Central Garden Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Central Garden Bundle

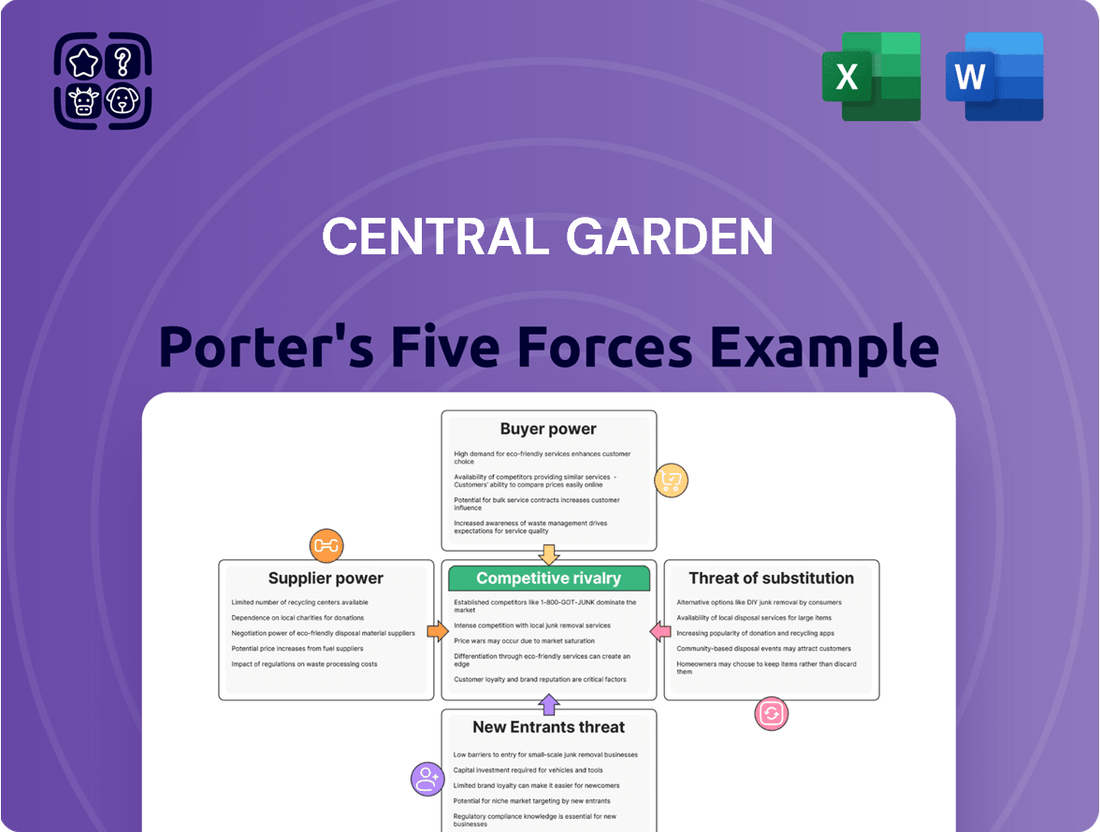

Central Garden faces moderate bargaining power from both suppliers and buyers, as well as a significant threat from substitute products in the lawn and garden sector. The intensity of rivalry within the industry is also a key consideration.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Central Garden’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

If Central Garden & Pet relies on a limited number of suppliers for essential components like specialized resins for plastic planters or unique nutrient blends for lawn care products, those suppliers gain considerable bargaining power. This leverage becomes more pronounced if the cost or difficulty of switching to a different supplier is substantial, or if these specific inputs are vital for maintaining Central's product differentiation and perceived quality.

The bargaining power of suppliers for Central Garden & Pet significantly diminishes when readily available substitutes for their necessary inputs exist. For instance, if the company can easily source standard packaging materials or common agricultural components from multiple vendors, individual suppliers lose leverage to impose unfavorable pricing or terms. In 2024, the agricultural supply chain, particularly for inputs like fertilizers and seeds, continued to see diversification, with new domestic and international producers entering the market, thereby increasing the availability of alternatives for companies like Central Garden & Pet.

