Cathay Pacific Airways PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Pacific Airways Bundle

Navigate the complex external forces shaping Cathay Pacific Airways's future with our comprehensive PESTLE analysis. Understand the political stability, economic shifts, and technological advancements impacting the airline's operations and strategic decisions. Gain a critical edge by leveraging these expert insights for your own market strategy. Download the full version now and unlock actionable intelligence.

Political factors

Cathay Pacific benefits significantly from the Hong Kong government's dedication to bolstering its position as a premier international aviation hub. This commitment is evident in substantial infrastructure projects, such as the HK$141.5 billion (approximately US$18 billion) Three-Runway System at Hong Kong International Airport, which aims to substantially increase passenger and cargo handling capabilities.

This strategic governmental backing directly supports Cathay Pacific's operational expansion and network development, allowing it to better compete on a global scale. The government's investment in aviation infrastructure fosters an environment conducive to growth for major carriers like Cathay Pacific, reinforcing Hong Kong's role as a vital transit and connectivity point.

Geopolitical tensions and shifting trade policies significantly impact Cathay Pacific's operations, especially its vital cargo segment. Trade disputes, like those that have seen tariffs imposed between major economies, can directly dampen global freight demand, thereby reducing revenue for the airline. For instance, in 2023, while overall air cargo demand saw a slight recovery, geopolitical uncertainties continued to pose risks to sustained growth.

Cathay Pacific operates within a complex web of aviation regulations, both international and domestic, which are constantly evolving. For instance, recent updates have introduced stricter guidelines concerning the use of portable power banks on aircraft, a directive Cathay Pacific has confirmed full compliance with.

These stringent safety standards are not merely bureaucratic hurdles; they are fundamental to the airline's operational continuity and the crucial trust it cultivates with its passengers. Failure to adhere to these evolving rules could lead to significant disruptions and reputational damage.

Government Shareholding and Influence

The Hong Kong SAR Government is a significant stakeholder in Cathay Pacific, holding a notable share that influences its strategic direction. This governmental backing has been crucial, particularly during periods of financial strain, evidenced by past preference share buybacks that bolstered the airline's stability.

This substantial government interest underscores Cathay Pacific's position as the de facto flag carrier, meaning its performance and strategic choices are often viewed through a national lens. Consequently, government shareholding can directly impact long-term planning and major operational decisions.

- Government Stake: The Hong Kong SAR Government maintains a significant equity stake in Cathay Pacific Airways.

- Past Support: The government provided critical financial assistance, including preference share buybacks, during past economic downturns.

- Strategic Influence: This shareholding grants the government a degree of influence over the airline's strategic decisions and future planning.

- Flag Carrier Status: The government's continued interest reinforces Cathay Pacific's role as Hong Kong's flag carrier.

Cross-Border Relations and Travel Policies

Cathay Pacific's operations are significantly influenced by cross-border relations and travel policies, especially concerning mainland China due to its extensive network there. Shifts in visa requirements or political tensions between Hong Kong and mainland China can directly affect passenger numbers and the financial viability of routes. For instance, in early 2024, Cathay Pacific saw a strong rebound in travel demand, with passenger numbers reaching 32.3 million for the full year 2023, a substantial increase from 2022, indicating the sensitivity to easing travel restrictions.

Changes in travel policies and visa regulations between Hong Kong, mainland China, and other international destinations can dramatically impact passenger volumes and route profitability.

- Hong Kong's Gateway Status: Cathay Pacific's position as a major hub relies on open borders and favorable travel agreements.

- Mainland China Connectivity: Over 70% of Cathay Pacific's pre-pandemic passenger traffic was to or from mainland China, highlighting the critical importance of bilateral travel policies.

- Geopolitical Sensitivity: Political developments and cross-border disputes can lead to sudden travel restrictions or advisories, directly affecting booking trends and operational planning.

