Caxton and CTP Publishers and Printers Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caxton and CTP Publishers and Printers Bundle

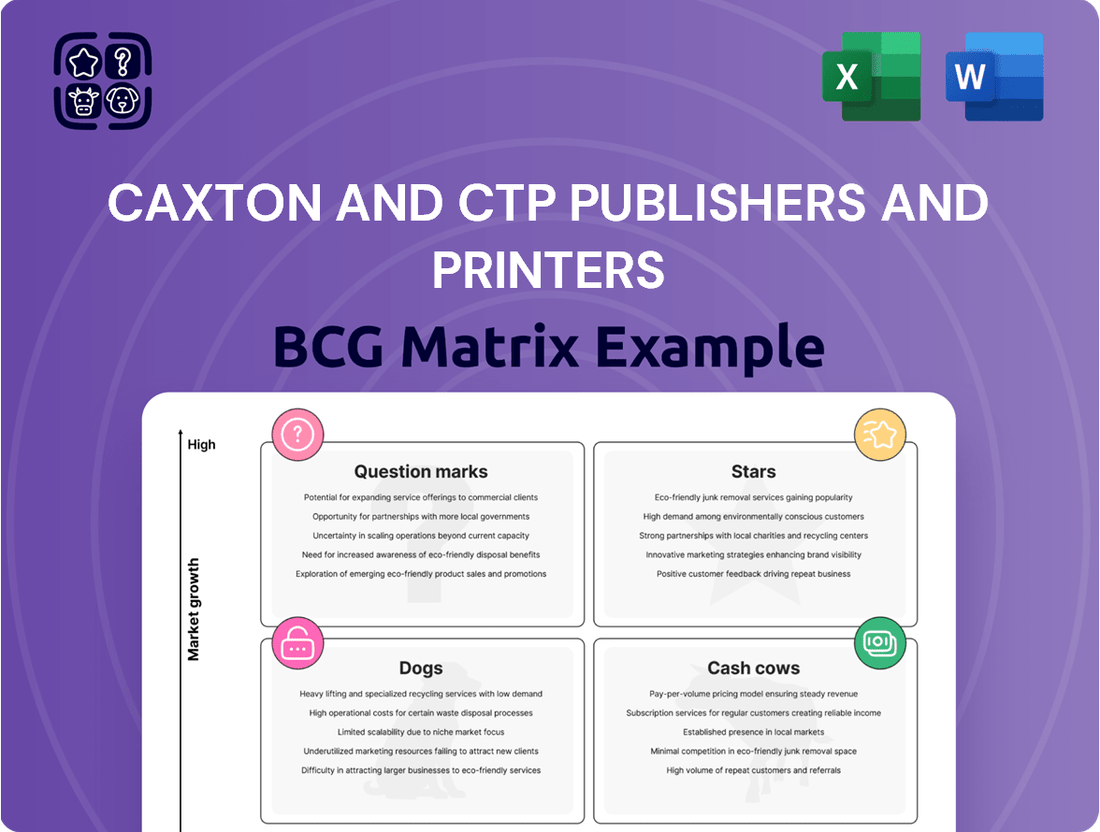

Curious about Caxton and CTP Publishers and Printers' market performance? Our BCG Matrix preview offers a glimpse into their product portfolio's potential, highlighting which segments are driving growth and which may need strategic attention.

Unlock the full strategic advantage by purchasing the complete BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on actionable insights. Get the full report to receive detailed quadrant placements, data-backed recommendations, and a clear roadmap for navigating the competitive landscape and optimizing Caxton and CTP's product strategy.

Stars

Caxton's packaging division is a clear star in their portfolio, demonstrating robust growth and resilience. This segment achieved a significant 55.7% of the group's total net sales recently, highlighting its dominant market position. The company's strategic expansion into new product lines and the commencement of commercial production in beverage packaging further underscore its high-growth potential.

Caxton's stationery operations are experiencing a significant boost following the acquisition of Tidy Files, effective August 1, 2024. This strategic integration has optimized product offerings and enhanced stock management, contributing to a strong performance in what appears to be a high-growth phase for this segment. The company is rapidly capturing market share, indicating a promising trajectory for its stationery division.

Caxton's digital local news platforms, boasting 58 websites, are a strong contender in the growing digital news market. In May 2024, these sites drew in 5 million users and generated 11.2 million pageviews, showcasing significant audience engagement and a substantial market share.

