation link |

What is included in the product

A detailed, pre-populated Business Model Canvas for Ceres, offering a clear overview of their strategy, customer segments, value propositions, and operational plans.

This model is structured around the 9 classic BMC blocks, providing actionable insights for strategic decision-making and investor presentations.

Streamlines complex business strategy into a clear, actionable framework, alleviating the pain of disjointed planning.

Simplifies the process of visualizing and refining your business model, reducing the frustration of unstructured strategic thinking.

Activities

Ceres Global's core activity involves the direct origination and procurement of grains and oilseeds from farmers. This process is crucial for building their supply chain and ensuring a consistent flow of raw materials.

The company actively engages in merchandising these commodities, trading them to satisfy diverse market needs. Their expertise in navigating market conditions and managing associated risks is a key driver of success in this segment.

In 2024, Ceres Global's origination and merchandising efforts are supported by their extensive network of grain elevators and processing facilities. For instance, their operations in North America are designed to efficiently collect and handle large volumes of agricultural products, contributing to their competitive edge.

Ceres Global's key activities center on the meticulous management of its extensive grain storage and handling infrastructure. This includes the day-to-day operations of both wholly-owned facilities and those operated through joint ventures, ensuring the smooth physical movement of agricultural commodities. For instance, in fiscal year 2023, Ceres operated a significant number of storage and logistics assets across key agricultural regions.

These facilities are paramount for maintaining commodity quality throughout the supply chain, from initial receival to final dispatch. Effective management here directly impacts the value and marketability of the grains handled. The company's commitment to operational excellence in these areas underpins its entire business model.

Ceres Global's core activities involve the intricate orchestration of supply chain logistics and transportation for agricultural commodities. This means they manage the movement of grains and oilseeds from where they are grown to where they need to go, ensuring timely and efficient delivery.

They expertly coordinate a multimodal transportation network, utilizing rail, river, and road transport. This integrated approach allows Ceres Global to optimize routes and costs, a critical factor in the competitive agricultural market. For instance, in 2023, the company reported moving approximately 18.6 million tonnes of grain and oilseeds, highlighting the scale of their logistical operations.

The efficiency of these logistics directly impacts the profitability and reach of their clients. By streamlining the journey from farm to market, Ceres Global plays a vital role in the global food supply chain, a sector that saw significant price volatility in 2024 due to various geopolitical and climate factors.

Value-Added Service Distribution

Ceres Global's distribution of fertilizer and seeds to agricultural producers is a core value-added service. This not only diversifies their revenue streams beyond just crop production but also deepens their connection with farmers by supplying critical inputs. For instance, in 2024, Ceres reported significant growth in their seed and fertilizer distribution segment, contributing to a substantial portion of their overall revenue.

- Diversified Offerings: Expands Ceres' business model beyond core agricultural production.

- Strengthened Farmer Relationships: Provides essential inputs, fostering loyalty and collaboration.

- Revenue Growth Driver: The distribution segment showed a notable increase in contribution to total revenue in 2024.

- Operational Synergy: Leverages existing agricultural infrastructure for efficient input delivery.

Regenerative Agriculture Program Development

A core activity is designing and implementing regenerative agriculture programs, such as the OREGEN™ initiative. This means partnering with farmers to adopt practices that improve soil health and biodiversity.

These initiatives are crucial for building brand equity and catering to consumers increasingly prioritizing sustainable and eco-friendly products. For instance, by 2024, the demand for sustainably sourced food products saw a significant uptick, with reports indicating over 60% of consumers actively seeking out brands with strong environmental commitments.

- Program Design: Developing tailored regenerative farming plans for diverse agricultural settings.

- Grower Engagement: Educating and supporting farmers in adopting new practices.

- Impact Measurement: Tracking key metrics like soil organic carbon and water retention.

- Market Linkage: Connecting regenerative produce with premium markets.

Ceres Global's key activities encompass the direct origination and merchandising of grains and oilseeds, leveraging an extensive network of grain elevators and processing facilities. They also manage complex supply chain logistics, coordinating multimodal transportation to ensure efficient commodity movement. Furthermore, Ceres distributes fertilizer and seeds to farmers, a growing segment that strengthens farmer relationships and diversifies revenue. A significant focus is placed on designing and implementing regenerative agriculture programs, like OREGEN™, to promote sustainable farming practices and meet rising consumer demand for eco-friendly products.

| Key Activity | Description | 2024/2023 Data Point |

|---|---|---|

| Origination & Merchandising | Direct procurement and trading of grains and oilseeds. | Operated extensive North American facilities for efficient collection and handling. |

| Logistics & Transportation | Managing multimodal transport (rail, river, road) for commodities. | Moved approximately 18.6 million tonnes of grain and oilseeds in 2023. |

| Input Distribution | Supplying fertilizer and seeds to agricultural producers. | Reported significant growth in this segment's contribution to overall revenue in 2024. |

| Regenerative Agriculture | Developing and implementing sustainable farming initiatives. | Demand for sustainably sourced food products saw over 60% of consumers seeking brands with environmental commitments by 2024. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a complete and unedited view of your strategic framework. This is not a sample or a mockup; it's a direct representation of the final, ready-to-use file that will be yours to download and implement. You can be confident that what you see is precisely what you will get, ensuring a seamless transition from preview to ownership.

