Central Garden Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Garden Bundle

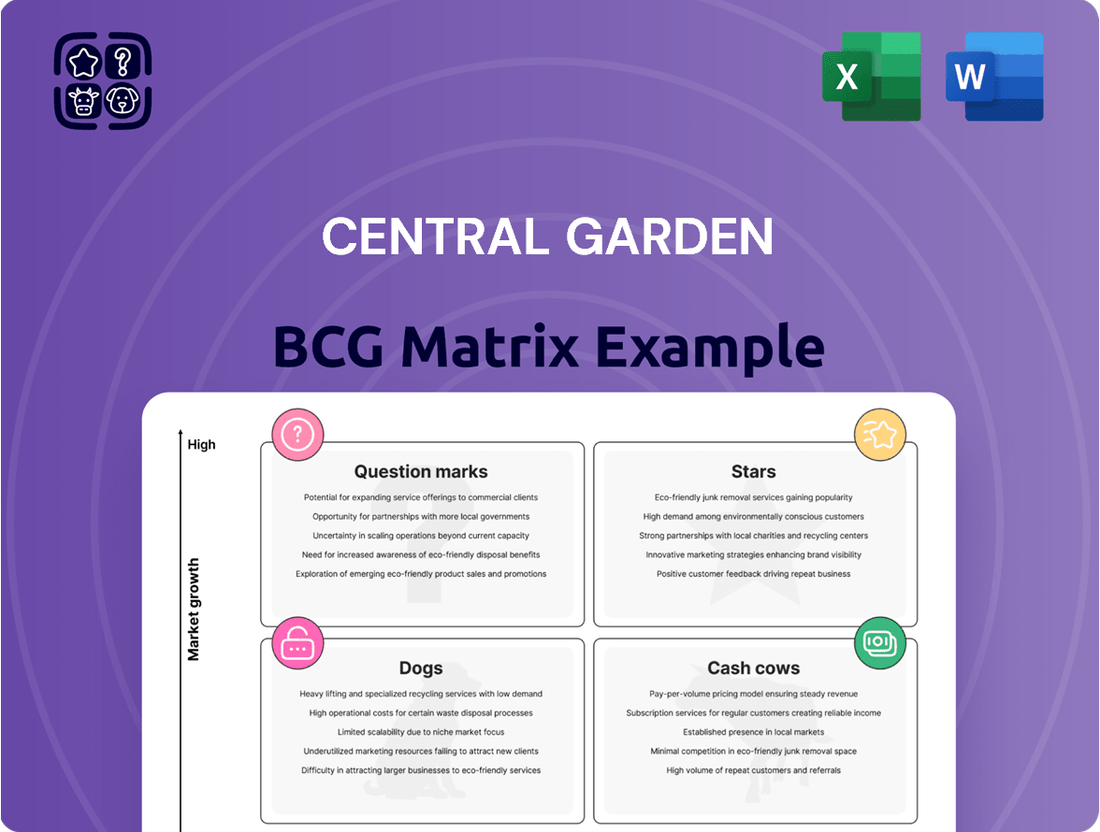

This glimpse into the Central Garden BCG Matrix highlights its current product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Understanding these placements is crucial for informed strategic decisions. Purchase the full BCG Matrix for a comprehensive breakdown, including detailed quadrant analysis and actionable recommendations to optimize your investment and product management strategies.

Stars

Pennington Grass Seed is a strong contender in the lawn and garden market, particularly within the booming e-commerce sector. Its number one online sales position highlights significant market penetration and customer reach through digital channels. This dominance in online sales, a segment experiencing rapid growth, suggests Pennington holds a substantial market share in this evolving retail landscape.

Central Garden & Pet has secured the top spot in online sales for the Wild Bird Feed category, a significant achievement reflecting their strong market presence. This success underscores the effectiveness of their investment in enhanced digital capabilities, which are directly translating into robust performance in the e-commerce channel.

The company's dominance in online Wild Bird Feed sales highlights a key growth area within the broader pet care market. In 2024, the online pet supplies market continued its upward trajectory, with e-commerce accounting for a substantial portion of overall sales, demonstrating the strategic importance of digital channels for companies like Central Garden & Pet.

