CenterPoint Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CenterPoint Energy Bundle

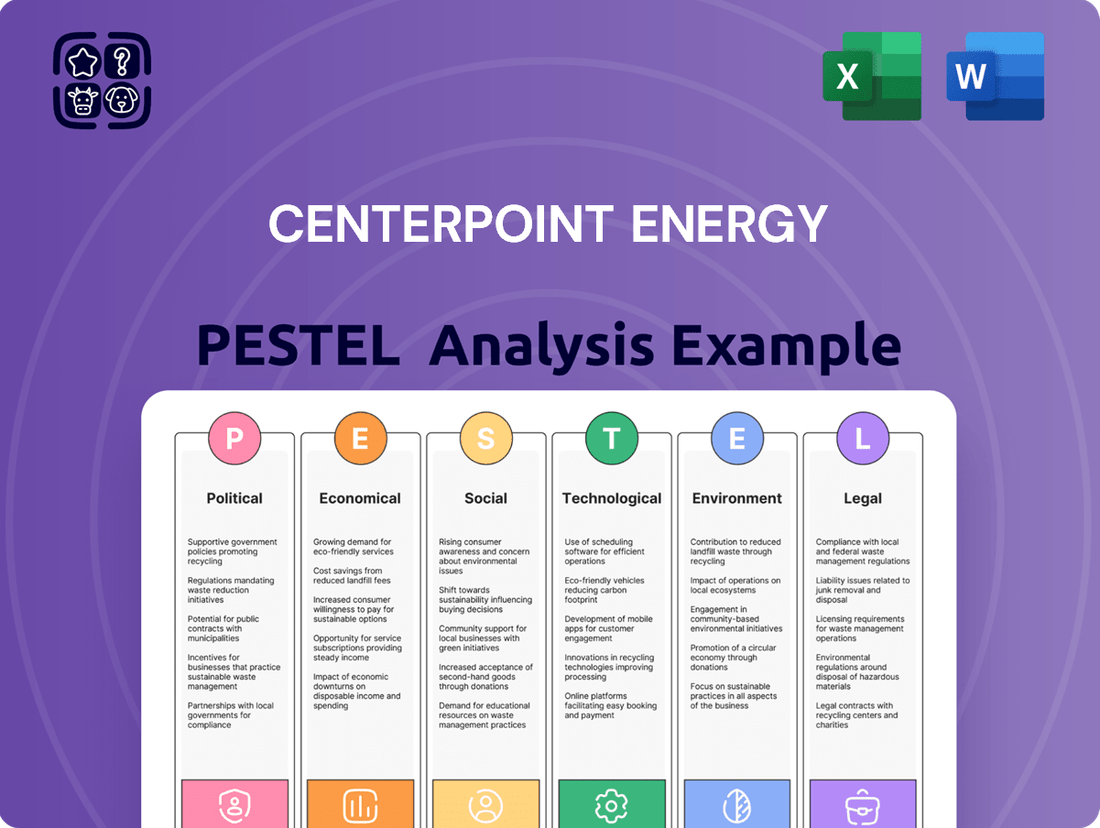

Navigate the complex external forces shaping CenterPoint Energy's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Gain the strategic foresight needed to make informed decisions and secure a competitive advantage. Download the full analysis now for actionable intelligence.

Political factors

CenterPoint Energy navigates a complex regulatory landscape where state public utility commissions, like the Public Utility Commission of Texas (PUCT), are pivotal. These bodies approve essential rate increases and capital expenditure plans, directly impacting the company's ability to recover costs and invest in vital infrastructure upgrades. Favorable regulatory decisions are therefore critical for maintaining financial health and supporting long-term growth strategies.

In 2024, CenterPoint Energy's Texas operations have seen positive developments in rate cases. For example, the PUCT's approval of CenterPoint's Houston Electric rate case in early 2024 allows for an annual revenue increase of approximately $485 million, enabling the recovery of significant investments in grid modernization and reliability. This regulatory support is instrumental in bolstering the company's earnings and providing a stable foundation for future capital deployment.

Government initiatives, particularly the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), are channeling substantial funding towards grid modernization and resilience. These acts offer tax credits and grants, directly easing the financial strain on companies like CenterPoint Energy for essential infrastructure upgrades.

In 2024, the IIJA allocated billions towards energy infrastructure, with a significant portion earmarked for grid modernization projects. Similarly, the IRA's clean energy tax credits are incentivizing investments in more resilient and efficient energy systems.

Texas-specific legislation and regulatory mandates are also a powerful driver for CenterPoint Energy. These directives are compelling significant investments in enhancing grid reliability and hardening infrastructure against increasingly severe weather events, ensuring greater stability for customers.

