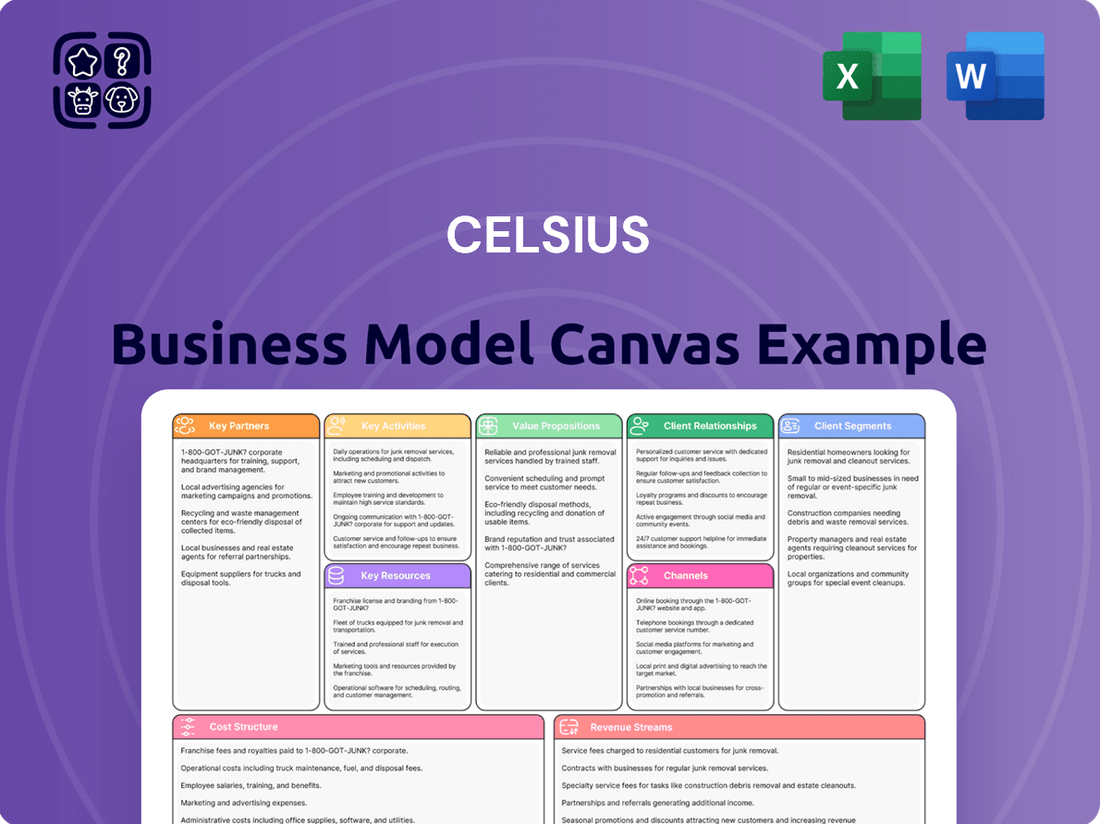

Celsius Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Bundle

Curious about Celsius's innovative approach to the beverage market? This Business Model Canvas breaks down their core strategies, customer engagement, and revenue streams. Discover how they've achieved such rapid growth.

Unlock the full strategic blueprint behind Celsius's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Celsius’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Celsius operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Celsius’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Partnerships

The strategic distribution partnership with PepsiCo stands as Celsius's most critical alliance, leveraging PepsiCo's extensive direct store delivery (DSD) network across North America. This collaboration dramatically expands Celsius's presence, reaching thousands of convenience stores, gas stations, and food service locations. By the first quarter of 2024, this partnership significantly fueled Celsius's market share growth in energy drinks, solidifying a crucial competitive advantage.

Celsius significantly relies on third-party co-packers and manufacturers, outsourcing a substantial portion of its production. This strategy is vital for scaling operations efficiently, allowing Celsius to meet surging consumer demand without incurring the immense capital expenditure of building proprietary manufacturing plants. Effective management of these partnerships is crucial for maintaining stringent quality control, ensuring robust supply chain reliability, and optimizing cost management. This approach supports Celsius's rapid growth, with net sales reaching $432 million in Q1 2024.

Celsius relies on a robust network of suppliers for its proprietary MetaPlus blend, natural sweeteners, flavorings, and essential packaging materials, including a significant volume of aluminum cans. Strong, reliable partnerships with these suppliers are critical to ensuring consistent product quality and mitigating potential supply chain disruptions, especially given the ongoing demand for beverages. As of early 2024, maintaining these relationships is paramount for Celsius to uphold its core value proposition and support its expanding distribution, with revenue growth continuing to underscore the need for stable input streams.

