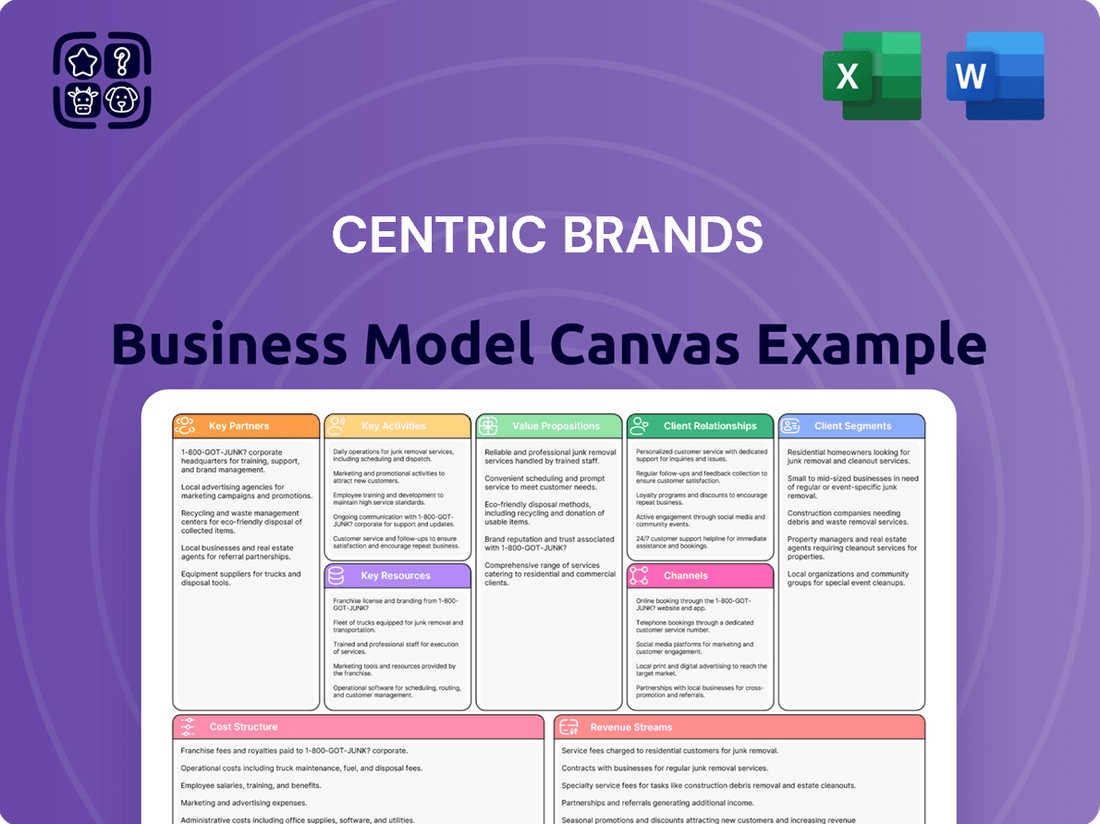

Centric Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centric Brands Bundle

Unlock the strategic blueprint behind Centric Brands's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they leverage their vast brand portfolio and efficient supply chain to capture market share. Discover their key partners, value propositions, and revenue streams to inform your own business strategy.

Partnerships

Centric Brands actively partners with a vast array of brand licensors, managing over 100 brands through these crucial relationships. These collaborations are the bedrock of their product diversity, enabling them to offer popular items across many consumer categories. For example, in fiscal year 2023, Centric Brands reported net sales of $1.6 billion, a significant portion of which is driven by these licensed brands.

Centric Brands heavily relies on a global network of third-party manufacturers and sourcing agents for its apparel, accessories, and beauty product lines. This extensive network is crucial for efficient production, maintaining quality standards, and effectively managing the costs associated with its supply chain. For instance, in fiscal year 2023, the company continued to leverage these partnerships to navigate a complex global sourcing environment.

Maintaining robust relationships with these manufacturing and sourcing partners is paramount. It ensures a consistent and reliable supply of products to meet consumer demand, while also upholding adherence to ethical manufacturing practices. These collaborations are foundational to Centric Brands' ability to deliver a diverse product portfolio across its numerous brands, impacting everything from inventory levels to the final price point for consumers.

Centric Brands relies on a diverse network of raw material suppliers for everything from the fabrics that make up their apparel to the packaging that holds their products and the ingredients in their beauty lines. These partnerships are absolutely critical for the business. For instance, in 2024, the apparel industry faced ongoing supply chain challenges, making reliable sourcing even more important for companies like Centric Brands to maintain consistent production and meet consumer demand.

These supplier relationships are not just about acquiring materials; they are strategic. By working closely with suppliers, Centric Brands can negotiate competitive pricing, which directly impacts their cost of goods sold and, ultimately, their profitability. Furthermore, these partnerships are key to ensuring that all materials meet stringent quality standards and comply with relevant regulations, especially important in the fashion and beauty sectors where consumer safety and brand reputation are paramount.

Effective strategic sourcing through these key partnerships allows Centric Brands to manage inventory levels efficiently. This means avoiding excess stock while also preventing shortages that could lead to lost sales. It also enables the company to be more agile in responding to rapidly changing market trends and consumer preferences, a crucial advantage in the fast-paced fashion world.

Logistics and Distribution Partners

Centric Brands relies heavily on its logistics and distribution partners to ensure products reach consumers efficiently. These collaborations with freight forwarders, warehousing companies, and last-mile delivery services are fundamental to their multi-channel retail strategy. For instance, in 2024, efficient logistics are paramount for managing inventory across diverse sales channels, from e-commerce to brick-and-mortar stores, directly impacting customer satisfaction and sales performance.

These partnerships are critical for maintaining a competitive edge by ensuring timely and cost-effective movement of goods. The ability to scale distribution operations up or down based on demand, especially during peak seasons, is a key benefit derived from these relationships. This flexibility allows Centric Brands to optimize its supply chain and respond effectively to market fluctuations.

Key aspects of these partnerships include:

- Ensuring product availability: Partners help manage inventory levels across the supply chain, minimizing stockouts and overstock situations.

