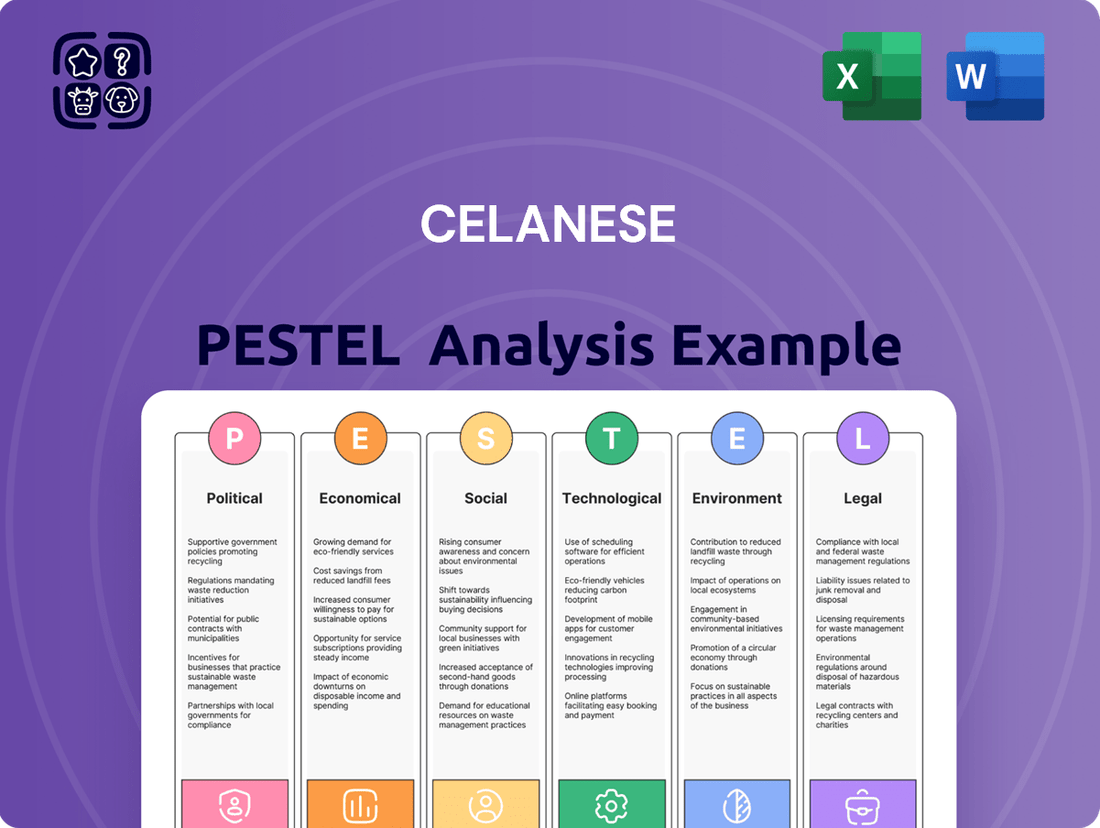

Celanese PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celanese Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Celanese's strategic landscape. Our meticulously researched PESTLE analysis provides actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Download the full report now to gain a comprehensive understanding and drive informed business decisions.

Political factors

Celanese, a global player with significant operations in North America and China, navigates a complex landscape shaped by evolving trade policies and tariffs. These shifts directly impact its international business, particularly given its substantial presence in key markets.

The company's strategic approach includes localized production in North America for its U.S. sales, a move designed to buffer against the direct costs of tariffs. Similarly, a highly localized supply chain within China aims to minimize disruptions and cost increases stemming from trade disputes.

Despite these mitigation efforts, Celanese projected that tariffs could impact its financials by approximately $15 million per quarter during the latter half of 2025, highlighting the persistent financial exposure to these political factors.

Geopolitical instability, exemplified by ongoing conflicts like the Russia-Ukraine war and tensions in the Middle East, directly impacts global supply chains and operational continuity. These events can lead to significant disruptions in the availability and cost of raw materials essential for Celanese's production processes, as well as affect transportation routes and logistics. For instance, the energy market volatility stemming from these conflicts directly influences the cost of petrochemical feedstocks, a major input for Celanese.