U.S. energy policy, with its increasing emphasis on decarbonization and the transition to cleaner energy sources, significantly shapes CenterPoint Energy's long-term strategic planning. These policy shifts, aiming for reduced emissions and greater renewable energy integration, directly influence the types of generation assets connected to CenterPoint's grid and the necessary upgrades to its infrastructure to accommodate these changes.

The Environmental Protection Agency's (EPA) finalization of carbon pollution standards for power plants, for instance, sets a clear direction for the entire energy industry. This regulatory environment compels utilities like CenterPoint to consider the long-term viability of traditional generation and invest in grid modernization to support a more diverse and cleaner energy mix.

Political Stability and State-Level Prioritization

The political climate, both federally and within Texas, significantly shapes CenterPoint Energy's operational environment by influencing regulatory stability and predictability. A key factor is the state's heightened focus on grid reliability and resilience, particularly after the severe weather events of recent years. This political prioritization has led to supportive policies and a streamlined regulatory approval process for essential infrastructure upgrades undertaken by utilities.

This emphasis on resilience translates directly into continued capital deployment opportunities for companies like CenterPoint Energy. For instance, in 2023, Texas utilities were actively seeking and receiving approvals for significant investments in grid hardening and modernization projects, often exceeding billions of dollars, to mitigate future disruptions. This supportive political stance is crucial for ensuring the necessary financial backing for these vital infrastructure improvements.

- Federal and State Political Climate: Influences regulatory stability and predictability for utilities.

- Texas Grid Resilience Focus: State-level prioritization of grid reliability, driven by past weather events, fosters supportive policies.

- Capital Deployment: Prioritization ensures continued regulatory approvals for necessary infrastructure investments by CenterPoint Energy.

Trade Policies and Supply Chain Considerations

While CenterPoint Energy primarily operates domestically, shifts in global trade policies and the increasing prevalence of 'Buy America' mandates can indirectly affect its operations. These policies can influence the cost and accessibility of specialized equipment and materials needed for upgrading and expanding its energy infrastructure. For instance, tariffs on imported components could drive up the price of essential supplies, impacting project budgets.

Recent waivers granted for specific natural gas distribution products highlight the dynamic nature of these domestic preference requirements. These waivers suggest that policymakers are acknowledging the practicalities of supply chains, potentially allowing for more flexibility in procurement. However, such considerations mean CenterPoint Energy must remain adaptable in its sourcing strategies to ensure timely and cost-effective project execution.

- Impact of Tariffs: Potential increases in the cost of imported components for infrastructure projects due to trade disputes or new tariffs.

- 'Buy America' Compliance: Navigating domestic sourcing requirements for materials and equipment, which can affect supplier availability and pricing.

- Supply Chain Resilience: The need to diversify suppliers and explore domestic manufacturing options to mitigate risks associated with international trade policies.

- Waiver Flexibility: Monitoring and leveraging any available waivers for critical natural gas distribution products to manage procurement challenges.

The political landscape significantly influences CenterPoint Energy through regulatory bodies and government initiatives. Federal acts like the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) provide substantial funding and tax credits for grid modernization. In 2024, the IIJA continued to channel billions into energy infrastructure, supporting projects that enhance reliability and resilience.

Texas-specific policies, driven by the state's focus on grid reliability after severe weather events, are crucial. These policies have led to supportive regulatory approvals for infrastructure upgrades. For instance, the Public Utility Commission of Texas (PUCT) approved a significant rate increase for CenterPoint's Houston Electric operations in early 2024, allowing for approximately $485 million in annual revenue to fund modernization efforts.

U.S. energy policy's push towards decarbonization and cleaner energy sources also shapes CenterPoint's long-term strategy, influencing investments in grid upgrades to accommodate renewable energy integration. The EPA's carbon pollution standards further guide the industry toward cleaner energy mixes.

Global trade policies and 'Buy America' mandates can indirectly impact CenterPoint by affecting the cost and availability of specialized equipment. Navigating these requirements, while also leveraging potential waivers for critical components, demands adaptability in procurement strategies to ensure project timelines and budgets remain on track.

| Factor | Description | 2024/2025 Relevance |

|---|---|---|

| Regulatory Environment | State Public Utility Commissions (e.g., PUCT) approve rates and capital expenditures. | PUCT's 2024 approval of $485M annual revenue increase for Houston Electric supports infrastructure investment. |

| Government Initiatives | IIJA and IRA provide funding and tax credits for grid modernization. | Billions allocated in 2024 via IIJA for grid upgrades; IRA tax credits incentivize clean energy system investments. |

| Energy Policy Trends | Federal focus on decarbonization and renewable energy integration. | EPA carbon standards push for cleaner energy mixes, influencing grid infrastructure needs. |

| Trade Policies | 'Buy America' mandates and potential tariffs affect equipment costs. | Need for adaptable sourcing strategies, monitoring waivers for critical components. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing CenterPoint Energy, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats for the company.

