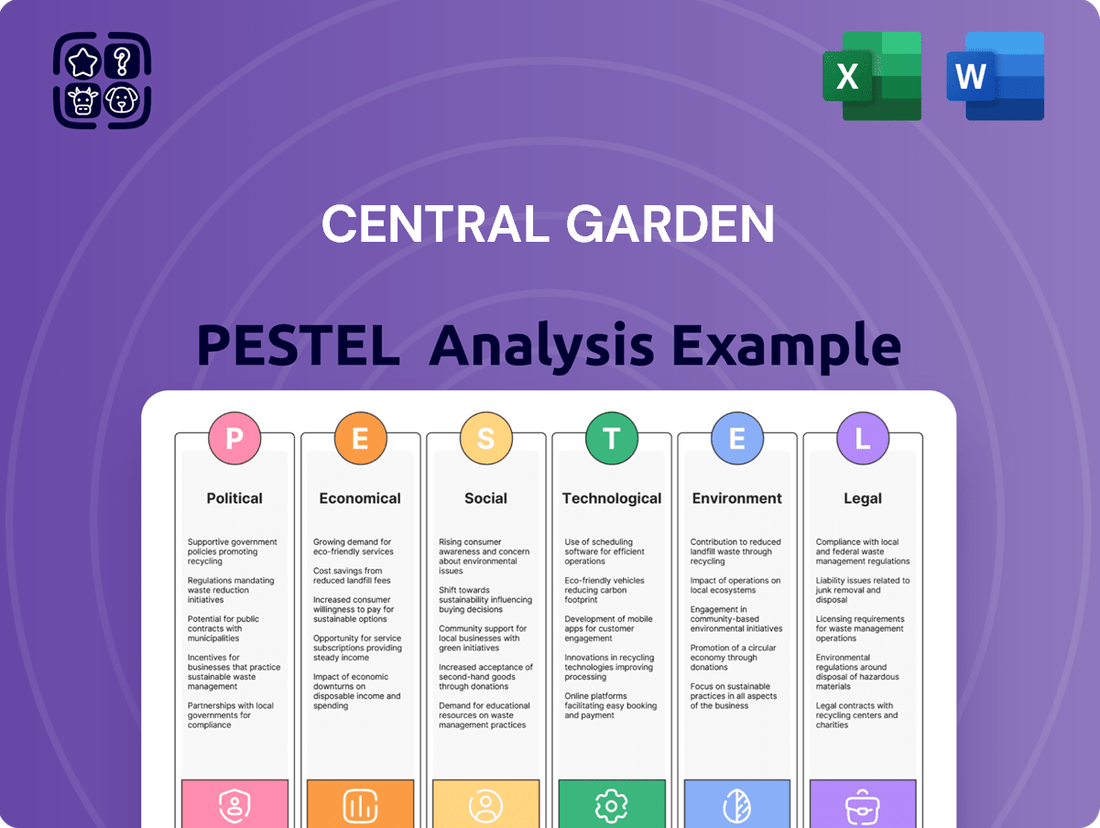

Central Garden PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Garden Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Central Garden's future. This comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Gain a competitive edge by understanding these external forces; download the full version now for deep-dive insights.

Political factors

Government regulations on product safety significantly shape Central Garden & Pet's operations. For instance, the U.S. Environmental Protection Agency (EPA) sets stringent standards for pesticide ingredients, impacting product development and potentially increasing compliance costs. In 2024, the EPA continued its review of various active ingredients, which could lead to revised usage guidelines or restrictions for products containing them.

Similarly, the Food and Drug Administration (FDA) oversees pet food safety, with evolving guidelines on ingredient sourcing and labeling. In 2024, there was ongoing attention to pet food recalls due to contamination, reinforcing the need for robust quality control and adherence to FDA regulations. Central Garden & Pet must continually adapt its formulations and manufacturing to meet these evolving safety mandates, ensuring compliance to maintain market access and consumer trust.

Global trade policies, particularly tariffs on imported raw materials like lumber or finished goods such as pet food ingredients, directly affect Central Garden & Pet's operational costs. For instance, the U.S. imposed tariffs on certain steel products in 2018, which could indirectly impact manufacturing equipment costs. Any shifts in these policies or new trade agreements, such as potential changes to existing U.S.-China trade relations, could reshape the cost-effectiveness of sourcing components or the viability of expanding into international markets, thereby influencing the company's overall profitability.

Government agricultural and environmental subsidies, a key political factor for Central Garden, are increasingly shaping the landscape. For instance, the U.S. Department of Agriculture's Conservation Reserve Program (CRP) incentivizes landowners to practice conservation, potentially boosting demand for eco-friendly lawn and garden products. These policies, such as those supporting water conservation in drought-prone regions like California, can steer Central Garden's product development towards drought-tolerant plants and water-saving irrigation systems, influencing market strategy.

