Centric Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centric Brands Bundle

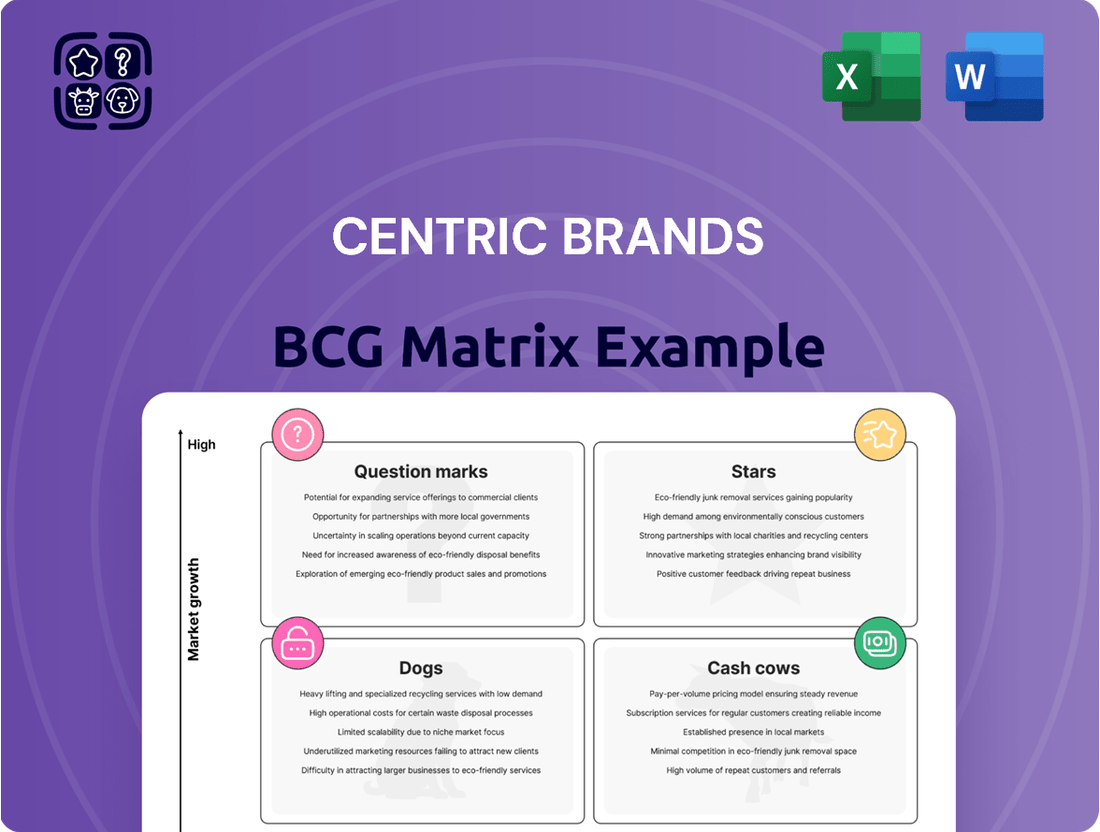

Centric Brands' BCG Matrix offers a powerful lens to understand its diverse product portfolio. See which brands are poised for growth (Stars), which are reliable profit generators (Cash Cows), and which may require a strategic rethink (Dogs or Question Marks).

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive breakdown of each brand's position, enabling you to make informed decisions about resource allocation and future investments.

Don't miss out on the strategic clarity this report provides. Invest in the full Centric Brands BCG Matrix today and navigate your product strategy with confidence and precision.

Stars

Centric Brands commands a significant presence in the kids' apparel market, boasting licenses for popular names like Calvin Klein, Tommy Hilfiger, Nautica, Spyder, and Under Armour. This strong portfolio suggests a substantial market share within a growing sector.

The strategic appointment of Rob Smith as President of the Kids division in July 2025 highlights Centric Brands' dedication to fostering growth and enhancing consumer connections in this key area. This move indicates these licensed brands are likely considered Stars, demanding continued investment to sustain their market leadership and expand internationally.

