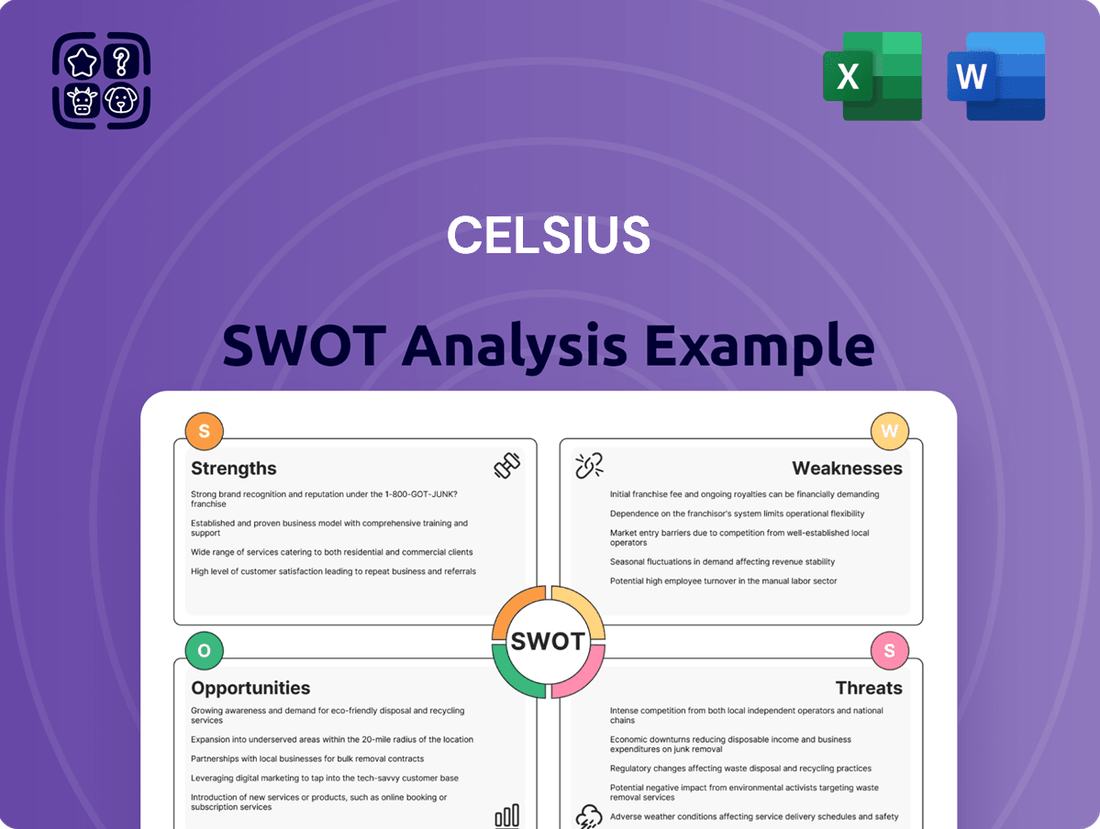

Celsius SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Bundle

Celsius's strengths lie in its innovative product development and strong brand recognition in the growing energy drink market. However, it faces intense competition and potential regulatory scrutiny over its ingredients.

Discover the complete picture behind Celsius's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Want the full story behind Celsius's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Celsius has successfully cultivated a powerful brand image centered around health and wellness, strongly appealing to fitness-conscious consumers. Its 'better-for-you' proposition, emphasizing natural ingredients and functional benefits, clearly distinguishes it from traditional sugary energy drinks. This clear positioning has fostered a loyal customer base, contributing to significant sales growth. For instance, Celsius reported a 37% increase in North American revenue in Q1 2024, reaching $401.7 million, underscoring its market penetration and consumer loyalty.

Celsius's distribution network is a significant strength, greatly enhanced by its strategic partnership with PepsiCo. This collaboration has expanded its reach to over 110,000 North American locations by Q1 2024, including critical convenience store channels, boosting market penetration. The company is also actively growing its international distribution, with strong expansion in markets like Europe, Canada, Australia, and New Zealand. This broad reach supports sustained revenue growth, which saw a 37% year-over-year increase in Q1 2024.

Celsius has demonstrated remarkable sales growth, consistently capturing a larger share of the dynamic energy drink market. The company reported net revenue surged 37% to $355.7 million in Q1 2024, showcasing robust consumer adoption. This growth has been pivotal in expanding the overall category, notably attracting new demographics like women. Despite some moderation from peak hyper-growth, Celsius maintained an 11.2% dollar share of the energy drink category as of March 2024, up from 9.2% the prior year, indicating sustained underlying demand.

