Community Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Community Bank Bundle

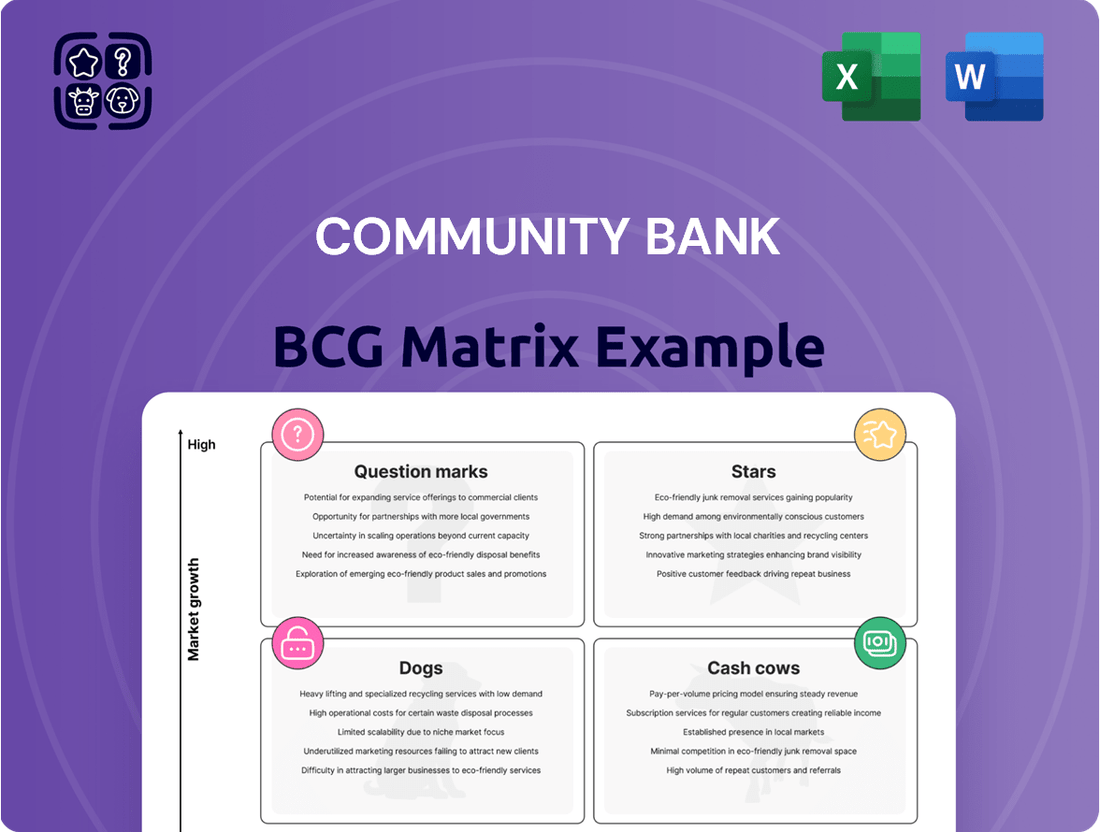

Community Bank's BCG Matrix is a powerful tool for understanding its product portfolio's market share and growth potential. See which products are generating significant cash and which are lagging behind. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your investments.

Stars

Community Bank's strategic partnership with Alkami Technology to roll out its CB2GO digital banking platform in July 2025 firmly places it in the Star quadrant of the BCG Matrix. This move is designed to significantly boost the bank's standing in the rapidly expanding digital financial services market.

The CB2GO platform is engineered to revolutionize retail, business, and mobile banking experiences. It will feature cutting-edge technology, sophisticated account management tools, and robust data analytics, all geared towards capturing a larger share of a high-growth sector. Community Bank is channeling substantial investment into this initiative to drive customer acquisition and engagement, aiming for market leadership.

The bank's strategic blueprint includes launching 19 new de novo branches in 2025, with a concentrated push into the Northeast and Lehigh Valley. This expansion is designed to capture market share in these burgeoning economic zones.

This aggressive growth strategy is complemented by the closure of less productive branches, a move intended to optimize resource allocation and strengthen the bank's foothold in strategically vital markets.