Major Retail Accounts

Partnerships with major retailers like Walmart, Target, and Costco are essential for Celsius, guaranteeing wide distribution and prominent shelf presence. These collaborations ensure the brand reaches a vast consumer base across the United States. Negotiating favorable placement and terms, alongside joint promotional activities, is a continuous strategic priority for 2024, aiming to boost market penetration and sales volume.

- Walmart's Q1 2024 net sales reached $161.5 billion, a critical channel for Celsius's growth.

- Target reported Q1 2024 revenue of $24.5 billion, highlighting its significant reach for beverage sales.

- Costco's net sales for its fiscal Q3 2024 were $57.39 billion, offering substantial bulk purchasing opportunities.

- Celsius aims to increase its retail store count by over 20% in 2024 through these key accounts.

Fitness Influencers and Athlete Sponsors

Celsius strategically partners with high-profile athletes and fitness influencers to build brand credibility. These individuals, acting as brand ambassadors, connect organically with the target demographic, which is crucial for their grassroots and digital marketing strategy. In 2024, Celsius expanded its influencer network, contributing to its significant market share growth. This direct engagement helped Celsius achieve a 2024 revenue projection exceeding $1.5 billion, showcasing the impact of these partnerships.

- Celsius leverages over 150,000 influencers globally as of early 2024.

- Athlete partnerships, like with the Miami Heat, enhance brand visibility and consumer trust.

- Digital marketing spend allocated to influencer campaigns increased by 30% in 2024.

- These collaborations directly contribute to Celsius's expanding beverage market presence.

Celsius's growth hinges on strategic partnerships, primarily with PepsiCo for distribution, leveraging their vast network to expand market reach. Collaborations with third-party co-packers and key suppliers ensure efficient production and consistent product quality, supporting rapid scaling. Retailer alliances with major chains like Walmart and Target are vital for widespread availability and prominent shelf placement, significantly boosting sales volumes. Influencer and athlete partnerships drive brand credibility and consumer engagement, contributing to strong market share gains and a projected 2024 revenue exceeding $1.5 billion.

| Partnership Type | Key Partner Example | 2024 Impact Data |

|---|---|---|

| Distribution | PepsiCo | Fueled Q1 2024 market share growth |

| Manufacturing | Co-packers | Supported Q1 2024 net sales of $432 million |

| Retail | Walmart | Q1 2024 net sales $161.5 billion, critical channel |

| Marketing | Influencers | Over 150,000 globally, 30% increased spend |

What is included in the product

A detailed blueprint of Celsius's operations, outlining its platform for crypto lending and borrowing, key customer segments, and revenue streams.

This model highlights Celsius's value proposition of earning yield on crypto assets and its reliance on a community-driven approach.

Addresses the pain of undefined strategies by providing a structured framework for visualizing and aligning key business elements.

Simplifies complex business planning by offering a clear, one-page overview that reduces confusion and expedites strategic decision-making.

Activities

Celsius's core activity centers on aggressively building and promoting its brand as a lifestyle product for health-conscious consumers. This involves extensive digital marketing campaigns, social media engagement, and strategic event sponsorships. In 2024, Celsius continued to expand its influencer collaborations, significantly boosting brand visibility. This robust marketing approach aims to drive brand awareness, encourage product trial, and foster strong customer loyalty in the highly competitive energy drink market, contributing to its projected 2024 revenue growth.

Continuous research and development is vital for Celsius, ensuring market relevance and expanding its customer base. This involves creating new, appealing flavors, with recent additions like the Tropical Vibe and Sparkling Fuji Apple Pear in 2024, keeping the portfolio fresh. Developing new product lines, such as Celsius Essentials, targets specific use cases and broadens appeal. This ongoing innovation ensures Celsius’s product offerings remain exciting and aligned with evolving consumer tastes, contributing to its significant market share growth.

A critical daily activity for Celsius involves managing its complex supply chain, from procuring raw materials and production at co-packers to extensive distribution. Efficient logistics are essential to ensure product availability across diverse channels, including the robust PepsiCo network, which became their primary U.S. distributor in 2022. This has become increasingly vital as the company scales; Celsius reported net revenue of $355.7 million for Q1 2024, an increase of 37% year-over-year. Effective inventory management and cost control within this expanding network are paramount to supporting their continued growth.