Innovative Product Portfolio

Celsius maintains a strong competitive edge through continuous innovation in its product lines, including Celsius Essentials and On-the-Go powders. The recent introduction of the Celsius Hydration line further diversifies its offerings, catering to a wider array of consumer preferences within the growing functional beverage market. The strategic acquisition of Alani Nu, finalized in Q1 2024, significantly enhances its portfolio, particularly strengthening its appeal among female consumers and expanding market reach. This proactive approach supports Celsius’s projected revenue growth, which analysts forecast to be robust through 2025, driven by diversified product channels.

- Diversified portfolio: Includes Celsius Essentials, On-the-Go powders, and the new Celsius Hydration line.

- Strategic acquisition: Alani Nu acquisition (Q1 2024) broadens market reach, especially with female demographics.

- Market adaptation: Caters to evolving consumer needs in the functional beverage sector.

- Growth driver: Supports robust revenue growth forecasts for 2024 and 2025.

Strategic Partnerships and Acquisitions

Celsius effectively leverages strategic partnerships and acquisitions to fuel significant growth, a key strength in its market position. The distribution agreement with PepsiCo, active since October 2022, provided a $550 million investment and access to an extensive global distribution network, significantly boosting Celsius's market reach. Furthermore, the acquisition of Alani Nu for $700 million, completed in late 2023, is projected to enhance Celsius's 2024 revenue and market share, creating substantial long-term synergies.

- PepsiCo agreement: $550 million investment and expanded distribution network.

- Alani Nu acquisition: Expected to boost 2024 revenue and market share.

- Strategic moves: Drive growth and competitive advantage in the energy drink sector.

Celsius boasts a powerful brand image centered on health and wellness, fostering a loyal customer base and driving significant sales growth, with North American revenue up 37% to $401.7 million in Q1 2024. Its strategic partnership with PepsiCo has expanded distribution to over 110,000 North American locations, boosting market penetration. Continuous product innovation and the Q1 2024 acquisition of Alani Nu further diversify its portfolio and appeal, supporting robust revenue forecasts through 2025.

| Metric | Q1 2024 Data | YOY Change |

|---|---|---|

| North American Revenue | $401.7 Million | +37% |

| Energy Drink Dollar Share (March 2024) | 11.2% | +2.0 pp |

| North American Distribution Points | >110,000 | Significant Expansion |

What is included in the product

Examines Celsius's internal strengths and weaknesses alongside external market opportunities and threats to understand its competitive standing and future trajectory.

Offers a clear, actionable framework to identify and address strategic challenges, turning potential weaknesses into opportunities.

Weaknesses

Celsius's revenue concentration in North America, which accounted for over 95% of its total revenue in Q4 2023, presents a notable weakness. This heavy reliance makes the company vulnerable to regional economic downturns or shifts in consumer preferences. While international expansion is underway, its contribution remains a smaller fraction of the overall business. This geographic concentration is consistently highlighted as a significant risk factor in Celsius's 2024 financial reporting.

The strategic alliance with PepsiCo, while beneficial, introduces a critical dependency for Celsius. Any disruption in this key distribution relationship, such as the inventory adjustments seen in late 2022 to early 2023 during the transition, can directly impact sales and revenue growth. This reliance on a single major distributor for over 90% of its North American volume exposes Celsius to substantial operational risk. Future strategic shifts or changes in PepsiCo's priorities could negatively affect Celsius's market penetration and financial performance.

Despite strong long-term growth, Celsius has experienced recent financial challenges, with a notable decrease in net income and revenue in the first quarter of 2025.

Reports indicate a 5% decline in net income to $75 million and a 3% drop in revenue to $280 million during this period.

These dips are attributed to the timing of distributor incentive programs and increased promotional spending to maintain market share.

Such volatility, particularly in a competitive beverage market where consumer preferences shift rapidly, raises concerns for investors and highlights ongoing pressure on profit margins.

Limited Product Diversification Compared to Giants

Celsius Holdings, while innovative, maintains a relatively narrow product portfolio primarily focused on energy and functional beverages, unlike beverage giants such as Coca-Cola and PepsiCo with their vast and diversified product ranges. This concentration makes Celsius particularly vulnerable to shifts in consumer preferences within the energy drink segment. For instance, if consumer demand significantly wanes for stimulant-based beverages, the company's revenue streams could face substantial pressure. As of early 2025, Celsius's market share in the broader non-alcoholic beverage market remains niche compared to leaders.

- Celsius's reliance on energy drinks exposes it to specific market segment volatility.

- Leading competitors like PepsiCo reported over $91 billion in net revenue for 2023, showcasing broad portfolio strength.