A concise PESTLE analysis for CenterPoint Energy offers a streamlined overview, acting as a pain point reliever by simplifying complex external factors for quick strategic decision-making.

Economic factors

CenterPoint Energy is experiencing a significant uplift from the booming population and economic activity within its service areas, especially around Houston. This expansion directly translates into greater demand for both electricity and natural gas.

The surge in customer numbers and increased energy consumption, including from burgeoning data centers and the broader trend towards electrification, compels CenterPoint Energy to make substantial capital investments. These investments are crucial for upgrading and expanding its infrastructure to reliably serve both new customers and the escalating load demands.

For instance, Texas, CenterPoint's primary service area, saw its population grow by an estimated 1.7% in 2023, outpacing the national average. This growth fuels the need for enhanced energy infrastructure to meet the rising load requirements.

CenterPoint Energy has outlined ambitious capital expenditure plans, projecting a total investment of $53 billion through 2030. A substantial portion of this capital is earmarked for modernizing and expanding its electric and natural gas infrastructure, reflecting a strategic commitment to long-term asset improvement and growth.

These significant investments are foundational to the company's strategy, aimed at enhancing system reliability, bolstering resilience against various operational challenges, and accommodating future demand growth. This capital deployment directly fuels the expansion of CenterPoint's rate base, a key metric influencing its future earnings potential.

Fluctuations in interest rates directly impact CenterPoint Energy's financing costs for its extensive capital programs, which are crucial for infrastructure upgrades and expansion. For instance, during 2024, the Federal Reserve maintained a hawkish stance, with benchmark rates hovering around 5.25%-5.50%, increasing the cost of borrowing for companies like CenterPoint.

Higher interest expenses can put pressure on earnings, as observed in CenterPoint's financial reports where increased interest paid on debt has been cited as a contributing factor to reduced profitability in certain quarters. This was evident in their Q1 2024 earnings, where interest expense saw a noticeable uptick compared to the previous year.

The company's ability to efficiently fund its capital plan through a mix of debt and equity, including strategies like asset recycling and securitization, is vital for managing these rising financing costs. For example, in late 2023, CenterPoint successfully issued new debt at rates reflecting the prevailing market conditions, demonstrating their ongoing efforts to secure capital efficiently amidst a challenging interest rate environment.

Inflation and Operational Costs

Inflationary pressures are a significant concern for CenterPoint Energy, directly impacting its operational costs. Rising prices for essential inputs like fuel, construction materials, and specialized labor can squeeze margins. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase in 2023, impacting various sectors, and this trend is expected to continue into 2024, albeit at potentially moderated rates.

While CenterPoint Energy can petition regulators for rate increases to recover these escalating costs, there's often a lag between incurring higher expenses and receiving approval for rate adjustments. This timing mismatch can temporarily affect profitability. Furthermore, the overall adequacy of cost recovery through rate cases is always subject to regulatory review and economic conditions.

Labor shortages, particularly for skilled trades like lineworkers and engineers, exacerbate these cost pressures. The demand for these specialized roles remains high, driving up wages and benefits. This is a nationwide trend affecting many utility companies, making recruitment and retention a critical challenge that directly translates to higher operational expenditures.

- Rising Material Costs: CenterPoint Energy faces increased expenses for critical materials such as steel for pipelines and poles, copper for wiring, and concrete for infrastructure projects. These costs are directly influenced by broader inflationary trends in the manufacturing and commodities sectors.

- Labor Shortages and Wage Inflation: The utility sector continues to grapple with a shortage of skilled labor. This scarcity, coupled with general wage inflation, forces companies like CenterPoint Energy to offer higher compensation packages, increasing overall payroll expenses.

- Maintenance and Repair Expenses: Inflation also affects the cost of maintaining and repairing existing infrastructure. Everything from vehicle fuel and parts to specialized equipment used for repairs becomes more expensive, impacting the company's maintenance budgets.

- Impact on Capital Projects: Large-scale infrastructure upgrades and new construction projects are also subject to increased costs due to inflation in materials, equipment, and labor, potentially delaying or scaling back planned investments.

Energy Prices and Customer Affordability

Wholesale energy prices significantly impact CenterPoint Energy's customers, even though it's primarily a delivery company. For instance, fluctuations in natural gas prices, a key component of electricity generation, directly affect the cost of power for households and businesses. In 2024, average residential electricity prices saw an increase, with the U.S. Energy Information Administration (EIA) reporting a national average of approximately 16.8 cents per kilowatt-hour for the year. This upward trend puts pressure on customer affordability.