Government policies directly shape Cathay Pacific's operational landscape, particularly through its significant equity stake and role as Hong Kong's de facto flag carrier. The Hong Kong SAR Government's past financial support, such as preference share buybacks, has been crucial for the airline's stability. Furthermore, ongoing investments in aviation infrastructure, like the Three-Runway System at Hong Kong International Airport, directly bolster Cathay Pacific's capacity and competitiveness.

| Factor | Impact on Cathay Pacific | Supporting Data/Example |

|---|---|---|

| Government Stake & Support | Provides financial stability and strategic influence. | Hong Kong SAR Government holds a significant equity stake; provided past financial assistance including preference share buybacks. |

| Infrastructure Investment | Enhances operational capacity and hub status. | HK$141.5 billion (approx. US$18 billion) Three-Runway System at Hong Kong International Airport. |

| Bilateral Travel Policies | Crucial for passenger volumes, especially with mainland China. | Over 70% of pre-pandemic traffic was to/from mainland China; passenger numbers reached 32.3 million in 2023. |

| Trade Policies & Geopolitics | Affects cargo demand and overall revenue. | Geopolitical uncertainties pose risks to sustained air cargo growth, impacting freight revenue. |

| Regulatory Compliance | Ensures operational continuity and public trust. | Adherence to evolving safety standards, such as those for portable power banks. |

What is included in the product

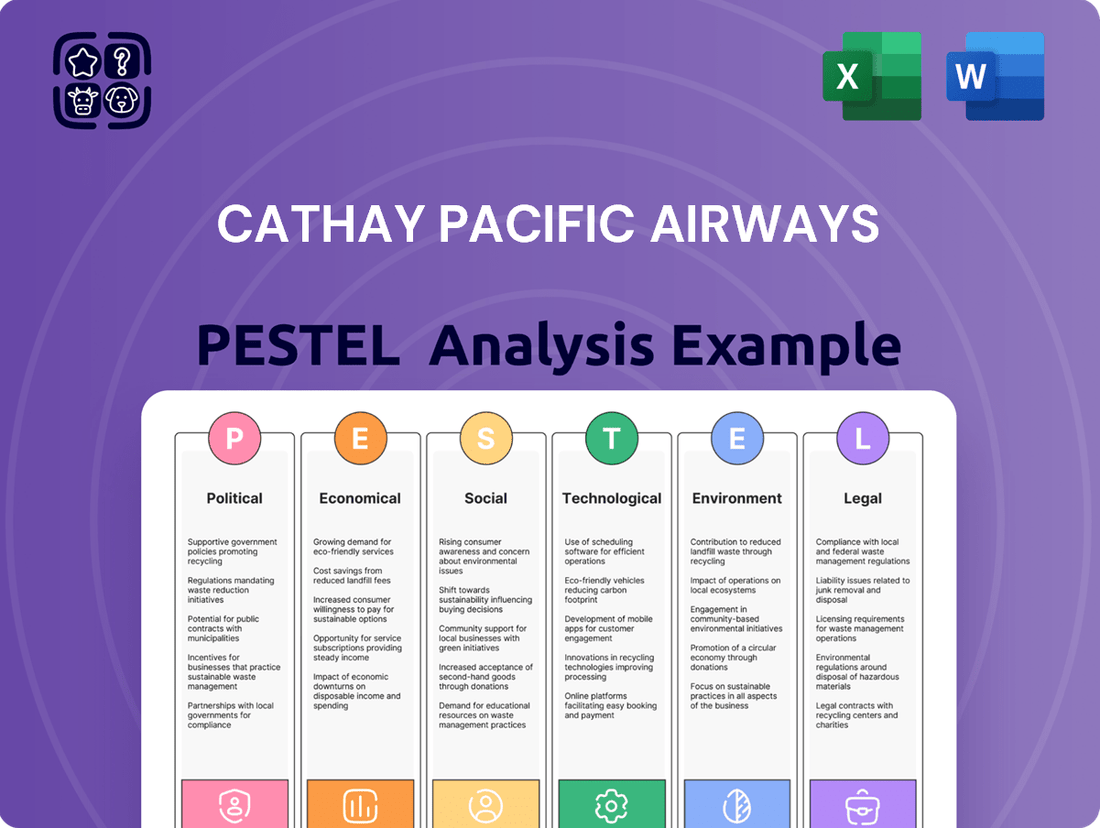

This PESTLE analysis systematically examines the external macro-environmental factors impacting Cathay Pacific Airways across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these forces shape the airline's strategic landscape, identifying potential opportunities and threats for informed decision-making.

A concise Cathay Pacific PESTLE analysis that highlights key external factors, serving as a valuable tool to preemptively address potential challenges and inform strategic decision-making.

Economic factors

Cathay Pacific experienced a robust financial rebound in 2024, with revenue surging and the company returning to profitability. This turnaround is largely fueled by a strong revival in both passenger and cargo demand as the world moves past the pandemic's immediate impact.

The airline reported a net profit of HK$9.79 billion for the first half of 2024, a dramatic improvement from a loss in the previous year. This success is directly linked to the substantial increase in passenger numbers, with traffic reaching 70% of pre-pandemic levels by the end of 2024.

