Caxton and CTP Publishers and Printers Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caxton and CTP Publishers and Printers Bundle

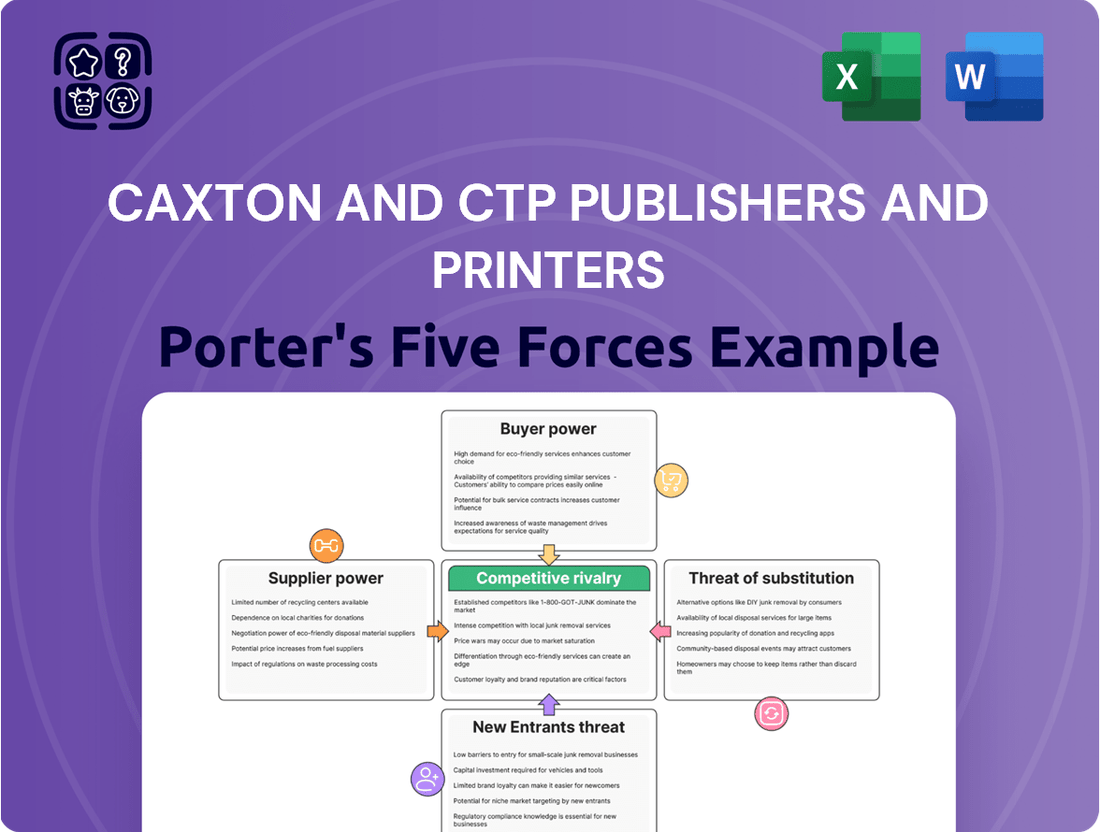

The printing and publishing landscape for Caxton and CTP Publishers and Printers is shaped by intense rivalry and evolving customer demands. Understanding the bargaining power of buyers and the threat of substitutes is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping Caxton and CTP Publishers and Printers’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Caxton and CTP Publishers and Printers' dependence on key raw materials like paper and ink significantly influences supplier bargaining power. The global supply chain for these essential inputs can be volatile, impacting availability and price. For instance, in 2024, paper prices experienced fluctuations due to energy costs and shipping disruptions, directly affecting printing companies.

A limited number of suppliers for specialized paper grades or high-quality inks can empower those suppliers. If Caxton relies on a few specialized providers, these suppliers can command higher prices or dictate terms, increasing their leverage over the publisher.

Suppliers of highly specialized printing machinery and proprietary software can wield significant bargaining power. For instance, if Caxton and CTP Publishers and Printers rely on a limited number of providers for advanced digital printing presses or unique workflow management systems, these suppliers can dictate terms and pricing. The cost and complexity associated with switching these critical equipment suppliers, which can involve substantial capital investment and retraining, further solidify their leverage.

