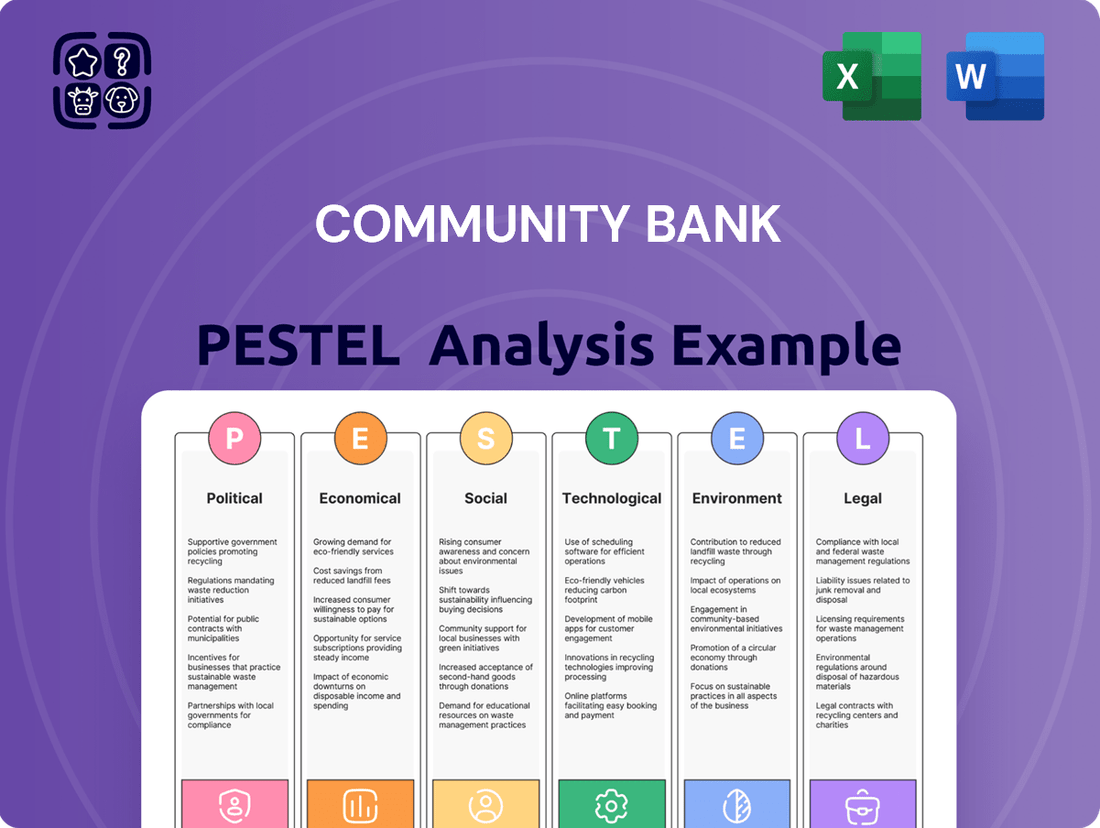

Community Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Community Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Community Bank's future. Our expertly crafted PESTLE analysis provides the deep-dive insights you need to anticipate challenges and capitalize on opportunities. Download the full version now to gain a strategic advantage and make informed decisions.

Political factors

The government's regulatory stance significantly shapes the operational landscape for community banks. A shift towards deregulation, as seen in some discussions around financial sector reforms in 2024, could potentially ease compliance burdens and foster expansion for institutions like Community Bank System, Inc. Conversely, a tightening of oversight, perhaps in response to emerging economic conditions or concerns about financial stability, might necessitate increased investment in compliance infrastructure and could constrain certain growth strategies.

Central bank monetary policy shifts significantly influence Community Bank System's financial performance. For instance, the Federal Reserve's interest rate hikes in 2022-2023, with the federal funds rate reaching a range of 5.25%-5.50% by July 2023, directly impacted the bank's net interest margin. While this generally boosts profitability on loans, it also presents a risk of dampening loan origination volume as borrowing becomes more expensive for customers.

Government fiscal policies, particularly taxation and public spending, significantly shape the economic landscape for Community Bank System, Inc. For instance, in 2024, many local governments are increasing infrastructure spending, which can stimulate economic activity and create demand for construction loans and business financing.

Tax incentives aimed at encouraging business investment or homeownership directly impact consumer confidence and local business growth. A reduction in local property taxes, for example, could free up disposable income for consumers, leading to increased deposits and loan demand at Community Bank.