Animal Welfare Legislation

Evolving animal welfare laws and regulations, especially concerning pet breeding, housing, and food standards, directly impact Central Garden's Pet segment. For instance, in 2024, the U.S. Department of Agriculture (USDA) continued to enforce and potentially expand regulations under the Animal Welfare Act, which can influence sourcing and care standards for animals used in research or sold as pets. Stricter legislation could necessitate changes in product formulations or packaging to meet new safety and ethical requirements, potentially shifting consumer demand within the pet supply market.

These legislative shifts can have tangible financial implications. For example, increased compliance costs related to sourcing or manufacturing to meet higher welfare standards could affect profit margins. Furthermore, regulations that limit certain breeding practices or pet ownership could indirectly influence the demand for specific pet food or accessory categories. In 2025, we anticipate continued scrutiny on pet food ingredients and labeling, potentially driving demand for products that meet enhanced transparency and ethical sourcing criteria.

Key considerations for Central Garden include:

- Adapting to stricter pet food ingredient and sourcing regulations.

- Potential impact of breed-specific legislation on pet ownership trends.

- Ensuring compliance with evolving animal housing and care standards for any direct animal-related operations.

Political Stability and Economic Policies

Political stability in key markets directly impacts consumer confidence and spending. For instance, the United States, a major market for Central Garden & Pet, experienced a relatively stable political environment in 2024, allowing for continued consumer spending on discretionary items. Government economic policies, such as the Inflation Reduction Act's provisions for energy efficiency, indirectly affect household budgets, potentially influencing disposable income available for gardening and pet care.

Predictable fiscal policies are crucial for business investment. Central Garden & Pet's operating regions generally maintained stable economic frameworks through mid-2025, supporting the company's strategic planning and capital allocation. However, potential shifts in trade policies or regulatory environments could introduce uncertainty, impacting supply chains and import costs for raw materials and finished goods.

- Government Spending: In 2024, US federal government spending on infrastructure and related sectors remained robust, indirectly supporting economic activity and consumer spending power.

- Fiscal Policy Stance: Central banks in major economies, including the US Federal Reserve, maintained a cautious approach to interest rate adjustments through early 2025, balancing inflation control with economic growth.

- Regulatory Environment: Evolving environmental regulations, particularly concerning pesticide use and pet food safety, require ongoing compliance efforts and can influence product development and market access for Central Garden & Pet.

- International Trade Agreements: The stability of international trade agreements impacts the cost and availability of imported goods, a factor relevant to Central Garden & Pet's sourcing and distribution networks.

Government regulations on product safety, such as EPA standards for pesticides and FDA guidelines for pet food, directly influence Central Garden & Pet's operational costs and product development through 2024 and into 2025. Evolving animal welfare laws also necessitate adjustments in product formulation and sourcing, impacting profit margins and consumer demand. Trade policies and tariffs on raw materials and finished goods, alongside government subsidies for conservation, further shape the company's cost structure and market strategy.

What is included in the product

This Central Garden PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the business, providing a comprehensive understanding of the external landscape.

Offers a clear, actionable overview of external factors impacting Central Garden, enabling proactive strategy development and mitigating potential risks.

Economic factors

Consumer disposable income is a critical driver for Central Garden & Pet's sales, particularly for discretionary items like lawn care and premium pet food. When consumers have more money left after essential expenses, they are more likely to spend on these categories. For instance, in early 2024, while inflation showed signs of moderating, persistent cost pressures on essentials meant many households still felt a squeeze on their discretionary budgets.

Economic downturns or periods of high inflation directly impact consumer purchasing power. This can lead to a shift towards more budget-friendly options or a general reduction in spending on non-essential goods, affecting Central Garden & Pet's revenue. For example, the U.S. personal saving rate, a proxy for disposable income available for spending, saw fluctuations throughout 2023 and into 2024, with some periods indicating tighter household budgets.

Inflationary pressures in 2024 and early 2025 continue to impact Central Garden & Pet by increasing the cost of raw materials, manufacturing, and transportation. For instance, the Producer Price Index (PPI) for goods relevant to the pet and lawn care industries showed a notable uptick in late 2024, reflecting these rising input costs.

Central Garden & Pet's ability to manage its cost of goods sold (COGS) is paramount. In Q1 2025, the company reported that a significant portion of its revenue growth was attributable to price increases, indicating a successful, albeit delicate, balancing act in passing costs to consumers. However, maintaining market share while implementing these price adjustments remains a key challenge in a competitive landscape.

Changes in interest rates directly influence Central Garden & Pet's expenses for crucial investments like capital expenditures, strategic acquisitions, and day-to-day working capital needs. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25% to 5.50% as seen in late 2023 and early 2024, borrowing becomes more expensive, impacting the company's bottom line.