Nylabone's dog chew and rawhide segment is shining brightly, having captured increased market share in Q2 FY2025. This performance is fueled by a robust pet care market, which saw a notable surge in pet ownership and spending on premium pet products throughout 2024. This expansion within a growing industry strongly suggests Nylabone's chew and rawhide products are indeed Stars in the Central Garden BCG Matrix.

Premium Pet Food & Treats (e.g., TDBBS acquisition)

Central Garden & Pet's acquisition of TDBBS, a premium natural dog treat provider, in late 2023 significantly bolsters its presence in the burgeoning pet segment. This strategic move aligns with the robust performance of the premium pet food sector, which experienced double-digit unit growth in 2024, underscoring its status as a high-potential market.

The company's emphasis on premium brands, exemplified by the TDBBS integration, positions these offerings as key growth drivers. This strategic focus is crucial for Central Garden & Pet's overall market strategy.

- Acquisition Impact: TDBBS acquisition enhances Central Garden & Pet's premium pet food and treats portfolio.

- Market Growth: The premium pet food segment exhibited strong double-digit unit growth in 2024.

- Strategic Positioning: Focus on premium brands like TDBBS drives growth and market share.

- BCG Matrix Placement: These premium offerings are likely positioned as Stars within the Central Garden portfolio due to high growth and market share potential.

Amdro (Pest Control)

Amdro, a prominent brand within Central Garden & Pet's extensive portfolio, plays a significant role in the pest control market. While precise 2025 market share figures for Amdro are not publicly detailed, the brand is recognized for its established presence in a category that experiences consistent demand from consumers seeking effective garden pest solutions.

Central Garden & Pet's strategic emphasis on fortifying its diverse brand offerings suggests Amdro likely holds a solid market standing. The pest control segment, though perhaps not experiencing explosive growth, remains a vital and consistently utilized product category within the broader gardening landscape.

The company's overall strategy often involves leveraging established brands like Amdro to meet ongoing consumer needs.

- Brand Strength: Amdro is a well-recognized name in pest control, contributing to Central Garden & Pet's portfolio of over 65 brands.

- Market Stability: The pest control segment, where Amdro operates, generally sees consistent demand, indicating a stable market position.

- Company Strategy: Central Garden & Pet's focus on strengthening its brand portfolio supports Amdro's likely continued relevance and market share.

Stars represent products with high market share in high-growth industries. Nylabone's chew and rawhide products are a prime example, experiencing increased market share in Q2 FY2025 amidst a booming pet care market. Similarly, Central Garden & Pet's premium pet food and treats, bolstered by the TDBBS acquisition, are positioned as Stars due to the segment's double-digit unit growth in 2024.

These brands exhibit strong performance and are in rapidly expanding markets, indicating significant potential for continued revenue generation and market leadership. Their current success and the favorable industry trends strongly suggest they will remain key growth drivers for Central Garden & Pet.

| Brand/Category | Market Growth | Market Share Trend | BCG Matrix Classification |

|---|---|---|---|

| Nylabone (Chews & Rawhide) | High (Booming Pet Care Market) | Increasing (Q2 FY2025) | Star |

| Premium Pet Food & Treats (e.g., TDBBS) | High (Double-digit unit growth in 2024) | Growing (Bolstered by acquisition) | Star |

What is included in the product

The Central Garden BCG Matrix analyzes its product portfolio by categorizing items into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, or maintenance for each product category.

Provides a clear, visual roadmap for resource allocation, easing the pain of strategic uncertainty.

Cash Cows

Farnam, a brand with a 75-year history in equine products, operates as a significant division within Central Garden & Pet. Its long-standing reputation and continued investment in strengthening its leadership position point to a well-established presence in the horse care market.

This maturity, coupled with a high market share, strongly suggests Farnam functions as a Cash Cow. Such brands typically generate substantial and reliable cash flow, a characteristic of mature businesses with limited but stable growth potential.

Central Garden & Pet's established fertilizers and weed control products are prime examples of Cash Cows within their portfolio. These are foundational items for homeowners, representing a mature market segment where consistent demand fuels steady cash flow.

The lawn and garden sector, particularly for these essential maintenance products, demonstrates resilience. In 2024, the US lawn and garden market was valued at approximately $10.5 billion, with fertilizers and weed control making up a significant portion. Central Garden & Pet likely holds a substantial market share in this segment, benefiting from recurring purchases rather than rapid expansion.

