China Development Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Development Financial Bundle

China Development Financial operates within a dynamic landscape shaped by intense competition and evolving market forces. Understanding the power of buyers, the threat of new entrants, and the influence of suppliers is crucial for navigating its strategic path.

The complete report reveals the real forces shaping China Development Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Development Financial (CDF) benefits from a wide array of capital sources. Its banking and insurance operations draw from a stable base of retail depositors, a key advantage. For its private equity and venture capital segments, CDF taps into institutional investors.

The substantial volume of domestic deposits in China, which reached approximately RMB 120 trillion by the end of 2023, provides a bedrock of funding stability for CDF’s banking and insurance businesses. This diversification helps to mitigate the bargaining power of individual depositors.

However, CDF's engagement with international capital markets for specific investment funds can introduce vulnerabilities. Fluctuations in global liquidity and interest rates, as seen in the Federal Reserve's rate hikes throughout 2022-2023, can amplify the influence of these international capital providers.

Suppliers of advanced technology, crucial for core banking, trading, and cybersecurity, currently possess moderate bargaining power. While these solutions are specialized, the market generally features several viable vendors, preventing any single supplier from dominating. China Development Financial’s strategic imperative to embrace digital transformation, a trend amplified across Taiwan’s financial landscape, necessitates ongoing investment in leading-edge technology. For instance, by the end of 2023, the Taiwanese fintech sector saw significant growth, with AI adoption in financial services projected to increase by 40% by 2025, underscoring the demand for specialized tech partners.

The availability of highly skilled professionals in finance, technology, and risk management is a critical factor in the bargaining power of suppliers. Taiwan boasts a developed talent pool, but specialized expertise in cutting-edge fields like advanced analytics, artificial intelligence (AI), and international investment banking can be limited. This scarcity means financial institutions often face intense competition for these sought-after individuals.

The competition for top talent significantly amplifies the bargaining power of these human capital suppliers. For instance, in 2023, the average salary for a data scientist in Taiwan, a role demanding advanced analytics skills, saw an increase, reflecting the high demand and limited supply. This trend is expected to continue as financial firms increasingly rely on technology and data-driven strategies.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers, including legal and auditing firms, wield considerable bargaining power within Taiwan's financial sector. This is due to the stringent regulatory landscape and the constant evolution of compliance standards, such as those for Anti-Money Laundering (AML) and the burgeoning fintech sector. The necessity for specialized expertise in navigating these complex requirements ensures that these service providers are indispensable.

The demand for these crucial services is amplified by Taiwan's commitment to maintaining a robust and secure financial system. For instance, in 2023, the Financial Supervisory Commission (FSC) continued to implement new regulations and oversight measures, increasing the reliance of financial institutions on external legal and compliance consultants. This dependence inherently strengthens the negotiating position of these suppliers.

- High Demand for Specialized Expertise: Financial institutions require in-depth knowledge of Taiwan's specific legal and regulatory frameworks, which only specialized firms possess.

- Increasing Regulatory Complexity: Ongoing reforms in areas like AML, data privacy, and fintech introduce new compliance challenges, escalating the need for expert guidance.

- Switching Costs: The process of changing legal or auditing partners can be time-consuming and costly, creating a barrier for financial institutions seeking to switch suppliers.

- Concentration of Expertise: A limited number of highly reputable firms dominate the specialized legal and compliance advisory market, further concentrating bargaining power among suppliers.

Information and Data Providers

The bargaining power of information and data providers for China Development Financial is a significant factor. Access to accurate and timely market data, economic forecasts, and credit ratings is absolutely crucial for their operations and strategic decision-making. Key data providers, especially those holding proprietary information or enjoying a dominant market position, can wield considerable influence.

The quality and comprehensiveness of the data directly impact China Development Financial's investment strategies and risk management capabilities. For instance, a sudden increase in subscription fees by a major financial data terminal provider, like Bloomberg or Refinitiv, could significantly impact operational costs without immediate viable alternatives for accessing comparable real-time global market intelligence. In 2024, the global financial data market was valued at over $30 billion, highlighting the scale and importance of these providers.

- High reliance on specialized data: Financial institutions often depend on niche data sets or analytics that only a few providers offer.