Centric Brands is strategically expanding Juicy Couture's reach into the booming beauty sector. In June 2025, a partnership with Authentic Brands Group was announced to launch a new line of cruelty-free hair, bath, nail, and cosmetic products. This move capitalizes on Juicy Couture's strong brand recognition within a market experiencing substantial growth.

This expansion into beauty is a calculated effort by Centric Brands to capture significant market share. The beauty industry, valued at over $500 billion globally in 2024, presents a lucrative opportunity for established lifestyle brands. Juicy Couture's new beauty offerings are positioned to become stars within Centric's portfolio, driving future revenue and brand engagement.

Centric Brands' joint venture with Jennifer Fisher, announced in March 2024, targets accelerated growth for the designer's core jewelry business and expansion into new lifestyle and accessories. This strategic alliance leverages Centric's proven ability to build brands across various categories.

The Jennifer Fisher brand itself has demonstrated strong performance, with reported revenues in the tens of millions of dollars prior to the JV, indicating significant existing market traction. This venture is categorized as a Star within the BCG Matrix due to the high-growth potential of the brand and the accessories market, necessitating ongoing investment to capture and expand market share.

Vince Accessories Licensing

In May 2024, Centric Brands entered into a significant licensing agreement with Authentic Brands Group for Vince accessories, encompassing handbags, small leather goods, and belts.

This strategic alliance empowers Centric Brands to utilize its established proficiency in the contemporary and luxury fashion sectors to expand the Vince brand's footprint within the accessories market.

The Vince accessories segment, characterized by its upscale and modern aesthetic, presents a compelling opportunity for substantial growth.

Centric Brands' active participation in this segment is designed to capture a dominant market share, positioning Vince Accessories as a Star in the BCG Matrix.

- Licensing Agreement: Centric Brands secured rights for Vince accessories in May 2024.

- Product Categories: The agreement covers handbags, small leather goods, and belts.

- Strategic Goal: To leverage Centric's expertise for growth in the luxury accessories market.

- BCG Classification: Positioned as a Star due to high growth potential and Centric's strategy to achieve high market share.

GAME 7 Apparel Line with Amazon

Centric Brands' partnership with GAME 7, launched in April 2025, positions the exclusive apparel line as a potential Star within its BCG Matrix. This collaboration leverages Amazon's massive e-commerce platform, aiming to capitalize on the burgeoning market for sports lifestyle wear. The strategy focuses on rapid market penetration and high growth potential by accessing Amazon's extensive customer base.

The venture is designed to capture significant market share, necessitating substantial investment in marketing and promotion. By aligning with Amazon, Centric Brands benefits from direct consumer access and a robust sales channel. This strategic move anticipates strong demand and aims to establish a dominant presence in the sports apparel segment.

- Strategic Partnership: Centric Brands partnered with GAME 7 in April 2025 for an exclusive apparel line on Amazon.

- Market Opportunity: Taps into the growing demand for sports lifestyle apparel and Amazon's vast e-commerce reach.

- Growth Potential: Aims for rapid market penetration and high growth due to exclusive access to a large consumer base.

- Investment Focus: Requires significant promotional support to solidify its position as a Star.

Stars in Centric Brands' portfolio represent high-growth, high-market-share ventures. The kids' apparel division, featuring brands like Calvin Klein and Tommy Hilfiger, is a prime example, benefiting from a growing market and strategic leadership appointments in 2025. Juicy Couture's expansion into the beauty sector, launched in June 2025, taps into a global market valued at over $500 billion in 2024, positioning it as a significant growth driver.