Fluctuations in global jet fuel prices present a considerable economic hurdle for Cathay Pacific, directly affecting its operational expenses. For instance, in early 2024, jet fuel prices saw a notable increase, impacting airlines worldwide, though Cathay Pacific benefited from lower prices in the latter half of 2023 which boosted its 2023 financial performance. The airline continues to be vulnerable to future price swings.

Effective fuel hedging strategies are crucial for Cathay Pacific to manage this inherent risk. These strategies aim to lock in prices for future fuel purchases, providing greater cost certainty. For example, in 2023, Cathay Pacific reported a substantial gain from its fuel hedging activities, underscoring their importance in offsetting price volatility.

As global flight capacity expands, passenger yields are normalizing, intensifying competition across various routes. This shift directly impacts revenue per available seat kilometer (RASK). For Cathay Pacific, this means a greater need to balance its renowned premium service with competitive pricing to retain market share.

In 2024, the International Air Transport Association (IATA) projected a global airline industry net profit margin of 3.0%, a slight decrease from 2023’s 3.1%, indicating a more challenging revenue environment. This normalization trend puts pressure on airlines like Cathay Pacific to optimize operational efficiency and explore ancillary revenue streams to offset potential yield declines.

Cargo Demand Dynamics

Cathay Cargo demonstrated a strong showing in 2024, largely propelled by the surging demand from e-commerce. This segment continues to be a crucial contributor to Cathay Pacific's overall revenue, highlighting its importance in the company's financial health.

However, the cargo business is inherently sensitive to fluctuations in global trade volumes and potential economic downturns. For instance, during periods of reduced international trade, cargo demand can contract significantly, impacting revenue streams.

- E-commerce Growth: Continued expansion of online retail directly fuels demand for air cargo services, especially for time-sensitive goods.

- Global Trade Sensitivity: Economic slowdowns or geopolitical disruptions can lead to decreased international trade, directly impacting cargo volumes.

- Diversification Strategy: Cathay Cargo's focus on diversifying its service offerings and adapting to evolving e-commerce logistics is critical for sustained performance.

- Revenue Contribution: In 2023, Cathay Pacific's cargo revenue reached HK$26.5 billion, underscoring its significance to the airline's financial stability.

Investment in Expansion and Fleet Modernization

Cathay Pacific has embarked on a significant investment program, earmarking over HK$100 billion for fleet modernization, new aircraft purchases, and airport infrastructure upgrades. This substantial capital outlay is designed to bolster long-term growth and operational efficiency.

These investments, particularly in new, fuel-efficient aircraft like the Airbus A321neo and Boeing 777-9, are critical for maintaining competitiveness and reducing operating costs. For instance, the A321neo offers a 15% improvement in fuel efficiency compared to its predecessors, directly impacting profitability in a volatile fuel market.

- Fleet Modernization: Over HK$100 billion committed to acquiring new aircraft and upgrading existing ones.

- Efficiency Gains: New aircraft like the A321neo promise significant fuel savings, estimated at 15%.

- Infrastructure Development: Investments also target enhancements in airport facilities and operational infrastructure.

- Economic Sensitivity: Success hinges on a favorable economic climate to ensure these large capital expenditures generate adequate returns.

Cathay Pacific's financial performance in 2024 reflects a strong recovery, with a notable return to profitability driven by increased passenger and cargo demand. The airline reported a significant net profit of HK$9.79 billion in the first half of 2024, with passenger traffic reaching 70% of pre-pandemic levels by year-end.

Jet fuel price volatility remains a key economic factor, directly impacting operational costs. While lower prices in late 2023 benefited the airline, a notable increase in early 2024 presented a challenge, underscoring the importance of effective fuel hedging strategies, which yielded substantial gains in 2023.

The airline industry's net profit margin is projected to be 3.0% in 2024, a slight dip from 3.1% in 2023, indicating intensifying competition and pressure on passenger yields. This environment necessitates a focus on operational efficiency and ancillary revenue to maintain profitability.