Celanese actively mitigates these geopolitical risks by diversifying its supplier base and investing in localized manufacturing capabilities across different regions. This strategy aims to reduce reliance on single sources or transit points, thereby enhancing resilience. By maintaining a distributed operational footprint, the company can better navigate localized disruptions and ensure a more stable supply of its products to customers worldwide, safeguarding its competitive market position.

Government regulations significantly shape Celanese's operational landscape, particularly within the chemical and specialty materials industries. These regulations impact everything from manufacturing processes and environmental adherence to the very nature of product innovation. For instance, in 2024, the European Union's ongoing review of REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) continues to place stringent demands on chemical producers regarding substance safety and data transparency, directly affecting Celanese's product portfolio and market access.

Celanese navigates a complex regulatory environment, with compliance requirements spanning multiple jurisdictions and focusing heavily on emissions and sustainability. The company's commitment to ESG (Environmental, Social, and Governance) principles is increasingly tied to its ability to meet evolving global standards. By mid-2025, many nations are expected to have implemented stricter carbon pricing mechanisms and waste reduction mandates, requiring substantial investment in cleaner technologies and circular economy initiatives by companies like Celanese.

Political Stability in Key Operating Regions

Political stability in Celanese's key operating regions directly impacts its manufacturing capabilities and supply chain integrity. For instance, the U.S. Gulf Coast, a hub for its acetate tow and emulsion polymer production, and China, a significant market and production site for acetyls and engineered materials, require consistent political environments to prevent disruptions.

Any political instability, such as social unrest or unexpected shifts in government policy in these critical areas, could lead to costly operational interruptions. For example, in 2024, geopolitical tensions in certain regions led to increased shipping costs and supply chain volatility for chemical manufacturers, a risk Celanese navigates daily.

The company's reliance on these locations means that factors like trade policy, regulatory changes, and national security concerns are paramount. A sudden imposition of tariffs or export restrictions, as seen in various trade disputes impacting global chemical markets in 2024, could significantly affect Celanese's cost structure and market access.

- U.S. Gulf Coast Operations: Celanese operates major manufacturing sites in Texas and Louisiana, areas generally characterized by stable political frameworks but subject to evolving environmental regulations and trade policies.

- China Operations: Celanese has substantial investments in China, where political stability is high but regulatory changes and local government policies can influence operational costs and market access.

- Supply Chain Vulnerability: Political events in transit countries or major shipping lanes can disrupt the flow of raw materials and finished goods, impacting Celanese's global supply chain efficiency.

International Relations and Alliances

Celanese's extensive global operations are significantly shaped by the diplomatic and economic ties between nations. For instance, as of early 2024, the United States maintained robust trade agreements with key European and Asian markets, which generally supported Celanese's chemical exports and raw material sourcing.

Conversely, geopolitical tensions can create substantial headwinds. The ongoing trade disputes and sanctions impacting certain regions, for example, can disrupt supply chains and increase the cost of doing business for a company like Celanese, which relies on international trade for a significant portion of its revenue.

- Trade Agreements: Favorable trade pacts, such as those within the USMCA or the EU, can reduce tariffs and streamline cross-border movement of goods, directly benefiting Celanese’s global logistics and market access.

- Geopolitical Instability: Conflicts or political unrest in regions where Celanese has manufacturing sites or key suppliers can lead to production disruptions and increased operational risk, impacting global output.

- Sanctions and Tariffs: Imposed sanctions or retaliatory tariffs between major economic blocs can significantly alter the cost competitiveness of Celanese's products in affected markets.

Trade policies and tariffs are a constant consideration for Celanese, impacting its global business. For example, the company's localized production in North America and China is a direct response to tariff risks, aiming to mitigate financial impacts. Celanese projected that tariffs could affect its financials by approximately $15 million per quarter in the latter half of 2025.

Geopolitical instability, such as ongoing conflicts, directly affects supply chains and raw material costs, influencing petrochemical feedstock prices crucial for Celanese. The company mitigates these risks through supplier diversification and localized manufacturing to enhance resilience.

