CenterPoint Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CenterPoint Energy Bundle

CenterPoint Energy operates in a regulated utility sector, but even here, competitive forces are at play, influencing pricing and operational strategies. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this landscape.

The complete report reveals the real forces shaping CenterPoint Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Regulatory bodies play a significant role in shaping the bargaining power of suppliers for regulated utilities such as CenterPoint Energy. These agencies often review and approve substantial supplier agreements, especially those involving fuel procurement and critical infrastructure components.

This regulatory scrutiny acts as a check on supplier leverage, ensuring that contracts are both fair and economically sound. By prioritizing consumer welfare and rate stability, regulators can influence contract terms, thereby reducing the ability of suppliers to dictate unfavorable conditions.

For instance, in 2023, CenterPoint Energy's fuel costs, a major component of supplier contracts, were subject to regulatory review to ensure they did not unduly burden customers. This process inherently limits the pricing power of fuel suppliers.

CenterPoint Energy's dependence on a select group of manufacturers for vital equipment like transformers and smart grid technology grants these suppliers considerable bargaining power. The specialized nature and stringent safety requirements for these components mean few alternatives exist, making it difficult for CenterPoint to switch suppliers without incurring significant costs and operational disruptions.

The bargaining power of suppliers in the natural gas and electricity markets, which are crucial for CenterPoint Energy's distribution business, is significant. The prices CenterPoint pays for these commodities are directly tied to global supply and demand dynamics, as well as geopolitical factors influencing production and trade.

While CenterPoint Energy is a distributor and not a producer, these market forces grant considerable leverage to primary natural gas producers and wholesale electricity traders. For instance, in early 2024, natural gas prices saw volatility, with benchmarks like Henry Hub fluctuating based on storage levels and weather patterns, directly impacting CenterPoint's procurement costs.

Labor Unions and Skilled Workforce

The utility sector, including companies like CenterPoint Energy, often depends on a highly specialized and unionized workforce for critical functions such as operations, maintenance, and the expansion of infrastructure. This reliance on skilled labor means that employees possess unique expertise that is not easily replicated.

The presence of strong labor unions further amplifies the bargaining power of this skilled workforce. Unions can negotiate for better wages, benefits, and working conditions, directly influencing CenterPoint Energy's labor costs and potentially limiting its operational flexibility. For instance, in 2023, the average wage for a utility worker in the United States saw an increase, reflecting ongoing demand for these specialized skills and the influence of collective bargaining agreements.

- Skilled Workforce Dependency: Utility operations require specialized knowledge in areas like electrical engineering, gas line maintenance, and grid management.

- Union Influence: Labor unions in the utility sector often negotiate comprehensive contracts that set wage scales and work rules, impacting labor expenses.

- Cost Implications: Increased labor costs due to union demands can directly affect a utility company's profitability and its ability to invest in new projects.

- Operational Flexibility: Union agreements can sometimes restrict management's ability to reassign workers or implement new operational procedures quickly.

Long-Term Supply Agreements and Infrastructure Dependencies

CenterPoint Energy, like many utilities, likely secures long-term supply agreements for essential services and materials, such as natural gas transportation capacity or specialized equipment maintenance. These agreements are crucial for operational stability.

Once CenterPoint Energy commits to significant infrastructure investments tied to these long-term contracts, the cost and complexity of switching suppliers become prohibitively high. This creates a strong dependency on existing suppliers, enhancing their bargaining power throughout the contract's term.

For instance, in 2024, infrastructure projects can involve billions in capital expenditure. If a substantial portion of this is dedicated to supplier-specific infrastructure, such as dedicated pipeline connections or specialized metering technology, the switching costs can easily run into hundreds of millions, if not billions, of dollars, solidifying supplier leverage.

- Long-Term Contracts: Utilities often enter into multi-year agreements for critical inputs like fuel and specialized maintenance.

- Infrastructure Lock-in: Significant capital investment in infrastructure tailored to specific suppliers makes switching costly.

- Supplier Leverage: High switching costs empower suppliers, especially those providing unique or essential components.

- Operational Stability: These agreements, while increasing supplier power, also ensure a reliable supply chain for essential services.

Suppliers of specialized equipment and raw materials, like natural gas and critical infrastructure components, hold significant bargaining power over CenterPoint Energy. This power is amplified by the high switching costs associated with long-term contracts and infrastructure lock-in, making it difficult and expensive for CenterPoint to change providers.

