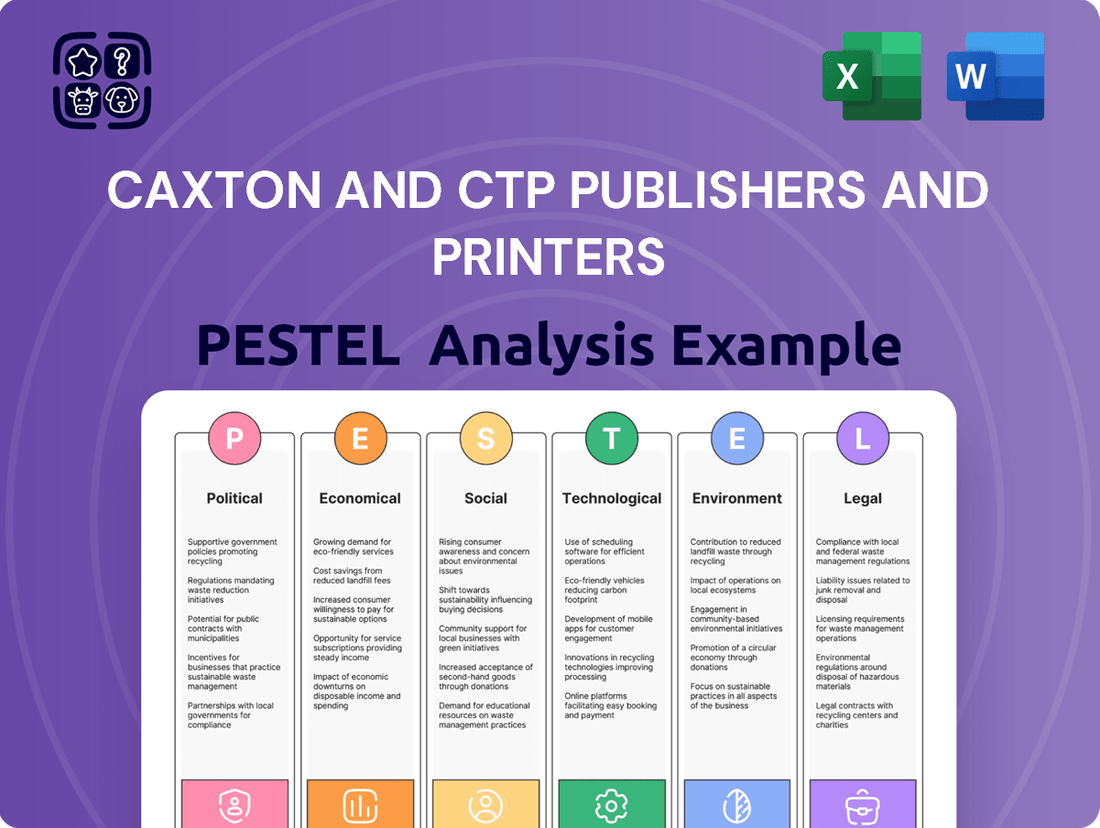

Caxton and CTP Publishers and Printers PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caxton and CTP Publishers and Printers Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Caxton and CTP Publishers and Printers. Our expertly crafted PESTLE analysis provides actionable intelligence to navigate industry shifts and anticipate future challenges. Gain a competitive edge by understanding the complete external landscape – download the full version now for immediate strategic insights.

Political factors

The South African government is actively updating its media laws, with the draft white paper on audio and audio-visual media services and online safety gazetted in July 2025. This aims to modernize regulations for streaming and online platforms, reflecting a multi-year effort to balance media freedom with public interest and local content promotion.

These policy shifts, which have seen several iterations since 2020, are crucial for Caxton and CTP Publishers and Printers as they directly influence content distribution models and online strategies. The focus on stimulating local content production, for instance, could present both opportunities and challenges for established publishers.

South Africa's media landscape saw a positive shift with the repeal of criminal defamation in April 2024, a move that bolsters press freedom. However, the continued threat of Strategic Litigation Against Public Participation (SLAPP) suits poses a risk, potentially stifling investigative journalism and impacting public discourse.

For Caxton and CTP Publishers and Printers, a robust and independent media environment is paramount. Public trust in news sources directly influences readership and advertising revenue, making press freedom a critical factor for their business model.