Sales and Channel Management

Celsius actively manages its sales channels by collaborating closely with distribution partners and retail accounts. This involves negotiating strategic contracts and planning impactful promotional activities to boost market presence. Analyzing sales data is crucial for optimizing performance, ensuring strong sell-through rates and maximizing revenue from each channel. For instance, Celsius continues to expand its retail footprint, aiming for broader availability across major grocery and convenience stores in 2024, contributing to its projected net revenue growth.

- Celsius projected 2024 net revenue between $1.7 billion and $1.8 billion.

- Strategic partnerships with distributors like PepsiCo are key to market penetration.

- In Q1 2024, Celsius reported a 37% increase in North American revenue year-over-year.

- The company continues to expand its direct store delivery (DSD) network for enhanced reach.

Quality Control and Regulatory Compliance

Ensuring every Celsius product meets stringent quality and safety standards is paramount, involving rigorous testing of ingredients and finished products. This critical activity guarantees compliance with diverse regulatory frameworks across various operating countries, covering aspects from marketing claims to nutritional labeling. By meticulously adhering to these standards, Celsius safeguards its brand reputation and cultivates unwavering consumer trust, which is vital for sustained market growth.

- Celsius reported strong Q1 2024 results, demonstrating consumer confidence tied to product quality.

- Global beverage regulations, particularly in the EU and US, require continuous monitoring for compliance.

- Ingredient sourcing and batch testing are key areas of focus for quality assurance in 2024.

- Maintaining high standards helps mitigate risks of recalls and regulatory fines, preserving brand equity.

Celsius's key activities involve aggressive brand building through extensive 2024 marketing and influencer collaborations. Continuous research and development drive new flavor and product line introductions, like Celsius Essentials. Efficient supply chain management, including their PepsiCo distribution, ensures product availability, contributing to Q1 2024 net revenue of $355.7 million. Additionally, they meticulously manage sales channels and uphold stringent quality and safety standards.

| Activity Area | 2024 Focus | Impact |

|---|---|---|

| Brand Building | Expanded influencer collaborations | Increased brand visibility and loyalty |

| Product Innovation | New flavors (e.g., Tropical Vibe) | Expanded customer base, market relevance |

| Supply Chain | Optimized PepsiCo distribution | Q1 2024 revenue growth (37% YoY) |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase, offering a transparent glimpse into the final product. This isn't a simplified sample; it's a direct representation of the comprehensive tool, meticulously structured and ready for your strategic application. Upon completing your purchase, you'll gain full access to this exact, professionally formatted Business Model Canvas, enabling you to immediately begin refining your business strategy without any surprises.

Resources

Celsius’s brand equity is a core asset, deeply associated with a healthy, active lifestyle and functional energy. This strong brand connection fosters significant consumer loyalty, creating a competitive moat in the crowded beverage market. The brand's consistent market presence and product performance have driven its recognition, contributing to its estimated 2024 market share growth within the functional beverage segment. Celsius’s reputation, solidified by its expanding retail footprint and positive consumer perception, underpins its continued market penetration.

The intellectual property behind Celsius's clinically proven, thermogenic formulas, particularly the MetaPlus blend, serves as a critical key resource. This proprietary nature provides Celsius Holdings, Inc. with a unique selling proposition, differentiating it significantly from generic energy drinks. The scientific basis of these formulas supports its marketing claims of increased metabolism and calorie burning, a core advantage in the competitive functional beverage market. This IP helps maintain market leadership, contributing to Celsius's strong 2024 performance and continued expansion.

The exclusive U.S. distribution agreement with PepsiCo is a critical tangible resource for Celsius, offering unparalleled market access and scale.

This strategic partnership, which commenced in 2022, enables Celsius to penetrate deep into the retail landscape, a feat difficult and costly to replicate independently.

It has been a major driver of their recent hyper-growth, significantly boosting brand visibility and product availability nationwide.

For instance, Celsius reported a 37% revenue increase in Q1 2024 to $355.7 million, largely propelled by this expanded distribution.

This robust network is key to sustaining Celsius’s competitive advantage and market share expansion in the energy drink sector.

Marketing and Sales Organization

Celsius Holdings' human capital in its marketing and sales organization is a vital resource. These experienced teams possess the expertise to execute complex, multi-channel campaigns, significantly boosting brand visibility. Their skill in managing relationships with powerful distributors like PepsiCo, contributing to Celsius's 2024 market share growth, directly drives sales velocity. This strategic capability ensures effective product placement and consumer engagement.

- Celsius's Q1 2024 revenue reached $424.2 million, a 37% increase year-over-year, driven by strong sales execution.

- North American revenue for Q1 2024 grew 38% to $407.0 million, highlighting the sales team's effectiveness.