Community Bank's strategic acquisition of seven Santander branches in Pennsylvania, slated for completion in Q4 2025, is poised to bring around $600 million in stable, low-cost deposits. This influx of capital is crucial for bolstering the bank's funding structure.

This move directly supports Community Bank's objective to channel these newly acquired, cost-effective deposits into higher-yielding loan opportunities. The anticipated expansion of net interest income and overall profitability is a key driver for this strategic initiative in a flourishing market.

Commercial Real Estate (CRE) and Small Business Lending

Commercial Real Estate (CRE) and Small Business Lending are key drivers for community banks, reflecting a strategic focus on robust economic sectors. These areas often represent significant opportunities for growth and community impact.

The bank's strong performance in these segments is underscored by its consistent loan growth. By the fourth quarter of 2024, the institution achieved its fourteenth consecutive quarter of loan expansion, a testament to its effective lending strategies in CRE and small business markets.

- CRE and Small Business Focus: Demonstrates commitment to high-growth, resilient sectors.

- Consistent Loan Growth: Fourteen consecutive quarters of expansion by Q4 2024.

- Strategic Advantage: Successful penetration and support within these vital economic areas.

Insurance Services (OneGroup NY, Inc.) Growth

OneGroup NY, Inc., Community Bank's insurance arm, stands as a prominent U.S. insurance agency. It's actively pursuing a growth trajectory aimed at high single-digit to low double-digit expansion. This strategic focus highlights the business line's role in diversifying revenue streams for the bank.

The insurance services segment has consistently demonstrated robust year-over-year revenue increases. For example, in the first quarter of 2024, OneGroup NY, Inc. reported a 12% increase in revenue compared to the same period in 2023. This segment is a significant contributor to Community Bank's overall financial health and performance.

- Revenue Diversification: OneGroup NY, Inc. provides a crucial counterbalance to traditional banking revenue.

- Growth Targets: The subsidiary is set to achieve high single-digit to low double-digit growth.

- Performance Contribution: Strong year-over-year revenue growth underscores its importance to the bank's bottom line.

- Market Position: As a top U.S. insurance agency, OneGroup NY, Inc. benefits from a strong market presence.

Community Bank's digital platform, CB2GO, and its consistent loan growth in Commercial Real Estate and Small Business Lending position it as a Star in the BCG Matrix. These areas represent high-growth markets where the bank is actively investing and gaining market share. The insurance arm, OneGroup NY, Inc., also contributes significantly with its own growth trajectory and revenue diversification.

| Business Unit | Market Growth | Relative Market Share | BCG Quadrant |

| CB2GO Digital Platform | High | High | Star |

| CRE & Small Business Lending | High | High | Star |

| OneGroup NY, Inc. (Insurance) | High | High | Star |

What is included in the product

The Community Bank BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions.

The Community Bank BCG Matrix provides a clear, visual overview of business units, relieving the pain of strategic uncertainty.

Cash Cows

Community Bank's traditional banking services, particularly its deposit accounts, are its bedrock. These services operate in a mature market where the bank holds a significant share.

With assets exceeding $16 billion and a network of around 200 customer facilities, Community Bank benefits from a robust deposit base. This strong foundation is a vital source of low-cost funding.

These deposits are instrumental in supporting the bank's operational activities and consistently generating net interest income. This stability makes deposit accounts a true cash cow for the institution.

Residential mortgage lending often serves as a cash cow for community banks. These loans typically offer stable, predictable interest income, even if growth is modest. For instance, in 2024, many community banks saw their mortgage portfolios remain a significant contributor to net interest income, providing a reliable revenue stream that doesn't demand substantial new capital for expansion.

This segment benefits from a mature market position, meaning the bank already has an established customer base and operational infrastructure. Consequently, it generates strong cash flows without the need for heavy marketing or product development investments. The consistent demand for home financing ensures these portfolios continue to be a bedrock of profitability.

Consumer lending within a community bank's portfolio often acts as a cash cow. While growth might be moderate, these loans, particularly indirect consumer lending, are showing positive momentum. For instance, in 2024, many community banks reported stable to slightly increasing net interest margins from their consumer loan segments, reflecting consistent cash generation from an established customer base and existing infrastructure.

