Celsius Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Bundle

The beverage industry, particularly energy drinks, is a dynamic battlefield. Celsius, a major player, faces intense rivalry, significant buyer power from distributors and consumers, and a constant threat from new entrants eager to capture market share.

The bargaining power of suppliers, while present, is somewhat mitigated by the scale of Celsius's operations. However, the availability of substitute products, from other energy drinks to coffee and functional beverages, presents a continuous challenge.

Understanding these forces is crucial for anyone looking to navigate or invest in the energy drink market. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Celsius’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for essential energy drink components, such as caffeine, taurine, and guarana extract, is highly concentrated among a select group of global manufacturers. This limited supplier base significantly enhances their bargaining power, allowing them to exert considerable influence over ingredient pricing. Celsius, with its reliance on these specialized suppliers for its proprietary blends, becomes vulnerable to price increases and potential supply chain disruptions. In 2024, maintaining diverse sourcing strategies is crucial to mitigate these risks and ensure stable production costs and availability.

Celsius faces high switching costs for its specialized ingredients, significantly empowering its suppliers. Changing suppliers for key components, such as its proprietary MetaPlus blend, involves substantial financial outlays in 2024, including extensive quality testing and regulatory certifications. This also necessitates potential reformulation and re-labeling, adding further expenses and time delays. Such high switching barriers lock Celsius into relationships with its current suppliers, considerably reducing its negotiating leverage. For instance, maintaining consistent flavor profiles and ingredient efficacy is paramount, making supplier changes risky and costly.

Celsius significantly relies on a network of co-packers for its beverage manufacturing, a strategy that offers operational flexibility but creates dependence on these third parties. This outsourcing model means Celsius depends on external partners for crucial production capacity and stringent quality control. For example, as Celsius navigated substantial growth, reporting a 37% year-over-year revenue increase in Q1 2024, the reliability of its co-packers became paramount to meet surging consumer demand. Any issues, such as capacity constraints or quality deviations from these partners, directly impact Celsius's ability to supply the market.

Fluctuating raw material and freight costs

The bargaining power of suppliers significantly impacts Celsius due to fluctuating raw material and freight costs, directly influencing gross margins. Volatile global shipping rates, such as the container spot rates which saw notable increases in early 2024 due to Red Sea disruptions, can raise operational expenses. Celsius has historically benefited from lower raw material and freight costs, contributing to improved gross margins, for instance, reporting a 48.7% gross margin in Q1 2024. Conversely, upward swings in these costs, driven by supply chain pressures or commodity price volatility, could pressure future profitability.

- Global freight rates, like the Shanghai Containerized Freight Index (SCFI), experienced spikes in early 2024, indicating potential cost pressures.

- Celsius reported a Q1 2024 gross margin of 48.7%, highlighting the importance of cost management.

- Increased raw material costs for ingredients such as caffeine or sweeteners could directly erode profit margins.

Use of proprietary blends

Celsius’s use of its proprietary MetaPlus blend, containing specific ingredients such as green tea extract, ginger root, and guarana, creates a unique product but also ties the company to specialized suppliers. This reliance can increase supplier leverage, especially for high-quality, consistent botanical extracts. In 2024, maintaining supply chain resilience for these specific components remains crucial for Celsius's production volumes.

- Celsius’s MetaPlus blend creates specific ingredient sourcing needs.

- Reliance on specialized suppliers can elevate their bargaining power.

- Supply chain consistency for these unique extracts is vital for Celsius’s operations.

- Strategic supplier relationships are key to mitigating this power in 2024.

