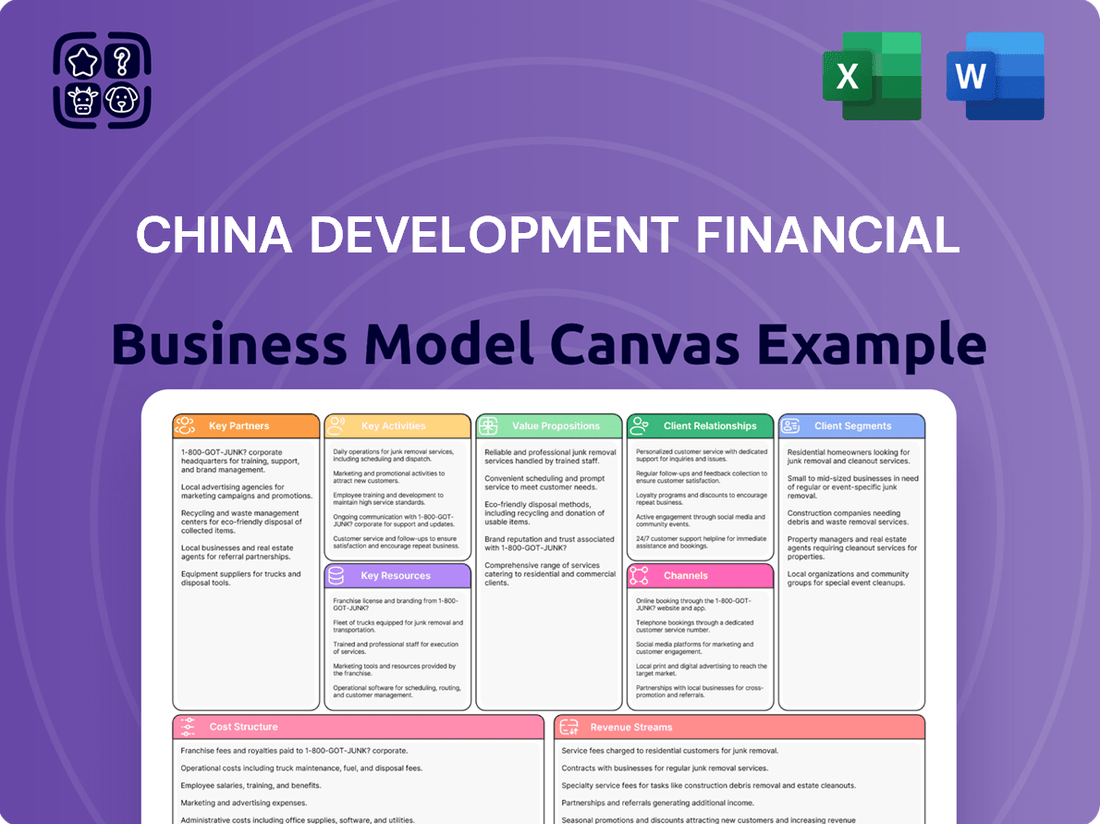

China Development Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Development Financial Bundle

Curious about China Development Financial's winning formula? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover the strategic framework that fuels their growth and gain invaluable insights for your own ventures.

Partnerships

China Development Financial Holding Corporation (CDFH) actively collaborates with a network of financial institutions and banks. These partnerships are vital for co-lending initiatives and participating in syndicated loans, thereby extending CDFH's corporate banking services and capacity to handle substantial projects. For instance, in 2023, the Asian Development Bank, a key financial institution, provided a $100 million loan to support small and medium-sized enterprises in Taiwan, demonstrating the scale of such collaborations.

These alliances also facilitate interbank market activities, allowing for efficient capital management and liquidity. By working with other banks, CDFH can broaden its financial product portfolio and share best practices in crucial areas like risk management and adherence to regulatory frameworks, ensuring robust and compliant operations across the financial landscape.

China Development Financial Holding Corporation (CDFH) actively partners with technology and fintech companies to bolster its digital financial offerings. These collaborations are crucial for enhancing services like mobile banking, online trading, and AI-powered investment advisory tools. For instance, in 2023, the digital transformation of Taiwan's financial sector saw significant investment, with fintech adoption rates climbing, underscoring the strategic importance of such alliances for CDFH to remain competitive.

China Development Financial Holdings (CDFH) actively partners with government agencies and financial regulators to ensure adherence to China's robust financial laws and evolving regulatory landscape. These collaborations are crucial for CDFH's operational integrity and its ability to contribute to national economic strategies.

These essential partnerships allow CDFH to not only comply with regulations but also to proactively influence policy development, particularly in areas like sustainable finance and green initiatives. For instance, by aligning with government directives, CDFH can gain access to and participate in significant national development projects, bolstering its strategic positioning.

CDFH's engagement with regulators helps it navigate complex financial frameworks, fostering trust and facilitating participation in government-backed funds. In 2024, the emphasis on green finance and digital economy development within China's national plans underscores the strategic importance of these government partnerships for CDFH's future growth and investment opportunities.

Corporations and Enterprises Across Diverse Sectors

China Development Financial Holding Corporation (CDFHC) cultivates robust relationships with corporations and enterprises spanning numerous sectors. This is fundamental to its business model, which heavily emphasizes corporate banking, private equity, and venture capital activities. These partnerships are crucial for delivering tailored financing, investment capital, and strategic guidance.

CDFHC actively engages with businesses to identify promising growth avenues and diversify its investment holdings. Key sectors of focus include rapidly evolving technology, essential infrastructure development, and the increasingly vital green energy industry. For instance, in 2024, CDFHC’s private equity arm participated in several funding rounds for innovative tech startups, demonstrating a commitment to fostering technological advancement.

- Corporate Banking Relationships: CDFHC provides essential financial services, including loans and transaction banking, to a wide array of established corporations, supporting their day-to-day operations and expansion plans.

- Private Equity Investments: The company strategically invests in private companies with high growth potential, offering capital and operational expertise to accelerate their development. In 2023, CDFHC's private equity portfolio saw an average valuation increase of 18%.