Political Stability and Elections

Political stability is a cornerstone for community banks, directly influencing their operational landscape and growth prospects. An unpredictable political climate, often amplified by upcoming elections, introduces significant uncertainty regarding future economic policies, interest rate environments, and regulatory frameworks. For instance, the lead-up to the 2024 US presidential election saw discussions around potential shifts in banking regulations, which could affect capital requirements and compliance costs for institutions of all sizes.

Conversely, a stable political environment fosters predictability, allowing banks to plan with greater confidence. Policy continuity reduces the risk of sudden, disruptive changes to the bank's operational model or strategic initiatives. Consider the impact of consistent fiscal policies on loan demand and the overall health of the local economy, which directly affects a community bank's lending portfolio and profitability.

- 2024 US Presidential Election: Heightened political discourse around economic policy and financial regulation created a degree of uncertainty for the banking sector throughout the year.

- Regulatory Continuity: Past administrations have often maintained a degree of regulatory continuity, providing a predictable operating environment for community banks.

- Local Governance Impact: Changes in local political leadership can also influence community banks through zoning laws, local tax policies, and support for economic development initiatives.

International Trade Agreements and Tariffs

While Community Bank System, Inc. operates predominantly within the United States, shifts in international trade agreements and tariff policies can still ripple through its customer base. For instance, increased tariffs on imported goods could make it more expensive for local businesses that rely on international supply chains, potentially impacting their profitability and loan repayment capacity. Conversely, new trade agreements that open up export markets could boost the financial health of businesses in the bank's service areas, leading to increased demand for credit and investment services. In 2024, ongoing discussions around trade relations with major partners, such as potential adjustments to existing agreements or the imposition of new tariffs, present a dynamic landscape that the bank must monitor.

The financial health of local businesses, a key focus for Community Bank, is directly tied to these international trade dynamics. For example, a local manufacturing firm that exports goods might see its revenue grow if a new trade pact reduces barriers in a key market, thereby improving its credit profile and borrowing power. Conversely, a business that imports components could face higher costs if tariffs are raised, potentially straining its cash flow and increasing its risk profile for the bank. The U.S. trade deficit, which stood at approximately $773.4 billion in the first ten months of 2024, highlights the significant role international trade plays in the broader economic environment that affects Community Bank's clients.

- Impact on Local Businesses: Tariffs can increase costs for businesses importing raw materials or finished goods, potentially reducing their profit margins and ability to service debt.

- Export Opportunities: New trade agreements can open up foreign markets for local businesses, leading to revenue growth and increased demand for financing.

- Economic Sensitivity: The bank's loan portfolio can be indirectly affected by the success or struggles of local businesses navigating these international trade policies.

Governmental regulatory shifts present a dynamic environment for community banks. In 2024, the ongoing debate around financial sector reform, including potential adjustments to capital requirements and compliance burdens, directly impacts operational strategies. For instance, proposed changes to Community Reinvestment Act regulations in 2024 could alter lending priorities and investment opportunities for institutions like Community Bank.

Political stability significantly influences economic predictability, which is crucial for community banks. The lead-up to the 2024 US elections, for example, brought discussions about potential changes in fiscal and monetary policy, creating a degree of uncertainty for financial institutions and their clients. Policy continuity, conversely, allows for more effective long-term strategic planning and investment.

Fiscal policies, such as tax rates and government spending, directly affect the economic health of communities served by banks. In 2024, many local governments are focusing on infrastructure development, which can spur economic activity and increase demand for commercial lending. Tax incentives aimed at encouraging small business growth can also boost local economies and, consequently, deposit and loan activity for community banks.

| Political Factor | 2024 Relevance | Potential Impact on Community Banks |

|---|---|---|

| Regulatory Environment | Discussions on CRA reform, potential easing of some compliance rules. | May reduce operational costs and foster new lending opportunities. |

| Fiscal Policy | Increased local infrastructure spending, potential tax adjustments. | Stimulates economic growth, potentially increasing loan demand and deposit bases. |

| Political Stability/Elections | Uncertainty surrounding 2024 election outcomes and potential policy shifts. | Can create volatility in interest rates and economic confidence, impacting lending and investment. |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the Community Bank, providing a comprehensive understanding of the external landscape.

It offers actionable insights and forward-looking perspectives to help the Community Bank navigate challenges and capitalize on emerging opportunities within its operating environment.

A concise PESTLE analysis for Community Bank offers a clear roadmap to navigate complex external factors, alleviating the pain point of strategic uncertainty.

Economic factors

The prevailing interest rate environment is a critical factor for Community Bank System, Inc. (CBU). For instance, in the first quarter of 2024, the Federal Reserve maintained its benchmark interest rate within a range of 5.25% to 5.50%, a level that has persisted since July 2023. This sustained higher rate environment generally benefits banks by widening the spread between what they earn on loans and what they pay on deposits, thereby boosting net interest income.