The Jennifer Fisher jewelry and accessories business, bolstered by a joint venture in March 2024, demonstrates strong existing revenue and high potential in a dynamic market. Similarly, the Vince accessories licensing agreement from May 2024 targets the upscale market, aiming for dominant share. The GAME 7 apparel line, launched in April 2025 on Amazon, leverages e-commerce and the sports lifestyle trend for rapid penetration.

| Brand/Division | Market Segment | Growth Potential | Centric Brands' Strategy | BCG Classification |

|---|---|---|---|---|

| Kids Apparel (Calvin Klein, Tommy Hilfiger) | Children's Apparel | High | Strategic leadership, strong brand portfolio | Star |

| Juicy Couture Beauty | Beauty Products | High | Expansion into a large, growing market | Star |

| Jennifer Fisher | Jewelry & Accessories | High | Joint venture for accelerated growth | Star |

| Vince Accessories | Luxury Accessories | High | Licensing agreement for market expansion | Star |

| GAME 7 Apparel | Sports Lifestyle Wear | High | E-commerce partnership for rapid penetration | Star |

What is included in the product

Highlights which Centric Brands units to invest in, hold, or divest based on market growth and share.

A clear visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Centric Brands' core licensed apparel brands, such as Calvin Klein and Tommy Hilfiger, are strong Cash Cows. These brands benefit from mature yet stable markets, leveraging established recognition and loyal customer bases for consistent sales.

With licenses for over 100 brands, including Nautica, Centric benefits from long-standing partnerships and efficient operations. This allows these apparel lines to maintain significant market share, reliably generating substantial cash flow with minimal need for heavy promotional spending.

Centric Brands' portfolio boasts licenses for powerhouse accessory brands like Coach, Kate Spade, and Michael Kors. These names hold substantial sway in the already established accessories market, indicating a stable, if not rapidly growing, demand.

The company's adeptness in design, sourcing, and distribution for these brands translates into impressive profit margins. This operational efficiency allows these segments to function as classic cash cows, generating the substantial cash flow needed to fuel other strategic ventures within Centric Brands.

Centric Brands' owned lifestyle brands, such as Hudson Jeans and Robert Graham, represent established players in their respective markets. Hudson Jeans, a recognized name in premium denim, and Robert Graham, offering sophisticated apparel and accessories, have cultivated dedicated customer followings.

These brands benefit from strong market positioning and customer loyalty, contributing to their stability. While their growth might be more moderate compared to high-growth sectors, their consistent performance and established market share make them significant cash generators for Centric Brands.

Private Label Business Segment

Centric Brands' private label segment functions as a Cash Cow within the BCG matrix. This business area benefits from strong consumer demand and consistent sales growth, often outperforming established national brands. The company's strategic acquisition of Daytona Apparel Group's hosiery division in 2022 bolstered this segment, adding robust, year-round replenishment revenue streams.

- High Market Share: Centric Brands holds a significant position in the private label market.

- Stable Growth: The segment experiences consistent, predictable sales increases.

- Strong Replenishment: Acquisitions like Daytona Apparel Group enhance recurring revenue.

- Value Proposition: Private label products appeal to a broad, value-conscious consumer base.

Entertainment Licensed Products (e.g., Disney, Marvel)

Centric Brands leverages its extensive portfolio of entertainment licenses, including major players like Disney, Marvel, Nickelodeon, and Warner Brothers, to create a robust cash cow segment. The enduring popularity of these franchises, especially within the children's apparel and accessories market, ensures consistent consumer demand. For instance, Disney's continued success with properties like the Marvel Cinematic Universe and Pixar films consistently drives sales for licensed merchandise. In 2023, the global toy market, which heavily overlaps with licensed entertainment products, was valued at over $110 billion, highlighting the significant revenue potential of these categories for Centric Brands.

- Consistent Demand: Global recognition of Disney and Marvel characters fuels steady sales year-round.

- High Volume Sales: These licensed products are mass-market items with broad appeal, leading to high unit volumes.

- Stable Revenue Generation: The predictable popularity of these franchises provides a reliable and significant cash flow stream for Centric Brands.

Centric Brands' established licensed apparel brands, such as Calvin Klein and Tommy Hilfiger, are prime examples of Cash Cows. These brands thrive in mature markets, benefiting from strong brand recognition and a loyal customer base that ensures consistent sales and substantial cash flow generation with minimal investment.