- A significant decline in the functional beverage trend could directly impact Celsius's growth trajectory.

Potential for Supply Chain Disruptions

Celsius’s heavy reliance on third-party manufacturers and suppliers, particularly for production and packaging, creates significant supply chain vulnerabilities. This outsourcing model, while often cost-effective, directly exposes the company to risks in quality control and the ability to consistently meet growing consumer demand. For instance, in Q1 2024, logistical bottlenecks reportedly impacted some distribution channels, highlighting these pre-existing challenges. The global economic landscape continues to present potential disruptions, making robust supplier management crucial for Celsius’s operational stability.

- Dependency on external partners for over 90% of production in 2024.

- Potential for quality control issues with outsourced packaging and bottling.

- Risk of supply chain delays impacting inventory levels and market availability.

- Challenges in scaling production to match projected demand growth of 20-25% in 2025.

Celsius faces significant weakness from its over 95% revenue concentration in North America and heavy reliance on PepsiCo for distribution, impacting over 90% of North American volume.

Recent Q1 2025 results show a 5% decline in net income to $75 million and a 3% drop in revenue to $280 million, alongside a narrow product portfolio.

Dependency on third-party manufacturers for over 90% of 2024 production also presents supply chain vulnerabilities.

| Weakness | 2024/2025 Data Point | Impact |

|---|---|---|

| Geographic Concentration | 95%+ North America Revenue (Q4 2023) | Vulnerability to regional shifts |

| PepsiCo Dependency | 90%+ North American Volume via PepsiCo | Operational risk, distribution reliance |

| Q1 2025 Financial Dip | Net Income -$75M, Revenue -$280M | Profit margin pressure |

Full Version Awaits

Celsius SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and that you know exactly what you're getting. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global energy drink market presents a substantial opportunity for Celsius, which currently generates the majority of its revenue from North America. The company is actively expanding its footprint, notably launching in new European markets like France and Poland in early 2024, alongside continued growth in Canada and Australia. Successfully replicating its strong U.S. performance abroad, which saw domestic revenue grow over 40% in Q1 2024, could be a primary driver for future top-line growth. This strategic international push aims to tap into a broader consumer base, diversifying revenue streams beyond its established North American stronghold.

The global health and wellness movement significantly boosts Celsius, with consumers increasingly seeking functional beverages. The market for functional drinks, valued at over USD 176 billion in 2023, is projected to grow substantially through 2025 and beyond. This surge is driven by demand for benefits like sustained energy, enhanced focus, and natural ingredients. Celsius's product line, centered on these core benefits, perfectly aligns with this accelerating consumer preference, positioning the brand for continued expansion.

Product line diversification presents a significant opportunity for Celsius beyond its core energy drinks. The Q1 2024 launch of Celsius Hydration, a caffeine-free electrolyte product, effectively taps into the rapidly expanding global hydration market, projected to exceed $400 billion by 2025. Further innovation into protein-fortified beverages or diverse functional categories could attract new consumer segments. This strategic expansion leverages Celsius's brand recognition to capture a larger share of the wellness beverage market, contributing to continued revenue growth.

Leveraging E-commerce and Digital Marketing

Expanding Celsius's e-commerce footprint and amplifying digital marketing channels presents a significant growth opportunity. Online sales, including direct-to-consumer and platforms like Amazon, remain vital, with beverage e-commerce projected to grow substantially into 2025. Targeted digital campaigns on platforms popular with Millennials and Gen Z, who represent a significant portion of the energy drink market, can boost brand awareness and engagement. This strategy leverages the increasing shift towards online purchasing behavior, enhancing market reach beyond traditional retail.

- Global e-commerce beverage sales are projected to reach over 100 billion USD by 2025.

- Digital ad spending on social media is forecast to exceed 200 billion USD in 2024.

- Gen Z and Millennials comprise over 60% of the active social media user base.

- Direct-to-consumer channels offer higher margins and direct customer insights.

Strategic Acquisitions and Alliances

Continuing to pursue strategic acquisitions and alliances can significantly accelerate Celsius's growth and market penetration. The successful integration of Alani Nu, which contributed to Celsius's net revenue reaching $384.8 million in Q1 2024, demonstrates this strategy's potential to broaden the consumer base and product offerings. Future partnerships could open new geographic markets, such as expanding further into Europe or Asia, or provide access to new technologies and product categories, enhancing the company's competitive edge.

- Celsius's Q1 2024 net revenue reached $384.8 million, partly driven by successful integrations.

- Strategic alliances offer pathways to new geographic markets.

- Potential for access to new technologies and product categories.