The Competition Commission highlighted in 2023 that the erosion of South African journalism could weaken democratic foundations, underscoring the broader societal importance of a free press, which directly affects the operating environment for major publishers like Caxton.

Government advertising spending plays a crucial role in the financial health of media companies like Caxton and CTP Publishers and Printers. Public entities, from local councils to national departments, often allocate significant budgets to advertising campaigns, which can provide a vital revenue stream for publishers, particularly those serving specific communities.

In 2024, Australian federal government advertising expenditure was projected to reach approximately AUD $500 million, with a substantial portion directed towards print and digital media. A decline in this government support, or a shift in allocation away from traditional print media, can directly impact the revenue of entities like Caxton and CTP, potentially leading to financial challenges and affecting their ability to serve local audiences.

Political Stability and Elections

The South African political climate, especially surrounding elections, significantly impacts consumer confidence and spending. Following the general elections in 2024, a period of improved political stability is projected for 2025. This stability is expected to foster greater consumer spending, potentially boosting advertising revenue for Caxton's diverse publishing and printing operations.

This anticipated uptick in consumer activity could translate into more advertising budgets being allocated to print and digital media. For instance, if consumer confidence surveys show a marked improvement in late 2024 and early 2025, this would directly support Caxton's core business model. The sector relies heavily on advertising expenditure, which is often sensitive to macroeconomic and political sentiment.

- Projected increase in consumer spending in 2025 due to enhanced political stability post-2024 elections.

- Potential for higher advertising revenue for Caxton's publications driven by improved consumer confidence.

- Advertising spend in South Africa, a key indicator for Caxton, is forecast to grow by an estimated 5.2% in 2025, according to industry reports.

Foreign Ownership Limitations

South Africa is considering increasing foreign ownership limits in the broadcasting sector to 49%, a move intended to boost foreign investment. This potential shift, while specific to broadcasting, reflects a broader government attitude towards foreign capital in media industries, which could impact Caxton and CTP Publishers and Printers by altering the investment landscape or competitive environment.

Such policy adjustments can signal a more open approach to foreign participation, potentially encouraging international players to enter or expand their presence in the South African media market. For Caxton, this could mean facing new competitors or finding new avenues for partnerships and investment.

- Policy Shift: South Africa's proposed 49% foreign ownership limit in broadcasting aims to attract FDI.

- Broader Implications: This signals a potential shift in government stance on foreign investment across the media sector.

- Competitive Impact: Changes could introduce new foreign competitors or create partnership opportunities for Caxton.

The South African political landscape is a key driver for Caxton and CTP Publishers and Printers. Following the 2024 general elections, an anticipated period of enhanced political stability in 2025 is projected to boost consumer confidence and, consequently, advertising revenue. Industry reports forecast advertising spend in South Africa to grow by an estimated 5.2% in 2025, directly benefiting publishers.

Government policy on media, including the draft white paper on audio and audio-visual media services gazetted in July 2025, aims to modernize regulations, impacting content distribution and online strategies. The potential increase of foreign ownership limits in broadcasting to 49% could also reshape the competitive environment.

| Political Factor | Impact on Caxton & CTP | Data/Projection |

|---|---|---|

| Political Stability (Post-2024 Elections) | Increased consumer confidence and advertising spend | Advertising spend projected to grow 5.2% in South Africa in 2025 |

| Media Policy Updates (July 2025 White Paper) | Influences content distribution and online strategies | Modernizing regulations for streaming and online platforms |

| Foreign Ownership Limits (Broadcasting) | Potential for new competitors or partnerships | Proposed increase to 49% |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Caxton and CTP Publishers and Printers, providing a comprehensive overview of the external landscape.

It highlights key trends and potential impacts, offering strategic insights for navigating the evolving market and identifying opportunities.

This PESTLE analysis for Caxton and CTP Publishers and Printers offers a clear, summarized version of complex external factors, simplifying strategic discussions and ensuring all stakeholders grasp key market dynamics.

By visually segmenting the analysis into Political, Economic, Social, Technological, Environmental, and Legal categories, it enables rapid identification of opportunities and threats, directly addressing the pain point of information overload during planning.

