CECO Environmental Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CECO Environmental Bundle

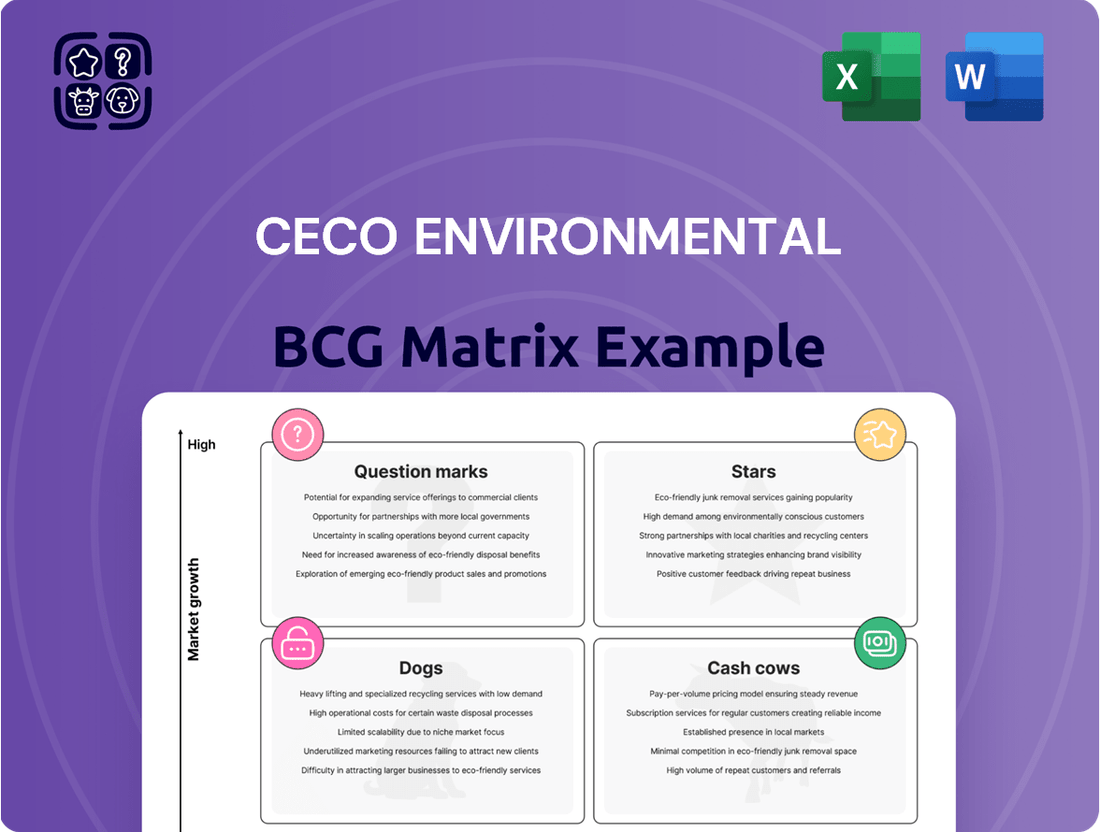

Understand CECO Environmental's strategic positioning with our BCG Matrix preview, highlighting their market share and growth potential across key product lines. See which segments are thriving and which require attention.

Unlock the full potential of CECO Environmental's portfolio by purchasing the complete BCG Matrix. Gain detailed insights into each quadrant – Stars, Cash Cows, Dogs, and Question Marks – and discover actionable strategies for optimizing your investments and product development.

Don't miss out on the comprehensive analysis that will empower your decision-making. Get the full CECO Environmental BCG Matrix today and transform your approach to market leadership.

Stars

CECO Environmental’s industrial air quality solutions for power generation are a key strength, particularly for large-scale projects. The company recently landed its largest order ever in this segment, a clear signal of its market leadership and the robust demand for its emissions management technologies. This success aligns with projections for substantial growth in the global industrial emission control systems market, fueled by tightening environmental regulations and a growing emphasis on cleaner energy.

The semiconductor industry is a significant growth engine for CECO Environmental, driven by global expansion and reshoring initiatives, particularly in North America. This sector demands advanced air quality and fluid handling solutions to comply with strict environmental regulations.