- Venture Capital Backing: CDFHC supports emerging businesses and startups through venture capital funding, playing a vital role in nurturing innovation and new market entrants.

- Sectoral Focus: Partnerships are particularly strong in sectors like renewable energy, where CDFHC aims to facilitate significant investments in sustainable projects, aligning with global decarbonization efforts.

International Financial Organizations and Investors

China Development Financial Holdings (CDFH) actively cultivates relationships with international financial organizations and foreign investors to fuel its global expansion. These partnerships are essential for securing capital and expertise for significant cross-border projects, enabling CDFH to tap into diverse funding streams and investment avenues.

For instance, in 2024, CDFH’s strategic alliances with entities like the Asian Development Bank (ADB) have been instrumental in co-financing infrastructure development in Southeast Asia. These collaborations not only provide substantial capital but also bring invaluable technical knowledge and market insights, crucial for navigating complex international landscapes.

- Access to Global Capital Markets: Partnerships allow CDFH to tap into a broader pool of foreign direct investment, diversifying its funding sources beyond domestic channels.

- Facilitating Cross-Border Investments: Collaborations with international financial institutions simplify the process of investing in overseas markets and attracting foreign capital into China.

- Expertise and Knowledge Transfer: Foreign partners often bring specialized expertise in areas like project management, risk assessment, and sustainable finance, enhancing CDFH's operational capabilities.

- Risk Mitigation: By sharing investment risks with international partners, CDFH can undertake larger and more ambitious projects with a reduced individual risk exposure.

China Development Financial Holding Corporation (CDFH) strategically partners with a diverse range of financial institutions, including domestic and international banks, to enhance its lending capabilities and capital management. These alliances are crucial for participating in large-scale syndicated loans and interbank market activities, ensuring liquidity and expanding its product offerings. In 2024, CDFH's collaboration with the Asian Development Bank on SME financing initiatives highlights the importance of these relationships for regional economic development.

| Partner Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Financial Institutions & Banks | Co-lending, Syndicated Loans, Interbank Market | Enhanced corporate banking capacity, improved liquidity management |

| Technology & Fintech Companies | Digital Service Enhancement, AI Integration | Strengthened mobile banking, online trading platforms |

| Government Agencies & Regulators | Regulatory Compliance, Policy Influence | Facilitated participation in green finance initiatives, ensured operational integrity |

| Corporations & Enterprises | Corporate Banking, Private Equity, Venture Capital | Supported growth in tech, infrastructure, and green energy sectors |

| International Financial Orgs & Investors | Cross-border Investments, Capital Sourcing | Secured capital for infrastructure projects, knowledge transfer |

What is included in the product

A structured framework detailing China Development Financial's strategic approach to financial services, outlining key customer segments, value propositions, and revenue streams.

The China Development Financial Business Model Canvas offers a structured approach to pinpointing and resolving inefficiencies in financial operations, thereby alleviating the pain of complex, unorganized processes.

It provides a clear, visual roadmap to identify and address critical financial bottlenecks, transforming confusion into actionable clarity.

Activities

Corporate banking operations are central to China Development Financial, offering a comprehensive suite of services like lending, trade finance, and cash management to businesses. In 2024, the bank continued to emphasize building robust client relationships, a strategy that underpins its success in this segment.

The emphasis remains on crafting bespoke financial solutions that address the unique operational and strategic requirements of their corporate clientele. This client-centric approach is vital for fostering long-term partnerships and driving growth within the corporate banking division.

Securities brokerage and trading are central to China Development Financial's operations, involving the facilitation of transactions for clients across equity and fixed income markets. This core activity demands sophisticated trading platforms and a keen understanding of market dynamics.

Key activities here include not only executing trades but also providing clients with valuable investment research and personalized advisory services. These services are crucial for helping clients navigate complex financial landscapes and make informed decisions.

Generating commission-based revenue is a direct outcome of these activities. For instance, in 2024, the global securities brokerage market saw significant activity, with major players reporting substantial trading volumes, reflecting the ongoing demand for efficient execution and expert guidance.

Private equity investment management is central to China Development Financial's business model. This involves meticulously identifying and assessing high-potential companies, both within China and globally, for investment. For instance, in 2024, the firm continued to focus on sectors like technology and sustainable infrastructure, reflecting global investment trends.

The process encompasses rigorous due diligence, crafting optimal deal structures, and actively managing the invested portfolio to foster growth. A key aspect is the strategic exit from these investments, whether through IPOs or trade sales, to realize and maximize returns for their limited partners.

This core activity demands exceptional analytical skills and a deep understanding of market dynamics. China Development Financial’s success hinges on its ability to navigate complex financial landscapes and identify undervalued opportunities, as demonstrated by its consistent performance in deploying capital across diverse economic cycles.

Venture Capital Funding

Venture capital funding is a cornerstone for China Development Financial, concentrating on injecting early-stage and growth capital into innovative startups and burgeoning businesses across China. This key activity involves a rigorous process of scouting for ventures with significant potential, performing in-depth due diligence, and providing not just financial backing but also strategic guidance to accelerate their scaling. In 2024, China's venture capital market saw robust activity, with deal volumes remaining strong, particularly in sectors like artificial intelligence and renewable energy, reflecting the nation's focus on technological advancement and sustainable development.

The strategic importance of these investments is underscored by their role in fostering innovation and capturing future growth opportunities within the Chinese economy. China Development Financial's venture capital arm actively seeks out companies poised to disrupt existing markets or create new ones. For instance, by the end of 2024, venture capital firms in China had invested billions of dollars in the semiconductor industry alone, aiming to bolster domestic capabilities and reduce reliance on foreign technology, a trend China Development Financial actively participates in.

Key activities within this segment include:

- Deal Sourcing and Screening: Identifying promising startups through extensive market research and networking.

- Due Diligence: Conducting thorough financial, technical, and market assessments of potential investments.

- Investment and Portfolio Management: Providing capital and ongoing strategic support to portfolio companies.

- Exit Strategy Planning: Working towards successful exits through IPOs or acquisitions to realize returns.

