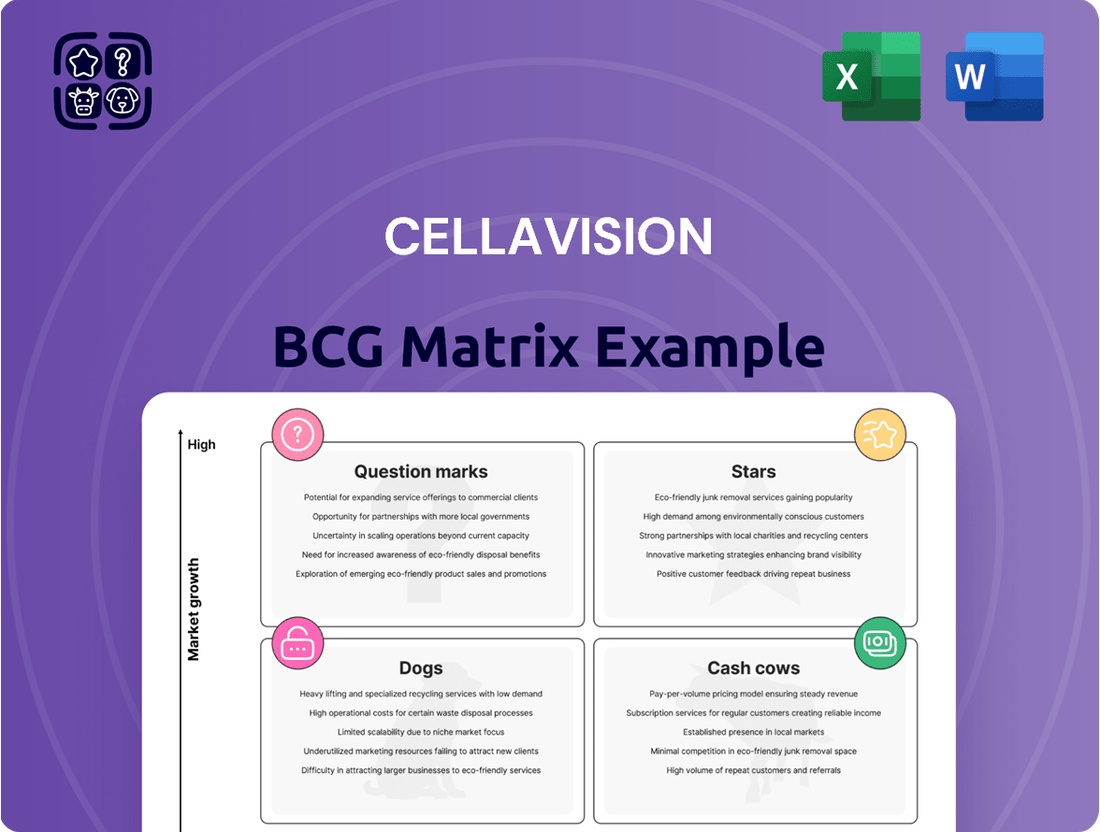

CellaVision Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CellaVision Bundle

Understanding a company's product portfolio is crucial for strategic growth. The CellaVision BCG Matrix offers a powerful framework to categorize products based on market share and growth rate, revealing their potential. This glimpse into the matrix highlights key product positions, but to truly unlock actionable insights and drive informed decisions, you need the complete picture.

Don't miss out on the opportunity to gain a comprehensive understanding of CellaVision's product landscape. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions that can propel your business forward.

Stars

CellaVision's digital cell morphology solutions, encompassing advanced analyzers and sophisticated software, have achieved widespread adoption among the world's leading hospitals. This strong market presence highlights their significant share in the expanding laboratory diagnostics sector. The company’s commitment to integrating AI-driven microscopy further cements its leadership in enhancing hematology workflows.

The impressive reach of CellaVision's technology is underscored by its presence in all 20 of the top-ranked U.S. hospitals and the top 10 children's hospitals as of 2025. This extensive penetration demonstrates a clear market advantage and trust from premier healthcare institutions.

CellaVision's integration with Sysmex, solidified by a strategic alliance extended to 2038, positions its cell morphology analyzers as a strong contender in the hematology market. This partnership, featuring the CellaVision DI-60, combines Sysmex's workflow optimization with CellaVision's advanced digital imaging and AI capabilities. Such synergy enhances laboratory precision and standardization, a key factor for growth.