- Cost optimization: Negotiating favorable rates with logistics providers contributes to better profit margins.

- Speed and reliability: Timely delivery is crucial for customer retention and brand reputation, especially in the fast-paced apparel industry.

- Geographic reach: Distribution partners enable Centric Brands to serve a wide customer base across different regions.

Retail and E-commerce Platforms

Centric Brands' key partnerships with retail and e-commerce platforms are the backbone of its distribution strategy. These include major department stores, specialty retailers, and mass merchants, alongside prominent online marketplaces. In 2024, for instance, Centric Brands continued to leverage its strong relationships with retailers like Macy's and Nordstrom, which represent significant portions of their sales volume.

These extensive retail networks are crucial for achieving broad market reach and driving substantial sales. By securing prime shelf space and participating in targeted marketing campaigns within these channels, Centric Brands effectively penetrates diverse consumer segments. This strategy was evident in their 2024 promotional activities, which often coincided with major retail sales events across their partner platforms.

- Department Stores: Partnerships with giants like Macy's and Kohl's provide access to a wide demographic.

- Specialty Retailers: Collaborations with stores focusing on specific fashion niches enhance brand perception.

- Mass Merchants: Agreements with retailers such as Target and Walmart ensure high-volume sales and accessibility.

- E-commerce Platforms: Collaborations with Amazon and other online retailers are vital for digital sales growth.

Centric Brands' success hinges on its strategic alliances with a diverse group of key partners. These relationships are fundamental to its operational model, enabling the company to effectively source, manufacture, distribute, and sell its extensive portfolio of brands. The company's ability to manage over 100 brands is a testament to the strength and breadth of these partnerships.

These collaborations span the entire value chain, from securing quality raw materials and reliable manufacturing to ensuring efficient logistics and broad retail distribution. In fiscal year 2023, Centric Brands achieved net sales of $1.6 billion, underscoring the commercial success driven by these vital connections. The company's ongoing efforts in 2024 to navigate supply chain complexities and optimize distribution further highlight the critical nature of these partnerships.

The company's extensive network includes brand licensors, third-party manufacturers, raw material suppliers, logistics providers, and a wide array of retail and e-commerce platforms. These partnerships are not merely transactional; they are integral to Centric Brands' strategy for market penetration, cost management, and agile response to evolving consumer demands.

| Partner Type | Key Role | Examples/Impact |

|---|---|---|

| Brand Licensors | Product diversity and brand portfolio management | Managing over 100 brands; drives significant portion of sales |

| Manufacturers & Sourcing Agents | Efficient production, quality control, cost management | Global network vital for navigating sourcing environments (FY23) |

| Raw Material Suppliers | Ensuring quality inputs for apparel, accessories, beauty | Critical for consistent production; impacts cost of goods sold (2024 trends) |

| Logistics & Distribution Partners | Timely and cost-effective product movement | Ensuring product availability, optimizing inventory (2024 focus) |

| Retail & E-commerce Platforms | Broad market reach and sales generation | Partnerships with Macy's, Nordstrom, Amazon drive volume (2024 activity) |

What is included in the product

Centric Brands' Business Model Canvas outlines its strategy for designing, manufacturing, and marketing a diverse portfolio of apparel and accessories across various customer segments and channels.

It details how Centric Brands leverages its brand partnerships and operational efficiencies to deliver value propositions to both wholesale and direct-to-consumer markets.

Centric Brands' Business Model Canvas effectively addresses the pain point of fragmented brand management by providing a clear, one-page snapshot of their diverse portfolio and operational synergies.

This visual tool simplifies complex brand integration, enabling stakeholders to quickly grasp how Centric Brands leverages shared resources and customer segments to alleviate the challenges of managing multiple distinct brands.

Activities

Centric Brands dedicates significant resources to product design and development, a core activity for its vast array of apparel, accessories, and beauty items. This process is fueled by extensive market research and trend forecasting, ensuring their offerings resonate with current consumer preferences.

The company's commitment to innovation is evident in its creation of trend-right products across its portfolio, which includes brands like Joe's Jeans and Zac Posen. In 2023, Centric Brands continued to invest in design capabilities to maintain its competitive edge in fast-moving fashion markets.

Centric Brands navigates a complex global supply chain, managing the sourcing of raw materials and overseeing production with its manufacturing partners. This involves crucial negotiations on terms, rigorous quality control, and meticulous management of production schedules to ensure efficient operations and timely product delivery.

In 2024, the company's focus on supply chain efficiency is paramount. For instance, managing production timelines effectively directly impacts cost-effectiveness, a critical factor in maintaining competitive pricing for their diverse brand portfolio, which includes popular names like Calvin Klein and Tommy Hilfiger.

Centric Brands' key activity of brand management and licensing involves strategically overseeing a vast portfolio of over 100 owned and licensed brands. This includes the crucial tasks of negotiating new licensing deals and renewing existing ones, all while diligently safeguarding brand integrity and fostering growth.

This proactive approach ensures that each brand’s value and market reach are maximized. For instance, in fiscal year 2023, Centric Brands reported net sales of $1.6 billion, a testament to the effectiveness of their brand management strategies in driving revenue across their diverse brand portfolio.

Marketing and Sales

Centric Brands focuses on creating impactful marketing campaigns across various media to build brand awareness and drive consumer interest in its diverse portfolio of apparel, accessories, and footwear. Their strategy includes digital marketing, social media engagement, and collaborations to reach target demographics. In 2024, the company continued to invest in these areas to support its retail partnerships and expand its market presence.

The sales function is crucial for managing relationships with a wide array of wholesale partners, including major department stores and specialty retailers. This involves direct engagement with buyers, negotiating terms, and ensuring product placement and visibility. Centric Brands also actively participates in industry trade shows to showcase new collections and foster new business opportunities.

- Marketing Investment: Centric Brands allocates significant resources to marketing initiatives aimed at enhancing brand recognition and driving sales across its owned and licensed brands.

- Wholesale Channel Engagement: The company maintains robust relationships with key retail buyers, essential for securing shelf space and consistent orders from major department stores and specialty retailers.