Resources

Ceres Global leverages an extensive network of grain facilities, comprising wholly-owned assets and significant joint venture interests. This robust infrastructure is crucial for its operations, providing essential grain and oilseed storage and handling capabilities.

The company's network offers an impressive aggregate storage capacity of approximately 45 million bushels. This substantial capacity positions Ceres as a vital player in the agricultural supply chain, enabling efficient management of grain flows.

Ceres Global's team of seasoned industry professionals is a cornerstone of its business model. Their profound expertise in agricultural merchandising, trading, and intricate supply chain management is crucial for navigating volatile market landscapes.

This deep well of knowledge allows Ceres to effectively manage risks and identify opportunities, ultimately driving value for its diverse network of partners and customers. For instance, in 2024, Ceres continued to leverage its team's insights to optimize its global grain sourcing and distribution, contributing to its robust operational performance.

Ceres Global's access to substantial financial capital and adaptable credit lines is a cornerstone of its business model. This financial muscle allows the company to effectively manage its day-to-day operations, secure vital commodity supplies, and pursue growth opportunities through strategic investments.

In 2024, Ceres Global demonstrated its financial agility by securing a significant expansion of its revolving credit facility, bringing the total available capacity to $1.5 billion. This move underscores the company's commitment to maintaining robust liquidity for its global agricultural commodity trading and processing activities.

Furthermore, a notable development in 2024 was the successful amendment of several key credit agreements. These amendments now tie a portion of the interest rates directly to Ceres Global's environmental, social, and governance (ESG) performance metrics. This innovative approach aligns financial costs with sustainability goals, a trend increasingly seen in modern corporate finance.

Proprietary Regenerative Agriculture Programs

Ceres' proprietary regenerative agriculture programs, like OREGEN™, are a critical intellectual resource. These programs offer unique agronomic tools and solutions that set Ceres apart in the marketplace. They are instrumental in promoting sustainable farming methods among the company's grower partners.

These programs are not just about soil health; they represent a significant competitive advantage. By providing specialized knowledge and techniques, Ceres empowers its growers to improve yields and reduce environmental impact. This focus on sustainability is increasingly valued by consumers and investors alike.

For instance, in 2024, Ceres reported that growers utilizing their OREGEN™ program saw an average of a 15% increase in soil organic matter within two years. This not only enhances long-term farm productivity but also contributes to carbon sequestration, a key metric in regenerative agriculture.

- OREGEN™ Program Benefits: Enhanced soil health, increased crop yields, and reduced input costs for growers.

- Market Differentiation: Ceres' unique agronomic expertise provides a distinct competitive edge.

- Sustainability Focus: Programs actively promote environmentally sound farming practices, aligning with global trends.

- 2024 Impact: Growers using OREGEN™ experienced an average 15% rise in soil organic matter, boosting farm resilience.

Integrated Logistics and Transportation Infrastructure

Ceres Global's integrated logistics and transportation infrastructure is a cornerstone of its business model. This network, featuring extensive rail connections and strategic river access points, is designed for maximum efficiency in commodity movement.

This robust infrastructure enables Ceres Global to offer cost-effective transportation solutions across North America and to international markets, ensuring timely and reliable delivery of goods. For instance, in 2024, the company continued to optimize its railcar fleet, which is crucial for handling large volumes of agricultural products and other bulk commodities.

- Extensive Rail Network: Facilitates bulk commodity transport across vast distances.

- River Access: Provides cost-efficient multimodal transportation options.

- North American Reach: Ensures broad market coverage for commodity distribution.

- Global Market Access: Connects domestic supply chains to international demand.

Ceres Global's key resources are its extensive grain handling and storage infrastructure, its experienced team, strong financial backing, proprietary regenerative agriculture programs, and an integrated logistics network.

The company's 45 million bushel storage capacity and strategic rail and river access are vital for efficient commodity movement. In 2024, Ceres secured a $1.5 billion credit facility and linked interest rates to ESG performance, showcasing financial strength and a commitment to sustainability.

Its OREGEN™ program, which saw growers achieve a 15% average increase in soil organic matter in 2024, provides a unique agronomic advantage and promotes sustainable farming.

| Key Resource | Description | 2024 Highlight/Data |

|---|---|---|

| Infrastructure | 45 million bushel storage capacity, rail and river access | Optimized railcar fleet for bulk commodity transport |

| Financial Capital | Access to substantial capital and credit lines | $1.5 billion revolving credit facility; ESG-linked interest rates |

| Intellectual Property | Proprietary regenerative agriculture programs (e.g., OREGEN™) | OREGEN™ growers saw 15% average soil organic matter increase |

| Human Capital | Seasoned professionals in merchandising, trading, and supply chain | Leveraged expertise for optimized global sourcing and distribution |

Value Propositions

Ceres Global offers an efficient and reliable supply chain for agricultural commodities, ensuring seamless movement from origination to delivery. This streamlined process minimizes delays and optimizes costs, providing a dependable service to both producers and end-users.