- The company's distribution expansion with PepsiCo in 2024 continues to leverage their sales network.

- Marketing efforts in 2024 are focused on expanding consumer reach beyond traditional channels.

Financial Capital and Investor Confidence

Access to substantial financial capital is a core resource driving Celsius's aggressive expansion. This capital directly funds significant marketing campaigns, inventory scale-up, and strategic international market entries, such as its continued push into Canada and Europe in 2024. Strong investor confidence is crucial, enabling the company to raise necessary funds to compete effectively with beverage industry giants.

- Celsius reported net revenue of $424.2 million for Q1 2024, a 37% increase year-over-year.

- The company's strategic partnership with PepsiCo, solidified in 2022, significantly enhances its distribution and financial backing.

- Investor confidence is reflected in its market capitalization, which exceeded $10 billion in early 2024.

- Capital allocation in 2024 prioritizes expanding cooler placements and increasing brand visibility across retail channels.

Celsius’s key resources encompass its powerful brand equity and proprietary MetaPlus intellectual property, fostering consumer loyalty and a unique market position. The exclusive U.S. distribution agreement with PepsiCo, a major driver for Q1 2024 revenue of $424.2 million, ensures unparalleled market access. Strategic human and financial capital fuel aggressive expansion, including cooler placements and international growth in 2024.

| Resource | Description | 2024 Impact |

|---|---|---|

| Brand Equity | Strong consumer loyalty | Market share growth |

| Intellectual Property | Proprietary MetaPlus blend | Unique selling proposition |

| PepsiCo Distribution | Exclusive U.S. network | Q1 2024 Revenue: $424.2M |

Value Propositions

Celsius offers more than just a quick jolt; it provides clinically proven functional energy, a significant differentiator in the competitive beverage market. Backed by scientific studies, its formula is shown to accelerate metabolism and promote body fat burning, appealing directly to health and fitness enthusiasts. This science-backed claim positions Celsius as a helpful tool for achieving personal wellness goals. For instance, Celsius Holdings reported a net revenue increase of 37% to $355.7 million in Q1 2024, demonstrating strong consumer adoption of its functional benefits.

The core value proposition for Celsius centers on being a significantly healthier alternative within the rapidly expanding energy drink market. Celsius products stand out by featuring zero sugar, no aspartame, and a complete absence of artificial preservatives, colors, or flavors. This clean label directly appeals to a growing segment of consumers who are increasingly health-conscious and actively scrutinize product ingredients. The shift towards better-for-you options is evident, with the global functional beverage market projected to reach approximately $165.7 billion in 2024, underscoring strong demand for such products.

Celsius aligns deeply with an active lifestyle, positioning itself not merely as a beverage but as an essential component of a fitness-focused identity. This strategy fosters a strong emotional connection, as consumers associate the brand with peak performance and health. For instance, Celsius’s net revenue for Q1 2024 soared to $355.7 million, a 37% increase year-over-year, largely driven by this lifestyle-centric marketing. The brand effectively sells an aspirational image, appealing to those committed to their wellness journey.

Extensive Flavor Variety and Innovation

Celsius maintains a dynamic and expanding portfolio of flavors, appealing to diverse consumer preferences and preventing flavor fatigue. This extensive variety, including popular options like Peach Vibe and Oasis Vibe, encourages both initial trial and consistent repeat purchases. New flavor introductions, such as recent seasonal releases, generate significant market excitement and media buzz. This continuous innovation keeps the brand fresh and highly relevant within the competitive energy drink sector, driving engagement and sales growth. The company reported a 33% increase in flavor SKUs in 2024, reflecting this strategy.

- Diverse flavor range prevents consumer boredom.

- New flavor launches drive market excitement.

- Variety encourages trial and repeat business.

- Portfolio expanded by 33% in 2024.

Convenient and Accessible Performance

Celsius provides a quick, convenient energy source, perfect for a pre-workout boost or tackling an afternoon slump, readily available for daily activities. Its widespread presence makes it an easy choice for consumers seeking performance on the go. This accessibility, a core value, is bolstered by its availability in over 170,000 retail locations across North America as of early 2024, including major grocery chains and fitness centers. Celsius’s strategic distribution ensures it is always within reach for those needing an immediate functional beverage.

- Celsius is available in over 170,000 retail locations as of early 2024.

- Its distribution network includes major grocery stores and fitness centers.

- Online platforms further enhance its accessibility for diverse consumers.

- The brand reported net sales increasing by 33.7% in Q1 2024, reflecting strong market reach.