Celsius faces significant supplier bargaining power due to a concentrated market for essential ingredients and high switching costs for its proprietary MetaPlus blend. Dependence on co-packers and volatile raw material and freight costs, such as early 2024 freight spikes, also elevate supplier influence. This directly impacts gross margins, which were 48.7% in Q1 2024, necessitating robust supply chain strategies.

| Factor | Impact on Celsius | 2024 Data Point |

|---|---|---|

| Ingredient Sourcing | Reliance on concentrated suppliers for key components. | Limited global suppliers for caffeine, taurine. |

| Switching Costs | High expenses for changing proprietary blend suppliers. | MetaPlus blend requires extensive testing, re-certification. |

| Operational Costs | Vulnerability to fluctuating raw material and freight expenses. | Q1 2024 Gross Margin: 48.7%; Early 2024 SCFI spikes. |

What is included in the product

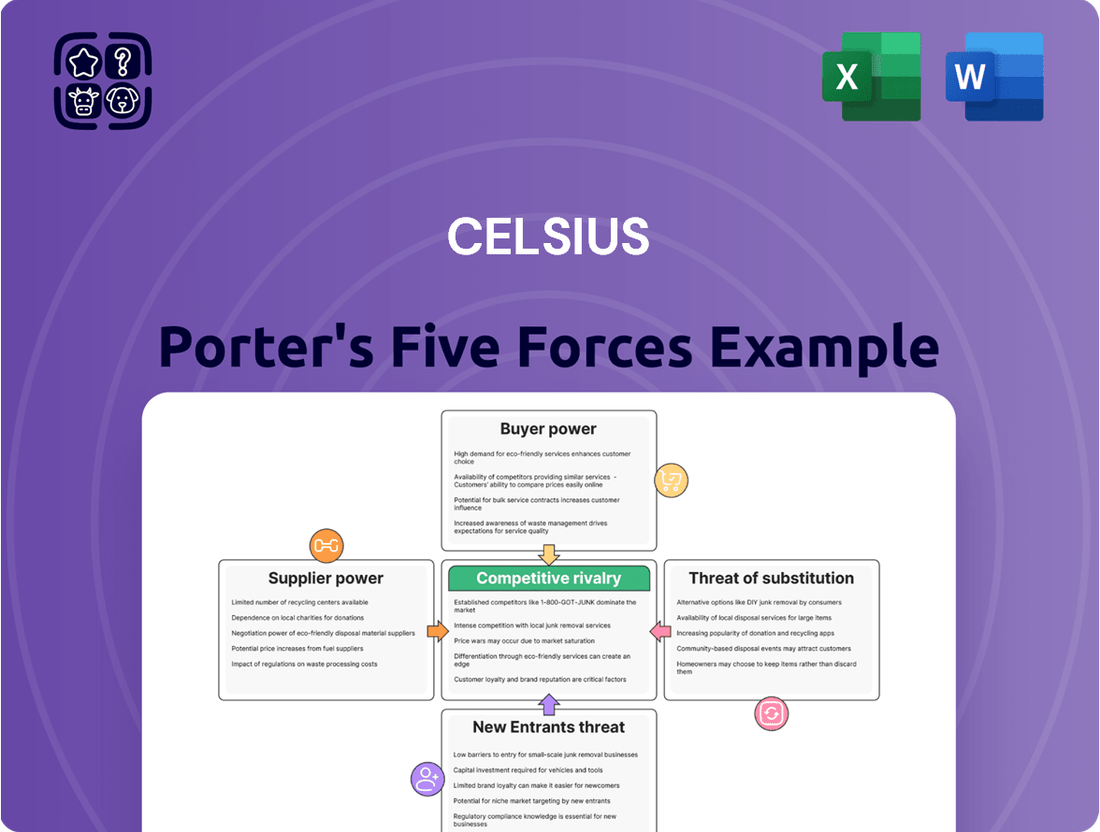

Celsius's Porter's Five Forces Analysis evaluates the intensity of competition, buyer and supplier power, threat of new entrants and substitutes, providing a strategic roadmap for sustained market leadership.

Easily identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on a customizable radar chart.