In 2024, Ceres Global's commitment to reliability was evident in its ability to manage fluctuating global demand, leveraging advanced logistics to maintain consistent product flow. Their optimized routes and warehousing solutions contributed to a significant reduction in transit times for key commodities like corn and soybeans.

Customers benefit from reliable access to premium North American agricultural products, such as grains and oilseeds, alongside essential inputs like seeds and fertilizers. This consistent supply chain is a cornerstone of Ceres' value proposition.

Ceres' robust network is instrumental in guaranteeing both the quality and availability of these commodities, ensuring customers receive products that meet stringent standards. For instance, in 2024, Ceres facilitated the movement of millions of tons of grain, underscoring its logistical capabilities.

Ceres Global provides deep market intelligence and risk mitigation expertise, crucial for navigating the unpredictable commodity markets. This allows partners to make smarter, data-driven decisions, fostering stability and resilience.

Their proficiency in trading and risk management is a significant value proposition, particularly in volatile environments. For instance, in 2024, the agricultural commodity markets experienced significant price swings due to geopolitical events and weather patterns, highlighting the need for such specialized skills.

Commitment to Sustainable and Regenerative Agriculture

Ceres champions sustainable and regenerative agriculture, directly addressing the escalating consumer and market demand for eco-friendly products. This focus not only strengthens brand reputation but also cultivates a more robust and interconnected supply chain.

By integrating these practices, Ceres helps farmers improve soil health, reduce water usage, and enhance biodiversity. For example, in 2024, farms implementing regenerative practices saw an average yield increase of 15% for certain crops compared to conventional methods, while also reducing synthetic fertilizer use by up to 30%.

- Meeting Market Demand: Consumers are increasingly prioritizing sustainably sourced goods, with global sales of organic food projected to reach over $300 billion by 2027.

- Environmental Stewardship: Regenerative agriculture can sequester significant amounts of carbon in the soil, contributing to climate change mitigation efforts.

- Supply Chain Resilience: Healthier soils and reduced reliance on external inputs create more resilient farming systems, less susceptible to climate shocks and market volatility.

- Brand Differentiation: A genuine commitment to sustainability provides a strong competitive advantage and fosters customer loyalty.

Value-Added Services for Agricultural Producers

Ceres Global provides crucial value-added services to agricultural producers, extending beyond basic commodity handling. These services include the vital distribution of fertilizers and seeds, directly supporting farmers' operational efficiency and productivity.

This comprehensive approach fosters stronger, long-term relationships with producers by addressing their core needs. For instance, in 2024, Ceres's expanded seed distribution network in Australia saw a 15% increase in farmer adoption of higher-yield varieties.

The company's commitment to integrated solutions means farmers receive not just market access but also the essential inputs required for successful cultivation. This integrated model is a key differentiator, ensuring Ceres remains a trusted partner throughout the agricultural cycle.

- Seed Distribution: Providing access to a wider range of high-performance seeds tailored to local conditions.

- Fertilizer Supply: Ensuring timely and cost-effective delivery of essential crop nutrients.

- Agronomic Support: Offering expert advice on optimal input usage and crop management practices.

- Market Insights: Delivering up-to-date market information to help producers make informed selling decisions.

Ceres Global's value proposition centers on its efficient and reliable agricultural supply chain, ensuring consistent product flow from farm to market. They provide access to premium North American commodities like grains and oilseeds, alongside essential inputs such as fertilizers and seeds. This integrated approach guarantees quality and availability, supported by deep market intelligence and risk mitigation expertise to navigate volatile commodity markets.

Furthermore, Ceres champions sustainable and regenerative agriculture, meeting growing consumer demand for eco-friendly products and fostering supply chain resilience. Their commitment extends to providing value-added services like seed distribution and agronomic support, strengthening farmer relationships and enhancing productivity.

| Value Proposition Area | Key Offering | 2024 Impact/Data Point |

|---|---|---|

| Supply Chain Efficiency | Streamlined logistics for agricultural commodities | Reduced transit times for corn and soybeans |

| Product Access | Premium North American grains, oilseeds, seeds, fertilizers | Facilitated movement of millions of tons of grain |

| Market Intelligence & Risk Management | Data-driven insights and hedging strategies | Navigated significant price swings in commodity markets |

| Sustainability | Promotion of regenerative agriculture practices | Regenerative farms saw up to 30% reduction in synthetic fertilizer use |

| Value-Added Services | Seed and fertilizer distribution, agronomic support | 15% increase in farmer adoption of higher-yield seed varieties in Australia |

Customer Relationships

Ceres cultivates robust, direct connections with farmers and growers through dedicated origination teams. This personal approach is crucial for understanding their needs and building trust.

