CenterPoint Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CenterPoint Energy Bundle

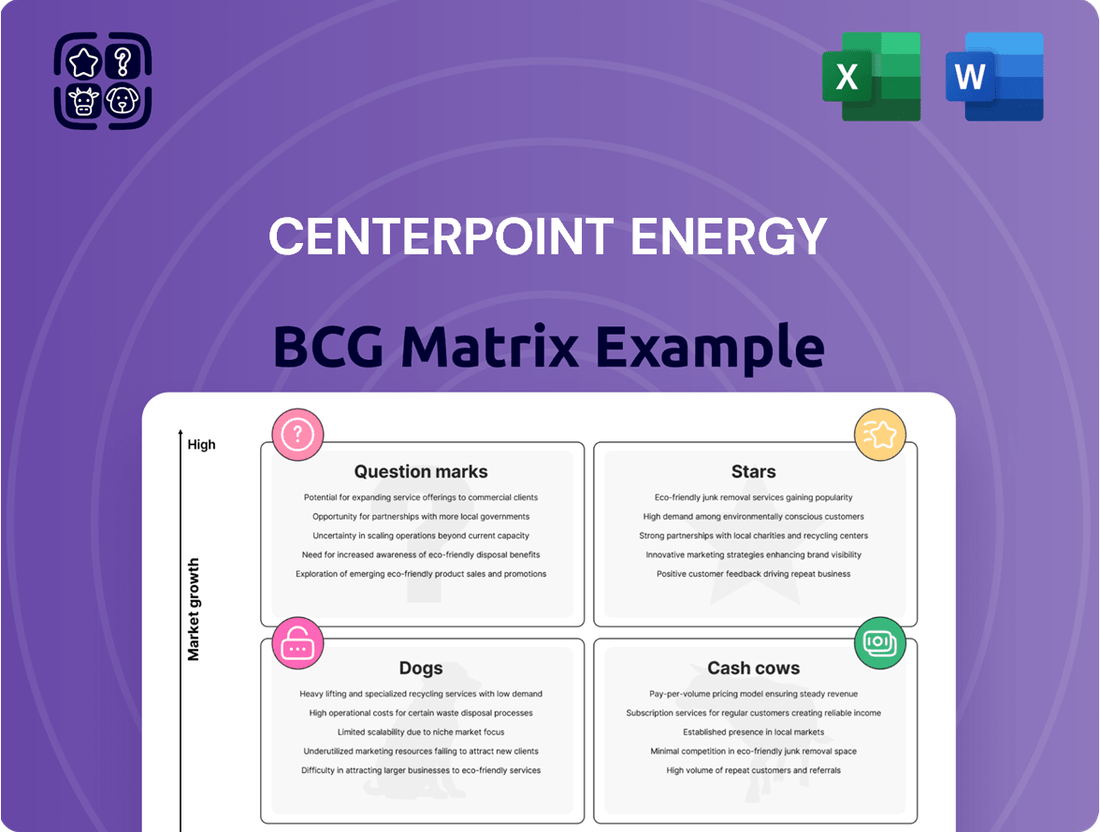

Curious about CenterPoint Energy's strategic product portfolio? Our BCG Matrix preview offers a glimpse into their market standing, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete report for a detailed breakdown and actionable insights to guide your investment decisions.

Stars

CenterPoint Energy's Houston electric transmission and distribution segment is a prime example of a Star in the BCG Matrix. The region's customer base is expanding rapidly, with energy demand expected to increase by almost 50% by 2031.

To meet this surging demand and bolster grid reliability, CenterPoint Energy is committing a substantial $53 billion over a decade, ending in 2030. A significant portion of this capital expenditure is earmarked for enhancing the Houston area's electric transmission and distribution infrastructure, including crucial resiliency upgrades.

These investments, alongside ongoing grid modernization initiatives, underscore the segment's high growth potential and its strategic importance in serving a dynamic and expanding market.

The System Resiliency Plan (SRP) represents a significant investment for CenterPoint Energy, totaling $3.2 billion from 2026 to 2028. This initiative is designed to bolster the company's grid against disruptions, aiming for a 30% improvement in overall resilience. Early indicators from the first half of 2025 demonstrate substantial progress, with customer outage minutes reduced by 50% compared to the same period in 2024.

CenterPoint Energy is showing strong conviction in its Texas natural gas operations, planning substantial investments to preserve a 60% electric and 40% natural gas business balance. This confidence is backed by a significant capital allocation, including $800 million specifically for Texas gas infrastructure. These funds are earmarked for crucial upgrades to handle increasing customer demand, bolster system reliability, and enhance the safety and modernization of its gas distribution network in a state experiencing rapid annual customer growth.

