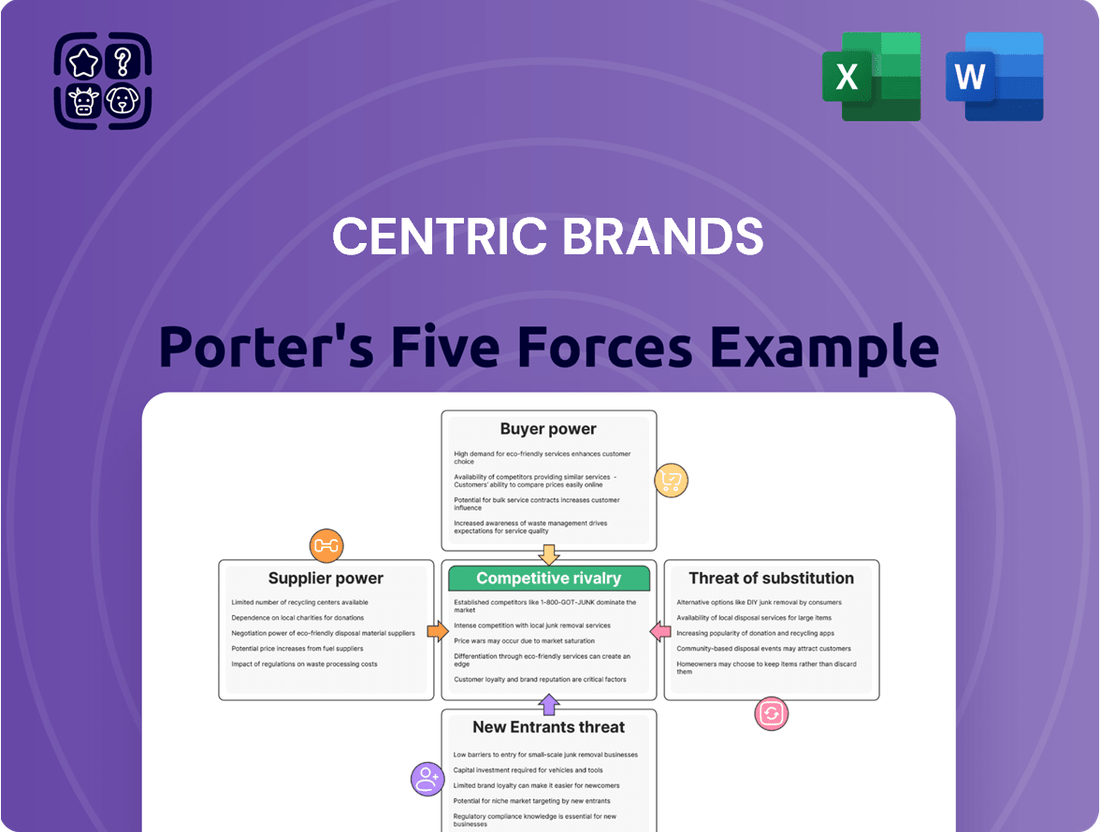

Centric Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centric Brands Bundle

Centric Brands faces a complex competitive landscape shaped by powerful buyer and supplier relationships, alongside the ever-present threat of new entrants and substitutes. Understanding these dynamics is crucial for any stakeholder. The full Porter's Five Forces Analysis dives deep into the intensity of each force, providing a clear roadmap of Centric Brands's strategic positioning.

Ready to move beyond the basics? Get a full strategic breakdown of Centric Brands’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The fashion industry's supply chain is a complex, global web. Raw materials might come from one continent, while manufacturing happens on another. This fragmentation means Centric Brands can often find alternative suppliers, reducing the leverage any single supplier holds. For instance, in 2024, many apparel companies continued to diversify sourcing away from single regions to manage these risks.

Suppliers of raw materials, especially for textiles and beauty products, are gaining more leverage. This is largely due to persistent shortages, inflation, and climbing energy prices. For companies like Centric Brands, this translates directly into higher costs for the goods they purchase, as suppliers are likely to pass on their increased production and shipping expenses. The global fashion supply chain is feeling significant strain from these issues in 2025.

The increasing consumer and regulatory push for sustainable and ethical sourcing directly strengthens the bargaining power of suppliers who can meet these criteria. Centric Brands, in its pursuit of trend-forward products, faces a growing need to procure materials that are eco-friendly and produced with transparency.