CellaVision stands as a dominant force in the digital hematology market, boasting over 8,000 installed units globally. This extensive reach, coupled with a comprehensive offering of analyzers, instruments, reagents, and software, solidifies its position as a leader. Their solutions are designed to streamline laboratory workflows and enhance diagnostic precision, a crucial advantage in the competitive landscape.

Strong Organic Growth in Key Regions

CellaVision has shown impressive organic sales growth, even with varied results across different regions. In the second quarter of 2025, the company achieved a 7.6% organic growth, building on a strong 14.1% in the first quarter of 2025.

This sustained growth is particularly evident in key markets like the APAC region and EMEA. Such consistent expansion in these crucial areas suggests a promising future for CellaVision's main product offerings.

- Q2 2025 Organic Growth: 7.6%

- Q1 2025 Organic Growth: 14.1%

- Key Performing Regions: APAC and EMEA

Continuous Innovation in AI and Digital Microscopy

CellaVision's dedication to continuous innovation is evident in its substantial research and development investments. In the second quarter of 2025, the company allocated an impressive 22% of its sales to R&D, underscoring a strategic focus on staying ahead in the competitive digital microscopy landscape. This commitment fuels the integration of advanced artificial intelligence and sophisticated image analysis capabilities into their product offerings.

This heavy investment ensures CellaVision's solutions remain at the cutting edge of digital cell morphology analysis. By consistently enhancing their technology with AI, CellaVision aims to provide superior diagnostic accuracy and efficiency for laboratories worldwide.

- R&D Spending: 22% of sales in Q2 2025.

- Focus Areas: AI integration and advanced image analysis.

- Market Position: Aiming to lead the digital cell morphology market.

- Strategic Goal: Maintain a competitive edge through technological advancement.

CellaVision's digital cell morphology solutions, enjoying widespread adoption in top hospitals, represent the company's Stars in the BCG matrix. Their strong market share in a growing sector, coupled with consistent organic growth of 7.6% in Q2 2025 and 14.1% in Q1 2025, particularly in APAC and EMEA, highlights their position. Significant R&D investment, 22% of sales in Q2 2025, further fuels their leadership in AI-driven microscopy.

| Category | Description | Key Metrics |

|---|---|---|

| Stars | CellaVision's core digital cell morphology solutions | Global installed units: Over 8,000 |

| Market Share | Dominant position in digital hematology | Presence in all top 20 U.S. hospitals (2025) |

| Growth | Strong organic sales expansion | Q2 2025: 7.6% organic growth |

| Investment | High R&D allocation for innovation | Q2 2025 R&D: 22% of sales |

What is included in the product

The CellaVision BCG Matrix analyzes product portfolio performance by categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on investment, holding, or divestment for each category.

Quickly identify underperforming areas for targeted intervention.

Cash Cows

CellaVision's established analyzer sales, a cornerstone of their business, are categorized as a Cash Cow within the BCG Matrix. This segment, representing the largest share of their revenue, signifies a mature market where the company holds a dominant position.

Despite a minor 2% dip in instrument sales during the second quarter of 2025, the continued strength of large instrument sales underscores the stability and significant revenue generation from this established product line. This indicates a reliable and substantial income source for CellaVision.

Recurring reagent sales, a key component of CellaVision's business, demonstrated robust performance with a 7% growth in Q2 2025. This recurring revenue stream is directly linked to the company's established installed base of instruments.

These essential consumables ensure the continued operation of CellaVision's systems, generating a stable and predictable cash flow within a mature market segment. The consistent demand for reagents underscores their importance to CellaVision's ongoing financial health.

CellaVision's business model is exceptionally profitable, as evidenced by its robust EBITDA margins. In the second quarter of 2025, the company reported an EBITDA margin of 31%, following a strong 34% margin in the first quarter of 2025. These figures strongly suggest that CellaVision's established products are generating significant surplus cash, a hallmark of a cash cow within the BCG matrix.

Global Partner Network

CellaVision's Global Partner Network is a prime example of a Cash Cow within the BCG matrix. Their sales model relies heavily on these partners, who provide local market support across more than 40 countries. This extensive network ensures efficient distribution and continued sales for their established products.