Renewable Energy and Decarbonization Initiatives

CenterPoint Energy is making significant strides in renewable energy and decarbonization, a key move to align with evolving industry demands and regulatory goals. These investments are positioned as high-growth opportunities that will bolster the company's long-term earnings potential and competitive standing.

The company has committed to investing in 1,000 megawatts of renewable generation capacity by 2026. This ambitious target underscores a strategic pivot towards cleaner energy sources.

CenterPoint Energy is also actively exploring the integration of low- and zero-carbon gases, such as renewable natural gas and green hydrogen. These initiatives are crucial for meeting decarbonization targets and diversifying the energy portfolio.

A prime example of this commitment is the Integrated Resource Plan for Indiana Electric, which aims for a remarkable 95% reduction in carbon emissions. This plan highlights the company's dedication to a sustainable energy future.

- Investment in Renewables: 1,000 MW of renewable generation by 2026.

- Exploration of Low-Carbon Gases: Focus on renewable natural gas and green hydrogen.

- Decarbonization Targets: Indiana Electric's Integrated Resource Plan targets a 95% carbon emission reduction.

- Strategic Importance: These initiatives are considered high-growth areas that future-proof earnings and enhance competitive advantage.

Workforce Expansion and Training Programs

CenterPoint Energy is significantly expanding its workforce to meet escalating energy demands. The company plans to hire 200 new lineworkers by the end of 2025, with an additional goal of bringing on nearly 800 by 2030. This expansion is a direct reaction to the anticipated 50% surge in Houston's energy consumption by 2031.

To ensure a skilled workforce, CenterPoint Energy has implemented robust training programs. The Energy Expressway™ initiative offers free, multi-week training sessions designed to cultivate the next generation of electric workers. This investment in human capital is vital for the successful execution of their growth strategy and maintaining high operational standards.

These workforce initiatives are directly linked to CenterPoint Energy's substantial capital investment plan. The company has allocated $53 billion towards its capital investments, and a well-trained, expanded workforce is essential to manage and implement these projects effectively.

- Workforce Expansion Target: 200 additional lineworkers by end-2025, nearly 800 by 2030.

- Demand Projection: 50% increase in Houston's energy demand by 2031.

- Training Program: Energy Expressway™ offers free multi-week training for electric workers.

- Capital Investment: $53 billion allocated to capital investment plans.

CenterPoint Energy's Houston electric transmission and distribution segment is a clear Star. The region's customer base is expanding rapidly, with energy demand projected to increase by nearly 50% by 2031.

To meet this demand and enhance grid reliability, CenterPoint Energy is investing $53 billion through 2030, with a significant portion dedicated to upgrading Houston's infrastructure and implementing resiliency measures. The System Resiliency Plan alone represents a $3.2 billion investment from 2026 to 2028, aiming for a 30% improvement in grid resilience, with early 2025 data showing a 50% reduction in customer outage minutes compared to the previous year.

The company's commitment to workforce expansion, including hiring 200 new lineworkers by the end of 2025 and nearly 800 by 2030, directly supports these growth initiatives and ensures operational capacity.

CenterPoint Energy's strategic focus on renewable energy, including a target of 1,000 MW of renewable generation by 2026 and exploration of low-carbon gases, positions these segments as high-growth opportunities that will strengthen long-term earnings and competitive advantage.

| Segment | BCG Category | Key Growth Drivers | Investment Focus | Key Metrics/Targets |

| Houston Electric T&D | Star | Rapid customer base expansion, increasing energy demand | Infrastructure upgrades, grid modernization, resiliency enhancements | 50% demand increase by 2031, $53B capital investment (ending 2030), 30% resilience improvement target |

| Renewable Energy & Decarbonization | Star | Evolving industry demands, regulatory goals, long-term earnings potential | Renewable generation capacity, low- and zero-carbon gas integration | 1,000 MW renewable generation by 2026, 95% carbon emission reduction target (Indiana Electric IRP) |

What is included in the product

The CenterPoint Energy BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

CenterPoint Energy's BCG Matrix provides a clear, one-page overview of business unit performance, relieving the pain of complex portfolio analysis.

Cash Cows

CenterPoint Energy's regulated electric transmission and distribution operations, especially in the bustling Houston area, are a significant cash cow. This segment serves a vast and expanding customer base, ensuring consistent and predictable revenue streams. The regulated nature of these operations allows for the recovery of costs and a fair return on invested capital, making it a dependable cash generator.