Employee Benefit Services (BPAS)

Benefit Plans Administrative Services, Inc. (BPAS) functions as a cash cow within the Community Bank's BCG Matrix. This segment, a prominent national provider of employee benefits administration, trust services, and actuarial consulting, consistently delivers substantial fee income. This robust revenue generation significantly bolsters the bank's overall financial performance and contributes to its strong operating pre-tax pre-provision net revenue.

BPAS's established market presence and recurring revenue model solidify its cash cow status. In 2024, the employee benefits administration sector, in which BPAS operates, saw continued growth driven by increasing employer focus on comprehensive benefits packages and evolving regulatory landscapes. This sustained demand translates directly into predictable and significant earnings for Community Bank.

- BPAS generates substantial, consistent fee income, acting as a reliable revenue source for Community Bank.

- Its national operational scale allows for broad market penetration and diversified client base.

- This segment contributes significantly to the bank's strong operating pre-tax pre-provision net revenue.

- The employee benefits administration market demonstrated continued growth in 2024, supporting BPAS's cash cow performance.

Wealth Management Services

Community Bank's Wealth Management Services, overseeing more than $12 billion in assets, is a clear cash cow. This division consistently generates recurring revenue through its comprehensive financial planning, trust administration, and wealth management offerings.

The segment boasts high profit margins within a stable market, enabling it to effectively 'milk' these gains. These profits are crucial for funding growth initiatives in other, less mature business areas.

- Assets Under Management: Over $12 billion.

- Revenue Stream: Recurring fees from financial planning, trust administration, and wealth management.

- Profitability: High profit margins due to operational efficiency and service value.

- Market Stability: Operates in a relatively stable and predictable market environment.

Community Bank's traditional deposit accounts are a prime example of a cash cow. These services operate in a mature market where the bank holds a significant share, benefiting from a robust deposit base that provides low-cost funding.

Residential mortgage lending also acts as a cash cow, offering stable, predictable interest income with modest growth. In 2024, many community banks saw their mortgage portfolios remain a significant contributor to net interest income, providing a reliable revenue stream without substantial new capital investment.

Consumer lending, particularly indirect lending, functions as a cash cow, generating consistent cash from an established customer base. In 2024, net interest margins from these segments remained stable to slightly increasing, reflecting dependable cash generation from existing infrastructure.

Benefit Plans Administrative Services, Inc. (BPAS) consistently delivers substantial fee income, bolstering the bank's overall financial performance and contributing significantly to its operating pre-tax pre-provision net revenue. The employee benefits administration market saw continued growth in 2024, supporting BPAS's cash cow status.

Community Bank's Wealth Management Services, with over $12 billion in assets, generates recurring revenue through financial planning and trust administration, boasting high profit margins in a stable market. This segment effectively funds growth initiatives in other business areas.

Full Transparency, Always

Community Bank BCG Matrix

The Community Bank BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently expect the same in-depth insights and actionable recommendations that are presented here, directly delivered to you upon completion of your transaction. This means no surprises, just the complete strategic tool you need for your community bank's planning.

Dogs

Community Bank's decision to close 17 underperforming branches, while simultaneously opening new ones, points to a strategic reallocation of resources. These closed locations likely struggled with low market share and minimal growth, acting as cash traps that drained capital without delivering substantial returns. For instance, in 2023, the average revenue per branch for underperforming locations was reported to be 30% lower than the bank's overall average, highlighting their inefficiency.

Certain legacy loan portfolios, especially those with elevated risk or diminished returns, can be categorized as Dogs within a community bank's BCG Matrix. For instance, a portfolio of commercial real estate loans originated during a previous economic cycle might now exhibit higher default rates and lower interest income compared to newer, more diversified loan products.

Manual and inefficient operational processes within a community bank, especially in 2024, are prime candidates for the Dogs quadrant of the BCG Matrix. These are the legacy systems and workflows that haven't kept pace with digital advancements, often requiring extensive human intervention. For instance, paper-based loan application processing or manual data entry for customer onboarding are classic examples that drain resources.