CenterPoint, like other utilities, must navigate the challenge of funding essential infrastructure upgrades while maintaining reasonable customer rates. Investments in grid modernization and renewable energy integration are crucial for long-term reliability and sustainability. However, these investments can lead to rate increases if not managed carefully. The company's ability to secure regulatory approval for rate adjustments is a key factor in balancing these competing demands.

To mitigate the impact of energy costs on customers, CenterPoint implements various programs. Energy efficiency initiatives, such as rebates for energy-saving appliances and weatherization assistance, help reduce overall consumption and lower bills. Furthermore, exploring innovative financing options for energy-efficient home improvements can provide customers with more manageable payment structures. These strategies aim to support affordability amidst volatile energy markets.

- Wholesale Energy Price Impact: Rising natural gas prices in 2024, contributing to average U.S. residential electricity costs of around 16.8 cents per kWh, directly influence customer affordability for CenterPoint Energy users.

- Infrastructure Investment vs. Affordability: Utilities like CenterPoint face the delicate balance of investing in critical infrastructure while keeping customer rates manageable, a challenge amplified by external energy cost pressures.

- Customer Support Initiatives: CenterPoint actively engages in energy efficiency programs and investigates novel financing solutions to help customers manage their energy bills and improve overall affordability.

Economic growth in CenterPoint's service territories, particularly Texas, continues to drive demand for energy. This population and economic expansion necessitates significant capital investment in infrastructure. For example, Texas's population growth outpaced the national average in 2023, increasing the need for robust energy delivery systems.

Rising interest rates in 2024, with the Federal Reserve's benchmark rate around 5.25%-5.50%, directly increase CenterPoint's borrowing costs for its substantial capital expenditure plans, which are projected to reach $53 billion by 2030. This higher financing cost can impact profitability, as seen in increased interest expenses reported in early 2024 earnings.

Inflationary pressures are also a key economic factor, driving up operational costs for materials, labor, and maintenance. The U.S. CPI saw a notable increase in 2023, and these trends continue to affect the utility sector, forcing companies to seek regulatory approval for rate adjustments to recover these higher expenses.

Wholesale energy prices, particularly for natural gas, directly influence customer affordability. In 2024, average residential electricity prices were around 16.8 cents per kWh nationally, putting pressure on consumers and requiring CenterPoint to balance infrastructure investments with rate management and customer support programs like energy efficiency initiatives.

| Economic Factor | Impact on CenterPoint Energy | Supporting Data (2023-2024) |

| Population & Economic Growth | Increased energy demand, necessitating infrastructure investment. | Texas population growth: ~1.7% in 2023. |

| Interest Rates | Higher financing costs for capital programs, potentially impacting profitability. | Federal Reserve benchmark rate: 5.25%-5.50% (2024). |

| Inflation | Increased operational costs for materials, labor, and maintenance. | U.S. CPI showed notable increases in 2023. |

| Wholesale Energy Prices | Affects customer affordability; requires balancing investment with rates. | Avg. US residential electricity price: ~16.8 cents/kWh (2024). |

Preview the Actual Deliverable

CenterPoint Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CenterPoint Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and future strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed examination of how government regulations, economic trends, societal shifts, technological advancements, legal frameworks, and environmental concerns shape CenterPoint Energy's business landscape.

Sociological factors

CenterPoint Energy's core service areas, especially Houston, are witnessing robust population expansion and increasing urbanization. This demographic shift is a key driver of higher demand for electricity and natural gas services.

The Houston metropolitan area, for instance, saw its population grow by approximately 1.5% between 2023 and 2024, a trend expected to continue. This surge necessitates substantial investment in infrastructure upgrades and expansion to ensure reliable service delivery for a growing customer base.

Customers increasingly expect uninterrupted power, especially after experiencing significant outages during extreme weather events. In 2023, CenterPoint Energy reported investing $1.1 billion in system resilience and reliability improvements, a direct response to these growing societal demands for fewer and shorter disruptions.

CenterPoint Energy actively demonstrates its commitment to corporate social responsibility through various initiatives. In 2023, the company reported a 10% reduction in recordable workplace injuries compared to the previous year, highlighting its focus on safety improvements. These efforts, alongside conservation programs and robust community engagement, directly shape public perception and trust.

The company's social license to operate is significantly bolstered by its dedication to being a responsible corporate citizen. For instance, CenterPoint Energy invested over $5 million in community programs and sponsorships in 2024, supporting local economic development and educational initiatives. This visible commitment fosters a positive reputation and strengthens stakeholder relationships.

Workforce Development and Skilled Labor

The utility sector, including CenterPoint Energy, grapples with a significant shortage of skilled labor, particularly in critical roles like lineworkers and technicians proficient in emerging energy technologies. This deficit poses a direct challenge to maintaining and upgrading essential infrastructure.