The specialized nature of components such as transformers and smart grid technology, coupled with stringent safety requirements, limits the pool of qualified suppliers, further increasing their leverage. In 2023, CenterPoint Energy's fuel costs, a major expense, were subject to regulatory review, demonstrating how regulators can moderate supplier pricing power to protect consumers.

The skilled and often unionized workforce also exerts considerable bargaining power, influencing labor costs and operational flexibility through collective agreements. For example, in 2023, average utility worker wages saw an increase, reflecting demand and union negotiations.

| Supplier Type | Factors Influencing Bargaining Power | Impact on CenterPoint Energy | Example Data/Trend (2023-2024) |

|---|---|---|---|

| Fuel Suppliers (Natural Gas) | Global supply/demand, geopolitical factors, storage levels, weather | Directly impacts procurement costs and price volatility | Henry Hub natural gas prices fluctuated in early 2024 due to storage and weather. |

| Specialized Equipment Manufacturers (Transformers, Grid Tech) | Limited qualified suppliers, high safety standards, specialized nature | High switching costs, potential for price increases, operational disruption risk | Infrastructure projects in 2024 can involve billions in CapEx, with specialized equipment being a significant portion. |

| Labor (Skilled Utility Workers) | Specialized expertise, unionization, demand for skills | Increased labor costs, potential limitations on operational flexibility | Average US utility worker wages increased in 2023 due to demand and union influence. |

What is included in the product

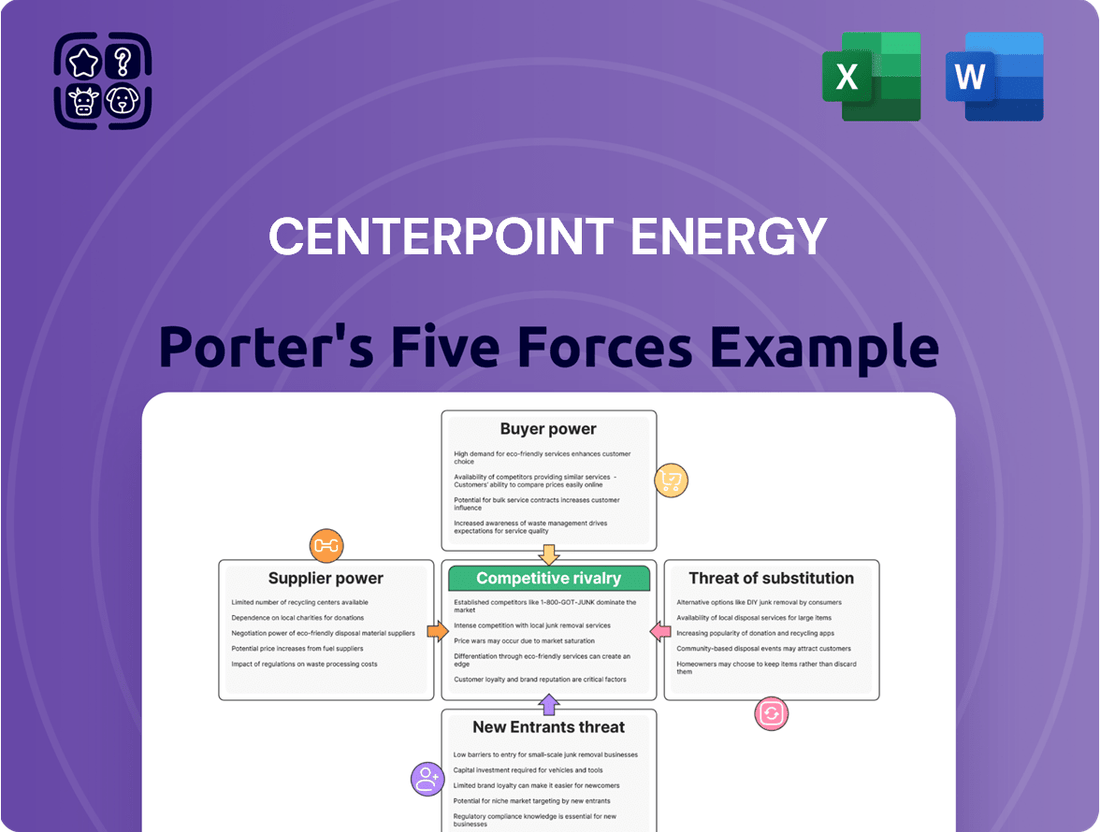

This analysis delves into the competitive forces impacting CenterPoint Energy, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the energy sector.