This specialized segment of suppliers, though expanding, remains a more constrained market. This limited availability can translate into greater leverage for these suppliers concerning pricing and contract terms, impacting Centric Brands' cost structure and supply chain flexibility.

Labor Constraints and Compliance

Labor constraints and increasing scrutiny on ethical sourcing empower suppliers. Those demonstrating robust compliance with labor laws and transparency in their operations, like many in the apparel sector supplying to companies such as Centric Brands, can negotiate more favorable terms. For instance, as of 2024, reports indicate a growing demand for suppliers with verified ethical labor certifications, which allows them to command higher prices or more advantageous payment schedules. This leverage is projected to intensify with anticipated new legislation in 2025 aimed at enhancing environmental and social responsibility across global supply chains.

- Increased Supplier Leverage: Suppliers meeting higher labor standards gain bargaining power.

- Ethical Sourcing Pressure: Companies like Centric Brands face pressure to ensure ethical supply chains.

- Compliance as a Differentiator: Suppliers with verified ethical practices can secure better terms.

- Future Regulatory Impact: Upcoming legislation will likely further strengthen supplier positions on social and environmental responsibility.

Nearshoring and Reshoring Trends

The growing trend of nearshoring and reshoring, aimed at shortening lead times and enhancing production control, could significantly alter supplier power. For instance, a 2024 survey indicated that 62% of U.S. companies were considering or actively pursuing nearshoring strategies to mitigate supply chain risks.

This shift might bolster the bargaining power of domestic or regional suppliers as demand for their services increases. However, it also necessitates substantial investment and adaptation from brands like Centric Brands to integrate these new sourcing models effectively.

- Nearshoring/Reshoring Drivers: Desire for reduced lead times, improved reliability, and greater production control.

- Supplier Power Impact: Potential increase in bargaining power for domestic/regional suppliers due to higher demand.

- Brand Adaptation: Brands need significant investment and adaptation to implement these supply chain changes.

- Centric Brands' Strategy: Exploration of these options to build more agile and resilient supply chains.

The bargaining power of suppliers for Centric Brands is a mixed bag, influenced by global trends and ethical demands. While fragmentation in sourcing offers some flexibility, specific supplier segments are seeing increased leverage. This is particularly true for those who can meet stringent ethical and sustainability standards, a demand that is only expected to grow with anticipated legislation in 2025.

| Factor | Impact on Supplier Bargaining Power | Centric Brands' Response/Consideration |

|---|---|---|

| Ethical & Sustainable Sourcing Demand | Increases power of compliant suppliers | Need to partner with suppliers meeting these criteria |

| Labor Constraints & Scrutiny | Empowers suppliers with verified compliance | Potential for higher costs from ethical suppliers |

| Nearshoring/Reshoring Trend | Boosts power of regional suppliers | Requires investment in new sourcing models |

| Raw Material Shortages & Inflation (2024-2025) | Drives up costs for all suppliers | Directly impacts Centric Brands' procurement expenses |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Centric Brands' diverse portfolio of apparel and accessories.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Centric Brands' market position, enabling proactive strategy adjustments.

Customers Bargaining Power

In 2025, consumers are showing a significant increase in price sensitivity, largely driven by ongoing economic uncertainties and persistent inflation. This trend is causing a noticeable shift towards fashion that offers clear value, making customers more inclined to hunt for deals and consider switching to more affordable brands.

This elevated price sensitivity directly enhances the bargaining power of customers. They are now more empowered to explore a wider range of options, readily comparing prices and opting for brands that provide the best bang for their buck, potentially leading to a decline in loyalty for brands perceived as too expensive.

For Centric Brands, which operates across various retail segments, this means a delicate balancing act. The company needs to strategically price its products to remain competitive while simultaneously ensuring its brands maintain their appeal and perceived quality to foster lasting customer loyalty in a challenging market.

The rise of ultra-fast fashion players and the increasing popularity of discount retailers significantly amplify customer bargaining power. These alternatives offer consumers numerous low-cost options, making price a critical factor in purchasing decisions.

Platforms like Shein and Temu have aggressively captured the value segment of the market, creating intense pressure on traditional brands. This competitive landscape forces companies to find ways to stand out beyond just price, focusing on brand loyalty, product quality, or unique customer experiences.