Customers Bargaining Power

Consumers in the energy drink market, including Celsius, exhibit high price sensitivity, a significant factor in their purchasing decisions. Given the numerous alternative products available in 2024, such as competing energy drinks, coffee, or even traditional sodas, customers can easily switch to a cheaper option if they perceive Celsius's average retail price, often around $2.50 to $3.00 per can, as too high. This ease of substitution empowers buyers, putting pressure on Celsius to maintain competitive pricing, especially as the market saw sustained growth in demand for functional beverages through early 2024.

Consumers face minimal costs or inconveniences when choosing to switch from Celsius to a competing energy drink. The market offers a vast array of alternatives, with brands like Monster, Red Bull, and Reign widely available across major retail chains and online platforms. This ease of access empowers consumers to explore new options effortlessly. While some brand loyalty exists, the inherent desire for variety among many energy drink users, a trend observed throughout 2024, keeps buyer power exceptionally strong in this competitive landscape.

The wide availability of alternative products significantly boosts customer bargaining power for Celsius. Consumers can easily switch to numerous other functional beverages, including established energy drink brands like Red Bull and Monster, which collectively held over 70% of the US energy drink market share in 2024. Beyond energy drinks, a broad spectrum of sports drinks, such as Gatorade and Powerade, and ready-to-drink coffees, like Starbucks RTD, offer viable substitutes. This vast selection, including private label brands, means customers face low switching costs and can readily choose products that better meet their preferences or price points, empowering their negotiating position.

Growing consumer health consciousness

Growing consumer health consciousness significantly increases customer bargaining power for companies like Celsius. As consumers prioritize health, their preferences shift towards beverages with natural ingredients and low sugar content, a trend that saw the global health and wellness market reach an estimated $4.8 trillion in 2024. This empowers customers to demand products meeting specific dietary and wellness criteria, pushing brands to innovate and be transparent.

- The low-sugar beverage segment is projected to grow annually by 5.86% from 2024 to 2028.

- Consumers are increasingly scrutinizing ingredient lists, with 60% reporting they check for artificial additives.

- This demand drives brands to offer more functional ingredients, like those in Celsius with metabolism-boosting properties.

- Companies must maintain clear labeling to retain trust and sales in a competitive market.

Influence of online reviews and social media

The rise of online reviews and social media platforms significantly amplifies the bargaining power of Celsius customers. Consumer opinions, shared widely on platforms like TikTok and Instagram, directly influence purchasing decisions for energy drinks. A single negative review or a shift in influencer endorsement can rapidly erode brand trust and impact sales, as seen by the 2024 trend of consumers prioritizing authenticity.

This collective digital voice empowers consumers, giving them considerable leverage over Celsius’s brand image and market position.

- Around 70% of consumers check online reviews before purchasing a beverage.

- Influencer marketing in the beverage sector is projected to grow substantially in 2024.

- Negative social media sentiment can reduce product sales by up to 10-15%.

- User-generated content drives higher engagement rates than traditional advertising.

Celsius customers wield strong bargaining power due to high price sensitivity and minimal switching costs, with the average retail price around $2.50 to $3.00 per can in 2024. The vast availability of alternatives, including Monster and Red Bull holding over 70% of the US energy drink market in 2024, empowers consumers to easily opt for other brands or healthy beverage choices. Growing health consciousness, with the global health and wellness market reaching $4.8 trillion in 2024, further drives demand for low-sugar options, enhancing buyer leverage. Online reviews and social media also amplify customer influence, with around 70% checking reviews before purchase.

| Factor | 2024 Data/Trend | Impact on Buyer Power |

|---|---|---|

| Price Sensitivity | Average Celsius can $2.50-$3.00 | High; drives competitive pricing |

| Alternative Availability | Monster/Red Bull >70% US market share | High; low switching costs for consumers |

| Health Consciousness | Global H&W market ~$4.8T | High; demand for low-sugar, natural products |

| Digital Influence | 70% check online reviews | High; collective voice impacts brand |

Full Version Awaits

Celsius Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Celsius Porter's Five Forces Analysis you see here details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted report is ready for your immediate use, providing valuable insights into Celsius's strategic position.