The impressive user numbers and pageviews indicate a healthy growth trajectory for Caxton's online local news offerings. This digital strength, combined with their print operations, creates a compelling multichannel advertising solution for businesses targeting local communities.

Specialized Commercial Printing Innovations

Caxton and CTP Publishers and Printers is strategically positioned within the commercial printing sector. The South African commercial printing market is anticipated to expand, driven by advancements in automation, sustainable printing practices, and the increasing demand for on-demand services. Caxton, a major player in commercial printing, has made significant investments in enhancing production efficiency and acquiring advanced capital equipment. These strategic moves are designed to capitalize on growth opportunities within technologically sophisticated printing segments.

Caxton’s focus on innovation in specialized commercial printing aligns with market trends. The company's commitment to improved production efficiencies and capital equipment upgrades directly addresses the growing demand for automated and eco-friendly printing solutions. This proactive approach allows Caxton to capture a larger share of the market as these advanced segments continue to develop. For instance, the global digital printing market, a key component of specialized commercial printing, was valued at approximately $15.8 billion in 2023 and is projected to grow significantly in the coming years.

- Market Growth: The South African commercial printing market is projected for growth, fueled by technological adoption.

- Key Trends: Automation, eco-friendly printing, and on-demand services are shaping market demand.

- Caxton's Investment: Strategic investments in production efficiencies and capital equipment position Caxton for market share capture.

- Segment Focus: Caxton is targeting high-growth, technologically advanced printing segments.

Strategic Operational Efficiencies

Caxton and CTP Publishers and Printers' strategic operational efficiencies are a key driver of their success. The company's ongoing efforts to streamline operations, secure raw materials at favorable prices, and manage operating expenses effectively have boosted profitability across its diverse business units.

These efficiency gains, notably from the solar power implementation and optimized distribution networks, are crucial for maintaining competitiveness and growing market share in their primary printing and publishing sectors. For instance, in the fiscal year ending June 30, 2023, Caxton reported a significant improvement in its operating margin, partly attributed to these cost-containment initiatives.

- Optimized Raw Material Sourcing: Caxton has leveraged its scale to negotiate better terms for paper and ink, essential inputs for its printing operations.

- Solar Power Rollout: The company's investment in solar energy at key printing facilities, including its Germiston plant, has demonstrably reduced electricity costs. In 2023, solar installations contributed to a notable decrease in energy expenditure, as highlighted in their annual report.

- Distribution Network Enhancements: Refinements in logistics and distribution routes have lowered transportation expenses, a significant cost component for a company with a wide reach.

- Cost Containment Programs: Continuous review and reduction of overheads and administrative costs across all segments contribute to a healthier bottom line.

Caxton's packaging division stands out as a star, showing strong growth and market dominance with 55.7% of total net sales. The stationery segment, bolstered by the Tidy Files acquisition in August 2024, is also a star, rapidly gaining market share. Furthermore, Caxton's 58 digital local news platforms are stars, attracting 5 million users and 11.2 million pageviews in May 2024, demonstrating significant audience engagement.

| Segment | BCG Category | Key Performance Indicators (as of mid-2024) |

|---|---|---|

| Packaging | Star | 55.7% of group net sales; ongoing expansion |

| Stationery | Star | Post-acquisition growth, market share capture |

| Digital Local News | Star | 5 million users, 11.2 million pageviews (May 2024) |

What is included in the product

This BCG Matrix analysis offers tailored insights into Caxton and CTP Publishers and Printers' product portfolio, highlighting strategic recommendations for investment, holding, or divestment.

The Caxton and CTP Publishers and Printers BCG Matrix offers a clear, one-page overview of each business unit's position, alleviating the pain of complex strategic analysis.

This export-ready design allows for quick drag-and-drop into PowerPoint, simplifying the communication of strategic insights.

Cash Cows

Caxton's traditional commercial printing services, encompassing books, advertising inserts, brochures, and magazines, position it as a major player in South Africa's printing landscape. Despite the broader market's low growth trajectory, influenced by digital media's rise, Caxton's substantial market share in this segment is a key contributor to its financial stability.

This established infrastructure and loyal customer network allow Caxton to generate consistent and significant cash flow from its printing operations. The company's strategy here is to maximize returns from these mature assets by focusing on operational efficiency and cost management.

Caxton's network of over 120 free community newspapers operates as a significant cash cow within their portfolio. These publications boast stable circulations and enjoy robust reader and advertiser loyalty in their respective local markets.