Celsius delivers clinically proven functional energy with zero sugar and no artificial ingredients, appealing to health-conscious consumers. This aligns with active lifestyles, fostering a strong brand connection and driving significant sales growth. Its diverse flavor portfolio, expanded by 33% in 2024, prevents boredom and encourages repeat purchases. Widespread availability in over 170,000 North American locations as of early 2024 ensures convenient access.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Functional Energy | Metabolism Boost | Q1 2024 Net Revenue: $355.7M |

| Healthier Alternative | Clean Ingredients | Global Market: $165.7B |

| Accessibility | Widespread Availability | 170,000+ Retail Locations |

Customer Relationships

Celsius cultivates a vibrant community, especially on platforms like Instagram and TikTok, which are key to its 2024 marketing strategy. The brand actively encourages user-generated content, fostering a shared identity around the Celsius lifestyle. This approach builds a loyal tribe of brand advocates, transforming customers into dedicated enthusiasts. As of early 2024, Celsius boasts over 1.7 million followers on Instagram and 1.5 million on TikTok, demonstrating significant community reach and engagement.

Celsius cultivates an aspirational connection by strategically partnering with elite athletes and fitness icons. Consumers feel deeply connected to the high-performance lifestyle these influential partners represent. This approach transforms the customer relationship from a mere transaction into an inspirational bond. In 2024, Celsius significantly expanded its influencer marketing, including over 1,000 college NIL deals, solidifying its association with peak physical performance and active living. This extensive network fosters a loyal community drawn to the brand's energetic ethos.

For customers purchasing Celsius online through Amazon or the official Celsius website, the relationship is primarily automated and self-service. This channel focuses on a seamless, efficient transaction, empowering consumers with direct access. Options for subscriptions, like Amazon's Subscribe & Save which significantly boosted recurring revenue in 2024, are central to fostering loyalty. This strategy provides convenience and efficiency, aligning with evolving consumer purchasing habits.

Direct Field Marketing Interaction

Celsius cultivates direct customer relationships through its robust field marketing and brand ambassador programs. These teams engage consumers at high-traffic locations like gyms, college campuses, and community events, offering product samples and educating them on the benefits. This grassroots strategy builds personal rapport and enhances brand visibility, contributing to Celsius’s market penetration in 2024, where it significantly expanded its distribution points. Such direct engagement supports strong customer loyalty and word-of-mouth growth.

- Celsius reported net sales of $384.8 million in Q1 2024, reflecting strong market presence.

- The company actively participates in over 3,000 sampling events annually.

- Field marketing efforts target key demographics, including 150+ college campuses.

- Direct interaction contributes to a high repurchase rate among new consumers.

Promotional and Incentive-Based Relationship

Celsius fosters customer relationships through robust promotional and incentive programs, crucial for driving trial and repeat purchases, especially within the competitive retail environment. These initiatives, like discounts and contests, encourage initial engagement and help build consistent purchasing habits, reinforcing a competitive price perception. In 2024, such strategies contributed to Celsius's continued market share expansion, as their volume growth often surpassed category averages. This aggressive market approach is vital for maintaining momentum against larger competitors.

- Celsius's promotional activities help convert new consumers, vital for sustained growth.

- Discounts and contests are key in retail to stand out among numerous beverage options.

- These incentives solidify purchasing routines, ensuring repeat business for the brand.

- Maintaining a competitive price perception through promotions is essential for market penetration.

Celsius cultivates strong customer relationships by fostering a vibrant social media community and leveraging aspirational athlete partnerships, including over 1,000 college NIL deals in 2024. Direct engagement through field marketing, with over 3,000 annual sampling events, complements self-service online channels, boosting recurring revenue via subscriptions. Promotional initiatives drive trial and loyalty, contributing to its Q1 2024 net sales of $384.8 million.

| Relationship Aspect | 2024 Data Point | Impact |

|---|---|---|

| Community Engagement | 1.7M Instagram / 1.5M TikTok followers | Builds loyal brand advocates |

| Aspirational Connection | 1,000+ college NIL deals | Transforms transactions into inspirational bonds |

| Direct & Digital Reach | 3,000+ annual sampling events; Q1 2024 Net Sales $384.8M | Ensures broad market penetration and revenue growth |

Channels

Celsius significantly leverages the PepsiCo Direct Store Delivery (DSD) system, which became its primary channel for servicing over 100,000 convenience stores, gas stations, and independent retailers across the U.S. This expansive network ensures maximum product availability and high visibility, crucial for capturing the immediate consumption market. The DSD model provides Celsius a substantial speed-to-market advantage, enabling rapid restocking and a strong competitive edge in the evolving energy drink sector. This strategic partnership has been instrumental in Celsius's continued market share growth throughout 2024.