For its publishing operations, Caxton and CTP Publishers and Printers depends on a range of suppliers, including authors, journalists, and content agencies. The leverage these suppliers hold is directly tied to how unique and sought-after their intellectual property is. For instance, if a particular author has a significant following or if an agency provides exclusive, high-quality content, they can negotiate for higher payment rates, which in turn affects Caxton's profit margins.

The bargaining power of these content creators is a critical factor. In 2023, the average advance paid to debut authors in the UK ranged from £1,000 to £5,000, but for established authors with proven sales records, these figures can escalate significantly, sometimes into six figures. This directly translates to higher input costs for Caxton's publishing division, especially if they are competing for exclusive rights to popular intellectual property.

Labor and Specialized Skills

The bargaining power of labor, especially those with specialized skills in printing, graphic design, and editorial functions, significantly impacts Caxton and CTP Publishers and Printers. A shortage of these skilled professionals or the presence of robust labor unions can lead to increased wage demands, directly influencing the company's operational expenses and overall profitability.

In 2024, the printing industry continued to face challenges in attracting and retaining skilled press operators and specialized technicians. For instance, reports from the Bureau of Labor Statistics indicated a projected slower than average growth for printing machine operators through 2032, suggesting a persistent scarcity of qualified individuals. This scarcity empowers existing skilled workers to negotiate for higher compensation and better working conditions.

- Skilled Labor Scarcity: A limited pool of experienced printing technicians and graphic designers gives these employees leverage in wage negotiations.

- Union Influence: Strong labor unions can collectively bargain for improved wages, benefits, and work rules, increasing labor costs for Caxton and CTP.

- Impact on Costs: Higher wage demands directly translate to increased operating expenses, potentially reducing profit margins if not offset by productivity gains or price adjustments.

- Operational Continuity: The availability of specialized skills is crucial for maintaining production quality and efficiency, making it difficult for the company to resist reasonable labor demands.

Logistics and Distribution Services

Caxton and CTP Publishers and Printers depend on external logistics and distribution providers to get their newspapers, magazines, and books to readers. The power these suppliers hold is influenced by how widespread their delivery networks are, how efficiently they operate, and whether other similar services are readily available. For instance, in 2023, transportation costs represented a significant portion of operational expenses for many print media companies, potentially increasing the leverage of logistics providers, especially in regions with fewer distribution options.

- Network Density: A supplier with a dense network across Caxton's key markets can command more favorable terms.

- Efficiency and Cost: The operational efficiency and pricing structure of logistics partners directly impact Caxton's delivery costs.

- Availability of Alternatives: The presence of multiple competing logistics firms limits the bargaining power of any single supplier.

- Industry Trends: Rising fuel prices and labor shortages in the logistics sector in 2024 could further empower these suppliers.

The bargaining power of suppliers for Caxton and CTP Publishers and Printers is shaped by the availability of critical inputs like paper, ink, and specialized machinery. Limited suppliers for these essential materials, coupled with the high switching costs of proprietary technology, grant suppliers significant leverage. In 2024, global supply chain disruptions continued to affect paper prices, underscoring this dependency.

Content suppliers, such as authors and journalists, also exert influence, particularly those with unique or in-demand intellectual property. The competition for established authors can drive up advance payments, as seen with figures for UK debut authors in 2023, impacting publishing costs. Similarly, skilled labor in printing and design, facing scarcity in 2024, can negotiate higher wages, increasing operational expenses.

Logistics providers' bargaining power is tied to their network reach and operational efficiency, with rising transportation costs in 2023 affecting print media companies. A lack of alternative distribution options can further empower these service providers.

| Supplier Type | Key Factors Influencing Power | 2023/2024 Data/Trend |

|---|---|---|

| Paper & Ink Manufacturers | Availability, number of suppliers, price volatility | Paper prices fluctuated in 2024 due to energy and shipping costs. |

| Machinery & Software Providers | Specialization, switching costs, proprietary nature | High capital investment and retraining needed for new equipment. |

| Content Creators (Authors, Journalists) | Uniqueness of IP, demand, author reputation | UK debut author advances in 2023: £1,000-£5,000; established authors much higher. |

| Skilled Labor (Printers, Designers) | Skill scarcity, unionization, demand for expertise | Projected slower than average growth for printing machine operators through 2032 (BLS). |

| Logistics & Distribution Services | Network reach, efficiency, availability of alternatives | Transportation costs were a significant operational expense in 2023. |

What is included in the product

This analysis dissects the competitive forces impacting Caxton and CTP Publishers and Printers, revealing industry attractiveness and strategic positioning.