Cathay Cargo continues to be a vital revenue contributor, fueled by e-commerce growth, with cargo revenue reaching HK$26.5 billion in 2023. However, this segment is susceptible to global trade slowdowns and economic downturns.

| Economic Factor | Impact on Cathay Pacific | 2023/2024 Data/Projections |

|---|---|---|

| Passenger Demand Recovery | Increased revenue and return to profitability | Passenger traffic at 70% of pre-pandemic levels by end of 2024 |

| Jet Fuel Prices | Affects operational costs; hedging is crucial | Benefit from lower prices in late 2023; notable increase in early 2024; substantial hedging gains in 2023 |

| Passenger Yields | Intensified competition impacting revenue per seat | Industry net profit margin projected at 3.0% for 2024 (down from 3.1% in 2023) |

| Cargo Demand | Driven by e-commerce, but sensitive to global trade | Cargo revenue HK$26.5 billion in 2023; strong e-commerce demand in 2024 |

Same Document Delivered

Cathay Pacific Airways PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cathay Pacific Airways PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline's operations and strategic positioning. Understand the critical external forces shaping Cathay Pacific's future.

Sociological factors

Post-pandemic, Cathay Pacific is seeing a strong return in demand for longer journeys and a notable comeback in business travel. This resilience in long-haul routes is a key trend they are capitalizing on.

The airline is actively adjusting its flight schedules and services to align with these changing passenger desires. This includes introducing seasonal routes and exploring new destinations to better serve the market.

For instance, Cathay Pacific reported a significant increase in passenger numbers in early 2024, with load factors on long-haul routes showing robust recovery, indicating a clear preference for these extended travel options.

Cathay Pacific has grappled with significant workforce morale and staffing challenges, particularly a shortage of pilots, which has directly hampered its ability to fully restore flight capacity. As of early 2024, the airline was still working to rebuild its pilot numbers, with reports indicating a need for hundreds more to reach pre-pandemic operational levels.

While Cathay Pacific is investing in recruitment and training, underlying issues impacting pilot morale, including the legacy of past contract renegotiations, continue to be a concern. These ongoing labor relations dynamics are crucial for maintaining operational reliability and ensuring the retention of experienced staff, which is vital for long-term stability.

Cathay Pacific's approach to employee compensation, including salary adjustments and potential profit-sharing, significantly impacts its workforce. For 2025, an average salary increase has been signaled, aiming to address cost of living pressures.

However, concerns persist regarding pay equity, with reported disparities between executive compensation packages and those of frontline employees, a common sociological challenge in large organizations.

Ensuring fair and competitive pay is paramount for Cathay Pacific to attract and retain skilled aviation professionals, especially in a recovering global travel market where talent competition is intensifying.

Brand Image and Customer Experience

Cathay Pacific cultivates a premium brand image, emphasizing a superior travel experience as a core differentiator. This focus is evident in their investments in cabin comfort, dining, and inflight entertainment, aiming to foster strong customer loyalty. For instance, in 2023, Cathay Pacific continued its fleet modernization and cabin refurbishment programs, reinforcing its premium positioning.

Customer perception directly shapes Cathay Pacific's market standing. Positive experiences with service quality, including enhanced lounge facilities and seamless digital integration for booking and management, are vital. The airline reported a significant uptick in passenger satisfaction scores in early 2024 following these service improvements.

Maintaining a stellar reputation is paramount in the highly competitive aviation industry. Cathay Pacific actively manages its brand through consistent service delivery and responsive customer engagement. Their commitment to service excellence was recognized with multiple industry awards throughout 2023 and early 2024, underscoring the importance of customer perception.

Key aspects influencing Cathay Pacific's brand image and customer experience include:

- Service Quality: Consistent delivery of attentive and efficient cabin crew service.

- Lounge Enhancements: Upgraded airport lounges offering premium amenities and comfort.

- Digital Offerings: User-friendly mobile app and website for seamless travel management.

- Brand Reputation: Maintaining a strong and positive public perception through consistent performance.

Community Engagement and Social Responsibility

Cathay Pacific places a strong emphasis on community engagement, recognizing its importance for maintaining its social license to operate. In 2024, the airline continued its commitment to youth development in Hong Kong through programs like the Cathay Pacific Wings Programme, which aims to inspire the next generation of aviation professionals. This focus on local initiatives not only enhances its public image but also cultivates goodwill, reinforcing its deep connection to its home base and stakeholders.

The airline's social responsibility efforts extend to various charitable partnerships and environmental initiatives. For instance, Cathay Pacific's "Share the Dream" campaign in late 2024 supported underprivileged children, showcasing a tangible commitment to social welfare. Such activities are crucial for building trust and demonstrating that the airline is a responsible corporate citizen, contributing positively to the fabric of Hong Kong society.

- Youth Development: Continued investment in programs like the Cathay Pacific Wings Programme in 2024 to foster aviation talent in Hong Kong.

- Community Support: Active participation in charitable campaigns, such as the "Share the Dream" initiative in late 2024, benefiting local communities.