Aqueon, a prominent brand in Central Garden & Pet's aquatics segment, operates within a steady, albeit not rapidly expanding, sector of the pet industry. This stability suggests a mature market position for Aqueon.

Given its established reputation, Aqueon is likely a significant player in the aquatics market, commanding a substantial share. This strong market position translates into reliable revenue streams for Central Garden & Pet, acting as a dependable source of cash flow for the company.

Kaytee (Small Animal & Bird Supplies)

Kaytee stands as a prominent brand in the small animal and bird supply market, indicating a substantial market share within this segment. While younger demographics like Gen Z are showing increased interest in specialized areas such as bird and fish keeping, Kaytee's broad product range for various small animals points to its strong, established presence in a market that isn't experiencing explosive growth.

This mature market position, coupled with consistent consumer demand for essential pet supplies, allows Kaytee to function as a reliable cash cow. The brand likely benefits from steady sales volumes, generating consistent revenue that can support other, potentially higher-growth ventures within the parent company's portfolio. For instance, the small animal food and bedding market, where Kaytee is a key player, saw consistent demand throughout 2024, with reports indicating stable year-over-year sales for essential pet care items.

- Brand Strength: Kaytee is a recognized leader in small animal and bird supplies.

- Market Position: Holds a high market share in a mature, stable market segment.

- Revenue Generation: Benefits from consistent demand, acting as a reliable cash generator.

- Growth Drivers: While overall growth may be moderate, niche category interest from Gen Z provides some uplift.

Core Pet Consumables (Excluding Premium/New)

The core pet consumables segment, excluding premium or new offerings, within Central Garden's pet business is a classic example of a Cash Cow. This category likely holds a substantial market share in a market that is both mature and stable.

These everyday pet essentials, such as standard kibble and common treats, generate predictable and consistent revenue streams. While premium pet food is indeed a growth driver, the foundational consumables are the bedrock of the business, ensuring reliable income.

- Market Share: High in a mature market.

- Revenue Generation: Consistent and predictable from essential products.

- Growth Potential: Limited, but stable cash flow is the primary objective.

- Strategic Importance: Provides stable funding for other business units.

Cash Cows within Central Garden & Pet's portfolio represent established brands in mature markets, generating consistent and substantial cash flow with limited growth prospects. These are the reliable revenue generators that fund other strategic initiatives.

Brands like Farnam in equine care and Aqueon in aquatics exemplify this, benefiting from high market share in stable segments. Similarly, core pet consumables and established lawn and garden products, such as fertilizers, contribute significantly to this category.

In 2024, the US lawn and garden market reached approximately $10.5 billion, with Central Garden & Pet's mature product lines holding a strong position, ensuring steady sales from repeat customers.

The small animal food and bedding market, where Kaytee is a leader, also demonstrated stable year-over-year sales for essential pet care items, underscoring the dependable nature of these Cash Cow brands.

| Brand Example | Market Segment | BCG Category | Key Characteristic | 2024 Market Context |

|---|---|---|---|---|

| Farnam | Equine Products | Cash Cow | High Market Share, Mature Market | Stable demand in established horse care market. |

| Aqueon | Aquatics | Cash Cow | High Market Share, Stable Growth | Reliable revenue from a mature pet sector. |

| Core Pet Consumables | Pet Food & Supplies | Cash Cow | High Market Share, Predictable Revenue | Foundation of pet business, consistent sales. |

| Fertilizers & Weed Control | Lawn & Garden | Cash Cow | High Market Share, Mature Market | Part of a $10.5 billion US market, recurring purchases. |

Delivered as Shown

Central Garden BCG Matrix

The Central Garden BCG Matrix you are currently previewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis is designed to provide your business with actionable insights into your product portfolio's strategic positioning, without any watermarks or placeholder content.

Dogs

Central Garden & Pet's durable private label pet products are currently positioned as a 'dog' in the BCG matrix. This segment has experienced a significant downturn, with sales declining by double digits.

The company has actively worked on SKU rationalization and has exited certain durable private label product lines. This strategic move reflects the reality of a low market share within a segment that is either experiencing low growth or is in decline, suggesting these products are candidates for divestiture or a substantial reduction in investment.