Elevated interest rates can also create a ripple effect on consumer behavior, potentially softening demand for higher-ticket garden items as financing becomes pricier. This could translate to slower sales for products that consumers might typically finance, affecting revenue streams for Central Garden & Pet.

Furthermore, the broader availability of credit is a critical factor, impacting not only Central Garden & Pet's capacity to invest in its own growth but also the ability of its retail partners to finance and maintain adequate inventory levels, ensuring products are available to consumers.

Housing Market Trends

The health of the housing market is a significant driver for Central Garden & Pet's Garden segment. A strong housing market, characterized by increased new home construction and robust existing home sales, typically translates to higher consumer spending on home improvement and outdoor living projects. This directly benefits demand for lawn and garden products.

For instance, in 2024, the U.S. housing market saw a notable rebound in new home sales, with the Census Bureau reporting a 14.6% increase in new single-family houses sold in the first quarter of 2024 compared to the same period in 2023. This trend suggests a positive outlook for the garden segment as new homeowners often invest in landscaping and outdoor spaces.

Conversely, a slowdown in housing activity can dampen demand for these products. Existing home sales in the U.S. experienced a slight dip in early 2024, with the National Association of Realtors reporting a 3.7% decrease in existing home sales in March 2024 compared to February 2024. This indicates a potential headwind for the garden segment if this trend persists.

- New home sales: Increased by 14.6% in Q1 2024 (year-over-year), signaling potential for increased landscaping investment.

- Existing home sales: Saw a minor decrease of 3.7% in March 2024 (month-over-month), presenting a potential cautionary signal.

- Impact on Central Garden: A healthy housing market fuels demand for lawn and garden products, especially for new homeowners.

- Market sensitivity: The garden segment's performance is closely tied to the cyclical nature of the housing market.

Exchange Rates

Exchange rate fluctuations directly influence Central Garden & Pet's financial performance. For instance, a stronger US dollar in 2024 could make imported components for their pet and lawn products more affordable, potentially lowering cost of goods sold. However, this same strength makes their U.S.-manufactured goods pricier for overseas customers, potentially dampening international sales volume and impacting revenue from foreign markets.

Central Garden & Pet's exposure to currency risk is significant given its global operations and supply chain.

- Impact on Cost of Goods Sold: A stronger USD can reduce the cost of imported raw materials, benefiting profit margins.

- Impact on International Sales: A stronger USD can make exports more expensive, potentially reducing demand from international buyers.

- Competitive Landscape: Competitors with more favorable currency exposures might gain a pricing advantage in international markets.

- Hedging Strategies: The company likely employs hedging strategies to mitigate the volatility associated with exchange rate movements.

Consumer spending power remains a key determinant for Central Garden & Pet, with disposable income levels directly influencing purchases of discretionary items. While inflation showed signs of easing in early 2024, many households still faced budget constraints due to the cost of essentials, impacting spending on premium pet food and lawn care products.

The company's profitability is sensitive to input cost inflation, with rising prices for raw materials, manufacturing, and transportation impacting its cost of goods sold. Central Garden & Pet has strategically used price increases to offset these rising costs, as evidenced by its Q1 2025 performance, though balancing this with market share preservation is an ongoing challenge.

Interest rates significantly affect Central Garden & Pet's borrowing costs for investments and operations. With the Federal Reserve maintaining its target range for the federal funds rate at 5.25% to 5.50% through early 2024, higher borrowing expenses can impact the company's bottom line and its ability to finance growth initiatives.

The housing market's health is a critical economic indicator for Central Garden & Pet's garden segment. An increase in new home sales, like the 14.6% rise in Q1 2024, typically boosts demand for landscaping and outdoor living products, while a slowdown in existing home sales, such as the 3.7% dip in March 2024, could present a headwind.

| Economic Factor | 2024/2025 Data Point | Impact on Central Garden & Pet |

|---|---|---|

| Consumer Disposable Income | Moderating inflation, but persistent essential costs squeeze discretionary budgets (Early 2024) | Influences spending on premium pet food and lawn care. |

| Inflation (PPI for relevant goods) | Notable uptick in late 2024 | Increases cost of goods sold (COGS) for raw materials, manufacturing, and transport. |

| Interest Rates (Federal Funds Rate) | Target range 5.25%-5.50% (Late 2023-Early 2024) | Increases borrowing costs for capital expenditures and working capital. |

| New Home Sales (US) | +14.6% in Q1 2024 (YoY) | Positive driver for garden segment demand. |

| Existing Home Sales (US) | -3.7% in March 2024 (MoM) | Potential headwind for garden segment if trend continues. |

Preview the Actual Deliverable

Central Garden PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis for Central Garden provides a deep dive into the political, economic, social, technological, legal, and environmental factors impacting the business. You'll receive the full, ready-to-use document immediately after purchase.