However, the pace at which asset yields adjust relative to funding costs can influence margin expansion or compression. If CBU can reprice its loan portfolio more quickly than its deposit costs increase, its net interest margin will likely improve. Conversely, if deposit costs rise sharply to retain customers in a competitive market, margins could face pressure even with elevated rates.

Persistent inflationary pressures, as seen with the US CPI reaching 3.4% year-over-year in April 2024, directly impact Community Bank System, Inc. by diminishing consumer and business purchasing power. This erosion can strain borrowers' ability to service loans, potentially leading to increased delinquency rates.

For Community Bank System, Inc., managing rising operational expenses due to inflation is a key challenge. Furthermore, the bank must assess how inflation affects the real value of its asset portfolio and its customers' financial resilience, necessitating careful risk management strategies.

Community Bank System, Inc.'s performance is intrinsically tied to the economic health of its operating regions. For instance, in the Northeastern U.S., where the bank has a significant presence, many local economies experienced moderate GDP growth in 2024, with projections for continued, albeit slower, expansion in 2025. This growth directly fuels demand for commercial loans and mortgages, bolstering the bank's lending portfolio.

Low unemployment rates are a key indicator of regional economic strength, directly impacting deposit levels and loan repayment capabilities. As of late 2024, many of Community Bank's core markets in New York and Pennsylvania reported unemployment rates below the national average, generally holding steady around 3.5% to 4.0%. This stability supports consistent deposit inflows and reduces the risk of loan defaults, contributing to asset quality.

Business expansion within these communities is a powerful driver for banking services. In 2024, reports indicated a notable uptick in small business formation and expansion in key service areas, particularly in sectors like healthcare and technology services. This trend translates into increased demand for business loans, treasury management services, and other crucial financial products offered by Community Bank.

Unemployment Rates and Consumer Spending

Lower unemployment rates typically boost consumer confidence and spending, which directly benefits community banks through increased demand for loans, including mortgages and personal loans. For instance, as of May 2024, the U.S. unemployment rate stood at 4.0%, a slight increase from previous months but still indicative of a relatively strong labor market. This environment generally supports higher consumer spending, a key driver for banking revenue.

Conversely, a rise in unemployment can significantly impact a bank's financial health. Higher joblessness often leads to increased loan delinquencies as individuals struggle to meet their financial obligations, potentially degrading the bank's asset quality. Furthermore, reduced consumer confidence during periods of high unemployment curtails demand for new loans and other banking services, directly affecting revenue streams.

- U.S. Unemployment Rate (May 2024): 4.0%

- Impact on Banks: Lower unemployment fuels loan demand and consumer spending, boosting revenue.

- Risk Factors: Rising unemployment increases loan defaults and reduces demand for banking services.

Real Estate Market Trends

Community Bank System, Inc. faces significant sensitivity to real estate market shifts. For instance, the median existing-home sales price in the U.S. was $412,100 in May 2024, a 2.4% increase from May 2023, demonstrating continued, albeit moderating, appreciation. This impacts the bank's collateral values and potential loan losses.

Residential housing demand, influenced by factors like interest rates and employment, directly shapes mortgage origination volumes. Commercial real estate development and occupancy rates are also crucial, as they affect the performance of business loans and the bank's exposure to commercial property sectors.

- Residential Property Values: Fluctuations in home prices directly impact the loan-to-value ratios on mortgages held by Community Bank System, Inc.

- Commercial Occupancy Rates: High vacancy rates in commercial properties can lead to increased defaults on business loans, affecting the bank's asset quality.

- Housing Demand: Strong demand can boost mortgage lending, while a slowdown can reduce origination opportunities for the bank.

Economic growth in Community Bank System, Inc.'s primary markets, particularly the Northeast, is projected to continue at a moderate pace through 2025. This sustained economic activity supports demand for various banking products, from business loans to consumer credit. For instance, while specific regional GDP figures vary, many Northeastern states have shown resilience, with some forecasting growth around 1.5% to 2.0% for 2025.

Interest rates remain a pivotal economic factor. The Federal Reserve's decision to hold the federal funds rate between 5.25% and 5.50% as of early 2024, a stance maintained since mid-2023, generally supports bank profitability through wider net interest margins. However, the bank must manage the potential for increased funding costs as depositors seek higher yields.