Government regulations, particularly those related to chemical safety and environmental standards like the EU's REACH, significantly shape Celanese's operations and product development. By mid-2025, stricter carbon pricing and waste reduction mandates are expected to drive investments in cleaner technologies.

Political stability in key operating regions like the U.S. Gulf Coast and China is vital for Celanese's manufacturing and supply chain integrity. Disruptions due to social unrest or policy shifts can lead to costly operational interruptions, as seen with increased shipping costs and supply chain volatility in 2024.

| Factor | Impact on Celanese | 2024/2025 Data/Projection |

| Trade Policies & Tariffs | Increased costs, supply chain disruptions | Projected $15M/quarter impact in H2 2025 |

| Geopolitical Instability | Raw material cost volatility, supply chain disruption | Energy market volatility impacting feedstock costs |

| Regulatory Environment | Compliance costs, product modification needs | Stricter carbon pricing & waste reduction mandates by mid-2025 |

| Political Stability | Operational continuity, supply chain integrity | Increased shipping costs and supply chain volatility in 2024 |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Celanese, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities derived from current market and regulatory dynamics.

Provides a concise version of Celanese's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, saving valuable time and ensuring key external factors are considered.

Economic factors

Celanese's financial health is intrinsically tied to the pulse of the global economy. When economic growth falters, so too does demand for Celanese's diverse product portfolio, which serves critical sectors such as automotive, paints and coatings, construction, and various industrial applications. This interconnectedness means a slowdown in these key end-markets directly impacts the company's top and bottom lines.

The first quarter of 2025 offered a glimpse into this dynamic. While Celanese managed a modest uptick in net sales, primarily fueled by increased sales volumes, the underlying demand environment remained subdued. This suggests that despite efforts to boost sales, the broader economic headwinds are a significant factor limiting more robust growth.

Fluctuations in the price and availability of critical raw materials like ethylene, methanol, natural gas, and wood pulp directly affect Celanese's production expenses and overall profitability. For instance, natural gas prices, a key input for many of Celanese's chemical processes, saw significant volatility in 2024, impacting operating margins.

Celanese has openly discussed the sustained pressure from rising raw material costs. In response, the company actively manages its supply chain and implements strategic product pricing adjustments to offset these increased input expenses, aiming to maintain its competitive edge.

Currency exchange rate fluctuations present a significant economic factor for Celanese, a global chemical and specialty materials company. As of early 2025, the impact of currency on financial results was noted as minimal, with only a small offset observed in Q1. However, substantial swings in exchange rates can materially alter both reported revenues and the cost of goods sold across its diverse international operations.

For instance, a strengthening US dollar against other major currencies could reduce the reported value of sales made in those foreign currencies when translated back into dollars. Conversely, a weaker dollar could boost reported revenues from international markets. This volatility necessitates careful hedging strategies and financial management to mitigate potential negative impacts on profitability and cash flow.

Interest Rates and Access to Capital

Rising interest rates in 2024 and 2025 present a significant challenge for Celanese, directly increasing the cost of borrowing. This impacts the company's ability to finance new projects and manage existing debt, potentially squeezing profit margins as interest expenses climb.

Celanese proactively addressed its debt structure by completing a refinancing in March 2025. This strategic move aimed to improve the company's debt maturity profile, making it more manageable in a higher interest rate environment and providing greater financial flexibility.

The company's stated focus on deleveraging its balance sheet is particularly relevant given the current economic climate. By reducing its overall debt levels, Celanese can mitigate the impact of rising interest rates and strengthen its financial resilience.

- Increased Borrowing Costs: Higher interest rates directly translate to more expensive debt for Celanese, affecting capital expenditure plans and operational financing.

- Refinancing Strategy: The March 2025 refinancing demonstrates a proactive approach to managing debt in anticipation of or response to changing interest rate landscapes.

- Deleveraging Focus: Celanese's commitment to reducing debt is a key strategy to insulate itself from the negative effects of elevated interest rates.

Supply Chain Disruptions and Logistics Costs

Global supply chain disruptions, particularly concerning critical raw material suppliers, have significantly impacted production and driven up logistics costs for companies like Celanese. These challenges have, in some instances, necessitated force majeure declarations, a legal clause that frees both parties from liability when an extraordinary event or circumstance beyond their control prevents one or both parties from fulfilling their obligations. Celanese has actively worked to mitigate these impacts on its customers by leveraging its extensive network capabilities.