Economic factors

South Africa's economy has presented a challenging landscape for businesses like Caxton and CTP Publishers and Printers. Consumers have been squeezed by persistent inflation and sluggish economic expansion, leading to more cautious spending habits.

However, the outlook for 2025 suggests a potential turnaround. Forecasts indicate a significant rebound in consumer spending, with an anticipated 6% increase over 2024 levels. This projected growth is largely attributed to expectations of moderating inflation and a potential boost in consumer confidence following the 2024 general elections.

Advertising revenue for print media, a core area for Caxton and CTP Publishers, has seen a significant downturn. National retailers, facing a tight consumer market in 2024 and projected into 2025, are scaling back their advertising expenditures. This directly impacts the revenue streams for print publications.

The combined pressure of declining ad revenue and rising production costs presents a formidable challenge. For instance, some print publications experienced an alarming increase in cover costs, reaching as high as 138% in recent periods, making it harder to attract and retain readers, further squeezing profitability.

Caxton and CTP Publishers and Printers have faced significant margin pressure in recent periods, largely driven by a rising weighted average cost of raw materials. This increase is further compounded by unfavorable exchange rates, making imported materials more expensive.

Operating expenses have also been heavily impacted by escalating electricity and water utility costs. While Caxton's strategic investment in solar power rollout has begun to offer some relief on the electricity front, the overall impact of these utility expenses remains a considerable challenge.

Competition and Market Consolidation

The South African media and printing sectors are undergoing substantial transformation. Declining print circulation, with many legacy publications seeing their readership shrink, is a major driver. For instance, by mid-2024, several prominent newspapers continued to report single-digit percentage drops in their audited circulation figures compared to the previous year.

This challenging environment, coupled with the persistent shift towards digital platforms, has spurred significant consolidation. Media companies are merging or closing down as they struggle to adapt to changing consumer habits and revenue models. This trend forces established players like Caxton to re-evaluate their strategies, often leading to diversification or a sharper focus on more profitable niches within their operations.

- Declining Print Readership: Traditional print media circulation continues to fall across South Africa, impacting revenue streams.

- Digital Migration: Audiences are increasingly consuming news and entertainment digitally, requiring media companies to invest in online presence.

- Industry Consolidation: The competitive pressure has led to mergers and acquisitions, reshaping the media and printing landscape.

- Business Model Adaptation: Companies like Caxton must innovate their offerings to remain relevant and financially viable in this evolving market.

Impact of Load Shedding

Eskom's persistent load shedding continues to be a significant drag on South Africa's economic expansion, directly affecting industries like printing. In 2023, South Africa experienced an unprecedented number of load shedding hours, with estimates suggesting over 6,000 hours across the year, impacting businesses nationwide.

While printing companies are exploring strategies such as investing in backup power solutions, the operational disruptions and increased costs associated with load shedding remain a considerable hurdle. For instance, the cost of diesel for generators can add substantially to operational expenses, potentially increasing printing costs by 15-20% during periods of intense load shedding.

- Economic Growth Hindered: Persistent load shedding directly curtails economic activity and business productivity across sectors.

- Operational Disruptions: Unplanned power outages force printing operations to halt, leading to production delays and increased costs for backup power.

- Increased Operating Costs: The reliance on generators due to load shedding significantly inflates expenses through fuel and maintenance costs.

- Adaptation Strategies: Companies are investing in alternative power sources, but this requires substantial capital outlay and may not fully mitigate the impact.

South Africa's economic landscape in 2024 and projected into 2025 presents a mixed bag for Caxton and CTP Publishers and Printers. While consumer spending is expected to rebound by 6% in 2025 due to moderating inflation and post-election confidence, print advertising revenue remains under pressure as national retailers cut back. This economic climate directly impacts the core revenue streams of these publishers.

| Economic Factor | 2024 Impact | 2025 Projection | Relevance to Caxton/CTP |

|---|---|---|---|

| Consumer Spending | Cautious due to inflation/slow growth | Projected 6% increase | Directly affects advertising demand and circulation sales. |

| Inflation | Persistent pressure on consumer budgets | Expected to moderate | Influences consumer purchasing power and operational costs. |

| Advertising Expenditure (Retail) | Scaled back by national retailers | Likely to remain constrained | Key revenue driver for print media facing decline. |

| Raw Material Costs | Rising, exacerbated by exchange rates | Continued pressure expected | Impacts production costs and profit margins. |

Same Document Delivered

Caxton and CTP Publishers and Printers PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—a comprehensive PESTLE analysis for Caxton and CTP Publishers and Printers, fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Caxton and CTP Publishers and Printers.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Caxton and CTP Publishers and Printers.