Inflationary pressures, though showing signs of moderation, continue to influence consumer spending and business investment. Elevated inflation, with the CPI hovering around 3.4% year-over-year in April 2024, can impact loan repayment capacity and increase operational costs for the bank. Managing these economic headwinds is crucial for maintaining asset quality and operational efficiency.

| Economic Indicator | Value (as of Q1/Q2 2024) | Impact on Community Bank System, Inc. |

|---|---|---|

| Federal Funds Rate | 5.25% - 5.50% | Supports net interest margin; potential for rising deposit costs. |

| U.S. CPI (Year-over-Year) | ~3.4% (April 2024) | Erodes purchasing power; potential for increased loan delinquencies. |

| U.S. Unemployment Rate | ~4.0% (May 2024) | Indicates a strong labor market, supporting loan demand and repayment. |

| Median Existing-Home Sales Price (U.S.) | $412,100 (May 2024) | Affects collateral values for mortgages; influences lending activity. |

Same Document Delivered

Community Bank PESTLE Analysis

The preview shown here is the exact Community Bank PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting community banking. Gain valuable insights into market dynamics and strategic considerations for your institution.

Sociological factors

Demographic shifts, particularly the aging of the population, significantly shape demand for community bank services. In 2024, the U.S. Census Bureau reported that individuals aged 65 and over represented 17.3% of the total population, a figure projected to grow. This older demographic often requires more sophisticated wealth management, estate planning, and trust services, areas where community banks can leverage personalized relationships.

Conversely, younger demographics, while perhaps less focused on traditional wealth management, are driving demand for digital banking solutions and accessible consumer loans. For instance, the Federal Reserve's 2023 Survey of Consumer Finances indicated a rising adoption of mobile banking among younger age groups. Community banks need to adapt their product offerings and service channels to cater to these evolving needs, balancing the requirements of an aging customer base with the digital-first expectations of emerging generations.

Consumers are increasingly shifting towards digital channels for their banking needs. In 2024, it's estimated that over 70% of banking transactions for many institutions occur digitally, a significant jump from previous years. This trend is fueled by a desire for convenience and accessibility, pushing community banks to enhance their mobile app functionalities and online service offerings.

The adoption of mobile banking is particularly strong, with a projected 85% of consumers using mobile banking apps by the end of 2025 for tasks ranging from deposits to loan applications. This necessitates robust, user-friendly digital platforms that can compete with larger, tech-savvy banks. Community Bank System, Inc. must invest in these technologies to remain competitive and meet evolving customer expectations for seamless, on-the-go financial management.

Furthermore, consumer interest in online financial planning and advisory services is on the rise. Many individuals, especially younger demographics, are seeking digital tools and platforms for budgeting, investment advice, and retirement planning. Banks that can integrate these digital advisory services into their offerings will be better positioned to attract and retain a broader customer base, ensuring long-term engagement and loyalty.

Community banks, such as Community Bank System, Inc., are deeply rooted in their local areas, and their success hinges on strong community ties and the trust they build. This trust is earned through consistent engagement and ethical operations.

A bank's commitment to local initiatives and its reputation for fair dealing and tailored customer service are crucial differentiators. For instance, in 2023, Community Bank System, Inc. reported a customer satisfaction score of 88%, highlighting the importance of these factors in retaining and attracting clients in a crowded financial landscape.

Financial Literacy Levels

The financial literacy of individuals within a community bank's service area directly influences product demand. Regions with higher financial literacy, for instance, might see greater uptake of complex wealth management or specialized lending products. Conversely, areas with lower financial literacy often necessitate simpler, more transparent offerings and robust customer education initiatives.

Recent data highlights these disparities. For example, a 2024 survey indicated that only 57% of American adults could answer three basic financial literacy questions correctly, a figure that varies significantly by demographic and geographic location. This suggests that community banks must tailor their product development and outreach strategies to the prevailing financial understanding of their customer base.

- Product Demand: Higher financial literacy correlates with demand for sophisticated financial products.

- Educational Needs: Lower financial literacy requires banks to offer educational resources and simpler products.

- Regional Variation: Financial literacy levels differ across geographic areas, impacting product strategy.

- 2024 Data: Only 57% of US adults demonstrated basic financial literacy in a recent survey, underscoring the need for tailored approaches.

Wealth Distribution and Income Inequality

Wealth distribution and income inequality significantly shape the demand for banking products within Community Bank System, Inc.'s service areas. In regions with substantial income disparities, the bank must offer a comprehensive suite of services, from essential checking accounts for lower-income households to sophisticated wealth management and investment solutions for high-net-worth individuals. This dual approach ensures relevance across diverse economic strata.

For instance, in 2024, the Gini coefficient, a measure of income inequality, varied across states where Community Bank System operates. In Pennsylvania, a key state for the bank, the Gini coefficient was around 0.47, indicating a notable level of inequality. This suggests a strong need for products catering to both ends of the economic spectrum.

- Income Disparities: Higher income inequality necessitates a broader product portfolio, serving both basic banking needs and advanced wealth management.

- Target Market Segmentation: Understanding local income distribution allows for more effective targeting of specific customer segments.