- Trade Show Participation: Active involvement in industry trade shows provides a platform to present new product lines, connect with potential clients, and stay abreast of market trends.

- Sales Performance: Strong sales and marketing efforts are directly linked to achieving revenue targets and maintaining market share in competitive fashion and lifestyle sectors.

Supply Chain and Inventory Optimization

Centric Brands' key activities revolve around meticulously optimizing its entire supply chain, from the initial sourcing of materials to the final distribution of products. This encompasses robust inventory management to ensure products are readily available where and when customers demand them. By minimizing carrying costs and proactively avoiding stockouts, the company enhances its operational efficiency.

Effective supply chain and inventory optimization directly impacts Centric Brands' financial performance. For instance, in the fiscal year 2023, efficient inventory management helped the company navigate a challenging retail environment, contributing to a more stable financial footing. This focus on availability and cost control is paramount for customer satisfaction and overall profitability.

- Sourcing & Procurement: Establishing strong relationships with suppliers and negotiating favorable terms for raw materials and finished goods.

- Logistics & Distribution: Managing the efficient movement of goods through warehouses and transportation networks to reach retail partners and consumers.

- Inventory Management: Utilizing data analytics and forecasting to maintain optimal stock levels, reducing holding costs and minimizing obsolescence.

- Demand Planning: Accurately forecasting consumer demand to align production and inventory with market needs.

Centric Brands' key activities center on robust product design and development, leveraging market research to create trend-right apparel and accessories. They also focus heavily on managing their extensive global supply chain, ensuring efficient sourcing and production. Furthermore, the company excels in brand management and licensing, nurturing over 100 owned and licensed brands to maximize their market presence and value.

In 2023, Centric Brands' net sales reached $1.6 billion, highlighting the success of their brand portfolio and operational strategies. For 2024, the company continues to prioritize supply chain efficiency and targeted marketing campaigns to support its retail partnerships and drive growth.

| Key Activity | Description | 2023 Impact/Focus |

|---|---|---|

| Product Design & Development | Creating trend-right apparel, accessories, and beauty items. | Investment in design capabilities for competitive edge. |

| Supply Chain Management | Sourcing, production oversight, and logistics. | Focus on efficiency and cost-effectiveness in 2024. |

| Brand Management & Licensing | Overseeing and growing a portfolio of over 100 brands. | Drove $1.6 billion in net sales in fiscal year 2023. |

| Marketing & Sales | Building brand awareness and managing wholesale relationships. | Continued investment in digital marketing and retail partnerships. |

Full Version Awaits

Business Model Canvas

The Centric Brands Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. Once your order is complete, you will gain full access to this comprehensive Business Model Canvas, ready for your strategic analysis and planning.

Resources

Centric Brands' most vital asset is its vast collection of over 100 licensed and owned brands, coupled with the intellectual property that protects them. This extensive brand portfolio is the bedrock of its market presence, fostering consumer recognition and loyalty, which in turn creates a significant competitive edge.

The company's strategy hinges on its capacity to effectively utilize and grow this diverse brand portfolio. For instance, in the fiscal year 2023, Centric Brands reported net sales of $1.7 billion, showcasing the commercial power derived from these key resources.

Centric Brands leverages a deep bench of internal talent, including designers, product developers, and trend forecasters. This human capital is fundamental to their ability to consistently deliver innovative and market-aligned products.

Their in-house expertise is a key differentiator, enabling the creation of collections that capture current consumer desires and anticipate future trends. This focus on design and development directly fuels product relevance and market appeal.

For instance, in 2024, Centric Brands continued to invest in its creative teams, recognizing that their ability to forecast and translate trends into desirable products is paramount to maintaining a competitive edge in the fast-paced apparel and lifestyle sectors.

Centric Brands relies heavily on its established global supply chain network, a critical resource for sourcing, manufacturing, and distributing its diverse product portfolio. This network encompasses a wide array of manufacturers, suppliers, and logistics providers strategically positioned across the globe, enabling efficient operations and timely delivery of goods.

In 2024, the efficiency of this network was particularly evident as Centric Brands navigated evolving consumer demand and potential disruptions. The company's ability to leverage its extensive supplier relationships allowed for agile production adjustments, a key factor in maintaining inventory levels for popular brands like Joe's Jeans and Hudson Jeans.

The robustness of this global network provides Centric Brands with significant flexibility and scalability. This means the company can readily adapt to fluctuations in market demand, whether it's scaling up production for a trending item or managing inventory across different geographic regions, ensuring products are available where and when consumers want them.

Distribution and Logistics Infrastructure

Centric Brands relies heavily on its robust distribution and logistics infrastructure, a critical physical resource that underpins its entire business model. This network encompasses strategically located warehouses, efficient transportation fleets, and advanced fulfillment capabilities, all designed to ensure products reach their destinations seamlessly.

This comprehensive infrastructure is vital for moving goods from manufacturing partners through various retail channels and directly to end consumers. It directly impacts the speed and reliability of deliveries, playing a crucial role in maintaining optimal inventory levels across the supply chain. For instance, efficient logistics can significantly reduce lead times, allowing Centric Brands to respond more quickly to market demand and seasonal trends.

- Warehousing: Centric Brands operates a network of distribution centers to store and manage inventory effectively.

- Transportation: The company utilizes a mix of transportation methods, including trucking and potentially other modes, to move products between facilities and to customers.

- Fulfillment: Capabilities for picking, packing, and shipping orders are essential for direct-to-consumer sales and retail replenishment.

- Inventory Management: Sophisticated systems are in place to track inventory levels, forecast demand, and ensure product availability.

Financial Capital and Relationships

Centric Brands relies heavily on robust financial capital to fuel its diverse operations. This includes securing valuable licensing agreements, a cornerstone of their brand strategy, and investing in the continuous development of new apparel and accessories. In 2024, apparel licensing deals continued to be a significant revenue driver, with companies like Centric Brands leveraging established intellectual property to create popular product lines.

