Celanese Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celanese Bundle

Celanese navigates a competitive landscape shaped by powerful buyer and supplier relationships, alongside the constant threat of substitutes. Understanding these dynamics is crucial for any stakeholder.

The full Porter's Five Forces Analysis dives deep into each of these pressures, providing a detailed strategic roadmap for Celanese. Unlock actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Celanese faces a significant challenge due to a concentrated raw material market, where a few specialized chemical suppliers dominate. This limited supplier base means these key input providers hold considerable sway in negotiations. For instance, in 2024, the top three global suppliers of certain essential chemicals used by Celanese controlled over 60% of the market, giving them substantial pricing power.

Celanese faces significant supplier power due to high switching costs. Reconfiguring a single production line to accommodate a new raw material supplier can cost Celanese approximately $3.2 million.

These substantial costs are driven by demanding technical certification requirements for new materials, a process that often spans 18 to 24 months. The lengthy qualification procedures further limit Celanese's ability to freely change its raw material sources, strengthening the bargaining position of its existing suppliers.

Supplier consolidation is a growing concern in the chemical industry. In 2023 alone, merger and acquisition activity within the chemical supply chain reached a substantial $42.6 billion. This significant M&A volume indicates a trend toward fewer, larger suppliers.

This increasing consolidation directly impacts companies like Celanese by potentially diminishing the number of viable alternative suppliers. When suppliers consolidate, they gain greater leverage, which can translate into increased pricing power and more stringent contract terms for their customers.

Impact of Energy Costs

Celanese's reliance on key raw materials makes it susceptible to shifts in energy prices, directly impacting supplier leverage. For example, the company has experienced cost pressures due to rising natural gas prices in the U.S., a critical input for many of its chemical processes. This sensitivity highlights how energy market volatility can empower suppliers by increasing their bargaining power.

The impact of energy costs on Celanese's operations is a significant factor in supplier bargaining power. Fluctuations in the price of natural gas, a primary feedstock, can directly translate into higher input costs for the company. This dynamic allows suppliers of natural gas and related energy products to exert greater influence over pricing and terms.

- Energy Price Sensitivity: Celanese's profitability is linked to energy market stability, as natural gas is a key raw material.

- Supplier Leverage: Increased energy costs, such as those seen with natural gas headwinds in the U.S., can bolster the bargaining power of energy suppliers.

- Cost Pass-Through Challenges: The ability to fully pass on these increased input costs to customers can be limited, impacting margins.

- 2024 Outlook: Analysts in early 2024 continued to monitor energy markets for potential impacts on chemical producers like Celanese, anticipating ongoing volatility.

Specialized Material Requirements

Celanese's reliance on specialized, high-performance materials, a core aspect of its differentiated chemistry solutions, often means suppliers hold unique capabilities or proprietary intellectual property. This specialization inherently limits Celanese's sourcing alternatives for critical components, thereby enhancing supplier leverage.

For instance, in 2024, Celanese's advanced engineered materials segment, which includes products like acetal copolymers (POM) and liquid crystal polymers (LCP), requires highly specific chemical precursors and manufacturing processes. Suppliers who can consistently deliver these niche inputs with stringent quality controls and technical specifications are in a strong bargaining position.

- Supplier Specialization: Many of Celanese's key inputs are not commoditized, requiring suppliers with advanced R&D and production expertise.

- Limited Alternatives: The difficulty in finding alternative suppliers for these specialized materials grants existing suppliers greater pricing power.

- Intellectual Property: Suppliers possessing patented or proprietary production methods for critical raw materials can command higher prices and favorable terms.

- Dependency: Celanese's innovation pipeline is directly tied to the availability and quality of these specialized inputs, increasing its dependence on a select group of suppliers.

Celanese's bargaining power with suppliers is constrained by a concentrated supplier base and high switching costs, as evidenced by the 2024 market share held by the top three global suppliers of certain essential chemicals, exceeding 60%. The significant expense and time involved in qualifying new raw material sources, often taking 18-24 months and costing around $3.2 million per production line reconfiguration, further entrench supplier leverage. This dynamic is exacerbated by ongoing supplier consolidation, with $42.6 billion in M&A activity in the chemical supply chain during 2023, leading to fewer, more powerful suppliers.

