Cathay Pacific Airways Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Pacific Airways Bundle

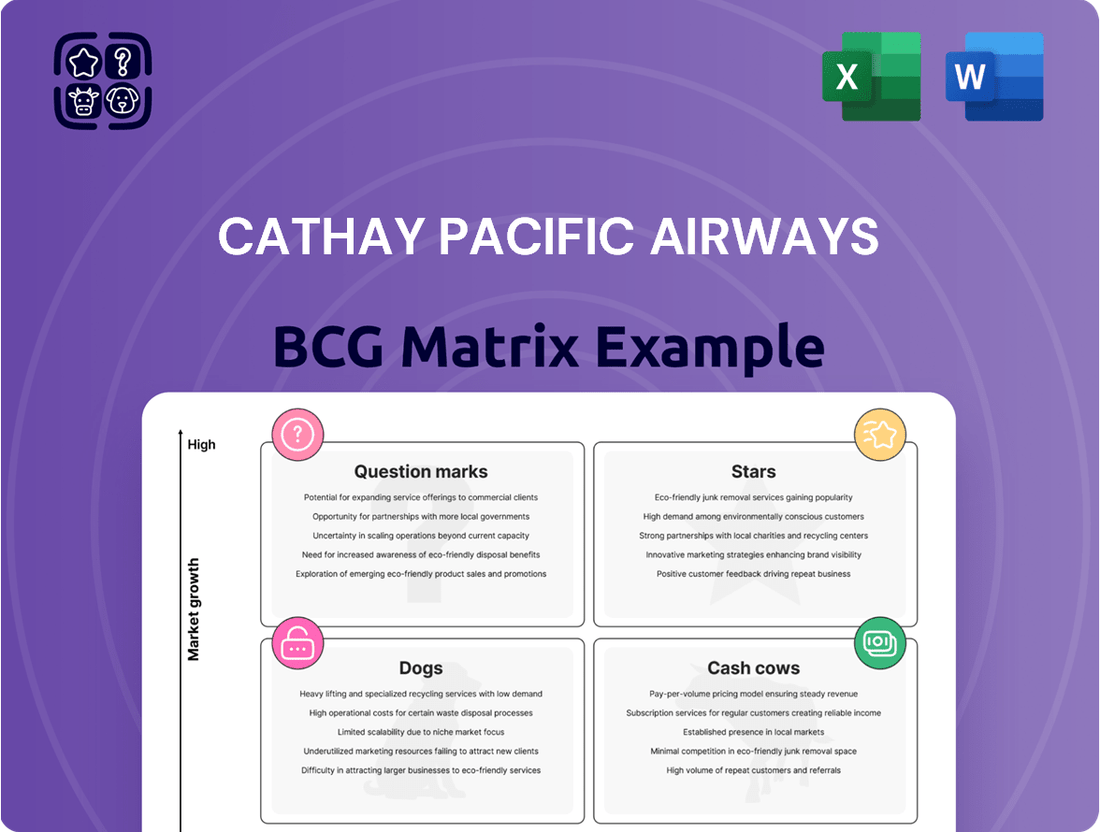

Cathay Pacific Airways' strategic positioning is laid bare in its BCG Matrix, highlighting its market share and growth potential across its diverse service offerings. Understanding which routes are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making. Purchase the full BCG Matrix to unlock a comprehensive analysis and actionable insights that will guide your investment and operational strategies.

Stars

Cathay Pacific is aggressively expanding its global passenger network, aiming for over 100 destinations by the close of 2025. This ambitious growth includes new routes to major hubs like Dallas Fort Worth, Munich, and Brussels, reflecting a strategy to capitalize on surging post-pandemic travel demand. The airline group projected another 30% capacity increase in 2025, following robust passenger volume growth throughout 2024.