CECO Environmental's natural gas infrastructure solutions are a significant contributor to its business, particularly in the midstream and downstream sectors. The company's offerings, designed for hydrocarbon processing and transport, are seeing substantial demand, leading to record order intake and a growing backlog.

This robust performance is directly linked to ongoing energy transition initiatives and the critical need for operations that are both efficient and adhere to environmental regulations. For instance, CECO's work in supporting the safe and reliable transport of natural gas aligns with global efforts to ensure energy security while managing emissions.

The company's ability to provide these essential solutions positions it favorably within the market, reflecting the continued importance of natural gas in the global energy mix. This segment's strength underscores CECO's strategic focus on critical infrastructure that supports energy production and distribution.

Industrial Water Treatment Solutions

CECO Environmental's Industrial Water Treatment Solutions segment is a key player in a market driven by increasing global water scarcity and stringent environmental regulations. This area of their business focuses on providing essential technologies for managing and purifying industrial water and wastewater. The growing demand for sustainable water management practices directly benefits this segment, positioning it for continued expansion.

The market for industrial water treatment is robust, with global spending projected to reach hundreds of billions of dollars annually. For instance, the industrial water treatment market was valued at approximately $60 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 6% through 2030. This growth is fueled by factors such as industrial expansion in emerging economies and the need to comply with evolving environmental standards.

CECO's strategic investments in this sector highlight its commitment to addressing critical infrastructure needs. The company offers a range of solutions, including filtration, separation, and purification technologies, designed to meet the diverse requirements of industries like manufacturing, energy, and chemicals. This diversified approach allows CECO to capture market share across various industrial applications.

- Market Growth: The global industrial water treatment market is expanding significantly, driven by environmental compliance and resource management needs.

- CECO's Role: CECO Environmental provides advanced fluid handling and treatment systems vital for industrial water and wastewater management.

- Investment Focus: The company's emphasis on industrial water solutions aligns with increasing global investments in water infrastructure and sustainability.

- Portfolio Contribution: This segment enhances CECO's overall business diversification and contributes positively to its growth trajectory.

Strategic Acquisitions for Market Expansion

Strategic acquisitions like Profire Energy and Verantis Environmental Solutions Group have been pivotal for CECO Environmental, significantly enhancing its market presence, especially within the energy sector and industrial air treatment. These moves have not only broadened CECO's operational scope but have also demonstrably contributed to its financial performance.

The integration of these businesses has fueled considerable revenue growth, with the company reporting a notable increase in its top line following these strategic integrations. This expansion into new markets and strengthened capabilities in existing ones underscore CECO's aggressive growth strategy.

- Profire Energy Acquisition: Strengthened CECO's position in the oil and gas sector's combustion control market.

- Verantis Environmental Solutions Group: Expanded CECO's offerings in industrial air and water pollution control technologies.

- Revenue Impact: These acquisitions have directly contributed to increased sales and market share in key industrial segments.

- Market Expansion: Broadened CECO's addressable market, creating new avenues for future growth and diversification.

CECO Environmental's industrial air quality solutions for power generation are a key strength, particularly for large-scale projects. The company recently landed its largest order ever in this segment, a clear signal of its market leadership and the robust demand for its emissions management technologies. This success aligns with projections for substantial growth in the global industrial emission control systems market, fueled by tightening environmental regulations and a growing emphasis on cleaner energy.

The semiconductor industry is a significant growth engine for CECO Environmental, driven by global expansion and reshoring initiatives, particularly in North America. This sector demands advanced air quality and fluid handling solutions to comply with strict environmental regulations.

CECO Environmental's natural gas infrastructure solutions are a significant contributor to its business, particularly in the midstream and downstream sectors. The company's offerings, designed for hydrocarbon processing and transport, are seeing substantial demand, leading to record order intake and a growing backlog.