The company's strategic focus on these established brands, including Nautica, allows for efficient operations and significant market share. This translates into reliable revenue streams, where Centric Brands can leverage its expertise in design and sourcing to maintain healthy profit margins, funding other growth initiatives.

Centric Brands' owned lifestyle brands, like Hudson Jeans and Robert Graham, also function as Cash Cows. Their established market positions and dedicated customer followings contribute to stable, albeit moderate, growth, making them consistent generators of significant cash for the company.

The private label segment, bolstered by acquisitions like Daytona Apparel Group's hosiery division in 2022, represents another strong Cash Cow. This area benefits from consistent consumer demand and predictable sales, providing robust, recurring revenue streams that are vital for Centric Brands' financial stability.

Delivered as Shown

Centric Brands BCG Matrix

The preview of the Centric Brands BCG Matrix you are currently viewing is the identical, fully unlocked document you will receive upon purchase. This means you get the complete strategic analysis, free from any watermarks or demo limitations, ready for immediate application to your business planning and decision-making processes.

Dogs

Within Centric Brands' vast portfolio of over 100 licensed brands, certain niche or legacy brands likely reside in stagnant or shrinking markets. These brands may struggle with low market share, contributing little to overall revenue and potentially operating at break-even or as cash consumers.

For instance, if a brand like the historic Xylos brand, licensed for a specific type of children's apparel, saw its market segment shrink by 5% in 2024 due to changing consumer preferences, it would fit this description. Such underperformers might be considered for non-renewal of their licensing agreements or even divestiture if their performance trajectory doesn't show signs of improvement.

Centric Brands' portfolio may include product lines that haven't adapted to current fashion. For example, if Centric still heavily relies on a particular style of denim that's fallen out of favor, this would represent an outdated product line. These items, while still costing money to produce and hold, are likely seeing minimal sales and consumer engagement.

These underperforming collections contribute to a low market share within their specific categories. In 2023, the apparel industry saw a significant shift towards sustainable and comfort-driven fashion, meaning brands that didn't pivot quickly enough likely experienced a decline in sales for older, less relevant styles. This directly impacts profitability as inventory costs outweigh revenue generated.

Brands heavily reliant on shrinking retail channels, like those primarily found in department stores or malls that have seen declining foot traffic, would likely fall into the Dogs category within Centric Brands' BCG Matrix. For example, if a brand's sales in physical stores dropped by 15% in 2024, and its e-commerce presence only grew by 3%, it would indicate a low-growth, low-market-share scenario.

Non-Strategic or Failed Acquisitions

Centric Brands has a history of strategic acquisitions, but any that faltered in integration or failed to deliver expected market synergies would be classified as Dogs. These acquisitions would likely exhibit a low market share within their specific product categories and demonstrate minimal growth. Such ventures could tie up valuable capital without generating sufficient returns for the company.

These underperforming acquisitions represent a drain on resources. For instance, if a brand acquired in 2022 for $50 million only generated $5 million in revenue in 2024 and had a negative growth rate, it would clearly fall into the Dog category. This scenario highlights the importance of post-acquisition integration and performance monitoring.

- Low Market Share: These acquisitions typically hold a negligible position in their respective markets.

- Stagnant or Declining Growth: They fail to expand their customer base or increase sales over time.

- Capital Drain: Resources invested in these ventures do not yield adequate financial returns.

- Integration Challenges: Difficulties in merging operations, culture, or technology hinder their success.

Low-Margin, High-Volume Basic Products

Centric Brands' low-margin, high-volume basic products, like certain apparel basics, can find themselves in the Dog quadrant. These items, often commoditized, face fierce price wars, making it difficult to achieve significant profit. For instance, in 2024, the average gross margin for basic t-shirts in the mass market hovered around 15-20%, a stark contrast to more differentiated apparel.