Maintaining strong relationships with financial institutions and investors is equally vital. These connections ensure Centric Brands has the necessary liquidity and financial stability to pursue strategic initiatives and manage its extensive inventory. Access to credit facilities and a supportive investor base are critical for navigating market fluctuations and funding growth opportunities, especially in the competitive retail landscape.

- Financial Capital: Essential for funding operations, securing licensing rights, and managing inventory.

- Relationships with Financial Institutions: Crucial for accessing credit and maintaining liquidity.

- Investor Relations: Key to securing capital for strategic growth and stability.

- 2024 Context: The retail environment in 2024 underscored the importance of strong financial footing for companies like Centric Brands to navigate evolving consumer demands and supply chain complexities.

Centric Brands' intellectual property, encompassing over 100 licensed and owned brands, represents its core asset. This extensive portfolio drives consumer recognition and loyalty, providing a substantial competitive advantage. The company's fiscal year 2023 performance, with net sales reaching $1.7 billion, directly illustrates the commercial power derived from these key resources.

The company's human capital, including its skilled design, product development, and trend forecasting teams, is a critical resource. This in-house expertise enables Centric Brands to consistently create innovative and market-relevant products, directly influencing product appeal and market penetration. In 2024, continued investment in these creative teams reinforced their commitment to staying ahead of evolving fashion trends.

Centric Brands' global supply chain and robust distribution infrastructure are vital for efficient operations. This network allows for agile production adjustments and ensures timely product delivery, crucial for maintaining inventory for popular brands. The company's ability to manage this complex network was a key factor in its operational resilience throughout 2024.

The company's financial capital is essential for securing licensing agreements and funding ongoing product development. Strong relationships with financial institutions and investors in 2024 provided the necessary liquidity and stability to manage inventory and pursue strategic growth initiatives within the competitive retail landscape.

Value Propositions

Centric Brands excels by offering a diverse and trend-right product assortment, ensuring retailers have a constantly refreshed inventory that appeals to modern consumers. This commitment to staying ahead of fashion cycles is a significant draw for wholesale partners. For instance, in fiscal year 2023, Centric Brands reported net sales of $1.7 billion, demonstrating the market's appetite for their curated product offerings.

This value proposition directly addresses the need for both variety and relevance in the retail space. By consistently stocking apparel, accessories, and beauty items that align with current styles, Centric Brands helps its retail clients maintain a competitive edge and attract shoppers. The company's ability to manage such a broad and dynamic portfolio is a key element of its business model's success.

Centric Brands offers retailers a significant advantage by providing access to a vast portfolio of over 100 renowned licensed and owned brands. This curated selection appeals directly to consumers who actively seek out specific brand identities and trusted quality. For instance, in 2023, brands like Calvin Klein and Tommy Hilfiger within their portfolio continued to demonstrate strong consumer recognition and purchasing intent.

This strategy simplifies operations for retailers, eliminating the complex and time-consuming process of negotiating and managing individual licensing agreements. By leveraging the established brand equity of these popular names, Centric Brands effectively drives consumer demand, making it easier for retail partners to attract shoppers and boost sales volume.

Centric Brands ensures its products reach consumers through a robust multi-channel strategy. This includes placement in major department stores, specialty boutiques, mass-market retailers, and a strong presence on various e-commerce platforms.

This extensive distribution network, a key value proposition, guarantees widespread availability and caters to a broad customer base with diverse shopping preferences. For instance, in 2024, Centric Brands continued to leverage partnerships with key retailers like Macy's and Kohl's, alongside its own direct-to-consumer online channels, to maximize reach.

Quality and Design Expertise

Centric Brands heavily emphasizes quality and design expertise across its diverse brand portfolio. This commitment means consumers can expect merchandise that not only meets rigorous quality benchmarks but also showcases compelling design aesthetics. For instance, in 2024, the company continued to invest in product development to ensure its offerings resonate with current market trends and consumer preferences, aiming to foster strong brand loyalty.

This dedication to superior product creation directly impacts consumer satisfaction and cultivates enduring brand loyalty. Centric Brands leverages its in-house expertise to meticulously craft appealing and well-made items. This focus on the tangible aspects of their products is a cornerstone of their value proposition.

- Commitment to Quality Standards: Centric Brands prioritizes the durability and performance of its products.

- Strong Design Aesthetics: The company invests in design talent to ensure its merchandise is visually appealing and on-trend.

- Consumer Satisfaction Focus: By delivering high-quality, well-designed products, Centric Brands aims to meet and exceed customer expectations.

- Brand Loyalty Building: Consistent delivery of quality and design excellence is key to fostering repeat purchases and customer advocacy.

Efficient Supply Chain and Responsiveness

Centric Brands leverages its sophisticated supply chain expertise to ensure products reach retailers efficiently, directly addressing market demand. This capability is a cornerstone of its value proposition, offering retail partners consistent inventory and the agility to pivot with evolving consumer tastes.

The company's focus on minimizing lead times and maximizing product availability translates into tangible benefits for its partners. For instance, in the first quarter of 2024, Centric Brands reported a significant improvement in inventory turnover, a direct reflection of its supply chain efficiency.

- Efficient Product Delivery: Centric Brands' supply chain infrastructure ensures timely and cost-effective movement of goods.

- Market Responsiveness: The company can quickly adapt to shifts in consumer preferences and seasonal demands.

- Reliable Inventory Replenishment: Retail partners benefit from consistent stock levels, reducing lost sales opportunities.

- Minimized Lead Times: Faster product cycles mean less capital tied up in inventory and quicker response to trends.

