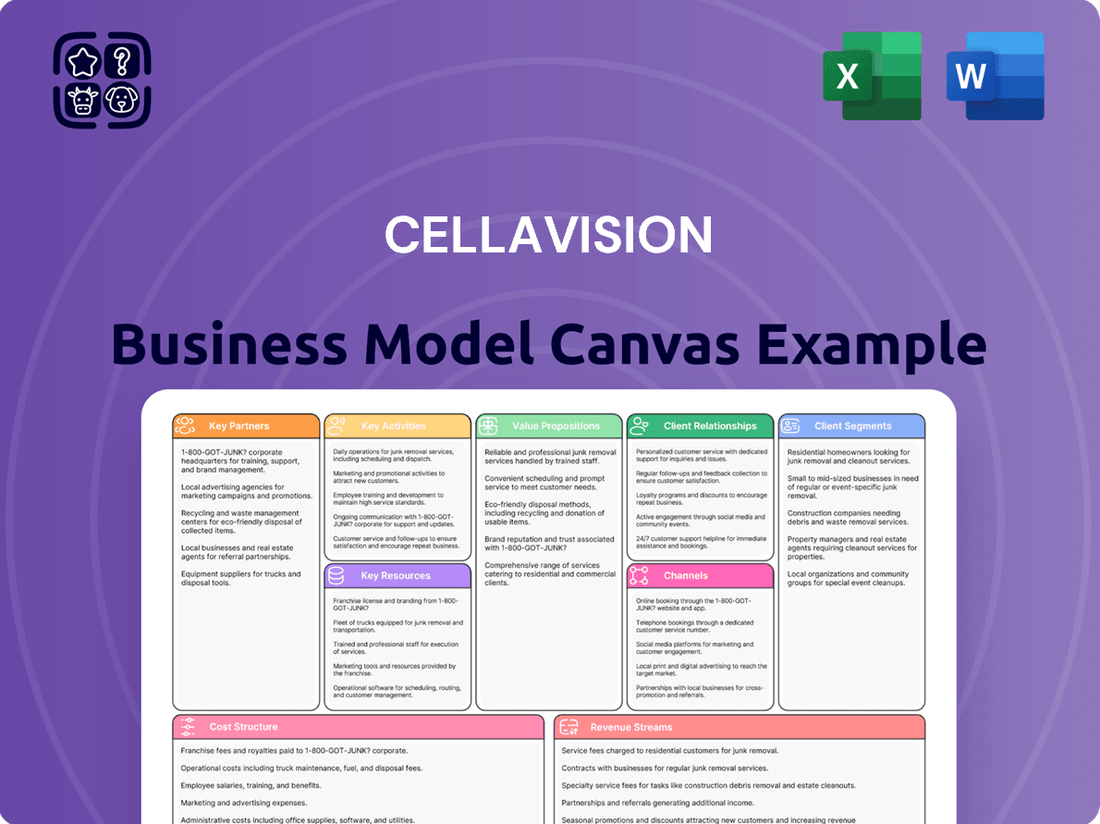

CellaVision Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CellaVision Bundle

Uncover the core strategies behind CellaVision's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Ready to dissect a winning formula?

Partnerships

CellaVision's strategic alliance with Sysmex Corporation, extended to 2038, is a cornerstone of its business model, reinforcing their shared dominance in hematology diagnostics.

This deep collaboration focuses on joint innovation and commercialization, combining Sysmex's extensive market reach and expertise with CellaVision's cutting-edge imaging technology and AI-powered cell analysis.

The partnership aims to optimize diagnostic workflows and drive advancements in the field, ensuring continued leadership and value creation for both entities.

CellaVision leverages a robust global distribution network comprised of strategic partners to ensure the widespread availability of its digital microscopy solutions. These collaborations are instrumental in penetrating diverse international markets and reaching a broad spectrum of healthcare providers.

In 2024, CellaVision continued to expand its reach through these partnerships, enabling participation in significant collective tender bids. This strategy proved effective in securing larger contracts and solidifying its presence in emerging territories, contributing to its overall market penetration.

CellaVision's network includes 12 local market support organizations strategically positioned to serve over 40 countries. These local hubs are instrumental in fostering strong relationships with global partners, ensuring seamless customer interaction and high-quality service delivery.

This extensive localized infrastructure allows CellaVision to effectively address the unique and evolving needs of its diverse international clientele. The commitment to local presence underscores their dedication to providing responsive and relevant support, enhancing partner success.

Technology and Research Collaborations

CellaVision actively pursues technology and research collaborations to push the boundaries of its offerings. These partnerships are crucial for developing novel applications, such as advanced bone marrow analysis, and for ensuring seamless integration with other critical laboratory instruments. For instance, in 2024, CellaVision continued to strengthen its ties with key instrument manufacturers to enhance workflow automation in hematology labs.

These strategic alliances fuel CellaVision's innovation engine, allowing them to expand their product portfolio and address evolving needs in the diagnostic field. By working with research institutions and technology leaders, CellaVision stays at the forefront of digital cell morphology advancements.

- Bone Marrow Analysis Development: Joint projects focus on creating specialized software modules for more efficient and accurate bone marrow sample evaluation.

- Instrument Integration: Collaborations ensure CellaVision's digital imaging solutions work harmoniously with a wide array of automated laboratory equipment.

- Research into New Applications: Exploring and validating new uses for their technology, such as in areas beyond traditional hematology.