In 2023, CenterPoint Energy reported that its electric utility segment generated a substantial portion of its operating income. The company's investments in infrastructure upgrades and modernization, often mandated by regulators, contribute to its rate base and, consequently, its earnings. For instance, their ongoing investments in grid modernization are designed to enhance reliability and accommodate future energy demands, further solidifying their cash-generating capacity.

CenterPoint Energy's natural gas distribution business is a classic cash cow. It operates in mature markets across several states, holding a significant market share. This segment reliably churns out substantial cash with limited growth potential, fitting the definition perfectly.

In 2024, CenterPoint Energy continued investing in its natural gas distribution infrastructure, with planned capital expenditures of approximately $2.1 billion for the segment. These investments focus on modernizing pipelines and replacing older materials, ensuring the business's long-term stability and continued cash generation.

CenterPoint Energy benefits from a substantial customer base exceeding 7 million metered customers across its electric and natural gas operations, ensuring a consistent and predictable revenue stream.

The company experienced a steady increase in both electric and natural gas throughput during the second quarter of 2025, signaling robust demand within its service areas. This consistent demand, coupled with established customer relationships, translates into strong profit margins and dependable cash flow, hallmarks of a cash cow business.

Constructive Regulatory Treatment

CenterPoint Energy's regulated utility businesses, especially in Texas, benefit from constructive regulatory treatment. This allows for the recovery of capital investments and operational expenses, leading to stable and predictable earnings.

Regulatory frameworks in its operating regions, particularly Texas, ensure that CenterPoint can earn a fair return on its infrastructure investments. For instance, in 2024, Texas regulators approved rate adjustments that support the company's ongoing modernization efforts, directly impacting its ability to generate consistent cash flow.

- Favorable Texas Regulation: Texas's regulatory environment is designed to allow utilities to recover costs and earn a reasonable return, underpinning the stability of CenterPoint's earnings.

- Capital Investment Recovery: Mechanisms are in place to ensure that significant capital expenditures, such as those for grid modernization, are reflected in customer rates, thereby supporting profitability.

- Consistent Cash Flow: This supportive regulatory structure translates into strong and consistent cash flow generation from its core utility operations, a hallmark of a cash cow.

Dividend Resilience and Payout Ratio

CenterPoint Energy has a strong track record of rewarding shareholders, having increased its dividend for five consecutive years. This consistent growth is underpinned by a healthy payout ratio of 55.8%, indicating that the company is not overextending its dividend payments relative to its earnings. The stable cash flows generated from its regulated utility operations provide a reliable foundation for this dividend resilience.

The company's core business model, centered on regulated utilities, acts as a dependable cash cow. This stability allows CenterPoint Energy to project a long-term objective of 6-8% annual dividend growth through 2030. Such a forecast highlights the company's confidence in its ongoing ability to generate excess cash and return value to its investors.

- Dividend Growth: Five consecutive years of dividend increases.

- Payout Ratio: A payout ratio of 55.8% demonstrates financial prudence.

- Cash Flow Generation: Stable cash flow from regulated utility operations.

- Future Outlook: Target of 6-8% annual dividend growth through 2030.

CenterPoint Energy's regulated utility operations, particularly its electric and natural gas distribution, function as its primary cash cows. These segments benefit from stable demand and constructive regulatory environments, ensuring consistent revenue generation. The company's substantial customer base, exceeding 7 million, further solidifies the predictable cash flow from these mature businesses.

The company's commitment to investing in infrastructure, such as the approximately $2.1 billion planned for natural gas distribution in 2024, reinforces the stability of these cash cows. These investments aim to modernize pipelines and enhance the grid, ensuring long-term operational efficiency and continued earnings power.

CenterPoint Energy's financial strategy leverages these cash cows to support shareholder returns. The company has a history of increasing its dividend, with a 55.8% payout ratio in 2024 indicating financial health. This stability supports their long-term objective of 6-8% annual dividend growth through 2030.

| Segment | Role in BCG Matrix | Key Characteristics | 2024 Capital Expenditure (Approx.) |

|---|---|---|---|

| Electric Transmission & Distribution (Houston) | Cash Cow | Large, expanding customer base, regulated for cost recovery and fair return. | Significant investments in grid modernization. |

| Natural Gas Distribution | Cash Cow | Mature markets, significant market share, reliable cash generation with limited growth. | $2.1 billion |

Delivered as Shown

CenterPoint Energy BCG Matrix

The CenterPoint Energy BCG Matrix preview you're viewing is the identical, fully formatted document you'll receive upon purchase. This means no watermarks or demo content, just a ready-to-use strategic analysis designed for immediate application. You can trust that the professional layout and comprehensive insights will be directly accessible for your business planning needs. This is the actual report, meticulously prepared to offer clear strategic direction for CenterPoint Energy's portfolio.