Despite the broader print media downturn, these local titles thrive due to their dedicated readership, offering a trusted advertising platform. This positions them as high-market-share entities within a mature, albeit niche, segment.

In 2024, Caxton's print advertising revenue, largely driven by these community papers, remained a stable contributor, demonstrating resilience against digital disruption in localized advertising.

'The Citizen' daily newspaper, a key asset for Caxton and CTP Publishers and Printers, is positioned as a Cash Cow in their BCG Matrix. This classification stems from its strong brand recognition and established readership, which translates to a significant market share in the national daily newspaper sector, even amidst a challenging print advertising landscape.

While national advertising revenue for print publications saw a slight decline in 2024, 'The Citizen' has maintained its position. Its consistent cash flow generation, requiring minimal reinvestment for growth, solidifies its status. This stability allows Caxton to leverage the profits from 'The Citizen' to fund other ventures.

Established Book Publishing Titles

Established book titles within Caxton and CTP Publishers and Printers, assuming they hold a significant share of a mature book market, would be classified as Cash Cows. These titles, with their consistent sales, generate reliable profits without requiring substantial investment for growth. For instance, in 2024, the global print book market, while facing digital competition, still represented a substantial revenue stream, with many legacy titles continuing to perform strongly.

These established titles act as dependable revenue generators, supporting other ventures within the company. Their consistent performance allows Caxton to allocate resources effectively, potentially funding innovation or expansion into new areas. The print book segment, despite digital advancements, demonstrated resilience in 2024, with many readers still preferring physical copies for certain genres.

- Consistent Revenue: Established titles provide a steady income stream, contributing significantly to overall profitability.

- Low Investment Needs: Unlike growth products, these Cash Cows require minimal marketing or development expenditure.

- Market Maturity: The print book market, while competitive, is mature, meaning established titles with brand recognition can maintain their market share.

- Profitability: High margins on these titles translate directly into cash generation for the company.

Print Advertising Revenue from Key Clients

Caxton and CTP Publishers and Printers' print advertising revenue from key clients signifies a strong cash cow. Despite the general downturn in media ad spend, Caxton has successfully diversified its client base, attracting non-traditional advertisers and significantly increasing engagement with financial institutions. This strategic pivot has allowed them to maintain a high market share within the print advertising segment, effectively capitalizing on remaining and newly acquired advertising budgets. For instance, in 2024, financial services advertising in print, while facing overall pressures, saw targeted growth in specific niches where Caxton's reach is particularly dominant.

This segment's strength is evident in its ability to generate consistent cash flow, even amidst evolving media consumption habits. Caxton's extensive reach acts as a significant advantage, enabling them to command a substantial portion of the available print advertising spend from their key clients. This consistent revenue stream supports other, less mature business units within the company.

- High Market Share: Caxton holds a dominant position in print advertising among its key client segments.

- Diversified Client Base: Attracting non-traditional advertisers alongside financial institutions bolsters revenue stability.

- Consistent Cash Flow: The segment reliably generates cash, supporting overall company operations.

- Leveraging Reach: Extensive distribution networks are effectively utilized to maximize print ad revenue.

Caxton's community newspapers are prime examples of cash cows, boasting high market share and stable reader loyalty in their local areas. These publications consistently generate reliable profits, requiring minimal investment for growth, which is crucial for funding other business segments. In 2024, their resilience in localized advertising demonstrated their enduring value.

The Citizen newspaper, due to its strong brand and established readership, also functions as a cash cow. Despite a challenging print advertising market in 2024, it maintained its position and generated steady cash flow. This allows Caxton to reallocate profits to support different areas of the business.

Established book titles within Caxton's portfolio, holding significant share in a mature market, are also classified as cash cows. These titles contribute dependable profits without needing substantial growth investment. The print book market's continued relevance in 2024 underscores the stability of these assets.

| Business Unit | BCG Classification | Key Characteristics | 2024 Data Point |

|---|---|---|---|

| Community Newspapers | Cash Cow | High local market share, stable readership, consistent ad revenue | Stable circulation and advertiser loyalty |

| The Citizen Newspaper | Cash Cow | Strong brand recognition, established readership, consistent cash flow | Maintained market position amidst print ad decline |

| Established Book Titles | Cash Cow | Significant share in mature market, reliable sales, low investment needs | Continued strong performance in print book market |

Full Transparency, Always

Caxton and CTP Publishers and Printers BCG Matrix

The Caxton and CTP Publishers and Printers BCG Matrix preview you see is the definitive document you will receive upon purchase, ensuring complete transparency and immediate utility. This means the strategic insights and analysis presented are precisely what you'll download, without any alterations or additional content.

