Celanese Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celanese Bundle

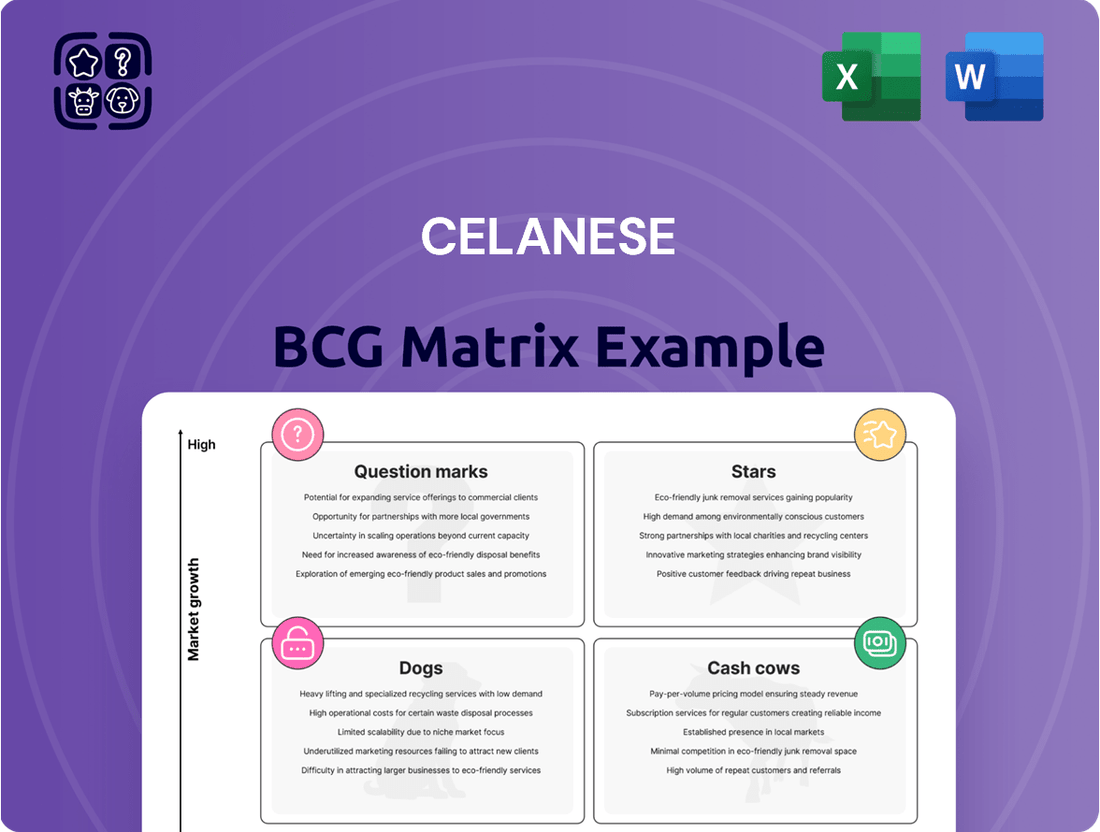

Uncover the strategic power of the Celanese BCG Matrix, revealing its product portfolio's position as Stars, Cash Cows, Dogs, or Question Marks. This essential tool helps you understand market share and growth potential at a glance. Purchase the full version for a comprehensive breakdown and actionable insights to optimize your investments and product strategy.

Stars

Celanese is making significant strides in the electric vehicle (EV) sector by offering advanced engineered materials. These materials are crucial for enhancing battery performance, preventing thermal runaway, and reducing the overall weight of battery enclosures, all vital for modern EVs.

The company's strategic focus on these critical EV components is paying off. In 2024, Celanese saw a substantial 30% increase in the value of projects secured within the electric vehicle market compared to the previous year. This growth trajectory highlights strong demand and Celanese's expanding role in this rapidly evolving industry.

Celanese is making strides in responsible production with its specialized ECO-B (bio-based), ECO-R (recycled), and ECO-C (carbon-captured) materials. These innovations highlight the company's dedication to lowering carbon emissions and promoting a circular economy, meeting the increasing consumer and industry demand for eco-friendly options.