Instantly understand strategic pressure with a powerful spider/radar chart for CenterPoint Energy's Porter's Five Forces.

Customers Bargaining Power

In its core regulated electric transmission and distribution and natural gas distribution segments, CenterPoint Energy operates as a natural monopoly. This means customers in its service territories, such as Houston for its electric operations, have no alternative providers for these essential utilities. For instance, in 2023, CenterPoint Energy served approximately 2.7 million electric customers and 2.1 million natural gas customers across Texas, highlighting the vast customer base with limited choice.

This lack of direct competition significantly curtails the bargaining power of individual customers. They cannot switch to a different provider to negotiate lower prices or better service terms, as they are tied to CenterPoint's offerings within their specific geographic area. This regulatory structure inherently concentrates power with the utility provider.

While individual customers of CenterPoint Energy possess limited bargaining power, regulatory bodies significantly amplify consumer interests. State Public Utility Commissions (PUCs) and federal agencies like the Federal Energy Regulatory Commission (FERC) scrutinize and approve rate adjustments, service quality benchmarks, and capital expenditure plans. This oversight effectively grants customers a collective voice, constraining CenterPoint Energy's autonomy in setting terms and pricing.

Customers face extremely high, if not impossible, switching costs for their primary electricity and natural gas delivery services. For instance, in 2024, the average cost to install a new natural gas line connection in a residential area can range from $1,500 to $5,000, making a switch prohibitively expensive.

Relocating or adopting entirely off-grid solutions are not practical alternatives for most households and businesses, further cementing CenterPoint Energy's position. The capital investment for reliable residential solar and battery storage systems, for example, often exceeds $20,000, a significant barrier for widespread adoption as a primary energy source.

Customer Leverage in Competitive Energy Services

For CenterPoint Energy's competitive energy services, like home repair and maintenance, customers wield considerable power. This is largely due to the abundance of alternative providers available, making consumers more attuned to pricing and service quality.

Customers can easily switch between providers, forcing companies to compete fiercely on price and service. This dynamic significantly impacts profitability in these specific service areas.

- High Availability of Alternatives: Customers in competitive energy services can choose from numerous providers, increasing their leverage.

- Price Sensitivity: The ease of switching makes customers highly sensitive to price differences, pressuring service providers to offer competitive rates.

- Focus on Service Quality: Beyond price, customers can also compare and select providers based on the quality of service offered, further empowering their decision-making.

Large Industrial and Commercial Customers

Large industrial and commercial customers, due to their substantial energy needs, can exert considerable bargaining power. Their significant consumption means that losing even one can impact revenue, giving them leverage to negotiate terms. For instance, in 2024, large commercial and industrial customers accounted for a significant portion of CenterPoint Energy's revenue, with their ability to explore alternative energy sources or relocate their operations adding further weight to their demands for competitive pricing and tailored service agreements.

These customers may also have the capacity to invest in self-generation, such as on-site solar or combined heat and power systems, which directly reduces their reliance on CenterPoint Energy. This potential for de-integration means CenterPoint must remain competitive and responsive to their needs, often leading to customized contracts that ensure reliability and favorable rates, all within the overarching regulatory environment that governs utility pricing and service standards.

- Significant Revenue Contribution: Large customers represent a substantial portion of utility revenue, making their retention a priority.

- Potential for Self-Generation: The ability of these customers to generate their own power creates a credible threat of switching, increasing their bargaining leverage.

- Relocation Threat: High energy costs or unfavorable service terms can incentivize large industrial users to relocate to areas with more competitive offerings.

- Negotiating Power for Service: Beyond price, these clients can negotiate for enhanced service reliability and specific operational support.

For CenterPoint Energy's core regulated utility services, customer bargaining power is exceptionally low due to the natural monopoly structure. Customers in its electric and gas distribution territories, like Houston, have no other utility providers available. For example, in 2023, CenterPoint served approximately 2.7 million electric and 2.1 million gas customers in Texas, all with limited choice.