- Product Demand: Economic stratification directly influences the demand for different financial products, from affordable credit to premium investment services.

Community trust and local engagement are paramount for community banks. In 2023, Community Bank System, Inc. reported an 88% customer satisfaction rate, underscoring the value of personalized service and ethical operations in building strong community ties.

Financial literacy levels vary significantly, impacting product demand. A 2024 survey found only 57% of US adults could answer basic financial literacy questions correctly, necessitating tailored product offerings and educational support from banks like Community Bank System, Inc.

Income inequality also shapes banking needs. With a Gini coefficient around 0.47 in Pennsylvania in 2024, Community Bank System, Inc. must cater to diverse economic strata, offering everything from basic accounts to advanced wealth management.

Technological factors

The ongoing development of digital banking platforms is a critical factor for Community Bank System, Inc. to stay competitive in the evolving financial landscape. Banks are increasingly investing in user-friendly, secure, and feature-rich online and mobile banking solutions to improve customer engagement and broaden access, thereby potentially decreasing reliance on traditional branch networks.

For instance, in 2024, a significant portion of banking transactions are expected to be conducted digitally. A report from Statista indicated that mobile banking adoption continues to rise globally, with projections suggesting that over 2.5 billion people will use mobile banking by 2025, highlighting the imperative for Community Bank System to enhance its digital offerings to meet this growing demand and maintain a competitive edge.

As Community Bank System, Inc. (CBS) continues its digital transformation, the escalating sophistication of cyber threats presents a critical challenge. In 2023, the financial services sector experienced a notable surge in ransomware attacks and data breaches, with incidents costing organizations an average of $4.73 million, according to IBM's Cost of a Data Breach Report 2023. This underscores the imperative for CBS to invest heavily in advanced cybersecurity infrastructure and proactive threat detection to protect sensitive customer data and maintain operational integrity.

Adherence to stringent data protection regulations, such as GDPR and CCPA, is not merely a compliance requirement but a foundational element for preserving customer trust. Failure to adequately safeguard personal and financial information can lead to severe reputational damage and significant financial penalties. For instance, regulatory fines for data privacy violations can reach millions of dollars, directly impacting a bank's profitability and market standing.

Fintech innovation is reshaping the financial landscape, creating both opportunities and threats for community banks. For instance, by the end of 2024, it's projected that over 60% of financial institutions will be actively integrating AI-powered solutions, a trend community banks like Community Bank System, Inc. must navigate. Strategic partnerships with fintechs can offer access to cutting-edge technologies, improving customer experience through faster digital onboarding or more personalized financial advice, a crucial step to remain competitive against agile fintech disruptors.

Artificial Intelligence and Machine Learning Adoption

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to significantly transform Community Bank System, Inc.'s operations. These advanced technologies can streamline everything from identifying fraudulent transactions and assessing credit risks to delivering personalized customer experiences and automating the entire loan application process. By embracing AI and ML, the bank can expect to see substantial gains in operational efficiency and a reduction in overhead costs, while simultaneously offering more customized financial products and services to its clientele.

The practical applications of AI and ML in banking are already demonstrating tangible benefits. For instance, AI-powered fraud detection systems are becoming increasingly sophisticated, with many institutions reporting a significant decrease in fraudulent activities. In 2024, it's estimated that AI in banking will save the industry billions globally through improved risk management and fraud prevention. Community Bank System can leverage these advancements to bolster its security measures and enhance customer trust.

Looking ahead, the adoption of AI and ML presents a competitive advantage for community banks. Consider these key areas of impact:

- Enhanced Fraud Detection: AI algorithms can analyze vast datasets in real-time to identify anomalous patterns indicative of fraud, often with greater accuracy than traditional methods.

- Personalized Customer Experiences: ML can power chatbots and virtual assistants that provide 24/7 customer support, answer queries, and even offer tailored product recommendations based on individual banking behavior.

- Automated Loan Processing: AI can automate credit scoring, document verification, and underwriting, accelerating loan approvals and improving the customer journey.

- Improved Risk Management: ML models can provide more accurate predictions of loan defaults and market fluctuations, enabling proactive risk mitigation strategies.

Data Analytics and Big Data Utilization

Community Bank System, Inc. leverages data analytics to gain a competitive edge. The increasing availability of customer and market data allows for sophisticated analysis to identify emerging trends and understand evolving customer preferences. This capability is crucial for optimizing product development and tailoring financial services to specific market segments.

The strategic utilization of big data analytics empowers Community Bank System, Inc. to make more informed decisions. By analyzing vast datasets, the bank can better predict customer behavior, identify cross-selling opportunities, and improve risk management. For instance, in 2023, the banking sector saw significant investment in AI and analytics, with many institutions reporting enhanced customer engagement and operational efficiency as a direct result.

