CECO Environmental SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CECO Environmental Bundle

CECO Environmental's strengths lie in its diversified product portfolio and established market presence, but it faces challenges from evolving regulatory landscapes and competitive pressures. Understanding these dynamics is crucial for strategic planning.

Want the full story behind CECO Environmental's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CECO Environmental has showcased impressive financial strength, with substantial growth in key metrics. For the first half of 2025, net sales climbed to $362.1 million, a 37.2% jump from the previous year, underscoring a strong market position.

The company's profitability has also surged, with net income reaching $45.5 million for the six months ended June 30, 2025, a significant leap from $5.9 million in the same period of 2024. This demonstrates effective operational management and increasing market demand for its solutions.

Further highlighting this upward trend, CECO's revenue for the second quarter of 2025 hit $185.4 million, marking a 35% increase year-over-year. Concurrently, adjusted EBITDA grew by an impressive 45% to $23.3 million, reflecting enhanced earnings power and operational efficiency.

CECO Environmental boasts a record backlog and order book, signaling robust future revenue streams. This strong pipeline is a testament to the company's market position and demand for its environmental solutions.

In the second quarter of 2025, CECO's backlog hit an all-time high of $688.1 million, a remarkable 76% jump from the previous year. This significant growth underscores the increasing need for the company's offerings in the environmental sector.

Further demonstrating this positive momentum, orders surged by 95% year-over-year to $274.1 million in Q2 2025. This marks the third consecutive quarter where bookings have surpassed the $200 million threshold, highlighting sustained demand and successful sales execution.

CECO Environmental boasts a robust and diversified portfolio, offering integrated solutions across industrial air quality, fluid handling, and energy transition sectors. This broad market reach, spanning industries from energy and manufacturing to environmental services, provides significant resilience against sector-specific downturns.

The company's strategic diversification is a key strength, enabling it to tap into growth opportunities across multiple industrial segments. For instance, in 2023, CECO reported revenue growth driven by demand in both traditional industrial markets and emerging areas like the energy transition, underscoring the benefit of its varied offerings.

Strategic Acquisitions and Divestitures

CECO Environmental has strategically honed its business portfolio by both acquiring and selling off segments. This approach aims to bolster its standing in key markets and concentrate on sectors showing robust expansion. For instance, the acquisition of Profire Energy in January 2025 significantly broadened CECO's capabilities in smart control systems for combustion equipment.

Furthermore, the divestiture of its Fluid Handling business in March 2025 was a calculated move to simplify operations and generate funds for future growth initiatives. These portfolio adjustments are crucial for maintaining a competitive edge and ensuring resources are allocated to the most promising opportunities.

- Portfolio Optimization: CECO actively manages its business units to align with market trends and growth potential.

- Strategic Acquisitions: The January 2025 acquisition of Profire Energy expanded its intelligent control solutions for combustion appliances.

- Divestiture for Focus: The March 2025 divestiture of the Fluid Handling business streamlined operations and freed up capital.

- Capital Allocation: These actions are designed to provide capital for reinvestment in high-growth areas.

Expertise in Critical Environmental Solutions

CECO Environmental excels in providing critical environmental solutions, specializing in the engineering, design, and manufacturing of equipment vital for pollutant removal and resource recovery. This expertise is particularly valuable for sectors like power generation, semiconductors, and water/wastewater treatment, which are increasingly subject to rigorous environmental mandates and a strong push for sustainability.

The company's solutions directly address the growing global need for cleaner air and water, and more efficient industrial processes. For instance, CECO's systems are designed to meet strict emissions standards, a crucial factor for industries operating under evolving environmental regulations. Their focus on resource recovery also aligns with circular economy principles, enhancing operational efficiency and providing economic benefits to their clients.

CECO's strength lies in its ability to deliver highly engineered applications tailored to complex industrial challenges. This capability positions them favorably in markets where environmental compliance and operational optimization are paramount. Their deep understanding of these critical applications allows them to develop and implement solutions that are both effective and economically viable for their diverse customer base.