- Proprietary data and algorithms: Providers with unique data sources or sophisticated analytical tools have a distinct advantage.

- Switching costs: Migrating data systems and retraining personnel can be expensive and time-consuming, reinforcing provider loyalty.

- Market concentration: A limited number of major players in certain data segments can lead to less competition and greater supplier power.

Suppliers of specialized technology, essential for CDF's digital transformation, hold moderate bargaining power. While these solutions are critical, the market offers several vendors, preventing any single supplier from dominating. Taiwan's fintech sector saw considerable growth in 2023, with AI adoption in financial services projected to rise by 40% by 2025, indicating strong demand for tech partners.

The bargaining power of human capital suppliers is amplified by the scarcity of specialized skills in areas like AI and advanced analytics. In 2023, the average salary for a data scientist in Taiwan increased, reflecting high demand. Regulatory and compliance service providers, such as legal and auditing firms, also possess significant power due to Taiwan's complex regulatory environment and the continuous evolution of standards like AML.

What is included in the product

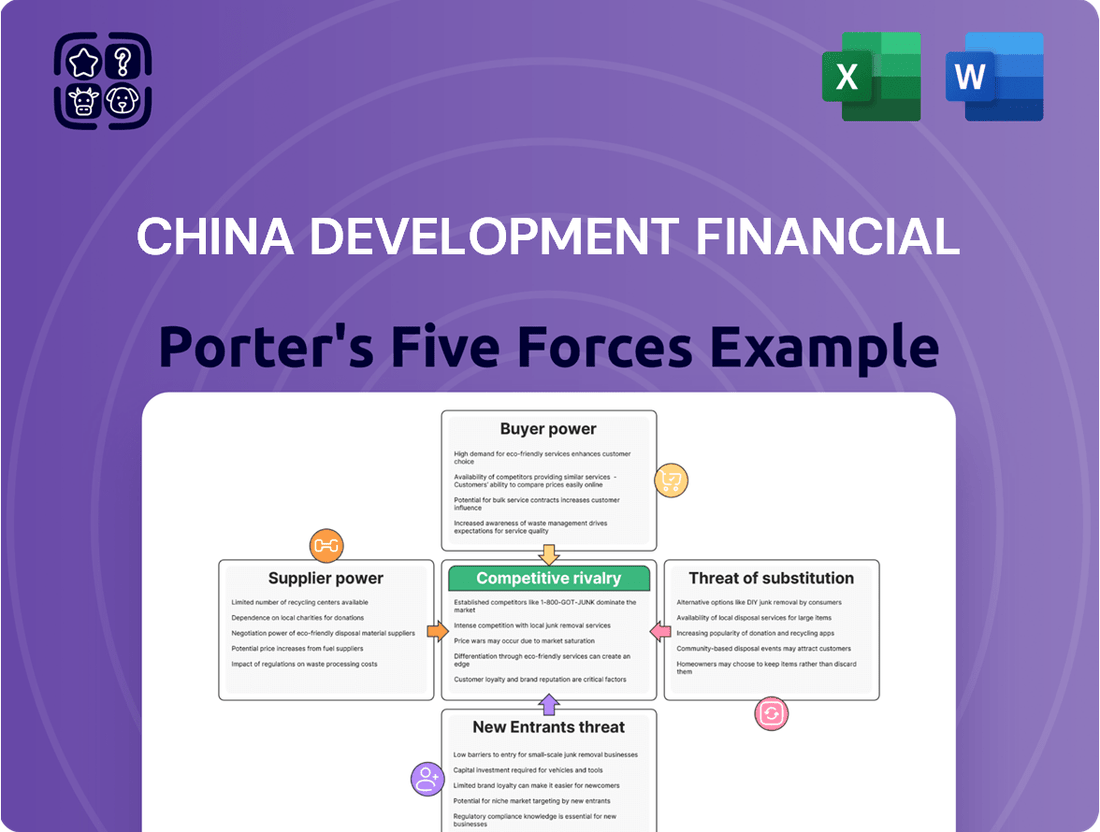

This analysis dissects the competitive forces impacting China Development Financial, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting China's development finance sector.