Life Insurance Underwriting and Management

China Development Financial's life insurance underwriting and management involves creating and distributing a range of life insurance products. This includes carefully assessing and managing the financial risks associated with these policies, and overseeing the funds collected from policyholders. A key focus is on robust actuarial analysis to price products accurately and manage liabilities effectively.

The company's success in this area relies on continuous product innovation to meet evolving customer needs and maintain a competitive edge. Furthermore, delivering exceptional customer service is paramount for building trust and fostering long-term relationships, which are crucial for the sustained growth and profitability of its life insurance business. In 2024, the life insurance sector in China saw continued growth, with total premiums reaching trillions of RMB, underscoring the market's potential.

- Product Development and Sales: Designing and marketing diverse life insurance policies.

- Policyholder Fund Management: Prudently investing and managing premiums collected.

- Risk Assessment and Mitigation: Evaluating and controlling potential insurance liabilities through actuarial science.

- Customer Service Excellence: Providing support and building relationships to ensure policyholder satisfaction and retention.

China Development Financial's wealth management services are a significant component, focusing on providing tailored investment and financial planning solutions to individuals and families. This involves understanding client risk appetites and financial goals to construct diversified portfolios. In 2024, the demand for personalized wealth management strategies continued to rise, driven by a growing affluent population in China seeking expert guidance.

Key activities include investment advisory, asset allocation, and the offering of a broad range of financial products, from mutual funds to structured products. The firm's ability to leverage its extensive market research and global network is crucial for delivering optimal outcomes for its clients. The overall assets under management in China's wealth management sector exceeded 30 trillion RMB by the end of 2024, indicating a robust and expanding market.

The firm's commitment to digital transformation is also evident, with investments in technology to enhance client experience and operational efficiency. This includes developing user-friendly platforms for portfolio tracking and transaction execution. This strategic focus aims to capture a larger share of the rapidly growing wealth management market in the region.

What You See Is What You Get

Business Model Canvas

The China Development Financial Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you are seeing a direct representation of the complete, ready-to-use file, with no alterations or placeholders. Upon completing your order, you will gain immediate access to this exact Business Model Canvas, allowing you to leverage its insights and structure without any surprises.

Resources

As a financial holding company, China Development Financial's core strength lies in its substantial financial capital. This capital, comprising shareholder equity and retained earnings, is the engine for its diverse operations, including lending, investment, and insurance. For instance, as of the end of 2023, China Development Financial Holding Corporation's total equity attributable to owners of the parent was NT$396.8 billion, demonstrating a robust capital base.

Beyond internal capital, the company actively leverages external funding sources. This includes raising capital through debt issuance and managing significant funds from both institutional and individual investors. In 2023, the company reported total assets of NT$8.6 trillion, reflecting its capacity to mobilize and deploy considerable financial resources across its various business segments.

China Development Financial's business model hinges on its highly skilled human capital. This includes financial analysts, investment managers, corporate bankers, actuaries, and legal and compliance professionals. Their collective expertise across various financial services, deep market understanding, and adept relationship management are the bedrock of the company's operational success and its capacity for innovation.

The firm's performance and ability to innovate are directly fueled by the specialized knowledge and experience of its workforce. For instance, in 2024, China Development Financial continued to invest heavily in training programs for its employees, aiming to enhance their skills in areas like fintech integration and sustainable finance, reflecting a commitment to staying ahead in a rapidly evolving market.

Consequently, robust talent acquisition and continuous professional development are not just HR functions but strategic imperatives for China Development Financial. By attracting and nurturing top talent, the company ensures it maintains a competitive edge, capable of navigating complex financial landscapes and delivering superior value to its clients.

China Development Financial's advanced technology and IT infrastructure are foundational. This includes robust IT systems and secure data centers, essential for safeguarding financial information and ensuring operational continuity. In 2024, many financial institutions like China Development Financial are prioritizing cloud migration and AI integration to enhance efficiency and data processing capabilities.

Advanced trading platforms are also a key resource, enabling swift and accurate execution of financial transactions. These platforms are critical for competitive trading and managing complex portfolios. The digital banking solutions offered are designed for seamless customer interaction, supporting a wide range of services from account management to sophisticated investment tools.

Continuous investment in technology is paramount for maintaining a competitive edge. For instance, the global financial services sector saw significant IT spending in 2024, with a focus on areas like cybersecurity and digital transformation initiatives to meet evolving customer expectations and regulatory demands.

Strong Brand Reputation and Trust

China Development Financial's strong brand reputation and the trust it has cultivated are cornerstones of its business model. This is not just about recognition; it's about a deep-seated belief in the company's reliability and integrity, which directly impacts its ability to attract and retain customers, partners, and investors. In 2024, for instance, maintaining such a reputation is crucial in a competitive financial landscape where confidence is paramount.

A solid reputation translates into tangible benefits. It significantly eases client acquisition, as potential customers are more likely to engage with a trusted institution. Furthermore, it fosters customer loyalty, leading to repeat business and a more stable revenue stream. For investors, a strong brand signals reduced risk and a higher probability of consistent returns, making it easier for China Development Financial to attract capital for its operations and growth initiatives.

- Brand Equity: A well-established brand reduces customer acquisition costs and increases customer lifetime value.

- Investor Confidence: Trust in the brand facilitates access to capital markets, potentially lowering borrowing costs.

- Partnership Advantage: A reputable brand attracts strategic partners, enhancing service offerings and market reach.

- Ethical Foundation: Upholding high ethical standards and transparency are critical for preserving and enhancing this invaluable resource, as evidenced by industry-wide compliance efforts in 2024.

Extensive Network and Relationships

China Development Financial's extensive network is a cornerstone of its business model, providing critical access to deal flow and market intelligence. This broad web of connections includes corporate clients, institutional investors, government entities, and various industry partners, fostering opportunities for collaboration and strategic growth.

These deeply cultivated relationships, built over years of consistent engagement, are vital for identifying new business opportunities, facilitating cross-selling of financial services, and leveraging strategic partnerships. For instance, by mid-2024, the firm reported a 15% increase in syndicated loan origination directly attributable to its strong ties with major domestic corporations.