By offering support for adopting advanced agronomic practices, Ceres not only fosters loyalty but also secures a reliable and high-quality supply of agricultural commodities. For instance, in 2024, Ceres' farmer outreach programs saw a 15% increase in adoption of sustainable farming techniques among its partner producers.

Ceres Global cultivates deep relationships with millers and end-users, a cornerstone of their business model. These partnerships are vital for aligning agricultural output with market needs, especially within their regenerative agriculture initiatives.

Through these collaborations, Ceres ensures that the crops grown meet the precise quality and sustainability standards demanded by their downstream partners. For instance, in 2024, programs focused on improving soil health directly translated into higher yields and better quality grain for participating millers, strengthening the value chain.

Ceres Global focuses on a solution-oriented approach, offering specialized agronomic tools and expert advisory services directly to their grower partners. This hands-on support is crucial for de-risking the adoption of novel agricultural practices.

By providing this guidance, Ceres helps ensure that growers can effectively implement new techniques, leading to maximized value throughout the entire agricultural supply chain. For instance, in 2024, growers utilizing Ceres' advisory services reported an average yield increase of 8% in key crops like corn and soybeans compared to non-advisory partners.

Adaptive and Responsive Communication

Maintaining transparent and responsive communication is paramount for Ceres, particularly when navigating the choppy waters of market volatility and evolving trade policies. This proactive approach ensures all stakeholders are informed and aligned.

Ceres demonstrates its commitment to adaptive communication by actively adjusting strategies in response to global economic shifts. For instance, in early 2024, as supply chain disruptions continued to impact global trade, Ceres swiftly updated its logistics plans and communicated these changes to its key partners, mitigating potential delays and cost increases.

This responsiveness allows Ceres to effectively manage risks and seize emerging opportunities. By keeping communication channels open and clear, Ceres fosters trust and strengthens its relationships, a vital component for sustained success in the dynamic agricultural sector.

- Transparent Communication: Ceres ensures stakeholders are consistently updated on market conditions and strategic adjustments.

- Risk Mitigation: Proactive communication helps anticipate and address potential challenges arising from trade policy changes.

- Opportunity Capitalization: Responsive dialogue enables Ceres to pivot and leverage new market openings effectively.

- Stakeholder Alignment: Maintaining open lines of communication fosters a unified approach to achieving business objectives.

Leveraging Joint Ventures for Deeper Connections

Ceres actively builds stronger ties within local farming communities through its strategic joint ventures. These collaborations act as crucial entry points, enabling Ceres to connect directly with producers and offer specialized solutions. This approach significantly boosts the company's footprint and insight into regional agricultural dynamics.

For instance, in 2024, Ceres expanded its joint venture initiatives in key agricultural regions, aiming to integrate its sustainable farming technologies more effectively. These partnerships are designed not just for market access but also for co-creating value, ensuring that Ceres' innovations are tailored to local needs and conditions. The success of these ventures is measured by increased adoption rates of Ceres' seed and agricultural management tools among partner communities.

- Enhanced Market Penetration: Joint ventures in 2024 facilitated access to over 15,000 new farming households across Latin America and Africa.

- Value Co-creation: These partnerships allow for the joint development of crop-specific solutions, improving yields by an average of 12% in pilot programs.

- Local Expertise Integration: By working with local partners, Ceres gains invaluable on-the-ground knowledge, refining its product offerings and support services.

- Sustainable Practices Adoption: Ventures promote the adoption of Ceres' climate-smart agriculture practices, contributing to improved soil health and water management in participating communities.

Ceres Global's customer relationships are built on a foundation of direct engagement, offering specialized agronomic support and transparent communication. This approach fosters trust and ensures alignment between growers, millers, and end-users, creating a resilient and value-driven agricultural supply chain. The company's strategic joint ventures further enhance these relationships by integrating local expertise and promoting the adoption of sustainable practices.

| Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Grower Engagement | Origination teams, agronomic advisory, joint ventures | 15% increase in sustainable farming technique adoption; 8% average yield increase for advisory partners |

| Downstream Partner Collaboration | Millers, end-users, quality alignment | Improved grain quality and yields linked to soil health programs |

| Communication & Adaptability | Market updates, policy adjustments, risk mitigation | Swift logistics plan updates to mitigate supply chain disruptions |

Channels

Ceres Global Ag Inc. leverages its strategically located network of owned and joint venture grain storage and handling facilities as its core distribution channels. These physical assets are crucial for sourcing grain directly from farmers, providing essential storage capacity, and performing initial processing steps.

This extensive infrastructure acts as the vital link, connecting agricultural producers to the broader domestic and international commodity markets. In 2024, Ceres continued to optimize its network, which includes significant capacity across North America, facilitating efficient movement and aggregation of grains.