Customers Bargaining Power

Taiwan's financial services sector is notably fragmented, presenting customers with a broad spectrum of options across banking, securities, and insurance. This extensive choice, especially in retail banking, means institutions like China Development Financial face significant pressure to offer compelling pricing and enhanced services to retain clients.

The competitive landscape in Taiwan's banking industry, for instance, is fierce, with numerous domestic players vying for market share. This environment directly translates to increased bargaining power for customers, who can readily switch providers for better terms or service quality, particularly with easily transferable retail financial products.

Customers are increasingly savvy, armed with more information than ever before thanks to the digital revolution. This heightened financial literacy means they can effortlessly compare offerings from various financial institutions, putting them in a stronger position to negotiate.

Consider Taiwan, where mobile payment penetration reached an impressive 89.1% in 2023, according to the National Development Council. This widespread adoption, alongside a significant increase in digital savings accounts, demonstrates a clear customer comfort and preference for digital financial services. This transparency and ease of access directly translate into customers demanding better terms and more tailored financial products.

For many standard financial products offered by China Development Financial, such as basic banking services, brokerage accounts, and certain types of insurance, the costs associated with switching to a competitor are quite low. This lack of significant switching costs grants customers considerable leverage, allowing them to easily shift their business to providers offering more appealing interest rates, reduced fees, or superior digital platforms. In 2023, the digital banking adoption rate in Taiwan reached over 70%, indicating a customer preference for convenient and accessible financial services, a trend China Development Financial must actively address.

Concentration of Large Corporate and Institutional Clients

While individual retail customers typically have limited bargaining power, China Development Financial's large corporate and institutional clients wield considerable influence. These sophisticated entities, often seeking tailored financial solutions such as corporate banking, private equity investments, or substantial asset management services, can negotiate more favorable terms. Their leverage stems from the sheer volume of business they represent and their strategic importance to the financial institution.

For instance, in 2024, major institutional investors and large corporations often accounted for a significant portion of a financial institution's revenue. Their ability to shift substantial assets or withdraw lucrative services means they can demand competitive pricing, customized product offerings, and preferential service levels. This concentration of powerful clients necessitates a strategic approach to client relationship management and service delivery to maintain profitability and market share.

- Concentrated Client Base: A few large corporate and institutional clients can represent a disproportionately large share of revenue.

- Negotiating Power: These clients can leverage their volume and strategic importance to secure better terms.

- Demand for Bespoke Solutions: Complex financial needs, like specialized corporate banking or large-scale asset management, increase client bargaining power.

- Impact on Profitability: Favorable terms for key clients can impact overall profit margins if not managed effectively.

Impact of Financial Inclusion Initiatives

Government initiatives promoting financial inclusion in China, such as the expansion of digital payment platforms and enhanced consumer protection regulations, have indirectly bolstered customer bargaining power. For instance, by mid-2024, over 1.3 billion individuals in China had access to mobile banking services, a significant increase that provides consumers with more options and greater leverage when choosing financial providers.

The focus on meeting the needs of diverse societal groups, including rural populations and low-income households, ensures that financial services become more accessible and equitable. This broader access empowers a larger customer base to compare offerings and demand better terms, thereby increasing their collective bargaining power within the financial sector.

- Increased Digital Penetration: By the end of 2023, China's digital payment user base exceeded 1.1 billion, giving customers unprecedented ease in switching providers.

- Enhanced Consumer Protection: Regulatory bodies have strengthened oversight, leading to a more transparent market where customer rights are better protected, facilitating informed decision-making.

- Diversification of Services: The proliferation of fintech solutions has introduced a wider array of financial products, from micro-loans to investment platforms, giving customers more choices and thus more power.

- Focus on Financial Literacy: Government-backed programs aimed at improving financial literacy empower more individuals to understand and compare financial products effectively.

Customers in Taiwan's financial sector hold significant bargaining power due to the market's fragmentation and the digital revolution. This allows them to easily compare offerings and switch providers for better terms, especially with low switching costs for standard products. For instance, Taiwan's mobile payment penetration reached 89.1% in 2023, highlighting customer comfort with digital platforms and their demand for better digital services.

