CECO Environmental Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CECO Environmental Bundle

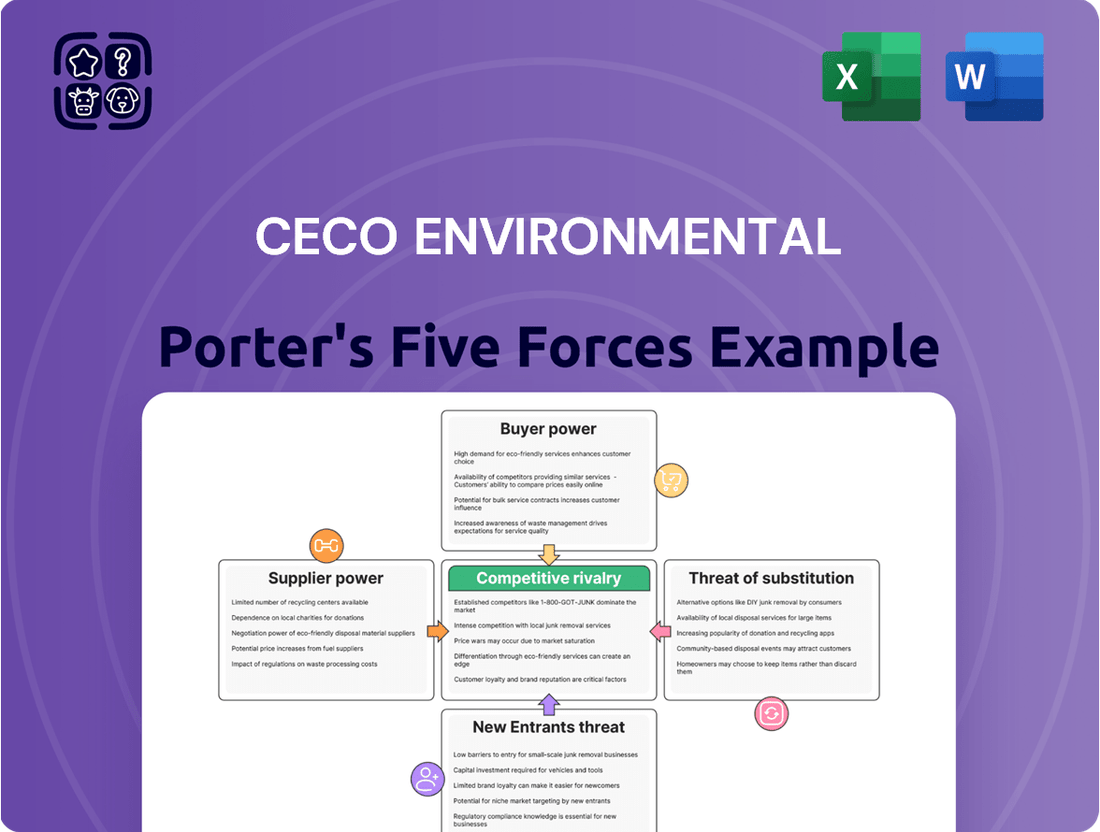

CECO Environmental faces a dynamic competitive landscape, with moderate bargaining power from buyers and suppliers influencing their market position. The threat of substitutes is present, but the intensity of rivalry among existing players is a key factor in their strategy.

The complete report reveals the real forces shaping CECO Environmental’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for critical components like specialized metals, advanced filtration media, and sophisticated control systems significantly impacts CECO Environmental's operational costs. If a limited number of suppliers provide these essential inputs, their ability to dictate terms and prices, known as bargaining power, grows considerably. This can translate directly into higher procurement expenses for CECO.

CECO Environmental's bargaining power of suppliers is influenced by the uniqueness of their inputs. If suppliers provide highly specialized or patented components, CECO's ability to negotiate lower prices diminishes, as alternatives are scarce. This was evident in the industrial filtration sector in early 2024, where a shortage of rare earth elements crucial for certain high-performance filters led to price increases from a few key suppliers.

The bargaining power of suppliers for CECO Environmental can be significant if switching costs are high. These costs might include the expense and time involved in re-tooling manufacturing processes, obtaining new certifications for components, or redesigning products to accommodate alternative suppliers. For instance, if CECO relies on highly specialized, proprietary components that require extensive integration and testing, moving to a new supplier could incur millions in upfront investment and production delays.