Central Garden & Pet's (CENT) reliance on its suppliers significantly influences their bargaining power. If CENT accounts for a substantial percentage of a supplier's total sales, that supplier has less leverage. For instance, if a key ingredient supplier derives 30% of its revenue from CENT, it's less likely to impose unfavorable terms, as losing CENT's business would be detrimental.

Conversely, if CENT is a minor client for a large supplier, the supplier's bargaining power increases. Imagine a specialized component manufacturer that supplies CENT with only 2% of its output. This supplier can more readily dictate terms or raise prices because CENT's business is not critical to its overall financial health.

In 2023, Central Garden & Pet reported total cost of goods sold of approximately $2.3 billion. The distribution of this spending across various suppliers dictates the specific bargaining dynamics at play. A supplier providing a unique, high-volume component would likely have less power than one supplying a commodity item where CENT can easily find alternatives.

Threat of Forward Integration by Suppliers

Suppliers might increase their leverage if they could credibly threaten to move into manufacturing and distributing their own finished lawn, garden, or pet products. This forward integration by suppliers would directly compete with Central Garden & Pet's existing business lines.

For instance, a major supplier of pet food ingredients could potentially start producing and branding its own line of pet food, bypassing Central Garden & Pet entirely. Such a move would force Central Garden & Pet to assess the potential impact on its market share and profitability.

The threat of forward integration is a significant factor in supplier bargaining power. In 2023, the global pet food market was valued at approximately $110 billion, with significant growth projected. A large ingredient supplier could capture a portion of this market if they chose to integrate forward.

- Supplier Forward Integration: Suppliers may gain power by threatening to produce and sell finished goods, directly competing with Central Garden & Pet.

- Competitive Impact: This threat forces Central Garden & Pet to evaluate the potential market share and profitability risks associated with supplier competition.

- Market Context: The substantial global pet food market, valued around $110 billion in 2023, presents a clear incentive for ingredient suppliers to consider forward integration.

Cost of Inputs Relative to Product Price

When the cost of key inputs makes up a large chunk of Central Garden & Pet's total product expenses, suppliers gain leverage. This is especially evident for specialized ingredients or materials, where any price hike directly and significantly affects Central's profit margins and its ability to price competitively. For instance, if a primary component for their popular lawn care products sees a substantial price increase, it directly squeezes Central's profitability.

This dynamic is amplified when Central Garden & Pet has limited alternatives for these critical inputs. If sourcing a particular chemical or packaging material is restricted to a few suppliers, those suppliers can dictate terms more effectively. This reliance on a narrow supplier base means Central has less room to negotiate favorable pricing or terms, potentially impacting their bottom line.

- Input Cost Significance: The proportion of input costs relative to the final selling price directly influences supplier bargaining power.

- Specialized Inputs: For unique or specialized materials, suppliers often command higher prices due to limited availability or proprietary nature.

- Profitability Impact: Price increases in critical inputs can substantially erode Central Garden & Pet's profit margins.

- Competitive Pricing: Higher input costs can force Central Garden & Pet to raise its own prices, potentially losing market share.

Suppliers hold significant bargaining power when Central Garden & Pet relies on a limited number of providers for critical, specialized inputs. This leverage is amplified if switching costs are high or if these inputs are crucial for product quality and differentiation. For example, if a unique nutrient blend for premium lawn care products is sourced from only one or two suppliers, those suppliers can command higher prices.

Conversely, supplier power wanes when readily available substitutes exist for essential materials, such as common packaging or basic agricultural components. In 2024, the agricultural sector saw increased diversification in sourcing, offering more alternatives. Central Garden & Pet's (CENT) substantial contribution to a supplier's revenue also reduces that supplier's leverage; if CENT represents a significant portion of their sales, they are less likely to impose unfavorable terms to avoid losing that business.

