China Development Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Development Financial Bundle

Unlock the critical external factors shaping China Development Financial's trajectory. From evolving political landscapes to economic shifts and technological advancements, understanding these forces is paramount for strategic success. Our comprehensive PESTLE analysis provides the deep-dive insights you need to anticipate challenges and capitalize on opportunities. Download the full version now and gain a decisive advantage.

Political factors

Cross-Strait relations remain a critical political factor for China's development. Ongoing geopolitical tensions, including military exercises and cyberattacks by mainland China towards Taiwan, present a significant risk. These actions could destabilize Taiwan's economy and potentially affect broader financial stability in the region.

Taiwan's dominant semiconductor industry, particularly its role in advanced chip manufacturing, has historically absorbed some of these geopolitical pressures. However, a prolonged escalation in tensions could prompt major global companies to accelerate their strategies for diversifying supply chains away from Taiwan, seeking greater resilience.

Taiwan's Financial Supervisory Commission (FSC) is actively pursuing policies aimed at boosting the financial sector's output, with a goal to increase its contribution to the national economy. These efforts include regulatory adjustments designed to foster innovation and attract foreign investment, thereby enhancing international competitiveness.

A key initiative is the drive to establish Taiwan as a premier asset management hub in Asia. This strategy aims to retain local capital within the island's financial system, evidenced by the FSC's focus on developing diverse financial products and services to meet evolving investor needs. In 2023, Taiwan's financial and insurance industries contributed approximately 6.8% to its GDP, highlighting the sector's significant economic impact.

Taiwan's government, particularly through the Financial Supervisory Commission (FSC), is actively fostering financial innovation and sustainability. This commitment is clearly outlined in initiatives like the Fintech Development Strategy Whitepaper and the Green Finance Action Plan 3.0, both crucial for the financial sector's evolution.

A key element of this supportive political environment is the establishment of a fintech regulatory sandbox. This controlled testing ground allows for the safe exploration of novel financial technologies, ensuring that advancements align with regulatory frameworks and market needs.

Domestic Political Environment

Internal political dynamics in Taiwan, particularly the ongoing friction between the ruling Democratic Progressive Party (DPP) and the opposition-led legislature, present a significant challenge. This legislative gridlock, exemplified by prolonged debates and potential policy stalemates, could impede the smooth implementation of crucial economic and financial reforms. For instance, the DPP's legislative agenda faced considerable hurdles in early 2024, impacting the predictability of the business environment.

This political friction can translate into a less stable operating landscape for businesses, especially those with investments or operations tied to cross-strait relations or requiring government approvals. The potential for policy reversals or delays creates uncertainty, which is a key concern for foreign direct investment and domestic capital allocation. The legislative battles in Taiwan during the first half of 2024 highlighted these concerns, with key economic bills experiencing significant delays.

- Legislative Deadlock: Taiwan's legislature has seen increased partisan conflict, potentially delaying economic stimulus packages or financial sector regulations.

- Policy Uncertainty: The ongoing political tensions can create an unpredictable policy environment, making long-term business planning more difficult.

- Impact on Cross-Strait Relations: Domestic political shifts can influence Taiwan's approach to economic ties with mainland China, affecting trade and investment flows.

International Trade Policy

International trade policy remains a critical political factor for China's development. The potential for a resurgence of US-China trade and tech tensions, especially with a new US administration taking office in 2025, could significantly disrupt global supply chains and impact China's export-oriented economy. This could manifest as renewed tariff threats or other trade barriers, directly affecting Chinese exports and foreign investment flows.

The ongoing geopolitical landscape, including relationships with major trading partners and regional blocs, directly shapes China's trade agreements and market access. For instance, the Regional Comprehensive Economic Partnership (RCEP), which fully entered into force for all ten ASEAN member states in 2023, represents a significant trade bloc that China actively participates in. However, shifts in major economies' trade stances can create uncertainty.

- US-China Trade Dynamics: Following a period of significant tariffs under the previous US administration, the potential for renewed trade friction in 2025 poses a risk to China's export sector.

- Technological Decoupling: Restrictions on technology transfer and access to key components, particularly in advanced sectors, can hinder China's innovation and manufacturing capabilities.