Key areas of CECO's expertise include:

- Air Pollution Control: Systems designed to capture and neutralize harmful emissions.

- Water and Wastewater Treatment: Technologies for purifying industrial and municipal water.

- Resource Recovery: Solutions that enable the reuse and recycling of valuable materials from waste streams.

- Industrial Process Optimization: Equipment that improves the efficiency and reliability of manufacturing operations.

CECO Environmental demonstrates significant financial health, with substantial year-over-year growth in sales and profitability. For the first half of 2025, net sales reached $362.1 million, a 37.2% increase, while net income surged to $45.5 million from $5.9 million in the prior year. This robust performance is further supported by a record backlog and order book, signaling strong future revenue potential.

The company's strategic portfolio management, including the acquisition of Profire Energy in January 2025 and the divestiture of its Fluid Handling business in March 2025, positions it for continued growth in key environmental sectors. This focus on high-growth areas and operational streamlining enhances its competitive edge.

CECO's core strength lies in its specialized expertise in critical environmental solutions, including air pollution control, water treatment, and resource recovery. These highly engineered applications address stringent environmental mandates and the growing global demand for sustainability, making them essential for industries like power generation and semiconductors.

| Financial Metric | H1 2025 | H1 2024 | % Change |

|---|---|---|---|

| Net Sales | $362.1M | $263.9M | 37.2% |

| Net Income | $45.5M | $5.9M | 671.2% |

| Q2 2025 Revenue | $185.4M | $137.3M | 35.0% |

| Q2 2025 Adj. EBITDA | $23.3M | $16.1M | 45.0% |

| Q2 2025 Backlog | $688.1M | $391.0M | 76.0% |

| Q2 2025 Orders | $274.1M | $140.6M | 95.0% |

What is included in the product

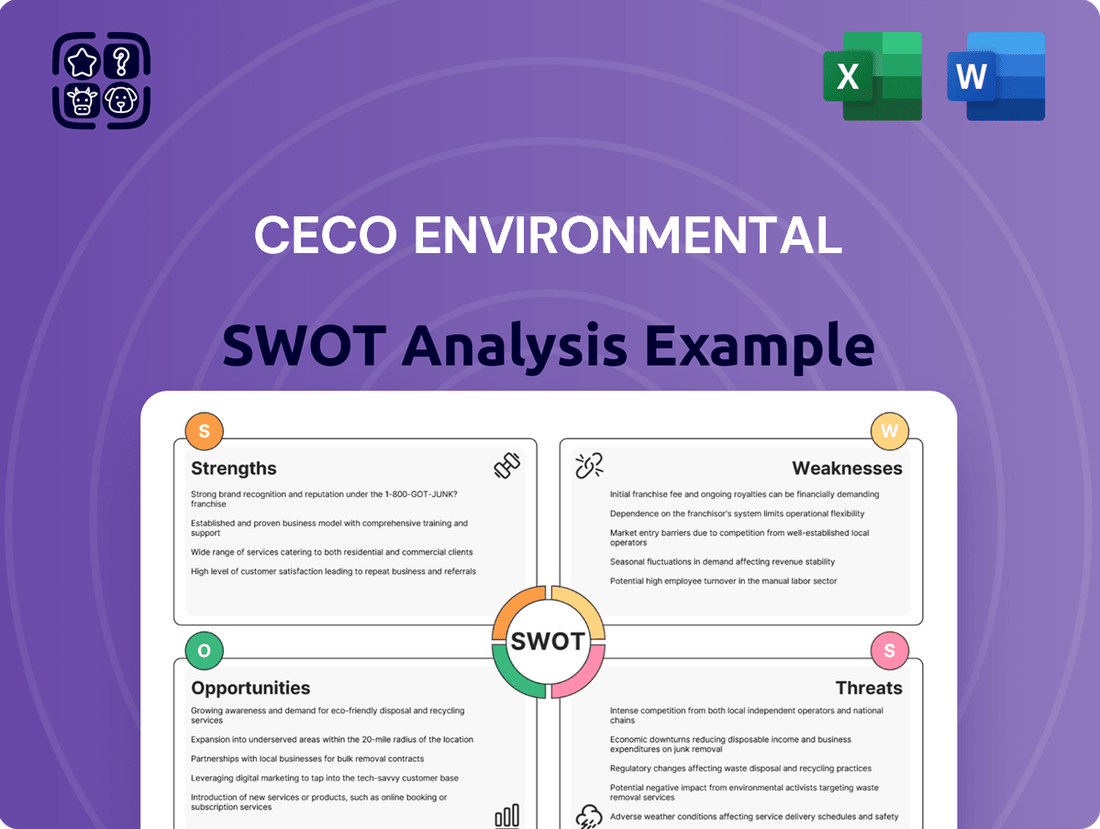

Delivers a strategic overview of CECO Environmental’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address CECO Environmental's key challenges and opportunities.

Weaknesses

CECO Environmental has faced difficulties in generating positive free cash flow, a key indicator of financial health. Despite revenue growth, the company's adjusted free cash flow was negative $18.0 million year-to-date as of June 30, 2025. This contrasts with a positive $0.7 million in the prior year's comparable period.

Further highlighting this weakness, operating cash flow also saw a decline. This trend suggests CECO needs to focus on enhancing its ability to convert its operational achievements into readily available cash.

CECO Environmental's gross debt has risen to $236.2 million as of June 30, 2025, a notable increase from $216.9 million at the close of 2024. While the company has increased its available borrowing capacity, this growing debt load presents a potential vulnerability.