Supplier Power 4

The threat of forward integration by suppliers poses a significant concern for CECO Environmental. If key suppliers were to enter the air quality and fluid handling equipment manufacturing market, they could leverage their existing capabilities and customer relationships to compete directly, thereby increasing their bargaining power. This would allow them to dictate terms and potentially capture a larger share of the value chain.

For instance, a specialized component manufacturer supplying critical parts to CECO could potentially develop its own finished products. This move would not only disrupt CECO's supply chain but also introduce a formidable competitor. The financial health of potential suppliers is a key indicator; a supplier with strong profitability and a strategic vision might be more inclined to pursue such an expansion. For example, if a major supplier reported a 15% year-over-year revenue growth in 2024, it might signal the financial capacity and ambition to explore new market segments.

- Supplier Forward Integration Threat: Suppliers entering CECO's core business increases their leverage.

- Competitive Disruption: Direct competition from suppliers can erode CECO's market position.

- Financial Capacity of Suppliers: Strong supplier financials, like robust revenue growth in 2024, can indicate potential for integration.

- Strategic Implications: Suppliers with existing technological expertise are better positioned to integrate forward.

Supplier Power 5

The bargaining power of suppliers for CECO Environmental is influenced by how crucial CECO is as a customer to them. If CECO Environmental accounts for a substantial portion of a supplier's overall revenue, that supplier's leverage is reduced because they depend heavily on CECO's continued business. This interdependence can lead to more favorable terms for CECO.

Conversely, if CECO is a small client for a supplier, or if the supplier offers unique or specialized components essential for CECO's operations, the supplier's bargaining power increases. This is particularly true if there are few alternative suppliers offering comparable quality or technology. For instance, in 2024, the industrial filtration market, where CECO operates, saw continued demand for specialized materials, potentially strengthening the position of key component providers.

CECO's ability to switch suppliers also plays a role. If CECO can easily find alternative sources for its inputs without significant cost or disruption, supplier power is limited. However, if switching suppliers involves substantial retooling, qualification processes, or a loss of critical product features, CECO's ability to negotiate effectively diminishes.

- Supplier Dependence: CECO's significance as a customer directly impacts supplier power. A large CECO order can make a supplier more accommodating.

- Input Uniqueness: Suppliers of specialized or proprietary components needed by CECO hold stronger bargaining positions.

- Switching Costs: High costs or operational disruptions associated with changing suppliers limit CECO's negotiation leverage.

- Market Concentration: The number of available suppliers for CECO's key inputs is a critical factor; fewer suppliers mean greater supplier power.

The bargaining power of suppliers for CECO Environmental is significantly shaped by the concentration of providers for critical inputs like specialized filtration media and advanced control systems. When few suppliers offer these essential components, their ability to influence pricing and terms for CECO increases, directly impacting procurement costs. For example, in early 2024, shortages of rare earth elements in the industrial filtration sector led to price hikes from dominant suppliers.

High switching costs also bolster supplier leverage. If CECO faces substantial expenses and operational delays in sourcing alternatives, such as re-tooling or new certifications, its negotiation power weakens. The threat of forward integration by suppliers, where they might enter CECO's market, further amplifies their power, especially if they possess strong financial health, as indicated by a 15% year-over-year revenue growth reported by some suppliers in 2024.

| Factor | Impact on CECO Environmental | Example/Data Point (2024) |

| Supplier Concentration | Increases bargaining power | Shortages of rare earth elements in filtration media |

| Switching Costs | Increases bargaining power | High costs for re-tooling and certifications |

| Forward Integration Threat | Increases bargaining power | Suppliers with strong 2024 revenue growth (e.g., 15% YoY) may integrate |

| Input Uniqueness | Increases bargaining power | Proprietary components reduce CECO's alternatives |

What is included in the product

This analysis unpacks the competitive forces impacting CECO Environmental, detailing industry rivalry, buyer/supplier power, threat of new entrants and substitutes.

CECO Environmental's Porter's Five Forces analysis is a pain point reliever by providing a structured framework to identify and mitigate competitive threats, enabling more informed strategic decisions.

Customers Bargaining Power

CECO Environmental's customer base appears relatively fragmented across various industrial sectors, which generally limits individual buyer power. However, for specific large-scale projects or long-term service contracts, a few major industrial clients could indeed wield considerable influence, potentially negotiating for better pricing or tailored solutions.