Rivalry Among Competitors

The energy drink market is intensely competitive, with established giants like Red Bull and Monster Beverage dominating a significant share. These industry leaders possess vast marketing budgets, demonstrated by Monster's reported $1.34 billion in selling and marketing expenses in 2023, and extensive global distribution networks. Their strong brand recognition creates a formidable barrier for Celsius, necessitating innovative strategies to capture market share. This high level of competitive rivalry requires constant adaptation and differentiation in the rapidly evolving beverage landscape.

The competitive landscape for Celsius is intensifying as beverage categories blur, extending rivalry beyond traditional energy drinks. Sports drinks, functional waters, and even coffee-based beverages now offer energy-boosting properties, directly competing for consumer share. For example, the US functional beverage market is projected to reach $68.4 billion in 2024, highlighting diverse options available. This broadens Celsius's competitive set significantly, requiring constant innovation to maintain its market position.

Energy drink companies engage in intense marketing, pouring resources into sponsorships and promotions to capture consumer attention. This includes significant spending on athlete endorsements and major event sponsorships, alongside aggressive in-store promotions. The result is a continuous battle for brand visibility and consumer loyalty in a crowded market. Celsius Holdings, Inc. itself acknowledged that increased promotional outlays, particularly in 2024, have exerted pressure on its revenue growth and profitability margins. This fierce promotional spending underscores the high competitive rivalry.

Acquisitions by major beverage corporations

Major beverage corporations are actively acquiring smaller, successful brands, significantly intensifying competitive rivalry for companies like Celsius. This trend allows giants such as PepsiCo, which invested in Celsius in 2022, to expand their presence in the rapidly growing energy drink market, leveraging their extensive distribution networks. Such acquisitions empower smaller innovative brands with vast resources, transforming them into formidable competitors. For instance, the energy drink market is projected to reach over $108 billion globally by 2024, attracting more aggressive strategic moves from industry leaders.

- PepsiCo's $550 million investment in Celsius in 2022 exemplifies major players entering the functional beverage space.

- The global energy drink market's projected value exceeding $108 billion in 2024 drives these strategic acquisitions.

- Keurig Dr Pepper's 2023 acquisition of Nutrabolt, maker of C4 Energy, for $863 million further consolidates market power.

- These moves mean Celsius faces competition from brands backed by the deep pockets and distribution prowess of beverage conglomerates.

Rapid innovation and new product introductions

The energy drink industry thrives on rapid innovation, with frequent new flavor launches and product introductions. Competitors constantly release sugar-free and natural ingredient options, reflecting evolving consumer preferences. This dynamic environment demands Celsius maintain a robust pace of innovation to stay competitive and relevant.

- The energy drink market is projected to reach $108.4 billion in 2024.

- Celsius reported net revenue of $384.8 million for Q1 2024.

- Competitors like Monster and Red Bull also frequently launch new flavors.

- Consumer demand for functional beverages drives product diversification.

The energy drink market is intensely competitive, marked by established giants and blurring product categories. Aggressive marketing and strategic acquisitions, like Keurig Dr Pepper's 2023 purchase of C4 Energy for $863 million, heighten rivalry. Celsius faces constant pressure to innovate, especially as the global energy drink market is projected to exceed $108 billion in 2024. This dynamic environment demands continuous differentiation to maintain market share.

| Key Competitor Action | Date/Period | Financial Impact/Data (USD) |

|---|---|---|

| Monster Beverage Marketing Spend | 2023 | $1.34 Billion |

| Keurig Dr Pepper C4 Energy Acquisition | 2023 | $863 Million |

| US Functional Beverage Market Projection | 2024 | $68.4 Billion |

SSubstitutes Threaten

Traditional coffee and tea pose a significant threat as primary substitutes for Celsius, offering a familiar caffeine boost. The established coffee culture, with its vast array of beverages from major chains like Starbucks to local cafes, provides readily accessible alternatives. For instance, the average cost of a brewed coffee can be considerably lower than many energy drinks, influencing consumer choice. The global coffee market alone was valued at over $450 billion in 2023, showcasing its immense scale and consumer loyalty.