Dogs

CenterPoint Energy has strategically divested several natural gas distribution utilities across Oklahoma, Arkansas, Louisiana, and Mississippi. These divested assets likely represented lower-growth markets or areas where CenterPoint held a smaller market share, making them prime candidates for divestiture.

Proceeds from these sales, totaling hundreds of millions of dollars, are being reinvested to bolster growth initiatives, particularly within CenterPoint’s core Texas operations. This strategic reallocation signals a focus on higher-potential markets and a shedding of less strategic, potentially underperforming, assets.

CenterPoint Energy's older infrastructure, particularly its remaining cast-iron pipes in the natural gas system, falls into the Dogs category. These assets represent a legacy burden, requiring ongoing investment for safety and compliance without generating significant returns or driving growth. For instance, as of the end of 2023, CenterPoint continued its program to replace older gas infrastructure, a necessary but capital-intensive undertaking that highlights the inefficiency of these legacy components.

Underperforming competitive energy services, such as home repair and maintenance, within CenterPoint Energy's portfolio may be classified as Dogs in the BCG Matrix. These segments likely exhibit low market share and minimal growth prospects, meaning they contribute little to overall revenue or profit. For instance, if these services are not seeing increased customer adoption or technological advancements, they could be draining resources without generating substantial returns.

Non-Strategic or Peripheral Assets

Non-strategic or peripheral assets for CenterPoint Energy would be those that don't directly contribute to its primary business of regulated electric and natural gas delivery, especially in its key Texas market. These might include smaller, less profitable, or geographically dispersed operations that don't fit the company's long-term growth strategy. For instance, if CenterPoint had any legacy infrastructure or smaller utility holdings outside its core service territories, these could be classified as such.

CenterPoint's stated strategy of portfolio rotation and divesting non-core assets highlights its commitment to shedding holdings that are less productive or don't align with its strategic vision. This approach aims to streamline operations and focus capital on areas with higher potential returns. In 2024, the company continued to evaluate its asset base to ensure it supports its strategic objectives.

- Focus on Core Business: Assets not directly related to regulated electric and natural gas delivery in key markets like Texas.

- Portfolio Rotation: Holdings that the company actively seeks to divest as part of its strategy to shed less productive assets.

- Strategic Alignment: Properties or ventures that do not fit with CenterPoint's long-term growth objectives or capital allocation priorities.

Areas with Strained Stakeholder Relations and High Scrutiny

Certain operational segments within CenterPoint Energy, like Houston Electric, have historically faced heightened stakeholder scrutiny and strained relations. For instance, the aftermath of Hurricane Beryl in July 2024 brought renewed attention to service reliability and emergency response, impacting public perception.

While efforts have been made to address these concerns, areas that continue to grapple with negative public sentiment or persistent regulatory hurdles can be categorized as question marks in a BCG matrix analysis. These segments demand significant resource allocation for remediation and reputation management, potentially hindering growth initiatives elsewhere.

- Houston Electric's post-Hurricane Beryl challenges in July 2024

- Ongoing negative public perception in specific service territories

- Persistent regulatory compliance issues requiring extensive resource diversion

- Impact on overall company reputation and operational efficiency

CenterPoint Energy's older, less efficient infrastructure, such as cast-iron gas pipes, are prime examples of Dogs in its BCG matrix. These assets require ongoing capital for maintenance and replacement, diverting funds from growth areas without contributing significantly to profitability. For instance, the company's ongoing gas infrastructure replacement program, a necessity for safety and compliance, underscores the low return these legacy components generate.

Underperforming competitive energy services that have low market share and minimal growth prospects also fit the Dog category. These segments may consume resources without yielding substantial returns, impacting overall financial performance. CenterPoint's strategic divestitures in 2024, targeting non-core assets, reflect an effort to prune such underperforming units.

These Dog assets represent a drag on the company's resources, demanding investment for upkeep rather than driving expansion. By identifying and managing these low-growth, low-market-share components, CenterPoint aims to optimize its capital allocation towards more promising ventures.

Question Marks

CenterPoint Energy is actively investigating nascent renewable technologies through pilot initiatives in Minnesota, focusing on areas like networked geothermal systems and onsite carbon capture. These ventures represent significant growth potential but are currently in experimental stages with minimal market penetration, requiring substantial investment without immediate profitability.