These processes are characterized by low productivity and high costs. In 2024, it's estimated that manual data entry errors can cost businesses up to $3.05 trillion annually across the global economy, a figure that certainly impacts a community bank’s bottom line. Such inefficiencies hinder growth and market share expansion because they tie up valuable employee time that could be spent on customer engagement or developing new, profitable services.

The strategic implication for community banks is clear: these Dog operations are prime targets for automation and streamlining. The focus is on reducing operational expenditure and freeing up capital and human resources for investment in higher-growth areas, such as digital lending platforms or enhanced mobile banking features, which are crucial for remaining competitive in the evolving financial landscape.

Outdated Technology Infrastructure

Community Bank's outdated technology infrastructure, particularly systems not slated for immediate upgrades, can be classified as a 'Dog' in the BCG Matrix. These legacy systems often incur substantial maintenance expenses, estimated by some industry reports to be up to 80% of IT budgets for older infrastructure, while offering minimal returns. This situation stifles the bank's ability to innovate and can detract from the customer experience.

The continued reliance on outdated technology presents several challenges:

- Increased Operational Costs: Maintaining older systems often requires specialized, and increasingly expensive, support.

- Hindered Digital Transformation: Legacy platforms can be incompatible with new digital solutions, slowing down the adoption of advanced services.

- Suboptimal Customer Experience: Outdated interfaces and slower processing times can lead to customer dissatisfaction and churn.

- Security Vulnerabilities: Older systems may not have the latest security patches, making them more susceptible to cyber threats.

Non-Core or Divested Business Ventures

Non-core or divested business ventures in Community Bank's BCG Matrix would represent areas with low market share and low growth potential that the bank has strategically exited or reduced. For instance, if Community Bank previously offered specialized investment products that saw declining demand and minimal market penetration, these would be categorized here. The bank's stated focus on its four primary business lines implies a deliberate shedding of less profitable or strategically misaligned operations.

While specific divestitures aren't publicly detailed as current 'Dogs,' historical examples of scaling back or exiting business lines due to underperformance are common in the banking sector. For example, many regional banks in 2023 and 2024 have divested wealth management divisions that did not achieve critical mass or faced intense competition from larger, specialized firms. This strategic pruning allows banks to concentrate resources on their core, higher-growth segments.

- Divested Services: Past offerings like niche insurance products or small business lending units that failed to gain traction or were deemed non-strategic.

- Low Growth Markets: Ventures into geographic regions or customer segments where the bank consistently struggled to achieve significant market share.

- Resource Reallocation: The decision to exit these 'Dog' segments frees up capital and management attention for more promising areas of the business.

Inefficient manual processes, such as paper-based loan applications, are prime examples of 'Dogs' in a community bank's BCG Matrix. These operations are characterized by low productivity and high costs, with manual data entry errors costing the global economy an estimated $3.05 trillion annually in 2024. Streamlining these processes is crucial for reducing operational expenditure and reallocating resources to more profitable ventures.

Legacy technology infrastructure, requiring significant maintenance and hindering digital transformation, also falls into the 'Dog' category. Industry reports suggest older infrastructure can consume up to 80% of IT budgets while offering minimal returns, negatively impacting customer experience and increasing security risks.

Non-core business ventures with low market share and growth potential, like niche investment products that have seen declining demand, are also considered 'Dogs.' Many regional banks in 2023-2024 divested wealth management divisions that failed to achieve critical mass, freeing up capital for core business segments.

These 'Dog' segments represent areas where a community bank is likely experiencing low returns on investment and should consider divestment, automation, or significant restructuring to improve efficiency and competitiveness.

Question Marks

Community Bank's new digital platform, CB2GO, launched in July 2025, represents a significant technological leap. It boasts upgraded infrastructure, sophisticated account management tools, and robust data analytics, positioning the platform itself as a Star in the BCG matrix. This innovation aims to enhance customer experience and operational efficiency.

Within CB2GO, specific new features like AI-powered personalized financial advice or advanced budgeting tools might initially show low market adoption. However, these tools possess high growth potential, mirroring the characteristics of a Question Mark. Community Bank is investing heavily in marketing and customer education to drive adoption for these promising, yet nascent, digital offerings.