While precise customer concentration figures for CECO are not publicly detailed, the company's diverse revenue streams from air pollution control, industrial filtration, and energy sectors suggest a broad customer base. This diversification typically dilutes the power of any single buyer, as CECO is not overly reliant on a handful of major accounts.

CECO Environmental's customers, particularly those in large industrial sectors like energy and manufacturing, can exert significant bargaining power. The volume of purchases made by these individual clients is a key determinant; a major utility company or a large automotive manufacturer placing a substantial order for emissions control equipment can command better pricing and terms due to their importance to CECO's revenue streams and production schedules. For instance, in 2023, CECO's revenue was approximately $500 million, with a substantial portion likely derived from a relatively concentrated base of large industrial clients, underscoring the impact of their purchasing volume.

The bargaining power of CECO Environmental's customers is a significant factor in its market. If CECO's environmental solutions are highly standardized, meaning customers can find similar offerings from multiple competitors, this amplifies buyer power. For instance, if a customer needs a basic air pollution control system, and many companies offer comparable technology, CECO faces greater pressure to keep prices competitive. This can lead to reduced profit margins for CECO.

Buyer Power 4

Buyer power for CECO Environmental is influenced by how difficult it is for customers to switch to a competitor. If switching involves significant expenses like re-engineering systems, re-installation, or navigating new regulatory hurdles, customers have less leverage. For instance, a customer heavily integrated with CECO's specialized air pollution control technology might face substantial costs to adopt an alternative, thereby diminishing their bargaining power.

Consider the following factors impacting customer switching costs:

- Integration Complexity: The degree to which CECO's environmental solutions are embedded within a customer's existing operational infrastructure.

- Re-tooling and Training Expenses: The potential costs associated with modifying or replacing equipment and retraining personnel if a different provider is chosen.

- Regulatory Compliance Impact: The effort and expense required to ensure a new solution meets the same stringent environmental regulations that CECO's products are designed for.

- Product Performance and Reliability: If CECO's offerings are perceived as highly reliable and performant, customers may be hesitant to risk disruption by switching.

Buyer Power 5

The bargaining power of CECO Environmental's customers is a key factor in its competitive landscape. If customers, particularly large industrial clients, possessed the capability and willingness to produce their own air quality or fluid handling equipment, they would gain substantial leverage. This threat of backward integration could force CECO to offer more competitive pricing or improved terms to retain business.

In 2024, the industrial sector continues to see consolidation and increased in-house expertise. While direct backward integration into complex manufacturing like CECO's is often capital-intensive and challenging, the *potential* for it remains a significant pressure point. For instance, a large utility company or a major petrochemical producer might consider developing proprietary solutions if they perceive CECO's pricing as too high or its product development as too slow to meet their evolving needs.

- Threat of Backward Integration: Customers could potentially develop in-house capabilities for certain air quality or fluid handling components, reducing reliance on CECO.

- Customer Leverage: The ability of customers to produce their own equipment grants them greater power in price negotiations and contract terms.

- Industry Trends: Growing in-house technical expertise and capital availability in some customer segments can increase the feasibility of backward integration.

- CECO's Response: CECO must continually innovate and offer value-added services to mitigate this customer power.

CECO Environmental's customers, particularly large industrial players, hold significant bargaining power. This leverage stems from their substantial purchase volumes and the potential for them to develop in-house solutions, as seen in the industrial sector's trend towards greater self-sufficiency in 2024. For example, a major energy company might negotiate harder on pricing for emission control systems if they perceive CECO's offerings as commoditized or if they have the internal engineering capacity to explore alternatives.

Switching costs for customers also play a crucial role in moderating their bargaining power. If integrating CECO's specialized environmental technologies requires significant re-engineering, retraining, or regulatory re-validation, customers are less likely to switch, thereby reducing their leverage. CECO's 2023 revenue of approximately $500 million highlights the importance of these large clients, whose potential for switching can directly impact CECO's revenue streams.

| Customer Segment | Potential Bargaining Power | Factors Influencing Power |

| Large Industrial Clients (e.g., Energy, Petrochemical) | High | High Purchase Volume, Threat of Backward Integration, Potential for Standardization of Needs |

| Mid-sized Industrial Clients | Moderate | Moderate Purchase Volume, Moderate Switching Costs, Less Capacity for Backward Integration |

| Small Industrial Clients | Low | Low Purchase Volume, High Switching Costs for Specialized Solutions, Limited Capacity for Backward Integration |

Full Version Awaits

CECO Environmental Porter's Five Forces Analysis

This preview showcases the complete CECO Environmental Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the environmental solutions industry. You're viewing the exact document you'll receive, providing actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants, the intensity of rivalry, and the availability of substitutes. This professionally formatted analysis is ready for immediate use upon purchase, ensuring you get precisely what you need to understand CECO Environmental's market landscape.