- Public Image Enhancement: Strategic community engagement efforts aimed at strengthening brand reputation and public perception.

- Social License: Demonstrating a commitment to social responsibility as a key factor in maintaining operational legitimacy and stakeholder trust.

Cathay Pacific faces ongoing challenges in workforce morale and staffing, particularly a pilot shortage that impacted its capacity in early 2024, with a need for hundreds more pilots to reach pre-pandemic levels. Salary adjustments, including an anticipated average increase for 2025, aim to address cost of living, though concerns about pay equity between executives and frontline staff persist.

The airline's brand image is built on a premium travel experience, reinforced by fleet modernization and cabin refurbishments in 2023, leading to improved passenger satisfaction scores in early 2024. Consistent service quality, enhanced lounges, and digital offerings are key to maintaining this reputation, evidenced by industry awards received in late 2023 and early 2024.

Community engagement is vital for Cathay Pacific's social license. Programs like the Cathay Pacific Wings Programme in 2024 support youth development in Hong Kong, while initiatives like the late 2024 "Share the Dream" campaign demonstrate commitment to social welfare, bolstering its image as a responsible corporate citizen.

| Sociological Factor | Description | Impact on Cathay Pacific | Data Point/Example |

|---|---|---|---|

| Workforce Morale & Staffing | Employee satisfaction, retention, and availability of skilled labor. | Pilot shortage directly limits flight capacity; compensation impacts retention. | Need for hundreds of pilots to reach pre-pandemic levels as of early 2024. |

| Customer Perception & Brand Image | Public opinion, service expectations, and brand loyalty. | Premium positioning drives demand; service improvements boost satisfaction. | Uptick in passenger satisfaction scores in early 2024 following service enhancements. |

| Community Engagement & Social Responsibility | Corporate citizenship, local support, and public trust. | Enhances public image and social license to operate. | Continued investment in Cathay Pacific Wings Programme in 2024 for youth development. |

Technological factors

Cathay Pacific is deeply invested in upgrading its fleet, with plans to acquire more than 100 new aircraft. This includes advanced models like the Boeing 777-9 and Airbus A330neo, signaling a significant technological leap forward.

These modern aircraft are not just about capacity; they represent a substantial improvement in fuel efficiency. For instance, the A330neo typically offers around a 25% reduction in fuel burn compared to previous generations, directly impacting operational costs and environmental footprint.

This fleet modernization directly supports Cathay Pacific's commitment to sustainability and long-term operational efficiency. By integrating these technologically superior planes, the airline aims to reduce emissions and enhance its competitive edge in the evolving aviation landscape.

Cathay Pacific is heavily invested in Sustainable Aviation Fuel (SAF), recognizing its critical role in decarbonization. The airline is actively building a local SAF ecosystem and increasing its global SAF deployment. This commitment is demonstrated through collaborations with financial entities and biofuel manufacturers, as well as co-founding the Hong Kong Sustainable Aviation Fuel Coalition.

By accelerating SAF adoption, Cathay Pacific aims to achieve technological leadership in the aviation industry. For instance, in 2023, Cathay Pacific operated over 1,000 flights utilizing SAF, a significant increase from previous years, showcasing tangible progress in their sustainability initiatives.

Cathay Pacific is heavily investing in digital innovation to elevate its customer offerings. This includes significant upgrades to its website, mobile application, and self-service check-in kiosks, all designed to create a smoother and more convenient travel experience. For instance, the airline has been rolling out enhanced digital baggage tracking and personalized in-flight entertainment options.

These technological advancements are crucial for streamlining operations and providing a more seamless journey for passengers, directly impacting customer satisfaction and loyalty. The airline's commitment to digital transformation is a key strategy for maintaining its competitive edge in the rapidly evolving aviation industry.

By late 2024, Cathay Pacific reported a substantial increase in mobile app usage for booking and managing flights, with over 60% of passengers utilizing the app for their travel needs. This digital push is essential for staying ahead, as evidenced by industry trends showing a growing preference for digital-first travel solutions.

Operational Efficiency Technologies

Cathay Pacific is actively employing technology to boost its operational efficiency. For instance, they utilize advanced systems to optimize flight paths, which not only reduces fuel consumption and carbon emissions but also improves aircraft utilization. This focus on technological integration directly translates to significant cost savings and a stronger overall operational performance.