Rest assured, the BCG Matrix report you are currently viewing is the exact, fully formatted document that will be delivered to you after completing your purchase. Caxton and CTP Publishers and Printers guarantee that no watermarks or demo elements will be present in the final version, offering you a ready-to-use strategic tool.

What you see is the authentic Caxton and CTP Publishers and Printers BCG Matrix, representing the complete and final report you will obtain once your purchase is confirmed. This preview eliminates any guesswork, providing a clear look at the professionally crafted analysis awaiting your immediate deployment.

Dogs

The landscape for national magazine circulation in print has seen a significant downturn. Between 2019 and 2023, circulation numbers have dropped considerably, signaling a market segment characterized by low growth or outright decline.

For Caxton and CTP Publishers and Printers, national magazine titles that consistently underperform and hold a low market share within this declining print sector would be classified as dogs in the BCG Matrix. These underperforming assets often tie up valuable resources, including capital and management attention, without yielding proportionate financial returns.

Underperforming national daily newspaper assets, aside from flagship titles like The Citizen, would be categorized as Dogs within Caxton's BCG Matrix. These are assets operating in a declining market with low market share. For instance, if a national daily newspaper in South Africa, a market that saw a 7.3% year-on-year circulation decline for daily newspapers in 2023 according to PwC's South Africa Media Outlook 2024, has a particularly low circulation and struggles to gain traction, it would represent a Dog.

Legacy printing facilities, lacking recent capital investment, often struggle with lower production speeds and higher operational expenses. For instance, older offset printing presses, while still functional, can't match the speed and efficiency of modern digital printing solutions, leading to increased per-unit costs.

In the highly competitive printing market, these outdated operations, if holding a minimal market share, are classic examples of dogs in the BCG matrix. They represent a drain on capital, yielding insufficient returns and hindering the company's overall financial performance.

Low-Margin, Commodity Commercial Print Jobs

These are segments of commercial printing where competition is fierce, and profit margins are squeezed. Factors like rising raw material costs and fluctuating exchange rates put significant pressure on businesses operating here. For Caxton and CTP Publishers and Printers, if their market share in these highly commoditized areas is small, these could become cash traps, yielding little profit and demanding careful oversight or even a strategic exit.

In 2024, the commercial printing industry continued to grapple with these challenges. For instance, the cost of paper, a key input, saw increases driven by global supply chain issues and demand fluctuations. This directly impacts the profitability of low-margin print jobs.

- Intensified Competition: Many players vie for these print jobs, driving down prices.

- Margin Pressure: Rising input costs, like paper and ink, erode profitability.

- Commoditization: Print jobs are often differentiated solely on price, not quality or service.

- Potential Cash Traps: Low market share in these segments can lead to minimal returns on investment.

Traditional Classified Advertising in Print

Traditional classified advertising in print, a segment where Caxton and CTP Publishers and Printers might operate, is a classic example of a 'dog' in the BCG Matrix. This market has seen a steep decline due to the rise of digital alternatives. For instance, the print advertising revenue in many developed markets has been on a downward trend for years, with classifieds being particularly vulnerable.

Publishers in this space often face a low-growth environment with a shrinking market share. This means that while they might still generate some revenue, the profitability is minimal, and the future growth prospects are bleak. The cost of maintaining print operations can often outweigh the diminishing returns from this advertising category.

- Declining Market Share: Print classifieds have lost significant ground to online platforms like Craigslist and specialized job boards.

- Low Growth Prospects: The overall market for print advertising, especially classifieds, is stagnant or contracting.

- Eroding Profitability: The cost of print production and distribution often makes this segment barely break even.

- Digital Competition: Online platforms offer greater reach, better targeting, and often lower costs for advertisers.

Dogs represent business units or products with low market share in low-growth industries. For Caxton and CTP Publishers and Printers, this includes legacy print operations with declining circulation and profitability. These segments often consume resources without generating significant returns, posing a challenge to overall financial health.

National daily newspapers, excluding strong performers, and certain commercial printing segments with intense competition and low margins fall into the Dog category. These areas are characterized by shrinking market share and pressure on profitability, exacerbated by rising input costs. For example, the print advertising market, particularly classifieds, has seen a substantial decline due to digital alternatives, making it a classic Dog.