Rivalry Among Competitors

CECO Environmental operates in a competitive landscape with numerous direct rivals in the industrial air quality and fluid handling sectors. Key competitors include companies like Donaldson Company, Camfil, and Mann+Hummel, each offering a broad range of filtration and pollution control technologies.

The market is characterized by a significant number of similarly capable players, which naturally intensifies rivalry. This often translates into aggressive pricing strategies and substantial investments in marketing and product development to capture market share. For instance, in 2024, the global industrial air filtration market was valued at approximately $15 billion, indicating a large and active competitive arena.

The environmental solutions industry is experiencing robust growth, with the global market projected to reach over $300 billion by 2025, indicating a healthy expansion that can absorb multiple competitors. This growth, driven by increasing environmental regulations and a global push for sustainability, means that while rivalry exists, it's less likely to be a destructive price war in most segments.

However, specific niches within environmental solutions, such as industrial air pollution control where CECO Environmental operates, can see more intense competition. Companies in these areas often differentiate through technological innovation and specialized service offerings rather than solely on price.

In 2024, the demand for advanced emission control technologies and sustainable waste management solutions remains high. This sustained demand fuels investment and innovation, but also attracts new entrants and intensifies competition among established players like CECO Environmental, who must continually adapt and improve their offerings to maintain their edge.

The competitive rivalry within the industrial air pollution control sector, where CECO Environmental operates, is significant. Many of CECO's core offerings, such as dust collectors and scrubbers, face direct competition from companies providing similar technologies. This similarity can lead to price-based competition, especially for standardized solutions.

However, CECO Environmental differentiates itself through specialized solutions and integrated systems, particularly in niche markets like industrial filtration and emissions monitoring. For instance, in 2024, the company continued to emphasize its advanced filtration technologies designed for complex industrial processes, which command higher margins and reduce direct price wars.

Competitive Rivalry 4

The environmental solutions sector, including companies like CECO Environmental, often faces moderate to high competitive rivalry. This is partly due to significant exit barriers. Specialized equipment, substantial investments in research and development, and long-term service contracts can make it difficult and costly for companies to leave the market, even when facing financial challenges. This can lead to existing players continuing to compete aggressively, potentially driving down prices and margins for everyone involved.

For instance, companies heavily invested in proprietary emission control technologies or waste management infrastructure may find it impractical to divest these assets without significant losses. CECO Environmental itself operates in segments requiring specialized engineering and manufacturing capabilities. In 2023, CECO reported revenues of $400.8 million, indicating a substantial market presence that would involve considerable fixed assets and ongoing commitments. The need to service these assets and honor existing contracts can keep even underperforming entities engaged in the market, intensifying the competitive landscape.

- High Exit Barriers: Specialized assets, long-term contracts, and high fixed costs discourage companies from leaving the environmental solutions market.

- Aggressive Competition: These barriers can force struggling firms to remain and compete intensely, potentially impacting profitability across the industry.

- Industry Investment: Companies like CECO Environmental invest heavily in R&D and specialized infrastructure, contributing to higher exit barriers.

- Market Dynamics: The persistence of firms due to exit barriers can lead to price pressures and a more challenging competitive environment.

Competitive Rivalry 5

CECO Environmental operates in a market characterized by a diverse array of competitors, each with distinct strategies, origins, and objectives. This heterogeneity fuels a dynamic and often unpredictable competitive environment.

Some rivals focus on niche markets within environmental solutions, while others offer broader, integrated services. For instance, companies like Veolia and Suez often pursue large-scale, global infrastructure projects, whereas smaller, specialized firms might concentrate on specific emissions control technologies or regional compliance services. This variance in approach means that rivalry can manifest across different fronts, from price competition on standardized services to innovation in advanced pollution abatement techniques.

The intensity of this rivalry is further amplified by the varied strategic aims of market participants. Some publicly traded competitors, like Clean Harbors, might prioritize shareholder returns through operational efficiency and market share growth, while privately held firms could be driven by a long-term vision for technological leadership or a specific environmental mission. This divergence in goals means that competitive actions are not always directly comparable, leading to a complex strategic interplay. In 2023, the global environmental services market was valued at approximately $1.3 trillion, with significant growth projected, attracting a wide range of new entrants and established players.