This increased leverage could become a concern, especially if interest rates continue to climb, impacting the cost of servicing this debt and potentially limiting future financial flexibility.

CECO Environmental foresees a potential headwind from modest inflationary pressures expected in the latter half of 2025. This could affect their operational costs and, consequently, their profit margins.

While CECO is actively working on execution and strategic sourcing to buffer these effects, persistent inflation might still chip away at profitability if pricing adjustments and cost-saving measures aren't sufficiently robust. For instance, if input costs rise by 3-5% more than anticipated, it could directly impact their gross margin by a similar percentage if not passed on.

Increased Selling and Administrative Expenses

CECO Environmental's selling and administrative expenses have seen a significant jump, reaching $102.4 million for the first six months of 2025. This is a notable increase from the $71.4 million reported during the same period in 2024. The company attributes this rise primarily to increased headcount, which is necessary to manage its growing backlog and support ongoing growth initiatives.

While investing in personnel is crucial for executing projects and driving future expansion, these escalating costs present a potential challenge. If not carefully controlled, these higher operating expenses could put pressure on the company's overall profitability, particularly in an economic climate marked by market uncertainties.

- Increased SG&A Costs: Selling and administrative expenses climbed to $102.4 million in H1 2025, up from $71.4 million in H1 2024.

- Driver of Increase: The rise is linked to higher headcount supporting backlog execution and growth strategies.

- Profitability Risk: Unmanaged expense growth could negatively impact profit margins amidst market volatility.

Potential for Project Delays

CECO Environmental experienced project-related delays in the latter half of 2024, primarily stemming from customer-side internal challenges. While the company has implemented measures to reduce the likelihood of recurrence, the inherent nature of large-scale projects still carries a risk of future delays. Such delays can directly affect the timing of revenue recognition and the predictability of cash flows, impacting financial planning.

These delays can have a tangible impact on financial performance. For instance, if a significant project is pushed back, the anticipated revenue for a particular quarter might not materialize as planned. This can lead to:

- Missed Revenue Targets: Projects delayed past their scheduled completion dates directly reduce reported revenue for the period.

- Cash Flow Volatility: Delayed project milestones can disrupt the expected inflow of payments, leading to less predictable cash flow.

- Increased Project Costs: Extended timelines on large projects can sometimes result in higher operational or overhead costs, further impacting profitability.