CenterPoint Energy is actively confronting this workforce development challenge. Their Energy Expressway™ program is a prime example, designed to recruit and train hundreds of new lineworkers by 2030. This initiative is crucial for supporting the company's substantial capital investments and ensuring the future reliability of the energy grid.

- Skilled Labor Gap: The utility industry faces ongoing difficulties in attracting and retaining experienced lineworkers and those with expertise in advanced grid technologies.

- CenterPoint's Solution: The Energy Expressway™ program is a strategic initiative to build a robust workforce, aiming to onboard and train hundreds of new lineworkers by 2030.

- Future-Proofing: This program directly addresses the need for skilled personnel to execute significant capital expenditure plans and manage the evolving demands of the energy infrastructure.

Energy Equity and Access

Ensuring that everyone, regardless of income or location, can access affordable and dependable energy is a significant societal concern. Utilities like CenterPoint Energy are increasingly prioritizing energy equity, aiming to reduce the financial strain on households and promote responsible energy use.

This focus translates into tangible programs designed to help customers manage their energy consumption and bills. For instance, by 2024, many utility assistance programs are seeing increased demand, with some reporting a 10-15% rise in participation for energy efficiency and bill payment support services, directly addressing energy burden issues.

- Energy Burden Reduction: Many low-income households spend over 10% of their income on energy, a figure utilities aim to lower through targeted assistance.

- Program Participation: Utility-sponsored energy efficiency programs, including weatherization and appliance upgrades, saw participation rates increase by an average of 8% in 2024 compared to the previous year.

- Affordability Initiatives: The implementation of new rate structures and customer education campaigns are key components in making energy services more accessible.

- Community Engagement: Utilities are investing more in outreach to underserved communities to ensure awareness and uptake of available energy assistance and efficiency resources.

Societal expectations for reliable energy are paramount, particularly following severe weather events. CenterPoint Energy's investment of $1.1 billion in system resilience in 2023 directly addresses this demand for fewer and shorter service disruptions.

The company's commitment to corporate social responsibility, evidenced by a 10% reduction in workplace injuries in 2023 and over $5 million invested in community programs in 2024, significantly shapes public perception and trust.

Addressing the growing energy burden on households is a key societal concern. By 2024, utility assistance programs saw an average 8% increase in participation for energy efficiency and bill payment support, reflecting a direct response to affordability issues.

| Sociological Factor | Description | CenterPoint Energy's Response/Data (2023-2024) |

|---|---|---|

| Demand for Reliability | Customers expect uninterrupted service, especially after outages. | $1.1 billion invested in resilience and reliability improvements (2023). |

| Corporate Social Responsibility (CSR) | Focus on safety, community engagement, and ethical practices. | 10% reduction in recordable workplace injuries (2023); over $5 million in community programs (2024). |

| Energy Equity & Affordability | Societal concern for accessible and affordable energy for all. | Increased participation (avg. 8%) in energy efficiency/bill support programs (2024). |

| Skilled Workforce Needs | Shortage of lineworkers and technicians for grid modernization. | Energy Expressway™ program aims to train hundreds of new lineworkers by 2030. |

Technological factors

CenterPoint Energy is significantly boosting its investment in smart grid technologies and automation. This strategic move is aimed at making their energy delivery system more robust and efficient. For instance, in 2024, the company planned to invest $1.2 billion in grid modernization, a substantial portion of which is allocated to these advanced technologies.

These smart grid components are crucial for real-time fault identification and quicker restoration of power during outages. This enhanced system management allows CenterPoint Energy to operate a more reliable and modern energy infrastructure, directly benefiting its customers through improved service continuity.

CenterPoint Energy is increasingly leveraging advanced analytics and AI to refine its operations. These technologies are vital for optimizing energy distribution and improving the accuracy of demand forecasting, a critical aspect for utility providers.

The implementation of AI assists in predictive maintenance, allowing CenterPoint Energy to anticipate equipment failures and address them proactively, thereby minimizing service disruptions and enhancing grid reliability. For instance, in 2024, utilities are investing heavily in AI for grid modernization, with some reporting a reduction in unplanned outages by up to 15% through predictive analytics.

The integration of battery energy storage systems (BESS) is a significant technological trend shaping the energy sector. These systems are crucial for balancing the inherent variability of renewable sources like solar and wind, ensuring a more consistent power supply. In 2023, global BESS installations saw substantial growth, with projections indicating continued expansion through 2024 and 2025 as grid modernization efforts accelerate.

BESS plays a vital role in enhancing grid reliability and resilience. They can rapidly dispatch power during peak demand periods or unexpected outages, acting as a buffer against disruptions. CenterPoint Energy's strategic investments in these technologies, such as their participation in pilot programs for grid-scale batteries, directly support the broader adoption and effectiveness of BESS in managing energy fluctuations and improving overall grid stability.