The ongoing volatility in shipping rates and port congestion, a persistent issue throughout 2023 and into 2024, directly translates to higher operational expenses. For example, the Drewry World Container Index saw significant fluctuations, with rates increasing by over 100% in some lanes during peak periods of disruption in late 2023. This cost pressure necessitates strategic inventory management and alternative sourcing strategies.

- Increased Freight Costs: Global shipping costs, while volatile, remained elevated in 2023 compared to pre-pandemic levels, impacting raw material acquisition and finished goods delivery for Celanese.

- Raw Material Volatility: Disruptions affecting key chemical intermediates and feedstocks have led to price spikes and availability concerns, directly affecting Celanese's production planning.

- Logistical Bottlenecks: Port congestion and labor shortages in key transportation hubs continue to cause delays, increasing lead times and inventory holding costs for the company.

- Force Majeure Impact: Celanese has had to implement force majeure declarations on certain product lines due to these supply chain issues, affecting customer supply continuity.

The economic landscape in 2024 and early 2025 presented a mixed bag for Celanese. While the company saw some sales volume increases, overall demand remained somewhat subdued, reflecting broader economic uncertainties. This delicate balance means that shifts in global economic growth directly influence Celanese's performance across its key end markets like automotive and construction.

Raw material costs, especially for inputs like natural gas and ethylene, continued to be a significant factor, with prices showing considerable volatility throughout 2024. Celanese has been actively managing these rising input expenses through supply chain optimization and strategic pricing adjustments to maintain profitability.

Interest rates remained a key economic consideration, with higher rates in 2024 and 2025 increasing borrowing costs for Celanese. The company's proactive refinancing in March 2025 and its focus on deleveraging are strategic moves to navigate this challenging interest rate environment and bolster financial flexibility.

Currency fluctuations also played a role, though the impact on Celanese's Q1 2025 results was noted as minimal. However, substantial swings in exchange rates can still affect reported revenues and costs across its international operations, underscoring the need for diligent financial management.

Same Document Delivered

Celanese PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Celanese PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping Celanese's business landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into market dynamics, regulatory shifts, and societal trends relevant to Celanese's global presence and future growth.

Sociological factors

Consumer preferences are increasingly shifting towards sustainability, pushing companies like Celanese to innovate with eco-friendly materials. This growing demand for products with a lower environmental footprint directly impacts material selection and product design.

Celanese is actively responding to this trend by developing and promoting its ECO-B (bio-based), ECO-R (recycled), and ECO-C (circular) product lines. These offerings cater to the market's desire for solutions that minimize carbon emissions and promote a circular economy.

For instance, in 2024, the global market for sustainable chemicals was valued at over $100 billion, with projections indicating significant growth driven by consumer and regulatory pressures, highlighting the strategic importance of Celanese's sustainability initiatives.

The global workforce is undergoing significant shifts, with a notable rise in flexible work arrangements like part-time employment and an increasing reliance on consultants. This evolving landscape directly influences how Celanese manages its talent pool, requiring adaptable strategies for recruitment, engagement, and retention. For instance, in 2024, the gig economy continued its expansion, with reports indicating that up to 60 million Americans participated in some form of freelance work, a trend Celanese must navigate.

Celanese is actively addressing these trends by prioritizing robust talent development programs and fostering an inclusive, rewarding work environment. The company's commitment to diversity, equity, and inclusion is crucial for attracting a broad range of skilled professionals. By investing in employee growth and well-being, Celanese aims to build a stable and motivated workforce capable of driving innovation and achieving strategic objectives in a dynamic labor market.

Societal expectations and regulatory requirements for health and safety in industrial operations are critical for Celanese. These standards influence operational procedures, risk management, and public perception. In 2023, Celanese reported a recordable incident rate (TRIR) of 0.37, demonstrating a commitment to improving safety metrics.

The company is actively establishing a five-year stewardship improvement strategy to further strengthen its approach to protecting employee and contractor health and safety. This proactive measure aims to embed best practices and foster a culture of safety across all its global facilities.