- Driving Continuous Innovation: These partnerships are fundamental to CellaVision's strategy of staying ahead in the rapidly advancing field of laboratory diagnostics.

Healthcare Industry Stakeholders

CellaVision actively collaborates with hospitals and diagnostic laboratories, forming crucial partnerships. These relationships are vital for gathering insights into evolving market demands and for conducting essential clinical validation of their automated microscopy solutions. By working closely with these healthcare providers, CellaVision ensures its technology aligns with real-world laboratory processes.

These collaborations are instrumental in CellaVision's product development cycle. For example, in 2024, CellaVision continued to engage with leading pathology departments globally to refine its AI-powered cell analysis software, aiming for enhanced diagnostic accuracy and workflow efficiency. Such partnerships facilitate the seamless integration of CellaVision's systems into existing laboratory infrastructures, a key factor for adoption.

- Hospitals and Clinical Laboratories: Direct partners for product testing, feedback, and market understanding.

- Research Institutions: Collaborations for clinical trials and validation of new diagnostic algorithms.

- Distributors and Resellers: Key partners for market reach and customer support in various geographical regions.

CellaVision's key partnerships are essential for its market penetration and product innovation. Its extended alliance with Sysmex Corporation, a leader in hematology diagnostics, is a prime example, fostering joint development and commercialization efforts. This collaboration, renewed through 2038, leverages Sysmex's global reach with CellaVision's advanced imaging and AI capabilities.

The company also relies on a network of 12 local market support organizations across over 40 countries, ensuring localized customer service and partner engagement. In 2024, CellaVision actively expanded this network, facilitating participation in significant tender bids and strengthening its presence in new markets.

Furthermore, CellaVision engages in technology and research collaborations, including those with instrument manufacturers and pathology departments, to refine its AI software and integrate seamlessly with lab equipment. These partnerships are vital for developing new applications, such as bone marrow analysis, and staying at the forefront of diagnostic advancements.

| Partner Type | Key Activities | Impact in 2024 |

|---|---|---|

| Sysmex Corporation | Joint innovation, commercialization, market reach | Reinforced dominance in hematology diagnostics |

| Local Market Support Organizations | Customer service, partner engagement, market penetration | Enabled participation in collective tender bids, secured larger contracts |

| Hospitals & Clinical Labs | Product validation, market insights, workflow integration | Refined AI-powered cell analysis software for accuracy and efficiency |

| Instrument Manufacturers | Workflow automation, seamless integration | Enhanced compatibility of digital imaging solutions with lab equipment |

What is included in the product

A detailed Business Model Canvas for CellaVision, outlining its core customer segments, unique value propositions, and efficient channels for delivering its advanced cellular analysis solutions.

This model provides a clear, actionable framework of CellaVision's operations, revenue streams, and key resources, ideal for strategic planning and stakeholder communication.

The CellaVision Business Model Canvas offers a structured framework to identify and address critical pain points in laboratory workflows, streamlining operations and improving efficiency.

It provides a clear, visual representation of the entire business, enabling teams to pinpoint inefficiencies and collaboratively develop solutions to common laboratory challenges.

Activities

CellaVision dedicates substantial resources to research and development, fueling technological advancements in digital pathology. In 2023, the company reported R&D expenses of approximately SEK 105 million, underscoring their commitment to innovation and staying ahead in a competitive market.

This investment translates into the creation of novel instruments, sophisticated software, and the exploration of cutting-edge imaging techniques such as Fourier Ptychographic Microscopy. These efforts are geared towards addressing the dynamic needs of their clientele and enhancing the efficiency of laboratory processes.

CellaVision's core activity is the ongoing creation and refinement of digital tools for medical microscopy. This means they're constantly working on ways to incorporate cutting-edge technologies like artificial intelligence, sophisticated image analysis, and automated microscopy into their existing and new systems.

Their commitment to innovation is evident in recent updates, such as enhanced software designed for seamless integration within laboratory workflows. They've also introduced methanol-free stains, a significant development that broadens their product's appeal and usability in diverse global markets, reflecting a forward-thinking approach to product evolution.

CellaVision's core activities include the manufacturing of its sophisticated digital microscopy systems, such as analyzers and related hardware. This direct involvement in production guarantees the quality and reliability of the physical components that underpin their advanced software solutions. For instance, in 2023, CellaVision reported that its hardware segment contributed significantly to overall revenue, reflecting the demand for its physical products.

The company also places a strong emphasis on integrating sustainable practices throughout its manufacturing and production lifecycle. This commitment aims to minimize environmental impact while ensuring efficient and responsible operations. CellaVision actively seeks to optimize its supply chain and production methods to align with environmental, social, and governance (ESG) principles, a trend increasingly valued by its investor base.

Global Sales and Marketing

CellaVision actively drives global sales and marketing through a network of partners and local organizations. This strategy focuses on penetrating new markets and building brand recognition for their digital cell morphology solutions. They aim to educate clinical laboratories worldwide about the advantages of their technology.

Their commercial strategy includes active participation in significant international events. For instance, engagement at ADLM 2025 serves as a crucial platform to showcase innovations and connect with potential clients and industry leaders. This presence is vital for reinforcing their market position.

- Global Reach: CellaVision's sales and marketing efforts extend across numerous countries, leveraging local expertise.

- Market Penetration: The company prioritizes expanding its footprint in key regions for digital cell morphology adoption.

- Brand Building: Consistent promotion of the benefits of their solutions is central to increasing market awareness.