The ready-to-drink (RTD) coffee and tea market poses a notable threat of substitution for Celsius. This segment is rapidly expanding, offering consumers convenient, on-the-go energy solutions that are often perceived as healthier alternatives to traditional energy drinks. The global RTD coffee market alone was projected to reach approximately $30 billion in 2024, highlighting its significant growth. These products directly compete for the same consumption occasions, drawing consumers seeking a quick energy boost away from Celsius's offerings.

The market for functional beverages is seeing a significant rise in substitutes for traditional energy drinks like Celsius. A wide array of other options, including sports drinks, vitamin-fortified waters, and nootropic beverages, now incorporate energy-boosting ingredients. These products attract consumers seeking not just energy but also additional benefits such as hydration or enhanced mental focus, blurring the lines of category definition. For instance, the global functional beverages market, projected to reach over 300 billion USD by 2024, highlights this diversification. This broad availability means consumers can easily choose a multi-benefit drink over a dedicated energy product, posing a direct threat to Celsius's market share.

Energy shots and powders

Energy shots and powdered drink mixes present a significant substitute threat to Celsius. Concentrated energy shots, like those from 5-hour Energy, offer a rapid energy boost in a compact form, appealing to consumers seeking immediate effects without a larger beverage volume. The energy shot market continues to be robust, with consumers valuing convenience and potency. Additionally, various powdered supplements available in 2024 provide a customizable and often more cost-effective alternative for at-home energy consumption, allowing users to control dosage and flavor. This diverse range of substitutes can divert consumers who prioritize different formats or price points.

- The global energy shot market was valued at approximately $15.5 billion in 2023, showcasing its significant scale.

- Powdered energy supplements often boast lower per-serving costs compared to ready-to-drink options like Celsius.

- Customization of dosage and ingredients is a key draw for consumers opting for powdered alternatives.

- Convenience and portability are strong competitive advantages for concentrated energy shots.

Homemade and natural energy-boosting alternatives

Health-conscious consumers increasingly consider homemade energy drinks or natural stimulants as alternatives to manufactured options like Celsius. The desire for clean labels and full control over ingredients drives some consumers away from processed beverages towards do-it-yourself solutions or minimally processed choices such as yerba mate. This trend poses a threat as consumers prioritize natural options, impacting the market share of traditional energy drink companies.

- In 2024, consumer interest in natural health products, including herbal stimulants, continued to rise.

- DIY beverage kits and natural ingredient sales for home use saw consistent growth.

- The clean label movement influences purchasing decisions, shifting preferences away from artificial additives.

- A 2024 consumer survey indicated a significant portion of younger demographics actively seek natural alternatives for energy.

Celsius faces a strong threat from diverse substitutes, including traditional coffee, which remains a primary caffeine source, and the rapidly growing ready-to-drink coffee market, projected at $30 billion in 2024. Functional beverages, valued over $300 billion in 2024, and energy shots, a $15.5 billion market in 2023, also compete directly. Consumers increasingly choose natural, customizable options or cost-effective powdered mixes, impacting Celsius's market share.

| Substitute Category | 2024 Market Value (Est.) | Key Advantage |

|---|---|---|

| RTD Coffee/Tea | $30 Billion | Convenience, Healthier Perception |

| Functional Beverages | $300 Billion+ | Multi-benefit, Hydration |

| Energy Shots | $15.5 Billion (2023) | Potency, Portability |

Entrants Threaten

Gaining access to extensive distribution networks, like those controlled by major players such as PepsiCo, presents a substantial barrier for new energy drink companies. Securing crucial shelf space in major retail chains and convenience stores, which is vital for market penetration, demands significant upfront investment. For instance, new entrants face challenges competing with Celsius's established network, especially after its 2022 long-term distribution agreement with PepsiCo, leveraging their vast reach across over 100,000 retail locations. This requires not only capital but also established relationships that are difficult for newcomers to forge quickly in 2024.