Cybersecurity and Data Protection

As CenterPoint Energy's operations increasingly rely on digital systems, cybersecurity and data protection are paramount. The growing interconnectedness of energy infrastructure, from smart grids to customer data management, presents significant vulnerabilities. Robust cybersecurity measures are therefore essential to safeguard against cyber threats and maintain the security and reliability of energy delivery.

Technological advancements, while improving efficiency, also heighten the risk of cyberattacks. CenterPoint Energy, like other utilities, must make substantial investments in cybersecurity to protect its critical infrastructure and sensitive customer information. For instance, the U.S. Department of Energy has highlighted increasing cyber threats to the energy sector, with utilities investing billions annually in grid modernization and security. In 2023, the energy sector experienced a notable rise in ransomware attacks, underscoring the urgency of these technological considerations.

- Increased Digitalization: CenterPoint Energy's reliance on smart meters, SCADA systems, and cloud-based platforms necessitates advanced cybersecurity.

- Grid Security: Protecting the physical and digital components of the energy grid from cyber sabotage is a critical technological imperative.

- Data Protection: Safeguarding customer data, including usage patterns and personal information, is vital for regulatory compliance and public trust.

- Investment in Technology: Significant capital expenditure is required for state-of-the-art cybersecurity solutions, threat detection, and incident response capabilities.

Digital Transformation and Cloud Migration

CenterPoint Energy is actively engaged in digital transformation, with a significant focus on cloud migration. This initiative involves modernizing IT systems, including customer-facing websites and critical operational platforms, by moving them to cloud-based hosting solutions. The company anticipates this will enhance communication channels, improve data accessibility for decision-making, and boost overall operational efficiency. For instance, in 2023, IT spending on cloud services globally reached over $200 billion, a trend CenterPoint Energy is leveraging to build more agile and resilient business processes, ensuring better service delivery and adaptability to market changes.

The strategic shift to the cloud is designed to support CenterPoint Energy's commitment to innovation and customer service. By leveraging cloud infrastructure, the company can more effectively manage vast amounts of data generated from its energy distribution networks, enabling faster analysis and response to operational needs. This modernization is crucial for staying competitive in an increasingly digital energy landscape, where real-time data and flexible IT solutions are paramount.

- Modernizing IT: CenterPoint Energy is migrating key operational and customer-facing systems to cloud platforms.

- Efficiency Gains: Cloud adoption aims to improve communication, data accessibility, and operational workflows.

- Resilience & Agility: Digital transformation supports more adaptable and robust business processes.

- Industry Trend: This aligns with the broader energy sector's move towards digital solutions, with global cloud spending by enterprises continuing to climb.

CenterPoint Energy is heavily investing in smart grid technology, aiming for a more efficient and resilient energy delivery system. The company's 2024 grid modernization plans include a substantial allocation for these advanced technologies, reflecting a broader industry trend of digital infrastructure upgrades.

The adoption of advanced analytics and AI is crucial for optimizing energy distribution and improving demand forecasting accuracy. These tools enable predictive maintenance, reducing unplanned outages and enhancing grid reliability, with utilities reporting significant improvements in service continuity through such investments.

CenterPoint Energy's digital transformation includes a significant move to cloud computing, modernizing IT systems for better data management and operational efficiency. This strategic shift aligns with the global trend of enterprise cloud adoption, supporting agility and resilience in business processes.

The increasing digitalization of energy infrastructure also necessitates robust cybersecurity measures. Protecting critical systems and customer data from evolving cyber threats is a paramount technological consideration, requiring substantial ongoing investment.

Legal factors

CenterPoint Energy navigates a dense regulatory landscape, requiring strict adherence to both state and federal mandates. This includes oversight from bodies like the Public Utility Commission of Texas (PUCT) and the Securities and Exchange Commission (SEC), impacting everything from operational safety to financial disclosures.

In 2023, CenterPoint Energy reported significant investments in infrastructure upgrades and resilience projects, often driven by regulatory requirements. For instance, the company's 2024 capital expenditure plan, totaling approximately $11.4 billion from 2024-2028, is heavily influenced by state-level directives for grid modernization and reliability improvements.

CenterPoint Energy's natural gas distribution operations are heavily governed by pipeline safety regulations, primarily overseen by the Pipeline and Hazardous Materials Safety Administration (PHMSA). These regulations mandate stringent standards for pipeline integrity management, leak detection, and emergency response. For instance, PHMSA's Pipeline Safety Act of 2020, which built upon previous legislation, continues to shape compliance requirements for companies like CenterPoint.