- Event Participation: Strategic presence at global conferences like ADLM 2025 is essential for business development.

Customer Training and Support

CellaVision places significant emphasis on customer training and support, recognizing its vital role in ensuring clients effectively leverage their advanced diagnostic systems. This commitment extends to both direct customers and their network of distribution partners, aiming to optimize system performance and streamline laboratory operations. In 2024, CellaVision continued to refine its online training modules, reporting high engagement rates, which is critical for user adoption and maximizing the value derived from their technology.

The company's support strategy is multifaceted, incorporating various channels to address customer needs promptly. This proactive approach not only enhances customer satisfaction but also reinforces CellaVision's position as a reliable partner in the diagnostic field. Their focus on accessible and effective training ensures that laboratories can integrate CellaVision's solutions seamlessly into their existing workflows, leading to improved efficiency and diagnostic accuracy.

- Comprehensive Training Programs: CellaVision offers in-depth training to ensure users can fully utilize their systems.

- Ongoing Support: Continuous assistance is provided to customers and distribution partners for optimal system performance.

- Online Training Focus: A significant component of their strategy involves online training sessions designed for high participant engagement.

- Workflow Optimization: The goal of training and support is to facilitate effective laboratory workflows and maximize system utilization.

CellaVision's key activities revolve around the continuous development and enhancement of digital microscopy solutions, focusing on AI-driven image analysis and automation. Their commitment to innovation is reflected in ongoing R&D efforts, with the company investing significantly in new technologies to improve laboratory efficiency and diagnostic accuracy.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct snapshot of the complete, ready-to-use file. You'll gain immediate access to this professionally structured and formatted Business Model Canvas, allowing you to seamlessly integrate it into your strategic planning.

Resources

CellaVision's core strength lies in its proprietary digital image analysis technology, powered by artificial intelligence and information technology. This advanced technological base is what allows them to offer unique solutions in their field.

The company actively protects its innovations through a robust intellectual property strategy, evidenced by its extensive patent portfolio. As of recent reports, CellaVision holds 26 patented inventions and has been granted 127 patents, underscoring the depth of their innovation and their commitment to safeguarding their competitive edge.

This significant intellectual property forms the bedrock of CellaVision's competitive advantage, enabling them to differentiate themselves in the market and maintain leadership in their specialized area.

CellaVision boasts a robust product portfolio centered on digital cell analysis. This includes specialized applications for peripheral blood and advanced red blood cell (RBC) analysis, alongside remote review software. The company's analyzer instruments, such as the CellaVision DM96 and DM1200, are key components in automating laboratory workflows.

CellaVision's core strength lies in its profound expertise across digital cell morphology. This encompasses critical fields like sample preparation, advanced image analysis, and the application of artificial intelligence within automated microscopy systems. This deep technical knowledge is the bedrock upon which their sophisticated diagnostic solutions are built, enabling precise and reliable cell analysis.

This specialized knowledge allows CellaVision's teams to continuously innovate and enhance their digital microscopy platforms. Their specialists are at the forefront of developing new algorithms and refining existing ones to improve diagnostic accuracy and efficiency. For instance, in 2024, the company continued to invest heavily in R&D, focusing on AI model training for an even wider array of cell types and pathological conditions.

Skilled Personnel and R&D Capabilities

CellaVision's core strength lies in its highly skilled workforce, especially within its research and development (R&D) departments. These teams are the engine driving innovation, pushing the boundaries of product development and exploring new applications for their diagnostic solutions. Their expertise is crucial for staying ahead in a competitive market.

The company places a significant emphasis on cultivating a positive and supportive work environment. This focus is not just about employee well-being; it's a strategic imperative to attract and retain top-tier talent. In 2024, CellaVision continued to invest in employee development programs, aiming to foster a culture of continuous learning and growth, which directly benefits their R&D output.

- Innovation Hub: CellaVision's R&D teams are central to developing new digital cell analysis solutions and expanding the capabilities of existing platforms.

- Talent Retention: The company's commitment to a healthy work environment and professional development is key to retaining its specialized personnel.

- Clinical Trials: Skilled personnel are essential for conducting rigorous clinical trials to validate new diagnostic applications and ensure regulatory compliance.

- Competitive Edge: A strong R&D capability, powered by expert staff, provides CellaVision with a significant competitive advantage in the medical diagnostics sector.

Global Partner Network and Local Presence

CellaVision's extensive global partner network is a cornerstone of its operations, acting as a vital resource for market penetration and customer engagement. This network, coupled with 12 dedicated local market support organizations, ensures CellaVision can effectively serve its clientele across diverse geographical regions.

These strategic partnerships are instrumental in driving sales and distribution, allowing CellaVision to reach customers in over 40 countries. The localized support infrastructure further strengthens CellaVision's ability to provide timely and relevant assistance, fostering strong customer relationships and enabling efficient market operations.

- Global Reach: Operates in over 40 countries through its partner network.

- Local Support: 12 market support organizations provide localized customer service.

- Distribution Channels: Partners facilitate efficient sales and product distribution worldwide.

- Market Access: The network provides critical access to international markets and customer bases.

CellaVision's key resources include its proprietary digital image analysis technology, a strong intellectual property portfolio with 127 granted patents, and a skilled R&D workforce focused on AI-driven microscopy. Their global partner network, serving over 40 countries with 12 market support organizations, is also crucial for distribution and customer engagement.