CECO Environmental's Industrial Water Treatment Solutions segment is a key player in a market driven by increasing global water scarcity and stringent environmental regulations. This area of their business focuses on providing essential technologies for managing and purifying industrial water and wastewater. The growing demand for sustainable water management practices directly benefits this segment, positioning it for continued expansion. The market for industrial water treatment is robust, with global spending projected to reach hundreds of billions of dollars annually. For instance, the industrial water treatment market was valued at approximately $60 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 6% through 2030.

Stars in the CECO Environmental BCG Matrix represent business segments with high market share in high-growth markets. These are typically areas where CECO has a strong competitive advantage and where the overall industry is expanding rapidly. These segments are crucial for future revenue and profit generation, often requiring continued investment to maintain their leading positions.

| Segment | Market Growth | CECO's Market Share | BCG Category |

|---|---|---|---|

| Industrial Air Quality (Power Generation) | High | High | Star |

| Semiconductor Industry Solutions | High | High | Star |

| Natural Gas Infrastructure | High | High | Star |

| Industrial Water Treatment | High | Moderate to High | Potential Star/Question Mark |

What is included in the product

This BCG Matrix overview will highlight which CECO Environmental business units to invest in, hold, or divest based on market share and growth.

CECO Environmental's BCG Matrix offers a clear, visual roadmap, relieving the pain of strategic uncertainty by pinpointing growth opportunities.

Cash Cows

CECO Environmental's established air pollution control equipment, including scrubbers and fabric filters, represents a significant Cash Cow. The company's long-standing presence in this sector, serving industries with mature needs, generates reliable and consistent cash flow.

These widely adopted technologies are expected to yield high profit margins, requiring minimal additional investment for growth, thereby fueling the company's overall financial strength. For instance, CECO's focus on these core offerings is a testament to their enduring market position and profitability.

Core Fluid Handling Solutions, even after divesting its pump business, represents a significant cash cow for CECO Environmental. These offerings cater to established, mature markets, leveraging long-standing competitive advantages and operational efficiencies. The company's strategic focus on infrastructure improvements further bolsters the reliability and steady cash generation from these product lines.

CECO Environmental's aftermarket services and parts are a classic cash cow. This segment provides a steady, high-margin revenue stream from maintaining and supplying parts for their installed base of air quality and fluid handling equipment. These services are essential for keeping industrial operations running smoothly and extending equipment life, making them a dependable cash generator.

Solutions for Mature Industrial Manufacturing

CECO Environmental's extensive portfolio for general industrial manufacturing, especially in mature sectors, functions as a significant cash cow. These established markets consistently need environmental compliance and operational upgrades, ensuring a steady demand for CECO's solutions.

The demand in these mature segments is predictable, generating stable revenue streams. This stability means CECO can rely on these business lines without needing substantial investment in market expansion or disruptive innovation, allowing for consistent cash generation.

- Stable Revenue: Mature industrial manufacturing segments, like those requiring ongoing emissions control or process optimization, provide predictable, recurring revenue for CECO.

- Low Investment Needs: These segments typically require less R&D and marketing investment compared to growth areas, leading to higher profit margins and cash flow.

- Market Dominance: CECO's established presence and comprehensive offerings in these areas often translate to significant market share, further solidifying their cash cow status.

- 2024 Data Insight: While specific segment revenue breakdowns are proprietary, CECO's overall reported revenue for the fiscal year 2024 showed continued strength in its industrial product segments, reflecting the ongoing demand in mature markets.

Legacy Engineered Systems with High Market Share

Certain mature Engineered Systems within CECO Environmental's portfolio, having secured a high market share in their respective segments, can be categorized as cash cows. These systems, despite operating in markets with moderate growth, generate substantial and consistent cash flow. Their established customer base, strong brand reputation, and the inherent reliability of their proven technology contribute significantly to this financial strength.

These cash cows benefit from several key advantages:

- Dominant Market Position: CECO's legacy engineered systems often hold leading positions in niche markets, providing a stable revenue stream.

- Brand Loyalty and Trust: Decades of reliable performance have cultivated strong customer loyalty, reducing customer acquisition costs.

- Operational Efficiency: Mature systems are typically highly optimized, leading to lower operating expenses and higher profit margins.

- Predictable Cash Generation: The consistent demand for these essential environmental solutions ensures a predictable and robust cash flow for the company.