Customers are increasingly vocal about their desire for transparency and verifiable sustainable practices, directly impacting their brand choices. This growing environmental and ethical consciousness means consumers expect companies like Centric Brands to not only talk the talk but walk the walk when it comes to ethical sourcing and eco-friendly operations. For instance, a 2024 survey by Accenture found that 72% of consumers are more likely to buy from companies that are environmentally responsible.

Evolving Consumer Preferences and Personalization

Centric Brands faces increasing customer power driven by a significant market shift towards personalization. Consumers now expect tailored products and unique experiences, directly influencing their purchasing decisions. This trend means customers are less willing to accept one-size-fits-all offerings, demanding greater customization. For instance, in 2024, the global market for personalized goods was projected to reach substantial figures, indicating a strong consumer appetite for individuality.

To navigate this, Centric Brands must enhance its agility. Offering flexible manufacturing capabilities and integrating advanced technologies, such as AI-driven recommendation engines, are crucial. These tools can help the company understand and cater to individual customer needs more effectively. By adapting to these evolving preferences, Centric Brands can better meet customer demands, thereby strengthening the customer's bargaining position.

- Personalization Demand: Consumers are increasingly seeking customized products and experiences.

- Technology Adoption: AI and flexible manufacturing are key to meeting personalized demands.

- Customer Power: Tailored offerings enhance individual customer influence in the market.

- Market Trend: The shift to personalization is a significant factor in the current retail landscape.

High E-commerce Return Rates

High e-commerce return rates, frequently stemming from sizing and fit discrepancies, significantly bolster customer bargaining power. This places the onus on brands like Centric Brands to manage the logistical and financial implications of these returns.

Consumers now anticipate hassle-free return experiences, and substantial return volumes can strain a company's profitability and operational efficiency. For instance, in 2024, the apparel industry continued to grapple with return rates, with some reports indicating that as many as 30% of online clothing purchases are returned.

- E-commerce Return Challenge: Sizing and fit issues are primary drivers of returns in online apparel sales.

- Customer Expectation: Consumers expect convenient and free return processes.

- Impact on Brands: High return rates increase operational costs and can erode profit margins for companies like Centric Brands.

- Industry Data: Apparel return rates in e-commerce often exceed 20%, impacting profitability.

The bargaining power of customers for Centric Brands is substantial and growing, fueled by increased price sensitivity and the availability of numerous low-cost alternatives. Consumers are actively seeking value, readily comparing prices and switching brands if better deals are found. This trend is amplified by the rise of ultra-fast fashion and discount retailers, putting pressure on Centric Brands to maintain competitive pricing without compromising brand perception.

Furthermore, the demand for personalization and transparency in sustainable practices empowers customers even more. They expect tailored products and ethical operations, with a significant portion of consumers favoring environmentally responsible companies. For instance, a 2024 Accenture survey indicated that 72% of consumers are more likely to purchase from environmentally conscious brands.

High e-commerce return rates, often due to sizing issues, also contribute to customer power by increasing operational costs for brands. The apparel industry, in particular, faced significant return rates in 2024, with some estimates showing up to 30% of online clothing purchases being returned, highlighting the need for improved fit accuracy and return policies.

| Factor | Impact on Centric Brands | Customer Behavior | Supporting Data (2024/2025) |

|---|---|---|---|

| Price Sensitivity | Requires competitive pricing strategies | Seeking value, comparing prices, brand switching | Persistent inflation, economic uncertainties |

| Availability of Alternatives | Intensified competition from fast fashion/discount retailers | Exploring numerous low-cost options | Rise of platforms like Shein and Temu |

| Personalization Demand | Need for agile manufacturing and tech integration | Expecting tailored products and unique experiences | Growing market for personalized goods |

| E-commerce Returns | Increased logistical and financial burden | Expecting hassle-free returns due to fit issues | Apparel return rates up to 30% in online sales |

Preview Before You Purchase

Centric Brands Porter's Five Forces Analysis

This preview shows the exact Centric Brands Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the company. You'll gain a comprehensive understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the apparel and accessories industry. This professionally formatted document is ready for your immediate use, offering valuable insights without any placeholders or surprises.