Switching costs are prohibitively high for essential utility services, effectively locking customers in. The expense of new connections, often ranging from $1,500 to $5,000 in 2024 for natural gas, and the significant investment for alternative energy solutions like solar and battery storage (often over $20,000), make changing providers impractical for most.

While individual customers have little sway, regulatory bodies like Public Utility Commissions act as a collective voice, approving rates and service standards. This oversight significantly constrains CenterPoint's pricing and service decisions, indirectly empowering consumers.

| Customer Type | Bargaining Power Factor | Impact on CenterPoint Energy |

|---|---|---|

| Residential Customers (Regulated) | Very Low (Monopoly, High Switching Costs) | Minimal direct negotiation; reliant on regulatory oversight. |

| Industrial/Commercial Customers (Regulated) | Moderate (Large Volume, Potential Self-Generation) | Can negotiate for favorable rates and service terms due to significant consumption and threat of de-integration. |

| Customers (Competitive Services) | High (Many Alternatives, Price Sensitive) | Forces competitive pricing and service quality to retain business. |

What You See Is What You Get

CenterPoint Energy Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive CenterPoint Energy Porter's Five Forces Analysis details the competitive landscape, including the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

CenterPoint Energy enjoys a significant advantage in competitive rivalry due to its regulated monopoly status in electricity transmission and distribution, as well as natural gas distribution within its designated service territories. This means other utility companies are generally prohibited from entering these specific areas to compete for the same customers, effectively eliminating direct head-to-head rivalry for its core services.

This regulated structure inherently shields CenterPoint Energy from the intense competitive pressures often seen in deregulated markets. For instance, in 2024, utilities operating under such frameworks typically face minimal direct competition for their essential services, allowing them to focus on operational efficiency and customer service rather than aggressive market share battles.

CenterPoint Energy encounters significant rivalry in its unregulated energy services, like home repair and maintenance. This sector is populated by numerous local and national companies vying for customer attention, making differentiation crucial.

In 2024, the home services market, which includes energy-related repairs, continued to be highly competitive. Companies focus on building brand loyalty through exceptional service and competitive pricing to stand out. For instance, a 2024 industry report indicated that customer retention in home services is heavily influenced by perceived value and reliability, with price being a key factor for a substantial portion of consumers.

CenterPoint Energy faces indirect competition from the growing adoption of distributed energy resources. For instance, the U.S. solar market saw installations reach approximately 6.4 gigawatts in the first quarter of 2024, according to the Solar Energy Industries Association. This trend, along with advancements in geothermal and other localized energy generation, can reduce customer demand for traditional grid-supplied electricity and natural gas, impacting CenterPoint's core business.

Industry Consolidation and Mergers

The utility sector, while generally stable, does experience periods of consolidation through mergers and acquisitions. These deals can reshape the competitive environment, though they typically don't introduce new direct rivals within a specific utility's regulated service area.

While CenterPoint Energy might not face immediate new utility entrants due to its regulated nature, these consolidation activities can lead to the emergence of larger, more diversified energy companies. These entities could indirectly influence the market through their scale and broader energy portfolios.

For instance, in 2023, the energy sector saw significant M&A activity. ExxonMobil's proposed acquisition of Pioneer Natural Resources for approximately $60 billion, and Chevron's acquisition of Hess Corporation for $53 billion, highlight the trend of larger players consolidating assets. While these are in the upstream oil and gas sector, they signal a broader industry movement towards larger, more integrated entities that could eventually impact the utility landscape.

- Industry Consolidation: The utility sector sees occasional mergers and acquisitions, altering the competitive landscape.

- Impact on Rivalry: While direct new entrants are rare in regulated territories, consolidation can create larger, diversified energy companies.

- Real-world Example: Major 2023 M&A deals in the broader energy sector, like ExxonMobil's acquisition of Pioneer Natural Resources for ~$60 billion, illustrate this consolidation trend.

Regulatory Environment and Rate Cases

Competition in the regulated utility sector often plays out within the confines of the regulatory process itself. Utilities essentially vie for favorable outcomes in rate cases, which directly influence their financial health and capacity for future investment. These outcomes, in turn, indirectly shape a utility's long-term competitive position relative to other utilities operating under different regulatory frameworks.