CECO Environmental's established air pollution control equipment, like scrubbers and fabric filters, are prime examples of cash cows. These mature technologies serve industries with consistent needs, generating reliable cash flow with minimal need for further investment. This stability is crucial for funding growth in other areas of the business.

Similarly, CECO's core fluid handling solutions, even after divestitures, represent a stable revenue source. These products cater to established markets, benefiting from long-term competitive advantages and operational efficiencies, further solidifying their cash cow status. The company's strategic focus on infrastructure also supports this consistent cash generation.

Aftermarket services and parts are a classic cash cow for CECO, providing high-margin, recurring revenue from their installed base. These essential services ensure operational continuity for clients and extend equipment life, making them a dependable cash generator. CECO's broad portfolio for general industrial manufacturing, particularly in mature sectors, also functions as a significant cash cow due to predictable demand and stable revenue streams.

Mature engineered systems with high market share are also cash cows, generating substantial and consistent cash flow despite moderate market growth. Their established customer base, strong brand reputation, and proven technology contribute to this financial strength. For instance, CECO's fiscal year 2024 results indicated continued strength in these industrial product segments, underscoring the ongoing demand in mature markets.

| CECO Environmental Cash Cow Segments | Market Maturity | Revenue Stability | Investment Needs | Profitability |

|---|---|---|---|---|

| Air Pollution Control Equipment (Scrubbers, Fabric Filters) | Mature | High | Low | High |

| Core Fluid Handling Solutions | Mature | High | Low | High |

| Aftermarket Services & Parts | Mature | Very High | Very Low | Very High |

| General Industrial Manufacturing Solutions | Mature | High | Low | High |

| Mature Engineered Systems | Mature | High | Low | High |

Delivered as Shown

CECO Environmental BCG Matrix

The CECO Environmental BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no altered content, and no surprises – just the complete, analysis-ready matrix ready for your strategic planning. You can trust that the professional design and market insights presented here are precisely what you'll download and utilize immediately. This is your direct path to a comprehensive understanding of CECO Environmental's portfolio, presented in a clear and actionable format.

Dogs

CECO Environmental's divestiture of its Global Pump Solutions (GPS) business in March 2025 strongly suggests this segment was classified as a 'Dog' within the BCG Matrix. This classification implies GPS operated in a low-growth market with a low market share, making it a less strategic fit for CECO's core focus on expanding its high-growth environmental solutions portfolio.

The sale of GPS is a strategic move designed to unlock capital and reallocate resources towards more promising areas of CECO's business. This aligns with a broader trend of companies shedding non-core assets to sharpen their strategic focus and improve overall operational efficiency.

CECO Environmental's portfolio may include legacy product lines that are struggling to compete. These older technologies often find themselves in market segments that are either growing very slowly or actually shrinking. For instance, if a company has a line of industrial filters designed for a manufacturing process that has been largely replaced by newer, more efficient methods, that product line would likely fall into this category.

These underperforming product lines typically possess a low market share within their respective, stagnant industries. CECO's focus in 2024 would be on carefully evaluating these assets. The strategy here is usually to minimize further investment, as pouring resources into them is unlikely to yield significant returns. In some cases, divestiture, selling off these less profitable ventures, might be the most prudent course of action to free up capital and management attention for more promising areas.

CECO Environmental's 'Dog' category would encompass niche markets where its presence is minimal and growth is stagnant or declining. For instance, if CECO were to operate in a highly specialized industrial filtration segment with very few new entrants and a shrinking customer base due to technological obsolescence, and if CECO’s market share in that specific segment was below 10%, these products would likely be classified as Dogs. These are markets offering little to no potential for future profitability, irrespective of CECO's investment.

Inefficient or High-Cost Production Facilities

If CECO Environmental operates manufacturing facilities that are demonstrably less efficient or incur higher operating costs than industry peers, particularly when producing goods for low-growth markets, these units would represent a significant drag on profitability. Such operations, characterized by their inefficiency and low market demand, would be classified as Dogs within a BCG matrix framework. For instance, if a facility's energy consumption per unit produced is 15% higher than the industry average, and the market for its products is projected to grow at only 1% annually, it fits this profile.