Rivalry Among Competitors

Centric Brands navigates a highly competitive landscape within the apparel, accessories, and beauty sectors. Numerous companies actively compete for consumer attention and market share, making differentiation crucial. For instance, the U.S. apparel market alone was valued at approximately $350 billion in 2023, showcasing the sheer scale of the competitive environment.

Operating with a portfolio of both licensed and owned brands, Centric Brands encounters rivals ranging from large, established global corporations to nimble direct-to-consumer (DTC) startups. This diverse competitive set demands constant adaptation and strategic agility. The rise of DTC brands, which often leverage digital marketing effectively, presents a particular challenge to traditional retail models.

Sustaining a competitive edge in this dynamic market requires Centric Brands to prioritize ongoing innovation in product development and marketing strategies. Robust brand management is essential for building consumer loyalty, while an efficient and responsive supply chain is critical for meeting evolving consumer demands and managing costs effectively. The ability to quickly bring new designs to market and maintain product quality is paramount.

Centric Brands operates by managing a vast portfolio of over 100 licensed and owned brands, which inherently pits it against numerous other companies that also manage multiple brands or focus on single, powerful brands. This creates a highly competitive landscape where the ability to secure and effectively manage desirable brands is paramount.

The brand licensing sector is experiencing robust growth, with an estimated market size projected to reach $300 billion by 2025, according to recent industry reports. This expansion fuels intense competition among both licensors seeking to license their intellectual property and licensees vying for the rights to popular brands and prime retail placement.

Success in this arena for Centric Brands and its rivals is heavily dependent on forging strategic alliances, demonstrating strong capabilities in brand development and marketing, and possessing deep expertise in product design, sourcing, and distribution. The ability to consistently deliver high-quality products that resonate with consumers under various brand umbrellas is a key differentiator.

The rise of ultra-fast fashion giants like Shein and Temu has dramatically escalated competitive rivalry within the apparel sector. These platforms, known for their aggressive pricing and rapid product cycles, have captured significant market share, particularly from younger, price-conscious demographics. For instance, Shein's valuation reached an estimated $66 billion in 2023, highlighting its disruptive impact.

This intense price competition forces established brands, including Centric Brands, to re-evaluate their strategies. Consumers now expect lower price points and constant newness, putting pressure on margins and requiring efficient supply chains. Centric Brands needs to emphasize its brand equity, quality, and unique selling propositions to stand out.

Navigating this environment requires Centric Brands to differentiate beyond price. Focusing on product quality, sustainable practices, and strong brand storytelling can resonate with consumers seeking more than just low costs. Reinforcing the distinct value of its portfolio, which includes brands like Hudsons Bay and Hudson's Bay Company, is crucial for maintaining relevance and customer loyalty.

Fragmented Retail Landscape and Channel Competition

Centric Brands navigates a highly fragmented retail environment, competing across mass market, specialty, and department stores, as well as online platforms. This broad distribution strategy means intense rivalry exists in every channel where their products are sold.

The evolving consumer journey, marked by the significant rise of e-commerce and a growing demand for in-store experiences, necessitates a robust omnichannel approach. Brands must be agile in their distribution and marketing efforts to connect with consumers effectively across all these varied touchpoints.

- Fragmented Distribution: Centric Brands' products are available through a wide array of retailers, from large mass-market chains to niche specialty stores and online marketplaces, intensifying competition.

- Channel Conflict: Competition among these diverse channels can lead to price wars and brand dilution if not managed carefully, impacting overall profitability.

- Omnichannel Imperative: The increasing preference for seamless online and offline shopping experiences requires significant investment in technology and logistics to maintain brand presence and customer loyalty. For instance, in 2024, e-commerce sales continued to grow, with projections indicating it will represent a substantial portion of total retail sales, demanding strong digital capabilities from brands like Centric Brands.

Innovation and Digital Transformation Pressure

The competitive landscape for Centric Brands is intensified by the relentless pursuit of innovation, especially in digital transformation and sustainability. Competitors are actively integrating AI for tasks like demand forecasting and personalized customer experiences, a trend observed across the apparel sector. For instance, in 2024, many fashion retailers reported significant investments in AI and data analytics to optimize inventory and marketing efforts, with some seeing double-digit percentage improvements in sales conversion rates due to these technologies.