Central Garden & Pet is phasing out its physical operations in the UK for its Pet segment. This move involves shifting to a direct export model, which is a clear indicator that the existing UK business was likely a Dog in the BCG matrix. The company's decision to incur initial costs for this transition points to the UK segment not meeting profitability or market share expectations, aligning with the characteristics of a low-growth, low-market share business unit.

Central Garden & Pet's live animal sales, particularly dogs, have experienced a notable slowdown following a pandemic-induced boom. This trend contrasts with stable or growing sales in cat and small animal categories, indicating a potential weakness in the dog segment.

The decline in dog sales, a significant industry driver, suggests that Central Garden & Pet may be facing low growth and possibly a reduced market share in this area compared to its other business units. For instance, in 2023, the pet industry saw a moderation in growth rates after the exceptional performance during 2020-2021, with some segments experiencing a slight contraction.

Underperforming Garden SKUs (SKU Rationalization)

Central Garden's strategic SKU rationalization initiative is actively addressing underperforming product lines within its garden segment. This process focuses on eliminating items that exhibit low market share and limited growth prospects, thereby freeing up valuable resources. These particular garden SKUs, characterized by their poor performance, would align with the 'Dogs' quadrant of the BCG Matrix.

- Underperforming Garden SKUs: Products with low market share and low growth potential are being identified for removal.

- Resource Reallocation: Eliminating these 'Dogs' allows Central Garden to redirect capital and operational focus to more promising areas.

- BCG Matrix Alignment: These rationalized garden products fit the 'Dogs' category, signifying a need for divestment or minimal investment.

- Industry Trend: SKU rationalization is a common strategy; for instance, in 2024, many large retailers reported reducing their product assortments by 10-15% to streamline operations and improve profitability.

Commodity-Driven Garden Products (e.g., certain grass seed inventory)

Commodity-driven garden products, such as certain types of grass seed, can face challenges within the Central Garden & Pet portfolio. For instance, Central Garden & Pet's fiscal 2024 fourth-quarter results were notably affected by a $13 million impairment charge related to grass seed inventory. This situation underscores the inherent volatility associated with agricultural commodity prices.

This volatility can lead to these products being susceptible to market fluctuations. Consequently, they may experience periods of low profitability and inconsistent market share. In times of market downturn or price instability for these commodities, such products can be classified as Dogs in the BCG Matrix.

- Inventory Impairment: Central Garden & Pet recorded a $13 million impairment of grass seed inventory in fiscal 2024 Q4.

- Commodity Price Volatility: Agricultural commodity prices directly impact the profitability of products like grass seed.

- Market Susceptibility: These products can be prone to low profitability and fluctuating market share due to price swings.

- BCG Classification: In periods of downturn or price instability, these items may be categorized as Dogs.

Central Garden & Pet's durable private label pet products and certain commodity-driven garden items, like grass seed, are currently positioned as 'Dogs' in the BCG matrix. These segments face declining sales, as evidenced by double-digit declines in some durable private label lines and a $13 million impairment charge for grass seed inventory in fiscal 2024 Q4. The company's strategic SKU rationalization and phasing out of UK physical operations for its Pet segment further highlight the challenges in these low-growth, low-market share areas.

| Product Category | BCG Classification | Key Performance Indicators | Strategic Action | Financial Impact (FY2024) |

|---|---|---|---|---|

| Durable Private Label Pet Products | Dogs | Double-digit sales decline, low market share | SKU rationalization, exiting product lines | N/A (specific financial impact not detailed) |

| Grass Seed | Dogs | Volatility in commodity prices, periods of low profitability | Inventory impairment, potential divestment | $13 million impairment charge (Q4 FY2024) |

| Live Animal Sales (Dogs) | Dogs | Slowdown post-pandemic boom, lower growth than other pet categories | Focus on other pet segments, potential repositioning | N/A (specific financial impact not detailed) |

Question Marks

The landscaping and gardening sector is rapidly adopting smart technologies like automated irrigation and robotic mowers. For Central Garden & Pet, venturing into these areas places them in a high-growth market. However, as these technologies are still emerging, the company would likely hold a low initial market share, necessitating substantial investment for market penetration.