For instance, in 2023, Celanese reported a significant increase in its sustainability-linked product portfolio, with ECO-B and ECO-R materials contributing to a substantial portion of new product revenue growth. This focus on sustainable solutions positions these materials as key growth drivers for the company, reflecting a strong market pull towards environmentally conscious chemical solutions.

Celanese's Hostaform® POM XAP®3, developed with Li Auto, represents a significant innovation in automotive materials. This ultra-low emission polymer targets vehicle cabin components, addressing a critical need for improved air quality in new energy vehicles.

The material boasts a remarkable 90% reduction in formaldehyde emissions, a key factor in enhancing passenger health and comfort. This advancement positions Celanese favorably within the rapidly expanding new energy vehicle market, suggesting a strong first-mover advantage and substantial growth prospects.

Advanced Medical and Healthcare Solutions

Celanese's engineered materials find critical applications in the advanced medical and healthcare sector, a market that consistently demands innovation and high-performance solutions. This segment, while not explicitly detailed as individual 'stars' within the BCG matrix framework, represents a strategic focus area for Celanese, indicating strong potential for future growth and market leadership.

The healthcare industry's reliance on advanced materials for devices, diagnostics, and drug delivery systems fuels sustained demand. Celanese's commitment to this high-value market underscores its strategic positioning for capturing future opportunities. For instance, the global medical device market was valued at approximately USD 520 billion in 2023 and is projected to grow significantly in the coming years, driven by an aging population and advancements in medical technology.

- Medical Device Applications: Celanese materials are utilized in a range of medical devices, from surgical instruments to implantable components, where biocompatibility and durability are paramount.

- Healthcare Market Growth: The healthcare sector's consistent expansion, fueled by technological advancements and increasing healthcare spending worldwide, provides a robust environment for Celanese's specialized offerings.

- Innovation Focus: Celanese's continued investment in research and development for healthcare-specific materials positions it to capitalize on emerging trends and unmet needs within the industry.

NEOLAST™ Fiber for Apparel

NEOLAST™ Fiber for Apparel, a recent innovation from Celanese, is positioned as a potential star in the BCG matrix. This high-performance fiber, developed in collaboration with Under Armour, offers a compelling alternative to traditional elastane in the apparel sector.

The key driver for NEOLAST™'s star status is its ability to address a significant market pain point: the recyclability of blended fabrics. By providing a more sustainable solution, it taps into growing consumer and regulatory demand for eco-friendly textiles, a market projected to reach $10.9 billion by 2028, growing at a CAGR of 5.7%.

- Market Opportunity: Addresses the challenge of recycling blended fabrics, a major hurdle in the textile industry.

- Innovation: NEOLAST™ fiber offers a high-performance, sustainable alternative to elastane.

- Partnership: Collaboration with Under Armour validates its performance and market appeal.

- Growth Potential: Positioned to capture significant market share in the expanding sustainable apparel market.

NEOLAST™ Fiber for Apparel, a recent innovation from Celanese, is positioned as a potential star in the BCG matrix. This high-performance fiber, developed in collaboration with Under Armour, offers a compelling alternative to traditional elastane in the apparel sector. The key driver for NEOLAST™'s star status is its ability to address a significant market pain point: the recyclability of blended fabrics. By providing a more sustainable solution, it taps into growing consumer and regulatory demand for eco-friendly textiles, a market projected to reach $10.9 billion by 2028, growing at a CAGR of 5.7%.

NEOLAST™ fiber addresses the challenge of recycling blended fabrics, a major hurdle in the textile industry. It offers a high-performance, sustainable alternative to elastane, validated by its collaboration with Under Armour. This positions NEOLAST™ to capture significant market share in the expanding sustainable apparel market.

| Product Category | Market Growth | Market Share | BCG Status |

| NEOLAST™ Fiber (Apparel) | High (Sustainable Apparel Market: 5.7% CAGR) | Low (Emerging Product) | Star |

What is included in the product

This overview details Celanese's product portfolio across the BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations for investment, holding, or divestment based on market share and growth.

A clear Celanese BCG Matrix overview helps leadership quickly identify underperforming units, alleviating the pain of strategic uncertainty.