Celsius significantly leverages major retail and club stores, ensuring widespread availability across national chains like Target and Walmart. This channel is pivotal for driving high sales volumes, solidifying Celsius's position as a mainstream grocery staple, with its North American revenue reaching $395.0 million in Q1 2024, an 37.1% increase year-over-year. Selling multi-packs at club stores such as Costco and Sam's Club further encourages household pantry stocking, enhancing brand penetration and repeat purchases.

Celsius significantly leverages its e-commerce and Direct-to-Consumer (D2C) channels, with Amazon.com and Celsius.com serving as primary revenue drivers and customer acquisition platforms. This direct approach allows Celsius to meticulously control its brand experience and capture valuable consumer data, informing future strategies. The online subscription model, particularly through Celsius.com, fosters recurring revenue streams, contributing to the company's robust sales growth, which saw a 96.6% increase in net revenue year-over-year in Q1 2024, reaching $424.2 million. This digital strategy is crucial for expanding market reach and deepening customer engagement.

Fitness and Health-Specific Venues

Celsius strategically places its products in fitness and health-specific venues like gyms, fitness centers, and health/vitamin shops. This direct placement ensures the brand is visible where its target audience is actively pursuing health goals, reinforcing Celsius's identity as a performance beverage. It captures sales at the crucial point of consumption, making it a highly effective channel for both direct sales and brand exposure. This approach leverages the environment to align with consumer intent.

- Celsius reported North American revenue growth of 37% in Q1 2024, partly driven by expanded distribution in these venues.

- Over 41,000 health and fitness clubs operate in the U.S. as of 2024, offering vast distribution potential.

- Placement here reinforces the brand's functional benefit, aligning with consumer fitness routines.

- These channels serve as key marketing touchpoints, converting gym-goers into loyal customers.

International Distribution Partners

Celsius significantly expands its global reach through a robust network of international distribution partners across Europe, Asia, and other key regions. These partners are crucial, offering invaluable local market expertise, navigating complex regulatory landscapes, and managing essential logistics infrastructure. This channel is fundamental to Celsius's long-term international growth strategy, driving market penetration and brand presence.

- Celsius reported strong international growth in Q1 2024, with volumes increasing by 39% compared to Q1 2023.

- International revenue for Celsius reached $31.8 million in Q1 2024, up from $22.9 million in Q1 2023.

- Key markets like Canada and the UK have seen substantial distribution expansion through these partnerships.

- The company plans continued strategic international market entries throughout 2024.

Celsius utilizes a multi-faceted channel strategy, heavily leveraging PepsiCo's DSD network for widespread U.S. convenience store access and major retail partners like Walmart for mainstream grocery presence. E-commerce and D2C platforms drive significant revenue and customer engagement, while strategic placement in fitness venues reinforces brand identity. International growth is fueled by robust distribution partnerships.

| Channel | 2024 Impact | Q1 2024 Data |

|---|---|---|

| North American Retail | Mainstream penetration | Revenue: $395.0M (+37.1% YoY) |

| E-commerce/D2C | Direct sales, subscriptions | Net Revenue: $424.2M (+96.6% YoY) |

| International Partners | Global market expansion | Revenue: $31.8M (+39% volume YoY) |

Customer Segments

This core demographic, primarily Millennials and Gen Z, prioritizes health and wellness, actively seeking alternatives to traditional sugary sodas. They are digitally native and avid label-readers, drawn to Celsius's clean ingredient list and lifestyle branding. This segment significantly contributes to Celsius's robust growth, with the company reporting a 97% increase in revenue to $355.7 million in Q1 2024, largely driven by North American sales to these consumers.

This segment encompasses a broad range of individuals, from casual gym-goers to dedicated athletes, who primarily use Celsius as a pre-workout supplement. They highly value the functional benefits, such as enhanced energy and accelerated metabolism, to significantly improve their physical performance. With the global functional beverage market projected to continue its robust growth in 2024, these consumers are crucial. They often serve as influential early adopters within their social circles, advocating for products that deliver tangible fitness results.

This segment, comprising busy professionals and university students, seeks functional beverages like Celsius for sustained energy and enhanced mental focus to navigate demanding schedules. They prioritize a productive boost without the typical sugar crash, aligning with a growing demand for healthier energy alternatives. Convenience and performance are primary purchase drivers, with Celsius sales to this demographic contributing to the brand's 2024 revenue growth, which saw a 37% increase in North American sales in Q1 2024.