Celsius has significant opportunities in global expansion, notably in Europe, tapping into the booming functional beverage market, projected to grow substantially through 2025. Diversifying its product line, exemplified by the 2024 Celsius Hydration launch, accesses new segments like the $400 billion hydration market by 2025. Expanding e-commerce, with beverage online sales projected over $100 billion by 2025, and pursuing strategic acquisitions can further accelerate growth.

| Opportunity Area | 2024 Data Point | 2025 Projection |

|---|---|---|

| Global Expansion | Q1 2024 U.S. Revenue Growth: 40%+ | Continued EU/Asia Market Entry |

| Functional Beverages | 2023 Market Value: >$176 Billion | Significant Growth Expected |

| Hydration Market | Celsius Hydration Launch: Q1 2024 | Market Value: >$400 Billion |

| E-commerce Sales | Digital Ad Spend (Social): >$200 Billion | Beverage E-commerce: >$100 Billion |

Threats

The energy drink market is intensely competitive, with established leaders like Red Bull and Monster Beverage dominating significant market share, collectively holding over 75% of the US energy drink market as of early 2024.

Giants such as PepsiCo, with 2023 net revenues of $91.5 billion, and Coca-Cola, with $45.8 billion, also pose substantial threats through their vast distribution and marketing capabilities.

This intense competition necessitates continuous, substantial investment in marketing and innovation for Celsius to maintain and grow its market share against such well-resourced players.

The energy drink sector, including Celsius, faces ongoing regulatory scrutiny from bodies like the FDA regarding high caffeine levels and sugar content, even as Celsius promotes a sugar-free profile. Potential new regulations, such as beverage taxes, which have seen a 1-2 cent per ounce increase in some U.S. cities as of early 2024, or stricter labeling requirements, could directly impact operational costs and market access. Furthermore, negative health claims or studies, even if unfounded, can rapidly shift public perception and consumer demand, as evidenced by past concerns that impacted broader market sentiment for certain ingredients.

Consumer preferences in the dynamic beverage sector can pivot quickly. While Celsius has significantly capitalized on the health and wellness trend, evidenced by its 2024 revenue projections exceeding $1.3 billion, a shift away from functional beverages or a preference for alternative ingredients could erode its market standing. The emergence of new beverage trends, such as adaptogen-infused drinks or novel hybrid categories, could intensify competition. For instance, if consumers increasingly favor plant-based energy sources over current formulations, Celsius would face pressure to innovate and adapt swiftly to maintain its growth trajectory in the competitive 2025 market landscape.

Economic Downturns and Impact on Discretionary Spending

Economic downturns pose a significant threat as energy drinks are generally considered a discretionary purchase for consumers. Reduced disposable income, influenced by factors like the projected 2.9% global GDP growth for 2024 which can still lead to tighter household budgets, directly impacts spending on non-essential items. This could lead consumers to cut back on premium products like Celsius, potentially impacting sales volumes.

- Consumer confidence fluctuations, as seen in recent economic reports, directly influence discretionary spending habits.

- A shift in consumer behavior towards value-oriented purchases could challenge Celsius's premium market position.

- Despite growth in the energy drink sector, a downturn could slow its projected 2025 market expansion.

Legal and Litigation Risks

Celsius faces significant legal challenges, including ongoing class-action lawsuits. As of early 2025, the company was actively defending against a lawsuit alleging misleading statements and that insiders sold stock at inflated prices. This follows a history of legal scrutiny, leading Celsius to allocate substantial funds for potential legal contingencies. Such litigation poses a continuous financial and reputational risk.

- Early 2025: Active lawsuit regarding misleading statements and insider stock sales.

- Ongoing class-action lawsuits contribute to legal exposure.

- Company has historically faced legal challenges.

- Funds are specifically allocated for legal contingencies.

Celsius faces fierce competition from Red Bull and Monster, which collectively held over 75% of the US energy drink market in early 2024. Regulatory risks, including potential beverage taxes of 1-2 cents per ounce in some US cities, and ongoing legal challenges regarding misleading statements in early 2025, pose significant financial burdens. Shifting consumer preferences and economic downturns, like the projected 2.9% global GDP growth for 2024, could reduce discretionary spending on premium products.

| Threat Category | Specific Risk | Impact |

|---|---|---|

| Market Competition | Red Bull/Monster dominance | >75% US market share (early 2024) |

| Regulatory/Legal | Beverage Taxes | 1-2 cents/ounce increase (early 2024) |

| Economic Volatility | Global GDP Growth | 2.9% projected for 2024 (discretionary spending risk) |

SWOT Analysis Data Sources

This analysis draws upon a comprehensive range of data, including Celsius's official financial statements, recent market research reports, and expert commentary from industry analysts to provide a robust assessment.