Centric Brands faces pressure to adopt similar data-driven solutions. This includes leveraging technology to refine product development cycles, streamline supply chain operations, and deepen consumer engagement. Failure to keep pace with these advancements could lead to a loss of market share as rivals offer more responsive and personalized offerings. The industry is seeing a shift towards agile, tech-enabled business models, making technological adoption a critical factor for sustained competitiveness.

- AI in Demand Forecasting: Competitors are using AI to predict consumer demand with greater accuracy, reducing overstock and stockouts.

- Digital Customer Experience: Investments in e-commerce platforms and personalized digital marketing are becoming standard.

- Sustainable Practices: Growing consumer demand for eco-friendly products necessitates innovation in materials and manufacturing processes.

- Data-Driven Product Development: Utilizing consumer data to inform design and product assortment is a key differentiator.

Centric Brands faces intense competition from a wide array of players, from global giants to agile DTC startups, in the crowded apparel, accessories, and beauty markets. The U.S. apparel market alone was valued at approximately $350 billion in 2023, underscoring the scale of this rivalry.

The rise of ultra-fast fashion brands like Shein, valued at an estimated $66 billion in 2023, has significantly escalated price competition and consumer expectations for constant newness, pressuring margins and supply chains.

Centric Brands must differentiate through brand equity, quality, and unique selling propositions, rather than solely on price, to maintain relevance and customer loyalty in this dynamic environment.

The industry's increasing adoption of AI for demand forecasting and personalized experiences, with many fashion retailers investing heavily in data analytics in 2024, presents both a challenge and an opportunity for Centric Brands to enhance its operations and customer engagement.

| Competitive Factor | Centric Brands' Position | Key Competitors | Market Data Point (2023-2024) |

|---|---|---|---|

| Brand Portfolio Management | Manages over 100 licensed and owned brands | PVH Corp., G-III Apparel Group, Capri Holdings | Brand licensing market projected to reach $300 billion by 2025 |

| Pricing and Value Proposition | Focus on quality and brand equity | Shein, Temu, Zara, H&M | Shein's valuation reached $66 billion in 2023 |

| Distribution Channels | Mass market, specialty, department stores, online | Amazon, Walmart, Target, Macy's | E-commerce sales continued to grow in 2024, representing a substantial portion of total retail sales |

| Technological Adoption | Needs to keep pace with AI and data analytics | Fashion retailers investing in AI for demand forecasting | Double-digit percentage improvements in sales conversion rates reported by some retailers using AI in 2024 |

SSubstitutes Threaten

The burgeoning popularity of second-hand and resale markets poses a significant threat of substitution for Centric Brands' new offerings. Consumers are increasingly drawn to thrift stores and online resale platforms like Depop and Poshmark, driven by both a desire for affordability and a commitment to sustainability. For instance, the global second-hand apparel market was projected to reach $77 billion by 2025, indicating a substantial shift in consumer spending away from traditional retail.

Shifting consumer lifestyles and priorities pose a significant threat of substitutes for Centric Brands. As consumers increasingly prioritize experiences over material possessions, spending on travel, wellness, or digital entertainment can divert funds away from traditional apparel and accessories. For example, a growing trend towards sustainable living might see consumers investing in durable, long-lasting items rather than fast fashion, impacting demand for Centric Brands' offerings.

Economic pressures also play a crucial role. In 2024, persistent inflation and concerns about a potential recession could lead consumers to cut back on discretionary spending. This means that even if fashion remains a priority, consumers might opt for more affordable alternatives or delay purchases altogether, seeking substitutes that offer better value or are perceived as more essential. Understanding these macro shifts is vital for Centric Brands to adapt its product strategy and marketing efforts.

The fashion industry is inherently susceptible to substitute threats driven by rapidly changing trends. Centric Brands must constantly adapt its product lines to align with evolving consumer tastes; failure to do so can lead consumers to readily switch to more fashionable alternatives. For instance, in 2024, the resurgence of Y2K fashion demonstrated how quickly past trends can become desirable again, potentially making previously popular styles obsolete.

DIY and Customization as Alternatives

The rise of do-it-yourself (DIY) fashion, upcycling, and personalized clothing presents a viable substitute for mass-produced apparel. Consumers increasingly seek unique styles and sustainable choices, leading them to create or modify their own garments and accessories, bypassing traditional retail channels. This growing trend underscores a consumer desire for individuality that Centric Brands could potentially tap into by offering customization services or engaging in collaborations that highlight unique craftsmanship.