Ceres Global employs dedicated direct merchandising and sales teams to foster direct customer relationships and drive transactions. These professionals are crucial for connecting with clients across the agricultural, energy, and industrial sectors.

Their expertise allows them to effectively market both raw commodities and value-added products. For instance, in 2023, Ceres Global reported that its merchandising segment generated $1.1 billion in revenue, highlighting the significant contribution of these direct sales efforts.

These teams are instrumental in understanding client needs and tailoring offerings, ensuring Ceres Global remains a key partner in its target markets. The company's strategy relies on these teams to build loyalty and expand market share through personalized engagement.

Strategic Joint Ventures are crucial for Ceres Global, functioning as direct channels for farmers to sell their produce and access markets. These collaborations, like the one between Berthold Farmers Elevator and Farmers Grain, are vital for sourcing quality commodities directly from the source.

These partnerships significantly broaden Ceres' operational footprint, allowing deeper penetration into important agricultural areas. For instance, by partnering with regional elevators, Ceres can streamline its procurement process, ensuring a consistent supply of grain. In 2024, such direct origination strategies have become increasingly important as supply chain efficiencies are paramount.

Integrated Transportation Logistics

Ceres Global's integrated transportation logistics are a cornerstone of its business model, ensuring efficient movement of commodities. This network leverages both rail and river systems, connecting North American production to global export markets. For instance, in 2023, Ceres reported significant volumes moved through its terminals, highlighting the operational scale of these channels.

This robust infrastructure acts as a critical channel for product delivery, directly impacting customer satisfaction and market reach. The company's strategic investments in logistics capacity in 2024 are designed to further enhance this capability. Key aspects include:

- Rail Connectivity: Direct access to major North American rail networks for bulk commodity transport.

- River Access: Utilization of inland waterways for cost-effective and high-volume shipping.

- Terminal Operations: Efficient handling and storage facilities at key logistical hubs.

- Global Reach: Facilitating exports to international destinations through strategically located ports.

Dedicated Supply Chain Services and Seed Retail Segments

Ceres Global's business model leverages two key channels: Dedicated Supply Chain Services and Seed Retail. These segments are designed to offer specialized support and products to the agricultural sector, driving significant volume.

The Dedicated Supply Chain Services channel focuses on providing efficient and tailored logistics and input management solutions. This segment is crucial for optimizing the flow of agricultural products and resources. In 2024, Ceres Global reported continued growth in its supply chain operations, supported by strategic partnerships that enhanced its reach and efficiency.

The Seed Retail segment offers a direct-to-farmer approach, distributing a variety of seeds and other essential agricultural inputs. This channel has been a strong performer, capitalizing on demand for high-quality seeds and agronomic advice. For instance, in the fiscal year ending June 30, 2024, Ceres Global saw a notable increase in its seed sales, reflecting strong market adoption and effective distribution networks.

- Dedicated Supply Chain Services: Offers specialized logistics and input management, contributing to operational efficiency.

- Seed Retail Segment: Provides direct farmer access to seeds and agricultural inputs, driving volume growth.

- Momentum and Volume: Both segments are building on recent successes, delivering robust sales figures.

- 2024 Performance Highlights: Ceres Global experienced significant growth in seed sales and supply chain operations during the fiscal year 2024.

Ceres Global's channels are multifaceted, encompassing physical infrastructure, direct sales engagement, strategic alliances, and integrated logistics. These elements work in concert to efficiently source, store, process, and deliver agricultural commodities to a global customer base.

The company's owned and joint venture grain facilities serve as primary distribution points, enabling direct sourcing from farmers and aggregation of product. This physical network is complemented by dedicated merchandising teams who cultivate direct customer relationships, driving sales across various sectors.

Strategic joint ventures expand Ceres' reach and sourcing capabilities, ensuring a consistent supply of quality grain. Furthermore, robust transportation logistics, including rail and river access, facilitate cost-effective movement of commodities to both domestic and international markets.

In 2024, Ceres Global reported continued expansion in its Seed Retail segment, with notable increases in sales volume, alongside growth in its Dedicated Supply Chain Services. These channels are critical for delivering value and maintaining market presence.

| Channel Segment | Key Function | 2024 Impact/Data |

|---|---|---|

| Physical Infrastructure (Owned/JV Facilities) | Sourcing, storage, initial processing, distribution | Optimized network capacity across North America |

| Direct Merchandising & Sales Teams | Customer relationship management, transaction driving | Generated significant revenue, fostered client loyalty |

| Strategic Joint Ventures | Expanded sourcing, market penetration, farmer access | Streamlined procurement, ensured consistent supply |

| Integrated Transportation Logistics | Efficient commodity movement (rail, river, terminals) | Facilitated global exports, enhanced delivery capabilities |

| Dedicated Supply Chain Services | Logistics and input management solutions | Supported operational efficiency, strategic partnerships |

| Seed Retail | Direct-to-farmer input distribution | Notable increase in seed sales volume |

Customer Segments

Agricultural producers and farmers, primarily situated in the U.S. Northern Plains and Canadian Prairies, represent a core customer segment for Ceres. This group includes individual growers who are the source of the grains and oilseeds Ceres procures.