- Data-Driven Insights: Analyzing customer transaction data and market behavior helps identify unmet needs and optimize service delivery.

- Personalized Offerings: Big data allows for the creation of highly personalized financial products and marketing campaigns, increasing customer loyalty.

- Operational Efficiency: Predictive analytics can streamline internal processes, from loan application reviews to fraud detection, reducing costs.

- Market Trend Identification: Early detection of market shifts enables proactive adjustments to strategy, ensuring continued relevance and growth.

The increasing adoption of digital channels is fundamentally altering how customers interact with banks. By 2025, projections indicate that over 2.5 billion individuals will utilize mobile banking, underscoring the necessity for Community Bank System to bolster its digital infrastructure to cater to this expanding user base and maintain its competitive standing.

Cybersecurity remains a paramount concern, with financial institutions facing escalating threats. In 2023, the average cost of a data breach in the financial sector reached $4.73 million, highlighting the critical need for robust security investments to safeguard customer data and ensure operational continuity.

Fintech innovation, particularly the integration of AI and Machine Learning, is reshaping the banking industry. By the close of 2024, it's anticipated that over 60% of financial institutions will be deploying AI-driven solutions, a trend Community Bank System must embrace to enhance efficiency and customer experience.

The strategic use of big data analytics is crucial for identifying market trends and customer preferences. In 2023, significant investments in AI and analytics within banking led to reported improvements in customer engagement and operational efficiency.

| Technological Factor | Impact on Community Bank System | Key Data/Trend |

|---|---|---|

| Digital Banking Platforms | Enhanced customer access and engagement, potential reduction in branch reliance. | 2.5 billion+ mobile banking users projected by 2025. |

| Cybersecurity Threats | Increased investment in advanced security measures to protect data. | Average data breach cost in finance: $4.73 million (2023). |

| Fintech & AI Integration | Streamlined operations, personalized services, competitive advantage. | 60%+ financial institutions integrating AI by end of 2024. |

| Data Analytics | Improved decision-making, personalized offerings, operational efficiency. | Banking sector AI/analytics investment yielded efficiency gains (2023). |

Legal factors

Community Bank System, Inc. navigates a stringent regulatory landscape, overseen by entities like the Federal Reserve, FDIC, and state banking authorities. Failure to comply with mandates on capital adequacy, loan concentration, and disclosure can result in significant fines and operational restrictions.

In 2024, the financial sector saw continued focus on cybersecurity and consumer protection regulations, impacting how banks like Community Bank System, Inc. manage data and interact with customers. Adherence to evolving compliance standards is paramount for maintaining trust and market access.

Consumer protection laws, such as the Truth in Lending Act and the Fair Credit Reporting Act, significantly shape how Community Bank System, Inc. operates. These regulations mandate transparency in loan disclosures and accuracy in credit reporting, directly affecting customer interactions and data handling. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces these rules, with significant penalties for non-compliance, underscoring the importance of adherence for banks like Community Bank.

Community Bank System, Inc. operates under strict Anti-Money Laundering (AML) and sanctions laws, crucial for preventing financial crimes. Failure to comply can result in significant penalties, impacting its regulatory standing and operational integrity. For instance, in 2023, the U.S. Treasury's Financial Crimes Enforcement Network (FinCEN) reported over 2.7 million Suspicious Activity Reports (SARs), highlighting the pervasive nature of financial crime and the extensive compliance burden on financial institutions.

Adherence to these regulations necessitates comprehensive customer due diligence, including Know Your Customer (KYC) procedures, and vigilant monitoring for suspicious transactions. The bank must also report any illicit financial activities promptly to authorities. The evolving landscape of financial crime, including cyber-enabled money laundering, demands continuous adaptation of these compliance frameworks.

Data Privacy and Security Regulations

Community Bank System, Inc. operates within a landscape increasingly shaped by data privacy and security regulations. Laws like the Gramm-Leach-Bliley Act (GLBA) and the California Consumer Privacy Act (CCPA) mandate stringent protection of customer financial information. As digital transactions grow, the bank must navigate these and potential new federal privacy standards, making compliance a critical factor in maintaining customer trust and avoiding costly penalties. For instance, in 2023, data breaches in the financial sector led to an average cost of $5.90 million per incident, highlighting the financial risk of non-compliance.

The increasing sophistication of cyber threats alongside evolving privacy legislation presents ongoing challenges. Community Bank System must invest heavily in robust cybersecurity measures and stay abreast of regulatory changes to safeguard sensitive data. Failure to do so not only exposes the bank to significant legal liabilities but also risks severe reputational damage, impacting its ability to attract and retain customers in the competitive banking environment.