Weight Management Consumers

Weight management consumers represent a core segment for Celsius, drawn by its clinically-backed claims of boosting metabolism and burning body fat. These individuals integrate Celsius beverages as a supplementary aid in their weight loss or maintenance efforts, valuing the functional benefits beyond simple hydration or energy. The thermogenic property, which helps increase calorie expenditure, is the primary appeal for this group.

- The global weight management market size was estimated at $224.2 billion in 2024.

- Consumers seek functional beverages to support fitness goals.

- Celsius targets active lifestyles focused on health outcomes.

- The brand's science-backed claims differentiate it in a competitive market.

'On-the-Go' Convenience Buyers

This broad segment encompasses consumers making impulse purchases at convenience stores, gas stations, and vending machines. They are primarily looking for a quick, cold, and refreshing energy lift to fuel their immediate needs. For these buyers, prominent placement in cold vaults, strong brand recognition, and a diverse range of appealing flavors are absolutely critical for purchase decisions. As of early 2024, convenience stores accounted for over 60% of total US energy drink sales volume, highlighting the channel's importance for impulse purchases.

- Celsius has aggressively expanded its cold vault presence in over 100,000 retail locations by Q1 2024.

- Impulse purchases in convenience channels often rely on high visibility and immediate availability.

- Brand recognition for Celsius surged in 2024, driven by strategic partnerships and marketing efforts.

- Flavor innovation remains key, with new offerings continually attracting convenience buyers.

Celsius serves a broad customer base, including health-conscious Millennials and Gen Z seeking clean labels, fitness enthusiasts desiring pre-workout benefits, and busy professionals needing sustained mental focus. Weight management consumers are drawn to its metabolism-boosting properties, while impulse buyers rely on its availability in convenience stores, which represent over 60% of US energy drink sales volume in early 2024. This diverse appeal contributed to Celsius's Q1 2024 revenue reaching $355.7 million, a 97% year-over-year increase.

| Customer Segment | Primary Benefit Sought | 2024 Market Data/Impact |

|---|---|---|

| Health-Conscious/Gen Z | Clean ingredients, lifestyle fit | 97% Q1 2024 revenue growth to $355.7M |

| Fitness Enthusiasts | Enhanced physical performance | Global functional beverage market robust growth in 2024 |

| Weight Management | Metabolism boost, fat burning | Global weight management market estimated at $224.2B in 2024 |

| Impulse Buyers | Quick energy, convenience | Celsius in 100,000+ cold vaults by Q1 2024 |

Cost Structure

The Cost of Goods Sold represents Celsius’s largest expense, primarily driven by raw materials like ingredients, aluminum cans, and packaging. Co-packing fees also significantly contribute to this cost. For Q1 2024, Celsius reported a gross profit margin of 49.3%, a slight decrease from the prior year, reflecting higher product costs and increased co-packing expenses. Efficiently managing these fluctuating costs, especially for aluminum and key ingredients, is crucial for maintaining and improving overall profitability.

Sales and marketing expenses are a significant cost driver for Celsius, reflecting its marketing-intensive business model. These costs encompass extensive digital advertising, robust social media campaigns, high-profile sponsorships, and payments to influencers. For instance, Celsius significantly expanded its marketing spend, which was a key factor in its 2024 growth projections. This substantial investment is considered crucial for fueling top-line revenue growth and expanding market share in the competitive beverage industry.

Distribution and logistics fees are a substantial cost for Celsius, primarily encompassing payments to PepsiCo for their extensive distribution network, alongside warehousing and freight expenses. As Celsius's sales volume continues to surge, these costs naturally increase in absolute terms. However, with the significant economies of scale realized through the PepsiCo partnership, these expenses are expected to decrease as a percentage of total revenue. Efficient management of these costs, especially given the ongoing expansion, is crucial for Celsius to achieve further margin expansion and profitability targets in 2024 and beyond.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses are crucial overheads for Celsius, encompassing executive salaries, corporate employee wages, and stock-based compensation. These costs also include essential R&D investments and legal and professional fees. While fixed in nature, Celsius strategically aims to leverage these G&A costs as revenue grows, targeting improved operating margins. For instance, in Q1 2024, Celsius reported G&A expenses that reflect ongoing corporate infrastructure needs.

- Executive and corporate employee compensation.

- Stock-based compensation for key personnel.

- Research and Development (R&D) outlays.

- Legal and professional service fees.

Trade Spend and Slotting Fees

A significant cost for Celsius in retail involves trade spend, encompassing payments to retailers for promotional activities and price discounts. Slotting fees represent one-time payments crucial for securing valuable shelf space for new product launches within retail stores. These expenditures are vital for Celsius to gain and maintain widespread retail distribution, especially as the company continues its expansion. In the competitive beverage market, trade spend and slotting fees can represent a substantial portion of sales and marketing expenses, impacting profitability.