CECO Environmental's cash flow generation remains a concern, with adjusted free cash flow turning negative at $18.0 million year-to-date as of June 30, 2025, a significant shift from the positive $0.7 million in the prior year. This decline in operating cash flow indicates a need to improve the conversion of sales into readily available cash.

The company's debt has increased, with gross debt reaching $236.2 million by June 30, 2025, up from $216.9 million at the end of 2024. While borrowing capacity has expanded, this rising leverage poses a risk, particularly if interest rates increase, affecting debt servicing costs and financial flexibility.

Higher selling and administrative expenses, totaling $102.4 million in the first half of 2025 compared to $71.4 million in the same period of 2024, are driven by increased headcount to manage backlog and growth. This rise in operating costs could pressure profitability if not managed effectively amidst market uncertainties.

| Metric | H1 2025 (YTD June 30) | H1 2024 (YTD June 30) | Change |

|---|---|---|---|

| Adjusted Free Cash Flow | -$18.0 million | $0.7 million | Significant Decrease |

| Gross Debt | $236.2 million | $216.9 million (FY 2024) | Increase |

| SG&A Expenses | $102.4 million | $71.4 million | +43.4% |

What You See Is What You Get

CECO Environmental SWOT Analysis

The preview you see is the same document the customer will receive after purchasing, offering a clear and accurate representation of CECO Environmental's strategic position. This ensures transparency and allows buyers to confidently assess the comprehensive nature of the analysis. Upon purchase, the full, detailed report becomes immediately accessible.

Opportunities

The global push for sustainability, coupled with increasingly stringent environmental regulations and a heightened focus on corporate social responsibility, is creating a substantial market for air quality and water treatment technologies. This trend is particularly evident in 2024 and projected to continue through 2025, as industries worldwide are actively seeking ways to reduce their environmental impact and enhance operational efficiency through cleaner processes and effective resource recovery.

CECO Environmental is strategically positioned to benefit from this growing demand. The company’s expertise in providing solutions for air pollution control and industrial water treatment aligns directly with the needs of sectors facing pressure to comply with environmental standards and adopt more sustainable practices. For instance, the global industrial wastewater treatment market alone was valued at over $50 billion in 2023 and is expected to see robust growth in the coming years, driven by these very factors.

The global shift towards cleaner energy sources like natural gas, hydrogen, nuclear, and renewables creates significant growth avenues for CECO Environmental. This energy transition is driving substantial investments in new and upgraded energy infrastructure, directly benefiting companies like CECO that offer essential emissions management and environmental control technologies.

CECO's recent performance highlights this trend, with the company securing its largest-ever order for emissions management in the power generation sector. This record order, valued at $100 million, underscores the escalating demand for CECO's specialized solutions as power plants worldwide adapt to stricter environmental regulations and integrate cleaner fuel sources.

CECO Environmental's strategic acquisitions and a diverse product range provide a strong foundation for entering new geographic regions and attracting different customer groups. This adaptability is crucial for growth in today's dynamic global economy.

The company's environmental solutions are particularly well-suited for rapidly expanding sectors. For instance, the electric vehicle market is projected to reach over $1.7 trillion by 2030, and CECO's technologies can support its manufacturing processes. Similarly, the semiconductor industry, a key area for CECO, saw global revenue reach $600 billion in 2023, highlighting significant demand for advanced manufacturing support.

Furthermore, CECO's expertise is increasingly vital in areas such as polysilicon fabrication for solar energy, advanced electronics manufacturing, and the burgeoning battery production and recycling industries. These high-growth markets represent substantial opportunities for CECO to leverage its capabilities and expand its market reach significantly in the coming years.

Leveraging Record Backlog for Future Revenue

CECO Environmental's significant backlog of $688.1 million at the end of Q1 2024 offers substantial revenue visibility, creating a robust platform for anticipated growth. This impressive backlog is a direct result of strong demand for the company's environmental solutions.