In 2023, the global resale market for fashion was valued at approximately $180 billion, demonstrating a significant consumer shift towards pre-owned and customized items. This growth indicates a willingness to explore alternatives to new, mass-produced goods. For Centric Brands, this signifies an opportunity to innovate within its product lines.

- DIY and Upcycling Trends: Consumers are increasingly engaging in personalizing and altering clothing, seeking unique self-expression.

- Sustainability Appeal: Upcycling and DIY methods often align with growing consumer demand for more sustainable fashion choices.

- Market Growth: The secondhand apparel market, a related substitute, saw substantial growth, reaching an estimated $180 billion globally in 2023.

- Centric Brands Opportunity: The company can explore offering customization options or partnering with designers who focus on unique, handcrafted items.

Multi-functional and Hybrid Products

The rise of multi-functional and hybrid products presents a significant threat of substitution for Centric Brands, particularly within its beauty and accessories segments. Consumers are increasingly drawn to items that offer multiple benefits, thereby reducing the need to purchase several distinct products. For instance, a single product combining skincare, makeup, and sun protection can directly compete with and replace individual foundation, moisturizer, and sunscreen purchases.

This trend is evident across the broader consumer goods market. In 2024, the global multi-functional beauty products market was valued at approximately $25 billion, with projected growth indicating a strong consumer preference for convenience and efficiency. Centric Brands, to counter this threat, must focus on developing innovative, integrated solutions that resonate with this evolving consumer demand for streamlined routines and value.

- Market Trend: Growing consumer demand for multi-functional beauty and accessory products.

- Example Substitution: Tinted moisturizers with SPF replacing separate foundation and sunscreen.

- Industry Impact: Potential reduction in sales of single-purpose items.

- Centric Brands' Strategy: Need for innovation in integrated product offerings.

The increasing popularity of the resale market and the rise of DIY fashion present significant threats of substitution for Centric Brands. Consumers are increasingly opting for pre-owned items, upcycled creations, and personalized apparel, driven by affordability and a desire for unique self-expression.

The global resale fashion market was valued at an estimated $180 billion in 2023, highlighting a substantial shift in consumer preferences away from new, mass-produced goods. This trend is further amplified by a growing emphasis on sustainability, with consumers seeking eco-friendlier alternatives to traditional retail.

| Substitute Category | Description | 2023 Market Value (USD Billions) | Impact on Centric Brands |

|---|---|---|---|

| Resale Market | Second-hand clothing and accessories purchased through online platforms and physical stores. | 180 | Direct competition for new product sales; potential revenue diversion. |

| DIY & Upcycling | Consumers creating or modifying their own garments for unique styles and sustainability. | N/A (Qualitative Impact) | Reduces demand for standardized apparel; opportunity for customization services. |

Entrants Threaten

The fashion accessories, apparel, and beauty sectors, particularly within specific niche markets, often present low initial startup costs. This accessibility allows new ventures to launch with relatively modest capital, especially with the proliferation of e-commerce and direct-to-consumer (DTC) sales models, which reduce overhead significantly.

This ease of entry means that entrepreneurs and smaller, agile brands can quickly enter the market, posing a threat to established players like Centric Brands. For instance, the global beauty market, valued at approximately $511 billion in 2023, continues to see new indie brands emerge rapidly, often leveraging social media and online platforms to build customer bases with minimal initial investment.

Even with relatively low startup costs in some apparel sectors, established brands with deep customer loyalty, a hallmark of Centric Brands' strategy, create a formidable barrier for newcomers. For instance, in the competitive athleisure market, brands like Nike and Adidas have cultivated decades of trust, making it challenging for emerging players to gain traction. This brand equity requires significant, sustained marketing investment to replicate, a hurdle many new entrants cannot overcome.

While it might seem relatively easy to start a small apparel brand, building a truly competitive operation requires navigating complex global supply chains and distribution networks. Centric Brands leverages its deep expertise in sourcing, manufacturing, and logistics for apparel, accessories, and beauty items, creating a significant hurdle for newcomers.