For instance, a successful rate case can grant a utility the necessary capital to upgrade infrastructure or pursue growth opportunities, thereby enhancing its competitive edge. Conversely, unfavorable decisions can constrain a company's ability to compete effectively. In 2023, CenterPoint Energy sought rate increases through filings in various jurisdictions, highlighting this dynamic. The outcome of these cases directly impacts their ability to fund projects like their Houston electric system modernization, a key area for future competitiveness.

- Rate Case Outcomes: Utilities compete indirectly by seeking regulatory approvals for rate increases that fund essential infrastructure and growth initiatives.

- Financial Health Impact: Favorable rate case decisions directly bolster a utility's financial standing, enabling greater investment and competitive positioning.

- Regional Disparities: Regulatory environments vary significantly across states, creating competitive advantages or disadvantages for utilities based on their operating regions.

CenterPoint Energy's competitive rivalry is largely mitigated in its core regulated utility operations due to its monopoly status in specific service territories. However, it faces competition in unregulated segments and indirectly from distributed energy resources, with industry consolidation also subtly reshaping the landscape.

The company's primary competitive arena often involves navigating regulatory processes, where favorable rate case outcomes are crucial for funding infrastructure and growth, thereby influencing its long-term competitive standing.

In 2024, the utility sector's stability, contrasted with the dynamic unregulated home services market, highlights where CenterPoint faces the most direct competitive pressures.

For example, the significant increase in distributed solar installations in Q1 2024, reaching 6.4 GW, underscores the growing indirect competition from alternative energy sources.

SSubstitutes Threaten

The threat of substitutes for CenterPoint Energy's traditional electricity delivery services is growing, primarily from distributed renewable energy generation. Customers increasingly have the option to generate their own power, most notably through rooftop solar installations.

As solar technology continues to advance, becoming more efficient and cost-effective, and as battery storage solutions improve, the ability for consumers to disconnect from or reduce their reliance on the established grid intensifies. This trend directly impacts the demand for CenterPoint Energy's core services.

For instance, in 2023, the U.S. saw a significant increase in residential solar installations, with projections indicating continued strong growth through 2024. This growing adoption means a portion of electricity demand previously met by CenterPoint Energy could be satisfied by self-generation, posing a direct substitute threat.

Improvements in energy efficiency and conservation represent a significant threat of substitutes for CenterPoint Energy. As homes, appliances, and industrial processes become more efficient, the overall demand for electricity and natural gas decreases. For instance, advancements in insulation and smart home technology in 2024 are directly impacting energy consumption patterns.

Programs actively promoting energy conservation, alongside the widespread adoption of smart thermostats and enhanced building insulation, directly reduce the amount of energy customers need from CenterPoint Energy. This shift towards lower consumption means fewer kilowatt-hours of electricity and therms of natural gas are purchased, impacting the utility's revenue streams.

The threat of substitutes for natural gas distribution, particularly in heating and cooling, is a significant factor. Electric heat pumps, geothermal systems, and other non-combustion heating solutions represent viable alternatives. As these technologies continue to improve and gain market traction, they can directly impact CenterPoint Energy's demand for natural gas.

In 2024, the adoption of electric heat pumps, especially in new construction and retrofits, is accelerating due to increasing energy efficiency standards and government incentives. For instance, the Inflation Reduction Act in the United States offers substantial tax credits for heat pump installations, making them a more financially attractive option for consumers. This trend directly challenges the traditional reliance on natural gas for residential and commercial heating.

Fuel Switching by Large Industrial Customers

Large industrial clients, particularly those with significant energy demands, possess the inherent ability to shift between various fuel sources based on cost and availability. This capacity to switch, for instance, from natural gas to propane or even invest in on-site generation, poses a potential long-term substitute threat to CenterPoint Energy's core natural gas distribution operations.

In 2024, the volatility in natural gas prices, influenced by global supply dynamics and geopolitical events, directly impacts the economic viability of fuel switching for these large consumers. For example, if natural gas prices spike significantly while alternatives remain stable or decrease, the incentive to switch intensifies.

- Industrial Energy Consumption: In 2023, industrial customers accounted for a substantial portion of CenterPoint Energy’s natural gas revenue, highlighting the importance of retaining this segment.

- Fuel Cost Differentials: Fluctuations in the spread between natural gas and alternative fuels like propane or oil directly influence the attractiveness of switching.

- Technological Advancements: Innovations in on-site generation and energy storage technologies can lower the barriers to self-sufficiency for industrial users.