- GLBA Compliance: Ensures the protection of nonpublic personal information.

- CCPA Adherence: Grants California consumers rights over their personal data.

- Cybersecurity Investments: Essential for mitigating data breach risks and associated costs, which averaged $5.90 million per incident in 2023 for financial institutions.

- Reputational Risk: Non-compliance can lead to significant loss of customer confidence and market share.

Employment and Labor Laws

Community Bank System, Inc., like all employers, must navigate a complex web of federal and state employment and labor laws. This includes regulations concerning minimum wage, overtime pay, workplace safety standards, and prohibitions against discrimination based on factors like age, race, gender, and disability. For instance, the Fair Labor Standards Act (FLSA) sets the baseline for many of these requirements across the United States.

Compliance is not just a legal obligation but a strategic imperative. Failing to adhere to these laws can lead to costly litigation, significant fines, and damage to the bank's reputation, impacting its ability to attract and retain talent. In 2024, the Department of Labor continued to emphasize enforcement in areas like wage and hour violations and worker classification, making robust internal compliance programs essential.

Key areas of focus for Community Bank System, Inc. include:

- Wage and Hour Laws: Ensuring accurate payment of wages, including overtime, for all eligible employees, adhering to federal and state minimum wage rates, which vary by location and are subject to periodic increases.

- Anti-Discrimination and Equal Employment Opportunity (EEO): Implementing policies and training to prevent discrimination and harassment, promoting diversity and inclusion in hiring and promotion practices.

- Employee Benefits and Leave: Complying with laws governing employee benefits, such as health insurance under the Affordable Care Act (ACA), and various family and medical leave entitlements, including the Family and Medical Leave Act (FMLA).

- Workplace Safety: Maintaining a safe working environment in compliance with Occupational Safety and Health Administration (OSHA) standards, though financial institutions often have fewer physical hazards than other industries.

Legal factors significantly influence Community Bank System, Inc.'s operations, demanding strict adherence to a complex regulatory framework. Compliance with consumer protection laws, such as the Truth in Lending Act, is critical for transparent customer interactions and avoiding penalties. Furthermore, robust Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols are essential to combat financial crime, with institutions like Community Bank System needing to file numerous Suspicious Activity Reports annually, as highlighted by FinCEN data.

Data privacy regulations, including GLBA and CCPA, impose stringent requirements on protecting customer financial information, with data breaches in the financial sector costing an average of $5.90 million per incident in 2023. Employment laws also mandate compliance with wage and hour regulations, anti-discrimination policies, and workplace safety standards, with the Department of Labor actively enforcing these areas in 2024.

| Regulatory Area | Key Legislation/Requirement | Impact on Community Bank System, Inc. | Example Data/Enforcement Focus (2023-2024) |

|---|---|---|---|

| Consumer Protection | Truth in Lending Act, Fair Credit Reporting Act | Mandates transparency in lending and accuracy in credit reporting; impacts customer interactions. | CFPB enforcement actions; focus on clear disclosures. |

| Financial Crime Prevention | AML, KYC, Bank Secrecy Act | Requires due diligence, transaction monitoring, and reporting to prevent financial crimes. | FinCEN received over 2.7 million SARs in 2023; focus on cyber-enabled money laundering. |

| Data Privacy & Security | GLBA, CCPA | Requires stringent protection of customer financial data; risk of significant penalties for breaches. | Average cost of data breaches in financial sector $5.90 million (2023); evolving federal privacy standards. |

| Employment Law | FLSA, EEO Laws, FMLA, OSHA | Governs wages, non-discrimination, benefits, and workplace safety; potential for litigation and fines. | DOL enforcement on wage/hour violations; ongoing focus on diversity and inclusion. |

Environmental factors

Community Bank System, Inc. faces significant climate change risks, both physical and transitional. Physical risks, like increased frequency of extreme weather events, could impact their loan portfolio, especially in sectors heavily reliant on stable environmental conditions. For instance, agricultural loans in regions prone to drought or flooding could see higher default rates.

Transitional risks arise as the economy shifts towards a low-carbon future. Sectors heavily dependent on fossil fuels may experience declining asset values, affecting the collateral for loans. This could impact Community Bank's exposure to energy or transportation industries undergoing significant transformation.

However, these challenges also create opportunities. Community Bank can capitalize on the growing demand for green financing, offering loans for renewable energy projects, energy-efficient upgrades, or sustainable infrastructure development. The bank could also develop sustainable investment products, attracting a growing segment of environmentally conscious investors.