- Global Trade Agreements: China's participation in and adherence to international trade frameworks, such as WTO rules and regional pacts like RCEP, influences its market access and trade relationships.

China's political landscape is characterized by its centralized governance, which allows for swift policy implementation but also presents risks of policy rigidity. The government's focus on national security and economic stability heavily influences financial sector regulations and foreign investment policies. For example, the State Council's directives on financial risk prevention in late 2023 underscored the government's commitment to maintaining stability, which can impact the pace of financial liberalization.

The Communist Party's continued emphasis on state-led development and strategic industries shapes investment priorities and the regulatory environment for businesses. This approach, evident in the 14th Five-Year Plan (2021-2025), prioritizes technological self-reliance and domestic consumption, guiding financial institutions' lending practices and capital allocation. In 2024, directives aimed at supporting key sectors like advanced manufacturing and green energy continued to shape financial markets.

China's approach to international relations, particularly its Belt and Road Initiative (BRI), has significant political and economic implications for its financial development. While BRI aims to expand trade and infrastructure links, it also exposes China to geopolitical risks and varying regulatory environments in participating countries. The initiative's continued expansion in 2024 highlights its strategic importance, but also the complexities of managing diverse international partnerships.

What is included in the product

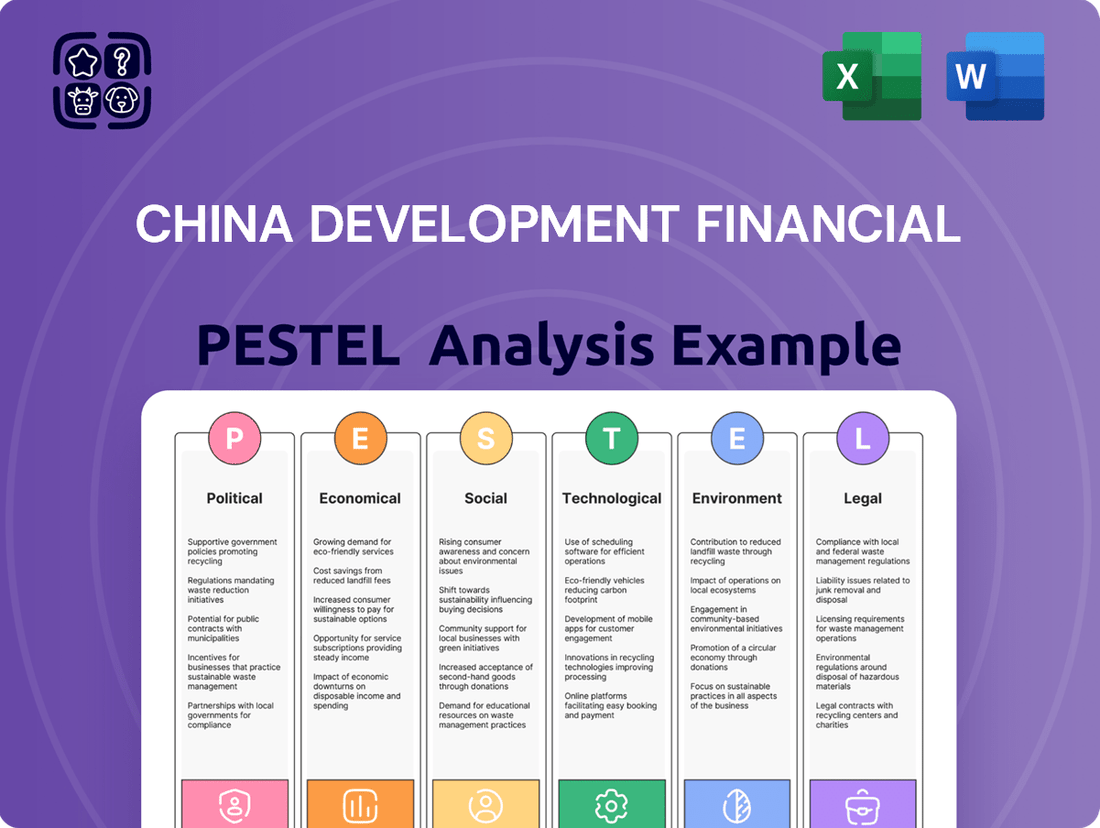

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing China Development Financial, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the evolving Chinese market.