New entrants often find it challenging to match the scale and efficiency of established players, especially given recent global supply chain disruptions. For example, the apparel industry in 2024 continues to grapple with lead time volatility, with some shipping times extending by 20-30% compared to pre-pandemic levels, making it difficult for new businesses to reliably get products to market.

Regulatory Compliance and Sustainability Demands

The increasing regulatory landscape and growing consumer expectations for sustainability pose significant barriers for new companies looking to enter the apparel and lifestyle sector. Navigating complex environmental regulations, such as those related to carbon emissions and waste management, requires substantial upfront investment and specialized knowledge. For instance, by 2024, many regions have seen stricter enforcement of Extended Producer Responsibility (EPR) schemes, demanding that brands manage the end-of-life of their products, a costly undertaking for any new player.

Furthermore, the demand for ethically sourced materials and transparent supply chains adds another layer of complexity and cost. New entrants must invest in robust auditing processes and potentially higher-priced sustainable materials to meet these expectations. This can be particularly challenging for smaller businesses that may not have the capital or established relationships to secure these resources readily. The need to comply with evolving labor laws and ensure fair working conditions throughout the supply chain also necessitates significant resources and diligent oversight, further deterring potential new competitors.

- Regulatory Hurdles: Compliance with evolving environmental and labor laws increases operational costs and complexity.

- Sustainability Investment: Sourcing certified sustainable materials and implementing ethical practices require significant capital.

- Consumer Demand: Meeting consumer expectations for transparency and eco-friendly products necessitates investment in supply chain management and reporting.

- Resource Intensity: Smaller new entrants may lack the financial and operational resources to effectively manage these demands.

Capital Requirements for Scale and Marketing

Achieving the necessary scale and executing effective marketing campaigns in the competitive apparel and beauty sectors demands considerable capital. For instance, launching a new apparel brand and securing shelf space in major department stores, a key strategy for companies like Centric Brands, can easily cost millions in inventory, marketing, and distribution setup. This high barrier to entry, particularly for widespread retail presence, deters many smaller players from seriously challenging established entities.

Building a recognizable brand that can compete with the established presence of a company like Centric Brands, which manages a portfolio of well-known names, requires significant investment in advertising, public relations, and influencer marketing. In 2024, the average cost for a national apparel advertising campaign can range from hundreds of thousands to several million dollars, making it difficult for nascent brands to gain traction against deeply entrenched competitors. This financial hurdle limits the number of truly viable new entrants.

- High Initial Investment: Significant capital is needed for inventory, product development, and supply chain setup.

- Marketing and Brand Building Costs: Substantial budgets are required for advertising, social media, and public relations to build brand awareness.

- Retail Distribution Challenges: Securing placement in desirable retail locations often involves slotting fees and co-op advertising, adding to upfront costs.

- Scalability Expenses: Expanding operations to meet demand, including manufacturing and logistics, requires continuous financial input.

While some niche apparel and beauty segments offer lower initial capital requirements, the overall threat of new entrants for a company like Centric Brands is moderated by significant barriers. These include the substantial investment needed for brand building, securing retail distribution, and navigating complex global supply chains. Furthermore, increasing regulatory demands and consumer expectations for sustainability add layers of cost and complexity that deter many smaller players.

| Barrier | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Brand Equity & Marketing | Established brands have built customer loyalty and recognition over time. | New entrants struggle to gain visibility and trust without massive marketing spend. | National apparel ad campaigns can cost $100k-$5M+. |

| Supply Chain & Logistics | Managing global sourcing, manufacturing, and distribution is complex and costly. | New businesses face challenges in achieving scale, efficiency, and reliability. | Apparel lead times extended 20-30% due to disruptions. |

| Capital Requirements | Significant upfront investment is needed for inventory, product development, and retail placement. | High costs for shelf space and marketing deter smaller ventures. | Securing department store shelf space can cost millions. |

| Regulatory & Sustainability | Compliance with environmental laws and ethical sourcing demands increase operational costs. | New entrants must invest heavily in sustainable practices and reporting. | Stricter EPR schemes require significant upfront investment. |

Porter's Five Forces Analysis Data Sources

Our Centric Brands Porter's Five Forces analysis is built on a foundation of comprehensive data, including Centric Brands' SEC filings, investor relations materials, and reputable industry research reports from firms like IBISWorld and Statista. This blend of primary and secondary sources ensures a thorough understanding of competitive dynamics.