While these products may generate substantial sales volume, their low profitability means they contribute little to the company's overall financial health or growth potential. Their market share is often stagnant, and investment in these categories yields minimal returns. Consider that a significant portion of the apparel market in 2024 was driven by fast fashion, where rapid turnover and lower quality standards often characterize these low-margin segments.

- Low Profitability: Gross margins for highly commoditized basics often struggle to exceed 20% in 2024.

- Intense Price Competition: Retailers frequently engage in aggressive discounting for these products.

- Negligible Market Share Growth: These product lines typically show minimal expansion in their market presence.

- Limited Differentiation: Basic products offer few unique selling propositions to command higher prices.

Brands within Centric Brands' portfolio that are in mature or declining markets with low market share are considered Dogs. These brands, like a legacy children's apparel line that saw a 5% market segment shrink in 2024, contribute minimally to revenue and may even consume resources without generating sufficient profit.

Product lines that haven't adapted to current trends, such as outdated denim styles, also fall into this category. These items, despite production and inventory costs, experience low sales and engagement, reflecting a low market share in a competitive landscape. For example, brands failing to pivot to the 2023 trend of sustainable fashion likely saw declines in sales for less relevant styles.

Acquisitions that failed to integrate or deliver expected synergies, exhibiting low market share and minimal growth, are also classified as Dogs. An example would be a $50 million acquisition in 2022 generating only $5 million in 2024 revenue with a negative growth rate, highlighting a drain on capital.

Low-margin, high-volume basic products, such as commoditized apparel basics, often become Dogs due to intense price competition. In 2024, basic t-shirt gross margins were around 15-20%, making it difficult for these products to contribute significantly to overall financial health despite high sales volume.

| Brand Example | Market Trend | 2024 Performance Indicator | BCG Category |

| Legacy Children's Apparel | Shrinking Niche Market | -5% Market Segment Decline | Dog |

| Outdated Denim Line | Shifting Fashion Preferences | Low Sales, Minimal Engagement | Dog |

| Underperforming Acquisition | Poor Integration/Synergy | Low Revenue ($5M on $50M cost), Negative Growth | Dog |

| Basic T-shirts (Commoditized) | Intense Price Competition | 15-20% Gross Margin | Dog |

Question Marks

Centric Brands' acquisition of the exclusive global licensing rights for the Messi Brand in March 2024 positions them to capitalize on Lionel Messi's immense global appeal. The planned Summer 2024 product launch targets a burgeoning lifestyle market, leveraging Messi's iconic status to potentially drive significant sales.

While the Messi Brand represents a high-potential opportunity, Centric Brands currently holds a minimal market share in this nascent lifestyle product category. This indicates that the brand, in its current form within Centric's portfolio, would likely be classified as a Question Mark in the BCG Matrix.

Substantial investment in product design, manufacturing capabilities, and a robust global distribution network will be crucial for Centric Brands to elevate the Messi Brand from a Question Mark to a Star. Success hinges on effectively translating Messi's popularity into tangible market share and revenue growth.

Centric Brands' November 2024 joint venture with Preston Lane, a lifestyle brand specializing in everyday essentials and home decor, positions Preston Lane as a Question Mark within Centric's BCG matrix. This strategic move targets the expanding lifestyle market, but Centric's current market share in this nascent brand is expected to be minimal.

As a Question Mark, Preston Lane requires significant investment to grow its market share and potential. The success of this venture hinges on Centric's ability to effectively build and develop the brand, capitalizing on consumer demand for accessible lifestyle products.

Centric Brands' exploration of new product categories at the 2024 Licensing Expo, particularly in 'baby' and entertainment-linked merchandise like that for the 'Wicked' movie, signals a strategic pivot towards high-growth potential areas. These emerging markets, fueled by new trends and cultural moments, present a significant opportunity for expansion.

While these categories are promising, Centric Brands currently holds a minimal market share in these nascent segments. This low penetration underscores the challenge and the substantial investment required to establish a strong foothold and capitalize on these emerging opportunities.

Successfully transforming these new ventures into Stars within the BCG matrix will necessitate considerable investment in marketing and product development. By strategically allocating resources, Centric Brands aims to capture market share and drive growth in these promising new product categories.