While individual retail customers have less sway, China Development Financial's large corporate and institutional clients possess considerable leverage. These clients, often representing substantial revenue streams, can negotiate favorable pricing and customized solutions, as seen in 2024 where major institutional investors heavily influenced terms due to the volume of business they control.

| Client Type | Bargaining Power Factor | Impact on Financial Institutions |

|---|---|---|

| Retail Customers | High due to market fragmentation and digital access | Pressure on pricing and service quality |

| Corporate/Institutional Clients | Very high due to volume and strategic importance | Ability to negotiate bespoke terms and preferential pricing |

Preview the Actual Deliverable

China Development Financial Porter's Five Forces Analysis

This preview showcases the complete China Development Financial Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

Taiwan's financial services sector is notably fragmented, featuring a substantial number of participants. As of recent data, this includes 38 domestic banks, 133 securities and futures brokers, and 51 insurance companies, many of which are consolidated under financial holding companies. This density, especially within the banking segment, fuels aggressive competition.

The sheer volume of players in Taiwan's financial market creates an intensely competitive environment. This overcrowding directly contributes to sustained pressure on profitability, often resulting in compressed profit margins, such as the observed low net interest margins in the banking sector. China Development Financial, therefore, navigates a landscape where differentiation and efficiency are paramount for success.

Financial institutions across Taiwan are aggressively investing in digital transformation, with a significant focus on fintech, artificial intelligence, and digital payment solutions. This surge in innovation means China Development Financial must constantly enhance its digital services to remain competitive. For instance, in 2023, Taiwanese fintech companies saw substantial funding rounds, indicating a rapid advancement in digital capabilities that directly pressures traditional players.

Competitors within China's financial sector are aggressively pursuing product diversification and innovation, a trend that directly impacts China Development Financial. We're seeing a continuous stream of new Exchange Traded Funds (ETFs) entering the market, alongside significant expansion in high-asset services offered by major banks. This dynamic landscape necessitates that China Development Financial consistently enhances its offerings and develops integrated financial solutions to stay competitive and capture new clientele.

Consolidation Efforts and Strategic Alliances

While government initiatives to foster consolidation within China's financial sector have yielded modest results, the highly fragmented nature of the market presents ongoing opportunities for mergers and acquisitions. These strategic moves are anticipated as key avenues for growth and enhanced operational efficiency.

Financial holding companies, including China Development Financial, are likely to pursue strategic alliances and partnerships. Such collaborations aim to broaden market access and bolster core competencies, thereby intensifying competitive pressures within specific market segments.

- Market Fragmentation: China's financial services landscape remains characterized by a large number of smaller players, creating a fertile ground for consolidation.

- Government Influence: While direct consolidation mandates have seen limited success, regulatory bodies continue to encourage greater efficiency and stability through various policy levers.

- Strategic Imperative: For entities like China Development Financial, M&A and alliances are critical for achieving economies of scale and expanding service offerings in a dynamic market.

- Competitive Intensification: These strategic maneuvers are expected to sharpen rivalry, particularly in areas like digital banking and wealth management, as firms seek to capture market share.

Influence of Systemically Important Banks

China Development Financial faces intense rivalry from Domestic Systemically Important Banks (D-SIBs). These large institutions, subject to more stringent capital requirements, possess significant scale and resilience advantages. For instance, as of early 2024, major Chinese banks like ICBC and CCB, designated as D-SIBs, maintain considerably higher capital adequacy ratios than smaller competitors, allowing them to absorb greater risk and potentially offer more competitive pricing.

These established giants can leverage their size to influence market dynamics, impacting interest rates and product offerings across the financial sector. China Development Financial must therefore develop strategies to effectively compete with these dominant players, potentially by focusing on niche markets or specialized services where scale is less of a determinant factor.

- D-SIBs possess inherent advantages in scale and resilience due to stricter capital requirements.

- Major Chinese D-SIBs, such as ICBC and CCB, had higher capital adequacy ratios in early 2024 compared to smaller institutions.

- These larger banks can influence pricing and market dynamics, posing a competitive challenge.

- China Development Financial needs to differentiate itself to compete effectively against these established entities.