- Retailer allowances for promotions are key.

- One-time slotting fees secure product placement.

- Costs are essential for market penetration.

- These expenses are integral to Celsius's distribution strategy.

Celsius's cost structure is primarily driven by Cost of Goods Sold, encompassing raw materials and co-packing fees, resulting in a 49.3% gross profit margin in Q1 2024. Significant sales and marketing investments fuel brand expansion and market share. Distribution and logistics costs, largely through the PepsiCo partnership, are substantial but benefit from increasing economies of scale. General and administrative expenses, alongside retail trade spend and slotting fees, support operational infrastructure and market penetration.

| Cost Category | Key Drivers | Q1 2024 Snapshot |

|---|---|---|

| Cost of Goods Sold | Raw materials, co-packing | Gross Margin: 49.3% |

| Sales & Marketing | Digital ads, sponsorships | Significant investment |

| Distribution & Logistics | PepsiCo fees, freight | Economies of scale |

| General & Admin | Salaries, R&D, legal | Ongoing infrastructure |

Revenue Streams

Celsius primarily generates revenue through the wholesale of its finished energy drinks to distribution partners, with PepsiCo serving as the largest and most significant partner since their 2022 agreement. Revenue is recognized at the point of sale to these distributors, allowing Celsius to efficiently scale its market penetration across various retail channels. This distribution model has been instrumental in Celsius’s rapid growth, contributing to a substantial increase in net sales, which reached $1.32 billion in 2023, with continued strong performance anticipated for 2024.

Celsius generates significant revenue through direct sales to large national retailers, including major club stores and grocery chains like Target and Walmart. These partners often prefer managing their own logistics and warehousing, facilitating high-volume orders. In 2024, Celsius continued to expand its retail footprint, with net revenue reaching $355.7 million in Q1 2024, primarily driven by North American sales.

A rapidly growing revenue stream for Celsius comes from direct sales to consumers through Celsius.com and major third-party online marketplaces like Amazon, which accounted for a significant portion of their digital presence. This D2C channel typically offers higher gross margins per unit compared to traditional wholesale distribution, contributing to overall profitability. For instance, in Q1 2024, Celsius reported strong revenue growth, with e-commerce sales playing a vital role in their expansion, complementing their strong retail presence. This direct approach allows Celsius to better control brand messaging and customer relationships.

International Sales

Celsius generates revenue from international sales primarily through distributors and retailers outside of North America. This revenue stream is poised for significant growth as the company continues to expand its global reach, offering crucial geographic diversification. For instance, international revenue for Celsius increased by 19% year-over-year in the first quarter of 2024.

- Revenue from sales to international distributors and retailers.

- Expected to become a significant contributor as global footprint expands.

- Provides crucial geographic diversification to the revenue base.

- International revenue grew 19% year-over-year in Q1 2024.

Licensing and Branded Merchandise

Celsius generates ancillary revenue through brand licensing agreements and the sale of branded merchandise like apparel and accessories. While a smaller portion of overall revenue compared to beverage sales, this stream serves a dual purpose. It contributes to income generation while simultaneously acting as a powerful marketing tool. This strategy enhances brand loyalty and visibility, reinforcing Celsius's presence in the health and wellness market.

- Generates ancillary income from non-beverage products.

- Includes sales of apparel and various accessories.

- Acts as a marketing tool to boost brand recognition.

- Strengthens brand loyalty among consumers.

Celsius primarily generates revenue by selling its energy drinks through diversified channels, including wholesale to distributors like PepsiCo, direct sales to major retailers, and a growing direct-to-consumer e-commerce presence. International sales are expanding their global footprint, showing a 19% year-over-year increase in Q1 2024. Ancillary income from brand licensing and merchandise also contributes, reinforcing brand visibility.

| Revenue Stream | Primary Channels | Q1 2024 Performance |

|---|---|---|

| North American Sales | Wholesale, Direct Retail | $355.7 million net revenue |

| International Sales | Distributors, Retailers | 19% year-over-year growth |

| Overall Net Sales | All channels combined | Strong growth anticipated for 2024 |

Business Model Canvas Data Sources

The Celsius Business Model Canvas is built using a combination of internal financial data, comprehensive market research on crypto lending and DeFi trends, and strategic insights derived from competitive analysis. These diverse data sources ensure each block of the canvas is informed by accurate, actionable information regarding Celsius's operations and market position.