Gain immediate clarity on competitive pressures by visualizing the five forces with an intuitive spider chart, simplifying complex market dynamics for Caxton and CTP Publishers and Printers.

Customers Bargaining Power

Individual readers of Caxton and CTP Publishers and Printers' products, like newspapers and magazines, typically hold low bargaining power on their own. However, when viewed collectively, this consumer base exhibits significant price sensitivity. This means Caxton faces limitations in raising prices without potentially seeing a drop in sales volume.

The widespread availability of free digital content further amplifies this consumer price sensitivity. For instance, in 2024, a significant portion of news consumption shifted to online platforms, often at no direct cost to the reader, putting pressure on traditional print media revenue models.

For Caxton and CTP Publishers and Printers' commercial printing division, customer power is significantly influenced by client concentration. If a small number of large clients account for a substantial percentage of the company's commercial printing revenue, these clients gain considerable leverage to negotiate lower prices or demand more favorable terms.

The ability of these key clients to switch to alternative printing providers also amplifies their bargaining power. For instance, if a major retail chain representing 15% of Caxton's commercial printing revenue can easily find comparable services elsewhere, they can effectively dictate terms.

Customers for news and entertainment now have a vast selection of options beyond traditional print. Digital news platforms, social media feeds, streaming services, and podcasts offer readily accessible content, directly impacting the bargaining power of Caxton and CTP Publishers and Printers' customers. This abundance of substitutes means consumers can easily switch to alternative sources if they are dissatisfied with print offerings, pressuring publishers to offer more competitive pricing and value.

Switching Costs for Commercial Clients

For Caxton and CTP Publishers and Printers, the bargaining power of commercial clients hinges significantly on switching costs. If clients can easily move to another printing provider with minimal disruption or additional expense, their power increases. This ease of switching is often a result of standardized printing processes and readily available alternative suppliers in the market.

Conversely, if Caxton offers integrated solutions, such as design, printing, and distribution services, or secures clients through long-term contracts with penalties for early termination, these factors can substantially raise switching costs. Higher switching costs effectively reduce the bargaining power of these commercial clients, making them less likely to demand lower prices or more favorable terms.

In 2024, the commercial printing industry saw a continued emphasis on digital transformation, which can lower switching costs for clients adopting new technologies. However, specialized printing needs or bespoke solutions provided by Caxton could still create significant barriers to switching. For instance, if a client requires highly specific paper stocks or unique finishing techniques that only Caxton can reliably provide, their ability to switch easily diminishes.

- Low Switching Costs: Clients can readily move to competitors if Caxton's services are easily replicable and require minimal setup for a new provider.

- High Switching Costs: Integrated service offerings, proprietary software, or long-term contractual agreements increase the difficulty and expense for clients to switch.

- Impact on Bargaining Power: Lower switching costs empower clients to negotiate harder on price and terms, while higher costs reduce their leverage.

- Industry Trends: Digitalization in printing can reduce some switching barriers, but specialized capabilities remain a key factor in client retention and bargaining power.

Demand for Value-Added Services

Customers, particularly commercial clients, are increasingly expecting more than just printing services. They are looking for integrated solutions that include design, logistics, and supply chain management. This growing demand for value-added services significantly amplifies their bargaining power.

If Caxton and CTP Publishers and Printers cannot meet these evolving customer needs for comprehensive offerings, clients can easily switch to competitors who do. This forces Caxton to either invest in expanding its service portfolio or risk losing business through price competition. For instance, in 2024, the global print market saw a rise in demand for integrated digital and physical print solutions, highlighting this trend.

- Increased demand for integrated services: Customers want design, logistics, and supply chain support alongside printing.

- Customer leverage: The ability to find competitors offering these expanded services gives customers greater negotiation power.

- Competitive pressure: Caxton must enhance its value-added services or face pricing pressure.

- Market shifts: The 2024 market indicates a strong move towards holistic print and marketing solutions.