These pilot projects embody the characteristics of 'Question Marks' within a BCG matrix framework. Their success hinges on future market development and technological maturation, with the potential to evolve into 'Stars' if they can demonstrate scalability and economic viability.

CenterPoint Energy is exploring electric vehicle (EV) infrastructure as a potential area for future capital investment. This aligns with the rapidly expanding EV market, which saw global sales surpass 13 million units in 2023, a significant jump from around 10 million in 2022. While this presents a high-growth opportunity, CenterPoint's current market share in EV charging infrastructure is likely minimal.

These EV initiatives can be viewed as question marks within a BCG matrix framework. They demand substantial upfront investment to establish a presence and capture market share. The long-term profitability remains uncertain, as the competitive landscape is evolving quickly and regulatory frameworks are still developing.

CenterPoint Energy's strategic vision extends beyond basic grid resiliency, embracing advanced modernization through technologies like automated fault detection and dynamic power rerouting. These innovations aim to create a more intelligent grid, capable of swiftly isolating issues and restoring service, significantly improving overall reliability and efficiency. For instance, in 2024, utilities are investing billions in smart grid technologies, with a significant portion allocated to advanced metering infrastructure and grid automation, reflecting the industry's commitment to these forward-looking initiatives.

Expansion into New or Underserved Texas Regions

CenterPoint Energy's expansion into new or underserved Texas regions represents a classic "Question Mark" in the BCG matrix. While the company has a strong presence in Houston, the vastness of Texas presents opportunities for growth in areas where its market share is currently minimal. This strategy involves high potential growth but also demands substantial investment to build infrastructure and customer bases, akin to entering a new, competitive market.

- Growth Potential: Texas's population continues to surge, with many smaller cities and rural areas experiencing significant development, creating demand for reliable energy infrastructure. For instance, the Permian Basin region, while primarily oil and gas focused, also sees increasing residential and commercial energy needs.

- Investment Needs: Establishing a foothold in these new territories requires considerable capital expenditure for building new transmission and distribution lines, substations, and customer service operations. This is a long-term play with uncertain immediate returns.

- Market Share: Initially, CenterPoint's market share in these new regions would be very low, necessitating aggressive strategies to capture customers and compete with existing providers or alternative energy solutions.

- Strategic Considerations: Success hinges on careful market analysis, understanding local regulatory environments, and efficient deployment of capital to overcome the initial low market share and high investment hurdles.

Advanced Predictive Maintenance and AI Tools

CenterPoint Energy is actively integrating advanced predictive maintenance and AI tools to enhance its operations. Investments in platforms like Technosylva and Neara are central to this strategy, aiming to leverage AI for more accurate forecasting of equipment failures and optimizing emergency response protocols.

These technologies represent a significant growth opportunity for CenterPoint, promising substantial improvements in operational efficiency and considerable cost savings through proactive maintenance. For instance, predictive analytics can reduce unplanned downtime, which is a major cost driver in the utility sector.

However, the full realization of these benefits is contingent on their comprehensive integration across CenterPoint's vast infrastructure. The impact and scalability of these AI tools are still being assessed as they move from pilot phases to broader deployment.

- High Growth Potential: AI tools like Technosylva and Neara are expected to drive significant operational efficiencies and cost reductions.

- Developing Integration: The full impact of these AI solutions across CenterPoint's entire system is still in progress.

- Strategic Investment Area: These technologies are considered question marks, requiring ongoing investment to unlock their complete potential and achieve widespread adoption.

- Focus on Optimization: The primary goals include optimizing maintenance schedules and improving the speed and effectiveness of emergency response.

CenterPoint Energy's exploration of new renewable technologies, such as networked geothermal and onsite carbon capture, along with its strategic moves into EV infrastructure and expansion in underserved Texas regions, all fit the 'Question Mark' profile in the BCG matrix.

These initiatives represent high growth potential but currently demand significant investment with uncertain returns, mirroring the characteristics of question marks needing careful nurturing to become future stars.

The company's adoption of advanced AI and predictive maintenance tools also falls into this category, requiring ongoing capital and integration efforts to fully realize their operational and cost-saving benefits.

CenterPoint Energy's strategic focus on these areas highlights a commitment to future growth, even as they navigate the inherent risks and investment requirements associated with developing markets and emerging technologies.

BCG Matrix Data Sources

Our BCG Matrix leverages CenterPoint Energy's official financial filings, industry growth forecasts, and market share data to accurately position business units.