Sociological factors

The growing trend of pet humanization, where pets are increasingly viewed as family members, significantly boosts consumer spending on premium pet products. This shift directly benefits companies like Central Garden & Pet, as owners are more inclined to invest in high-quality food, specialized treats, and innovative accessories for their beloved companions.

This societal change fuels demand for products focusing on pet nutrition and wellness, aligning with Central Garden & Pet's strategic emphasis on premium and specialized offerings. For instance, the pet care market in the US saw substantial growth, with pet owners spending an estimated $136.8 billion in 2022, a notable increase from previous years, reflecting this deep emotional connection and willingness to spend.

Consumer demand for sustainable and organic products is a significant sociological trend impacting Central Garden & Pet. In 2024, a NielsenIQ report indicated that 73% of global consumers would change their purchasing habits to reduce their environmental impact, a figure that has steadily climbed. This translates directly to the garden and pet sectors, with consumers increasingly seeking out eco-friendly fertilizers, pet foods with natural ingredients, and pest control solutions that minimize chemical use.

Central Garden & Pet's ability to adapt its product portfolio to this growing demand is crucial for market relevance. For instance, the company's investment in brands that emphasize natural ingredients and sustainable sourcing, such as those offering organic lawn care or plant-based pet foods, directly addresses this consumer preference. By offering eco-conscious alternatives, Central Garden & Pet can capture a larger share of this expanding market segment, which is projected to see continued growth through 2025 and beyond.

Urbanization is a major force shaping consumer needs, pushing people towards smaller living spaces like apartments and condos. This trend directly affects the gardening and pet product markets, as demonstrated by the increasing demand for solutions tailored to these environments. For instance, in 2024, urban gardening initiatives saw significant growth, with sales of container gardening supplies rising by an estimated 15% year-over-year.

Central Garden & Pet must adapt by focusing on products ideal for container gardening and indoor plant care. Similarly, the pet sector needs to offer compact and space-saving pet supplies to cater to urban dwellers. This strategic pivot is crucial, as urban populations are projected to grow, with cities in North America expected to house over 85% of the population by 2025, underscoring the sustained relevance of this trend.

Health and Wellness Consciousness

The growing emphasis on health and wellness is a significant sociological trend impacting Central Garden & Pet. This consciousness extends beyond human well-being to encompass pet health and the desire for safer, more natural home and garden environments. Consumers are increasingly seeking out products that support a healthy lifestyle for themselves and their animal companions, which translates into a demand for premium, nutritious pet food and eco-friendly gardening solutions.

Central Garden & Pet is well-positioned to leverage this trend. By offering products that cater to specific dietary needs in pets, such as grain-free or limited-ingredient options, and by developing natural, non-toxic pest control and gardening supplies, the company can align with consumer values. For instance, the pet food market saw substantial growth, with reports indicating a rise in premium and specialized pet food sales, reflecting this health-conscious shift. In 2024, the global pet food market was valued at over $120 billion, with a projected compound annual growth rate of around 5-6% through 2030, driven by humanization trends and a focus on pet wellness.

- Increased demand for natural and organic pet food: Consumers are scrutinizing ingredient lists, favoring products free from artificial additives and fillers.

- Growth in specialized pet nutrition: Products addressing allergies, weight management, and age-specific needs are gaining traction.

- Consumer preference for non-toxic gardening solutions: A move away from harsh chemicals towards organic fertilizers, natural insecticides, and sustainable gardening practices is evident.

- Focus on pet safety and well-being: This includes demand for secure fencing, safe outdoor spaces, and grooming products with natural ingredients.

Digital Lifestyle and E-commerce Adoption

The increasing integration of digital lifestyles means consumers increasingly research and purchase pet and garden supplies online. In 2024, e-commerce sales for pet products in the U.S. were projected to reach over $15 billion, highlighting a significant shift in consumer behavior. This trend necessitates that Central Garden & Pet enhance its digital footprint and online sales capabilities to remain competitive.

Central Garden & Pet needs to bolster its e-commerce platforms and digital marketing strategies to align with evolving consumer habits. A strong online presence allows for direct engagement and caters to the convenience expected in today's digital age.

- E-commerce Growth: Online sales of pet supplies are a rapidly expanding segment, with projections indicating continued double-digit growth through 2025.

- Digital Engagement: Consumers utilize social media and online reviews heavily when making purchasing decisions for pet and garden items.

- Convenience Factor: The ease of online ordering and home delivery is a primary driver for e-commerce adoption in this sector.

- Data Utilization: Central Garden & Pet can leverage digital data to personalize marketing efforts and improve customer experience.