| Factor | Impact on Celanese | Supporting Data (2023-2024) |

|---|---|---|

| Supplier Concentration | Limited negotiation options, increased pricing power for suppliers | Top 3 global suppliers control >60% of key chemicals (2024) |

| Switching Costs | High costs and time to change suppliers | ~$3.2M cost per production line reconfiguration; 18-24 month qualification period |

| Supplier Consolidation | Fewer, larger suppliers gain more leverage | $42.6B in chemical supply chain M&A (2023) |

| Specialized Inputs | Dependency on suppliers with unique capabilities | Niche materials for engineered materials segment require advanced R&D and production |

What is included in the product

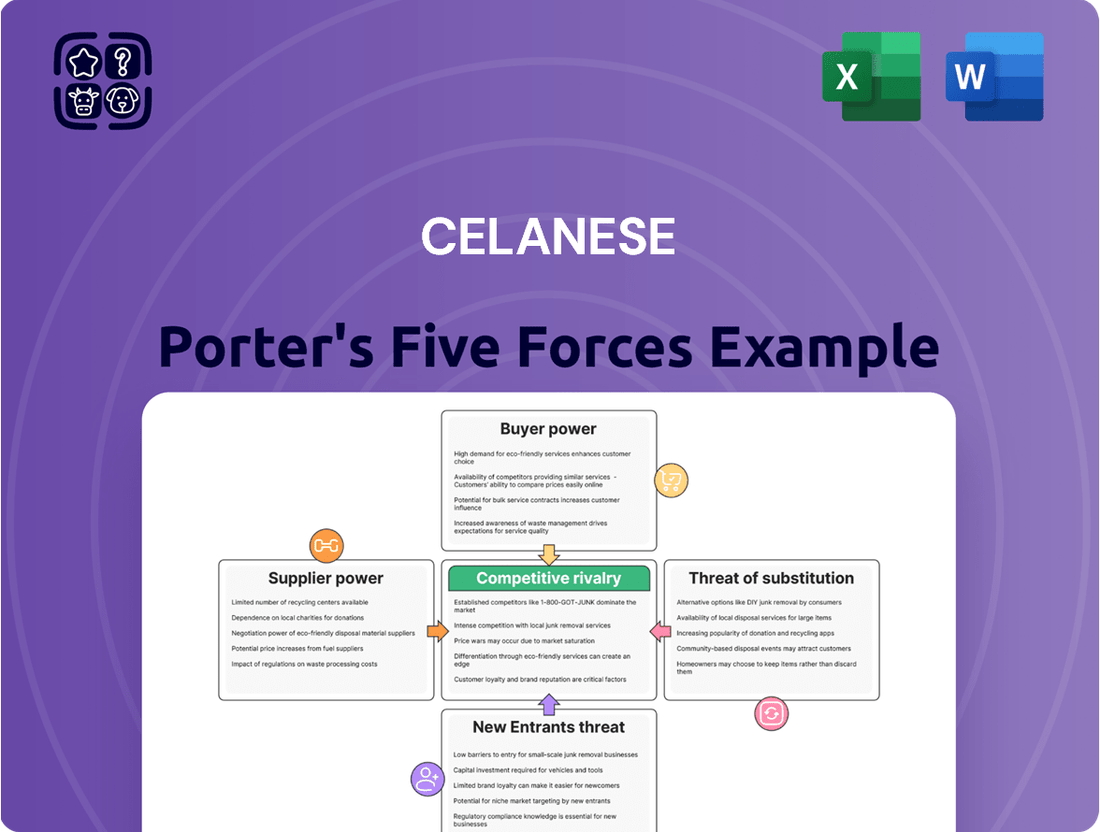

This analysis meticulously examines the five competitive forces impacting Celanese, assessing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Celanese's diverse end-market exposure significantly dilutes customer bargaining power. With automotive accounting for 28% of revenue, industrial materials 35%, consumer goods 22%, and electronics 15%, the company's broad reach means no single customer segment holds excessive sway. This diversification acts as a buffer, as a downturn in one sector can be absorbed by the resilience of others, preventing any one customer group from dictating terms.

The bargaining power of customers in Celanese's engineered materials segment is moderated by a degree of price sensitivity, but this is counterbalanced by significant customer switching costs. These costs stem from the highly specialized nature of Celanese's chemical solutions, which are often integrated into complex manufacturing processes.

Furthermore, typical contract durations of three to five years lock in customers, reducing their incentive to frequently seek alternative suppliers. This contractual stability, coupled with the technical integration, limits the immediate leverage customers can exert on pricing, even with moderate price sensitivity.