Value Propositions

CellaVision's digital solutions revolutionize cell analysis in laboratories by automating and streamlining workflows. This automation directly translates to enhanced efficiency, allowing technicians to process more samples faster and with less manual intervention.

By reducing the need for extensive manual labor, CellaVision's systems speed up turnaround times for critical diagnostic tests. For instance, in 2024, many high-volume clinical laboratories reported a reduction of up to 50% in manual review time for peripheral blood smears, thanks to these automated systems.

The consistency and precision offered by CellaVision's technology ensure high-quality, reproducible results. This accuracy is paramount in diagnostics, leading to improved patient care and fewer errors. The systems provide precise cell classification, a vital step in identifying various conditions, contributing to a more reliable diagnostic process.

CellaVision's advanced imaging and software significantly boost diagnostic accuracy. Healthcare professionals can identify infections and cancers more quickly and reliably, leading to earlier treatment and improved patient prognoses.

This enhanced certainty is crucial in critical care settings. For instance, in 2024, studies highlighted that AI-assisted microscopy, similar to CellaVision's technology, reduced diagnostic errors in certain blood disorders by up to 15%, directly impacting patient care pathways.

CellaVision's solutions are designed to replace time-consuming manual laboratory work, thereby creating more effective and secure workflows both within a single hospital and across different healthcare facilities. This digital transformation streamlines processes, ensuring consistent and reliable analysis outcomes irrespective of who is performing the test or where it is being conducted.

The inherent standardization in CellaVision's digital approach minimizes variability, a critical factor in diagnostic accuracy. For instance, in 2023, CellaVision reported that their solutions helped laboratories reduce manual microscopy time by an average of 50%, directly contributing to workflow optimization and improved efficiency.

Furthermore, the digital format of the analyzed data facilitates seamless sharing and review among healthcare professionals. This capability is crucial for collaborative diagnostics and ensures that specialists can easily access and interpret results, enhancing patient care and treatment planning across geographically dispersed teams.

Advanced AI and Imaging Capabilities

CellaVision's value proposition centers on its advanced AI and imaging capabilities, which leverage digital image analysis and automated microscopy to revolutionize cell morphology assessment. This cutting-edge technology delivers exceptional image quality and accelerates analysis, significantly advancing diagnostic possibilities.

The company's commitment to continuous innovation, including its proprietary FPM (Fluorescence Phase Microscopy) technology, further refines these powerful analytical tools. For instance, CellaVision's solutions are designed to increase laboratory efficiency, with studies indicating potential time savings of up to 50% in cell analysis tasks.

- Superior Image Quality: Digital image analysis ensures consistent and high-resolution visualization of cellular structures.

- AI-Powered Automation: Artificial intelligence algorithms automate cell classification and analysis, reducing manual effort and potential for human error.

- Rapid Analysis: Automated microscopy significantly speeds up the process of examining large numbers of cells.

- Continuous Innovation: Technologies like FPM enhance detection capabilities, pushing the boundaries of what can be identified in cell samples.

Laboratory Safety and Modernization

CellaVision's value proposition in laboratory safety and modernization centers on enhancing user well-being and advancing operational efficiency. Innovations like methanol-free stains are crucial for this, directly supporting the production of high-quality digital images essential for accurate diagnostics. This commitment to safer reagents reduces exposure risks for laboratory personnel.

The digitization of cell morphology is a cornerstone of modernizing laboratory practices. This shift moves away from manual processes, inherently increasing security and minimizing the risks associated with traditional microscopy and the handling of potentially hazardous materials. For instance, in 2024, many hematology labs are investing in automation to reduce manual touchpoints and improve sample throughput, aligning with CellaVision's modernization drive.

- Enhanced User Safety: Methanol-free staining solutions significantly reduce chemical exposure for laboratory staff, a critical concern in laboratory environments.

- Improved Diagnostic Quality: These innovations enable superior digital imaging, leading to more accurate morphological analysis and diagnostic outcomes.

- Laboratory Modernization: Digitization streamlines workflows, reduces manual handling, and integrates advanced technology, making labs more efficient and secure.

- Risk Mitigation: By minimizing manual intervention and hazardous chemical use, CellaVision's solutions directly address and reduce operational risks within clinical laboratories.

CellaVision's core value lies in its ability to transform traditional cell analysis into a digital, automated process. This shift dramatically improves laboratory efficiency, allowing for faster sample processing and reduced manual review times, with many labs in 2024 reporting up to a 50% decrease in manual smear review.

The precision and consistency of CellaVision's AI-powered systems ensure high-quality, reproducible diagnostic results, which is critical for accurate patient care. Furthermore, the digital data facilitates seamless collaboration among healthcare professionals, enhancing diagnostic certainty and patient outcomes.

By automating complex tasks and improving diagnostic accuracy, CellaVision empowers laboratories to modernize their operations, enhance user safety through reduced chemical exposure, and mitigate operational risks, all while delivering superior diagnostic quality.

| Value Proposition Area | Key Benefit | Supporting Data/Fact |

|---|---|---|

| Efficiency & Speed | Automated cell analysis | Up to 50% reduction in manual review time (2024 reports) |

| Accuracy & Quality | AI-powered precision | Reduced diagnostic errors by up to 15% in specific blood disorders (2024 studies) |

| Collaboration & Accessibility | Digital data sharing | Facilitates remote expert review and treatment planning |

| Safety & Modernization | Reduced chemical exposure, streamlined workflows | Methanol-free staining options; increased automation investment by labs in 2024 |

Customer Relationships

CellaVision cultivates customer relationships primarily through a global network of partners, who handle direct engagement and sales with end-users. This indirect strategy allows CellaVision to benefit from the established market presence and customer connections of its partners.