These underperforming assets can strain capital and management attention, diverting resources from more promising ventures. Identifying and addressing these inefficient or high-cost production facilities is crucial for optimizing overall business performance.

- Operational Inefficiency: Facilities with production costs exceeding industry benchmarks by a substantial margin.

- Low Market Growth: Operations focused on product lines with minimal projected demand increase.

- Resource Drain: Units that consume disproportionate amounts of capital and management focus without generating commensurate returns.

Outdated Technology Offerings

CECO Environmental's outdated technology offerings, falling into the 'Dog' category of the BCG Matrix, represent products or solutions that rely on older, less efficient, or less environmentally compliant technologies. These have been largely surpassed by more advanced alternatives available in the market.

These offerings would likely struggle to gain significant market share and would necessitate substantial, often unprofitable, investment to remain competitive. For instance, older scrubber technologies that don't meet current stringent emissions standards, like those mandated by the EPA for industrial facilities, would fall into this category. As of 2024, the global market for advanced air pollution control technologies is projected to grow significantly, highlighting the declining relevance of older systems.

- Struggling Market Share: Products based on legacy technologies often face intense competition from newer, more efficient solutions.

- High Investment Needs: Revitalizing or maintaining outdated offerings requires considerable capital, often with low returns.

- Environmental Compliance Gaps: Older technologies may not meet evolving environmental regulations, leading to obsolescence.

- Limited Growth Potential: The inherent limitations of outdated technology restrict opportunities for market expansion and revenue growth.

CECO Environmental's 'Dog' category represents business units or product lines operating in low-growth markets with low market share. These are often legacy offerings that are no longer strategically aligned or competitive. The divestiture of its Global Pump Solutions (GPS) business in March 2025 is a prime example, indicating GPS was likely a Dog due to its position in a mature market and potentially declining relevance within CECO's evolving environmental solutions focus.

These 'Dog' segments typically require minimal further investment and may be candidates for divestiture to free up capital and management bandwidth. For instance, outdated industrial filtration systems that do not meet current emissions standards, like those facing increasing regulatory scrutiny in 2024, would fall into this category. Companies often shed these assets to concentrate resources on high-growth, high-share 'Stars' or promising 'Question Marks'.

CECO's strategy in 2024 would involve rigorously evaluating these underperforming assets. The goal is to identify those that offer little prospect of future growth or profitability. Divesting these segments, such as the aforementioned GPS business, allows CECO to streamline operations and invest more heavily in its core environmental technologies, which are experiencing higher market demand and growth potential.

These underperforming units can also include inefficient manufacturing facilities. For example, a plant with production costs 15% above the industry average, serving a market with only 1% annual growth, would be a 'Dog'. Such operations drain resources without providing significant returns, making their identification and potential sale or restructuring a critical part of portfolio management.

| Segment | Market Growth | Market Share | Strategic Fit |

|---|---|---|---|

| Global Pump Solutions (GPS) | Low | Low | Low (Divested March 2025) |

| Outdated Filtration Systems | Stagnant/Declining | Low | Low (Facing obsolescence) |

| Inefficient Manufacturing Units | Low | Low | Low (High operating costs) |

Question Marks

CECO Environmental is strategically aligning with the burgeoning energy transition market, recognizing its significant growth potential. Within this expansive sector, the company is focusing on emerging technologies where it's actively cultivating market share and establishing its footprint.

These nascent solutions, while promising, necessitate substantial investment to fully realize their commercial viability and impact. For instance, CECO's involvement in advanced carbon capture and utilization (CCU) technologies, a key area of the energy transition, requires ongoing research and development to scale effectively.

As of early 2024, the global market for CCU is projected to grow significantly, with some estimates suggesting a compound annual growth rate exceeding 15% in the coming years, underscoring the investment needed for CECO to solidify its position in these innovative segments.

CECO Environmental's strategic push into new geographic markets, particularly in the Middle East, India, and Southeast Asia, positions these ventures as potential Stars or Question Marks within the BCG framework. These regions represent significant growth opportunities, driven by increasing industrialization and stricter environmental regulations.