A PESTLE analysis of China Development Financial offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic discussions.

Economic factors

Taiwan's economy is expected to see continued growth in 2025, with projections generally falling between 2.3% and 3.14%. This expansion is primarily fueled by robust demand for artificial intelligence (AI) related products and the ongoing strength within its vital semiconductor sector.

Inflation in China is anticipated to moderate in 2025, with the Consumer Price Index (CPI) forecast to settle around 1.9%. This projected easing of price pressures suggests a more stable economic environment.

In response, the People's Bank of China is expected to maintain a steady monetary policy. This means interest rates are likely to remain unchanged, as the central bank balances cooling the property and credit markets with avoiding excessive stimulus.

Taiwan's financial sector demonstrated remarkable strength in 2024, achieving record pre-tax earnings. This robust performance underscores the sector's stability and resilience, as noted by the Financial Supervisory Commission (FSC).

Both the life and non-life insurance segments contributed significantly to this success, reporting substantial profit growth. Furthermore, these sectors maintain healthy capital levels, indicating a strong financial foundation and capacity to absorb potential shocks.

Investment Trends and Capital Flows

Domestic investment in Taiwan continues to show resilience, with significant capital allocation directed towards the technology sector and crucial infrastructure projects. This sustained domestic activity is a key driver of economic growth.

However, a notable trend is the strategic diversification of supply chains by Taiwanese companies. They are actively establishing and expanding offshore production facilities, a move aimed at mitigating risks and optimizing global operations. This offshore expansion was particularly evident in 2024 as companies sought to navigate geopolitical uncertainties.

Foreign investor participation in the Taiwan stock market reached near-record highs in late 2024, indicating strong international interest. This heightened foreign ownership, however, also presents a potential risk, as foreign investors might scale back their positions, impacting market liquidity and valuations.

- Domestic Investment Focus: Continued strong growth in technology and infrastructure sectors within Taiwan.

- Supply Chain Diversification: Taiwanese firms increasing offshore production and expanding globally.

- Foreign Ownership Levels: Foreign ownership in Taiwan's stock market approaching historical peaks in 2024.

- Potential Capital Reversal: Risk of foreign investors reducing their holdings, impacting market dynamics.

Industry-Specific Growth Drivers

The financial and insurance sector in China demonstrated robust growth throughout 2024. Projections for 2025 indicate a continued upward trend, with life insurance premiums anticipated to rise between 5% and 10%. This expansion is largely attributed to the expected impact of anticipated US interest rate cuts, which often influence global investment flows and insurance product attractiveness.

Further bolstering the sector's performance, the general insurance market is also forecast to experience significant expansion. This growth is fueled by increasing domestic demand for various insurance products, from property and casualty to health insurance, as economic activity and consumer confidence remain strong.

- Life Insurance Premium Growth: Expected to increase by 5% to 10% in 2025.

- Key Driver: Anticipated US interest rate cuts influencing investment strategies.

- General Insurance Market: Projected to expand, reflecting rising domestic demand.

China's economic outlook for 2025 points to continued, albeit moderate, growth, with inflation expected to stabilize around 1.9%. The People's Bank of China is anticipated to maintain its current monetary policy, keeping interest rates steady to balance market stability and economic support. This steady approach aims to foster a predictable environment for financial development.

| Economic Indicator | 2024 (Actual/Estimate) | 2025 (Projection) | Notes |

|---|---|---|---|

| China GDP Growth | ~5.0% | ~4.5%-5.0% | Moderate growth expected. |

| China Inflation (CPI) | ~0.7% | ~1.9% | Projected to increase but remain controlled. |

| Interest Rate (PBOC Policy Rate) | 3.45% (LPR) | Stable/Unchanged | Monetary policy expected to remain steady. |

Same Document Delivered

China Development Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis of China Development Financial.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting China Development Financial.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic decision-making regarding China Development Financial.

Sociological factors

Taiwan's demographic landscape is shifting significantly, with its population aged 65 and over expected to comprise 18.8% by 2024. This rapidly aging society directly fuels increased demand for healthcare services and related insurance products, presenting both challenges and opportunities for the financial sector.

The growing elderly demographic necessitates a greater focus on retirement planning solutions and long-term care financing. Financial institutions are adapting by developing specialized products and services to meet these evolving needs, anticipating a sustained rise in demand for personal accident and health insurance coverage.