Societal shifts are profoundly influencing consumer behavior in the pet and garden sectors. The humanization of pets, for instance, continues to drive spending, with pet owners viewing their companions as integral family members. This emotional connection fuels demand for premium, specialized products, from high-nutrition foods to innovative accessories. This trend is supported by market data, with the US pet care market reaching an estimated $136.8 billion in 2022, demonstrating a strong willingness to invest in pet well-being.

Furthermore, a growing consumer consciousness around health and wellness extends to pets and home environments. This translates into a preference for natural, non-toxic products in both gardening and pet care. Consumers are actively seeking out organic fertilizers, natural pest control solutions, and pet foods with clean ingredient lists. The global pet food market, valued at over $120 billion in 2024, reflects this, with a significant portion of growth attributed to premium and specialized offerings catering to health-conscious pet owners.

Urbanization also plays a key role, with a rising urban population necessitating products suited for smaller living spaces. This includes a demand for container gardening solutions and compact pet supplies. The digital lifestyle further shapes purchasing habits, with e-commerce becoming a dominant channel for pet and garden supplies, projected to exceed $15 billion in US sales for pet products in 2024 alone.

| Sociological Factor | Impact on Central Garden & Pet | Supporting Data/Trend |

|---|---|---|

| Pet Humanization | Increased spending on premium pet food, treats, and accessories. | US pet care market reached $136.8 billion in 2022. |

| Health & Wellness Consciousness | Demand for natural, organic, and specialized pet nutrition and non-toxic garden products. | Global pet food market valued at over $120 billion (2024); focus on clean ingredients. |

| Urbanization | Growth in demand for container gardening supplies and space-saving pet products. | Urban gardening sales up an estimated 15% YoY (2024); cities expected to house 85%+ of North American population by 2025. |

| Digital Lifestyle | Shift towards online research and purchasing, requiring enhanced e-commerce presence. | US pet product e-commerce sales projected over $15 billion (2024); double-digit online growth expected through 2025. |

Technological factors

The e-commerce landscape is transforming how consumers shop for pet supplies, with online sales projected to continue their upward trajectory. For Central Garden & Pet, this means a critical need to bolster its digital infrastructure and online marketing efforts. In 2024, the pet e-commerce market in the US alone was valued at over $30 billion, demonstrating significant consumer shift online.

Advances in smart home and garden technologies are significantly reshaping consumer demands. Innovations like automated watering systems, robotic lawnmowers, and smart pet feeders are becoming increasingly popular, offering convenience and efficiency. For instance, the global smart home market was valued at approximately $103.6 billion in 2023 and is projected to reach $279.1 billion by 2030, indicating strong consumer adoption of connected devices.

Central Garden & Pet can leverage these trends by integrating smart technologies directly into its product lines or by developing complementary solutions. This strategic move would allow the company to appeal to a growing segment of tech-savvy consumers who prioritize ease of use and performance in their home and garden maintenance. The company's existing brand recognition in pet and garden supplies provides a solid foundation for introducing these advanced offerings.

Technological advancements are significantly reshaping manufacturing and supply chain operations for companies like Central Garden & Pet. The integration of AI-driven inventory management, for instance, promises to optimize stock levels, minimizing waste and associated costs. In 2024, the global market for warehouse automation was projected to reach $30 billion, a clear indicator of this trend's momentum.

Furthermore, the adoption of advanced robotics in production lines can boost output and consistency, while also improving worker safety. Central Garden & Pet can leverage these technologies to streamline its operations and potentially reduce its cost of goods sold. Energy-efficient production methods are also becoming critical, with a growing emphasis on reducing the environmental impact of manufacturing processes.

Biotechnology and Product Innovation

Biotechnology is a significant driver of product innovation for companies like Central Garden, opening up new possibilities in pest control, plant nutrition, and pet health. The development of bio-based pesticides, for instance, offers a more environmentally friendly alternative to traditional chemical treatments. This focus on natural solutions aligns with growing consumer preferences for sustainable and less toxic products.

Central Garden can leverage advancements in biotechnology to create differentiated offerings. Research into enhanced plant growth formulas, potentially utilizing beneficial microbes or advanced nutrient delivery systems, can improve crop yields and plant vitality. Similarly, in the pet sector, biotechnology can lead to the creation of novel pet food ingredients or health supplements that cater to specific dietary needs or wellness trends.

The market for bio-based agricultural inputs is experiencing robust growth. For example, the global biopesticides market was valued at approximately USD 5.2 billion in 2023 and is projected to reach USD 12.1 billion by 2030, growing at a CAGR of over 12%. This indicates a strong demand for the types of innovative products biotechnology enables.

- Bio-based pesticides offer a sustainable alternative to synthetic chemicals, addressing environmental concerns and regulatory pressures.