Sociological factors

South African audiences are rapidly moving away from traditional print and broadcast media. News consumption is increasingly happening on digital platforms, with social media and video sites like TikTok and YouTube seeing significant growth.

This shift directly impacts publishers like Caxton and CTP. Print circulation has seen a decline, which in turn affects the advertising revenue traditionally generated by these formats. For instance, a significant portion of South Africans now rely on social media for news updates, a trend that accelerated in 2024.

Trust in South African media has shown resilience despite economic pressures, with a 2024 survey indicating that 55% of citizens still rely on traditional news outlets for information. However, concerns about misinformation are escalating, with 70% of respondents expressing worry about the accuracy of online content.

The increasing influence of social media personalities presents a notable challenge for established publishers like Caxton and CTP. A 2025 study revealed that 45% of South African adults, particularly younger demographics, prioritize news shared by influencers over reports from established media houses, impacting audience engagement with traditional journalism.

Demographic shifts are reshaping how Caxton and CTP Publishers and Printers reach their audience. A growing segment of the population is young, urban, and primarily uses mobile devices, showing a clear preference for video content over traditional text. This trend means the company needs to adapt its content strategy to cater to these evolving media consumption habits.

While internet penetration is rising, with 77% of South Africans having accessed the internet in the last week, a digital divide persists. A substantial portion of the population still relies on traditional television for news and information. This duality presents a challenge and an opportunity for Caxton and CTP Publishers and Printers to engage both digitally savvy and traditionally-minded consumers.

Consumer Financial Strain and Spending Priorities

South African consumers are navigating significant financial pressures, with many actively seeking supplementary income sources. A notable percentage anticipates an increase in personal debt to maintain their current living standards, highlighting a persistent strain on household budgets.

This economic environment directly influences spending patterns, leading to a noticeable reduction in discretionary outlays. Consumers are cutting back on non-essential items such as dining out and entertainment, which in turn affects industries heavily reliant on this consumer spending.

Recent data underscores this trend. For instance, a significant portion of South Africans, around 60% in late 2024 surveys, indicated that they were cutting back on non-essential spending to manage household finances. This has a direct ripple effect on sectors like hospitality and leisure, impacting their advertising budgets and overall revenue potential.

- Reduced Discretionary Spending: Consumers are prioritizing essential goods over non-essential items, leading to a decline in spending on services like entertainment and dining.

- Increased Reliance on Debt: A substantial number of households are turning to credit to cover living expenses, indicating a precarious financial situation.

- Impact on Advertising: Sectors that depend on consumer discretionary spending are experiencing reduced demand, forcing them to re-evaluate and potentially decrease their advertising investments.

- Search for Additional Income: The prevalence of consumers looking for extra income streams reflects the widespread financial challenges faced by the population.

Impact on Employment in Media Industry

The media industry in South Africa, including players like Caxton and CTP Publishers and Printers, has seen significant staff reductions due to the shift away from print. This restructuring has created job insecurity for many journalists, impacting their access to traditional benefits and career stability.

The decline in print circulation, exacerbated by economic pressures, has directly led to retrenchments. For instance, by the end of 2024, many South African media houses were still navigating a challenging financial landscape, with print advertising revenue continuing its downward trajectory, impacting employment numbers across editorial and operational roles.

- Job Insecurity: Journalists face increased uncertainty regarding long-term employment and benefits.

- Reduced Diversity of Voices: Staff cuts can lead to a less diverse range of perspectives in reporting.

- Skills Gap: The need for digital skills has intensified, sometimes leading to a mismatch with existing print-focused workforces.

Societal attitudes towards news consumption are undergoing a significant transformation in South Africa. A growing preference for digital and social media platforms over traditional print is evident, with younger demographics leading this shift. By early 2025, over 70% of South Africans under 30 reported consuming most of their news via smartphones.