Persistently weak global demand across key sectors like automotive and construction in 2024 significantly impacted Celanese. This slowdown meant customers had more leverage, as they could demand lower prices or more favorable terms in a market where selling was tougher.

Long-Standing Customer Relationships

Celanese cultivates enduring relationships with key clients in its engineered materials sector, often through multi-year contracts. These deep-rooted partnerships, further strengthened by leveraging distribution networks to broaden market access, foster significant customer loyalty. This loyalty, in turn, can diminish the individual bargaining power of these customers.

For instance, in 2024, Celanese reported that a substantial portion of its engineered materials revenue was derived from long-term agreements, underscoring the stability these relationships provide. This strategic approach to customer engagement is a critical factor in managing the bargaining power of buyers.

- Customer Loyalty: Multi-year agreements and distribution partnerships foster strong customer loyalty.

- Reduced Individual Leverage: Established relationships limit the ability of individual customers to negotiate unfavorable terms.

- Revenue Stability: Long-term contracts contribute to predictable revenue streams for Celanese.

- Market Reach: Distribution partners enhance Celanese's ability to serve a wider customer base.

Customer Focus on Sustainable Solutions

Customers are increasingly demanding products with a lower environmental impact, making sustainability a key factor in their purchasing choices. This trend directly affects the bargaining power of customers, as those prioritizing eco-friendly options may switch to competitors offering greener alternatives if their needs aren't met.

Celanese is actively addressing this by expanding its range of sustainable solutions, including materials with a reduced carbon footprint. For instance, in 2024, Celanese highlighted its progress in developing bio-based and recycled content polymers, aiming to capture a larger share of this growing market segment.

By offering these sustainable products, Celanese can strengthen its relationships with environmentally conscious customers, potentially mitigating price sensitivity. Customers actively seeking sustainable options may be less inclined to exert downward price pressure if Celanese provides the desired solutions.

- Growing Demand for Sustainable Materials: Consumer preference for eco-friendly products is a significant driver in purchasing decisions.

- Celanese's Sustainable Portfolio Expansion: The company is investing in and promoting lower-carbon footprint and recycled content solutions.

- Impact on Customer Relationships: Meeting sustainability demands can foster loyalty and reduce customer churn.

- Mitigating Price Pressure: Offering green alternatives can lessen the bargaining power of customers focused solely on price.

The bargaining power of Celanese's customers is generally moderate, influenced by several factors. While price sensitivity exists, especially in a weaker demand environment like that seen in 2024, it's often offset by high switching costs associated with the specialized nature of Celanese's chemical solutions and long-term contracts that can extend for three to five years.

Moreover, Celanese's diversified end-market exposure, with automotive at 28% and industrial materials at 35% of revenue in 2024, prevents any single customer segment from wielding significant leverage. The company's focus on building strong customer loyalty through multi-year agreements and distribution networks further limits individual customer bargaining power.

The increasing customer demand for sustainable products also plays a role. Celanese's investment in eco-friendly materials, such as bio-based and recycled content polymers highlighted in 2024, aims to meet these needs, potentially reducing price sensitivity and strengthening customer relationships.

| Factor | Impact on Customer Bargaining Power | Celanese's Mitigation Strategy |

|---|---|---|

| End-Market Diversification (2024 Revenue Breakdown) | Dilutes power of any single customer segment. | Broad exposure across automotive (28%), industrial (35%), consumer (22%), and electronics (15%). |

| Switching Costs | High due to specialized, integrated solutions. | Technical integration into customer processes. |

| Contract Durations | Typically 3-5 years, locking in customers. | Secures revenue and limits immediate negotiation leverage. |

| Global Demand (2024) | Weakened demand increased customer leverage. | Customers sought lower prices or better terms. |

| Customer Loyalty Initiatives | Fosters loyalty, reducing individual leverage. | Multi-year contracts and distribution partnerships. |

| Sustainability Demand | Customers may switch for greener alternatives. | Expansion of sustainable solutions (bio-based, recycled content). |

Preview the Actual Deliverable

Celanese Porter's Five Forces Analysis

This preview showcases the complete Celanese Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately upon purchase, ensuring no surprises. You can confidently expect to download this exact file, ready for immediate use and strategic application.

Rivalry Among Competitors

The specialty chemicals and advanced materials sector is a battleground where companies like Celanese fight for every inch of market share. This often translates into aggressive pricing, rapid innovation cycles, and determined efforts to enter new markets, making the competitive landscape incredibly dynamic.