This mature sales infrastructure means CellaVision can maintain strong revenue streams from its existing product lines with minimal need for additional promotional spending. In 2023, CellaVision reported net sales of SEK 493.1 million, a testament to the enduring strength of their product portfolio and the effectiveness of their partner network.

- Established Distribution: CellaVision operates in over 40 countries through its global partner network.

- Mature Product Sales: The network efficiently drives sales of CellaVision's established, high-demand products.

- Reduced Investment Needs: Sustained sales from mature products minimize the requirement for new promotional investments.

- Revenue Generation: In 2023, CellaVision's net sales reached SEK 493.1 million, highlighting the network's contribution.

High Customer Loyalty and Market Penetration

CellaVision's digital morphology solutions have achieved significant traction, with widespread adoption by leading hospitals and laboratories worldwide. This broad acceptance points to strong customer loyalty and impressive market penetration.

This established customer base translates into a reliable and consistent demand for CellaVision's existing product portfolio. Such stability is a hallmark of a cash cow, ensuring steady revenue streams.

- High Customer Loyalty: CellaVision's solutions are integrated into critical laboratory workflows, making switching costs high for existing users.

- Market Penetration: The company serves a substantial portion of the global market for automated cell analysis, indicating a strong foothold.

- Stable Demand: The essential nature of diagnostic tools ensures consistent demand, even in varied economic conditions.

- Consistent Cash Generation: The combination of loyalty and penetration fuels predictable and robust cash flow for the company.

CellaVision's analyzer sales, a mature segment with a dominant market share, generate substantial and stable revenue. The company's robust EBITDA margins, reaching 31% in Q2 2025, further confirm the strong cash-generating capability of these established products. This consistent performance solidifies their position as a Cash Cow.

| Financial Metric | Q1 2025 | Q2 2025 |

| EBITDA Margin | 34% | 31% |

| Net Sales (2023) | SEK 493.1 million | |

What You’re Viewing Is Included

CellaVision BCG Matrix

The CellaVision BCG Matrix document you are previewing is the identical, fully-formatted report you will receive immediately after purchase. This means no watermarks or demo content, just a professional, analysis-ready strategic tool. You can confidently use this preview to understand the depth and clarity of the insights provided, knowing the final version is prepared for your immediate business planning needs.

Dogs

Older, less differentiated software versions of CellaVision, even with consistent updates, might be categorized as Dogs. These versions may not offer the newest user interface features or integration capabilities that drive significant new sales. Consequently, they could generate minimal revenue while still incurring maintenance costs, offering little return on investment.

Niche or discontinued accessories within CellaVision's portfolio, such as older model slide holders or specialized staining kits that are no longer actively marketed, likely fall into the Dogs category. These items often have a very small market share and contribute minimally to overall revenue, potentially even incurring costs for inventory management or support.

For instance, if CellaVision had a specific accessory designed for a now-discontinued microscope model, its demand would be extremely low. While it might still serve a small user base, its strategic importance and revenue generation are negligible, fitting the profile of a Dog in the BCG Matrix.

Products with Limited Geographical Reach, often found in the 'Dogs' quadrant of the BCG Matrix, represent offerings that haven't gained substantial traction outside their initial markets. These might be facing challenges like stringent import regulations in new territories, intense competition from established local players, or a simple lack of company investment to expand their footprint.

For CellaVision, certain product lines might be exhibiting 'Dog' tendencies if their market penetration remains confined to specific regions with little prospect for broader adoption. For instance, if a particular analyzer model is only widely used in North America and hasn't seen significant uptake in Asia or Oceania due to unique market demands or distribution challenges, it could be classified here.

The company's Q2 2025 performance, which saw slight sales dips in the Americas and EMEA attributed to currency fluctuations and varied market conditions, could indicate that some of CellaVision's products are indeed falling into this 'Dog' category. If these regional performance issues persist and aren't countered by strategic initiatives, these products risk becoming cash traps with minimal future growth potential.

Non-Strategic Legacy Products

CellaVision, a company with a 30-year history of innovation, may possess legacy products that, despite past success, now exhibit low growth and a diminished market share. These offerings, while potentially still functional and utilized by some customers, are not considered core to the company's forward-looking strategic direction. Consequently, they might be candidates for divestment or phasing out to reallocate resources to more promising ventures.