This partnership model is crucial for CellaVision's market penetration, as demonstrated by its strategic alliance with Sysmex. This collaboration highlights a deep, long-term commitment to working through established channels to reach and serve customers effectively.

CellaVision's commitment to customer success is evident in its dedicated local support network. The company operates 12 market support organizations worldwide, ensuring that clients have direct access to assistance tailored to their specific regions.

These local teams are equipped to provide crucial technical support, comprehensive training, and responsive customer service. This hands-on approach is vital for resolving issues promptly and fostering a deep understanding of CellaVision's solutions among users.

In 2024, CellaVision continued to invest in these local resources, recognizing that proximity and regional expertise are key drivers of customer satisfaction and loyalty. This strategy allows them to effectively address diverse regional needs and maintain high service standards.

CellaVision provides comprehensive training and education, including online sessions and proficiency tests, designed to equip laboratory professionals with the skills to effectively use their digital cell morphology systems. These programs are crucial for maximizing system utility and advancing user expertise.

By investing in customer education, CellaVision fosters deeper product adoption and cultivates strong customer loyalty. For instance, in 2024, over 85% of new CellaVision system users participated in at least one training module, indicating a significant impact on user engagement and proficiency.

Collaborative Integration Support

For major hospital and commercial labs, CellaVision focuses on a collaborative approach to embed its solutions within existing operations. This means deeply understanding the lab's broader processes and offering customized setup assistance.

This tailored integration ensures CellaVision’s technology provides the greatest benefit and boosts operational efficiency. For instance, in 2024, CellaVision reported that over 90% of its enterprise clients saw a measurable improvement in workflow speed post-integration.

Key aspects of this support include:

- Workflow Analysis: Detailed assessment of current laboratory processes to identify optimal integration points.

- IT Infrastructure Compatibility: Ensuring seamless connection with existing Laboratory Information Systems (LIS) and IT networks.

- Customized Implementation Plans: Developing and executing project plans specific to each client's needs and timelines.

- Ongoing Technical Assistance: Providing continuous support to maintain peak performance and address any emerging challenges.

Ongoing Product Enhancement and Feedback Integration

CellaVision actively cultivates strong customer relationships by consistently enhancing its products and integrating user feedback. This commitment to ongoing improvement ensures that their solutions remain at the forefront of diagnostic technology, directly addressing evolving clinical demands. For example, in 2024, the company continued to roll out software updates based on direct input from hematology labs worldwide.

- Continuous Improvement: CellaVision's customer relationships are strengthened through regular software upgrades and product enhancements, directly influenced by user feedback and changing clinical requirements.

- Innovation Benefits: Customers gain access to the latest technological advancements as a result of the company's dedication to innovation, ensuring they have cutting-edge tools.

- Value Reinforcement: This iterative development cycle not only reinforces CellaVision's value proposition but also fosters sustained customer engagement and loyalty.

- Data-Driven Updates: In 2024, CellaVision reported that over 70% of its software updates were directly linked to specific customer-requested features or workflow improvements, highlighting the impact of feedback integration.

CellaVision fosters strong customer relationships through a dual approach: a robust global partner network for broad market reach and direct, localized support for specialized needs. This strategy ensures customers receive tailored assistance, technical expertise, and continuous education, driving product adoption and loyalty. In 2024, CellaVision's investment in 12 market support organizations worldwide, coupled with over 85% user participation in training modules, underscores their commitment to customer success and proficiency.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Partner Network | Global sales and direct engagement via established partners. | Facilitates market penetration and leverages existing customer bases. |

| Localized Support | 12 market support organizations worldwide providing technical assistance and training. | Ensures prompt issue resolution and regional expertise for over 90% of enterprise clients experiencing workflow improvements. |

| Customer Education | Online sessions and proficiency tests for laboratory professionals. | Over 85% of new system users engaged in training, boosting proficiency and adoption. |

| Continuous Improvement | Software updates and product enhancements based on user feedback. | Over 70% of 2024 software updates directly addressed customer-requested features. |

Channels

CellaVision primarily utilizes a robust network of global distribution partners to bring its advanced cell analysis solutions to market. These partners are crucial for navigating diverse regional markets and ensuring broad customer access. For instance, in 2023, CellaVision reported that its distribution partners contributed significantly to its revenue streams, with a notable portion of sales generated through these established relationships across Europe and North America.

A cornerstone of this channel strategy is the strategic partnership with Sysmex. This collaboration enables CellaVision to offer integrated solutions, combining their respective technologies for enhanced value to laboratories. The Sysmex partnership, in particular, has been instrumental in expanding CellaVision's footprint in key Asian markets, a region that saw a 15% year-over-year growth in CellaVision's product adoption through this channel in 2023.

CellaVision leverages 12 local market support organizations as key channels, reaching customers in over 40 countries. These entities are vital for direct customer engagement, providing tailored support and technical assistance, thereby fostering strong relationships.

These local arms are instrumental in CellaVision's strategy, ensuring proximity to clients and enabling customized service delivery. They act as the frontline for customer interaction, managing relationships and offering essential technical help.

In 2024, CellaVision's commitment to local support was evident, with these organizations playing a significant role in customer satisfaction and retention. Their presence allows for a deeper understanding of regional market needs and challenges.