The bargaining power of suppliers for Central Garden & Pet is also influenced by the proportion of input costs to the final product price. When key inputs represent a large percentage of expenses, suppliers gain leverage, especially for specialized materials where price hikes directly impact Central's profit margins and competitive pricing. This is compounded by limited alternatives for these critical inputs, reducing Central's negotiation flexibility.

| Factor | Impact on Supplier Bargaining Power | Example for Central Garden & Pet |

|---|---|---|

| Supplier Concentration | High power if few suppliers exist for critical inputs. | Sourcing specialized pet food ingredients from a single, dominant producer. |

| Availability of Substitutes | Low power if many alternative suppliers or materials exist. | Easily sourcing standard plastic resins for planters from multiple vendors. |

| Importance of Input to Buyer | High power if input is critical for product quality or differentiation. | Unique nutrient blends vital for premium lawn care product performance. |

| Switching Costs | High power if changing suppliers is costly or difficult. | High costs associated with retooling manufacturing for new packaging materials. |

| Threat of Forward Integration | High power if suppliers can become competitors. | A major pet food ingredient supplier launching its own branded pet food line. |

What is included in the product

This analysis unpacks the competitive forces impacting Central Garden, revealing the intensity of rivalry, buyer and supplier power, the threat of new entrants and substitutes, and their collective influence on the company's profitability.

A dynamic template that allows for easy visualization of competitive intensity, helping to pinpoint and address key market pressures.

Customers Bargaining Power

Central Garden & Pet's customer base is quite diverse, encompassing everyone from large big-box retailers to smaller, independent garden centers. This variety means that the company doesn't rely too heavily on any single type of buyer. However, the concentration of sales within a few key mass-merchant accounts can significantly shift the balance of power.

For instance, if a substantial percentage of Central Garden & Pet's revenue, say over 30%, comes from just a handful of major retailers, those large customers gain considerable leverage. This leverage translates into their ability to demand lower prices, more favorable payment terms, or even specific product customizations, directly impacting the company's profitability and strategic flexibility.

Customers hold significant bargaining power when a wide array of substitute products are readily available. For Central Garden & Pet, this means if consumers can easily find similar lawn, garden, or pet supplies from other brands or even through private label options, they are more likely to push for better pricing or terms. For instance, the pet food market, a key segment for Central Garden & Pet, saw significant growth in private label sales, with some reports indicating these brands captured over 20% of the market share in recent years, directly impacting the bargaining power of consumers.

Central Garden & Pet's customers, especially large mass merchants like Walmart and Target, exhibit significant price sensitivity. This sensitivity directly translates into increased bargaining power for these retailers.

In the highly competitive retail landscape, these mass merchants rely on offering attractive prices to consumers. Therefore, they actively seek to negotiate lower costs from their suppliers, including Central Garden & Pet, to protect their own profit margins and remain competitive on the shelf.

For instance, in fiscal year 2023, Central Garden & Pet reported that its top customers accounted for a substantial portion of its net sales, underscoring the leverage these large buyers hold. This reliance makes it challenging for Central Garden & Pet to resist demands for price concessions when customers have readily available alternatives.

Threat of Backward Integration by Customers

Large retail customers, such as major big-box stores and online marketplaces, hold significant bargaining power. This power is amplified by the potential for backward integration, where these retailers could develop and manufacture their own private-label lawn and garden or pet products. This capability allows them to reduce their dependence on suppliers like Central Garden & Pet, giving them leverage during price and contract negotiations.

For instance, in 2024, the increasing prevalence of private-label brands across various retail sectors, including home and garden, suggests a growing willingness among large retailers to control more of their supply chain. This trend directly impacts companies like Central Garden & Pet by creating a credible threat that could shift purchasing power.

- Threat of Backward Integration: Large retail customers can leverage their scale to produce private-label goods, diminishing reliance on Central Garden & Pet.

- Negotiating Leverage: The possibility of in-house production grants retailers greater power in negotiating terms and pricing with suppliers.