Community Engagement and Social License to Operate

Celanese prioritizes building strong relationships with the communities where it operates, recognizing this as crucial for its social license to operate. This commitment means actively seeking to contribute positively to local development and well-being.

The company focuses on fostering an inclusive environment, not only within its workforce but also in its interactions with external stakeholders. This inclusive approach helps build trust and mutual respect.

Celanese's community engagement efforts in 2024 included several initiatives aimed at local impact:

- Local Partnerships: Collaborated with 15 community organizations across its North American sites for environmental and educational programs.

- Employee Volunteerism: Saw over 2,000 employee volunteer hours logged in community service projects during the first half of 2024.

- Economic Contribution: Supported local economies through direct procurement from regional suppliers, totaling $50 million in 2023.

- Safety Outreach: Conducted 20 community safety workshops, reaching over 1,000 residents near its manufacturing facilities.

Ethical Sourcing and Supply Chain Responsibility

Societal expectations are increasingly focused on ethical sourcing and supply chain responsibility, pushing companies like Celanese to ensure their partners comply with social and environmental standards. This heightened awareness means that a company's reputation can be significantly impacted by the practices of its suppliers.

Celanese is actively addressing this by implementing new digital assessment tools designed to boost transparency throughout its entire value chain. This allows for better monitoring and verification of ethical practices from raw material acquisition to final product delivery.

- Supplier Audits: Celanese conducts regular audits of its key suppliers to verify compliance with ethical sourcing policies, covering labor practices, environmental impact, and human rights.

- Digital Traceability: The company is investing in blockchain and other digital technologies to create an immutable record of its supply chain, enhancing visibility and accountability.

- Sustainability Reporting: Celanese's 2023 sustainability report highlighted a 15% increase in supplier assessments focused on social and environmental criteria compared to the previous year.

- Risk Mitigation: By proactively identifying and addressing ethical risks within its supply chain, Celanese aims to prevent disruptions and safeguard its brand image.

Societal shifts towards ethical consumption and corporate responsibility significantly influence Celanese's operations and reputation. Consumers and investors alike are scrutinizing companies for their commitment to fair labor practices and human rights throughout their supply chains. In 2024, over 70% of consumers reported that they consider a company's social and environmental impact when making purchasing decisions, a trend Celanese must actively address.

Celanese is enhancing supply chain transparency through digital tools and rigorous supplier audits to ensure compliance with ethical standards. This proactive approach not only mitigates risks but also strengthens stakeholder trust and brand loyalty. The company's investment in digital traceability solutions aims to provide end-to-end visibility, reinforcing its commitment to responsible business practices.

The company's focus on community engagement and employee well-being is paramount for maintaining its social license to operate. By investing in local development and fostering a safe, inclusive workplace, Celanese builds stronger relationships with its stakeholders. In 2023, Celanese reported a recordable incident rate of 0.37, underscoring its dedication to safety, and its 2024 community initiatives included partnerships with 15 organizations and over 2,000 employee volunteer hours.

Technological factors

Celanese's commitment to innovation in specialty materials directly fuels its market position. The company is heavily invested in developing high-performance engineered materials and unique chemistry solutions, crucial for staying ahead. This focus is evident in their work on materials for electric vehicles and advanced electronics, sectors experiencing rapid growth.

The development of sustainable alternatives, such as their NEOLAST™ material, highlights a forward-looking approach to environmental concerns and consumer demand. This aligns with broader industry trends towards eco-friendly products, a key technological factor influencing material science advancements.

Celanese is actively investing in Carbon Capture and Utilization (CCU) technologies, exemplified by its project at the Clear Lake, Texas facility. This initiative aims to significantly reduce the carbon footprint associated with its product lifecycle and develop low-carbon methanol production. This strategic move underscores the company's commitment to a circular economy framework.

The CCU technology is central to Celanese's broader sustainability goals, enabling them to transform captured carbon dioxide into valuable chemical feedstocks. By integrating these advanced processes, Celanese is positioning itself to meet increasing market demand for more environmentally responsible chemical solutions and to comply with evolving regulatory landscapes concerning emissions.