The company projects converting this considerable backlog into recognized revenue within the next 18 to 24 months. This conversion timeline directly underpins CECO's recently upgraded full-year 2025 revenue outlook, indicating confidence in their ability to execute and deliver on existing contracts.

- Record Backlog: $688.1 million as of Q1 2024.

- Revenue Visibility: Strong indication of future earnings.

- Conversion Timeline: Expected over the next 18-24 months.

- Impact: Supports raised full-year 2025 revenue outlook.

Strategic Cost Actions and Operational Efficiency

CECO is set to launch strategic cost-saving initiatives in the second quarter of 2025. These actions will involve reducing redundant general and administrative positions and broadening productivity enhancement programs.

These cost-reduction efforts, coupled with anticipated robust volume increases, are projected to drive operating margin growth across 2025. This focus on efficiency is a key opportunity for improving the company's financial performance.

- Targeted Cost Reductions: CECO aims to streamline operations by eliminating duplicated administrative functions, a common practice to boost efficiency.

- Productivity Expansion: The company plans to invest in and expand programs designed to increase output and effectiveness across its workforce.

- Margin Improvement: By Q4 2025, these combined efforts are expected to contribute to a notable expansion in operating margins, potentially increasing profitability.

- Volume Growth Synergy: The cost actions are designed to complement and amplify the benefits of anticipated strong sales volume growth.

The global demand for environmental solutions is accelerating, driven by stricter regulations and a focus on sustainability, creating a fertile ground for CECO's offerings. The company's position in air quality and water treatment technologies aligns perfectly with these market needs, as evidenced by the industrial wastewater treatment market's projected growth. Furthermore, the ongoing energy transition, favoring cleaner sources, directly translates into increased demand for CECO's emissions management technologies, as demonstrated by their record power generation order.

CECO's strategic acquisitions and diverse product portfolio enhance its ability to penetrate new markets and customer segments, a crucial advantage in a dynamic global economy. The company is well-positioned to capitalize on growth in burgeoning sectors such as electric vehicles and semiconductors, with significant market values projected for both. CECO's expertise is also increasingly vital in high-growth areas like solar energy component manufacturing, advanced electronics, and the battery industry.

| Opportunity Area | Market Context (2023-2025 Data) | CECO Relevance |

|---|---|---|

| Sustainability & Regulations | Global industrial wastewater market >$50B (2023) | Direct alignment with core business |

| Energy Transition | Increased investment in cleaner energy infrastructure | Demand for emissions management tech |

| Emerging Sectors | EV market projected >$1.7T (by 2030) | Support for manufacturing processes |

| Semiconductors | Global revenue $600B (2023) | Demand for advanced manufacturing support |

Threats

CECO Environmental is navigating significant market pressures, including the impact of geopolitical tariff considerations that can alter cost structures. For instance, ongoing trade disputes can introduce volatility into the pricing of essential components and finished goods.

Furthermore, the company contends with the persistent threat of raw material shortages. A prime example is the potential scarcity and price escalation of critical metals or specialized components vital for environmental control systems, directly impacting CECO's cost of goods sold and project execution timelines.

These supply chain vulnerabilities and market uncertainties could strain CECO's ability to maintain competitive pricing and adhere to project schedules, thereby affecting overall profitability and operational efficiency throughout 2024 and into 2025.

The environmental solutions sector is indeed a crowded space. CECO Environmental faces significant competition from numerous players offering comparable air quality and fluid handling technologies. This crowded market means that maintaining a strong market position requires constant vigilance and strategic adaptation.

This intense competition can directly impact pricing power and market share. Companies like CECO must be prepared for price pressures as competitors vie for customers. To counter this, continuous innovation and clear differentiation of its product and service portfolio become absolutely critical for sustained success.

For instance, in 2023, the global air pollution control market was valued at approximately $20.5 billion, with projections indicating steady growth. This highlights the substantial market opportunity but also underscores the competitive landscape CECO operates within, where staying ahead requires more than just offering standard solutions.