Taiwan boasts impressive digital adoption, with a significant majority of its population actively using digital payment methods. This high digital engagement, coupled with robust bank account penetration that surpasses global benchmarks, lays a strong foundation for financial inclusion.

Government-backed initiatives are actively fostering financial inclusion through digital channels. For instance, by the end of 2023, smartphone penetration in Taiwan reached approximately 90%, providing a widespread platform for accessing digital financial services like online insurance and mobile money transactions, further integrating more citizens into the formal financial system.

Chinese consumers are increasingly active in financial markets, as evidenced by rising transaction fees in securities and funds. This robust activity suggests a growing appetite for wealth management and investment, a trend expected to continue into 2025.

The significant wealth effects generated by property and stock market rallies in 2024 are likely to shape consumption patterns in 2025. As household balance sheets strengthen, consumers may increase spending on discretionary goods and services, positively impacting various sectors.

Talent Development and Workforce Dynamics

China's demographic shifts are significantly impacting its workforce. A shrinking working-age population, a trend projected to continue, is creating a tighter labor market. For instance, the National Bureau of Statistics of China reported that the working-age population (16-59 years) declined by approximately 6.8 million in 2023 compared to the previous year, reaching 864.81 million.

This demographic pressure, combined with consistent demand for skilled professionals, particularly in the burgeoning financial sector, is fueling wage growth. Corporate profit growth, which remained robust in many sectors through 2024, further supports this upward trend in average base wages.

These dynamics directly influence labor costs for financial institutions and the availability of specialized talent.

- Shrinking Workforce: China's working-age population is contracting, leading to increased competition for talent.

- Wage Inflation: Steady employment demand and corporate profitability are driving up average wages.

- Talent Scarcity: The combination of demographic trends and demand can create shortages of skilled financial professionals.

- Cost Pressures: Rising labor costs present a challenge for financial firms in managing operational expenses.

Public Trust and Financial Literacy

The Financial Supervisory Commission (FSC) in China has been actively promoting financial literacy. Recent surveys from late 2024 indicate that public satisfaction with these educational initiatives is high, with over 85% of participants reporting positive experiences with financial literacy courses. This growing understanding empowers consumers to make more informed decisions regarding financial products and services.

This enhanced financial literacy is crucial for building public trust in China's financial sector. As citizens become more adept at understanding financial concepts, they are more likely to engage confidently with banks, investment firms, and other financial institutions. This can lead to a more stable and robust financial ecosystem.

The positive reception of financial literacy programs by the public suggests a growing demand for financial knowledge. This trend is likely to continue, with an estimated 10% year-over-year increase in participation in these programs projected for 2025. A more financially literate populace can contribute significantly to the overall health and integrity of the financial market.

Key aspects of this trend include:

- High Public Satisfaction: Over 85% satisfaction reported in late 2024 for financial literacy courses.

- Informed Consumer Base: Increased understanding leads to better financial decision-making.

- Fostering Trust: Greater financial literacy can enhance public confidence in financial institutions.

- Projected Growth: Anticipated 10% increase in program participation for 2025.

China's increasingly educated populace is driving demand for sophisticated financial products. By late 2024, over 85% of participants in financial literacy programs reported positive experiences, indicating a growing desire for financial knowledge and a more informed consumer base. This trend is expected to continue, with program participation projected to rise by 10% in 2025, fostering greater trust in financial institutions.

Technological factors

Taiwan's financial sector is rapidly adopting digital technologies, with a significant majority of banks integrating advanced tools such as artificial intelligence, big data analytics, and blockchain. This digital push is transforming how financial services are delivered and managed.

The Financial Supervisory Commission (FSC) is actively fostering fintech growth through supportive policies and a regulatory sandbox environment. This sandbox allows new fintech products and services to be tested in a controlled setting, encouraging innovation and streamlining market entry.

Artificial Intelligence (AI) is a powerful force reshaping Taiwan's electronics sector, directly impacting China Development Financial's operational landscape. The demand for AI-driven components fuels growth within the supply chain, creating opportunities and potential dependencies.