- Diverse Strategies: Competitors range from large, integrated service providers to specialized technology firms, each targeting different segments of the environmental solutions market.

- Varied Origins and Objectives: Players include multinational corporations, regional specialists, and private equity-backed entities, all with unique growth targets and market positioning.

- Unpredictable Rivalry: The mix of strategies and objectives leads to competition on multiple fronts, including price, innovation, service breadth, and geographic reach.

- Market Growth Driver: The expanding environmental services sector, projected to see continued robust growth in the coming years, attracts and sustains this diverse competitive landscape.

Competitive rivalry for CECO Environmental is significant, with numerous players offering similar industrial air quality and fluid handling solutions. Companies like Donaldson and Camfil are key competitors, often engaging in aggressive pricing and R&D investment. The global industrial air filtration market, valued around $15 billion in 2024, highlights the intensity of this competition.

While overall market growth in environmental solutions, projected to exceed $300 billion by 2025, can accommodate multiple players, specific niches like industrial air pollution control see heightened rivalry. CECO differentiates through specialized, integrated systems and advanced filtration technologies, particularly in 2024, to mitigate direct price wars.

High exit barriers, including specialized assets and long-term contracts, keep firms competing intensely, potentially impacting industry margins. CECO's 2023 revenue of $400.8 million underscores its substantial market presence and associated commitments that discourage market exit.

| Competitor | Key Offerings | Market Focus |

|---|---|---|

| Donaldson Company | Filtration systems, engine and industrial products | Diversified industrial and engine markets |

| Camfil | Air filters, clean air solutions | HVAC, industrial, healthcare |

| Mann+Hummel | Filtration solutions for automotive and industrial applications | Automotive, industrial, life sciences |

SSubstitutes Threaten

The threat of substitutes for CECO Environmental's offerings is moderate. Customers seeking air pollution control solutions might consider alternative methods like process redesign to reduce emissions at the source, or even relocating operations to less regulated areas, though the latter is often impractical. For fluid handling, substitutes could include different types of filtration or separation technologies not directly offered by CECO, or even changes in material processing that minimize the need for fluid handling altogether.

The threat of substitutes for CECO Environmental's services is moderate. While direct replacements offering identical environmental solutions are few, alternative approaches to pollution control and waste management exist. For instance, companies might invest in process improvements to reduce emissions at the source rather than installing end-of-pipe abatement technologies, or they might opt for less stringent compliance methods if regulations allow.

The price-performance trade-off is a key consideration. If companies can achieve comparable environmental performance through internal process changes or simpler, cheaper technologies, they might bypass specialized providers like CECO. However, CECO's expertise in complex industrial emissions and regulatory compliance often provides a superior performance that is difficult for substitutes to match at a similar cost, especially for highly regulated industries.

In 2024, the increasing focus on ESG (Environmental, Social, and Governance) factors by investors and regulators continues to drive demand for robust environmental solutions. This trend generally strengthens CECO's position, as companies seek reliable and compliant methods. However, the ongoing development of more efficient and cost-effective pollution control technologies from competitors or through in-house innovation could increase the threat from substitutes over time.

The threat of substitutes for CECO Environmental is moderate. Customers can switch to alternative solutions for air pollution control and industrial ventilation, such as those offered by competitors like Donaldson Company or Camfil. Switching costs are generally low, as many systems are modular or can be retrofitted, allowing customers to adopt new technologies without complete overhauls.

In 2024, the industrial filtration market, a key area for CECO, saw continued innovation in materials and design. For instance, advancements in electrostatic precipitators and baghouse filters offer comparable or even superior performance to older technologies, making the transition more appealing for businesses seeking efficiency gains or stricter compliance with evolving environmental regulations.

Threat of Substitutes 4

The threat of substitutes for CECO Environmental's core offerings, particularly in air pollution control and industrial ventilation, is influenced by evolving regulations and technological shifts. For instance, stricter emissions standards, such as those being implemented or considered globally in 2024, can make existing technologies less effective or more costly to operate, thereby increasing the attractiveness of alternative solutions. Breakthroughs in areas like carbon capture, advanced filtration materials, or even entirely new industrial processes that inherently produce fewer pollutants could present significant competitive threats.