Broader economic downturns or macro uncertainties could impact industrial spending and project investments, potentially leading to reduced demand for CECO's solutions. For instance, a global recession could dampen capital expenditure across key sectors CECO serves.

While CECO Environmental has demonstrated resilience, a significant economic slowdown, such as a projected global GDP contraction in 2025, could affect its growth trajectory and project pipeline. This could translate to slower revenue growth or even a decline in specific business segments.

Integration Risks of Acquisitions

While CECO Environmental's strategic acquisitions can fuel expansion, they introduce significant integration risks. These challenges often involve merging disparate operational processes, IT systems, and corporate cultures, which can be complex and time-consuming. For instance, a poorly managed integration could hinder the realization of expected cost savings or revenue enhancements.

Failure to smoothly integrate acquired entities can result in operational disruptions, impacting overall efficiency and profitability. CECO Environmental needs robust post-acquisition integration plans to mitigate these threats. For example, in 2023, the company completed several acquisitions, and successful integration is key to unlocking their full value.

- Operational Inefficiencies: Integrating new business units can disrupt existing workflows, leading to temporary drops in productivity.

- Cultural Clashes: Mismatched company cultures can create internal friction, hindering collaboration and employee morale.

- Synergy Shortfalls: If integration is not managed effectively, the anticipated financial and operational benefits (synergies) from an acquisition may not materialize.

- Financial Strain: Unexpected integration costs can strain financial resources, impacting the company's liquidity or debt levels.

Fluctuations in Industrial End Markets

CECO Environmental operates across various industrial sectors, making it susceptible to the inherent cyclical nature of these markets. For instance, the power generation sector, a significant area for CECO, experienced a notable slowdown in new project development in late 2023 and early 2024 due to shifting energy policies and economic uncertainty, impacting demand for emissions control systems. This diversification, while generally a strength, means that a synchronized downturn across multiple key industries could lead to reduced orders for CECO's environmental solutions and services.

The manufacturing sector, another core market, also faces its own set of challenges. Global supply chain disruptions and rising input costs throughout 2024 have pressured manufacturers, leading some to delay or scale back capital expenditures on new equipment, including environmental compliance technologies. This directly translates to a potential threat for CECO, as a broad-based economic slowdown could dampen overall demand for its product and service offerings.

Specific market dynamics highlight these threats:

- Power Generation Volatility: Uncertainty surrounding the pace of energy transition and regulatory changes for fossil fuel power plants creates unpredictable demand for emissions control solutions.

- Manufacturing Sector Slowdown: Economic headwinds impacting global manufacturing output, such as inflation and reduced consumer spending, can lead to decreased capital investment in environmental upgrades.

- Industrial Capital Expenditure Cycles: Many of CECO's customers make large capital investments in new equipment and upgrades based on economic outlooks; a negative shift in these outlooks directly impacts CECO's order pipeline.

CECO Environmental faces intense competition in the environmental solutions market, with numerous companies offering similar air quality and fluid handling technologies. This crowded landscape necessitates continuous innovation and clear differentiation to maintain market share and pricing power, especially as the global air pollution control market, valued at approximately $20.5 billion in 2023, continues to grow.

Economic downturns pose a significant threat, as reduced industrial spending and project investments can directly impact demand for CECO's solutions. For instance, a projected global GDP contraction in 2025 could hinder capital expenditure across key sectors, potentially slowing revenue growth and affecting the company's project pipeline.

The cyclical nature of CECO's core markets, such as power generation and manufacturing, presents another challenge. Volatility in energy policies and economic headwinds impacting manufacturing output can lead to delayed or scaled-back capital investments in environmental compliance technologies, directly affecting CECO's order flow.

Furthermore, CECO's strategic acquisitions, while driving expansion, introduce integration risks. Poorly managed integration of new business units can lead to operational disruptions, cultural clashes, synergy shortfalls, and financial strain, potentially hindering the realization of expected benefits and impacting overall efficiency.

SWOT Analysis Data Sources

This CECO Environmental SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, industry-specific market research, and expert analyses of environmental regulations and trends.