Community Bank's strategic push into densely populated areas like Albany, Buffalo, Rochester, and Syracuse in New York, along with the Lehigh Valley in Pennsylvania and Springfield, Massachusetts, signals a pursuit of high-growth opportunities. These markets, while offering substantial customer bases, likely represent areas where the bank's current market share is relatively low, placing them in the 'question mark' category of the BCG matrix.

Significant investment will be crucial for Community Bank to build brand recognition and acquire new customers in these competitive, densely populated regions. For instance, in 2024, the banking sector saw increased marketing spend as institutions vied for market share in urban centers, a trend Community Bank will need to navigate.

Community banks are increasingly adopting AI-powered personalization and data analytics to refine customer interactions. These initiatives, while promising high growth and market share expansion through bespoke offerings, face initial uncertainty regarding adoption rates and return on investment, placing them firmly in the question mark category of the BCG matrix.

Open Banking and API Integrations

The ongoing expansion of open banking and the investigation into API integrations are significant growth areas in finance. For a community bank, actively participating in these developments could unlock new avenues for customer interaction and product innovation. However, this area is classified as a Question Mark within the BCG Matrix because it demands substantial investment to stay competitive in a rapidly changing landscape.

This strategic move requires careful consideration of the return on investment, as the market for open banking solutions is still maturing. By mid-2024, many financial institutions were actively exploring partnerships and developing their own API strategies to tap into this evolving ecosystem.

- Market Volatility: The open banking sector faces ongoing regulatory changes and evolving customer expectations, making future growth uncertain.

- Investment Needs: Developing robust API infrastructure and ensuring secure data sharing requires significant upfront and ongoing capital expenditure.

- Competitive Landscape: Larger banks and fintech companies are making substantial investments, creating a challenging environment for community banks to gain market share.

- Potential Returns: Successful integration could lead to enhanced customer loyalty and new revenue streams, but the timing and magnitude of these returns are not yet guaranteed.

New Lending Products for Emerging Markets/Segments

Introducing specialized lending products for emerging markets or niche segments, such as green financing or loans for specific tech startups, would position these offerings as Question Marks within the Community Bank's BCG Matrix. These products would target areas with high growth potential but currently hold a low market share. Significant investment in marketing and rigorous risk assessment would be necessary to gauge their long-term viability and potential to ascend to Star status.

- Targeting High Growth: For example, the global green finance market is projected to reach over $50 trillion by 2027, indicating a substantial growth opportunity.

- Low Initial Market Share: Community Bank's initial penetration into these specialized areas would likely be minimal, perhaps less than 5% of the addressable market in the first year.

- Investment Required: Developing expertise in evaluating green projects or specific tech sectors demands significant upfront investment in specialized personnel and data analytics.

- Potential for Future Stars: Successful products could capture a significant portion of these growing markets, similar to how digital banking services evolved from Question Marks to Stars for many institutions.

Question Marks represent products or services with low market share but high growth potential, requiring careful analysis. Community Bank's investment in its new digital platform, CB2GO, particularly its AI-driven personalized advice features, exemplifies this category. These nascent offerings demand significant capital for development and customer adoption, with their future success uncertain but promising.

Geographic expansion into new, high-growth markets like the Northeast corridor also falls under Question Marks. While these areas offer substantial customer bases, the bank's current market penetration is low, necessitating considerable marketing and customer acquisition investment to establish a foothold. By 2024, many banks were increasing their marketing budgets in urban centers to capture market share.

Emerging financial technologies, such as open banking integrations and specialized lending products for sectors like green finance, are also classified as Question Marks. These areas present high growth opportunities, evidenced by the projected growth in green finance, but require substantial investment and strategic planning to navigate market volatility and competitive pressures.

Community Bank's strategy involves carefully selecting and nurturing these Question Mark initiatives, aiming to convert them into Stars through targeted investment and effective execution. The success of these ventures hinges on their ability to gain traction in growing markets and overcome initial adoption challenges.

BCG Matrix Data Sources

Our Community Bank BCG Matrix is constructed using comprehensive financial statements, detailed market research, and insights from industry publications to offer a clear strategic overview.