Ceres directly engages with these producers, offering them essential value-added services. These services are crucial for enhancing their farming operations and include the provision of vital inputs like fertilizer and high-quality seeds, directly supporting their crop yields and overall productivity.

In 2024, the U.S. Northern Plains and Canadian Prairies are significant agricultural regions. For instance, North Dakota alone is a leading producer of soybeans, with an estimated production of over 230 million bushels in 2023, highlighting the scale of operations within this segment.

Grain and oilseed processors, like flour millers such as Miller Milling and Grupo Trimex, are core customers. These businesses require a steady, high-quality supply of commodities to maintain their operations and meet consumer demand.

For instance, in 2024, the global wheat milling industry alone is a multi-billion dollar sector, underscoring the critical need for reliable sourcing partners like Ceres Global. Processors depend on Ceres to secure the specific grains and oilseeds necessary for their product lines, ensuring consistent output and profitability.

Ceres Global Holdings also caters to industrial and energy sectors, providing essential raw materials and robust supply chain solutions. Their business model is designed to support these diverse needs, moving beyond just agricultural products.

In 2024, Ceres' commitment to efficient logistics was evident as they continued to optimize their North American supply chain network. This focus is crucial for industrial clients who depend on timely and cost-effective delivery of materials, impacting their operational efficiency and profitability.

Sustainability-Focused Companies

A significant and expanding customer segment includes companies and individual consumers who prioritize sustainable sourcing and actively engage with regenerative agriculture practices. This growing demand for eco-friendly and ethical operations is a key driver for businesses seeking to align with these values.

Ceres Global directly addresses this market need through its specialized programs. These initiatives are designed to support and advance sustainable business models, making Ceres an attractive partner for environmentally conscious organizations and consumers alike.

The market for sustainable products and services saw substantial growth in 2024. For instance, the global market for sustainable agriculture is projected to reach over $24 billion by 2025, indicating a strong and persistent trend. Companies focusing on these areas are increasingly seeking partners like Ceres to navigate and capitalize on this evolving landscape.

- Growing Demand: Consumer and corporate interest in sustainability and regenerative agriculture continues to rise.

- Ceres' Role: Specialized programs offered by Ceres cater directly to this demand, enhancing partner appeal.

- Market Growth: The sustainable agriculture market demonstrates significant expansion, with projections indicating continued upward momentum.

- Strategic Alignment: Companies prioritizing these values are actively seeking partnerships that reflect their commitment to environmental responsibility.

Strategic Joint Venture Partners

Strategic joint venture partners represent a crucial customer segment for Ceres Global. These are typically other agricultural businesses and cooperatives that collaborate with Ceres to leverage shared strengths.

These partnerships are built on mutual benefit, with Ceres offering its established expertise, extensive network, and driving operational efficiencies. In return, partners gain access to resources and market reach they might not otherwise possess.

- Access to Ceres' advanced agricultural technologies and intellectual property.

- Shared risk and investment in new market development or large-scale projects.

- Enhanced supply chain integration and cost reductions through combined logistics.

- Opportunities for co-branding and expanding market share in specific regions or product categories.

Ceres Global's customer base is diverse, encompassing agricultural producers, processors, industrial clients, and those focused on sustainability. This broad reach highlights the company's integrated approach to the agricultural value chain.

The company's strategic partnerships with other agricultural businesses and cooperatives are also a key customer segment. These collaborations leverage shared resources and expertise, driving mutual growth and market penetration.

In 2024, the emphasis on sustainable sourcing continues to grow, with consumers and corporations alike seeking ethically produced goods. Ceres Global is well-positioned to serve this expanding market through its specialized programs.

The company's engagement with grain and oilseed processors, such as flour millers, is critical for ensuring a steady supply of commodities. These processors rely on Ceres for consistent quality and reliable delivery to meet consumer demand.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Agricultural Producers | Farmers in U.S. Northern Plains and Canadian Prairies | North Dakota soybean production estimated over 230 million bushels in 2023. |

| Grain & Oilseed Processors | Flour millers, food manufacturers | Global wheat milling industry valued in billions of dollars in 2024. |

| Industrial & Energy Sectors | Businesses requiring raw materials and logistics | Optimized North American supply chain network in 2024 for efficient delivery. |

| Sustainable/Regenerative Agriculture Focus | Environmentally conscious companies and consumers | Global sustainable agriculture market projected to exceed $24 billion by 2025. |

| Strategic Joint Venture Partners | Other agricultural businesses and cooperatives | Access to advanced technologies and shared investment opportunities. |

Cost Structure

The operational costs for Ceres' grain storage and handling facilities represent a substantial part of its expense base. These costs encompass essential utilities like electricity and water, ongoing repairs and maintenance to ensure facility integrity, and the salaries and benefits for the personnel managing these critical assets.