China Development Financial operates in a market characterized by a high number of domestic banks, securities firms, and insurance companies, leading to intense competition. This fragmentation, particularly evident in Taiwan's financial sector, where 38 domestic banks and 133 securities and futures brokers operate, forces companies like China Development Financial to focus on efficiency and differentiation to maintain profitability.

The competitive landscape is further intensified by aggressive digital transformation efforts across the industry, with a strong emphasis on fintech and AI. For instance, significant funding rounds for Taiwanese fintech companies in 2023 highlight the rapid pace of innovation, compelling China Development Financial to continuously upgrade its digital services to stay relevant.

Moreover, the presence of Domestic Systemically Important Banks (D-SIBs) like ICBC and CCB, which held higher capital adequacy ratios in early 2024, presents a significant challenge due to their scale and resilience. These larger entities can leverage their size to influence market pricing and product offerings, requiring China Development Financial to adopt strategic approaches, potentially focusing on niche markets or specialized services.

| Competitor Type | Number of Entities (Taiwan, approx.) | Key Competitive Factor | Impact on China Development Financial |

|---|---|---|---|

| Domestic Banks | 38 | Scale, Pricing Power | Pressure on margins, need for differentiation |

| Securities & Futures Brokers | 133 | Product Innovation, Digital Services | Need for advanced offerings, investment in fintech |

| Insurance Companies | 51 | Product Diversification, Customer Reach | Competition for customer loyalty, need for integrated solutions |

| D-SIBs (e.g., ICBC, CCB) | Major Institutions | Capital Strength, Market Influence | Challenge in pricing and market share, strategic positioning required |

SSubstitutes Threaten

The burgeoning fintech sector, particularly digital payment platforms and mobile wallets, presents a substantial threat to traditional financial institutions like China Development Financial. Taiwan's government has actively promoted non-cash transactions, aiming for a significant increase in mobile payment adoption. For instance, by the end of 2023, Taiwan's Financial Supervisory Commission reported that the total value of electronic payments processed reached NT$3.9 trillion, a 20% increase year-on-year, highlighting the rapid shift away from cash.

Alternative lending, encompassing peer-to-peer (P2P) platforms and other non-bank financing, presents a significant threat to traditional financial institutions like China Development Financial in Taiwan. This sector has seen robust growth, with the Taiwanese P2P lending market projected to reach approximately NT$20 billion (around USD 650 million) by the end of 2024, offering businesses and individuals faster and often more flexible access to capital. These platforms directly compete with China Development Financial's core lending services, potentially siphoning off market share and impacting profitability.

Customers are increasingly bypassing traditional securities brokerages by opting for direct online investment platforms or investing directly in various assets, such as cryptocurrencies or peer-to-peer lending. This shift is fueled by greater accessibility and lower costs. For instance, the global robo-advisory market, a form of direct investment, was projected to reach over $3.2 trillion by 2024, demonstrating a significant move away from traditional advisory services.

The expansion of the investor base, particularly among younger demographics, and the growing availability of fractional share trading further enhance the appeal of direct investment. In 2024, platforms offering fractional shares saw a surge in new accounts, with some reporting double-digit percentage growth year-over-year in this segment. This trend directly challenges the necessity of traditional brokerage services, potentially impacting revenue streams for subsidiaries of firms like China Development Financial.

Insurtech and Direct-to-Consumer Insurance Models

Insurtech and direct-to-consumer (DTC) models present a significant threat of substitution for China Development Financial. These platforms enable consumers to acquire insurance policies online, often with enhanced convenience and more attractive pricing, directly challenging traditional distribution channels.

This shift bypasses intermediaries like agents and brokers, which are crucial for China Development Financial's existing life insurance business. For instance, by mid-2024, the global insurtech market was projected to reach over $100 billion, indicating substantial consumer adoption of these digital alternatives.

- Digital-First Platforms: Insurtechs like ZhongAn Insurance in China have already captured significant market share by offering specialized, digitally delivered products.

- Price Sensitivity: DTC models often leverage lower overheads to offer more competitive premiums, directly impacting the pricing strategies of established players.