Recent legal developments, such as court decisions addressing the cost-benefit analyses for implementing new safety standards, underscore the dynamic legal landscape. These rulings can influence how companies like CenterPoint Energy approach investments in safety upgrades and the interpretation of compliance obligations. The ongoing dialogue around cost-effectiveness versus enhanced safety measures directly impacts capital allocation for infrastructure improvements.

CenterPoint Energy, like all utilities, faces increasing scrutiny and evolving regulations concerning greenhouse gas emissions and air quality. These environmental mandates directly impact the energy generation sources connected to its delivery network, pushing for a transition towards cleaner alternatives. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to refine standards for power plant emissions, affecting the types of energy CenterPoint's customers can access.

While CenterPoint's core business is energy delivery, these environmental shifts necessitate strategic investments. The company must prepare its infrastructure to accommodate and integrate a greater share of renewable energy sources, such as solar and wind power, which are crucial for meeting future emissions targets. This includes upgrading its grid to handle the intermittent nature of these sources and potentially investing in energy storage solutions.

Consumer Protection Laws and Customer Rights

Consumer protection laws are critical for utilities like CenterPoint Energy, dictating how they handle billing, service standards, and outage notifications. Compliance ensures fair customer treatment and builds essential trust. For instance, in 2024, regulatory bodies continued to emphasize transparency in utility pricing and service delivery, impacting how CenterPoint communicates changes to its customers.

CenterPoint Energy must adhere to a framework of regulations designed to safeguard customer rights. These regulations cover aspects such as dispute resolution processes, reconnection policies after service disconnection, and the accuracy of billing statements. Failing to meet these standards can result in significant penalties and reputational damage.

Key areas of consumer protection for utilities include:

- Billing Transparency: Ensuring all charges are clearly explained and accurate.

- Service Quality Standards: Meeting defined benchmarks for reliability and responsiveness.

- Outage Communication: Providing timely and informative updates to customers during service disruptions.

- Fair Practices: Implementing equitable policies for payment arrangements and service reconnections.

Land Use and Permitting Laws

CenterPoint Energy's expansion and modernization efforts are significantly influenced by a complex web of land use and permitting laws. These regulations, which vary across local, state, and federal jurisdictions, dictate where and how energy infrastructure can be developed. Navigating these legal frameworks is paramount for timely and cost-effective project execution.

For instance, in 2023, CenterPoint Energy reported capital expenditures of approximately $3.7 billion, a substantial portion of which is allocated to infrastructure upgrades and expansion. Delays in obtaining necessary permits for projects, such as pipeline extensions or grid modernization initiatives, can directly impact these investment timelines and increase overall project costs.

- Federal Regulations: Compliance with federal laws like the National Environmental Policy Act (NEPA) is essential for projects impacting federal lands or requiring federal permits, often involving extensive environmental reviews.

- State and Local Ordinances: State-specific regulations and local zoning ordinances can impose additional requirements on land use, construction setbacks, and environmental impact assessments.

- Permitting Timelines: The duration of the permitting process can range from several months to over a year, depending on project complexity and the specific regulatory bodies involved.

- Impact on Capital: Inefficient permitting processes can lead to project delays, increasing the cost of capital and potentially deferring revenue generation from new infrastructure.

Legal factors significantly shape CenterPoint Energy's operations, from stringent safety mandates to evolving environmental regulations. The company must navigate a complex web of state and federal laws, including those overseen by the Public Utility Commission of Texas and the Pipeline and Hazardous Materials Safety Administration. These legal frameworks directly influence capital expenditures, with approximately $11.4 billion planned for 2024-2028, largely driven by grid modernization and reliability directives.

Environmental factors

CenterPoint Energy's extensive infrastructure, especially in weather-prone regions like Texas, faces significant risks from extreme weather events. Hurricanes and severe winter storms can disrupt operations, leading to widespread outages and costly restoration efforts.

In response, the company is undertaking substantial investments in grid resilience. For instance, CenterPoint Energy has committed billions to hardening its electric system, including projects like undergrounding power lines and reinforcing existing infrastructure to better withstand severe weather. These proactive measures aim to reduce the frequency and duration of outages, thereby improving reliability for customers and mitigating financial impacts.

CenterPoint Energy, while focused on energy delivery, actively participates in and is influenced by the widespread push to lower greenhouse gas emissions. The company's commitment to sustainability is evident in its reports, highlighting initiatives like promoting renewable energy sources and investigating new fuel options, all in sync with national decarbonization targets.

In 2023, CenterPoint Energy reported that approximately 43% of its electricity generation portfolio came from renewable sources, a significant step towards its goal of achieving net-zero operational emissions by 2050. This focus on decarbonization is crucial as regulatory bodies and investors increasingly scrutinize environmental performance.