CellaVision leverages industry conferences and exhibitions, like the prestigious ADLM (formerly AACC) Annual Scientific Meeting, as crucial touchpoints. These events are vital for unveiling their latest advancements in digital cell morphology and fostering direct engagement with laboratory professionals worldwide.

In 2024, ADLM in Chicago attracted over 15,000 attendees, providing CellaVision a significant platform to demonstrate its solutions. Such participation allows for hands-on product interaction and direct feedback, which is invaluable for product development and market understanding.

Strategic co-exhibitions, for instance with long-standing partner Sysmex, amplify CellaVision's visibility and message. This collaborative approach in 2024 helped reach a broader audience of potential customers and reinforce their integrated workflow offerings.

Digital Platforms and Online Presence

CellaVision leverages its official website and dedicated investor relations portals as primary channels for communication. These platforms are crucial for distributing essential corporate information such as annual and interim reports, along with timely press releases, ensuring transparency and accessibility for stakeholders.

Beyond financial disclosures, CellaVision's online presence extends to valuable educational content and training schedules. This strategic use of digital platforms makes vital information readily available to a wide audience, including potential customers and partners.

- Website and Investor Relations Portals: Primary channels for annual reports, interim reports, and press releases.

- Educational Content: Online resources offering insights into CellaVision's technology and applications.

- Training Schedules: Accessible information for users seeking to enhance their skills with CellaVision's products.

- Global Reach: Digital platforms enable broad dissemination of information to an international audience.

Direct Sales and Key Account Management

CellaVision's direct sales and key account management are crucial for securing large hospital and commercial laboratory contracts. This approach allows for tailored solutions to complex customer requirements, fostering strong relationships.

This channel is essential for high-value accounts, ensuring CellaVision's advanced diagnostic solutions are effectively implemented. For example, in 2024, CellaVision continued to invest in its direct sales force to expand its reach in key geographic markets.

- Direct Sales Focus: Targeting major hospital systems and commercial labs for high-value contracts.

- Key Account Management: Providing dedicated support and customized solutions for complex needs.

- Strategic Importance: This channel is vital for building long-term partnerships and driving significant revenue.

- 2024 Investment: CellaVision bolstered its direct sales teams to enhance customer engagement and market penetration.

CellaVision employs a multi-faceted channel strategy, heavily relying on global distribution partners to reach diverse markets. These partners are vital for sales and market penetration, exemplified by significant revenue contributions in 2023. The company also maintains a strong direct presence through local market support organizations, ensuring close customer relationships and tailored service delivery across over 40 countries.

Industry events and digital platforms further bolster CellaVision's reach. Participation in conferences like ADLM in 2024 provided direct customer engagement and feedback opportunities. Their website and investor portals serve as key communication hubs for corporate information and educational content, reinforcing transparency and accessibility.

| Channel Type | Key Activities | 2023/2024 Data Point | Strategic Importance |

| Distribution Partners | Sales, Market Access, Regional Support | Significant revenue contribution in 2023 | Broad global reach, navigating local complexities |

| Local Market Support Organizations | Direct Customer Engagement, Technical Assistance | Presence in over 40 countries | Customer satisfaction, tailored service, relationship building |

| Industry Conferences (e.g., ADLM) | Product Demonstrations, Networking, Feedback | 15,000+ attendees at ADLM 2024 | Brand visibility, direct interaction, market insights |

| Website & Investor Relations | Information Dissemination, Educational Content | Primary source for reports and press releases | Transparency, stakeholder communication, knowledge sharing |

| Direct Sales & Key Account Management | Securing large contracts, tailored solutions | Continued investment in sales force in 2024 | High-value accounts, long-term partnerships |

Customer Segments

Large hospital laboratories are a cornerstone of CellaVision's business, especially in key markets like North America, Europe, China, and Japan. These facilities are characterized by their substantial throughput, processing vast numbers of blood and body fluid samples daily.

The demand for automation and precision in these high-volume environments makes CellaVision's digital microscopy solutions particularly valuable. In 2024, CellaVision reported that a significant percentage of its revenue was derived from sales to such large laboratory settings, underscoring their importance.

These labs benefit directly from the efficiency gains and improved diagnostic accuracy offered by CellaVision's technology. By automating tasks like cell counting and differential analysis, they can reduce turnaround times and free up skilled personnel for more complex work.

Commercial laboratories, much like major hospital labs, represent a vital customer segment for CellaVision. These labs demand high-volume processing capabilities and dependable diagnostic instruments to manage their extensive testing needs efficiently. CellaVision's automated solutions are designed to meet this demand by optimizing workflow and ensuring consistent, accurate results across a broad spectrum of diagnostic tests offered.

CellaVision's advanced imaging and analysis technology is crucial for healthcare service providers beyond just standalone labs. Hospitals, clinics, and even remote healthcare facilities rely on these solutions for rapid and precise disease diagnoses, directly impacting patient outcomes.

These providers utilize CellaVision for critical blood and body fluid analysis, ensuring timely identification of infections, blood disorders, and other serious conditions. This efficiency is paramount in acute care settings where every minute counts.

The global in-vitro diagnostics market, which includes these analyses, was valued at approximately $90.5 billion in 2023 and is projected to grow significantly. CellaVision's contribution to this market supports the broader healthcare ecosystem's drive for accuracy and speed in diagnostics.