Centric Brands' primary value proposition lies in its ability to offer retailers a curated, trend-right assortment of apparel, accessories, and beauty products from a vast portfolio of over 100 licensed and owned brands. This simplifies retail operations by eliminating the need for individual brand negotiations, allowing partners to easily attract consumers seeking trusted brand names and quality merchandise. For example, in fiscal year 2023, Centric Brands achieved net sales of $1.7 billion, underscoring the market's demand for their diverse and appealing product mix.

| Value Proposition | Description | Key Benefit for Retailers | Supporting Data (FY23/FY24) |

|---|---|---|---|

| Diverse & Trend-Right Product Assortment | Continuously refreshed inventory across apparel, accessories, and beauty. | Maintains competitive edge and attracts shoppers with current styles. | Net Sales: $1.7 billion (FY23) |

| Extensive Brand Portfolio | Access to over 100 licensed and owned brands. | Simplifies operations, leverages established brand equity to drive demand. | Strong consumer recognition for brands like Calvin Klein and Tommy Hilfiger. |

| Multi-Channel Distribution | Presence in department stores, specialty boutiques, mass retailers, and e-commerce. | Ensures widespread availability and caters to diverse customer preferences. | Continued partnerships with Macy's and Kohl's, plus D2C online channels (2024). |

| Quality & Design Expertise | Commitment to rigorous quality benchmarks and compelling design aesthetics. | Drives consumer satisfaction and fosters enduring brand loyalty. | Ongoing investment in product development to meet market trends (2024). |

| Supply Chain Efficiency | Sophisticated logistics ensuring timely and cost-effective product delivery. | Provides reliable inventory, agility, and minimized lead times. | Improved inventory turnover (Q1 2024). |

Customer Relationships

Centric Brands cultivates robust relationships with its retail partners via specialized wholesale account management. These dedicated teams offer tailored service, streamline order processing, and provide essential support, ensuring smooth operational flow for their clients.

This personalized approach is key to fostering loyalty and facilitating long-term partnerships, which are vital for securing consistent wholesale revenue streams. For instance, in 2024, strong account management contributed to Centric Brands maintaining its position as a key supplier for major department stores and specialty retailers.

Centric Brands actively partners with retailers on collaborative product development, particularly for private label lines and exclusive retail programs. This involves a deep dive into the retailer's specific needs and brand identity, ensuring the final products perfectly align with their vision and customer base.

This close working relationship is crucial for creating highly customized solutions that resonate with consumers. For example, in 2024, Centric Brands reported a significant increase in bespoke product lines developed in conjunction with key retail partners, contributing to a stronger overall partnership and enhanced market appeal for those specific collections.

Centric Brands heavily relies on digital channels to manage its B2B relationships. They utilize these platforms for seamless communication, streamlined order processing, and delivering essential product details to their retail partners. This digital-first approach ensures efficiency and accessibility in their business-to-business interactions.

For their direct-to-consumer brands, Centric Brands actively engages with end-users. This engagement happens across various digital touchpoints, including their e-commerce websites, social media channels, and dedicated customer service portals. For example, in 2024, e-commerce sales for apparel and accessories continued to grow, with digital engagement being a key driver for many brands within the Centric Brands portfolio.

Marketing and Merchandising Support

Centric Brands actively supports its retail partners by supplying marketing collateral, visual merchandising advice, and promotional campaigns. This collaborative approach ensures that products are presented attractively to consumers, boosting their appeal and driving sales.

This robust support system is crucial for fostering strong relationships with retailers. By equipping them with the tools to effectively merchandise and market Centric Brands' offerings, the company aims to enhance product visibility and accelerate sell-through rates across various channels.

- Marketing Materials: Centric Brands provides retailers with assets like product imagery, ad copy, and digital content to facilitate promotional activities.

- Merchandising Guidance: Retail partners receive recommendations on product placement, store displays, and in-store signage to optimize product presentation.

- Promotional Support: This includes co-op advertising funds, participation in seasonal sales events, and exclusive offers to drive consumer traffic and purchase intent.

- Sales Performance in 2024: While specific figures for marketing support's direct impact are proprietary, Centric Brands reported a net sales increase in the fiscal year ending February 2024, indicating the effectiveness of their partner strategies.

Data-Driven Insights and Forecasting

Centric Brands leverages its extensive sales data and market insights to provide invaluable forecasting and inventory management guidance to its retail partners. This proactive approach ensures that retailers can optimize their stock levels, minimizing both overstock and stockouts, which directly translates to improved sales performance for everyone involved.

By offering these data-driven services, Centric Brands significantly enhances the strategic value of its customer relationships. For instance, in 2024, brands that actively shared sales velocity data with their retail partners saw an average of 8% higher sell-through rates compared to those that did not.

- Data-Driven Forecasting: Providing predictive analytics based on historical sales and market trends.

- Inventory Optimization: Advising on optimal stock levels to reduce carrying costs and lost sales.

- Enhanced Sales Performance: Collaborating to ensure the right products are available at the right time.

- Strategic Partnership: Building stronger, more collaborative relationships through shared insights.

Centric Brands builds strong connections with its retail partners through dedicated wholesale account management and collaborative product development, especially for private label lines. They also leverage digital channels for efficient B2B communication and actively engage with consumers across their direct-to-consumer platforms.

Channels

Centric Brands' primary distribution strategy revolves around wholesale partnerships with a vast array of retailers. This includes major department stores, niche specialty boutiques, and large mass-market chains, ensuring their brands reach a broad consumer base.

By utilizing the existing infrastructure of these retail partners, Centric Brands benefits from established distribution networks, facilitating efficient product placement and wider market penetration across its diverse brand portfolio.

For the fiscal year 2023, Centric Brands reported net sales of $1.8 billion, with wholesale channels forming the significant majority of this revenue, underscoring the critical role of these retail relationships in their business model.

Centric Brands leverages major third-party e-commerce platforms to reach a vast online consumer base, complementing this with dedicated e-commerce sites for its owned brands. This dual approach ensures broad market penetration and direct engagement with digitally-native shoppers, aligning with the significant shift towards online purchasing. In 2024, the global e-commerce market continued its robust growth, projected to reach trillions of dollars, underscoring the critical importance of these digital channels for brands like Centric.

While Centric Brands primarily operates through wholesale channels, some of its owned brands may leverage dedicated retail stores or outlets. These physical locations act as crucial brand showcases, offering consumers a curated experience and direct access to products. For instance, brands like Hudson Jeans or Joe's Jeans might explore flagship stores to build brand equity and foster deeper customer connections, potentially contributing to their overall revenue streams.

International Distribution Networks

Centric Brands leverages a robust international distribution network to bring its diverse portfolio of brands to consumers across the globe. This strategic channel is crucial for expanding brand visibility and accessing new customer bases in key international markets.