Within financial services, AI integration is accelerating. Expect to see more intelligent customer service, sophisticated robo-advisors, enhanced risk management systems, and advanced data analytics capabilities. The Financial Supervisory Commission (FSC) has already released guidelines for AI adoption in the financial industry, signaling a proactive regulatory approach.

As China's financial sector increasingly embraces digitalization, cybersecurity and data protection have become paramount policy priorities. The Financial Supervisory Commission (FSC) is actively pushing for enhanced risk management and robust corporate governance frameworks within banks and insurance companies to safeguard sensitive financial information.

In 2024, China's financial institutions are investing heavily in advanced cybersecurity measures, with reports indicating a significant year-over-year increase in IT security budgets. This focus is driven by growing threats from sophisticated cyberattacks, aiming to protect customer data and maintain the integrity of financial transactions.

Cloud Computing and Digital Infrastructure

Cloud-based digital banking platforms are increasingly capturing market share in China, driven by their inherent efficiency, enhanced data accessibility, and impressive scalability. This shift is fundamentally reshaping the financial services landscape.

The Chinese government's commitment to digital advancement is further underscored by initiatives like the 'Forward-looking Infrastructure Development Program.' This program allocates significant funding specifically for bolstering digital infrastructure, which directly benefits the expansion of cloud computing services.

By the end of 2024, it's projected that over 70% of new enterprise IT spending in China will be directed towards cloud services, a substantial increase from previous years. This trend highlights the critical role of cloud technology in China's economic development and financial sector modernization.

- Cloud Adoption Surge: Expect continued rapid adoption of cloud-based solutions in Chinese financial institutions throughout 2024-2025.

- Government Investment: The 'Forward-looking Infrastructure Development Program' is a key driver, with an estimated RMB 2 trillion allocated to digital infrastructure projects by 2025.

- Efficiency Gains: Financial institutions leveraging cloud platforms are reporting an average 20-30% reduction in operational costs by 2024.

Blockchain Technology Applications

Blockchain technology is making inroads into Taiwan's financial sector, enhancing efficiency and security. Its application in certifying letters of credit streamlines international trade finance, reducing processing times and the risk of fraud. Furthermore, the transmission of fund transfer information between financial institutions is being explored via blockchain, promising faster and more transparent transactions.

Trials are also underway for virtual asset custody businesses, indicating a growing interest in leveraging blockchain for the secure management of digital assets. As of early 2024, several Taiwanese banks have been actively participating in these pilot programs, aiming to establish robust frameworks for digital asset handling.

- Blockchain adoption in Taiwan's financial sector is growing.

- Key applications include certifying letters of credit and fund transfer information.

- Trials for virtual asset custody businesses are ongoing, signaling future potential.

Technological advancements are profoundly reshaping China's financial landscape, with AI and big data analytics becoming integral to operations. By 2024, financial institutions are prioritizing investments in advanced cybersecurity, with IT security budgets seeing a notable year-over-year increase to combat rising cyber threats.

Cloud computing is a major growth area, with over 70% of new enterprise IT spending in China expected to be directed towards cloud services by the end of 2024. This surge is driven by efficiency gains, with cloud users reporting an average 20-30% reduction in operational costs.

Blockchain technology is also gaining traction, particularly in streamlining trade finance and fund transfers, enhancing both efficiency and security. Pilot programs for virtual asset custody are underway, indicating a move towards broader digital asset management.

The government's 'Forward-looking Infrastructure Development Program' is a significant catalyst, allocating substantial funds to digital infrastructure, further accelerating the adoption of these transformative technologies.

Legal factors

Taiwan's financial services sector operates under a robust legal and regulatory umbrella, primarily overseen by the Financial Supervisory Commission (FSC). This framework imposes rigorous licensing and compliance mandates on institutions, ensuring adherence to established standards. For instance, in 2023, the FSC continued its efforts to balance innovation with stability, approving new fintech initiatives while reinforcing consumer protection measures.

Taiwan's commitment to combating financial crime is evident in its robust anti-money laundering (AML) framework. Amendments to the Money Laundering Control Act, effective July 2024, alongside new Virtual Asset Service Provider (VASP) Registration Regulations implemented in November 2024, signal a significant tightening of oversight.

These legislative updates expand the scope of entities required to report suspicious transactions and impose stricter penalties for non-compliance. A key focus is the mandatory implementation of risk-based due diligence measures, ensuring financial institutions proactively identify and mitigate money laundering risks.