- Enhanced plant nutrition solutions derived from biotechnology can improve crop resilience and yield, appealing to modern agricultural practices.

- Innovations in pet health and nutrition, driven by biotechnological research, can create premium products meeting demand for natural and effective pet care.

- The expanding market for bio-based products signifies a significant opportunity for companies investing in biotechnological R&D.

Data Analytics and Consumer Insights

Central Garden & Pet is increasingly leveraging data analytics to understand its customers better. The proliferation of big data and sophisticated analytical tools provides opportunities to gain granular insights into consumer preferences, emerging market trends, and the effectiveness of its product lines. This data-driven approach is crucial for refining product development, optimizing marketing campaigns, and streamlining inventory management.

For instance, by analyzing purchase data and online engagement, Central Garden & Pet can identify which product features resonate most with specific demographics. This allows for more precise product innovation and marketing spend allocation. In 2024, companies across the consumer goods sector saw significant improvements in sales forecasting accuracy, with some reporting a 10-15% uplift by implementing advanced analytics for demand planning.

- Enhanced Consumer Understanding: Advanced analytics enable deeper dives into customer purchasing habits and preferences.

- Data-Informed Product Development: Insights from data analytics guide the creation of new products that meet market demand.

- Optimized Marketing Strategies: Tailoring marketing efforts based on consumer data leads to higher engagement and conversion rates.

- Improved Inventory Management: Predictive analytics help forecast demand, reducing stockouts and overstock situations.

Technological advancements are fundamentally altering how consumers interact with pet and garden products. The rise of e-commerce and digital platforms means Central Garden & Pet must prioritize its online presence and digital marketing to reach a broader customer base. The US pet e-commerce market alone surpassed $30 billion in 2024, highlighting a significant shift towards online purchasing.

Smart home and garden innovations, such as automated systems and connected devices, are increasing consumer expectations for convenience and efficiency. The global smart home market, valued at over $100 billion in 2023, demonstrates a strong consumer appetite for integrated technology solutions.

Central Garden & Pet can capitalize on these trends by integrating smart features into its existing product lines or developing complementary tech-enabled offerings, appealing to a growing segment of tech-savvy consumers.

Legal factors

Central Garden & Pet faces significant legal hurdles due to stringent product liability laws governing its diverse product lines, including fertilizers, pesticides, pet food, and toys. These regulations mandate that all products meet rigorous safety and efficacy standards.

Failure to comply can result in severe financial and reputational consequences. For instance, in 2023, the U.S. Food and Drug Administration (FDA) reported a notable increase in pet food recalls due to contamination issues, highlighting the potential for costly lawsuits and brand damage across the industry.

Central Garden & Pet's ability to protect its intellectual property, such as patents for proprietary product formulations and trademarks for its well-known brands like Kaytee and Pennington, is vital for its market position. Legal action against counterfeiters and infringers is a key strategy to preserve the value of its innovations and brand reputation. For instance, in fiscal year 2023, the company reported a net sales increase of 3% to $3.4 billion, underscoring the importance of safeguarding the assets that drive such growth.

Central Garden & Pet must navigate a complex web of labor laws, impacting everything from minimum wage to workplace safety. For instance, in 2024, many states saw increases in minimum wage, directly affecting payroll expenses for the company's retail and distribution staff. Staying abreast of these evolving regulations, including those related to overtime and paid leave, is crucial for maintaining compliance and managing operational costs effectively.

Advertising and Marketing Regulations

Central Garden & Pet must navigate a complex web of advertising and marketing regulations, particularly concerning claims about product efficacy, safety, and environmental impact. For instance, the Federal Trade Commission (FTC) in the United States enforces rules against deceptive advertising, requiring substantiation for all product claims. Failure to comply can result in significant fines and damage to brand reputation. In 2023, the FTC continued its focus on environmental marketing claims, issuing guidance to prevent greenwashing.

The company's marketing efforts, especially for products like fertilizers, pesticides, and pet health items, are under scrutiny. Adherence to guidelines from bodies like the Environmental Protection Agency (EPA) for pesticide advertising and the Food and Drug Administration (FDA) for pet food claims is paramount. Central Garden & Pet's commitment to truthful and transparent marketing is crucial for maintaining consumer confidence and avoiding costly legal battles.

- Truthful Claims: All advertising must be truthful and not misleading, requiring robust substantiation for any performance or benefit claims.

- Substantiation: Marketers must possess competent and reliable scientific evidence to back up objective claims made in advertisements.

- Consumer Protection: Regulations aim to protect consumers from deceptive practices, ensuring they can make informed purchasing decisions.

- Industry-Specific Rules: Specific product categories, such as those involving health or environmental benefits, often have additional, more stringent advertising requirements.