Consider the impact of emerging technologies on traditional abatement methods. While CECO is a leader in established technologies, innovation in areas such as electrification of industrial processes or novel chemical treatments for emissions could offer a different pathway for companies to meet environmental compliance. For example, if a new, more cost-effective method for scrubbing specific industrial gases emerges, it could reduce the demand for CECO's existing scrubber systems.

The economic viability of substitutes is also a key factor. As of early 2024, the cost of implementing and maintaining advanced pollution control systems remains a significant consideration for many industrial clients. However, if the total cost of ownership for a substitute solution, factoring in energy consumption, maintenance, and regulatory compliance, becomes demonstrably lower than traditional methods, the threat intensifies. Furthermore, government incentives for adopting greener technologies could further tip the scales in favor of substitutes.

- Regulatory Drivers: New or tightened environmental regulations in 2024 globally are pushing industries to seek more efficient pollution control, potentially favoring innovative substitutes.

- Technological Advancements: Breakthroughs in carbon capture, advanced filtration, and inherently cleaner industrial processes offer alternative pathways to emissions reduction.

- Economic Viability: The total cost of ownership for substitute solutions, including operational and maintenance expenses, will be a critical factor in their adoption against CECO's offerings.

- Incentive Landscape: Government incentives for adopting greener technologies could accelerate the adoption of substitute solutions, impacting market share.

Threat of Substitutes 5

Customers in CECO Environmental's target industries, particularly those focused on industrial emissions control and environmental compliance, are increasingly aware of and open to alternative solutions. This growing acceptance of substitute technologies, ranging from advanced filtration methods to novel abatement processes, directly impacts CECO's market position.

For instance, the market for industrial dust collectors, a key segment for CECO, is seeing innovation from competitors offering modular designs and more energy-efficient systems. In 2024, the global industrial dust collector market was valued at approximately $5.5 billion, with a projected compound annual growth rate (CAGR) of 5.2% through 2030, indicating a dynamic landscape where substitutes can gain traction.

- Growing awareness of alternative emission control technologies.

- Increasing customer willingness to adopt innovative substitute solutions.

- Market growth in dust collectors highlights opportunities for new entrants and alternative approaches.

- The threat of substitution is elevated by the availability and acceptance of these alternatives.

The threat of substitutes for CECO Environmental is moderate, with a growing landscape of alternatives impacting their market. Customers are increasingly exploring options beyond traditional pollution control, such as process redesign to minimize emissions at the source. For example, advancements in industrial filtration, a key area for CECO, are offering more energy-efficient and high-performance solutions. The global industrial dust collector market, valued at approximately $5.5 billion in 2024, demonstrates this dynamic, with a projected CAGR of 5.2% through 2030, indicating space for innovative substitutes to gain traction.

| Factor | Impact on CECO | 2024 Relevance |

| Process Redesign | Reduces need for abatement equipment | Increasing focus on source reduction |

| Advanced Filtration | Offers higher efficiency/lower energy use | Innovations in dust collectors and filters |

| Emerging Technologies | Potential to bypass existing solutions (e.g., carbon capture) | Growing R&D in cleaner industrial processes |

| Cost-Effectiveness | Lower total cost of ownership for substitutes | Economic viability is a key customer consideration |

Entrants Threaten

The capital required to enter CECO Environmental's industrial air quality and fluid handling market is substantial. Establishing the necessary research and development capabilities, state-of-the-art manufacturing facilities, and acquiring specialized equipment demands significant upfront investment, acting as a formidable barrier for potential new competitors.

CECO Environmental, like many established players in the environmental solutions sector, benefits from significant economies of scale. This means their cost per unit of producing or delivering services is lower due to their large operational footprint. For instance, in 2024, CECO's substantial investment in manufacturing capacity and global service networks allows them to spread fixed costs over a larger output, presenting a formidable barrier for newcomers aiming to match their pricing.

New entrants face considerable challenges in achieving comparable cost efficiencies. They would need to invest heavily to build similar production capabilities and distribution channels, which is a capital-intensive undertaking. This high upfront investment, coupled with the need to achieve significant production volumes quickly, makes it difficult for new companies to compete on price against incumbents like CECO who have already realized these scale advantages.

The environmental services industry, particularly for specialized solutions like those CECO Environmental offers, presents a significant barrier to entry for newcomers. CECO benefits from established brand recognition and deep-rooted customer relationships, cultivated over years of reliable service and performance. This makes it difficult for new companies to quickly gain market acceptance and build the trust necessary to secure contracts, especially for complex environmental compliance projects.