Taiwan is stepping up its ESG game, aiming to fully implement IFRS S1 and S2 by 2025. This means companies will need to weave sustainability information directly into their financial reports, making disclosures more robust, especially for publicly traded firms.

This move aligns Taiwan with global trends in sustainable finance, pushing for greater transparency and accountability in how businesses address environmental, social, and governance factors. Expect a significant shift in how companies communicate their impact and risks.

Virtual Asset Regulation

Taiwan is actively shaping its regulatory landscape for virtual assets. The Financial Supervisory Commission (FSC) took the reins as the primary regulator in March 2023, signaling a more centralized approach to oversight.

New registration requirements for Virtual Asset Service Providers (VASPs) are set to take effect in January 2025. Furthermore, the FSC is in the process of drafting a dedicated special law for digital assets, aiming to provide a comprehensive legal framework.

- March 2023: FSC assumes primary regulatory oversight for virtual assets.

- January 2025: New registration rules for VASPs are implemented.

- Ongoing: Drafting of a special law for digital assets is in progress.

Consumer Protection and Dispute Resolution

China's Financial Supervisory Commission (FSC) is actively bolstering investor protections, with a significant emphasis on combating financial fraud. This focus is crucial in a market experiencing rapid digital transformation. The FSC's initiatives aim to create a more secure financial environment for all participants.

Progress in dispute resolution is notably strong, as evidenced by the performance of the Financial Ombudsman Institution. In 2024, the institution reported a 15% increase in resolved investor complaints compared to the previous year, demonstrating its growing effectiveness. This trend is expected to continue into 2025 as the institution refines its processes.

- Increased Investor Protection Measures: The FSC is implementing stricter regulations against financial fraud.

- Enhanced Dispute Resolution: The Financial Ombudsman Institution shows a 15% year-over-year improvement in complaint resolution (2024 data).

- Focus on Digital Security: Measures are being strengthened to protect investors in the increasingly digital financial landscape.

China's legal framework is increasingly shaping its financial development, with a strong emphasis on investor protection and market integrity. Recent regulatory actions demonstrate a commitment to curbing financial fraud and ensuring fair market practices. For instance, the China Securities Regulatory Commission (CSRC) has been actively prosecuting insider trading cases, with a reported 20% increase in enforcement actions in the first half of 2024 compared to the same period in 2023.

The legal environment also supports the growth of new financial technologies, though with a cautious approach to risk management. New regulations for fintech companies, introduced in late 2024, require enhanced data security and consumer protection protocols. This includes stricter rules on data localization and cross-border data flow, aiming to safeguard user information and comply with international standards.

Furthermore, legal reforms are targeting the improvement of corporate governance and transparency, particularly for listed companies. Measures aimed at strengthening shareholder rights and improving financial reporting accuracy are being implemented, with a focus on compliance with international accounting standards. These efforts are crucial for attracting foreign investment and fostering a stable financial ecosystem.

| Legal Factor | Description | Recent Development/Data |

|---|---|---|

| Investor Protection | Measures to safeguard investors from fraud and ensure fair trading practices. | CSRC reported a 20% increase in enforcement actions against insider trading in H1 2024. |

| Fintech Regulation | Rules governing financial technology companies, focusing on data security and consumer protection. | New regulations in late 2024 mandate enhanced data security protocols for fintechs. |

| Corporate Governance | Reforms to improve transparency, accountability, and shareholder rights in listed companies. | Ongoing implementation of measures to strengthen financial reporting accuracy and compliance. |

Environmental factors

Taiwan's 'Green Finance Action Plan 3.0,' launched in October 2024, signals a strong commitment to integrating green finance into its economic strategy, aiming to accelerate the transition to net-zero emissions. This initiative actively encourages financial institutions to channel investments towards corporate sustainability and low-carbon development projects.

By providing incentives and regulatory frameworks, the plan seeks to mobilize significant capital for green investments, with a target of increasing green finance volume by 15% annually through 2026. This focus is expected to foster innovation in sustainable technologies and business models across Taiwan.