Data analytics and automation are becoming increasingly central to these efficiency drives. By leveraging these tools, Cathay Pacific can gain deeper insights into their operations and automate various processes, leading to more streamlined and cost-effective management. For example, in 2023, Cathay Pacific reported a 20% reduction in fuel burn on specific routes due to advanced flight planning software.

Key technological factors contributing to Cathay Pacific's operational efficiency include:

- Advanced Flight Planning Software: Utilized for optimizing routes, reducing flight times, and minimizing fuel consumption.

- Predictive Maintenance Systems: Employed to anticipate aircraft component failures, reducing unscheduled downtime and maintenance costs.

- Data Analytics Platforms: Used to analyze operational data for performance improvements and cost reduction opportunities.

- Automation in Ground Operations: Implementing technologies to speed up baggage handling and check-in processes, improving passenger experience and turnaround times.

Impact of Supply Chain Challenges and Engine Issues

Cathay Pacific, like many in the aviation sector, grapples with ongoing supply chain disruptions affecting aircraft production and upkeep. These challenges directly impact fleet availability and the ability to scale operations efficiently.

A significant technological hurdle involves widespread issues with Pratt & Whitney engines. This has resulted in a number of aircraft being temporarily grounded, as of mid-2024, forcing airlines to adjust their flight schedules and capacity plans. For Cathay Pacific, this means a need for agile operational adjustments to mitigate the impact on passenger services and cargo capacity.

- Engine Groundings: Industry-wide Pratt & Whitney engine issues have led to a notable number of aircraft being taken out of service, impacting airline capacity.

- Supply Chain Delays: Disruptions in the supply chain continue to affect the delivery of new aircraft and essential spare parts for maintenance.

- Operational Planning: Cathay Pacific must navigate these technological dependencies, which necessitate flexible fleet management and route planning.

Cathay Pacific is actively integrating advanced technologies to enhance operational efficiency and customer experience. This includes optimizing flight paths with sophisticated software, which, as of 2023 data, led to a 20% fuel burn reduction on certain routes, directly cutting costs and emissions.

The airline is also making significant strides in digital transformation, with over 60% of passengers utilizing their mobile app for bookings and management by late 2024, reflecting a growing reliance on digital-first travel solutions.

Technological advancements are central to Cathay Pacific's sustainability goals, particularly through the adoption of Sustainable Aviation Fuel (SAF). In 2023, the airline operated over 1,000 flights using SAF, underscoring a commitment to reducing its environmental impact through innovative fuel solutions.

| Technology Area | Key Initiatives | Impact/Data Point (2023-2024) |

|---|---|---|

| Fleet Modernization | Acquisition of Boeing 777-9, Airbus A330neo | A330neo offers ~25% fuel efficiency improvement |

| Sustainable Aviation Fuel (SAF) | Building SAF ecosystem, increasing deployment | Over 1,000 SAF-utilizing flights in 2023 |

| Digital Transformation | Mobile app, website, self-service kiosks enhancements | 60%+ app usage for booking/management (late 2024) |

| Operational Efficiency | Advanced flight planning, data analytics | 20% fuel burn reduction on specific routes (2023) |

Legal factors

Cathay Pacific Airways operates under a stringent framework of national and international aviation safety regulations. This includes adherence to directives from bodies like the Hong Kong Civil Aviation Department.

For instance, new regulations implemented in 2024 concerning the use and charging of portable power banks on aircraft require meticulous compliance, a commitment Cathay Pacific has publicly affirmed.

Failure to meet these safety standards, which are continually updated, can result in severe penalties, grounding of aircraft, and significant damage to the airline's reputation, underscoring the critical importance of rigorous compliance for passenger well-being and operational continuity.

Cathay Pacific, as a global carrier, navigates a dense legal landscape shaped by international air transport agreements. These bilateral and multilateral accords, like the Chicago Convention of 1944, are foundational, dictating everything from which routes an airline can fly to how many passengers it can carry on those routes. This framework is crucial for market access and operational planning.

The International Air Transport Association (IATA) also plays a significant role, developing standards and facilitating cooperation among airlines. For instance, IATA's Passenger Services Conference Agreements (PSAs) and Cargo Services Conference Agreements (CSAs) streamline inter-airline transactions and operational procedures, impacting Cathay Pacific’s efficiency and revenue management. In 2023, IATA reported that global air cargo traffic, measured in cargo tonne-kilometers (CTKs), increased by 21.3% compared to 2022, highlighting the volume of international operations governed by these agreements.