- Market Dynamics: The growing trend of private-label expansion in 2024 across consumer goods sectors underscores this potential threat to established brands.

Information Availability to Customers

Customers today have an unprecedented amount of information at their fingertips. This easy access to competitor pricing, product reviews, and detailed specifications significantly levels the playing field.

For Central Garden & Pet, this means customers can readily compare offerings across the lawn and garden and pet supply sectors. This transparency directly translates into enhanced bargaining power for consumers, as they can actively seek out the most competitive prices and superior value propositions.

- In 2024, online price comparison tools are widely used by consumers, with studies indicating that over 70% of shoppers utilize them before making a purchase in retail sectors.

- The lawn and garden market, in particular, has seen a surge in direct-to-consumer (DTC) brands offering transparent pricing and detailed product information, further educating consumers.

- For pet supplies, online retailers often provide loyalty programs and subscription discounts, which consumers are adept at leveraging to reduce their overall spending.

Central Garden & Pet's customers, particularly large retailers, wield considerable bargaining power due to their significant purchasing volume and the availability of substitutes. This leverage allows them to negotiate lower prices and more favorable terms, directly impacting the company's profitability. The threat of backward integration, where retailers might develop their own private-label products, further amplifies this customer power.

The increasing transparency in pricing, driven by online comparison tools and direct-to-consumer brands, empowers consumers to seek the best value. In 2024, the widespread use of these tools means customers are well-informed, pushing for competitive pricing and potentially reducing the pricing power of suppliers like Central Garden & Pet.

| Customer Segment | Bargaining Power Factors | Impact on Central Garden & Pet |

|---|---|---|

| Large Mass Merchants (e.g., Walmart, Target) | High purchase volume, price sensitivity, threat of backward integration (private labels) | Significant leverage for price negotiations, potential loss of sales to private labels |

| Independent Garden Centers | Lower individual volume, but collective power can increase with substitutes | Less individual leverage, but can shift to other suppliers if pricing is unfavorable |

| Online Retailers/Marketplaces | Price transparency, ability to bundle and offer discounts, customer loyalty programs | Pressure to offer competitive online pricing and promotions |

Full Version Awaits

Central Garden Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're viewing a comprehensive Porter's Five Forces analysis of Central Garden, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted analysis is ready for your immediate use.

Rivalry Among Competitors

The lawn and garden sector is quite crowded, featuring a mix of large, well-known companies and smaller, niche businesses. This variety means there are many players all trying to grab a piece of the market. For example, in 2024, the U.S. lawn and garden market alone was valued at over $100 billion, showcasing the significant number of companies operating within it.

This high number of competitors, each with different strengths and strategies, fuels intense rivalry. Companies must constantly innovate and differentiate their products and services to stand out. The pet supply market mirrors this, with numerous brands competing for consumer loyalty, especially as pet ownership continues to grow, reaching an estimated 66% of U.S. households in 2023.

The growth rate of the pet and garden sectors directly impacts how intensely companies compete. When the market is expanding rapidly, businesses can often grow by simply capturing a larger piece of the increasing pie. However, in slower growth environments, the competition heats up considerably.

In 2024, the pet industry in the U.S. saw continued resilience, with spending projected to reach over $140 billion according to the American Pet Products Association (APPA). While this indicates ongoing demand, a mature market often means companies must fight harder for every customer. This can lead to more aggressive strategies like price reductions or increased advertising to stand out.

Similarly, the garden sector, while experiencing a resurgence, faces its own competitive pressures. For instance, the National Gardening Association reported that while participation remains high, market share battles are fierce among retailers and product manufacturers. In slower economic periods or when growth moderates, expect more intense price competition and a greater emphasis on promotional activities as companies vie for consumer attention and loyalty.

Central Garden & Pet’s strategy hinges on its vast portfolio of over 65 brands, such as Amdro, Kaytee, and Pennington, to cultivate strong brand loyalty and distinguish its offerings. This differentiation is crucial in mitigating intense competition.