These non-strategic legacy products could represent older generations of their digital cell imaging technology. For instance, if CellaVision's current focus is on advanced AI-driven analysis, earlier models that require more manual input might fall into this category. Such products would likely contribute minimally to overall revenue growth and could even incur higher support costs relative to their market contribution.

- Low Market Growth: These products operate in mature or declining market segments.

- Low Market Share: They hold a small portion of their respective markets, often due to newer, more competitive alternatives.

- Resource Drain: Continued investment in R&D or marketing for these items may detract from resources needed for high-growth areas.

- Divestment Potential: Companies often consider selling or discontinuing such products to streamline operations and focus on strategic priorities.

Manual or Less Automated Solutions

Manual or Less Automated Solutions represent offerings that require substantial human input and do not leverage advanced technology. These might include older laboratory equipment or services that haven't been updated to meet current digital standards. For instance, if CellaVision still offered traditional slide staining services alongside their automated analyzers, those services would fall into this category.

These solutions are likely to have limited growth potential. The broader laboratory diagnostics market, valued at over $100 billion globally in 2024, is rapidly embracing automation and artificial intelligence to improve accuracy and throughput. Companies that do not adapt risk falling behind.

- Low Market Growth: As the industry shifts towards digital and AI, manual solutions face declining demand.

- Reduced Efficiency: They do not offer the speed and consistency of automated systems.

- Higher Operational Costs: Manual processes often require more labor and time.

- Competitive Disadvantage: Competitors offering advanced automation gain a significant edge.

Products classified as Dogs within CellaVision's portfolio are those with low market share and low market growth potential. These offerings may include older software versions or niche accessories that no longer align with current market demands or technological advancements. While they might still have a small, dedicated user base, their contribution to overall revenue and strategic importance is minimal, often requiring resources for maintenance without generating significant returns.

For example, legacy hardware components or specialized reagents designed for outdated laboratory equipment could be considered Dogs. The global laboratory diagnostics market, while robust, is increasingly focused on integrated digital solutions and AI-driven analysis. Products that do not fit this evolving landscape, such as manual staining kits or older analyzer models with limited connectivity, are likely to exhibit Dog characteristics.

In 2024, CellaVision's focus on expanding its AI-powered digital pathology solutions suggests a strategic move away from products with limited growth prospects. Any offerings that do not integrate with or support these newer technologies, and consequently face declining demand or are difficult to support, would fit the Dog profile. These products often represent a drain on resources that could be better allocated to high-potential areas.

Consider the market for manual microscopy accessories. While CellaVision may still offer some, their market share is likely shrinking as automated digital imaging systems become the industry standard. In 2024, the demand for advanced digital pathology solutions continued to surge, making older, less automated products increasingly marginalized. This creates a scenario where such products become Dogs, with low growth and minimal competitive advantage.

| Product Category | Market Growth | Market Share | Strategic Importance | Example |

| Legacy Software Versions | Low | Low | Minimal | Older CellaVision software with limited AI integration. |

| Discontinued Accessories | Very Low | Very Low | Negligible | Slide holders for obsolete microscope models. |

| Manual Reagents/Kits | Declining | Low | Low | Specialized staining kits not compatible with automated systems. |

| Region-Specific Products | Low | Low | Limited | Analyzer models with poor adoption in emerging markets. |

Question Marks

CellaVision is developing a new bone marrow analysis application, aiming for CE marking in 2025. This innovation targets a potentially billion-dollar annual market, presenting a substantial growth avenue.

The success of this application hinges on clinical validation and market acceptance, factors that introduce inherent uncertainty into its future performance within the CellaVision portfolio.

CellaVision is positioning Fourier Ptychographic Microscopy (FPM) as a potential star product, integrating it into their upcoming hematology systems. This advanced imaging technique offers significant potential for enhanced diagnostic capabilities across hematology, cytology, and pathology. While FPM shows great promise, its market penetration is currently low, reflecting its nascent stage of commercialization.

The integration of FPM into CellaVision's product line aligns with a strategy focused on high-growth potential, characteristic of a question mark in the BCG matrix. This technology's ability to provide richer, more detailed images could lead to improved accuracy and efficiency in laboratory diagnostics. However, the significant investment required for R&D and market education means its future success hinges on adoption rates and competitive responses.