- Regulatory Environment: Government policies and incentives related to energy sources can either encourage or discourage fuel switching by industrial customers.

Emerging Technologies and Microgrids

The rise of advanced microgrids and community energy systems poses a significant threat of substitution for CenterPoint Energy. These systems allow for localized energy generation and distribution, potentially reducing reliance on traditional utility infrastructure. For instance, by 2024, the U.S. Department of Energy reported that over 200 microgrids were operational or under development, showcasing a growing trend toward energy independence.

While these solutions are currently in their nascent stages for widespread adoption, they represent a viable long-term alternative to CenterPoint's centralized model. This shift could impact demand for traditional grid services, especially in areas where microgrid technology becomes more cost-effective and accessible. The ability to generate power locally, perhaps through solar or battery storage, directly substitutes for the energy CenterPoint delivers.

The economic viability of microgrids is improving, driven by falling renewable energy costs and advancements in energy storage technology. As these technologies mature, they could offer consumers more control over their energy supply and costs, presenting a direct substitute for the services provided by established utilities like CenterPoint Energy.

- Microgrid Development: Over 200 operational or planned microgrids in the U.S. by 2024, indicating growing localized energy solutions.

- Energy Independence: These systems enable communities to generate and manage their own power, reducing reliance on central grids.

- Technological Advancement: Falling costs of renewables and improved battery storage make microgrids increasingly competitive.

- Substitution Threat: Localized energy generation offers a direct alternative to traditional utility grid services.

The threat of substitutes for CenterPoint Energy's core services is multifaceted, driven by technological advancements and evolving consumer preferences. Distributed generation, energy efficiency, alternative heating/cooling solutions, and localized energy systems all present viable alternatives that can reduce demand for traditional utility services.

For instance, the increasing adoption of rooftop solar, coupled with advancements in battery storage, allows customers to generate and store their own electricity, directly substituting for grid-supplied power. Similarly, the growing efficiency of electric heat pumps provides a cleaner and often more cost-effective alternative to natural gas for heating, especially with supportive government incentives like those seen in 2024.

Furthermore, the development of microgrids and community energy systems offers localized energy solutions that can bypass traditional utility infrastructure altogether. These trends, supported by falling renewable energy costs, are reshaping the energy landscape and intensifying the threat of substitutes for CenterPoint Energy.

| Substitute Type | Key Drivers | Impact on CenterPoint Energy |

|---|---|---|

| Distributed Renewables (e.g., Solar) | Falling technology costs, government incentives, energy independence desires | Reduced electricity sales, potential grid disengagement |

| Energy Efficiency & Conservation | Improved building materials, smart home technology, consumer awareness | Lower overall energy demand, reduced kilowatt-hour sales |

| Electric Heat Pumps | Higher energy efficiency, environmental concerns, tax credits (e.g., Inflation Reduction Act) | Decreased natural gas demand for heating |

| Microgrids & Community Energy Systems | Technological advancements, localized control, cost-effectiveness of renewables | Potential bypass of traditional grid infrastructure, reduced reliance on utility services |

Entrants Threaten

The threat of new entrants for a company like CenterPoint Energy is significantly diminished by the sheer scale of capital required to establish competing infrastructure. Building out a new electricity transmission and natural gas distribution network demands billions of dollars. For instance, utility infrastructure projects often run into the hundreds of millions, if not billions, of dollars for even localized expansions, making a full-scale new entrant investment exceptionally challenging.

New entrants into the energy utility sector, like CenterPoint Energy, are significantly deterred by stringent regulatory requirements and the lengthy approval processes involved. This includes securing numerous licenses, permits, and certificates of public convenience and necessity from various state and federal agencies, a process that can take years and involve substantial legal and consulting fees.

For instance, in 2023, the average time for a major utility project to receive all necessary federal permits in the United States was estimated to be over 4.5 years, a testament to the complexity and scrutiny involved. This regulatory labyrinth acts as a formidable barrier, making it exceptionally difficult and costly for potential new players to establish a competitive presence.

CenterPoint Energy's existing rights-of-way and easements are significant barriers to new entrants. These established pathways for its pipelines and power lines are essential for delivering energy services. For instance, in 2023, CenterPoint Energy reported managing thousands of miles of transmission and distribution lines across its service territories, a network built over decades.