In 2024, the global specialty chemicals market is projected to reach over $800 billion, highlighting the sheer scale of competition. Companies are investing heavily in research and development to differentiate their offerings, with R&D spending in the sector averaging around 3-5% of revenue for leading players.

Celanese faces rivals such as Dow, BASF, and DuPont, all of whom possess significant resources and established market positions. These competitors are constantly introducing new products and expanding their global reach, intensifying the pressure on Celanese to maintain its competitive edge through technological advancement and strategic partnerships.

Celanese operates in a highly competitive landscape, facing intense rivalry from global chemical giants like BASF SE, Dow Chemical Company, LyondellBasell, Eastman Chemical, and Chemours. These established players command vast resources, extensive product offerings, and a significant worldwide presence, amplifying the competitive pressures Celanese encounters.

The sheer scale and diversification of these competitors mean they can leverage economies of scale, invest heavily in research and development, and maintain strong customer relationships across various end markets. For instance, in 2024, BASF reported revenues exceeding €60 billion, illustrating the financial muscle Celanese must contend with.

Celanese, particularly within its core acetyls business, faces intense competitive rivalry stemming from significant overcapacity. This oversupply situation is a direct result of increased production capacity meeting reduced market demand, creating a challenging environment for profitability.

The imbalance between supply and demand exerts considerable downward pressure on pricing and margins. In 2023, the global acetyls market, a key area for Celanese, saw capacity utilization rates dip, with some regions experiencing utilization below 80%, a clear indicator of oversupply and intensified competition as players vie for market share.

This overcapacity forces companies like Celanese to compete more aggressively on price to move inventory, further eroding profit margins. The struggle to maintain profitability in such an environment amplifies the existing competitive rivalry within the industry.

Pricing Pressures and Volume Declines

Celanese is experiencing significant pricing pressures and volume declines, a common scenario when competition intensifies. In 2024, the company saw its net sales drop by 6%. This decrease was largely fueled by a 4% fall in pricing and a 1% dip in sales volume, reflecting a tough market where companies are vying for market share.

These market conditions often trigger more aggressive competitive behavior. When demand softens and prices fall, companies tend to compete more fiercely on price and product differentiation to secure sales. This can lead to a cycle of price reductions and increased marketing efforts.

- Pricing Pressures: Celanese reported a 4% decrease in average selling prices in 2024, indicating a challenging pricing environment.

- Volume Declines: The company experienced a 1% reduction in sales volume for the same period, suggesting weaker demand.

- Impact on Rivalry: These factors combined often intensify competition as players fight to maintain or gain market share amidst reduced overall demand.

Strategic Cost Reduction and Innovation

Celanese is actively pursuing aggressive cost reduction programs to bolster its competitive standing. For instance, in 2023, the company achieved approximately $250 million in cost savings, demonstrating a commitment to operational efficiency.

Innovation and cash generation are central to Celanese's strategy for maintaining its edge. The company continues to invest in new product development and process improvements, aiming to drive both revenue growth and margin expansion.

- Aggressive Cost Reduction: Celanese targeted significant cost savings in 2023, aiming to enhance profitability and competitiveness.

- Strategic Innovation: Investment in research and development remains a priority to introduce new, high-value products and solutions.

- Cash Generation Focus: Initiatives are in place to optimize working capital and generate strong free cash flow, providing financial flexibility.

Competitive rivalry is a significant force for Celanese, given the presence of major global chemical players like BASF, Dow, and LyondellBasell. These competitors possess substantial resources, broad product portfolios, and established market footholds, intensifying the competition Celanese faces.

The specialty chemicals sector, valued at over $800 billion in 2024, is characterized by aggressive pricing and rapid innovation as companies vie for market share. For instance, Celanese reported a 4% decrease in average selling prices in 2024, alongside a 1% dip in sales volume, underscoring the intense market pressures.

Overcapacity, particularly in the acetyls market, exacerbates this rivalry, pushing prices down and margins thinner. In 2023, some regions saw acetyls capacity utilization fall below 80%, a clear signal of oversupply driving more aggressive competition.

| Competitor | 2024 Revenue (Approx.) | Key Product Areas |

| BASF SE | €65 Billion | Chemicals, Materials, Industrial Solutions |

| Dow Chemical Company | $50 Billion | Performance Materials & Coatings, Industrial Intermediates |

| LyondellBasell | $45 Billion | Olefins & Polyolefins, Advanced Polymer Solutions |

| Eastman Chemical | $10 Billion | Advanced Materials, Additives & Functional Products |

SSubstitutes Threaten

The market for engineering plastics, including those produced by Celanese, faces a significant threat from the rise of bio-based and recycled polymers. These alternatives are increasingly capturing market share due to growing environmental awareness and stricter regulations globally.