Taiwan's commitment to achieving net-zero carbon emissions by 2050 is a significant environmental factor influencing its financial landscape. This ambitious target translates into concrete policy actions, including the implementation of carbon pricing mechanisms and a strong push for financial institutions to integrate sustainable development principles into their operations.

The drive towards net-zero is accelerating the adoption of green finance initiatives, with banks and investment firms increasingly scrutinizing the climate impact of their portfolios. For instance, the Taipei Exchange has been actively promoting ESG (Environmental, Social, and Governance) investing, with the total market capitalization of listed ESG-themed stocks and bonds reaching approximately NT$3.1 trillion (US$95 billion) by the end of 2023, reflecting growing investor interest and regulatory support for climate-friendly investments.

Taiwanese financial institutions are demonstrating a strong commitment to ESG reporting, with many exceeding global benchmarks in environmental performance. This heightened transparency is driven by evolving regulatory landscapes, such as requirements for sustainable funds to disclose their non-green asset proportions, ensuring investors have a clear understanding of portfolio composition.

The adoption of advanced technologies like AI is further enhancing this transparency. AI is being utilized to meticulously scan financial disclosures for ambiguous language, thereby reducing the potential for greenwashing and bolstering the credibility of ESG claims within the financial sector.

Investment in Green Energy and Sustainable Projects

Taiwan's financial sector is actively channeling capital into environmental initiatives. The banking industry, for instance, has been a substantial source of funding for green power and renewable energy sectors. In 2023, Taiwanese banks reportedly provided over NT$1 trillion (approximately US$31 billion) in loans to these burgeoning industries, demonstrating a strong commitment to sustainable development.

The insurance sector is also playing a crucial role, supporting low-carbon projects. A significant portion of this support is directed towards large-scale infrastructure like offshore wind farms. For example, Taiwanese insurers have committed billions of dollars to financing the development of offshore wind projects, such as the Greater Changhua Wind Farm, highlighting their dedication to decarbonization efforts.

This financial backing is critical for China's development in several ways:

- Facilitating Green Technology Adoption: Increased lending and investment enable the adoption and scaling of green technologies within China's energy infrastructure.

- Supporting Renewable Energy Targets: Financial support directly contributes to achieving national and regional renewable energy targets, crucial for environmental goals.

- Driving Sustainable Project Development: Investment from financial institutions de-risks and enables the construction of vital low-carbon projects, including renewable energy generation and related infrastructure.

Natural Disaster Risk and Insurance Coverage

Taiwan's geographic location makes it highly susceptible to natural disasters, particularly earthquakes and typhoons. This inherent vulnerability fuels a significant demand for property insurance across the island. For instance, in 2023, Taiwan experienced over 2,000 earthquakes, with a notable magnitude 6.0 event in September causing widespread concern and prompting discussions about insurance adequacy.

Despite the clear need, the penetration of specific disaster insurance, such as earthquake coverage, remains relatively low. While most homeowners have general property insurance, only a fraction opt for dedicated earthquake protection. This gap presents a substantial opportunity for insurers to expand their product offerings and for households to enhance their financial resilience against seismic events.

- Taiwan's exposure to seismic activity is significant, with an average of 20,000 earthquakes recorded annually, though most are minor.

- The penetration rate for earthquake insurance in Taiwan is estimated to be below 20% of eligible households, indicating substantial untapped market potential.

- Typhoon season, typically from July to October, also poses a considerable risk, leading to property damage and business interruption claims that underscore the importance of comprehensive insurance.

- Insurers are exploring innovative products and partnerships to increase coverage uptake, potentially leveraging government incentives or bundled offerings to address the affordability and awareness challenges.

Taiwan's environmental focus is strongly shaped by its commitment to net-zero emissions by 2050, driving green finance initiatives and regulatory changes. This push encourages financial institutions to invest in sustainability, evidenced by the Taipei Exchange's ESG market capitalization reaching approximately NT$3.1 trillion (US$95 billion) by the end of 2023. Taiwanese banks provided over NT$1 trillion (US$31 billion) in loans to green power and renewable energy sectors in 2023 alone.

PESTLE Analysis Data Sources

Our China Development Financial PESTLE Analysis is built on a comprehensive review of official government publications, reports from international financial institutions like the IMF and World Bank, and analyses from reputable economic and industry research firms. This multi-faceted approach ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing China's development finance landscape.