Individual consumers of Caxton and CTP Publishers and Printers' print products possess limited individual bargaining power, but as a collective, their price sensitivity is high, especially with the prevalence of free digital alternatives available in 2024. For the commercial printing division, the bargaining power of customers is amplified by client concentration and the ease with which they can switch to competitors, particularly when printing processes are standardized.

The demand for integrated services, such as design and logistics, further empowers commercial clients, forcing Caxton to adapt its offerings or face price competition. In 2024, the trend toward digital and physical print solutions underscored this shift, impacting customer expectations and negotiation leverage.

| Factor | Impact on Bargaining Power | Caxton's Position |

|---|---|---|

| Price Sensitivity (Individual Consumers) | High | Limits pricing flexibility for print products. |

| Availability of Free Digital Content | Increases | Pressures traditional print revenue models. |

| Client Concentration (Commercial Printing) | High for large clients | Major clients can negotiate better terms. |

| Switching Costs (Commercial Printing) | Low for standardized services | Empowers clients to seek alternative providers. |

| Demand for Integrated Services | High | Requires Caxton to expand service portfolio. |

What You See Is What You Get

Caxton and CTP Publishers and Printers Porter's Five Forces Analysis

The document you see here is your deliverable, offering a comprehensive Porter's Five Forces analysis of Caxton and CTP Publishers and Printers. It’s ready for immediate use, providing actionable insights into the competitive landscape without any need for customization or setup.

Rivalry Among Competitors

The South African media and printing sectors are characterized by a substantial number of competitors, ranging from large, established media houses to specialized publishers and a wide array of commercial printing businesses. This fragmentation means Caxton and CTP Publishers and Printers faces rivalry from many different types of companies.

This diverse competitive environment intensifies rivalry as businesses constantly battle for a share of both the content market and print services. For instance, in 2024, the South African advertising market saw significant competition across digital and print platforms, with companies like Media24 and Independent Media also being major players in the media space, directly impacting revenue streams.

The competitive rivalry within the printing and publishing sector, particularly for companies like Caxton and CTP Publishers, is significantly influenced by market maturity. In segments like traditional print media, which has seen a decline, companies often engage in intense competition for a smaller customer base. This dynamic can lead to price wars and reduced profit margins.

Conversely, growth in areas such as packaging solutions presents a different competitive landscape. While still competitive, these growth segments may offer more opportunities for expansion and less direct head-to-head rivalry compared to mature print markets. Understanding these overall market trends is crucial for strategic positioning.

For instance, the global printing market size was valued at approximately USD 790.1 billion in 2023 and is projected to grow at a CAGR of around 3.5% from 2024 to 2030, indicating a mixed maturity across its various segments. This growth is largely driven by demand in packaging and digital printing, while traditional publication printing faces ongoing challenges.

The printing industry demands substantial upfront investment in printing presses and related equipment, creating a high fixed-cost environment for companies like Caxton and CTP Publishers and Printers. This means that once the machinery is in place, the cost of running it is relatively low compared to the initial outlay.

To recoup these significant fixed costs, printing firms are compelled to operate their machinery at the highest possible capacity. This drive for maximum capacity utilization often results in aggressive pricing tactics, especially when the market experiences oversupply or a downturn in demand. For instance, in 2024, many commercial printers reported operating at utilization rates below 70%, leading to intense price wars to secure any available business and cover overheads.

Product Differentiation and Brand Loyalty

Competitive rivalry within the publishing and printing sector, particularly for companies like Caxton and CTP Publishers and Printers, is significantly shaped by product differentiation and the cultivation of brand loyalty. When Caxton's newspapers, magazines, and books, along with its commercial printing services, offer unique content, superior quality, or distinct features, it can lessen the pressure of direct price competition. For instance, a newspaper known for its in-depth investigative journalism or a magazine with exclusive interviews builds a loyal readership that is less likely to switch based solely on price. In 2024, the ongoing digital transformation continues to challenge traditional print media, making unique value propositions and strong brand identity even more critical for survival and competitive advantage.