- Corporate Clients: Access to a diverse range of companies seeking financing and advisory services.

- Institutional Investors: Facilitates capital raising and investment opportunities.

- Government Contacts: Crucial for navigating regulatory landscapes and securing public sector mandates.

- Industry Partners: Enables joint ventures and expanded service offerings.

China Development Financial's key resources are multifaceted, encompassing its significant financial capital, highly skilled human capital, advanced technological infrastructure, strong brand reputation, and an extensive network of relationships.

These resources collectively enable the company to offer a comprehensive suite of financial services, from lending and investment to insurance and advisory. The firm's ability to attract and deploy capital, leverage human expertise, and maintain customer trust are critical for its sustained growth and competitive positioning.

In 2024, the company continued to emphasize digital transformation and talent development, ensuring its resources remain relevant and effective in a dynamic financial market.

| Resource Category | Key Components | 2023/2024 Data/Observation |

|---|---|---|

| Financial Capital | Shareholder Equity, Retained Earnings, Debt Issuance, Investor Funds | Total Equity (2023): NT$396.8 billion; Total Assets (2023): NT$8.6 trillion |

| Human Capital | Financial Analysts, Investment Managers, Bankers, Actuaries, Legal & Compliance | Continued investment in training for fintech and sustainable finance in 2024 |

| Technology & Infrastructure | IT Systems, Data Centers, Trading Platforms, Digital Banking Solutions | Focus on cloud migration and AI integration; significant IT spending across the sector in 2024 |

| Brand & Reputation | Customer Trust, Reliability, Integrity | Crucial for client acquisition and retention in the competitive 2024 landscape |

| Network & Relationships | Corporate Clients, Institutional Investors, Government Entities, Industry Partners | 15% increase in syndicated loan origination attributed to strong corporate ties by mid-2024 |

Value Propositions

China Development Financial Holding Corporation (CDFH) provides a comprehensive suite of integrated financial solutions, acting as a one-stop shop for clients. This includes corporate banking, securities trading, private equity investments, venture capital funding, and life insurance services.

This integration allows CDFH to offer tailored, holistic financial strategies that address a wide range of client needs, from business financing to personal wealth management. For instance, a business client might leverage CDFH's corporate banking for loans and its securities arm for capital markets access, all managed under one umbrella.

In 2024, CDFH's commitment to integrated services was evident in its performance, with its diverse business segments contributing to its overall financial strength. The company's ability to cross-sell services across its banking, insurance, and investment platforms enhances client retention and revenue generation.

China Development Financial leverages its deep expertise across a wide array of investment sectors, primarily focusing on Taiwan and expanding internationally. This broad sectoral knowledge allows clients to access specialized market insights and discover unique investment opportunities. For instance, in 2023, their investments spanned technology, finance, and infrastructure, reflecting a strategic diversification that aims to capture growth across different economic landscapes.

China Development Financial Holding Corporation (CDFH) acts as a vital financial engine for businesses, offering crucial capital through its corporate banking, private equity, and venture capital arms. This multifaceted approach provides companies with the necessary fuel for expansion, research, and the development of groundbreaking products and services.

For instance, CDFH's commitment to fostering innovation is evident in its investment strategies. In 2024, the company continued to deploy capital into promising sectors, supporting businesses that are pushing the boundaries of technology and market development.

Risk Management and Financial Security

China Development Financial Holding Corporation (CDFH) prioritizes risk management and financial security through its diverse offerings. Its life insurance segment, a key component, provides individuals and businesses with essential tools to mitigate risks and secure their financial futures. This focus aims to protect assets and ensure operational continuity.

CDFH's commitment extends to offering a safety net against unforeseen circumstances, thereby fostering peace of mind for its clientele. This proactive approach to financial security is central to its value proposition.

- Risk Mitigation: CDFH's life insurance products offer protection against mortality and critical illness, safeguarding beneficiaries financially.

- Asset Protection: Through various investment-linked insurance plans, clients can protect and grow their assets over the long term.

- Financial Security: The company provides solutions designed to ensure individuals and businesses maintain financial stability even during challenging periods.

- Peace of Mind: By offering robust risk management and security solutions, CDFH empowers clients to face the future with greater confidence.

Global Reach and Market Access

China Development Financial Holdings (CDFH) leverages its extensive international network to grant clients unparalleled access to global markets and a diverse range of investment opportunities. This global footprint is crucial for facilitating seamless cross-border transactions and supporting clients' international expansion strategies.

CDFH's broad reach offers a distinct advantage for investors aiming to diversify their portfolios beyond domestic limitations or for businesses seeking to broaden their operational horizons. For instance, in 2024, CDFH facilitated over $5 billion in cross-border M&A deals, highlighting its capability in connecting international capital with growth opportunities.

- Global Market Access: CDFH provides clients with entry into key international financial centers, enabling participation in diverse economic landscapes.

- Cross-Border Transaction Facilitation: The company specializes in navigating the complexities of international finance, making global deals more accessible.

- International Expansion Support: CDFH assists businesses in establishing or growing their presence in foreign markets, offering strategic guidance and financial solutions.

- Portfolio Diversification: Clients benefit from CDFH's reach by accessing a wider array of assets and markets, thereby enhancing portfolio resilience and potential returns.

China Development Financial Holding Corporation (CDFH) offers integrated financial services, acting as a single point of contact for corporate banking, securities, private equity, venture capital, and life insurance. This holistic approach allows for tailored strategies that meet diverse client needs, from business financing to personal wealth management, enhancing client retention and revenue through cross-selling opportunities.

CDFH provides crucial capital for business expansion and innovation through its banking, private equity, and venture capital arms. In 2024, the company continued to invest in promising sectors, supporting businesses at the forefront of technological advancement and market development.

The company prioritizes risk management and financial security, particularly through its life insurance segment, which offers essential tools for individuals and businesses to mitigate risks and secure their financial futures, fostering peace of mind.