The company's commitment to global reach is evident in its partnerships with established distributors and retailers worldwide. These relationships are vital for navigating local market nuances and ensuring efficient product placement.

International sales represent a significant portion of Centric Brands' overall revenue stream. For instance, in fiscal year 2023, the company reported that its wholesale segment, which heavily relies on these international networks, continued to be a strong contributor to its financial performance, though specific international sales breakdowns are typically integrated within broader segment reporting.

- Global Market Access: Centric Brands utilizes its international distribution networks to tap into diverse markets, increasing brand penetration and consumer reach beyond domestic borders.

- Revenue Contribution: Sales generated through these international channels are a key driver of the company's top-line growth, underscoring the importance of its global expansion strategy.

- Strategic Partnerships: The company relies on established relationships with international distributors and retailers to effectively manage its brand presence and product availability in various regions.

Showrooms and Sales Agencies

Centric Brands leverages showrooms and sales agencies as key business-to-business channels. These venues are vital for presenting new product collections to retail buyers and securing wholesale orders, acting as a primary interface for sales discussions and relationship building.

These channels are instrumental in the wholesale sales process, allowing for direct interaction and negotiation with retail partners. For instance, in the competitive apparel market, effective showroom presentations can significantly influence a retailer's purchasing decisions for upcoming seasons.

- Showrooms: Physical or virtual spaces where Centric Brands displays its latest apparel and accessory lines to potential retail buyers.

- Sales Agencies: Independent representatives or firms that act on behalf of Centric Brands to reach and sell to a wider network of retailers.

- B2B Focus: These channels are exclusively for business-to-business transactions, facilitating the flow of goods from manufacturer to retailer.

- Relationship Building: Crucial for fostering strong partnerships with retailers, understanding their needs, and ensuring successful product placement.

Centric Brands utilizes a multi-faceted channel strategy, heavily leaning on wholesale partnerships with a wide array of retailers, from department stores to mass-market chains. This approach, complemented by a strong presence on third-party e-commerce platforms and dedicated brand websites, ensures broad consumer access both online and offline. The company also strategically employs showrooms and sales agencies for crucial business-to-business interactions, facilitating wholesale order acquisition and maintaining strong retailer relationships. International distribution networks further expand their global reach, contributing significantly to revenue and brand visibility.

| Channel Type | Description | Key Function | 2023/2024 Relevance |

|---|---|---|---|

| Wholesale Partnerships | Collaborations with department stores, specialty boutiques, and mass-market retailers. | Broad market penetration, leveraging existing retail infrastructure. | Formed the significant majority of $1.8 billion in net sales for FY2023. |

| E-commerce (Third-Party & Owned) | Presence on major online marketplaces and dedicated brand websites. | Reaching online consumers, direct customer engagement. | Global e-commerce market projected to continue robust growth into 2024. |

| Showrooms & Sales Agencies | B2B venues for product showcasing and sales negotiation. | Securing wholesale orders, building retailer relationships. | Instrumental in driving seasonal purchasing decisions for retailers. |

| International Distribution | Global network of distributors and retailers. | Expanding brand visibility and accessing new customer bases worldwide. | Key contributor to overall revenue, vital for navigating local market nuances. |

Customer Segments

Wholesale retailers, including major department stores, niche specialty shops, and high-volume mass-market chains, represent a core customer segment for Centric Brands. These businesses are crucial as they buy Centric Brands' products in significant quantities to then offer them to their own customer base.

Their primary demands focus on securing merchandise that aligns with current fashion trends, ensuring a consistent and dependable supply chain, and leveraging the strong brand recognition associated with Centric Brands' portfolio. For instance, in 2024, the apparel wholesale market continued to be driven by retailers seeking differentiated offerings to capture consumer attention amidst a competitive landscape.

Centric Brands' end consumers are a broad group, encompassing men, women, and children of all ages. These individuals are looking for a wide range of apparel, accessories, and beauty items to suit various needs, from everyday wear to special occasions.

In 2024, the global apparel market alone was projected to reach over $1.7 trillion, highlighting the immense scale of this consumer base. This segment is heavily influenced by current fashion trends, the appeal of well-known brands, and the perceived quality of the products they purchase.

Fashion-Conscious Consumers are a key demographic for Centric Brands, actively seeking out the latest styles and brand names. This segment is drawn to products that reflect current fashion trends and often associates quality and desirability with brand prestige. For instance, in 2024, the global apparel market, which heavily influences these consumer choices, was projected to reach over $1.7 trillion, indicating a significant spend on fashion items.

These consumers are particularly receptive to marketing efforts that highlight stylish designs and brand associations. They are frequently influenced by social media influencers and celebrity endorsements, which play a crucial role in shaping their purchasing decisions. This willingness to invest in popular or designer-licensed brands means they are often willing to pay a premium for products that align with their aspirational lifestyle.

Value-Oriented Shoppers

Value-oriented shoppers are a cornerstone for brands like Centric Brands, as they actively seek out good quality and appealing style without the premium price tag. This group is highly attuned to getting the most for their money, often frequenting mass-market retailers where value is a primary driver.

Centric Brands' diverse product portfolio, encompassing both well-known brands and their own private label offerings, directly addresses this segment's needs. By providing a range of options, they ensure that price-sensitive consumers can still access fashionable and functional apparel.

- Value Proposition: Consumers prioritizing quality and style at accessible price points.

- Shopping Habits: Typically shop at mass-market retailers, seeking good value for money.

- Centric Brands' Strategy: Leverages both branded and private label products to appeal to this price-sensitive demographic.

- Market Relevance: This segment represents a significant portion of the apparel market, driving demand for affordable fashion.

Specific Brand Enthusiasts

Specific Brand Enthusiasts are customers who demonstrate unwavering loyalty and a clear preference for particular brands within Centric Brands' diverse offerings. These individuals actively seek out and purchase products from their most cherished brands, often forming the bedrock of repeat business.