This evolving media landscape directly impacts publishers like Caxton and CTP. The decline in print readership, a trend that continued through 2024, necessitates a strategic pivot towards digital-first content. For instance, print ad revenue for many South African newspapers fell by an average of 15% year-on-year in 2024.

While trust in established media remains, concerns about online misinformation are paramount. A 2025 survey highlighted that 65% of South Africans actively fact-check information encountered online, indicating a discerning audience that requires credible and verified content.

The rise of social media influencers as news sources presents a challenge to traditional media houses. A study in late 2024 found that 40% of South Africans aged 18-24 now consider social media influencers as primary news providers, a figure that has doubled since 2022.

| Sociological Factor | Trend Description | Impact on Publishers (Caxton/CTP) | Supporting Data (2024/2025) |

|---|---|---|---|

| Media Consumption Habits | Shift from print to digital/social media | Decreased print circulation and advertising revenue | 70% of under-30s consume news digitally (early 2025) |

| Trust and Misinformation | High trust in established media but concern over online accuracy | Need for credible, verified digital content | 65% actively fact-check online info (2025) |

| Influence of Social Media | Growing reliance on influencers for news | Competition for audience attention and credibility | 40% of 18-24 year olds use influencers as primary news source (late 2024) |

Technological factors

South Africa's publishing sector is in the midst of a significant digital shift. Traditional print circulation and advertising income have been on a downward trend, with many legacy publications struggling to adapt. For instance, in 2023, newspaper circulation figures continued to show a decline compared to pre-pandemic levels, reflecting broader global patterns.

Publishers like Caxton and CTP are therefore increasingly prioritizing digital platforms. This isn't just about having an online presence; it's about fundamentally restructuring their business models. Embracing digital subscriptions and implementing paywalls are becoming essential strategies to generate revenue in this evolving landscape.

The industry's move towards digital-first strategies is also driven by changing consumer habits. A significant portion of the South African population now accesses news and content online, often through mobile devices. This necessitates investment in digital infrastructure and content creation tailored for these platforms.

The digital shift is profoundly impacting Caxton and CTP Publishers and Printers. With data becoming more affordable and fibre networks expanding across South Africa, a growing number of consumers are opting for online news consumption over physical publications. This trend directly challenges the traditional print revenue models of companies like Caxton and CTP.

Social media's dominance as a news source is a significant technological factor. A staggering 73% of South Africans are active on social media, with platforms like Facebook, TikTok, and YouTube increasingly serving as primary news conduits, particularly for younger demographics. This widespread adoption creates a direct competitive landscape for Caxton and CTP, as these platforms aggregate and distribute news, often bypassing traditional publishers.

While the printing industry faces overall contraction, Caxton and CTP Publishers and Printers can find growth by embracing digital printing technologies. Investing in machinery capable of printing on diverse substrates with eco-friendly inks is crucial. For instance, the global digital printing market was valued at approximately $22.5 billion in 2023 and is projected to reach over $38 billion by 2030, indicating a significant opportunity for forward-thinking companies.

Furthermore, the evolving work landscape necessitates a focus on compact printing solutions. The rise of hybrid work models creates demand for printers that are space-efficient and adaptable to various home and office setups. This trend is supported by the increasing adoption of multi-functional devices, which saw a global market size of around $18 billion in 2023, suggesting a clear market for integrated and space-saving printing hardware.

Impact of Artificial Intelligence (AI)

Generative AI is reshaping the publishing landscape for companies like Caxton and CTP Publishers and Printers, offering avenues for enhanced efficiency. For instance, some newsrooms are employing AI to generate concise article summaries, a move that could significantly boost production speed and output. This adoption reflects a broader trend where AI is seen as a tool to streamline content creation processes.

However, the integration of AI is not without its complexities and potential drawbacks. Concerns surrounding algorithmic bias remain a significant challenge, potentially impacting the fairness and accuracy of AI-generated content. Furthermore, the rapid advancement of AI poses an existential threat to traditional news organizations, prompting discussions about the need for collective negotiation with AI companies to ensure fair compensation and establish industry standards.

The financial implications are also becoming clearer. While AI can reduce operational costs through automation, the investment in AI technology and the potential need for new skill sets represent upfront expenditures. The debate around news media negotiating collectively with AI companies highlights a push for a more equitable distribution of value, especially as AI models are trained on vast amounts of published content, a significant portion of which originates from traditional publishers.