The CellaVision® DC-1 is attracting significant interest, especially from smaller labs within larger healthcare networks. This trend suggests a strong potential for growth as more organizations recognize its value. For instance, CellaVision reported a 15% year-over-year increase in sales for its automated imaging solutions in 2024, with the DC-1 contributing to this expansion.

While the DC-1 shows considerable promise for the small and medium-sized laboratory market, its market share is still in the building phase. This positions it as a question mark within the CellaVision portfolio, indicating a product with high growth potential but requiring further market penetration and adoption to solidify its standing.

Expansion of Reagent Portfolio in New Markets

CellaVision's expansion into new markets, particularly the United States, with its methanol-free RAL® MCDh Digital Grade Stains on Sysmex's platform, highlights a significant growth opportunity. This strategic move targets a large, established market where their specific reagent offering is yet to gain substantial traction. The company anticipates strong reagent sales growth, with the US market representing a key driver for this expansion.

The US market for diagnostic reagents is substantial, with the global in vitro diagnostics market projected to reach approximately $130 billion by 2024. Penetrating this market with a differentiated product like methanol-free stains offers CellaVision a chance to capture unproven market share and capitalize on a high-growth segment. The successful integration with Sysmex's staining platform is crucial for unlocking this potential.

- Market Opportunity: The US market represents a substantial, largely untapped territory for CellaVision's specialized reagents.

- Product Differentiation: The methanol-free RAL® MCDh Digital Grade Stains offer a unique selling proposition in the diagnostics space.

- Strategic Partnership: Leveraging Sysmex's staining platform is key to facilitating market entry and adoption.

- Growth Potential: Successful US market penetration is expected to significantly boost overall reagent sales and market share.

New Geographic Market Penetration Initiatives

CellaVision's strategic focus on new geographic market penetration initiatives, particularly in emerging economies, positions these efforts as question marks within the BCG matrix. These markets, while offering substantial long-term growth prospects, demand considerable upfront investment in sales infrastructure, marketing, and local regulatory navigation. For instance, expanding into Southeast Asia or parts of Africa requires understanding diverse healthcare systems and varying levels of digital adoption.

These initiatives carry inherent risks. Market adoption rates can be slower than anticipated due to factors like cost sensitivity or existing entrenched competitors. CellaVision must carefully assess the competitive landscape in these new territories, as established local players or other international companies may already have a foothold.

- High Growth Potential: Emerging markets often exhibit faster economic growth, leading to increased demand for advanced medical diagnostic solutions.

- Significant Investment Required: Penetrating new regions necessitates substantial capital for market research, establishing distribution channels, and localized marketing campaigns.

- Market Adoption Risks: Success hinges on overcoming potential barriers to adoption, such as price sensitivity, infrastructure limitations, or resistance to new technologies.

- Competitive Dynamics: Understanding and navigating the existing competitive environment, including local and international rivals, is crucial for successful market entry.

CellaVision's new bone marrow analysis application and its Fourier Ptychographic Microscopy (FPM) technology both represent significant potential growth areas but are currently in early stages of market penetration. These products require substantial investment and face uncertainties regarding customer adoption and competitive responses.

The CellaVision® DC-1, while gaining traction with smaller labs, is still building its market share, positioning it as a question mark. Similarly, expansion into new geographic markets, particularly emerging economies, offers high growth potential but involves considerable investment and adoption risks.

| Product/Initiative | Current Market Share | Growth Potential | Investment Needs | Risk Factors |

| Bone Marrow Analysis App | Low/Nascent | High (Billion-dollar market) | High (R&D, Clinical Validation) | Market Acceptance, Clinical Validation |

| Fourier Ptychographic Microscopy (FPM) | Low | High (Enhanced Diagnostics) | High (R&D, Market Education) | Adoption Rates, Competitive Response |

| CellaVision® DC-1 | Building | High (Small/Medium Labs) | Moderate | Market Penetration, Adoption |

| Emerging Market Expansion | Nascent | High (Long-term growth) | High (Sales Infra, Marketing) | Adoption Rates, Competition, Regulation |

BCG Matrix Data Sources

Our CellaVision BCG Matrix leverages comprehensive data from internal sales figures, market share reports, and competitor analysis to provide actionable insights.