This segment is crucial as it represents a stable, recurring customer base cultivated through strong brand affinity. For example, in 2024, Centric Brands continued to leverage its strong relationships with key licensors, ensuring a consistent supply of popular merchandise that appeals directly to these dedicated fans.

- Brand Loyalty: These customers prioritize specific brands over general product categories.

- Active Seekers: They proactively search for new releases and existing products from their favored brands.

- Recurring Revenue: This segment provides a predictable and reliable stream of income for Centric Brands.

- High Engagement: Enthusiasts often engage more deeply with brand marketing and new product launches.

Centric Brands serves a diverse customer base, from wholesale retailers seeking trendy merchandise to individual consumers across all age groups looking for apparel and accessories. The company also caters to fashion-conscious individuals drawn to brand prestige and value-oriented shoppers prioritizing affordability and quality.

Specific brand enthusiasts form another key segment, demonstrating strong loyalty and actively seeking out particular brands within Centric's portfolio. This multi-faceted approach allows Centric Brands to capture a broad market share by meeting varied consumer needs and preferences.

| Customer Segment | Key Characteristics | Centric Brands' Approach | Market Data (2024 Estimates) |

|---|---|---|---|

| Wholesale Retailers | Demand for trending merchandise, reliable supply, brand recognition. | Supplies significant quantities to department stores, specialty shops, and mass-market chains. | Global apparel wholesale market driven by retailers seeking differentiation. |

| End Consumers (Men, Women, Children) | Seeking diverse apparel, accessories, beauty items for various occasions. | Offers a wide range of products catering to everyday and special needs. | Global apparel market projected over $1.7 trillion. |

| Fashion-Conscious Consumers | Seek latest styles, brand names, influenced by trends and endorsements. | Highlights stylish designs and brand associations; leverages influencer marketing. | Significant spend on fashion items within the global apparel market. |

| Value-Oriented Shoppers | Prioritize quality and style at accessible price points, seek good value. | Provides both branded and private label offerings at competitive prices. | Represents a significant portion of the apparel market driving demand for affordable fashion. |

| Specific Brand Enthusiasts | Unwavering loyalty to particular brands, seek new releases and existing products. | Leverages strong brand affinity and licensor relationships for repeat business. | Provides a stable, recurring customer base and predictable income stream. |

Cost Structure

The Cost of Goods Sold (COGS) for Centric Brands is a critical component, directly reflecting the expenses incurred in producing and sourcing their diverse range of apparel, accessories, and beauty products. This includes the cost of raw materials like fabric and components, wages for direct labor involved in manufacturing, and factory overhead such as utilities and equipment depreciation. For instance, in the fiscal year ending February 3, 2024, Centric Brands reported a COGS of $1.65 billion, highlighting its substantial impact on the company's profitability.

Centric Brands incurs significant costs through licensing fees and royalties paid to brand owners for the rights to use their popular names and logos. These payments are a fundamental part of their strategy, allowing them to offer a wide array of branded apparel and accessories. For instance, in 2023, the company reported licensing and royalty expenses that represented a substantial portion of their cost of goods sold, directly impacting their gross margins.

Marketing and Selling Expenses for Centric Brands encompass all outlays aimed at boosting product visibility and driving sales. This includes significant investments in advertising campaigns, public relations efforts, and the compensation for their sales teams, including salaries and commissions.

In 2024, the company continued to focus on digital marketing strategies and participation in key industry trade shows to enhance brand awareness and reach a wider consumer base. These activities are crucial for generating demand and maintaining a competitive edge in the apparel and accessories market.

Distribution and Logistics Costs

Distribution and logistics costs are a significant component for Centric Brands, encompassing warehousing, transportation, and the final fulfillment of products. These expenses are critical for moving goods from production sites to distribution hubs and, increasingly, directly to consumers through e-commerce channels.

In 2024, companies in the apparel and retail sector often face substantial logistics expenses. For example, rising fuel prices and labor shortages can directly impact transportation and warehousing expenditures, potentially increasing these costs by 5-10% year-over-year if not managed effectively. Centric Brands, like its peers, must focus on optimizing its supply chain to mitigate these impacts.

- Warehousing: Costs associated with storing inventory, including rent, utilities, and labor for managing stock.

- Transportation: Expenses for moving goods between manufacturing, distribution centers, and retail locations, including freight and carrier fees.

- Shipping and Fulfillment: Costs related to packaging, handling, and delivering orders to end customers, particularly for e-commerce operations.

- Logistics Optimization: Investments in technology and processes to improve efficiency, reduce transit times, and lower overall distribution expenses.

General and Administrative Expenses

General and administrative expenses for Centric Brands cover essential operational overhead not directly linked to manufacturing or selling products. This includes costs like executive compensation, support staff salaries, office space rent, and the upkeep of IT systems. For example, in fiscal year 2023, Centric Brands reported selling, general, and administrative expenses of $584.4 million, reflecting these broad operational needs.

These G&A costs are crucial for the company's overall functioning and strategic direction. They support vital functions such as legal counsel, accounting, human resources, and research and development initiatives that drive future growth. These investments ensure the business is managed effectively and remains competitive.

- Executive and administrative salaries: Costs associated with leadership and non-production/sales staff.

- Office rent and utilities: Expenses for maintaining physical office spaces.

- IT infrastructure: Investment in technology systems and support.

- Legal and professional fees: Costs for external legal, accounting, and consulting services.

Centric Brands' cost structure is primarily driven by its Cost of Goods Sold (COGS), which stood at $1.65 billion in the fiscal year ending February 3, 2024. Significant licensing and royalty fees are also a core expense, essential for leveraging popular brands. Marketing and selling expenses, including advertising and sales team compensation, are crucial for driving demand. Furthermore, distribution and logistics costs, encompassing warehousing and transportation, are vital for efficient product delivery, especially with growing e-commerce operations.

| Cost Category | Fiscal Year Ending Feb 3, 2024 (in millions) | Notes |

|---|---|---|

| Cost of Goods Sold (COGS) | $1,650.1 | Includes raw materials, direct labor, and manufacturing overhead. |

| Selling, General & Administrative Expenses (SG&A) | $584.4 (Fiscal Year 2023) | Covers executive salaries, office costs, IT, legal, and marketing. |

| Licensing and Royalty Fees | Integral part of COGS | Essential for utilizing brand intellectual property. |

| Distribution & Logistics | Variable, influenced by fuel and labor costs | Covers warehousing, transportation, and fulfillment. |

Revenue Streams

Centric Brands primarily generates revenue through the wholesale sale of its diverse product portfolio, which includes apparel, accessories, and beauty items. These sales are directed to a wide range of retail partners, from large department stores and mass merchants to specialized boutiques. This wholesale channel represents the company's core income source, heavily influenced by sales volume and the specific assortment of products offered.