Cash Cows

Celanese's Acetyl Chain Products, encompassing acetic acid and VAM, represent a dominant force in the chemical industry. As the global leader in acetic acid production, Celanese leverages its scale to supply essential intermediates crucial for manufacturing paints, coatings, adhesives, and textiles.

In 2024, this segment achieved net sales of $4.8 billion. While this marks a slight dip from the previous year, it underscores the segment's substantial market presence and its role as a significant cash generator for the company.

The Clear Lake Acetic Acid expansion, a significant 1.3 million ton project that began operations in March 2024, represents a strategic move by Celanese. This facility is designed to be the world's most cost-effective and environmentally friendly acetic acid producer, a crucial advantage in a competitive global market.

This expansion directly bolsters Celanese's standing as a leader in the acetic acid sector. By securing the lowest cost and carbon footprint, the company is well-positioned to capture demand in a mature but consistently growing market, demonstrating strong operational efficiency and a keen eye on future market needs.

Celanese's Engineered Materials segment, a significant contributor with $5.6 billion in net sales, navigates established industries such as automotive, electronics, and consumer goods. Despite some demand headwinds encountered in 2024, this segment is strategically positioned to generate substantial cash flow.

The company's proactive approach to cost reduction and the optimization of its manufacturing network within Engineered Materials are key initiatives. These efforts are designed to preserve the segment's robust profit margins, ensuring its continued role as a cash cow for Celanese.

Santoprene and DuPont M&M Integration Synergies

Celanese's acquisition of Santoprene in late 2021 and a significant portion of DuPont's Mobility & Materials (M&M) business in late 2022 has dramatically bolstered its engineered materials segment. This strategic move positions Celanese as a dominant global player in this sector, creating substantial opportunities for these integrated businesses to become cash cows.

The synergy between the acquired Santoprene and DuPont M&M assets is projected to unlock significant cost savings and enhance profit margins. These combined entities are expected to generate robust cash flows from their established market positions.

- Market Leadership: The integration positions Celanese as one of the largest global producers of engineered materials, leveraging the strengths of Santoprene and DuPont's M&M portfolio.

- Synergy Realization: Expected cost synergies and margin expansion are key drivers for these businesses to become strong cash generators.

- Established Markets: The focus on established markets provides a stable foundation for consistent cash flow generation.

- Financial Impact: Celanese anticipated approximately $150 million in run-rate synergies from the DuPont M&M acquisition by the end of 2023, with a significant portion of these savings flowing through to the bottom line and contributing to cash flow.

Cellulose Derivatives for Pharmaceutical and Food Applications

Celanese's cellulose derivatives business serves growing demand for natural ingredients in pharmaceuticals and food. This segment, though mature, offers consistent revenue from essential markets. In 2024, the global cellulose derivatives market was valued at approximately $8.5 billion, with projections indicating steady growth driven by these applications.

The company's involvement in this area positions it to capitalize on the trend toward bio-based and sustainable materials. These derivatives are key components in drug formulations, food texturizers, and stabilizers, industries that continue to expand.

- Market Position: Stable contributor to Celanese's portfolio, benefiting from demand in essential industries.

- Growth Drivers: Increasing use of natural and bio-based ingredients in pharmaceuticals and food sectors.

- Revenue Stability: Provides predictable income streams due to the mature and consistent nature of its end-markets.

- Industry Trends: Aligns with the broader shift towards sustainable and naturally derived product components.

Celanese's Acetyl Chain Products, particularly acetic acid and VAM, are prime examples of cash cows within the company's portfolio. Despite a slight dip in 2024 net sales to $4.8 billion, the segment's leadership in acetic acid production, bolstered by the cost-effective Clear Lake expansion operational since March 2024, ensures consistent and robust cash generation from essential intermediate chemicals.

The Engineered Materials segment, with $5.6 billion in net sales for 2024, also functions as a cash cow. Strategic cost reductions and manufacturing network optimization are preserving profit margins in established markets like automotive and electronics, further solidified by the accretive acquisitions of Santoprene and DuPont's M&M business, which are expected to yield significant synergies.