Expansion into Untapped International Markets

Centric Brands' strategic pursuit of untapped international markets for its diverse brand portfolio positions these ventures as potential Question Marks within the BCG framework. These markets, while presenting significant growth opportunities, often require considerable upfront investment to build brand awareness and establish robust distribution channels. For instance, entering a new market like Southeast Asia for a brand like Joe's Jeans would necessitate substantial capital for localized marketing campaigns and supply chain development.

The high growth potential associated with emerging economies offers a compelling reason for Centric Brands to explore these territories. However, the challenge lies in achieving a meaningful market share quickly, given the potential presence of established local competitors and varying consumer preferences. Centric's ability to effectively adapt its product offerings and marketing strategies will be crucial for success in these nascent international ventures.

- Market Entry Costs: Entering new international markets can involve significant upfront expenses, including market research, legal fees, establishing distribution networks, and initial marketing campaigns.

- Brand Recognition Challenges: In many untapped markets, Centric Brands' existing brands may have low initial recognition, requiring substantial investment in brand building and consumer education.

- Investment in Localization: Tailoring products, marketing messages, and distribution strategies to suit local cultural nuances and consumer demands is essential for market penetration.

- Potential for High Growth: Despite the challenges, these markets often offer higher growth rates compared to mature markets, providing a pathway for long-term expansion and revenue diversification.

Unproven Digital Commerce Initiatives & AI Integration

Centric Brands' pursuit of a data-driven digital transformation, including AI integration for supply chain enhancement, places its newer digital commerce initiatives and AI-driven product development in the question mark category of the BCG matrix. These ventures, while crucial for future competitiveness, are in their nascent stages, demanding substantial investment with outcomes yet to be fully realized.

These initiatives represent significant growth potential, but their early-stage nature means returns are uncertain, and market acceptance is not guaranteed. For example, companies investing heavily in AI for personalized customer experiences in e-commerce might see initial dips in profitability as the technology is refined and integrated. In 2024, the global AI market was projected to reach over $200 billion, highlighting the scale of investment in this area, but also the inherent risks in unproven applications.

- Uncertain Returns: Early-stage digital commerce platforms and AI integration projects often have unpredictable revenue streams and profitability timelines.

- High Investment Needs: Significant capital is required for development, implementation, and ongoing optimization of these new technologies.

- Market Adoption Risk: Customer acceptance and the competitive landscape for novel digital solutions can significantly impact their success.

- Strategic Importance: Despite the risks, these initiatives are vital for Centric Brands to maintain long-term market relevance and operational efficiency.

Centric Brands' strategic acquisition of licensing rights for the Messi Brand in early 2024 positions it as a Question Mark. While the brand has immense global appeal, Centric's current market share in this nascent lifestyle product category is minimal, requiring substantial investment to transform potential into market dominance.

Similarly, the joint venture with Preston Lane in November 2024, targeting the expanding lifestyle market, also falls into the Question Mark category. Centric's low initial market share necessitates significant investment to build brand awareness and capture a substantial portion of consumer demand.

The company's exploration of new product categories like 'baby' and 'Wicked' movie merchandise at the 2024 Licensing Expo represents further Question Marks. These emerging markets, while promising high growth, require considerable investment in marketing and product development to establish a strong foothold against potential competitors.

Centric Brands' expansion into untapped international markets for its existing brands, such as Joe's Jeans in Southeast Asia, also presents as Question Marks. These ventures demand significant upfront investment for localization, brand building, and distribution network establishment, despite the high growth potential of emerging economies.

Finally, Centric's digital transformation efforts, including AI integration for supply chain enhancement and new digital commerce initiatives, are classified as Question Marks. These early-stage ventures require substantial investment with uncertain returns, though they are strategically vital for long-term market relevance and efficiency, especially given the projected over $200 billion global AI market in 2024.

BCG Matrix Data Sources

Our Centric Brands BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.