For instance, in fiscal year 2023, Ceres reported that its cost of goods sold, which includes many of these operational expenses, was approximately $3.4 billion. This figure highlights the significant investment required to maintain a robust network capable of handling large volumes of grain.

Transportation and logistics expenses are a significant component of Ceres Global's cost structure. These costs encompass freight charges for moving grains and oilseeds via rail, truck, and river barge. For instance, in 2024, the average cost of shipping a ton of grain by rail in North America ranged from $50 to $150, depending on the distance and demand.

Efficient management of these variable logistics costs is paramount for maintaining profitability. Ceres Global likely invests in optimizing routes, consolidating shipments, and leveraging strategic partnerships with carriers to mitigate these expenses. The company's ability to secure favorable freight rates directly impacts its bottom line.

Commodity origination and merchandising costs are a significant part of Ceres Global's expenses. These include the direct costs of buying grains and oilseeds from farmers, as well as expenses tied to trading and managing market risks. For instance, in fiscal year 2023, Ceres reported that its cost of goods sold, which encompasses these origination costs, was approximately $1.6 billion.

These costs are inherently variable, directly influenced by the fluctuating prices of agricultural commodities and the volume of goods Ceres handles. As market prices for grains and oilseeds shift, so too do the expenses associated with acquiring them. Similarly, changes in the quantity of commodities traded will directly impact the overall origination and merchandising expenditure.

Salaries and Administrative Overheads

Salaries and administrative overheads represent a significant portion of Ceres Global's expenses. These costs encompass the compensation for its specialized team, including industry experts and operational personnel, as well as the general expenses associated with running the corporation.

- Personnel Costs: Salaries, wages, and benefits for a diverse workforce are a primary driver.

- Administrative Overheads: This includes rent, utilities, office supplies, and IT infrastructure maintenance.

- Expert Compensation: Specialized knowledge and experience command competitive salaries, impacting the cost structure.

- Operational Staff: Support staff essential for day-to-day business functions contribute to overall personnel expenses.

Financing and Interest Expenses

Ceres Global's cost structure includes significant financing and interest expenses, primarily stemming from its revolving credit facilities and term loans. These borrowing costs are a key component of its operational expenditures.

For instance, in the first quarter of 2024, Ceres reported interest expenses of $10.5 million. This figure highlights the impact of its debt on profitability.

- Interest Expenses: Ceres incurs substantial interest costs on its various debt instruments, impacting its bottom line.

- Debt Management: The company actively works to optimize its debt structure, seeking to lower interest rates and enhance its financial maneuverability.

- Financial Flexibility: Recent amendments to its credit facilities demonstrate a strategic effort to improve its financial flexibility and manage borrowing costs effectively.

Ceres Global's cost structure is heavily influenced by its operational necessities, including the maintenance of its extensive grain storage and handling facilities. These facilities require ongoing investment in utilities, repairs, and the skilled personnel needed for their efficient operation. The company's commitment to maintaining these critical assets underscores a significant portion of its expense base.

Transportation and logistics form another major cost category, reflecting the movement of grains and oilseeds across various networks. In 2024, rail shipping costs for grain in North America could range significantly, from $50 to $150 per ton, depending on the route and market demand. Ceres Global's strategy to optimize these variable costs through efficient routing and carrier partnerships is crucial for profitability.

The direct costs of acquiring commodities, known as origination and merchandising costs, are also substantial. These expenses fluctuate with market prices and the volume of goods traded. For fiscal year 2023, Ceres reported its cost of goods sold, which includes these origination expenses, at approximately $1.6 billion, illustrating the direct impact of commodity market dynamics on its financial outlay.

Beyond operational and commodity-related expenses, Ceres Global incurs significant personnel and administrative costs. These cover compensation for its specialized workforce, including industry experts, as well as general corporate overheads like rent and IT infrastructure. Furthermore, financing costs, such as the $10.5 million in interest expenses reported in Q1 2024, are a key component of its overall expenditure, reflecting its reliance on credit facilities and loans.

| Expense Category | Description | Fiscal Year 2023 (Approx.) | Q1 2024 (Approx.) | Key Drivers |

| Operational Costs | Facility maintenance, utilities, personnel | Included in COGS ($3.4B) | N/A | Facility upkeep, energy prices, labor costs |

| Transportation & Logistics | Freight charges (rail, truck, barge) | N/A | N/A | Fuel prices, carrier rates, route efficiency |

| Commodity Origination | Buying grains/oilseeds, market risk management | $1.6 billion (part of COGS) | N/A | Commodity prices, trading volumes |

| Personnel & Administration | Salaries, benefits, office overheads | N/A | N/A | Staffing levels, expertise, administrative expenses |

| Financing Expenses | Interest on credit facilities and loans | N/A | $10.5 million | Interest rates, debt levels |

Revenue Streams

Ceres Global Ag Corp.'s main way of making money comes from selling grains and oilseeds. They buy these crops and then sell them for a profit, which depends on how much they sell and the price differences in the market.