The energy drink market truly thrives on strong brand loyalty, making it tough for new companies to break in. Consumers often stick with their favorite brands, showing a clear preference for established names like Red Bull, Monster, and Celsius. In 2024, Red Bull and Monster continue to hold significant market share, collectively dominating over 70% of the US energy drink sector. This means any new entrant must pour substantial capital into marketing and brand building just to persuade consumers to consider switching from these trusted, well-known options.

Building a recognizable brand like Celsius in the crowded energy drink market demands substantial marketing investment. New entrants must allocate a massive budget for advertising, with digital ad spending in the beverage industry projected to exceed $4.5 billion in 2024. Competing requires heavy spending on sponsorships, such as major sports leagues or influencers, and robust social media campaigns to rival established players.

Economies of scale enjoyed by incumbents

Established financial entities and large blockchain platforms often benefit significantly from economies of scale in their operations. These incumbents can spread their fixed costs over a larger volume of transactions, leading to lower per-unit costs for services like lending, trading, or custody. For instance, a new crypto lending platform entering the market in 2024 would face substantial infrastructure and regulatory compliance costs without the benefit of an existing large user base or operational efficiency. This cost disadvantage makes it challenging for new entrants to compete on price or offer equally attractive yields without compressing their own profit margins, creating a significant barrier to entry.

- Incumbents like major financial institutions leverage extensive existing infrastructure.

- New crypto platforms face high initial setup and compliance costs, estimated at millions in 2024.

- Established players achieve lower transactional costs due to high volume.

- New entrants struggle to offer competitive pricing without sacrificing profitability.

Regulatory hurdles and ingredient scrutiny

New entrants into the energy drink market, like those competing with Celsius, face significant regulatory hurdles. The industry is under increasing scrutiny regarding ingredients, caffeine content, and marketing, particularly concerning sales to minors. For instance, in 2024, several states continue to propose legislation restricting energy drink sales to minors, adding complexity. Navigating this intricate landscape requires substantial legal and compliance investment, which can easily deter smaller, less capitalized new companies.

- Regulatory oversight intensifies, with 2024 legislative discussions ongoing in states like New York and California regarding age restrictions for energy drink purchases.

- Compliance costs for new beverage formulations and labeling can exceed millions of dollars annually, acting as a significant barrier.

- The Food and Drug Administration (FDA) maintains a watchful eye on caffeine levels, requiring extensive testing and adherence to evolving guidelines for new products.

New entrants face significant barriers due to Celsius's vast distribution network, bolstered by its 2022 PepsiCo agreement covering over 100,000 retail locations. Strong brand loyalty to established players like Red Bull and Monster, which collectively hold over 70% of the US market in 2024, necessitates immense marketing investment. Additionally, new companies must navigate escalating regulatory hurdles and substantial compliance costs, especially with ongoing 2024 legislative discussions on energy drink sales.

| Barrier | 2024 Data/Context | Impact on New Entrants |

|---|---|---|

| Distribution Access | Celsius-PepsiCo covers 100,000+ locations | High capital needed for shelf space |

| Brand Loyalty | Red Bull/Monster >70% US market share | Massive marketing spend required |

| Regulatory Compliance | Millions in annual compliance costs | Significant legal/setup investment |

Porter's Five Forces Analysis Data Sources

Our Celsius Porter's Five Forces analysis utilizes a comprehensive dataset, including Celsius's own investor relations materials, SEC filings, and annual reports. We also incorporate data from industry-specific market research reports and competitor analysis from financial news outlets.