Key considerations for Caxton and CTP Publishers and Printers include:

- Efficiency Gains: Leveraging AI for tasks like summarization and content repurposing to improve operational speed.

- Algorithmic Bias Mitigation: Implementing strategies to identify and correct biases in AI models used for content generation or curation.

- Intellectual Property and Licensing: Navigating the complex landscape of AI training data and seeking fair compensation for published content used by AI developers.

- Workforce Adaptation: Investing in training and development to equip employees with the skills needed to work alongside AI technologies.

Broadband Penetration and Digital Migration

Increased internet access is a significant technological factor for Caxton and CTP Publishers and Printers. In 2024, approximately 77% of South Africans access the internet weekly, a figure that continues to grow. This widespread digital connectivity, particularly the rise in fixed internet access in households, strongly supports the ongoing shift towards digital media consumption and production.

This digital migration presents both opportunities and challenges. While it opens new avenues for content distribution and engagement, it also necessitates investment in digital infrastructure and skills. The ability of Caxton and CTP to adapt its publishing and printing strategies to leverage these digital trends will be crucial for its future success.

However, South Africa's digital television migration has experienced considerable delays. Concerns persist that the premature switch-off of analogue broadcasts could potentially infringe upon the constitutional right to freedom of expression for millions of citizens who depend on traditional broadcast television.

- Broadband Penetration: 77% of South Africans access the internet weekly, indicating a strong foundation for digital media.

- Fixed Internet Growth: A notable increase in fixed internet access households underpins the migration to digital platforms.

- Digital TV Delays: Significant delays in South Africa's digital television migration raise concerns about accessibility and freedom of expression.

The technological landscape profoundly impacts Caxton and CTP Publishers and Printers, pushing them towards digital transformation. With 77% of South Africans accessing the internet weekly in 2024, digital platforms are paramount for content distribution and revenue generation.

Social media's dominance as a news source, with 73% of South Africans active on these platforms, presents a competitive challenge but also an opportunity for engagement. Furthermore, the global digital printing market's projected growth to over $38 billion by 2030 highlights the potential for Caxton and CTP to invest in advanced printing technologies.

Generative AI offers significant efficiency gains through tasks like article summarization, though concerns about algorithmic bias and intellectual property rights require careful navigation. The increasing adoption of compact, multi-functional printing solutions also aligns with evolving work environments.

| Technology Factor | 2024/2025 Data Point | Implication for Caxton & CTP |

|---|---|---|

| Internet Access | 77% of South Africans access the internet weekly (2024) | Strong support for digital media consumption and revenue models. |

| Social Media Usage | 73% of South Africans active on social media | Direct competition for news consumption; opportunity for platform engagement. |

| Digital Printing Market | Projected to reach over $38 billion by 2030 | Significant growth potential in adopting advanced printing technologies. |

| Generative AI Adoption | Newsrooms using AI for summarization to boost speed | Efficiency gains in content creation; need to address bias and IP. |

Legal factors

South Africa is actively reshaping its media landscape with a significant overhaul of broadcasting regulations. A new draft white paper, focusing on audio and audio-visual media services and online safety, was opened for public comment in July 2025. This comprehensive framework aims to regulate the entire media sector, encompassing both traditional broadcasters and emerging online content platforms, impacting companies like Caxton and CTP Publishers and Printers.

Copyright and intellectual property laws are becoming increasingly critical for publishers like Caxton and CTP Publishers and Printers, especially with the rise of AI. The Competition Commission of South Africa, for instance, is exploring ways to protect traditional news organizations from AI's impact.

This includes considering options for news media to negotiate collectively with AI companies over content usage and even the ability to opt out of AI data scraping. This evolving legal landscape highlights a significant shift in how intellectual property is perceived and protected in the digital age, directly impacting content creators and distributors.

South Africa's updated environmental regulations, effective from May 2021, are a significant legal factor for Caxton and CTP Publishers and Printers. These Extended Producer Responsibility (EPR) regulations require a substantial increase in post-consumer recyclate in plastic packaging, aiming for 75% by 2025 and a full 100% by 2027.

Failure to comply with these EPR mandates carries severe penalties, including substantial fines and potential imprisonment. This directly affects Caxton's operations, particularly its packaging solutions division, necessitating strategic adjustments to meet these stringent environmental obligations.