Community Bank System, Inc. faces growing ESG pressure from various stakeholders, impacting its operations and investment choices. Investors are increasingly scrutinizing environmental, social, and governance factors, with ESG-focused funds attracting significant capital. For instance, global sustainable investment assets reached an estimated $37.8 trillion in 2024, a notable increase from previous years, indicating this trend's momentum.

Adopting robust ESG practices can bolster Community Bank System's reputation and attract a wider pool of responsible investors. This focus also helps in managing long-term risks, such as climate-related financial exposures or social license to operate challenges. By prioritizing ESG, the bank can align its strategies with evolving market expectations and regulatory landscapes.

Community Bank System, Inc. is increasingly expected to integrate sustainable practices into its operations. This includes reducing energy usage in its numerous branches, implementing robust waste management programs, and actively encouraging paperless transactions. These initiatives are not just about environmental responsibility; they can also translate into tangible cost savings and enhance the bank's brand appeal among its growing base of environmentally aware customers.

Environmental Regulations and Reporting

Community Bank System, Inc. (CBU) might face environmental regulations concerning its operational footprint, such as energy efficiency in its branches or waste management. While not a primary focus for financial institutions, indirect impacts can arise from the environmental performance of companies CBU finances, potentially leading to increased scrutiny on its lending portfolios. For instance, evolving regulations around climate risk disclosure, such as those proposed or implemented by the SEC, could necessitate more robust reporting on financed emissions or environmental, social, and governance (ESG) factors within its loan book.

The trend towards greater sustainability reporting is a significant environmental factor. Banks are increasingly expected to detail their environmental impact and how they are addressing climate-related risks. This could involve adopting new internal policies or enhancing data collection to track the environmental performance of their clients. For example, the Task Force on Climate-related Financial Disclosures (TCFD) framework is gaining traction globally, influencing how financial institutions, including community banks, report on climate risks and opportunities.

- Increased ESG Scrutiny: Financial institutions are facing growing pressure from investors and regulators to demonstrate strong ESG performance, impacting lending practices and investment decisions.

- Climate Risk Disclosure: Evolving regulatory landscapes, such as potential SEC rules on climate-related financial disclosures, may require banks to report on their financed emissions and climate risk exposure.

- Sustainable Finance Growth: The market for green bonds and other sustainable finance products is expanding, presenting both opportunities and compliance considerations for banks.

Natural Disaster Preparedness

Community Bank System, Inc. (CBU) must prioritize natural disaster preparedness due to its reliance on physical branches and local infrastructure. The increasing frequency and intensity of extreme weather events, such as those experienced in 2024, pose significant risks to operational continuity and asset security. For instance, the widespread flooding and severe storms impacting parts of the Northeast in early 2024 highlighted the need for robust disaster recovery plans.

Effective business continuity strategies are crucial for CBU to maintain essential services and customer support during environmental crises. This includes safeguarding data, ensuring employee safety, and having contingency plans for branch operations. The bank's 2024 investments in technology upgrades and remote work capabilities are designed to bolster resilience against such disruptions.

- Infrastructure Resilience: CBU is investing in hardening its physical branches against common natural disasters prevalent in its operating regions, which include areas prone to flooding and severe winter weather.

- Business Continuity Planning: The bank maintains comprehensive business continuity plans, regularly updated and tested, to ensure minimal disruption to customer services and internal operations following an event.

- Employee Safety Protocols: Protocols are in place to ensure the safety and well-being of CBU employees during natural disasters, including communication plans and remote work options where feasible.

- Customer Support Continuity: Strategies are implemented to ensure continued customer access to banking services, including digital platforms and alternative service channels, even when physical branches are affected.

Community Bank System, Inc. is navigating a landscape increasingly shaped by environmental concerns. The growing demand for sustainable finance presents a significant opportunity, with the global green bond market projected to reach over $1 trillion in 2024. This shift encourages banks like CBU to develop and offer eco-friendly financial products, aligning with investor preferences and potentially attracting new capital.

The bank must also contend with evolving regulations and stakeholder expectations regarding environmental impact. For instance, the increasing adoption of frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) means CBU may need to enhance its reporting on financed emissions and climate risk exposure. This focus on transparency is crucial for maintaining investor confidence and regulatory compliance in the 2024-2025 period.

Furthermore, physical risks from climate change, such as extreme weather events, directly threaten operational continuity and asset values. CBU's investments in infrastructure resilience and business continuity planning, as seen in its 2024 technology upgrades, are vital for mitigating these impacts and ensuring service delivery during environmental disruptions.

PESTLE Analysis Data Sources

Our Community Bank PESTLE analysis is built on a robust foundation of data sourced from federal and state regulatory bodies, financial industry associations, and reputable economic forecasting firms. We integrate insights from public financial statements, demographic data, and legislative updates to ensure a comprehensive view.