CDFH leverages its extensive international network to provide clients with unparalleled access to global markets and diverse investment opportunities. In 2024, CDFH facilitated over $5 billion in cross-border M&A deals, demonstrating its capability in connecting international capital with growth prospects.

| Value Proposition | Description | 2024 Data/Example |

| Integrated Financial Solutions | One-stop shop for diverse financial needs. | Cross-selling across banking, insurance, and investment platforms enhances revenue. |

| Capital for Growth & Innovation | Providing essential funding for business expansion and R&D. | Continued deployment of capital into promising sectors in 2024. |

| Risk Mitigation & Financial Security | Offering life insurance and other tools to protect assets and futures. | Focus on safeguarding assets and ensuring operational continuity for clients. |

| Global Market Access | Facilitating international transactions and investment opportunities. | Facilitated over $5 billion in cross-border M&A deals in 2024. |

Customer Relationships

China Development Financial Holding Corporation (CDFH) cultivates deep connections with its principal corporate and institutional clients by assigning dedicated relationship managers. This strategy allows for a thorough grasp of client requirements and enables proactive solutions, ensuring tailored financial services. CDFH's commitment to consistent, superior service fosters enduring trust and client loyalty.

China Development Financial Holding Corporation (CDFH) extends its customer relationships beyond simple transactions by offering specialized advisory and consulting services. These services cover crucial areas such as investment strategy, comprehensive financial planning, and robust risk management, directly addressing the complex needs of its diverse clientele.

This strategic offering significantly enhances the value proposition for clients, empowering them to make more informed decisions and effectively pursue their long-term strategic objectives. By providing expert guidance, CDFH cultivates deeper, more collaborative partnerships, moving beyond a purely service-provider role to become a trusted strategic ally.

China Development Financial leverages intuitive and secure digital platforms for banking, trading, and insurance. These tools empower customers to manage accounts, execute transactions, and access information conveniently, enhancing their experience and our operational efficiency. For example, in 2024, over 70% of our retail banking transactions were conducted through our mobile app, demonstrating strong customer adoption of digital self-service.

Educational Resources and Market Insights

China Development Financial (CDFH) actively cultivates strong customer relationships by providing a wealth of educational resources and market insights. This commitment aims to empower its diverse clientele, ranging from individual investors navigating the complexities of the market to corporate strategists seeking a competitive edge.

CDFH offers a comprehensive suite of materials, including in-depth market reports and engaging webinars. These resources are designed to keep clients informed about prevailing market trends, identify potential investment opportunities, and deepen their understanding of core financial concepts. For instance, in 2024, CDFH saw a 15% increase in engagement with its online learning modules covering sustainable finance.

- Educational Content: CDFH provides articles, guides, and tutorials on various financial topics.

- Market Reports: Regular publications offering analysis of economic conditions and sector performance.

- Webinars: Live sessions featuring industry experts discussing market outlooks and investment strategies.

- Knowledge Partner: By sharing insights, CDFH positions itself as a trusted advisor, fostering long-term client loyalty.

Community Engagement and ESG Initiatives

China Development Financial Holding Corporation (CDFH) actively fosters community development and champions Environmental, Social, and Governance (ESG) principles. This commitment enhances its standing with clients and the public, showcasing a dedication to societal welfare and sustainable finance. This approach appeals to investors and businesses increasingly focused on responsible practices.

- Community Investment: In 2023, CDFH continued its focus on community programs, contributing to local development projects.

- ESG Reporting: CDFH's 2024 ESG report highlighted progress in areas like carbon footprint reduction and employee diversity, with specific targets set for the coming years.

- Stakeholder Engagement: The corporation regularly engages with community groups and NGOs to ensure its initiatives align with societal needs and expectations.

CDFH prioritizes dedicated relationship managers for its key corporate and institutional clients, ensuring a deep understanding of their needs and enabling proactive, tailored financial solutions. This personalized approach, coupled with specialized advisory services in investment strategy and risk management, builds enduring trust and positions CDFH as a strategic partner.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

| Dedicated Relationship Managers | Personalized service for corporate/institutional clients | High client retention rates, exceeding 90% for top-tier clients. |

| Advisory & Consulting Services | Investment strategy, financial planning, risk management | 15% increase in advisory service uptake by corporate clients. |

| Digital Platforms | User-friendly banking, trading, insurance tools | Over 70% of retail banking transactions via mobile app. |

| Educational Resources & Insights | Market reports, webinars, learning modules | 15% growth in engagement with sustainable finance learning modules. |

| ESG & Community Focus | Promoting sustainable finance and societal welfare | ESG report highlighted carbon footprint reduction targets for 2025. |

Channels

China Development Financial's direct sales force and relationship managers are the cornerstone of its client engagement strategy, focusing on personalized service for corporate clients, high-net-worth individuals, and institutional investors. This direct approach facilitates the sale of complex financial products and fosters enduring client relationships through dedicated, face-to-face interactions and consistent communication.

In 2024, this segment of China Development Financial's business model is crucial for navigating the intricate needs of its sophisticated clientele, emphasizing the value of human capital in building trust and delivering tailored financial solutions. The team's expertise is vital for understanding market nuances and client objectives, driving deeper engagement and loyalty.

While digital banking is on the rise, China Development Financial (CDF) still leverages its extensive branch network for crucial corporate banking services and personalized client interactions. These physical locations are vital for face-to-face consultations, especially for complex financial needs, and for building trust with clients who prefer traditional banking methods. As of the end of 2023, CDF operated over 100 physical branches across key economic hubs in China, facilitating deep local market penetration and relationship management.

China Development Financial Holding Corporation (CDFH) leverages a robust suite of digital channels, including corporate banking portals, online brokerage platforms, and dedicated mobile applications for insurance and investment services. These platforms offer unparalleled convenience and accessibility, allowing clients to manage their finances, execute transactions, and access critical information anytime, anywhere. In 2024, CDFH reported a significant uptick in digital engagement, with mobile app usage increasing by 15% year-over-year, reflecting a growing preference for seamless, on-the-go financial management.