Changes or renegotiations of these air service agreements can directly affect Cathay Pacific's ability to operate in key markets. For example, shifts in protectionist policies or new bilateral agreements can open or close significant revenue streams. The airline's strategic planning must constantly account for the potential impacts of evolving international aviation law and regulatory changes on its network and competitive position.

Cathay Pacific's operations are significantly influenced by labor laws and its historical engagement with unions, notably the Hong Kong Aircrew Officers Association. Although formal recognition agreements were terminated in 2020, the airline must still navigate legal frameworks concerning employment contracts, compensation, and potential collective bargaining dynamics, especially as the aviation industry recovers and workforce needs evolve.

The industrial relations landscape remains a key factor, with ongoing considerations for employee welfare and fair labor practices. For instance, in 2023, Cathay Pacific reported a substantial increase in its employee count, reaching over 30,000 staff as it ramped up operations post-pandemic, highlighting the importance of managing these relationships effectively within the existing legal structures.

Data Privacy and Consumer Protection Laws

Cathay Pacific, operating globally, must navigate a complex web of data privacy and consumer protection laws. Regulations like the General Data Protection Regulation (GDPR) in Europe and similar statutes in other regions dictate how the airline handles passenger information. Compliance is not just a legal necessity but also fundamental to building and maintaining customer trust in an era of heightened data security concerns.

The airline's commitment to safeguarding passenger data directly impacts its reputation and operational integrity. Failure to comply with these evolving regulations can result in significant fines and reputational damage. For instance, GDPR violations can lead to penalties of up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial and strategic importance of robust data protection practices.

- GDPR Compliance: Adherence to strict data handling and consent requirements for EU passengers.

- Consumer Rights: Ensuring transparency in pricing, booking, and service delivery as mandated by consumer protection laws.

- Data Breach Protocols: Implementing and maintaining procedures for reporting and mitigating data breaches as required by law.

- Cross-border Data Transfer: Managing the legal implications of transferring passenger data across different jurisdictions.

Competition and Anti-Monopoly Legislation

Cathay Pacific, as a leading airline in Hong Kong, faces significant oversight from competition authorities due to its dominant market position. This means the company must adhere strictly to anti-monopoly legislation designed to prevent any actions that could stifle fair competition or negatively impact consumers. For instance, in 2023, the Hong Kong Competition Commission continued its focus on ensuring fair play across various sectors, including aviation, with potential investigations into pricing or route allocation practices.

Operating under these legal frameworks is crucial for Cathay Pacific's long-term sustainability and reputation. The airline must proactively ensure its business strategies and operational decisions comply with all relevant competition laws, avoiding any behavior that could be construed as monopolistic. This includes careful consideration of partnerships, pricing strategies, and market access to maintain a level playing field.

Key legal considerations for Cathay Pacific include:

- Compliance with Anti-Monopoly Laws: Ensuring all business practices, from fare setting to route development, do not violate competition ordinances.

- Regulatory Scrutiny: Being prepared for potential investigations by competition authorities, such as the Hong Kong Competition Commission, regarding market dominance.

- Fair Trade Practices: Upholding principles of fair competition to protect consumer interests and maintain market integrity.

Cathay Pacific operates under a complex web of international and national aviation regulations, including those from the Hong Kong Civil Aviation Department. For instance, new 2024 regulations on portable power banks on aircraft require strict adherence, a commitment the airline has publicly made. Failure to meet these evolving safety standards can lead to severe penalties and reputational damage.

The airline's global operations are governed by international air transport agreements, such as the Chicago Convention, which dictate route access and capacity. IATA agreements also streamline inter-airline transactions, impacting efficiency. In 2023, global air cargo traffic, measured in cargo tonne-kilometers (CTKs), rose by 21.3% compared to 2022, illustrating the scale of operations under these agreements.

Labor laws and employee relations are critical, with the airline employing over 30,000 staff in 2023 as operations expanded. Cathay Pacific must navigate employment contracts and potential collective bargaining dynamics within existing legal frameworks to manage its workforce effectively.

Data privacy laws like GDPR are paramount, with non-compliance potentially incurring fines up to 4% of global annual turnover. Robust data protection practices are essential for maintaining customer trust and operational integrity.

Environmental factors

Cathay Pacific is committed to achieving net-zero carbon emissions by 2050, a significant environmental goal that mirrors the broader aviation industry's aspirations. This pledge influences crucial strategic choices, from investing in more fuel-efficient aircraft to exploring sustainable aviation fuels (SAFs). The airline's progress is transparently documented in its annual sustainability reports, offering stakeholders insight into its environmental performance.