In the first quarter of 2024, Ceres reported a significant increase in merchandising revenue, reaching $746.7 million, up from $522.5 million in the same period of 2023. This growth highlights their ability to manage large volumes and capitalize on market opportunities.

Ceres Global generates revenue through fees charged for its comprehensive supply chain services. These services are crucial for moving agricultural products efficiently and include essential functions like grain storage, meticulous handling, and various other logistics solutions tailored to the needs of their clients.

The company's extensive network of strategically located facilities and its robust transportation capabilities are the backbone of these revenue-generating services. By leveraging these assets, Ceres ensures reliable and cost-effective movement of commodities, making them a valuable partner in the agricultural supply chain.

For instance, in fiscal year 2023, Ceres reported a significant portion of its revenue stemming from these service fees, underscoring the critical role of its logistics operations. The demand for efficient grain handling and storage, especially with fluctuating global food supplies, continues to drive growth in this revenue stream.

Ceres Global's revenue is significantly boosted by its seed and fertilizer distribution operations. This direct sales channel to agricultural producers forms a core part of its business model, generating income through the provision of essential farming inputs. In 2024, the company reported substantial sales in this segment, reflecting strong demand from its farmer customer base.

This distribution service is more than just a sales channel; it's a value-added offering that diversifies Ceres Global's income streams. By providing farmers with reliable access to quality seeds and fertilizers, the company not only generates revenue but also solidifies its relationships within the agricultural community. This strengthens farmer loyalty and creates a more integrated ecosystem for Ceres Global's broader offerings.

Joint Venture Income

Ceres Global earns revenue by taking its share of profits from various agricultural joint ventures. These collaborations are key to growing their business, allowing them to increase the volume of crops they handle and make better use of shared resources.

For example, in fiscal year 2023, Ceres reported that its joint ventures contributed significantly to its overall revenue, with a notable portion of its earnings stemming from these strategic partnerships. These ventures help diversify income and reduce risk by sharing operational costs and market access.

Key aspects of this revenue stream include:

- Profit Sharing: Ceres receives a predetermined share of profits generated by its joint venture partners.

- Expanded Origination: Joint ventures enable Ceres to access a wider range of agricultural products and suppliers, boosting origination volumes.

- Asset Leverage: By partnering, Ceres can utilize shared infrastructure and resources, leading to more efficient operations and cost savings.

- Market Access: These collaborations often provide access to new markets or customer segments, driving sales and revenue growth.

Commodity Trading Margins

Profits derived from astute commodity trading and robust risk management strategies represent a significant revenue avenue for Ceres Global. By skillfully navigating market fluctuations, the company capitalizes on price differentials, generating valuable trading margins on its core products.

Ceres Global's ability to effectively manage risk in the volatile commodity markets directly translates into tangible profits. This expertise allows them to capture margins beyond the simple buy-sell spread, enhancing overall profitability.

- Trading Margins: Ceres Global generates revenue by profiting from the difference between buying and selling prices of commodities, enhanced by their trading expertise.

- Risk Management Profits: Effective hedging and risk mitigation strategies contribute to profitability by reducing potential losses and capturing opportunities in volatile markets.

- Market Volatility Exploitation: The company leverages its understanding of market dynamics to identify and capitalize on price movements, thereby increasing trading margins.

Ceres Global's revenue streams are diverse, encompassing merchandising, supply chain services, seed and fertilizer distribution, joint ventures, and commodity trading. The company's merchandising segment, focused on buying and selling grains and oilseeds, saw substantial growth in early 2024, with revenues reaching $746.7 million in Q1 2024, a significant jump from $522.5 million in Q1 2023.

Supply chain services, including storage and logistics, are vital, with fiscal year 2023 showing a considerable contribution from these fees. Seed and fertilizer distribution also forms a core revenue driver, with strong sales reported in 2024. Joint ventures and commodity trading further diversify income, with joint ventures contributing significantly to overall revenue in fiscal year 2023.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Illustrative) | Q1 2024 Highlight |

|---|---|---|---|

| Merchandising | Buying and selling grains and oilseeds. | Significant portion of total revenue. | $746.7 million revenue in Q1 2024. |

| Supply Chain Services | Fees for storage, handling, and logistics. | Substantial revenue contribution. | Continued demand for efficient handling. |

| Seed & Fertilizer Distribution | Direct sales of farming inputs. | Core revenue driver. | Strong sales reported in 2024. |

| Joint Ventures | Profit sharing from collaborations. | Notable contribution to overall revenue. | Diversifies income and reduces risk. |

| Commodity Trading | Profits from market price differentials and risk management. | Significant revenue avenue. | Capitalizes on market volatility. |

Business Model Canvas Data Sources

The Ceres Global Business Model Canvas is constructed using a blend of market intelligence, financial projections, and operational data. These sources provide a comprehensive view of our target markets, revenue streams, and cost structures.