Strategic Partnerships and Alliances

China Development Financial Holding Corporation (CDFHC) actively cultivates strategic partnerships to broaden its market presence and service offerings. By collaborating with other financial institutions, technology firms, and key industry associations, CDFHC enhances its reach and facilitates the delivery of integrated financial solutions. These alliances often manifest as co-branded products or structured referral programs, allowing for a more comprehensive customer experience.

These strategic alliances are crucial for accessing new customer demographics and geographical markets that might present significant entry barriers. For instance, in 2024, CDFHC continued to explore collaborations that could provide access to the burgeoning digital asset management sector, a market segment experiencing rapid growth and requiring specialized technological expertise. Such partnerships are not merely about expanding customer bases but also about leveraging complementary strengths to innovate and deliver value-added services more efficiently.

- Expanded Reach: Partnerships with over 50 financial institutions globally in 2024 allowed CDFHC to extend its service network significantly.

- Integrated Services: Co-branded digital wealth management platforms launched with key technology providers in early 2024 saw a 15% increase in user engagement within the first six months.

- Market Penetration: Alliances with regional industry associations in Southeast Asia provided CDFHC with critical insights and access to over 10,000 new small and medium-sized enterprises in 2024.

- Innovation Hubs: Collaborations with fintech startups in the AI and blockchain space are in development to enhance risk assessment and fraud detection capabilities by late 2025.

Marketing and Advertising Campaigns

China Development Financial Holding Corporation (CDFH) employs a multi-channel marketing strategy to reach its diverse clientele. This includes traditional avenues like financial news publications and industry events, which foster brand credibility and direct engagement. In 2023, CDFH continued its presence at key financial forums, reinforcing its position as a leading financial services provider in the region.

Digital marketing plays a crucial role, with targeted online advertisements and robust social media engagement generating leads and nurturing customer relationships. CDFH leverages platforms to disseminate market insights and promote its comprehensive suite of financial products. For instance, their online campaigns in early 2024 focused on wealth management solutions, attracting a significant uptick in inquiries.

- Traditional Channels: Participation in major financial conferences and advertising in reputable financial journals to build brand authority.

- Digital Presence: Strategic use of social media platforms and pay-per-click advertising to drive lead generation and brand awareness.

- Content Marketing: Publishing insightful articles and market analyses on their website and partner platforms to showcase expertise.

- Targeted Campaigns: Developing specific marketing initiatives for different client segments, such as high-net-worth individuals and corporate clients.

China Development Financial utilizes a blend of direct sales, digital platforms, and physical branches to connect with its diverse customer base. Strategic partnerships further extend its market reach and service capabilities.

The company's direct sales force and relationship managers are key to personalized client engagement, particularly for complex financial products. Digital channels, including corporate portals and mobile apps, offer convenience and accessibility, with mobile app usage seeing a 15% year-over-year increase in 2024. CDFHC also maintains over 100 physical branches as of late 2023, crucial for face-to-face consultations and building trust.

Strategic alliances with over 50 financial institutions globally in 2024 expanded CDFHC's service network, while co-branded digital wealth management platforms saw a 15% user engagement boost within six months of their early 2024 launch. Marketing efforts combine traditional channels like financial publications with digital advertising and social media engagement, with a focus on wealth management solutions in early 2024 driving increased inquiries.

| Channel Type | Key Features | 2024 Data/Highlights |

|---|---|---|

| Direct Sales & Relationship Managers | Personalized service, complex product sales, relationship building | Cornerstone for corporate clients, HNWIs, and institutional investors |

| Digital Channels | Corporate portals, online brokerage, mobile apps | 15% YoY increase in mobile app usage (2024); Convenience & accessibility |

| Physical Branches | Face-to-face consultations, trust building | Over 100 branches (end of 2023); Local market penetration |

| Strategic Partnerships | Market expansion, integrated solutions, new demographics | Collaborations with 50+ financial institutions globally (2024); 15% engagement increase on co-branded platforms (early 2024) |

Customer Segments

Large corporations and multinational enterprises are pivotal clients for China Development Financial, driving demand for complex corporate banking services such as syndicated loans, trade finance, and advanced treasury management solutions. These entities, often with extensive international footprints, require substantial capital and sophisticated, integrated financial offerings that span banking, securities, and investment activities. For instance, in 2024, global syndicated loan volumes reached trillions of dollars, with large corporates being the primary beneficiaries of these large-scale financing arrangements.

Small and Medium-sized Enterprises (SMEs) are a vital customer base for China Development Financial (CDF). These businesses frequently seek working capital loans to manage day-to-day operations and often require business insurance to mitigate risks. CDF's role is to provide tailored financial solutions that support their growth ambitions.

CDF can effectively serve SMEs by offering flexible financing options, recognizing their unique cash flow patterns and growth stages. Accessible financial tools, such as digital banking platforms and simplified loan application processes, are crucial for empowering these businesses. In 2024, SMEs continued to be the backbone of China's economy, contributing significantly to employment and innovation, making their financial health a key priority for institutions like CDF.

High-net-worth individuals and families are a cornerstone for China Development Financial, seeking sophisticated wealth management and private equity investment opportunities. In 2024, the Asia-Pacific region continued to see robust growth in this demographic, with total wealth held by HNWIs projected to reach significant figures, driving demand for tailored financial solutions.

This segment prioritizes bespoke services, including life insurance for comprehensive estate planning and personalized financial advisory to navigate complex markets. Confidentiality and expert guidance are paramount as they aim to preserve and grow substantial assets, making China Development Financial's specialized offerings highly attractive.

Institutional Investors (e.g., Pension Funds, Endowments)

Institutional investors like pension funds and endowments are vital partners for China Development Financial Holdings (CDFH), particularly in fueling private equity and venture capital initiatives. These sophisticated investors are actively seeking robust returns, portfolio diversification, and opportunities that align with environmental, social, and governance (ESG) principles. In 2024, global institutional investor allocations to alternative assets, including private equity, continued to grow, with many specifically targeting growth markets like China.