The degree of differentiation directly impacts the intensity of rivalry. Highly differentiated products, such as specialized niche publications or premium printing services with advanced capabilities, tend to face less direct competition than commoditized offerings. When products are perceived as similar, price becomes the primary deciding factor, escalating competitive pressures. Caxton's strategic focus on building strong, recognizable brands for its various publications and investing in unique content creation are key strategies to counter this commoditization. In the first half of 2024, many media companies reported a renewed emphasis on subscription models that reward reader loyalty through exclusive content and community engagement, demonstrating the tangible benefits of brand loyalty in a competitive landscape.

Brand loyalty acts as a powerful buffer against intense rivalry. Effective loyalty programs, consistent delivery of value, and strong brand messaging can foster a dedicated customer base that is less susceptible to competitor promotions. For Caxton and CTP Publishers and Printers, this translates to a more stable revenue stream and reduced marketing costs associated with customer acquisition. Reports from the printing industry in late 2023 and early 2024 indicated that clients seeking high-quality, reliable commercial printing services often prioritize established relationships and proven track records over marginal price differences, highlighting the enduring value of brand loyalty in B2B relationships as well.

- Product Differentiation: Caxton's newspapers, magazines, books, and commercial printing services can reduce price competition if they offer unique content, superior quality, or specialized features.

- Brand Loyalty: Strong brands and unique value propositions foster customer loyalty, making them less sensitive to price changes and reducing direct competition.

- Market Trends (2024): The ongoing digital shift and renewed focus on subscription models emphasize the importance of unique content and reader engagement for brand loyalty.

- Industry Insights (2023-2024): Commercial printing clients increasingly value established relationships and proven reliability over minor price advantages, underscoring the impact of brand loyalty in B2B sectors.

Exit Barriers in the Industry

High exit barriers within the publishing and printing industry, like specialized printing machinery or significant investments in digital platforms, can trap companies with declining profitability. This means even struggling firms may continue operating, contributing to market overcapacity. For instance, in 2024, the global printing market, while showing resilience, still faces challenges where the cost of divesting specialized assets can outweigh their resale value.

These barriers directly impact competitive rivalry by prolonging the presence of less efficient players. Such a scenario often fuels intense price competition as these companies fight to maintain market share, even at lower margins. Employee severance packages and contractual obligations with suppliers also add to the financial burden of exiting, further entrenching these companies.

- Specialized Assets: Machinery for offset printing or bookbinding is difficult to repurpose for other industries.

- Employee Costs: Significant severance packages and potential retraining obligations increase exit expenses.

- Contractual Commitments: Long-term leases on facilities or supply agreements can be costly to break.

- Brand and Reputation: A poorly managed exit can damage a company's reputation, affecting future ventures.

The competitive rivalry for Caxton and CTP Publishers and Printers is intense due to the fragmented nature of the South African media and printing sectors. Numerous players, from large media houses to niche printers, vie for market share, leading to price wars, especially in mature segments like traditional print media. In 2024, the South African advertising market saw significant competition, with companies like Media24 and Independent Media directly impacting revenue streams for all players.

High fixed costs associated with printing machinery compel firms to operate at high capacity, fueling aggressive pricing. In 2024, many commercial printers reported utilization rates below 70%, leading to price wars to cover overheads. Product differentiation and brand loyalty are crucial differentiators; for instance, newspapers known for investigative journalism build loyal readerships less sensitive to price. The first half of 2024 saw a renewed emphasis on subscription models rewarding reader loyalty through exclusive content, highlighting the value of strong brands.

| Factor | Impact on Rivalry | 2024 Context |

| Market Fragmentation | Intensifies competition among diverse players. | South African advertising market highly competitive across digital and print. |

| Fixed Costs & Capacity Utilization | Drives price competition to cover high overheads. | Low utilization rates (below 70% in 2024) force price wars. |

| Product Differentiation & Brand Loyalty | Reduces price sensitivity and direct competition. | Subscription models in H1 2024 rewarded loyalty with exclusive content. |

SSubstitutes Threaten

The most significant substitute for Caxton and CTP Publishers and Printers' traditional print offerings is the explosion of digital news and information platforms. Websites, news aggregators, social media feeds, and mobile applications provide immediate, often free, access to content, directly competing for audience attention and advertising dollars. In 2024, digital advertising spending is projected to reach over $600 billion globally, highlighting the immense shift away from print.