For instance, the global market for bioplastics was valued at approximately $50 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a robust growth trajectory for these substitutes. This trend directly impacts demand for traditional petroleum-based engineering plastics.

Global sustainability trends are a major force pushing for the creation and use of bio-based materials. This shift is directly impacting industries, including those that rely on traditional chemical products.

The market for sustainable materials is expected to grow substantially. Projections indicate this market could reach over $200 billion by 2027, offering a compelling reason for manufacturers to investigate and adopt renewable material alternatives. This expansion presents a clear threat of substitution for conventional chemical products.

Ongoing investments in material science, particularly in areas like nanotechnology and synthetic biomaterials, are creating new substitutes that could outperform Celanese's current offerings. For instance, advancements in advanced composites are offering lighter and stronger alternatives for automotive and aerospace applications, potentially impacting Celanese's engineered materials segment.

These emerging materials often boast improved performance characteristics, such as higher temperature resistance or greater durability, coupled with potentially lower production costs as technologies mature. This cost-performance advantage poses a direct threat, as customers may switch to these newer materials, eroding Celanese's market share in key sectors.

Celanese's 2024 strategic priorities likely include closely monitoring these technological shifts and investing in their own R&D to either develop competitive alternatives or enhance their existing product lines to counter the threat of substitution.

Performance and Cost Barriers to Immediate Substitution

The threat of substitutes for Celanese's products is currently mitigated by the performance and cost advantages of traditional materials. Many sustainable alternatives, while improving, still lag behind in key performance metrics. This performance gap often necessitates a higher cost for the alternative, creating a barrier to immediate widespread adoption.

For instance, in certain applications, traditional materials can offer a performance advantage of 15-20% over emerging substitutes. Furthermore, these established options are often 22-35% less expensive to produce and procure. This cost differential, coupled with the performance edge, provides a significant, albeit temporary, buffer against customers readily switching to alternative solutions.

- Performance Gap: Traditional materials often outperform sustainable alternatives by 15-20% in critical application metrics.

- Cost Premium: Sustainable substitutes can be 22-35% more expensive than incumbent materials.

- Market Inertia: The combination of performance and cost creates inertia, slowing down the immediate adoption of substitutes.

- Innovation Lag: While innovation in alternatives is ongoing, a critical mass of cost-effective, high-performing substitutes has not yet emerged across all segments.

Celanese's Proactive Sustainable Product Development

Celanese is actively mitigating the threat of substitutes by pioneering its own sustainable product lines. This includes introducing low-carbon polyoxymethylene (POM) materials and innovative products that integrate recycled content or bio-based feedstocks. By doing so, Celanese aims to preemptively address market shifts and customer preferences for greener alternatives.

This strategy is crucial for retaining market share in an environment where substitute materials, often driven by environmental concerns, are gaining traction. For instance, the increasing demand for bio-plastics and recycled polymers across various industries, including automotive and packaging, presents a significant challenge. Celanese's proactive development of its own sustainable offerings allows it to capture this growing market segment and offer competitive, eco-conscious solutions.

- Proactive Sustainable Development: Celanese is developing low-carbon POM and products with recycled or bio-based content.

- Meeting Customer Demand: This strategy directly addresses growing customer preferences for environmentally friendly materials.

- Market Share Retention: By offering sustainable alternatives, Celanese aims to keep its competitive edge against substitute materials.

- Industry Trends: The move aligns with broader industry trends towards circular economy principles and reduced environmental impact, with the global bio-plastics market projected to reach over $10 billion by 2027.

The threat of substitutes for Celanese's engineered materials remains moderate, primarily due to the performance and cost advantages of incumbent products. While bio-based and recycled polymers are gaining traction, they often still present a performance gap and a cost premium compared to traditional alternatives. For example, established materials can offer a 15-20% performance edge and are 22-35% less expensive to produce, creating inertia against immediate widespread adoption of substitutes.

Celanese is actively mitigating this threat by investing in its own sustainable product lines, including low-carbon POM and materials incorporating recycled or bio-based feedstocks. This proactive approach aims to capture the growing demand for environmentally friendly solutions and retain market share. The global bioplastics market, projected to exceed $10 billion by 2027, underscores the importance of this strategy in aligning with evolving industry trends and customer preferences.