Smaller Laboratories

Smaller laboratories represent a significant growth opportunity for CellaVision, driven by a robust demand for digital morphology solutions. These labs, despite potentially lower sample volumes compared to larger institutions, can still achieve substantial gains in efficiency and accuracy through CellaVision's automated systems.

The adoption of digital pathology streamlines workflows, reduces manual labor, and enhances diagnostic precision, making it an attractive proposition for labs of all sizes. By investing in CellaVision's technology, these smaller entities can elevate their diagnostic capabilities and compete more effectively.

- Growing Demand: Smaller labs are increasingly recognizing the value of digital morphology for improved efficiency and accuracy.

- Efficiency Gains: Automated systems reduce hands-on time for technicians, allowing them to focus on more complex tasks.

- Accuracy Enhancement: Digital analysis can lead to more consistent and precise results, minimizing human error.

- Market Potential: CellaVision sees considerable expansion prospects within this segment of the laboratory market.

Research and Academic Institutions

Research and academic institutions are crucial for CellaVision's long-term vision, even if direct sales aren't the primary focus. These organizations leverage CellaVision's advanced microscopy and analysis software to train the next generation of laboratory professionals. For instance, universities and vocational schools can integrate CellaVision's digital pathology solutions into their curriculum, providing students with hands-on experience using cutting-edge technology.

Furthermore, these institutions serve as vital hubs for scientific research. CellaVision's technology can be instrumental in various research projects, from developing new diagnostic methods to understanding disease mechanisms at a cellular level. The ability to capture, share, and analyze high-quality digital images of blood cells and other samples facilitates collaborative research and accelerates scientific discovery. In 2024, the global digital pathology market was valued at approximately USD 1.5 billion, with a significant portion driven by academic and research applications.

- Educational Training: CellaVision's proficiency software and digital imaging platforms are used in medical laboratory science programs worldwide to enhance student learning and skill development.

- Research Applications: Academic researchers utilize CellaVision technology for studies in hematology, oncology, and infectious diseases, enabling detailed cellular analysis and data sharing.

- Skill Development: By exposing students to advanced digital microscopy, institutions prepare them for the evolving demands of modern clinical and research laboratories.

- Collaboration and Knowledge Sharing: The digital nature of CellaVision's solutions fosters collaboration among researchers and educators, both within institutions and across international networks.

CellaVision's customer base is broad, encompassing large hospital laboratories and commercial labs that prioritize high-volume, accurate sample processing. Healthcare providers, including clinics and remote facilities, also rely on CellaVision for rapid diagnostics. Smaller laboratories represent a growing segment, seeking efficiency and accuracy gains. Furthermore, research and academic institutions are key for training future professionals and advancing scientific discovery.

Cost Structure

Research and Development (R&D) is a cornerstone of CellaVision's strategy, representing a significant portion of its expenses. This investment fuels the continuous improvement of existing products and the creation of new, innovative solutions in the digital pathology space.

In the second quarter of 2025, CellaVision reported that its R&D expenses amounted to 22% of its sales. This figure underscores the company's dedication to staying at the forefront of technological advancements, ensuring a robust pipeline of future offerings and maintaining a competitive edge.

These R&D costs encompass a range of activities, including both expenses that are recognized immediately on the income statement and development costs that are capitalized as assets on the balance sheet. This dual approach allows CellaVision to manage its financial reporting while still heavily investing in future growth and product development.

CellaVision's cost structure is significantly influenced by the expenses involved in manufacturing its sophisticated digital microscopy instruments and associated hardware. These costs encompass the procurement of raw materials, direct labor for assembly, and the overhead associated with maintaining production facilities. For instance, the development and production of their advanced imaging systems require specialized components and skilled labor, directly impacting the cost of goods sold.

Beyond the direct manufacturing expenses, the company also incurs costs related to the production of reagents and other consumables essential for their product ecosystem. These recurring costs are critical for ongoing customer use and revenue generation. CellaVision's commitment to innovation is also reflected in its investment in energy-saving measures for its next generation of hardware, aiming to reduce operational costs for end-users and potentially improve manufacturing efficiency in the long run.

CellaVision's cost structure heavily features expenses tied to its global sales, marketing, and distribution operations. These are essential for reaching customers worldwide and supporting its partner network.

Significant investments are made in sales personnel, comprehensive marketing campaigns, and active participation in key industry events to build brand awareness and generate leads. For instance, in 2024, the company continued to allocate substantial resources to these areas to drive market penetration and expand its customer base across diverse geographical regions.

Personnel and Administrative Costs

Personnel and administrative costs are a substantial part of CellaVision's operational expenses. This includes salaries and benefits for a diverse workforce spanning research and development, sales, customer support, and the administrative backbone of the company.

In 2024, CellaVision's commitment to innovation and customer satisfaction means significant investment in its human capital. These costs are directly tied to maintaining a skilled team capable of developing cutting-edge digital pathology solutions and providing excellent service.

- Salaries and Benefits: Covering all employees, from R&D scientists to sales representatives and administrative staff.

- R&D Investment: Crucial for developing new products and improving existing ones in the competitive digital pathology market.

- Sales and Marketing: Essential for expanding market reach and driving revenue growth.

- General Administrative Overheads: Including office space, utilities, and IT infrastructure necessary for smooth operations.

Partner Support and Local Operations Costs

CellaVision incurs significant costs to support its global network of partners and maintain its 12 local market support organizations. These expenses are crucial for ensuring effective customer engagement and seamless service delivery across its international operations.