However, if these products are perceived as interchangeable or brand allegiance falters, the competitive landscape shifts dramatically. Companies then resort to price-based competition, which can significantly squeeze profit margins.

For instance, in the pet supplies market, where brand loyalty can be strong for premium food or specialized accessories, a shift towards commoditization in basic pet care items would likely intensify rivalry among players like Central Garden & Pet and its competitors.

High Fixed Costs and Inventory Management

Central Garden & Pet, operating in sectors like lawn and garden and pet supplies, faces significant competitive rivalry driven by high fixed costs. Companies in these industries, particularly those with substantial manufacturing and distribution infrastructure, are compelled to run at high capacity to spread these fixed expenses. This often translates into aggressive pricing tactics, especially when trying to clear inventory during off-peak periods.

The pressure to achieve economies of scale in manufacturing and distribution can lead to price wars. For instance, in the broader home improvement retail sector, which includes lawn and garden products, companies might offer deep discounts to move seasonal inventory. This dynamic is amplified by the need to manage perishable or time-sensitive goods, like live plants or certain pet foods, adding another layer of complexity to inventory management and pricing decisions.

- High fixed costs in manufacturing and distribution necessitate high capacity utilization.

- This can lead to intense rivalry and aggressive pricing strategies to maximize sales volume.

- Inventory management is critical, especially for seasonal or time-sensitive products, influencing pricing.

Exit Barriers

Central Garden & Pet, like many in the lawn and garden industry, faces the challenge of high exit barriers. These can include specialized manufacturing equipment, long-term supply agreements, and substantial costs associated with workforce severance or plant closures. For instance, a company heavily invested in specific types of fertilizer production machinery would find it difficult and expensive to repurpose or sell that equipment if market demand shifted.

These significant exit costs can trap even unprofitable businesses within the industry. Such companies might continue to operate, albeit at reduced profit margins, to simply cover their fixed costs or avoid the immediate financial shock of shutting down. This persistence of struggling firms intensifies competition for healthier players like Central Garden & Pet, as they are forced to compete against businesses that may not be operating under the same profitability expectations.

The presence of these barriers means that the competitive landscape can remain crowded even when some participants are clearly underperforming. This situation can lead to price wars or a general downward pressure on margins across the sector. For Central Garden & Pet, this translates to a need for continuous operational efficiency and strategic differentiation to maintain its competitive edge against firms that are, in essence, subsidized by their inability to exit the market gracefully.

- Specialized Assets: High capital investment in manufacturing plants and equipment for products like fertilizers or pesticides can be difficult to sell or repurpose.

- Long-Term Contracts: Commitments with suppliers or distributors can obligate companies to continue operations even when unprofitable.

- Employee Severance Costs: Significant payouts for laid-off workers can act as a deterrent to closing facilities.

- Market Saturation: A crowded market, even with struggling players, means more direct competition for Central Garden & Pet's market share.

The lawn and garden sector is characterized by intense rivalry due to a large number of competitors, ranging from major corporations to smaller specialized firms. This crowded market, valued at over $100 billion in the U.S. in 2024, forces companies like Central Garden & Pet to constantly innovate and differentiate their offerings, such as their portfolio of over 65 brands, to capture market share and maintain profitability.

SSubstitutes Threaten

The threat of substitutes for Central Garden & Pet's garden segment is significant. Consumers are increasingly exploring alternative lawn and garden care methods that bypass traditional chemical fertilizers and pesticides. This includes a growing interest in organic gardening, which relies on natural pest control and soil enrichment, as well as a rise in low-maintenance landscaping designs that inherently reduce the need for extensive product usage.

Furthermore, the availability of professional landscaping services presents another substitute. Many homeowners opt to outsource their lawn and garden maintenance, effectively removing the demand for the types of products Central Garden & Pet offers. For instance, reports from 2024 indicate continued growth in the landscaping services sector, with industry revenue projected to reach over $140 billion in the US alone, directly impacting the market share for DIY lawn and garden products.