E-books and audiobooks present a significant threat of substitution for Caxton and CTP Publishers and Printers' traditional print book segment. These digital formats offer readers enhanced convenience and portability, often at a more attractive price point. For instance, in 2024, the global audiobook market was projected to reach over $6 billion, demonstrating a clear shift in consumer preference.

Digital advertising, social media marketing, search engine optimization, and influencer campaigns present significant substitutes for traditional print advertising. These online channels offer businesses more granular audience targeting and immediate performance data, often at a lower cost per impression compared to print. For instance, by mid-2024, digital ad spending globally was projected to surpass $600 billion, indicating a strong shift away from print.

Sustainable and Alternative Packaging Materials

The threat of substitutes in the commercial printing sector, especially for packaging, is significant. This includes alternatives like reusable containers, biodegradable plastics, and even digital solutions that reduce the need for physical packaging altogether. For instance, the global market for sustainable packaging is projected to reach $478.6 billion by 2027, indicating a strong shift away from traditional materials.

This trend directly impacts companies like Caxton and CTP Publishers and Printers. They face pressure to adapt their offerings to include these more environmentally friendly and innovative packaging formats. Failing to do so could lead to a loss of market share as consumers and businesses increasingly prioritize sustainability.

- Sustainable Packaging Market Growth: The global sustainable packaging market is expanding rapidly, driven by consumer demand and regulatory pressures.

- Innovation in Materials: New materials like mushroom-based packaging and seaweed-derived films offer alternatives to traditional paper and plastic.

- Digital Integration: QR codes and NFC tags can replace printed information, reducing the need for extensive packaging inserts.

- Consumer Preference: Studies show a growing consumer willingness to pay more for products with sustainable packaging, influencing brand choices.

Virtual and Augmented Reality Content

While still in its early stages, the threat of virtual and augmented reality (VR/AR) as substitutes for traditional print media is a growing concern for publishers like Caxton and CTP Publishers and Printers. These immersive technologies offer novel ways to engage with information, potentially drawing audiences away from static printed content.

The market for VR/AR content is expanding, with global spending on AR and VR expected to reach $120.2 billion in 2024, a significant increase from previous years. This growth indicates a potential shift in consumer preferences towards more interactive and experiential media consumption.

As VR/AR technology matures and becomes more accessible, it could offer compelling alternatives for storytelling, education, and entertainment, directly competing with the core offerings of print publishers. This represents a long-term strategic challenge as media consumption habits continue to evolve.

- Growing VR/AR Market: Global spending on AR and VR is projected to hit $120.2 billion in 2024, signaling increased adoption and potential for these technologies to displace traditional media.

- New Content Delivery: VR/AR offers immersive experiences that can replace or augment traditional print content, providing interactive storytelling and educational modules.

- Evolving Consumer Habits: As consumers increasingly adopt digital and immersive platforms, the appeal of static print media may diminish, posing a long-term substitute threat.

The threat of substitutes for Caxton and CTP Publishers and Printers is multifaceted, primarily driven by the digital revolution and evolving consumer preferences. Digital platforms offer immediate access to news and information, directly siphoning audiences and advertising revenue from print. Similarly, digital book formats like e-books and audiobooks provide convenience and often lower costs, challenging the traditional print book market.

In the commercial printing sector, especially for packaging, alternatives like sustainable materials and digital solutions are gaining traction. The global market for sustainable packaging is projected to reach $478.6 billion by 2027, indicating a significant shift away from conventional printing substrates. Furthermore, emerging technologies like VR/AR offer entirely new, immersive ways to consume content, posing a long-term threat to static print media.

| Substitute Category | Key Examples | Impact on Print | 2024 Market Data/Projections |

|---|---|---|---|

| Digital News & Information | Websites, News Apps, Social Media | Audience and advertising revenue diversion | Global digital ad spending projected over $600 billion |

| Digital Reading Formats | E-books, Audiobooks | Competition for book sales | Global audiobook market projected over $6 billion |

| Alternative Packaging | Sustainable materials, Reusable containers | Reduced demand for printed packaging | Sustainable packaging market projected to reach $478.6 billion by 2027 |

| Immersive Media | Virtual Reality (VR), Augmented Reality (AR) | Potential long-term displacement of static content | Global VR/AR spending projected at $120.2 billion |

Entrants Threaten

The commercial printing sector, particularly for businesses aiming for large volumes and premium quality, demands considerable upfront investment. This includes acquiring advanced printing presses, maintaining suitable facilities, and integrating cutting-edge technology.