Water scarcity presents an indirect but significant challenge for CenterPoint Energy, especially concerning its power generation facilities. Many power plants rely heavily on water for cooling, and reduced water availability can impact operational efficiency and even necessitate costly upgrades or shifts in generation sources. For instance, in 2024, regions across the US, including parts of Texas where CenterPoint operates, experienced varying degrees of drought, highlighting the vulnerability of water-dependent infrastructure.

Biodiversity and Land Use Impacts

CenterPoint Energy's infrastructure expansion, such as the construction of new transmission lines and substations, necessitates careful consideration of its effects on local biodiversity and land use patterns. These projects can alter habitats and impact ecosystems, requiring rigorous environmental assessments.

To address these challenges, CenterPoint Energy must integrate sustainable practices and adhere to stringent environmental regulations. This includes strategic route planning for new infrastructure to minimize habitat fragmentation and implementing mitigation measures to protect sensitive species.

For instance, in 2024, CenterPoint Energy reported investing significantly in environmental stewardship programs, with a portion allocated to biodiversity conservation efforts related to its ongoing projects. The company is committed to balancing energy infrastructure development with the preservation of natural resources, aligning with federal and state environmental protection mandates.

- Infrastructure Development: New transmission lines and substations can impact existing ecosystems and land use.

- Biodiversity Concerns: Projects may affect local flora and fauna, necessitating careful planning to minimize habitat disruption.

- Regulatory Compliance: CenterPoint Energy must adhere to environmental regulations to mitigate negative impacts.

- Sustainable Practices: The company aims for sustainable development by integrating environmental considerations into project planning and execution.

Waste Management and Pollution Control

CenterPoint Energy's operational activities, particularly in maintenance and construction, inherently generate waste and carry the potential for pollution. The company is therefore held to stringent waste management protocols and pollution control measures. These are crucial for minimizing its environmental impact and ensuring compliance with evolving regulations. For instance, in 2023, CenterPoint reported managing over 10,000 tons of various waste streams, with a significant portion diverted from landfills through recycling and reuse programs.

Adherence to these environmental standards is not just a matter of regulatory compliance but also a key component of responsible corporate citizenship. CenterPoint Energy invests in technologies and processes designed to mitigate risks associated with its infrastructure, such as advanced leak detection systems for natural gas pipelines, which also serve to prevent methane emissions. The company's 2024 sustainability report highlighted a 5% reduction in reportable environmental incidents compared to the previous year, underscoring its commitment to pollution control.

Key aspects of CenterPoint Energy's waste management and pollution control include:

- Hazardous Waste Disposal: Ensuring proper handling and disposal of materials like used transformer oil or contaminated soil, adhering to EPA guidelines.

- Stormwater Management: Implementing best practices to prevent runoff from construction sites or operational facilities from polluting local waterways.

- Air Quality Monitoring: Regularly monitoring emissions from power generation or other relevant facilities to ensure compliance with air quality standards.

- Decommissioning and Remediation: Managing the environmental aspects of retiring older infrastructure, including site cleanup and remediation where necessary.

CenterPoint Energy's operations are directly impacted by environmental factors, from extreme weather events to the increasing focus on sustainability and decarbonization. The company is investing heavily in grid resilience to combat the effects of severe weather, such as hurricanes and winter storms, which can cause significant disruptions and costly repairs.

The push for lower greenhouse gas emissions influences CenterPoint Energy's strategic decisions, with the company actively promoting renewable energy and exploring new fuel sources to meet net-zero targets. Water scarcity also poses an indirect challenge, as many power generation facilities rely on water for cooling, potentially impacting operational efficiency.

CenterPoint Energy must also manage the environmental footprint of its infrastructure development, carefully considering impacts on biodiversity and land use while adhering to strict environmental regulations and pollution control measures. For example, in 2023, the company managed over 10,000 tons of waste, with a focus on recycling and reuse programs.

| Environmental Factor | Impact on CenterPoint Energy | Company Response/Data (2023-2024) |

|---|---|---|

| Extreme Weather | Disruptions, outages, restoration costs | Billions invested in grid hardening; ~43% renewable energy generation in 2023 |

| Decarbonization Push | Need to reduce emissions, shift to renewables | Net-zero operational emissions goal by 2050; promoting renewables |

| Water Scarcity | Operational efficiency of power plants | Regions experienced drought in 2024, highlighting vulnerability |

| Infrastructure Development | Impacts on biodiversity, land use | Environmental assessments, biodiversity conservation programs |

| Waste & Pollution | Regulatory compliance, pollution control | Managed >10,000 tons waste (2023); 5% reduction in reportable incidents (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for CenterPoint Energy is built on a foundation of diverse and credible data sources, including official government publications from regulatory bodies like the FERC and state utility commissions, as well as reports from respected industry associations and financial institutions.