Professional lawn and pest control services present a significant threat of substitution for Central Garden & Pet's product offerings. Consumers may opt for these services due to the convenience and expertise they provide, bypassing the need to purchase and apply fertilizers, weed killers, or pest control solutions themselves. This is particularly true for individuals with limited time or gardening knowledge.

In 2024, the demand for professional home services, including lawn care and pest control, remained robust. For instance, the U.S. pest control market alone was projected to reach approximately $25 billion in 2024, indicating a substantial consumer preference for outsourced solutions. This trend directly competes with Central Garden & Pet's DIY product market, as consumers weigh the cost and effort of DIY against the perceived value of professional service.

The rise of generic and private label products in both the pet and garden sectors presents a considerable threat of substitutes for Central Garden & Pet. These alternatives frequently come with lower price tags, attracting budget-minded shoppers and potentially chipping away at the market share of established brands. For instance, in the pet food aisle, store-brand kibble can be a compelling alternative to premium offerings, especially when economic conditions tighten.

This pressure is amplified by the fact that many retailers actively promote their own private label brands, often giving them prime shelf space. In 2023, private label sales across the grocery sector in the US accounted for approximately 20% of total sales, a figure that has seen steady growth, indicating consumer willingness to embrace these less branded options. This trend directly impacts Central Garden & Pet's ability to command premium pricing for its branded products.

Pet Adoption Trends and Humanization of Pets

The humanization of pets, a significant trend, means owners are increasingly treating pets as family members. This can lead to demand for premium and specialized products, potentially diverting spending from more traditional, broadly categorized pet supplies that Central Garden & Pet offers. For example, while Central Garden & Pet is a major player in the pet supplies market, the rise of bespoke pet food subscriptions or high-tech pet monitoring devices represents a shift in consumer spending priorities.

While pet adoption rates have generally shown resilience, shifts in these rates can impact the overall market size for pet products. In 2023, for instance, the American Pet Products Association (APPA) reported continued strong spending in the pet industry, but localized data might show variations. A slowdown in adoption in key demographic segments could mean a smaller pool of new pet owners entering the market, affecting demand for entry-level and general pet supplies.

The threat of substitutes also emerges from niche and specialized pet care solutions. As pet owners become more invested in their pets' well-being, they may opt for highly specific products or services that cater to unique needs, such as hypoallergenic grooming supplies or specialized dietary supplements. This fragmentation of the market could mean that Central Garden & Pet's broader product lines face competition from these more targeted offerings.

- Humanization of Pets: Owners increasingly view pets as family, driving demand for premium and specialized items.

- Niche Solutions: Growth in bespoke pet food, high-tech monitoring, and specialized grooming products offers alternatives to broad-line offerings.

- Adoption Rate Impact: Changes in pet adoption trends can influence the overall market size for pet supplies.

Shifting Consumer Preferences (e.g., sustainability)

Central Garden & Pet faces a growing threat from substitutes driven by shifting consumer preferences, particularly towards sustainability. As consumers become more aware and actively seek out eco-friendly and natural products, traditional offerings from Central Garden & Pet could be perceived as less aligned with these evolving values. This trend fuels demand for alternative solutions that cater to a desire for environmentally conscious choices.

For instance, the rise of DIY gardening using organic compost and natural pest control methods directly challenges the market for chemically-based fertilizers and pesticides. In 2023, the global organic gardening market was valued at an estimated $20.1 billion and is projected to grow significantly, indicating a strong consumer shift. This growing preference for "green" alternatives means that if Central Garden & Pet's product portfolio isn't perceived as sufficiently sustainable, consumers may opt for these substitute solutions.

- Growing Demand for Organic Gardening Supplies: The market for organic fertilizers and pest control products is expanding, offering consumers alternatives to conventional chemical-based options.

- Increased Adoption of Natural Lawn Care: Consumers are increasingly opting for natural lawn care solutions, reducing reliance on synthetic treatments.