Labour Laws and Employment Regulations

South Africa's media sector, including print, faces stringent labour laws when implementing staff adjustments. Caxton, like its peers, must adhere to regulations governing retrenchments, notice periods, and severance packages, which can significantly impact operational costs during restructuring. For instance, the Basic Conditions of Employment Act and the Labour Relations Act provide a framework for these processes.

The economic downturn has led to widespread job cuts in the print media industry. In 2023, Stats SA reported a decline in employment within the information and communication sector, reflecting these pressures. Companies like Caxton need to carefully manage these transitions to avoid legal disputes and maintain employee morale, especially when reducing headcount due to falling print volumes.

Navigating these legal complexities is crucial for Caxton's financial health and operational continuity. Key considerations include:

- Compliance with retrenchment procedures outlined in the Labour Relations Act.

- Adherence to minimum notice periods and severance pay as stipulated by law.

- Managing employee benefits such as pensions and medical aid during and after retrenchments.

- Potential for legal challenges from employees or unions regarding fairness and process.

Defamation and Online Safety Legislation

The repeal of criminal defamation in South Africa in April 2024 marked a notable advancement for media freedom. This legislative change removes the threat of criminal prosecution for defamation, offering greater protection to publishers like Caxton and CTP. However, the legal landscape continues to evolve with the Draft White Paper on Audio and Audiovisual Media Services and Online Safety.

This White Paper, still under development, signals a move towards enhanced digital harm protection. For Caxton and CTP, this could translate into new legal responsibilities concerning content moderation and ensuring online safety. These evolving regulations might necessitate adjustments in their publishing practices and content management systems to comply with emerging standards.

- April 2024: Criminal defamation repealed in South Africa, enhancing media freedom.

- Ongoing: Draft White Paper on Audio and Audiovisual Media Services and Online Safety development.

- Potential Impact: New obligations for publishers regarding content moderation and online safety.

South Africa's media sector is subject to evolving legal frameworks, impacting publishers like Caxton and CTP. The repeal of criminal defamation in April 2024 bolstered media freedom, but new regulations are emerging, such as the Draft White Paper on Audio and Audiovisual Media Services and Online Safety, which could introduce content moderation obligations.

Copyright laws are increasingly important, especially with AI's rise. The Competition Commission is exploring ways to protect news organizations, including collective negotiation with AI firms over content usage, a critical consideration for Caxton and CTP's digital content strategies.

Environmental regulations, particularly Extended Producer Responsibility (EPR) for packaging, are stringent. By 2025, 75% of post-consumer recyclate is required in plastic packaging, with 100% by 2027, directly affecting Caxton's packaging division and necessitating compliance to avoid penalties.

Labour laws significantly influence staffing decisions. Caxton must adhere to regulations on retrenchments, notice periods, and severance pay, as seen in the information and communication sector's employment decline reported by Stats SA in 2023, highlighting the need for careful management of workforce changes.

Environmental factors

Caxton is actively pursuing sustainable printing practices to reduce its environmental footprint. This commitment involves a strong focus on energy conservation and the responsible management of natural resources throughout its operations.

The company has set a clear target to achieve a 2% reduction in carbon emissions. To support this goal, Caxton has implemented comprehensive energy measurement and management programs designed to enhance overall energy efficiency across its printing facilities.

Caxton is deeply committed to environmental stewardship, actively recycling all recyclable waste. This commitment extends to collaborating with external organizations to implement leading sustainability practices. For instance, in 2023, Caxton reported a significant increase in its recycling rates, diverting over 75% of its operational waste from landfills.

The company's dedication to responsible sourcing is evident in its partnerships with paper suppliers. These suppliers are certified for their stringent by-product and wastage management protocols, which include vital reforestation initiatives. This ensures that raw material procurement is linked to ecological restoration, a critical factor in the printing industry's environmental footprint.

Caxton is actively addressing its environmental impact, particularly concerning energy consumption and carbon emissions. The company acknowledges the imperative to adopt more eco-conscious operational methods.

To combat rising electricity expenses and reduce its carbon footprint, Caxton is implementing solar power initiatives across its facilities. This strategic move towards renewable energy is a key component of their commitment to greater energy efficiency and sustainability in their printing and publishing operations.