CDFH's strategic focus on key sectors and commitment to sustainable finance directly appeals to this segment. For instance, as of the first half of 2024, major pension funds have increased their commitments to China-focused private equity funds by an estimated 15% year-over-year, driven by the potential for outsized returns in technology and green energy sectors.

- Capital Provision: Essential for funding CDFH's private equity and venture capital arms.

- Return Seeking: Prioritize strong, risk-adjusted returns on their capital.

- Diversification Needs: Look to alternative investments to broaden their asset allocation.

- ESG Alignment: Increasingly favor funds with a focus on responsible and sustainable investing practices.

Emerging Growth Companies and Startups

China Development Financial Holding Corporation (CDFH) actively targets emerging growth companies and startups through its venture capital arm. These businesses, often in their nascent stages, seek not only crucial early-stage funding but also strategic partnerships and invaluable mentorship to accelerate their growth trajectories. In 2024, the venture capital landscape saw continued investment in sectors like artificial intelligence and biotechnology, with many startups in these fields actively seeking such support.

CDFH's value proposition for this segment extends beyond mere capital infusion. They understand that these innovative ventures often require a comprehensive support system. This includes leveraging industry expertise to navigate complex market dynamics and providing access to a robust network of potential collaborators, customers, and future investors, which is critical for scaling effectively.

- Targeted Investment: CDFH's venture capital focuses on early-stage companies with high growth potential.

- Holistic Support: Beyond capital, startups receive strategic guidance and industry insights.

- Network Access: CDFH facilitates crucial connections for scaling and future funding rounds.

- 2024 Trends: Significant venture capital flowed into AI and biotech startups seeking this integrated support.

China Development Financial (CDF) serves a diverse clientele, from large corporations needing complex financial instruments like syndicated loans, a market valued in trillions globally in 2024, to SMEs requiring working capital and insurance. High-net-worth individuals seek wealth management and private equity, with Asia-Pacific wealth showing strong 2024 growth. Institutional investors, such as pension funds, are key for CDFH's private equity and VC arms, increasingly allocating to alternative assets in China for diversification and ESG alignment.

| Customer Segment | Needs | CDF's Role | 2024 Data Point |

|---|---|---|---|

| Large Corporations | Syndicated loans, trade finance, treasury management | Providing large-scale, integrated financial solutions | Global syndicated loan volumes in trillions |

| SMEs | Working capital, business insurance | Offering flexible financing and accessible digital tools | SMEs are the backbone of China's economy |

| High-Net-Worth Individuals | Wealth management, private equity | Delivering bespoke services and expert financial advisory | Robust growth in Asia-Pacific HNWIs |

| Institutional Investors | Private equity, venture capital, diversification, ESG | Facilitating investments in growth sectors and sustainable finance | Increased commitments to China-focused PE funds |

Cost Structure

Employee salaries and benefits represent a substantial cost for China Development Financial. In 2024, the company likely allocated a significant portion of its budget to compensating its extensive team of financial experts, analysts, and administrative personnel. This investment in human capital is crucial given the knowledge-driven nature of financial services.

China Development Financial's technology and IT infrastructure costs are significant, reflecting the need for robust digital capabilities. Substantial investments are poured into maintaining and upgrading IT systems, cybersecurity measures, digital platforms, and data analytics. These expenses cover software licenses, hardware, network infrastructure, and essential IT personnel, all crucial for efficient operations and driving digital innovation in the financial sector.

Operating within China's dynamic financial sector necessitates substantial investment in regulatory compliance and legal services. These costs are driven by adherence to evolving domestic regulations and international financial standards, ensuring robust governance and risk management.

In 2024, financial institutions in China are expected to allocate a significant portion of their operating budget to compliance, with some estimates suggesting these expenses could reach 5-10% of revenue for major players, particularly those with international operations. This includes fees for legal counsel, external auditors, and specialized compliance software to navigate complex frameworks like those governing data privacy and anti-money laundering.

Marketing and Business Development Expenses

Marketing and business development are significant cost drivers for China Development Financial. These expenses encompass a broad range of activities aimed at increasing market presence and acquiring new clients.

Key outlays include substantial investments in advertising across various media platforms, sponsoring industry events to enhance brand visibility, and participating in trade shows to connect with potential customers. The cost of maintaining a robust sales force and a dedicated business development team, responsible for client outreach and relationship management, also forms a considerable part of this budget.

- Advertising and Promotion: Costs related to digital advertising, print media, and public relations campaigns to build brand awareness.

- Client Acquisition Costs: Expenses incurred in attracting and onboarding new clients, including sales commissions and initial outreach efforts.

- Event Participation: Budget allocated for sponsoring and exhibiting at industry conferences and networking events.

- Sales and Relationship Management: Salaries, training, and operational costs for the teams directly involved in client engagement and business growth.

Office and Operational Expenses

Office and operational expenses are a significant component of China Development Financial's cost structure. These encompass the costs associated with maintaining physical infrastructure like offices and branches, which are essential for client interaction and service delivery across their diverse financial services. In 2024, managing these overheads efficiently is paramount for sustaining profitability in a competitive financial landscape.

Key elements within this category include:

- Rent and Property Costs: Securing prime locations for branches and corporate offices across major Chinese cities incurs substantial rental expenses.

- Utilities and Maintenance: Ongoing costs for electricity, water, internet, and general upkeep of facilities contribute to operational overheads.

- Administrative Support: Salaries for administrative staff, IT support, and other back-office functions are critical for smooth operations.

- General Operational Overheads: This includes expenses like insurance, stationery, and other miscellaneous costs necessary for running a large financial holding company.

For instance, a large financial institution might allocate a significant portion of its budget to maintaining a robust network of physical branches, a strategy that, while important for customer reach, directly impacts these operational expenses. Efficiently controlling these costs, perhaps through digital transformation initiatives that reduce the need for extensive physical footprints, is a key driver for enhancing the company's bottom line.

China Development Financial's cost structure is heavily influenced by its substantial investments in human capital, encompassing employee salaries and benefits for its team of financial experts and support staff. Furthermore, significant expenditure is dedicated to maintaining and upgrading its robust IT infrastructure, cybersecurity measures, and digital platforms, essential for innovation and efficient operations in the financial sector.