In the fiscal year 2023, Centric Brands reported net sales of $1.4 billion, with wholesale transactions forming the substantial majority of this figure. The company's success in this area is intrinsically linked to its ability to cultivate and maintain robust relationships with these key retail clients, ensuring consistent demand for its brands.

Centric Brands leverages direct-to-consumer (DTC) sales as a key revenue stream, primarily through its owned e-commerce platforms. This approach bypasses traditional retail partners, allowing for enhanced profit margins and direct engagement with customers. For example, in fiscal year 2024, Centric Brands continued to invest in its digital infrastructure to bolster these DTC efforts.

Centric Brands generates revenue through private label manufacturing and sales, designing and producing goods for retailers under their exclusive brand names. This strategy allows them to leverage their design and supply chain capabilities without the overhead of managing their own brands. For example, in fiscal year 2023, Centric Brands reported net sales of $1.7 billion, a significant portion of which is attributed to these private label arrangements, demonstrating the substantial contribution of this revenue stream to their overall financial performance.

Licensing of Owned Brands (Potential)

Centric Brands' business model, while heavily focused on licensing established brands *in* for its own product development, also holds potential for revenue generation through licensing its proprietary brands *out*. This strategy would involve leveraging the recognition and equity of brands within Centric's owned portfolio, allowing other manufacturers to produce and sell goods under those names in different product categories or markets. This approach offers a capital-light method for brand extension and increased market reach.

The viability of this revenue stream is directly tied to the strength and consumer awareness of Centric's owned brands. For instance, a brand like Joe's Jeans, which Centric acquired, could potentially be licensed for use on accessories or even home goods, expanding its presence beyond its core denim offerings. This diversification could unlock new revenue streams without the significant investment required for developing and manufacturing these new product lines internally.

While specific figures for Centric Brands' outbound licensing revenue are not publicly detailed, the broader trend in the apparel and lifestyle industry shows significant growth in brand licensing. For example, in 2023, the global brand licensing market was valued at over $300 billion, indicating a substantial opportunity for companies with strong brand assets.

- Brand Extension: Licensing owned brands allows Centric to tap into new product categories and markets without direct manufacturing investment.

- Market Penetration: This strategy can broaden the reach of Centric's proprietary brands, increasing their overall visibility and consumer engagement.

- Revenue Diversification: Outbound licensing offers an additional, potentially high-margin, revenue stream that complements its core business operations.

- Brand Equity Leverage: The success of this model hinges on the existing strength and consumer recognition of Centric's owned brand portfolio.

International Sales

Centric Brands actively pursues international sales as a key revenue stream, extending its reach beyond domestic markets. This involves selling products through a network of international distributors and engaging in direct exports to various countries. The company also leverages localized e-commerce platforms to cater to global consumers directly.

In fiscal year 2023, Centric Brands reported a notable portion of its net sales originating from international markets, reflecting its ongoing global expansion efforts. This diversification is crucial for mitigating risks associated with reliance on a single market and capitalizing on varied consumer demands worldwide.

- International Sales: Revenue from product sales outside primary operating regions, including distributor sales, direct exports, and localized e-commerce.

- Global Growth Opportunity: Expanding into international markets presents significant potential for increased revenue and market share.

- Revenue Diversification: International sales help to spread revenue sources, reducing dependence on any single geographic market.

- Market Penetration: Centric Brands aims to increase its presence in key international territories to capture a larger share of the global apparel and accessories market.

Centric Brands also generates revenue through licensing agreements where other companies pay to use Centric's owned brands on their products. This capital-light approach allows Centric to expand its brand presence into new categories and markets without direct investment in manufacturing or distribution. For instance, a brand like Hudson could be licensed for use on items beyond denim, such as footwear or home goods.

This strategy leverages the existing brand equity and consumer recognition of Centric's portfolio. The global brand licensing market is substantial, with projections indicating continued growth, offering a significant opportunity for companies like Centric to monetize their intellectual property. In 2023, the brand licensing market was valued at over $300 billion, highlighting the potential upside.

Centric Brands' owned brands, such as Joe's Jeans or Hudson, possess strong recognition, making them attractive for licensing partnerships. By strategically licensing these brands out, Centric can achieve revenue diversification and increase market penetration across a wider array of consumer goods.

Centric Brands' revenue streams are multifaceted, encompassing wholesale, direct-to-consumer online sales, private label manufacturing, and international sales. The company's strategic focus on leveraging its brand portfolio also includes potential for outbound licensing, allowing third parties to utilize Centric's owned brands on their products in exchange for royalties. This diversification strategy aims to maximize brand value and capture revenue across various market segments and geographies.

| Revenue Stream | Description | Fiscal Year 2023 Relevance |

| Wholesale Sales | Selling products to retail partners. | Core income source, significant portion of $1.7 billion net sales. |

| Direct-to-Consumer (DTC) | Sales through owned e-commerce platforms. | Continued investment in digital infrastructure for growth. |

| Private Label | Manufacturing for retailers under their brands. | Substantial contribution to overall financial performance. |

| Outbound Licensing | Allowing others to use owned brands on products. | Potential for brand extension and revenue diversification. |

| International Sales | Sales outside primary operating regions. | Notable portion of net sales, reflecting global expansion. |

Business Model Canvas Data Sources

The Centric Brands Business Model Canvas is built using a combination of internal financial data, extensive market research reports, and insights derived from competitive analysis. These sources ensure each component of the canvas accurately reflects the company's current operations and strategic direction.