- Customer Experience: The streamlined, user-friendly experience offered by many insurtechs appeals to a growing segment of digitally native consumers, potentially drawing them away from traditional insurers.

- Product Innovation: Insurtechs are also quicker to innovate with niche products tailored to specific digital needs, creating alternative coverage options that may not be readily available through traditional channels.

Emerging Virtual Assets and Decentralized Finance (DeFi)

Emerging virtual assets and decentralized finance (DeFi) pose a potential threat by offering alternative financial services outside traditional channels. While still developing and subject to evolving regulations, these platforms can attract investors looking for novel instruments. For instance, by mid-2024, the global DeFi market capitalization has seen significant fluctuations, with some estimates placing it in the hundreds of billions of dollars, indicating a substantial, albeit volatile, alternative financial ecosystem.

The Financial Supervisory Commission's (FSC) engagement with regulating Virtual Asset Service Providers (VASPs) underscores the acknowledgment of this nascent substitution threat. This regulatory attention suggests that policymakers are considering how these new financial technologies might impact established financial institutions.

Tech-savvy investors, in particular, may be drawn to the innovative nature and potential high returns offered by virtual assets and DeFi protocols, representing a segment of the market that could shift away from traditional banking and investment services.

- DeFi Market Growth: While precise figures vary, DeFi protocols managed billions in total value locked (TVL) throughout 2024, showcasing a significant alternative financial infrastructure.

- Regulatory Scrutiny: Increased regulatory focus on VASPs globally in 2024 highlights the growing recognition of virtual assets as a potential substitute for traditional financial products.

- Investor Interest: Surveys in 2024 indicated a sustained, albeit cautious, interest from retail and institutional investors in exploring virtual assets as part of diversified portfolios.

The rise of digital payment platforms and mobile wallets presents a direct substitute for traditional banking services, impacting transaction fees and customer loyalty for institutions like China Development Financial. Taiwan's push for a cashless society is evident, with electronic payments reaching NT$3.9 trillion by the end of 2023, a 20% year-on-year increase.

Alternative lending platforms, including P2P services, offer faster and more flexible capital access, directly competing with China Development Financial's lending products. The Taiwanese P2P market is projected to reach NT$20 billion by the end of 2024, indicating a growing preference for these non-traditional financing options.

Direct online investment platforms and the growing interest in virtual assets and DeFi offer alternatives to traditional brokerage and banking services. The global robo-advisory market, expected to exceed $3.2 trillion by 2024, signifies a substantial shift towards self-directed and technology-driven financial management.

| Substitute Category | Key Characteristics | Impact on China Development Financial | 2024 Market Indicator |

| Digital Payments & Mobile Wallets | Convenience, speed, lower transaction costs | Reduced transaction revenue, potential disintermediation | Taiwan electronic payments: NT$3.9 trillion (end 2023) |

| Alternative Lending (P2P) | Faster approval, flexible terms, direct access to capital | Loss of lending market share, reduced interest income | Taiwan P2P market projection: NT$20 billion (end 2024) |

| Direct Investment Platforms & Robo-Advisors | Accessibility, lower fees, self-service | Decreased brokerage and advisory fees, client attrition | Global robo-advisory market projection: >$3.2 trillion (2024) |

| Virtual Assets & DeFi | Novelty, potential high returns, decentralized control | Diversion of investor capital, regulatory uncertainty | DeFi market capitalization: Billions of USD (mid-2024) |

Entrants Threaten

The financial services sector in Taiwan presents a formidable challenge for new entrants due to exceptionally high regulatory hurdles and substantial capital demands. Establishing a commercial bank, for example, necessitates a minimum paid-in capital of NTD10 billion, a significant sum that effectively discourages many aspiring players.

In the financial services industry, particularly in China, building trust and brand recognition is paramount. Customers entrust their money and financial futures to institutions, making reliability and security non-negotiable. Established entities like China Development Financial, with decades of operation, have cultivated strong reputations and loyal customer bases, creating a significant barrier for newcomers.

New entrants into China's financial sector face a steep uphill battle to gain consumer confidence. For instance, in 2024, while digital banking adoption is soaring, traditional banks still hold a substantial majority of assets under management. This indicates that despite technological advancements, legacy trust remains a powerful differentiator, requiring new players to invest heavily in marketing and transparent operations to even begin to chip away at established brand loyalty.