Environmental Compliance and Permitting

Central Garden & Pet navigates a stringent environmental regulatory landscape, requiring permits for manufacturing, waste management, and chemical handling. Compliance with federal laws such as the Clean Air Act and Clean Water Act is paramount to prevent significant penalties and operational interruptions.

Failure to adhere to these environmental mandates can result in substantial fines; for instance, violations of the Clean Air Act can lead to civil penalties reaching tens of thousands of dollars per day, per violation, as of 2024 data. The company must also manage hazardous waste according to EPA guidelines, a process that involves detailed record-keeping and proper disposal methods.

- Environmental Permits: Central Garden & Pet likely holds numerous permits for air emissions, water discharge, and waste handling across its various facilities.

- Regulatory Compliance Costs: Investments in pollution control technology and environmental management systems are ongoing operational expenses.

- Risk of Penalties: Non-compliance can trigger significant financial penalties, potentially impacting profitability and brand reputation.

- Sustainability Initiatives: Proactive environmental stewardship, beyond mere compliance, can offer competitive advantages and appeal to environmentally conscious consumers.

Central Garden & Pet's legal obligations extend to product safety and labeling, particularly for pet food and chemicals. For example, the U.S. Consumer Product Safety Commission (CPSC) sets standards for pet toys, and any non-compliance can lead to recalls and fines. Adherence to the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) is critical for its lawn and garden products, ensuring proper registration and labeling to protect consumers and the environment.

The company must also contend with international trade laws and customs regulations when importing and exporting goods, impacting supply chain efficiency and costs. Furthermore, data privacy laws, such as the California Consumer Privacy Act (CCPA), necessitate careful handling of customer information collected through its e-commerce platforms and loyalty programs.

Central Garden & Pet's intellectual property is protected by trademark and patent laws, requiring vigilance against infringement. The company actively defends its brands and proprietary technologies through legal means, as seen in its fiscal year 2023 efforts to protect its market position. This legal framework is essential for maintaining competitive advantage and brand value.

Navigating employment law is also a key legal consideration, covering areas like wage and hour compliance and workplace safety regulations. In 2024, many states saw adjustments to minimum wage laws, directly impacting the company's labor costs across its operations.

| Legal Factor | Description | Impact on Central Garden & Pet | Relevant Regulations/Examples | 2023/2024 Data/Trends |

| Product Liability & Safety | Ensuring products meet safety and efficacy standards. | Risk of recalls, lawsuits, and reputational damage. | CPSC, FIFRA, FDA regulations. | Increased FDA pet food recalls in 2023 due to contamination. |

| Intellectual Property | Protecting patents, trademarks, and proprietary formulations. | Safeguarding brand value and market position. | Patent and trademark laws. | Company reported net sales increase in FY2023, highlighting asset protection importance. |

| Labor Laws | Compliance with wage, hour, and workplace safety rules. | Impact on payroll costs and operational compliance. | Minimum wage laws, OSHA standards. | Multiple states increased minimum wage in 2024. |

| Advertising & Marketing | Adhering to truthfulness and substantiation requirements. | Avoiding fines and protecting brand reputation. | FTC Act, EPA guidelines for pesticide advertising. | FTC continued focus on environmental marketing claims in 2023. |

Environmental factors

Climate change and increasingly unpredictable weather patterns are significantly altering the gardening landscape. This directly impacts Central Garden & Pet’s business by affecting the length of the gardening season, water availability, and the types of pests that thrive, all of which influence consumer demand for specific products. For instance, extended dry spells in some regions may boost demand for drought-tolerant plants and water-saving irrigation systems, while unseasonably warm winters could increase the need for pest control solutions.

Central Garden & Pet must proactively adapt its product lines and supply chain to these environmental shifts. This could involve investing in research and development for drought-resistant seeds and plants, or creating more targeted pest management solutions suited to changing insect populations. The company’s ability to anticipate and respond to these evolving conditions, such as the projected increase in extreme weather events impacting agricultural yields, will be crucial for maintaining market relevance and profitability.

Central Garden & Pet's reliance on raw materials like peat moss and fertilizers presents significant environmental challenges. The availability of these resources is increasingly tied to sustainable land management practices, with growing consumer and regulatory pressure to reduce environmental footprints. For instance, concerns over peat bog degradation, a key component in many potting soils, are driving innovation towards alternatives.

The company's commitment to responsible sourcing is paramount, especially as consumers demand transparency regarding the origins and environmental impact of ingredients in products, including pet food. Exploring renewable and recycled material alternatives for packaging and product components is becoming essential for long-term viability and brand reputation, especially in light of increasing waste reduction mandates.

Central Garden & Pet faces growing pressure from consumers and regulators to minimize waste and adopt eco-friendly packaging. This directly influences their product development, pushing for materials that are recyclable or compostable. For instance, in 2023, the U.S. generated approximately 300 million tons of municipal solid waste, with packaging accounting for a significant portion, highlighting the urgency of this trend.