The process of acquiring new rights-of-way for a competing energy network is exceedingly difficult, often taking many years and incurring substantial costs, frequently encountering public resistance and regulatory hurdles. This makes it incredibly challenging for potential competitors to replicate CenterPoint's extensive infrastructure footprint.

Economies of Scale and Network Effects

Incumbent utilities like CenterPoint Energy possess significant advantages due to their established economies of scale. This allows them to spread the high costs of infrastructure, operations, and maintenance across a vast customer base, leading to lower per-unit costs. For instance, in 2023, CenterPoint Energy reported operating expenses of approximately $15.4 billion, a figure that reflects the massive scale of their service delivery.

A new entrant would find it incredibly challenging to match these cost efficiencies. Building a comparable network and customer base from scratch would require immense capital investment, making it difficult to compete on price against a utility that already benefits from decades of scaled operations. This inherent cost disadvantage acts as a significant barrier.

- Economies of Scale: CenterPoint Energy's extensive infrastructure and large customer base in 2023 contribute to lower per-unit operating costs compared to a potential new entrant.

- Network Effects: While less pronounced than in tech, a utility's established network of transmission and distribution lines creates a de facto barrier, as replicating this infrastructure is prohibitively expensive.

- Capital Intensity: The high capital expenditure required to build and maintain utility infrastructure, estimated in the billions for companies like CenterPoint, deters new market participants.

Brand Recognition and Customer Trust in Essential Services

For essential services like electricity and natural gas, customers place a high premium on reliability and unwavering trust. CenterPoint Energy, as a long-standing provider, leverages decades of established brand recognition and deep customer reliance, making it a trusted name in the communities it serves.

A new entrant would face a significant challenge in cultivating the necessary trust and demonstrating consistent reliability to effectively compete with, let alone displace, an incumbent utility like CenterPoint Energy. This is particularly true in 2024, where concerns about energy security and service continuity remain paramount for consumers.

- Brand Loyalty: In 2023, residential customer satisfaction scores for CenterPoint Energy in Texas averaged 7.5 out of 10, indicating a strong existing customer base.

- Capital Intensity: The substantial infrastructure investment required for new entrants in the utility sector acts as a significant barrier, often exceeding billions of dollars.

- Regulatory Hurdles: Obtaining the necessary permits and approvals from state and local regulatory bodies can be a lengthy and complex process, typically taking several years.

The threat of new entrants for CenterPoint Energy is very low due to the immense capital needed to build competing infrastructure, often in the billions of dollars. Furthermore, the complex and lengthy regulatory approval processes, which can take years and significant legal fees, act as a substantial deterrent.

Existing rights-of-way and established economies of scale provide CenterPoint with significant cost advantages that new players struggle to match. In 2023, CenterPoint Energy’s operating expenses were approximately $15.4 billion, highlighting the scale that new entrants would need to replicate.

Customer trust and brand loyalty, cultivated over decades, are difficult for new entrants to overcome, especially in 2024 when energy reliability is a key consumer concern. For example, CenterPoint Energy's residential customer satisfaction scores in Texas averaged 7.5 out of 10 in 2023, reflecting strong existing relationships.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Intensity | Building new utility infrastructure requires billions in investment. | Prohibitively expensive for most potential competitors. | Utility infrastructure projects often exceed hundreds of millions to billions of dollars. |

| Regulatory Hurdles | Extensive licensing, permits, and approvals are needed. | Time-consuming (years) and costly, deterring new market entry. | Average federal permit time for major utility projects exceeded 4.5 years in 2023. |

| Economies of Scale | Existing utilities have lower per-unit costs due to large operations. | New entrants face higher costs and struggle to compete on price. | CenterPoint Energy's 2023 operating expenses of ~$15.4 billion illustrate its scale advantage. |

| Established Network & Rights-of-Way | Existing infrastructure and easements are difficult to replicate. | New entrants face significant challenges in acquiring necessary pathways. | CenterPoint Energy manages thousands of miles of transmission and distribution lines. |

| Brand Loyalty & Trust | Incumbents benefit from long-standing customer relationships. | New entrants struggle to gain customer trust and market share. | CenterPoint Energy's 2023 Texas residential customer satisfaction averaged 7.5/10. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CenterPoint Energy is built upon a foundation of publicly available information, including annual reports, SEC filings, and investor relations materials. We also incorporate insights from industry-specific publications and market research reports to provide a comprehensive view of the competitive landscape.