Existing financial holding companies in China, like CITIC Securities and China International Capital Corporation (CICC), already enjoy substantial economies of scale and scope. For instance, in 2024, these firms managed assets in the trillions of RMB, enabling them to spread fixed costs across a vast array of services, from investment banking to wealth management. This broad operational infrastructure significantly lowers their average cost per transaction and service offering.

New entrants face a considerable hurdle in matching these cost efficiencies. To achieve similar economies of scale, a new player would require massive upfront capital investment to build a comparable network of branches, technology platforms, and a diverse product portfolio. Without this scale, new entrants will likely operate at a higher cost base, making it difficult to compete on price or offer the same breadth of services as established players.

Approval of Digital-Only Banks

The threat of new entrants in China's financial sector is being reshaped by regulatory shifts, particularly the approval of digital-only banks. While traditional banking faces high capital and regulatory hurdles, the Financial Supervisory Commission's (FSC) green light for three online-only banks signals a potential opening for digitally-native players. These new entrants, unburdened by extensive physical infrastructure, can leverage lower operational costs to offer competitive digital services, thereby increasing competitive pressure.

These digital-only banks, such as WeBank and MYbank, have already demonstrated their disruptive potential. For instance, WeBank reported over 300 million individual customers by the end of 2023, showcasing rapid customer acquisition through digital channels. Their agility allows them to quickly adapt to market demands and introduce innovative products, potentially eroding market share from incumbent institutions that are slower to embrace digital transformation.

- Regulatory Approval: The FSC's decision to permit online-only banks lowers the entry barrier for digital-first financial institutions.

- Lower Operational Costs: Digital banks typically have significantly lower overheads compared to traditional brick-and-mortar banks, enabling more competitive pricing and service offerings.

- Agility and Innovation: These new entrants can rapidly deploy new technologies and services, challenging established players with their innovative approaches.

- Customer Acquisition: By focusing on digital channels and user experience, online-only banks can attract a large customer base, as evidenced by the millions of users acquired by early entrants.

Fintech Sandbox and Innovation Policies

China's Financial Supervisory Commission (FSC) has actively fostered innovation through its fintech sandbox regime and updated guidelines. This strategic move encourages partnerships between established financial institutions and agile fintech companies, effectively lowering the traditional barriers to entry.

These policies are designed to allow specialized fintech startups to pilot and launch novel financial products and services in a controlled environment. For instance, by mid-2024, over 100 projects had successfully completed testing within various regulatory sandboxes globally, demonstrating the potential for rapid market penetration by innovative players.

- Regulatory Support for Fintech: The FSC's sandbox and innovation policies create a more accessible pathway for new fintech entrants.

- Reduced Barriers to Entry: Lowered regulatory hurdles enable startups to test and deploy new financial technologies and services.

- Increased Competition: This environment can lead to a surge in specialized fintech firms challenging incumbents with innovative offerings.

- Market Disruption Potential: The ability for new players to quickly bring novel solutions to market poses a significant threat to existing financial institutions.

The threat of new entrants in China's financial sector is evolving, with digital-only banks and fintech startups gaining traction. While traditional institutions benefit from established trust and economies of scale, regulatory support for innovation is lowering barriers for agile, digitally-native players. These new entrants can leverage lower operational costs and rapid technological adoption to challenge incumbents.

| New Entrant Type | Key Advantage | 2024 Market Impact Indicator |

|---|---|---|

| Digital-Only Banks | Lower operational costs, rapid customer acquisition | WeBank: Over 300 million users by end of 2023 |

| Fintech Startups | Agility, innovative product deployment | Over 100 projects tested in global regulatory sandboxes by mid-2024 |

| Traditional Banks | Established trust, substantial capital, economies of scale | Trillions of RMB in assets under management by major players |

Porter's Five Forces Analysis Data Sources

Our China Development Financial Porter's Five Forces analysis is built upon a robust foundation of data, including official government reports, financial statements from listed companies, and comprehensive industry research from reputable consultancies.