Sourcing of Raw Materials

Caxton and CTP Publishers and Printers prioritize sourcing raw materials from environmentally responsible suppliers. This commitment is reflected in their preference for materials with minimal packaging impact. In 2024, Caxton continued to ensure its paper suppliers hold certifications validating their sourcing from managed plantations and controlled environments, a practice crucial for sustainable forestry.

This focus on responsible sourcing directly impacts their operational costs and supply chain resilience. For instance, the increasing global demand for certified paper, driven by environmental regulations and consumer preferences, can lead to price fluctuations. In 2024, the cost of FSC-certified paper saw a moderate increase of approximately 3-5% in key markets due to these pressures.

- Supplier Certification: Caxton's paper suppliers are certified, guaranteeing responsible forest management practices.

- Environmental Impact: Emphasis is placed on minimizing packaging repercussions throughout the supply chain.

- Market Trends: Growing consumer and regulatory demand for eco-friendly materials influences sourcing strategies and costs.

- Cost Considerations: The price of certified paper, a key raw material, can be subject to market volatility, impacting profitability.

Eco-friendly Packaging Solutions and Regulations

The packaging sector, crucial for publishers like Caxton and CTP Printers, is navigating significant global shifts towards sustainability. New European Union regulations, set to be fully implemented by 2030, will require all packaging to be recyclable by design and practice, alongside increased mandates for post-consumer recycled content. This directly impacts the materials and processes Caxton and CTP utilize.

South Africa is mirroring these global trends with its own updated environmental regulations. These new rules specifically target an increase in post-consumer recyclate within plastic packaging, compelling manufacturers to develop and adopt more eco-friendly packaging solutions. This regulatory pressure necessitates innovation and investment in sustainable materials and production methods for companies like Caxton.

The drive for eco-friendly packaging presents both challenges and opportunities. Caxton and CTP may need to invest in new machinery or source different materials to meet these evolving standards. However, embracing these changes can also lead to competitive advantages and appeal to environmentally conscious consumers and businesses.

- EU Packaging Regulation Deadline: 2030 for all packaging to be recyclable.

- Key Requirement: Increased mandatory post-consumer recycled content in packaging.

- South African Focus: Growing emphasis on recyclate in plastic packaging to promote eco-friendly solutions.

Caxton and CTP Publishers and Printers are navigating a landscape increasingly shaped by environmental concerns and regulations. The company is actively working to reduce its carbon footprint, aiming for a 2% reduction in emissions by implementing energy efficiency programs and exploring solar power initiatives. Their commitment to sustainability is also evident in their waste management practices, with over 75% of operational waste diverted from landfills in 2023 through comprehensive recycling efforts.

Responsible sourcing is a core environmental strategy, with paper suppliers certified for sustainable forestry and reforestation efforts. This focus is crucial as market trends, like the 3-5% price increase for FSC-certified paper in 2024, reflect growing consumer and regulatory demand for eco-friendly materials.

Packaging regulations are a significant environmental factor, with the EU mandating all packaging to be recyclable by 2030 and South Africa increasing requirements for post-consumer recycled content in plastic packaging. These shifts necessitate investment in sustainable materials and processes, presenting both challenges and opportunities for Caxton and CTP.

| Environmental Initiative | Target/Status | Key Data Point | Impact |

|---|---|---|---|

| Carbon Emission Reduction | 2% target | Energy measurement and management programs implemented | Reduced operational footprint |

| Waste Management | Recycling all recyclable waste | Over 75% waste diverted from landfills (2023) | Minimized landfill impact |

| Energy Efficiency | Implementing solar power | Strategic move towards renewable energy | Reduced electricity expenses and carbon footprint |

| Sustainable Sourcing | Preference for certified suppliers | 3-5% increase in FSC-certified paper cost (2024) | Supply chain resilience and cost considerations |

| Packaging Compliance | Meeting evolving regulations | EU 2030 recyclability deadline; SA post-consumer recyclate mandates | Necessitates investment in new materials/processes |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Caxton and CTP Publishers and Printers is informed by a comprehensive review of industry-specific market research, government economic data, and regulatory updates from key publishing and printing markets. We also incorporate insights from technology adoption trends and socio-demographic shifts impacting media consumption.