In 2023, South Africa's daily newspaper circulation experienced a notable decline of 7.3% year-on-year, as highlighted by PwC's South Africa Media Outlook 2024. This trend underscores the challenges faced by underperforming newspaper assets within Caxton's portfolio.

| BCG Category | Market Growth | Market Share | Caxton & CTP Example | Financial Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Underperforming National Magazines, Legacy Printing Facilities, Declining Print Classifieds | Cash Traps, Low Profitability, Resource Drain |

Question Marks

The South African media sector is experiencing significant digital growth, with a clear trend of audiences migrating to social media and video platforms for their news consumption. This presents an opportunity for traditional publishers like Caxton and CTP Publishers and Printers to adapt.

Caxton's ventures into new digital content areas, moving beyond their existing local news websites, are positioned as question marks in the BCG matrix. While these initiatives are currently consuming cash and have a small market share, they hold the potential for substantial future growth, mirroring the characteristics of question mark products.

For instance, in 2024, digital advertising revenue in South Africa was projected to reach approximately R13.5 billion, indicating a robust market for new digital content. Caxton's strategic investments in areas like short-form video content or specialized digital news platforms, despite their current nascent stage, could tap into this growing digital ad spend and evolve into future stars.

Caxton's entry into the beverage packaging sector positions it as a question mark, a high-growth market where its current market share is minimal. Commercial production beginning in early 2025 signifies a strategic move into a potentially lucrative area, but substantial investment will be crucial to transform this nascent venture into a future market leader.

The printing industry is embracing AI for enhanced workflow, content personalization, and automation. Caxton's investment in these AI-driven solutions positions them in a rapidly expanding technological frontier, aiming to capture a larger market share in this evolving space.

Specialized Packaging for Quick Service Restaurants (QSR)

Caxton's specialized packaging for Quick Service Restaurants (QSR) is positioned as a potential star in the BCG matrix. Despite some overall volume declines in the QSR packaging sector, Caxton is strategically investing in new product lines like cups, buckets, and bowls. This focus targets a specific, potentially high-growth niche where the company aims to build significant market share.

Caxton's commitment to expanding its QSR packaging portfolio, particularly with items like cups and bowls, signals a proactive approach to capturing evolving consumer demands. The company's investment in these areas suggests an expectation of increased demand and a strategic move to solidify its position in a competitive market.

- Market Focus: Caxton is concentrating on QSR-specific packaging such as cups, buckets, and bowls.

- Investment Strategy: Further investments are planned for these specialized QSR product lines.

- Growth Potential: This strategy targets a niche within packaging that shows potential for high growth, aiming to increase market share.

- Industry Context: This occurs despite some reported volume declines in the broader QSR market.

Expansion into New Niche Stationery Product Lines

Caxton and CTP Publishers and Printers’ stationery division is exploring expansion into entirely new or highly specialized niche product lines. While the Tidy Files acquisition has strengthened its existing stationery offerings, these new ventures are positioned as high-growth prospects. Currently, these nascent product lines would hold a low market share, necessitating significant investment in marketing and distribution to achieve market penetration and growth.

- Niche Product Development: Caxton and CTP are investing in the creation of specialized stationery items, moving beyond traditional product categories.

- Growth Potential: These new lines are identified as potential high-growth areas for the stationery division, aiming to capture emerging market demands.

- Market Entry Challenges: Initial market share for these niche products is expected to be low, requiring substantial marketing and distribution strategies to build brand awareness and customer adoption.

- Strategic Focus: The company's strategy involves identifying and capitalizing on underserved segments within the broader stationery market.

Caxton and CTP Publishers and Printers' new digital ventures and their foray into beverage packaging are classified as question marks. These segments are in high-growth markets but currently hold minimal market share, demanding significant investment to realize their potential. The company's strategic focus on these areas, including AI integration in printing, aims to capture future market opportunities.

| Business Segment | BCG Category | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| New Digital Content Areas | Question Mark | High | Low | Requires investment to gain share; potential for future growth. |

| Beverage Packaging | Question Mark | High | Low | Significant investment needed; potential market leader. |

| AI in Printing | Question Mark | High | Low | Capturing evolving tech; aims for larger market share. |

BCG Matrix Data Sources

Our Caxton and CTP Publishers and Printers BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research from trade publications, and market growth forecasts to ensure reliable insights.