In 2024, the cost of a new, high-speed offset printing press can range from $500,000 to over $2 million, with digital printing solutions also requiring significant capital outlays. These substantial financial hurdles effectively limit the number of new players that can realistically enter the market.

For publishing, building effective distribution networks for print media is a significant hurdle. Newcomers must either invest heavily to create their own, or secure access to existing ones, a task made difficult by the established presence of companies like Caxton and CTP Publishers and Printers.

Caxton, for instance, benefits from extensive and long-standing relationships with distributors and retailers across South Africa. In 2023, the South African print media market, while facing digital shifts, still relied on these physical networks for a substantial portion of its revenue, estimated to be in the billions of South African Rand.

Gaining comparable reach and efficiency in logistics, including warehousing and timely delivery to diverse geographic locations, would require immense capital outlay and time for any new entrant. This existing infrastructure acts as a formidable barrier, protecting Caxton's market share.

Caxton and CTP Publishers and Printers benefits significantly from strong brand loyalty and a well-established reputation across its diverse portfolio of newspapers, magazines, and book publishing. This established trust with consumers acts as a substantial barrier to entry for potential new publishers. For instance, Caxton's flagship titles have cultivated decades of reader engagement, making it difficult for newcomers to replicate that level of ingrained consumer preference without substantial, long-term marketing investment.

Access to Content and Editorial Talent

New entrants into the publishing industry, particularly those looking to compete with established entities like Caxton, face significant hurdles in securing high-quality content and attracting seasoned editorial talent. The ability to consistently produce compelling and diverse material is paramount, and this requires deep industry connections and a strong reputation.

Caxton benefits from its long-standing relationships with a wide array of authors, journalists, and a proven editorial team. This established network provides a distinct advantage, making it challenging for newcomers to match the breadth and depth of content quality that Caxton can readily access and curate. For instance, established publishers often have exclusive contracts or first-look deals that limit access for new players.

- Content Acquisition Costs: New entrants must invest heavily to acquire rights to desirable content, often facing bidding wars with established publishers.

- Talent Acquisition and Retention: Attracting and retaining experienced editors, proofreaders, and content strategists is difficult without a proven track record and competitive compensation packages.

- Brand Reputation and Trust: Established publishers like Caxton have built trust with both creators and consumers, which is a significant barrier for new entrants to overcome.

Regulatory Hurdles and Compliance Costs

The media and printing sectors, including companies like Caxton and CTP Publishers and Printers, face significant barriers to entry due to stringent regulatory frameworks. These can encompass media ownership rules, content regulations, and environmental compliance for printing operations.

Navigating this complex web of regulations and bearing the associated compliance costs can deter potential new entrants. For instance, in 2024, the cost of obtaining environmental permits for printing facilities in South Africa, where CTP operates, can range from R5,000 to R50,000 depending on the scale and type of operation.

- Regulatory Complexity: Media ownership laws and content standards create a challenging landscape for newcomers.

- Environmental Compliance: Printing businesses must adhere to environmental regulations, adding to operational expenses.

- High Entry Costs: The combined effect of regulatory navigation and compliance can significantly increase the capital required to enter the market.

The threat of new entrants for Caxton and CTP Publishers and Printers is moderate, primarily due to high capital requirements for advanced printing technology and the complexities of establishing robust distribution networks.

Significant investment is needed for printing equipment, with new offset presses costing upwards of $2 million in 2024, alongside substantial outlays for digital solutions. Furthermore, building efficient logistics and securing established distribution channels, which Caxton already possesses, demands considerable time and financial resources.

Established brand loyalty and the difficulty in acquiring premium content and talent also serve as barriers. Newcomers must overcome decades of consumer trust and compete for skilled editorial staff and desirable intellectual property, often facing exclusive contracts held by incumbents.

Navigating stringent regulatory frameworks, including media ownership rules and environmental compliance for printing, further elevates entry costs and complexity for potential competitors.

Porter's Five Forces Analysis Data Sources

Our analysis of Caxton and CTP Publishers and Printers leverages data from industry-specific market research reports, financial statements, and competitor annual reports to provide a comprehensive view of the competitive landscape.