To align with environmental targets and consumer preferences, the company must invest in innovative packaging solutions. This includes exploring reduced packaging designs and materials that can be easily recycled or composted. Companies that successfully navigate this shift often see improved brand perception and potentially lower long-term waste disposal costs.

Water Conservation and Pollution

Water scarcity and pollution are significant environmental factors impacting Central Garden & Pet. Growing concerns over limited freshwater resources and contamination from agricultural and industrial activities directly influence the garden and pet supply sectors. For instance, in 2023, the U.S. experienced widespread drought conditions, affecting water availability for gardening and potentially increasing demand for drought-resistant products.

Central Garden & Pet has a clear incentive to innovate in water conservation. This includes developing and promoting water-efficient garden products, such as low-flow irrigation systems and drought-tolerant plant foods. The company must also ensure its manufacturing processes are optimized to minimize water consumption and prevent the discharge of pollutants, adhering to increasingly stringent environmental regulations.

- Water Scarcity Impact: Regions facing water stress, like parts of California and the Southwest, see a direct impact on consumer gardening habits and product demand.

- Pollution Concerns: Runoff from agricultural fertilizers and pesticides, as well as industrial wastewater, can contaminate water sources, affecting both ecosystems and human health, and thus consumer perception of related products.

- Regulatory Pressure: Environmental Protection Agency (EPA) regulations on water quality and discharge limits are becoming more rigorous, requiring companies like Central Garden & Pet to invest in cleaner production methods.

- Consumer Demand for Sustainability: A growing segment of consumers is actively seeking out environmentally friendly products, including those that promote water conservation in homes and gardens.

Biodiversity and Ecosystem Protection

Central Garden & Pet faces increasing scrutiny regarding the environmental impact of its products, particularly garden chemicals and certain pet supplies, on local ecosystems and biodiversity. This concern stems from the potential for these products to harm beneficial insects, pollinators, and aquatic life, disrupting delicate ecological balances. For instance, studies in 2024 continue to highlight the negative correlation between widespread neonicotinoid use and declining bee populations, a key concern for the gardening sector.

To address this, Central Garden & Pet can proactively develop and market eco-friendly alternatives, such as organic pest control solutions and biodegradable pet waste bags. Promoting responsible product usage through clear labeling and educational campaigns is also crucial. By the end of 2025, the company aims to have at least 25% of its new product introductions be certified as environmentally preferable. Furthermore, a rigorous review of its supply chain in 2024 revealed opportunities to partner with suppliers committed to sustainable sourcing and to phase out ingredients linked to habitat degradation, particularly in regions with high biodiversity.

- Growing consumer demand for sustainable gardening and pet products.

- Regulatory pressures on chemical usage in lawn and garden care.

- Potential for brand enhancement through demonstrable commitment to biodiversity.

- Risk of negative publicity and consumer backlash for non-compliance.

Environmental factors significantly shape Central Garden & Pet's operational landscape, from sourcing raw materials to consumer purchasing decisions. Climate change impacts product demand by altering growing seasons and pest prevalence, while water scarcity and pollution necessitate innovative, water-efficient solutions. The company must also navigate increasing consumer and regulatory demands for sustainable packaging and reduced environmental footprints, particularly concerning product ingredients and their impact on biodiversity.

| Environmental Factor | Impact on Central Garden & Pet | Key Data/Trends (2023-2025) |

| Climate Change & Weather Patterns | Alters demand for gardening products, influences pest control needs. | Extended dry spells boost demand for drought-tolerant items; warmer winters increase pest control product needs. |

| Resource Availability & Sustainability | Availability of peat moss and fertilizers tied to sustainable practices; consumer pressure for eco-friendly alternatives. | Concerns over peat bog degradation drive innovation in potting soil alternatives. |

| Waste Management & Packaging | Pressure for recyclable/compostable packaging; need to reduce waste. | US generated ~300 million tons of municipal solid waste in 2023, packaging a significant portion. |

| Water Scarcity & Pollution | Impacts gardening habits; requires water-efficient product development. | Widespread drought conditions in 2023 affected water availability. EPA regulations on water quality are tightening. |

| Ecosystem Impact & Biodiversity | Scrutiny on garden chemicals and pet supplies affecting local ecosystems. | Studies in 2024 highlight negative correlations between neonicotinoid use and bee populations. Company aims for 25% of new products to be environmentally preferable by end of 2025. |

PESTLE Analysis Data Sources

Our Central Garden PESTLE analysis is built on a robust foundation of data from leading horticultural industry reports, government agricultural statistics, and environmental research institutions. We integrate insights from market trend analyses, consumer behavior studies, and regulatory updates to provide a comprehensive view.