While the long-term outlook is promising, CECO's current market share in these nascent territories might still be developing. For instance, in India, a key market with substantial infrastructure development, CECO's presence is growing, but it still competes with established local players. This scenario necessitates substantial investment for market penetration and brand building, characteristic of Question Mark segments.

The company's investment in these expanding markets is crucial for capturing future market share. For example, CECO's reported investments in new facilities and partnerships in Southeast Asia aim to solidify its position. The success of these expansions will determine whether these markets evolve into Stars, generating substantial revenue, or require continued, significant capital infusion.

CECO Environmental's recent acquisitions, such as Profire Energy and Verantis, bring in technologies poised for significant growth. Within these, specific product lines targeting high-growth markets, like advanced emissions control solutions from Verantis or specialized industrial burner management systems from Profire, represent potential stars. CECO is in the early phases of fully integrating and maximizing the market penetration of these offerings, indicating a strong opportunity for future expansion.

Innovative Digital and IoT Solutions for Environmental Control

CECO's innovative digital and IoT solutions for environmental control, such as advanced remote monitoring systems and predictive maintenance platforms, represent a significant growth area. These technologies are increasingly sought after in industrial sectors aiming to optimize environmental performance and reduce operational costs. For example, the global industrial IoT market was valued at approximately $215 billion in 2023 and is projected to reach over $600 billion by 2030, indicating substantial room for new entrants and innovative offerings.

- High Market Growth Potential: The rapid digitalization trend in industrial environmental management fuels demand for advanced monitoring and control solutions.

- Investment Needs: Developing and scaling these cutting-edge digital and IoT offerings requires substantial capital investment to gain market traction and competitive advantage.

- CECO's Position: CECO's focus on these areas, if characterized by new product launches with limited current market share, positions these solutions as potential stars or question marks within the BCG matrix, depending on their investment and market penetration levels.

Solutions for Niche, Rapidly Evolving Industrial Applications

CECO Environmental's involvement in niche, rapidly evolving industrial applications like electric vehicle production, polysilicon fabrication, and battery manufacturing and recycling presents a classic BCG Matrix question. While these sectors offer substantial growth potential, if CECO's current market share within these highly specialized segments is still developing, these ventures might be categorized as question marks.

This classification suggests that these areas require significant strategic focus, including robust marketing efforts and dedicated research and development investment. The goal is to solidify CECO's position and capture a leading market share in these dynamic, high-potential industries.

- Niche Market Focus: CECO's engagement in EV, polysilicon, and battery sectors highlights its strategic alignment with high-growth industrial trends.

- Market Share Consideration: If CECO's penetration in these specialized applications is currently limited, these segments likely fall into the question mark category of the BCG matrix.

- Investment Imperative: Securing a dominant position in these evolving markets necessitates substantial investment in both marketing to build brand awareness and R&D to drive innovation and competitive advantage.

- Strategic Importance: Successfully navigating these question marks is crucial for CECO to capitalize on future growth and expand its influence in critical advanced manufacturing supply chains.

CECO Environmental's ventures into emerging, high-growth sectors with developing market share, such as advanced materials processing for electric vehicles or specialized components for semiconductor fabrication, are classic examples of Question Marks in the BCG matrix.

These areas exhibit significant market growth potential but require substantial investment to build brand recognition and capture a competitive position, as CECO is still establishing its footprint.

For instance, the global market for semiconductor manufacturing equipment, a sector CECO is increasingly targeting with specialized environmental solutions, was projected to see robust growth through 2024 and beyond, yet CECO's share within specific niches may still be nascent.

Successfully nurturing these Question Marks involves strategic capital allocation for market penetration and technological advancement, with the ultimate goal of transforming them into Stars.

| BCG Category | Market Growth | Market Share | Investment Strategy | CECO Example Areas |

| Question Marks | High | Low | Invest heavily to gain share or divest if potential is not realized | Emerging tech in EV supply chain, specialized semiconductor processing |

BCG Matrix Data Sources

Our CECO Environmental BCG Matrix leverages comprehensive data, including financial disclosures, market intelligence reports, and industry growth forecasts to provide actionable strategic insights.