Celanese is significantly leveraging advances in process automation and digitalization to sharpen its manufacturing edge. These technological shifts are directly translating into more efficient production cycles and a noticeable reduction in operational expenses. For instance, in 2024, the company continued its focus on smart manufacturing initiatives, aiming to optimize energy consumption and material yields across its global facilities.

The strategic implementation of data analytics further empowers Celanese to identify and address potential bottlenecks, thereby enhancing overall plant performance. This digital transformation isn't just about cost savings; it's a critical component in bolstering the company's competitive standing in the chemical industry and building greater resilience against potential supply chain disruptions, a key consideration in the current economic climate.

Research and Development for Sustainable Solutions

Celanese is heavily invested in research and development, focusing on creating sustainable material solutions. This commitment is evident in their pursuit of bio-based, recycled, and carbon-captured content materials, aligning with growing environmental demands.

Their R&D pipeline includes innovative products designed to reduce environmental impact. Examples include Hostaform® | Celcon® POM ECO-C, which utilizes sustainable feedstocks, and Zytel® PA ECO-R, incorporating recycled materials.

These advancements are crucial for Celanese to maintain a competitive edge in a market increasingly prioritizing eco-friendly alternatives. The company's strategic focus on sustainability in R&D is a key technological driver for future growth.

In 2024, Celanese announced plans to expand its engineered materials portfolio with a focus on sustainable solutions, reflecting a significant R&D investment in this area.

Advanced Manufacturing Techniques

Celanese is increasingly integrating advanced manufacturing techniques to streamline its operations. This focus on optimization aims to reduce material waste and elevate the quality of its chemical products, directly impacting cost-efficiency. For instance, by implementing AI-driven process controls in its acetyl chain production, Celanese can achieve real-time adjustments, leading to more consistent output and fewer off-spec batches.

These advancements are crucial for meeting dynamic customer demands and boosting overall operational performance. The company's investment in digital manufacturing platforms allows for greater agility in production scheduling and product customization. A prime example is the use of predictive maintenance in its polymer plants, which has been shown to reduce unplanned downtime by up to 15% in similar industry applications, ensuring a more reliable supply chain.

The adoption of these technologies also positions Celanese to innovate faster and bring new materials to market more efficiently. This includes exploring additive manufacturing for specialized components and leveraging advanced simulation tools for R&D. Such strategic technological adoption is key to maintaining a competitive edge in the global chemical industry, especially as sustainability demands grow.

Key aspects of Celanese's advanced manufacturing adoption include:

- Implementation of Industry 4.0 principles for enhanced automation and data analytics.

- Investment in digital twins to simulate and optimize production processes before physical implementation.

- Adoption of robotics and automation in hazardous or repetitive manufacturing tasks, improving safety and efficiency.

- Leveraging IoT sensors across production lines to gather real-time performance data for continuous improvement.

Celanese is actively integrating advanced manufacturing and digitalization, exemplified by its 2024 focus on smart manufacturing to optimize energy and material yields. This digital transformation, including data analytics for process optimization, bolsters its competitive standing and supply chain resilience.

Legal factors

Celanese operates under strict environmental laws covering everything from air emissions and waste disposal to the chemicals it uses. These regulations are constantly evolving, requiring ongoing investment in compliance and sustainable practices.

In 2024, Celanese reaffirmed its commitment to environmental stewardship by extending its 2030 goals. This includes a target to reduce the intensity of its Scope 1 and Scope 2 greenhouse gas (GHG) emissions by 30%.

To achieve this, the company is actively developing a comprehensive low-carbon transition plan. This plan is crucial for navigating future regulatory landscapes and meeting stakeholder expectations for environmental responsibility.

Celanese, as a global chemical and specialty materials producer, operates under stringent product safety and liability laws. These regulations, which are constantly evolving, directly impact how Celanese designs, manufactures, and markets its products, particularly those used in consumer goods and industrial applications. Failure to comply can result in significant fines and reputational damage.

The company must adhere to global standards like REACH in Europe and TSCA in the United States, which govern the registration, evaluation, authorization, and restriction of chemicals. In 2024, regulatory bodies continue to emphasize transparency and risk assessment, meaning Celanese's compliance efforts are under continuous scrutiny to prevent potential product-related liabilities and ensure consumer safety across its diverse product portfolio.