Celanese's cellulose derivatives business, serving the pharmaceutical and food industries, represents another stable cash cow. This mature segment benefits from consistent demand for natural and bio-based ingredients, a trend that contributed to the global cellulose derivatives market valuation of approximately $8.5 billion in 2024, ensuring predictable revenue streams.

| Segment | 2024 Net Sales (Billion USD) | Key Cash Cow Characteristics | Supporting Data/Events |

| Acetyl Chain Products | 4.8 | Market leadership, cost advantage, essential intermediates | Clear Lake Acetic Acid expansion (March 2024) |

| Engineered Materials | 5.6 | Established markets, synergy realization, margin preservation | Acquisitions of Santoprene and DuPont M&M, $150M run-rate synergies anticipated |

| Cellulose Derivatives | N/A (Mature Segment) | Stable demand, essential applications, alignment with sustainability trends | Global cellulose derivatives market valued at ~$8.5B in 2024 |

Delivered as Shown

Celanese BCG Matrix

The Celanese BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, showcasing Celanese's business units within the BCG framework, is ready for immediate strategic application without any watermarks or demo content. You'll gain access to the complete, professionally designed report, enabling you to conduct in-depth market share and growth rate analysis for informed decision-making. This is the exact, unedited version you'll download, perfect for presentations or internal strategy sessions.

Dogs

Celanese’s decision to close its Luxembourg Mylar Specialty Films manufacturing operations, a joint venture with Teijin, clearly places this business unit in the 'Dog' category of the BCG Matrix. This move signifies a strategic pivot away from an underperforming asset that was likely draining resources without generating sufficient returns.

The closure reflects a business segment that was not contributing meaningfully to Celanese's overall growth or profitability. In 2024, companies are increasingly scrutinizing their portfolios for underperforming assets, and divesting such operations is a common strategy to reallocate capital to more promising ventures.

Celanese's Engineered Materials segment encountered heightened competition in standard-grade applications during 2024. This competitive pressure notably counteracted the benefits derived from internal cost-improvement initiatives.

This situation points to potential underperformance in certain standard-grade products within the Engineered Materials portfolio. These products may exhibit both low market share and limited growth prospects, potentially evolving into cash traps.

The intensified competition and subsequent weak pricing power for these standard-grade materials directly contribute to their cash trap status. For instance, the broader chemical industry in 2024 saw increased capacity additions in many commodity-like segments, putting pressure on margins for established players like Celanese in their standard offerings.

Celanese is strategically looking to shed underperforming assets, a common move for companies aiming to boost cash flow and simplify operations. This often involves divesting business units or product lines that have both low market share and low growth potential, fitting the description of 'Dogs' in the BCG matrix. For instance, in 2023, Celanese completed the sale of its Emulsion Polymers business, a segment that may have fallen into this category, allowing the company to focus resources on its more promising ventures.

Segments Impacted by Western Hemisphere Demand Weakness

The Acetyl Chain segment experienced notable demand weakness in the Western Hemisphere during 2024. This downturn impacted product lines tied to construction and automotive end-markets, which saw reduced consumer spending and industrial activity in these regions.

Similarly, the Engineered Materials segment also grappled with softened demand, especially in Europe and North America throughout 2024. Specific applications within automotive and consumer electronics, sensitive to economic headwinds, contributed to this slowdown.

These regional demand challenges meant that certain product families within both segments could be viewed as 'dogs' in the BCG matrix. For instance, Celanese noted in its 2024 investor reports that specific acetyl derivatives used in industrial coatings in North America saw a volume decline of approximately 5-7% year-over-year due to sluggish construction activity.

- Acetyl Chain Weakness: Demand for certain acetyl products in North America and Europe declined in 2024, impacting segments tied to construction and automotive.

- Engineered Materials Slowdown: European and North American markets saw reduced demand for engineered materials, particularly in automotive and consumer electronics applications.

- Specific Product Line Impact: Product lines reliant on these struggling regional markets, such as industrial coating acetyls, faced volume contractions, with some reporting declines of 5-7% in 2024.

Certain Acetate Tow Businesses with Seasonality Headwinds

Celanese anticipates headwinds from seasonality in its acetate tow business, particularly in the first quarter of 2025. This segment, while part of the larger Acetyl Chain, faces specific challenges due to fluctuating demand patterns.