- Rise of Indoor and Vertical Farming: These methods often utilize specialized nutrient solutions and growing mediums that can bypass traditional outdoor garden supply chains.

- DIY and Upcycling Trends: Consumers are increasingly making their own gardening inputs or repurposing materials, reducing the need to purchase new products.

Central Garden & Pet faces a significant threat from substitutes, particularly in the form of professional services and private label brands. The growing preference for convenience means consumers may opt for landscaping or pest control services rather than purchasing DIY products. For example, the U.S. pest control market was projected to exceed $25 billion in 2024, highlighting this trend.

Additionally, private label brands, often priced lower, are gaining traction. In 2023, private label sales represented about 20% of U.S. grocery sales, demonstrating consumer willingness to choose these alternatives over established brands, impacting Central Garden & Pet's pricing power.

The humanization of pets also drives demand for niche, specialized products, diverting spending from broader pet supply categories. While the pet industry showed resilience in 2023, these specialized offerings represent a substitute for more general pet care items.

| Substitute Category | Description | 2024 Market Data/Trend |

|---|---|---|

| Professional Services | Outsourcing lawn care, gardening, and pest control. | U.S. Landscaping Services: Projected over $140 billion. U.S. Pest Control Market: Projected approx. $25 billion. |

| Private Label Brands | Retailer-owned brands offering lower price points. | U.S. Private Label Grocery Sales: Approx. 20% of total sales (2023). |

| Niche Pet Products | Specialized, premium, or bespoke pet food, accessories, and services. | Growing demand driven by pet humanization trend. |

| Organic & Natural Gardening | DIY solutions using compost, natural pest control, and eco-friendly materials. | Global Organic Gardening Market: Valued at $20.1 billion (2023), with significant projected growth. |

Entrants Threaten

Entering the lawn and garden and pet supply sectors, particularly to compete with established players like Central Garden & Pet, demands considerable financial resources. This includes significant outlays for production plants, logistics infrastructure, and extensive marketing campaigns.

For instance, in fiscal year 2023, Central Garden & Pet reported net sales of $2.2 billion, indicating the scale of operations that new entrants would need to match to gain meaningful market share. The capital needed for such an endeavor acts as a substantial hurdle, deterring many potential new competitors.

Central Garden & Pet's formidable brand loyalty and deeply entrenched distribution networks present a significant barrier to new entrants. The company boasts a diverse portfolio of over 65 well-recognized brands, fostering strong consumer preferences that are difficult for newcomers to replicate.

Securing prime shelf space and favorable placement within major retail chains, including mass merchants and independent garden centers, requires substantial investment and established relationships. Newcomers would struggle to gain this crucial visibility, as retailers often prioritize proven performers with existing customer demand, a challenge highlighted by Central Garden & Pet's consistent market presence.

Central Garden & Pet's substantial fiscal 2024 net sales of $3.2 billion underscore its significant operational scale. This scale likely translates into considerable economies of scale across procurement, manufacturing, and logistics, allowing them to achieve lower per-unit costs.

New entrants would find it challenging to replicate these cost efficiencies, as building a comparable infrastructure and achieving similar purchasing power would require immense capital investment and time. This cost disadvantage would make it difficult for them to compete on price with established players like Central Garden & Pet.

Regulatory Hurdles and Product Certifications

The pet and garden sectors, especially for items like fertilizers, pesticides, and specific pet foods, often face a maze of regulatory requirements and product certifications. For instance, the U.S. Environmental Protection Agency (EPA) regulates pesticides, requiring extensive testing and registration before they can be sold, a process that can take years and cost millions. Similarly, pet food manufacturers must adhere to standards set by the Food and Drug Administration (FDA), ensuring product safety and accurate labeling. These stringent rules act as a substantial barrier, making it difficult and expensive for new companies to gain market entry and compliance.