Entrants Threaten

The chemical manufacturing sector, especially for advanced materials, necessitates massive upfront capital. Building new production facilities can easily cost between $250 million and $500 million, creating a formidable barrier to entry for aspiring competitors.

Celanese's formidable intellectual property portfolio, boasting 1,247 active patents in 2024 with an estimated value of $680 million, acts as a significant deterrent to new entrants.

These patents safeguard Celanese's unique chemistry solutions and advanced specialty materials, establishing robust legal barriers that make it exceedingly difficult for competitors to legally replicate their proprietary products and manufacturing processes.

The specialty chemicals sector, where Celanese operates, presents significant barriers to entry due to intricate regulatory frameworks and demanding certification processes. New companies must contend with extensive compliance requirements, often involving rigorous testing and documentation to meet industry standards and governmental regulations.

These qualification processes for new materials can be lengthy, frequently spanning 18 to 24 months. This extended timeline significantly increases the capital investment and time-to-market for potential entrants, making it challenging to compete with established players like Celanese who have already navigated these hurdles.

Economies of Scale and Established Distribution

Established players like Celanese enjoy substantial cost advantages due to significant economies of scale in manufacturing, raw material sourcing, and logistics. For instance, Celanese's integrated production facilities allow for greater efficiency and lower per-unit costs.

Newcomers would find it incredibly difficult to match these cost efficiencies without achieving comparable production volumes, which requires massive initial investment. Furthermore, replicating Celanese's established global distribution channels, which are crucial for reaching customers worldwide, presents a major barrier.

- Economies of Scale: Celanese leverages its size to reduce production and procurement costs, making it harder for new entrants to compete on price.

- Distribution Networks: The company's extensive global distribution infrastructure is a significant hurdle for new companies aiming to serve a broad customer base.

- Capital Requirements: Achieving the scale necessary to overcome these barriers demands substantial capital investment, deterring many potential new entrants.

Strong Brand Recognition and Customer Relationships

Celanese benefits from significant brand recognition and deeply entrenched customer relationships. This loyalty, cultivated over years of reliable supply and product performance, creates a substantial barrier for newcomers. Customers in industries relying on Celanese’s specialty materials often prioritize proven suppliers for critical components, making it challenging for new entrants to displace established trust and secure initial market share.

For example, Celanese’s Acetyl Chain business, a core segment, serves industries where product consistency and supplier reliability are paramount. In 2024, the company continued to emphasize its innovation and customer-centric approach, reinforcing these bonds. New entrants would need to overcome not only the technical hurdles of producing comparable materials but also the significant challenge of building equivalent levels of trust and demonstrating long-term value to a discerning customer base.

The difficulty for new entrants is further amplified by the capital investment required to match Celanese’s scale and technological sophistication. Without established brand equity and proven customer loyalty, new players face an uphill battle in convincing customers to switch, especially when the cost of failure in material sourcing can be extremely high.

The threat of new entrants for Celanese is moderate, largely due to the substantial capital requirements and established competitive advantages. While the chemical industry generally presents high barriers, specific factors within Celanese's operating segments influence this threat.

New entrants face significant hurdles in matching Celanese's economies of scale and extensive global distribution networks. The capital needed to establish comparable production capacity and logistics is immense, estimated to be in the hundreds of millions of dollars for new facilities in advanced materials.

Celanese's robust intellectual property, with over 1,200 active patents in 2024, alongside stringent regulatory compliance and lengthy certification processes, further deters new competition by creating legal and operational barriers.

The established brand recognition and deep customer relationships, particularly in sectors demanding high product consistency like the Acetyl Chain, mean new entrants must not only match technical capabilities but also build significant trust, a process that typically takes years and substantial investment.

| Barrier Type | Impact on New Entrants | Celanese's Advantage (2024 Data) |

|---|---|---|

| Capital Requirements | Very High | Estimated $250M-$500M+ for new facilities |

| Intellectual Property | High | 1,247 active patents |

| Economies of Scale | High | Integrated production, lower per-unit costs |

| Distribution Networks | High | Established global reach |

| Brand Recognition & Customer Loyalty | High | Deeply entrenched relationships in critical sectors |

Porter's Five Forces Analysis Data Sources

Our Celanese Porter's Five Forces analysis is built upon a robust foundation of data, including Celanese's annual reports and SEC filings, alongside industry-specific market research from firms like IHS Markit and Chemical & Engineering News.