Businesses within acetate tow that experience consistently low growth and are highly susceptible to seasonal swings could be classified as question marks or even dogs in a BCG matrix if their performance remains weak. For instance, if a specific acetate tow product line sees a significant revenue drop in off-peak seasons and fails to gain market share during peak times, it would fit this profile.

While specific 2024 financial data for individual acetate tow sub-segments is not publicly detailed, the broader Acetyl Chain segment for Celanese has shown varied performance. For example, Celanese reported that its Acetyl Chain segment's net sales decreased by 14% in the first quarter of 2024 compared to the first quarter of 2023, reflecting lower volumes and pricing. This broader trend can impact even resilient parts of the chain, highlighting the potential for specific, seasonally sensitive products to underperform.

- Seasonality Impact: First quarter of 2025 expected to bring additional headwinds to the acetate tow business due to seasonal demand.

- BCG Matrix Classification: Acetate tow sub-segments with low growth and high seasonality susceptibility could be considered dogs if consistently underperforming.

- Broader Segment Performance: Celanese's Acetyl Chain net sales saw a 14% decrease in Q1 2024 year-over-year, indicating potential pressure on its components.

Celanese's strategic divestment of underperforming assets, such as the Luxembourg Mylar Specialty Films operation, clearly places these units in the 'Dog' category of the BCG Matrix. This action reflects a deliberate move to shed businesses with low market share and limited growth prospects, thereby optimizing resource allocation for more profitable ventures.

The company's Engineered Materials segment faced significant competitive pressures in standard-grade applications during 2024, which offset internal cost-saving efforts. Similarly, the Acetyl Chain segment experienced demand weakness, particularly in Western Hemisphere markets tied to construction and automotive, leading to volume declines in specific product lines like industrial coating acetyls. These factors indicate potential 'Dog' classifications for certain product families within Celanese's portfolio.

Celanese's Acetyl Chain segment saw net sales decrease by 14% in Q1 2024 compared to Q1 2023, driven by reduced volumes and pricing. This overall segment performance underscores the challenges faced by individual product lines, especially those susceptible to seasonality, such as certain acetate tow products, which could be classified as 'Dogs' if they exhibit persistent low growth and underperformance.

| Business Unit/Segment | BCG Category Indication | Key Factors |

| Luxembourg Mylar Specialty Films | Dog | Closure due to underperformance, low returns |

| Engineered Materials (Standard Grades) | Potential Dog | Intensified competition, weak pricing power, low growth prospects |

| Acetyl Chain (Specific Products) | Potential Dog | Demand weakness in Western Hemisphere, impact on construction/automotive linked products |

| Acetate Tow (Seasonally Sensitive) | Potential Dog | High seasonality, potential low growth if off-peak performance is weak |

Question Marks

Celanese's Hostaform® POM XAP®3, a new ultra-low emission material developed with Li Auto, is positioned as a Question Mark within the BCG Matrix. Its entry into the rapidly expanding new energy vehicle (NEV) market, a segment projected to grow significantly, offers substantial future potential.

While the NEV market itself is a high-growth area, Hostaform® POM XAP®3 is a nascent product with a currently low market share. This necessitates considerable investment in marketing and sales to build brand awareness and secure adoption, a hallmark of a Question Mark needing strategic development to transition to a Star.

Celanese's new ECO-B, ECO-R, and ECO-C product lines represent a strategic play in the burgeoning circular economy. These offerings, focusing on bio-based, recycled, and carbon-captured materials respectively, tap into a significant growth trend. For instance, the global circular economy market was valued at approximately $2.9 trillion in 2023 and is projected to reach $5.7 trillion by 2030, showcasing substantial potential.

Despite this promising market, Celanese's ECO-B, ECO-R, and ECO-C products are likely in the early adoption phase, meaning they possess low current market share. This positions them as question marks within the BCG matrix, requiring substantial investment in research, development, and marketing to educate customers and build demand. Companies entering this space often face challenges in scaling production and achieving cost competitiveness compared to traditional materials.

Celanese is actively developing engineered materials for advanced mobility, looking beyond just EV battery components. Think about solutions for making vehicles lighter to improve fuel efficiency across all powertrains, not just electric. They are also innovating in areas like advanced composites for structural components and high-performance polymers for thermal management in next-generation vehicles.