Central Garden & Pet's exploration into new digital and e-commerce initiatives beyond its strongholds like wild bird feed and grass seed signifies a strategic pivot. These ventures, targeting less established product lines, are positioned in a rapidly expanding digital marketplace. However, they represent a significant investment with uncertain immediate returns, reflecting a high-risk, high-reward profile within the BCG matrix.

For instance, while Central Garden & Pet saw its e-commerce sales grow significantly, with digital channels contributing a substantial portion of revenue in recent years, these new initiatives are inherently speculative. In 2023, the company reported robust growth across its digital platforms, but the success of entirely new e-commerce ventures for categories with minimal existing digital presence remains to be seen. These efforts would likely be classified as question marks, requiring substantial capital and focused management attention to gain market traction.

The pet travel accessories and services segment represents a burgeoning area within the pet industry. Younger demographics, in particular, are increasingly choosing to travel with their pets, fueling demand for specialized products and services. This trend is supported by data indicating a significant rise in pet-friendly accommodations and transportation options.

Central Garden & Pet's potential involvement in this high-growth market, perhaps through new product lines for pet travel or strategic alliances within the pet boarding sector, would place it in a category with substantial future potential. However, if the company currently holds a minimal share of this specific market, it would align with the characteristics of a question mark in the BCG matrix, requiring careful consideration for investment and strategic development.

Pet Fitness Monitoring & Wellness Products

Central Garden & Pet's potential expansion into pet fitness monitoring and wellness products taps into a booming sector. The global pet wearable market was valued at approximately $4.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 16.5% through 2030, reaching an estimated $12.4 billion. This positions such ventures as potential stars within the BCG matrix, demanding significant investment to capture a nascent market share.

- Market Growth: The pet fitness care market is experiencing rapid expansion, driven by the humanization of pets and increased owner spending on pet health and well-being.

- Investment Needs: Entering this segment would likely require substantial investment in research, development, and marketing to establish a competitive presence.

- Strategic Fit: Aligning with the humanization trend, these products offer a high-growth opportunity that could diversify Central Garden & Pet's portfolio.

- Potential Returns: Successful penetration into this market could yield significant returns as pet owners increasingly prioritize advanced health monitoring for their companions.

Sustainable & Eco-Friendly Garden Solutions

The demand for sustainable and eco-friendly gardening solutions is rapidly expanding, driven by increasing environmental awareness. Central Garden & Pet's strategic focus on this area positions it to capitalize on a high-growth market segment. For instance, the U.S. market for sustainable landscaping services alone was valued at approximately $10.8 billion in 2023 and is projected to grow significantly.

Central Garden & Pet's investment in drought-resistant plants, native species, and organic gardening products aligns with this burgeoning trend. Such initiatives could represent new product lines or brand acquisitions, placing the company in a category with substantial future potential. However, as a relatively new entrant into these specific niches, their initial market share might be modest, requiring substantial effort to establish a dominant presence.

- Market Growth: The global green or eco-friendly landscaping market is expected to reach $254.6 billion by 2030, growing at a CAGR of 5.9% from 2023 to 2030.

- Consumer Demand: A 2024 survey indicated that over 60% of U.S. homeowners are interested in incorporating more native or drought-tolerant plants into their gardens.

- Investment Focus: Central Garden & Pet's reported investments in research and development for organic fertilizers and water-saving irrigation systems underscore their commitment to this segment.

Question marks in the BCG matrix represent business units or product lines that are in high-growth markets but currently hold low market share. These ventures require significant investment to increase market share and are uncertain to succeed. Central Garden & Pet's forays into areas like smart gardening technology and pet travel accessories exemplify this category. The company must carefully allocate resources to these emerging opportunities, as they have the potential to become future stars or may fail to gain traction.

| Business Area | Market Growth | Market Share (Estimated) | Investment Need | Potential |

|---|---|---|---|---|

| Smart Gardening Tech | High | Low | High | Star or Dog |

| Pet Travel Accessories | High | Low | High | Star or Dog |

| Pet Fitness Monitoring | Very High (CAGR ~16.5% 2023-2030) | Low | High | Potential Star |

| Sustainable Gardening | High (US Market ~$10.8B in 2023) | Low | High | Potential Star |

BCG Matrix Data Sources

Our Central Garden BCG Matrix is constructed using a blend of internal sales data, customer feedback, and market research reports. This ensures a comprehensive view of product performance and market dynamics.