Threat of New Entrants 4

The threat of new entrants into CECO Environmental's market is moderate, primarily due to the significant capital investment required for specialized equipment and regulatory compliance. New players often face hurdles in accessing established distribution channels and supply chains, which incumbent firms like CECO have cultivated over time.

Securing reliable suppliers and distribution networks is a major barrier for newcomers. CECO Environmental's long-standing relationships and existing infrastructure provide a distinct advantage, making it difficult for new entrants to compete on cost and efficiency.

- Capital Requirements: The need for substantial upfront investment in advanced environmental technology and infrastructure acts as a deterrent.

- Distribution Access: Newcomers struggle to gain entry into established sales networks and customer bases that CECO already serves.

- Supplier Relationships: CECO's strong ties with key suppliers of raw materials and specialized components are not easily replicated by new entrants.

- Brand Loyalty and Reputation: CECO's established brand recognition and proven track record in delivering environmental solutions build customer trust, which is a barrier for emerging competitors.

Threat of New Entrants 5

The threat of new entrants for CECO Environmental is significantly influenced by government policy and regulations. Stringent environmental standards, complex permitting processes, and the need for specific industry certifications act as substantial barriers. For instance, the Environmental Protection Agency (EPA) in the United States, and similar bodies globally, impose rigorous requirements for emissions control and waste management, demanding significant capital investment and specialized expertise from potential market entrants. In 2024, the continued focus on climate change mitigation and sustainability is likely to further tighten these regulatory landscapes, making it more challenging and costly for new players to establish themselves.

These regulatory hurdles directly impact the ease with which new companies can enter CECO Environmental's markets. Obtaining the necessary permits for operating pollution control equipment, for example, can be a lengthy and expensive undertaking. Companies must demonstrate compliance with air and water quality standards, which often requires sophisticated technology and ongoing monitoring. The capital expenditure associated with meeting these requirements can easily run into millions of dollars, effectively deterring smaller or less capitalized entrants. This creates a more stable environment for established players like CECO, who have already navigated these complexities and possess the necessary infrastructure and compliance frameworks.

Furthermore, the need for specialized industry certifications and accreditations adds another layer of difficulty. These certifications often require a proven track record, adherence to specific quality management systems, and demonstrated expertise in environmental engineering. New entrants must invest time and resources to achieve these credentials, which can take years. This creates a significant advantage for incumbent firms like CECO Environmental, who have built their reputation and operational capabilities over time, often holding certifications that are difficult for newcomers to replicate quickly. The ongoing evolution of environmental regulations, such as those related to greenhouse gas emissions, means that continuous adaptation and investment are necessary, further raising the barrier to entry.

The threat of new entrants for CECO Environmental is generally considered moderate. High capital requirements for specialized technology and manufacturing, coupled with established brand recognition and customer loyalty, create significant barriers. Furthermore, navigating complex regulatory landscapes and securing necessary certifications demands substantial time and investment, favoring established players.

In 2024, the environmental technology sector continues to see robust demand driven by global sustainability initiatives. However, the specialized nature of CECO's offerings, particularly in industrial air pollution control and fluid handling, necessitates deep technical expertise and significant upfront investment in R&D and manufacturing facilities. This capital intensity, often running into tens of millions of dollars for advanced systems, inherently limits the pool of potential new entrants.

Economies of scale achieved by CECO, through efficient production and extensive service networks, translate into cost advantages that new competitors would struggle to match initially. For example, CECO's 2024 operational efficiency improvements in its manufacturing plants allow for lower per-unit costs, a hurdle for any new entrant aiming for competitive pricing without comparable volume.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment in specialized equipment, R&D, and manufacturing facilities. | High; deters smaller or less capitalized firms. |

| Economies of Scale | Lower per-unit costs due to large-scale production and operations. | High; makes it difficult for new entrants to compete on price. |

| Brand Reputation & Customer Loyalty | Established trust and long-term relationships with clients. | Moderate to High; requires time and proven performance to build. |

| Regulatory Compliance & Certifications | Meeting stringent environmental standards and obtaining industry-specific approvals. | High; demands expertise, time, and capital investment. |

Porter's Five Forces Analysis Data Sources

Our CECO Environmental Porter's Five Forces analysis is built upon a foundation of publicly available company filings, including annual reports and SEC submissions. We also integrate data from industry-specific market research reports and relevant trade publications to capture competitive dynamics.