These advanced mobility solutions are positioned in a rapidly expanding market, driven by global trends towards sustainability and electrification. While the overall market for advanced automotive materials is projected to reach hundreds of billions of dollars by 2030, Celanese's specific offerings in these newer, non-battery applications might currently represent a smaller slice of that pie, reflecting their early-stage market penetration and thus fitting a potential question mark in a BCG matrix analysis.

New Polymer Developments for Specific High-Growth Applications

Celanese's innovation engine is actively fueling growth, particularly in burgeoning sectors like electric vehicles (EVs) and medical devices. New polymer developments targeting these specific, high-growth applications are prime candidates for the 'Question Mark' category within the BCG Matrix.

These advanced materials, designed for demanding applications such as battery components in EVs or specialized surgical instruments, represent significant technological advancements. However, their market penetration is initially low, necessitating substantial investment to build production capacity and market awareness.

- EV Battery Components: Polymers offering enhanced thermal stability and electrical insulation for EV battery packs. For instance, Celanese's GUR® UHMW-PE is being explored for separator films, a critical component in lithium-ion batteries, a market projected to grow significantly.

- Medical Devices: Biocompatible and sterilizable polymers for advanced medical applications, including implantable devices and sophisticated drug delivery systems. The global medical plastics market is expected to reach over $50 billion by 2027, highlighting the potential for new material solutions.

- Advanced Composites: Lightweight yet strong polymer composites for aerospace and automotive industries, contributing to fuel efficiency and performance improvements. The automotive lightweight materials market alone is anticipated to exceed $30 billion by 2026.

Initiatives to Increase Market Share in Specific Geographic Regions

Celanese is actively exploring strategic acquisitions and partnerships in high-growth regions to accelerate market penetration. For instance, in 2024, the company announced its intention to expand its presence in Southeast Asia, a market projected to see significant demand growth for its specialty materials.

Targeted marketing campaigns and localized product development are key components of this strategy. By tailoring offerings to specific regional needs, Celanese aims to build stronger brand recognition and customer loyalty in emerging markets where its current footprint is smaller.

- Acquisitions: Pursuing bolt-on acquisitions in regions with favorable regulatory environments and strong economic growth potential.

- Partnerships: Collaborating with local distributors and manufacturers to leverage existing networks and market knowledge.

- Localized R&D: Establishing regional R&D centers to adapt products and solutions to specific market demands, particularly in Asia-Pacific.

- Market Entry: Developing phased market entry strategies for new geographic territories, focusing on key customer segments initially.

Question Marks in Celanese's product portfolio represent areas with high growth potential but currently low market share. These are often new product introductions or ventures into emerging markets that require significant investment to gain traction.

Celanese's Hostaform® POM XAP®3 for the NEV market and its ECO-B, ECO-R, and ECO-C lines in the circular economy are prime examples of Question Marks. They are positioned in rapidly expanding sectors but are in early stages of adoption.

Similarly, advanced materials for future mobility solutions, including non-EV battery components, are also considered Question Marks. These innovations target substantial future markets but currently hold a small market share, demanding strategic investment.

The company's focus on EV battery components and medical devices also yields Question Marks. These advanced materials, while technologically significant, face initial low market penetration, necessitating investment in production and awareness.

| Product/Initiative | Market Potential | Current Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| Hostaform® POM XAP®3 (NEV) | High (Rapidly expanding NEV market) | Low | Question Mark | Marketing & Sales Investment |

| ECO-B, ECO-R, ECO-C (Circular Economy) | High (Global circular economy market projected to reach $5.7T by 2030) | Low | Question Mark | R&D, Marketing, Scaling |

| Advanced Mobility Solutions (Non-EV) | High (Hundreds of billions by 2030) | Low (Specific applications) | Question Mark | Market Penetration, R&D |

| EV Battery Components | High (Significant growth in EV market) | Low | Question Mark | Production Capacity, Market Awareness |

| Medical Devices | High (Medical plastics market over $50B by 2027) | Low | Question Mark | Production Capacity, Market Awareness |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.