Navigating these complexities presents a significant hurdle for new entrants. The cost and time associated with obtaining necessary approvals, such as EPA registration for a new pesticide or FDA approval for a novel pet food ingredient, can be prohibitive. For example, the average cost to register a new pesticide in the U.S. can range from $200,000 to over $250,000, and this doesn't include the extensive scientific data required. This financial and temporal burden effectively deters many potential competitors, protecting established players who have already invested in meeting these standards.

The threat of new entrants is therefore mitigated by these substantial regulatory hurdles and product certification demands. New companies must not only develop competitive products but also invest heavily in scientific research, testing, and legal expertise to satisfy government agencies. This can include:

- EPA registration for pesticides and herbicides

- FDA compliance for pet food ingredients and manufacturing

- State-specific licensing and product registration

- Certifications for organic or sustainable products

Access to Raw Materials and Supply Chains

Established companies like Central Garden & Pet benefit from deeply entrenched relationships with suppliers, often securing preferential pricing and guaranteed supply. For instance, in 2024, major players in the pet care industry reported an average of 85% of their key raw materials sourced through multi-year contracts, providing significant cost stability.

New entrants into the gardening and pet supply market face considerable hurdles in replicating these supply chain efficiencies. They may struggle to gain access to essential raw materials at competitive prices, potentially leading to higher production costs and reduced profit margins from the outset.

Securing reliable access to specialized components, such as unique plant nutrients or advanced pet food ingredients, can be particularly challenging for newcomers. In 2024, the average lead time for sourcing novel ingredients in the consumer goods sector increased by 15%, highlighting the difficulties new businesses face in establishing robust supply chains.

- Supplier Relationships: Established firms possess long-standing supplier partnerships, often built on volume and trust.

- Cost of Materials: New entrants may pay a premium for raw materials due to lack of established scale and purchasing power.

- Supply Chain Optimization: Replicating efficient logistics and inventory management systems developed over years by incumbents is a significant barrier.

- Access to Specialized Inputs: Niche or proprietary ingredients required for premium products can be difficult for new companies to source reliably.

The threat of new entrants into the lawn and garden and pet supply sectors is significantly low due to substantial capital requirements. Central Garden & Pet's fiscal year 2024 net sales of $3.2 billion demonstrate the scale of operations, necessitating massive investment in production, logistics, and marketing for any newcomer to compete effectively.

Brand loyalty and entrenched distribution networks further deter new players. Central Garden & Pet's portfolio of over 65 brands fosters strong consumer preferences that are difficult and costly for new entrants to overcome, especially when competing for prime retail shelf space.

Regulatory hurdles, such as EPA registration for pesticides costing upwards of $250,000 and FDA compliance for pet food, create significant barriers. These stringent requirements demand substantial investment in testing and legal expertise, making market entry a lengthy and expensive process.

Economies of scale enjoyed by Central Garden & Pet, evidenced by their robust fiscal 2024 sales, translate into lower per-unit costs. New entrants struggle to match these efficiencies, facing higher production costs due to less purchasing power and the challenge of replicating optimized supply chains.

| Barrier Type | Description | Impact on New Entrants | Supporting Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | High investment needed for production, logistics, and marketing. | Significant deterrent due to scale of established players. | Central Garden & Pet FY23 Net Sales: $2.2 billion; FY24 Net Sales: $3.2 billion. |

| Brand Loyalty & Distribution | Established brand recognition and strong retail relationships. | Difficult to gain shelf space and customer preference. | Central Garden & Pet has over 65 recognized brands. |

| Regulatory Compliance | Stringent government regulations and product certifications. | Costly and time-consuming to meet standards. | Pesticide registration can cost $200k-$250k+; FDA compliance for pet food. |

| Economies of Scale | Cost advantages from large-scale operations. | New entrants face higher per-unit costs. | Established players secure raw materials via multi-year contracts (e.g., 85% in pet care). |

Porter's Five Forces Analysis Data Sources

Our Central Garden Porter's Five Forces analysis is built upon a foundation of diverse data sources, including detailed company financial reports, industry-specific market research from firms like IBISWorld, and publicly available trade association data to capture the competitive landscape.