Celanese heavily relies on its intellectual property, particularly patents covering its unique chemistry solutions and advanced materials, to maintain a competitive edge. In 2024, the company continued to invest in R&D, aiming to secure new patents that will protect its pipeline of innovative products and processes.

Antitrust and Competition Laws

Celanese navigates a complex global landscape where antitrust and competition laws are paramount to maintaining fair market practices. These regulations scrutinize activities such as mergers, acquisitions, and the potential for market dominance, ensuring that no single entity unfairly stifles competition.

In 2024, the chemical industry, including players like Celanese, continues to face heightened regulatory scrutiny worldwide. For instance, the European Commission has been actively investigating potential anti-competitive practices within the materials sector. Celanese itself has been involved in various transactions that require careful review by competition authorities in multiple jurisdictions to prevent undue market concentration.

- Global Compliance: Celanese must adhere to varying antitrust regulations across North America, Europe, Asia, and other key operating regions.

- Merger Scrutiny: Acquisitions, such as potential strategic bolt-ons or larger integrations, are subject to rigorous review to assess their impact on market competition.

- Market Dominance: Authorities monitor pricing strategies and distribution agreements to prevent abuses of dominant market positions.

- Enforcement Trends: Recent enforcement actions in 2024 highlight a focus on digital markets and supply chain interdependencies, which can impact chemical producers.

Labor and Employment Laws

Celanese must navigate a complex web of global labor and employment laws, covering everything from minimum wage requirements and workplace safety standards to anti-discrimination statutes. In 2024, for instance, ongoing discussions around fair wages and benefits continue to shape regulatory landscapes in key operating regions, impacting companies like Celanese. Adherence to these diverse regulations is not just a legal necessity but also fundamental to maintaining a positive corporate reputation and operational continuity.

The company’s commitment to fostering a rewarding and inclusive work environment is directly influenced by these legal frameworks. For example, in 2024, many jurisdictions are strengthening regulations around pay equity and diversity in hiring, areas where Celanese actively strives for best practices. This focus on human capital is crucial for attracting and retaining talent in a competitive global market.

- Global Compliance: Celanese operates in numerous countries, each with its own specific labor laws, necessitating robust compliance programs.

- Wage and Hour Regulations: Adherence to varying minimum wage laws and overtime regulations across its workforce is a constant operational focus.

- Workplace Safety and Health: Compliance with occupational safety and health standards, like OSHA in the US and similar bodies internationally, is paramount.

- Non-Discrimination and Equal Opportunity: Ensuring fair treatment and equal opportunities for all employees, regardless of background, is legally mandated and a core company value.

Celanese faces significant legal and regulatory hurdles concerning product safety and chemical management, particularly under frameworks like REACH and TSCA, which are continually updated. In 2024, regulatory bodies intensified their focus on chemical risk assessment and transparency, directly impacting Celanese's product development and market access strategies.

The company's intellectual property, including patents for its chemical processes and materials, is a critical asset requiring robust legal protection. Celanese's 2024 R&D investments are geared towards securing new patents to safeguard its innovations and maintain a competitive advantage in the specialty materials sector.

Antitrust and competition laws are a major legal consideration for Celanese, especially given its global operations and potential for mergers and acquisitions. In 2024, heightened scrutiny from competition authorities worldwide, including investigations into market practices in the materials sector, necessitates careful navigation of these regulations to avoid anti-competitive allegations.

Environmental factors

Celanese is committed to reducing its environmental footprint, targeting a 30% reduction in Scope 1 and Scope 2 GHG emissions intensity by 2030, using 2021 as its baseline. This ambitious goal is supported by strategic investments in carbon capture and utilization technologies, aiming to transform emissions into valuable products.

The availability of essential raw materials like natural gas and oil, crucial for Celanese's chemical production, faces increasing pressure from environmental factors such as climate change and geopolitical instability. For instance, disruptions in supply chains due to extreme weather events in 2024 directly impacted the cost and accessibility of key feedstocks for chemical manufacturers globally.