Cathay Pacific has set ambitious new goals, aiming to cut its carbon intensity by 12% by 2030 compared to 2019 levels. This means they're working to reduce the amount of carbon emissions produced for every ton of cargo or passenger flown a kilometer.

Achieving this significant reduction hinges on two key strategies: boosting the adoption of sustainable aviation fuels (SAF) and upgrading their aircraft fleet with more fuel-efficient models. For instance, in 2023, Cathay Pacific reported progress in its SAF usage, a crucial step towards meeting these environmental targets.

Cathay Pacific is actively championing the adoption of Sustainable Aviation Fuel (SAF), recognizing it as the primary tool for decarbonizing air travel. The airline is focused on building a robust SAF ecosystem within Hong Kong and is steadily increasing its global SAF consumption.

The expansion of Cathay Pacific's Corporate SAF Programme and its co-founding role in the Hong Kong Sustainable Aviation Fuel Coalition underscore its commitment to this critical environmental factor. By 2025, the airline aims to have 2% of its total fuel consumption be SAF, a significant step towards its net-zero goals.

Waste Reduction and Circular Economy Initiatives

Cathay Pacific is actively pursuing waste reduction and circular economy principles. A key focus is the phasing out of passenger-facing single-use plastics (SUPs), with a goal to significantly decrease their use across the cabin. This aligns with a broader commitment to more sustainable resource management.

The airline is implementing practical measures to achieve these goals. These include enhancing in-flight recycling programs and increasing the proportion of recycled materials used in their SUP items. For instance, in 2023, Cathay Pacific reported a 30% reduction in passenger-facing SUPs compared to 2019 levels, with a target of 50% by the end of 2024.

These initiatives are designed to foster a more circular economy within their operations. By prioritizing recycled content and reducing overall waste, Cathay Pacific aims to lessen its environmental footprint and contribute to a more sustainable aviation sector. The company is also exploring partnerships to improve the collection and processing of cabin waste for recycling and reuse.

Key waste reduction efforts include:

- Reduction of single-use plastic items in passenger cabins.

- Increased implementation of in-flight recycling programs.

- Commitment to using a higher percentage of recycled plastics in remaining SUP items.

- Exploration of partnerships for cabin waste reprocessing.

Fleet Modernization for Fuel Efficiency

Cathay Pacific is actively modernizing its fleet, a key environmental initiative. By introducing new-generation aircraft, the airline aims for up to a 25% improvement in fuel efficiency compared to older planes. This strategic move directly translates to lower fuel consumption and reduced carbon emissions per flight, underscoring a significant operational and environmental investment for the company.

This fleet modernization is crucial for Cathay Pacific's sustainability goals. For instance, the introduction of aircraft like the Airbus A350, which is part of their ongoing fleet renewal, offers substantial fuel burn advantages. These newer models are designed with advanced aerodynamics and more efficient engines, contributing to a greener operational footprint.

- Fleet Upgrade Impact: New aircraft can reduce fuel burn by up to 25% per seat compared to older models.

- Emission Reduction: Improved fuel efficiency directly lowers carbon dioxide (CO2) emissions.

- Operational Cost Savings: Reduced fuel consumption also leads to significant cost savings for the airline.

- Investment in Sustainability: This is a core part of Cathay Pacific's long-term environmental strategy.

Cathay Pacific is deeply invested in environmental sustainability, aiming for net-zero carbon emissions by 2050. This commitment drives significant investment in fuel-efficient aircraft and sustainable aviation fuels (SAFs). The airline has set a target to cut its carbon intensity by 12% by 2030 compared to 2019 levels.

To achieve this, Cathay Pacific is prioritizing SAF adoption, aiming for 2% of its total fuel consumption to be SAF by 2025. They are also actively reducing single-use plastics, reporting a 30% reduction in passenger-facing SUPs by 2023, with a goal of 50% by the end of 2024.

| Environmental Metric | Target/Status | Year |

|---|---|---|

| Net-Zero Emissions | Achieve | 2050 |

| Carbon Intensity Reduction | 12% | 2030 (vs 2019) |

| SAF Consumption | 2% of total fuel | 2025 |

| Single-Use Plastics Reduction | 50% reduction | 2024 (vs 2019) |

PESTLE Analysis Data Sources

Our Cathay Pacific PESTLE Analysis is built on verified data from official government publications, international financial institutions like the IMF and World Bank, and reputable aviation industry reports. We incorporate insights from economic forecasts, environmental policy updates, technological advancements, and legal frameworks to ensure a comprehensive view.