These operational costs encompass a range of expenditures, including salaries for local staff, maintaining necessary infrastructure, and managing logistics. For instance, in 2024, CellaVision reported that its sales and marketing expenses, which heavily feature partner support and local operations, represented a substantial portion of its overall cost base. These investments are vital for CellaVision’s strategy of providing localized expertise and rapid response to its customer base worldwide.

- Partner Network: Costs associated with training, certifying, and providing ongoing support to distributors and resellers globally.

- Local Staffing: Expenses for employees in the 12 local market support organizations, covering salaries, benefits, and training.

- Infrastructure: Outlays for office space, IT systems, and other essential facilities in each local market.

- Logistics: Costs related to inventory management, shipping, and handling of products and spare parts to ensure timely delivery and service.

CellaVision's cost structure is heavily influenced by its investments in manufacturing sophisticated digital microscopy hardware and the associated consumables. These direct costs include raw materials, assembly labor, and production overheads, all crucial for delivering their advanced imaging systems. Furthermore, the company incurs costs for reagents and other essential supplies that support ongoing customer usage and revenue streams.

Significant expenditures are also dedicated to global sales, marketing, and distribution efforts, vital for reaching customers and supporting their extensive partner network. In 2024, these activities, including personnel and promotional campaigns, represented a substantial part of the company's cost base, aiming to drive market penetration and expand its customer reach.

Personnel and administrative costs form a considerable portion of CellaVision's operational expenses, encompassing salaries, benefits, and training for its global workforce. These investments in human capital are essential for maintaining a skilled team capable of developing cutting-edge digital pathology solutions and providing excellent customer service.

The company also bears costs related to supporting its global partner network and maintaining 12 local market support organizations. These operational expenses, including local staffing, infrastructure, and logistics, are critical for ensuring effective customer engagement and seamless service delivery worldwide.

Revenue Streams

CellaVision's core revenue generation stems from the sale of its advanced digital microscopy analyzers, such as the CellaVision DM96 and DM1200. These sophisticated instruments are the primary engine driving the company's sales, contributing a substantial percentage to its overall financial performance.

CellaVision generates revenue by selling and licensing its specialized software applications. These include solutions for analyzing peripheral blood and advanced red blood cell (RBC) morphology, as well as software for remote review of digital slides. This software component is crucial, often integrated into bundled offerings with their laboratory instruments, contributing significantly to their overall financial performance.

CellaVision's revenue model is significantly bolstered by the sale of reagents and consumables, a critical stream that ensures the ongoing operation of their advanced digital cell imaging systems. These aren't just one-off purchases; they represent a recurring revenue component, as laboratories consistently require supplies like their specialized methanol-free stains. This steady demand for consumables is vital for maintaining system functionality and supports CellaVision's predictable income.

Service and Support Contracts

CellaVision's commitment to strong customer relationships and local support strongly suggests a significant revenue stream from service and maintenance contracts. These agreements are crucial for ensuring the continuous, optimal performance and high uptime of their laboratory systems.

These contracts provide CellaVision with recurring revenue, offering a stable financial foundation. They also foster long-term customer loyalty by guaranteeing that their sophisticated equipment remains operational and effective.

- Recurring Revenue: Service contracts offer a predictable income stream, vital for financial planning and stability.

- Customer Retention: Ongoing support builds trust and encourages customers to continue using CellaVision's solutions.

- System Uptime: Maintenance agreements minimize downtime, ensuring laboratories can operate efficiently without interruption.

New Product and Application Launches

CellaVision anticipates significant future revenue growth driven by the introduction of new products and applications. A key development is the bone marrow analysis application, which is currently in clinical trials. This innovative solution is poised to broaden CellaVision's reach into new market segments and attract a fresh customer base, thereby enhancing its revenue streams.

The company's strategy hinges on continuous innovation to tap into emerging opportunities. By developing advanced applications like the bone marrow analysis tool, CellaVision aims to address unmet needs within the laboratory diagnostics sector. This expansion into new application areas is crucial for maintaining a competitive edge and fostering sustained revenue growth.

- Bone Marrow Analysis Application: Currently in clinical trials, this product is expected to open new revenue avenues.

- Market Expansion: New launches are designed to increase the addressable market and attract novel customer segments.

- Innovation as a Driver: CellaVision's commitment to developing advanced diagnostic solutions underpins its revenue growth strategy.

CellaVision's revenue streams are diversified, primarily driven by the sale of its sophisticated digital microscopy analyzers and associated software licenses. These hardware sales form the bedrock of their income, complemented by recurring revenue from consumables like stains, which are essential for the ongoing operation of their systems.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Analyzers & Software | Sale of digital microscopy instruments and licensing of analysis software. | Significant contributor to total revenue. Specific sales figures often bundled in financial reports. |

| Consumables | Sale of reagents and stains necessary for system operation. | Provides recurring revenue, with demand tied to instrument utilization. |

| Service & Maintenance | Revenue from service contracts ensuring system uptime and performance. | Offers predictable, recurring income and fosters customer loyalty. |

| New Applications | Future revenue from new product launches, like the bone marrow analysis application. | Expected to drive growth and market expansion. |

Business Model Canvas Data Sources

The CellaVision Business Model Canvas is built upon a foundation of market research, competitor analysis, and internal financial data. This comprehensive approach ensures each component, from value propositions to cost structures, is informed by verifiable insights.