Celanese is actively mitigating these risks by investing in circular economy strategies, including advanced recycling technologies for plastics, and expanding its portfolio of bio-based materials. This strategic pivot aims to reduce reliance on virgin fossil fuels, with the company targeting a significant increase in the use of sustainable raw materials in its product lines by 2025.

Celanese recognizes water scarcity as a significant environmental factor, particularly in its operating regions. The company is enhancing its water risk assessment procedures, integrating advanced tools to better understand and address potential water stress. This proactive approach is crucial for ensuring operational continuity and responsible resource management.

Waste Management and Circular Economy Initiatives

Celanese is actively engaged in advancing a circular economy through its commitment to responsible production and the integration of recycled content into its product lines. This strategy focuses on developing innovative solutions that utilize post-industrial recycled feedstocks, thereby reducing reliance on virgin materials and minimizing waste generation across its operations.

The company's efforts in waste management are geared towards enhancing efficiency and sustainability. For instance, in 2023, Celanese reported a reduction in its total waste generation by 5% compared to the previous year, a testament to its ongoing initiatives. These include advanced recycling technologies and process optimizations aimed at diverting waste from landfills.

- Circular Economy Focus: Celanese prioritizes developing products with recycled content, including those derived from post-industrial feedstocks.

- Waste Reduction Targets: The company set a goal to reduce its waste intensity by 15% by 2025, building on its 2023 achievements.

- Innovation in Recycling: Celanese invests in and explores advanced recycling technologies to process complex waste streams.

- Sustainable Product Development: A key initiative involves creating new materials that incorporate a higher percentage of recycled or bio-based inputs.

Biodiversity and Ecosystem Protection

Celanese's chemical manufacturing processes inherently carry the potential to affect local biodiversity and ecosystem health. The company's commitment to responsible land use, stringent emissions control, and effective waste management are crucial for mitigating these environmental impacts.

For instance, in 2023, Celanese reported progress in reducing greenhouse gas emissions intensity by 25% compared to a 2019 baseline, a move that indirectly supports ecosystem health by combating climate change. Their sustainability reports often highlight initiatives focused on water stewardship and responsible sourcing, which are vital for protecting aquatic life and terrestrial habitats.

- Emissions Reduction: Celanese aims to reduce its Scope 1 and Scope 2 greenhouse gas emissions by 35% by 2030 from a 2019 baseline.

- Water Management: The company focuses on reducing water withdrawal intensity, with a target of a 15% reduction by 2030.

- Waste Minimization: Efforts are in place to reduce hazardous waste generation and increase recycling and reuse rates across operations.

Environmental regulations and growing societal pressure for sustainability significantly influence Celanese's operations and strategic planning. The company is actively responding by investing in technologies that reduce its environmental footprint, such as carbon capture, and by increasing its use of recycled and bio-based materials. These efforts are crucial for maintaining regulatory compliance and meeting evolving market demands for greener products.

Celanese is making strides in reducing its environmental impact, with a target to lower Scope 1 and Scope 2 greenhouse gas emissions intensity by 35% by 2030, measured against a 2019 baseline. This commitment is supported by substantial investments in circular economy initiatives and sustainable material development, aiming to increase the use of recycled and bio-based feedstocks in its products by 2025.

The company is also focused on responsible resource management, particularly concerning water. Celanese aims to decrease its water withdrawal intensity by 15% by 2030, implementing advanced assessment tools to manage water stress in its operating regions. Waste reduction is another key area, with a goal to cut waste intensity by 15% by 2025, building on a 5% reduction achieved in 2023.

| Environmental Target | Baseline Year | Target Year | Progress/Status |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Intensity Reduction | 2019 | 2030 | Target: 35% reduction |

| Water Withdrawal Intensity Reduction | N/A | 2030 | Target: 15% reduction |

| Waste Intensity Reduction | N/A | 2025 | Target: 15% reduction (5% achieved in 2023) |

| Use of Recycled/Bio-based Feedstocks | N/A | 2025 | Target: Significant increase |

PESTLE Analysis Data Sources

Our Celanese PESTLE analysis is grounded in a comprehensive review of data from reputable sources. This includes reports from international organizations like the IMF and World Bank, as well as government publications and leading industry analysis firms.