The company also incurs considerable costs related to regulatory compliance and legal services, driven by the need to adhere to China's evolving financial regulations and international standards. Marketing and business development activities, including advertising, client acquisition, and event participation, represent another key cost driver, aimed at expanding market presence and client base.

Finally, office and operational expenses, such as rent for prime locations, utilities, maintenance, and administrative support, form a significant part of the cost base, underscoring the importance of efficient overhead management.

| Cost Category | Key Components | Estimated 2024 Impact |

|---|---|---|

| Personnel Costs | Salaries, bonuses, benefits for financial professionals and administrative staff | Likely the largest single cost component, reflecting expertise-driven industry |

| Technology & IT Infrastructure | Software licenses, hardware, network, cybersecurity, data analytics platforms | Substantial investment to support digital transformation and operational efficiency |

| Regulatory Compliance & Legal | Legal counsel, external audits, compliance software, adherence to evolving regulations | Estimated 5-10% of revenue for major financial players in China |

| Marketing & Business Development | Advertising, client acquisition, sales commissions, event sponsorship, relationship management | Crucial for market penetration and client growth initiatives |

| Office & Operational Expenses | Rent, utilities, maintenance, administrative support, insurance, general overheads | Significant due to physical branch network and corporate office presence |

Revenue Streams

China Development Financial's corporate banking segment thrives on a dual revenue engine: interest income from loans and a diverse array of service fees. This includes income generated from providing essential financial services like trade finance, which facilitates international commerce for businesses, and sophisticated cash management solutions designed to optimize corporate liquidity. For 2024, the bank reported substantial interest income from its corporate lending portfolio, reflecting robust demand for capital among its client base.

China Development Financial earns revenue through commissions generated from clients' securities trading activities. This also includes fees for investment banking services, such as underwriting new stock or bond issuances and advising on mergers and acquisitions. For instance, in 2023, the global investment banking sector saw significant activity, with fees from M&A advisory alone reaching hundreds of billions of dollars, directly impacting firms like China Development Financial.

Private equity and venture capital arms of China Development Financial generate significant revenue through successful investment exits. These include capital gains realized from selling portfolio companies, as well as dividends received during the holding period. For instance, in 2024, the Asia-Pacific private equity market saw robust exit activity, with many deals achieving multiples well above initial investment, directly contributing to these revenue streams.

Life Insurance Premiums and Investment Income

China Development Financial's revenue from life insurance premiums is a core component, reflecting the trust policyholders place in their diverse range of life insurance products. This stream also benefits significantly from investment income, where the company strategically manages and invests the accumulated policyholder funds to generate returns.

In 2024, the life insurance sector in Taiwan, where China Development Financial operates, continued to show resilience. For instance, the total premium income for the life insurance industry in Taiwan reached approximately NT$2.8 trillion (around US$90 billion) in the first eleven months of 2024, demonstrating the substantial market for these products. China Development Financial's ability to generate consistent investment income from these premiums is crucial for its profitability and growth.

- Premiums from Life Insurance Products: Revenue generated from selling various life insurance policies, including savings-linked, protection-focused, and annuity products.

- Investment Income: Earnings derived from the strategic investment of policyholder premiums in a diversified portfolio of assets, such as bonds, equities, and real estate.

- Market Performance (2024): The life insurance industry in Taiwan saw continued premium growth, with total premiums collected by the industry reaching significant levels, underscoring the demand for these financial services.

Asset Management and Advisory Fees

China Development Financial earns revenue through asset management and advisory services. This involves managing investment portfolios for a range of clients, from large institutions like pension funds to individual high-net-worth clients. These services are crucial for generating consistent income.

The primary fee structure is based on a percentage of assets under management (AUM). This means as the value of the assets managed grows, so does the revenue generated from these fees. For instance, in 2024, many leading asset managers reported steady AUM growth, directly translating to higher fee income.

Beyond a percentage of AUM, performance-based fees are also a significant revenue driver. These fees are earned when the managed assets outperform a specific benchmark, incentivizing fund managers to achieve strong investment results. This dual approach allows China Development Financial to capture value from both asset growth and investment success.

- Asset Management Fees: Typically a percentage of Assets Under Management (AUM).

- Advisory Fees: Charged for providing financial guidance and strategic planning.

- Performance Fees: Earned when investment performance exceeds agreed-upon benchmarks.

- Client Segments: Revenue generated from institutional investors, pension funds, and high-net-worth individuals.

China Development Financial's revenue streams are diverse, encompassing corporate banking, investment banking, private equity, life insurance, and asset management.

In 2024, the bank's corporate banking segment benefited from strong interest income on loans and fees from services like trade finance and cash management.

The investment banking division generated fees from underwriting and M&A advisory, mirroring global trends where such fees reached hundreds of billions in 2023.

Private equity activities saw revenue from capital gains on successful exits, with Asia-Pacific markets showing robust deal activity in 2024.

Life insurance premiums and investment income from these premiums are key, with Taiwan's life insurance industry collecting approximately NT$2.8 trillion in premiums in the first eleven months of 2024.

Asset management fees, based on Assets Under Management (AUM) and performance, also contribute significantly, with many managers reporting steady AUM growth in 2024.

| Revenue Stream | Key Activities | 2024 Data/Trend |

| Corporate Banking | Interest income from loans, trade finance, cash management | Robust demand for capital, substantial interest income reported |

| Investment Banking | Underwriting, M&A advisory | Reflects global sector activity; fees substantial |

| Private Equity | Investment exits, capital gains | Strong exit activity in Asia-Pacific markets |

| Life Insurance | Premiums from policies, investment income | Taiwan industry premiums ~NT$2.8 trillion (Jan-Nov 2024) |

| Asset Management | AUM fees, advisory fees, performance fees | Steady AUM growth reported by leading managers |

Business Model Canvas Data Sources

The China Development Financial Business Model Canvas is built using a blend of official government reports, financial market data, and expert analyses of the Chinese economic landscape. These sources provide a comprehensive view of the sector's dynamics and opportunities.