Cathay Pacific is significantly investing in its premium offerings, notably with new cabin products like the Aria Suite for Business Class on its Boeing 777-300ER fleet and an upcoming First Class experience on its 777-9 aircraft, slated for a 2025 debut. This strategic move aligns with the robust demand observed in 2024 for premium cabins and business travel, highlighting a high-growth, high-value market segment. By enhancing these lucrative offerings, Cathay Pacific aims to reinforce its standing as a premier full-service airline and capture a greater share of the premium travel market. This focus on premium services within a recovering travel landscape positions these initiatives as Stars in the BCG Matrix.

Cathay Pacific's digital transformation is a key strategic move, highlighted by the creation of Cathay Technologies. This new entity aims to monetize the airline's internally developed digital innovations, such as the Electronic Flight Folder (EFF), which has already transformed pilot workflows and is now available for external licensing. This initiative taps into the burgeoning aviation technology sector, offering significant potential for growth and market penetration beyond traditional airline services.

Sustainable Aviation Fuel (SAF) Leadership

Cathay Pacific is making significant strides in sustainable aviation fuel (SAF), showcasing a remarkable 22-fold increase in SAF usage in 2024 compared to 2022. This aggressive adoption highlights their commitment to a greener future for air travel.

The airline is not just a user but also a developer, actively working to build a local SAF ecosystem in Hong Kong. Their co-initiation of the Hong Kong Sustainable Aviation Fuel Coalition underscores their dedication to fostering industry-wide change.

These substantial investments and leadership in SAF position Cathay Pacific at the forefront of a crucial and expanding segment within aviation. As the industry pivots towards environmental responsibility, their proactive SAF strategy marks them as a clear Star in the BCG Matrix.

- Pioneering SAF Adoption: 22-fold increase in SAF usage in 2024 vs. 2022.

- Ecosystem Development: Actively fostering a local SAF ecosystem in Hong Kong.

- Industry Collaboration: Co-initiated the Hong Kong Sustainable Aviation Fuel Coalition.

- Strategic Positioning: Leading a critical and growing segment of the aviation industry.

Post-Pandemic Passenger Volume Rebound

Cathay Pacific has demonstrated a remarkable post-pandemic recovery, with flight volumes reaching pre-pandemic levels by January 2025. In 2024 alone, the airline reported an impressive year-on-year growth in passenger numbers exceeding 30%.

This robust rebound highlights Cathay Pacific's strong performance within a global travel market that is actively recovering and expanding. The airline's swift restoration of capacity and its success in attracting passengers underscore its solid standing in this dynamic environment.

- Passenger Volume Rebound: Flight volumes returned to pre-pandemic levels by January 2025.

- 2024 Growth: Reported over 30% year-on-year passenger number increase in 2024.

- Market Position: Signifies a high-growth market where Cathay is consolidating share.

- Capacity Restoration: Swiftly restored capacity and attracted travelers effectively.

Cathay Pacific's investment in premium cabin products, such as the Aria Suite and upcoming First Class on the 777-9, positions these offerings as Stars. This strategy capitalizes on strong demand for premium travel, a high-growth segment. The airline's focus on enhancing these lucrative services aims to solidify its premium brand and capture greater market share.

Cathay Pacific's aggressive expansion of its global network, targeting over 100 destinations by the end of 2025, including new routes like Dallas Fort Worth and Munich, signifies strong growth potential. This expansion, coupled with a projected 30% capacity increase in 2025 following robust 2024 passenger volume growth, marks its network as a Star.

The airline's pioneering adoption of Sustainable Aviation Fuel (SAF), evidenced by a 22-fold increase in usage in 2024 compared to 2022, and its efforts to build a local SAF ecosystem in Hong Kong, clearly identify SAF initiatives as Stars. These efforts place Cathay Pacific at the forefront of a critical and expanding segment within aviation.

| BCG Category | Cathay Pacific Offering | Rationale | Key Metrics (2024/2025 Projections) |

|---|---|---|---|

| Stars | Premium Cabin Products (Aria Suite, 777-9 First Class) | High demand in premium travel segment, strategic investment in high-value offerings. | Strong demand observed in 2024 for premium cabins. |

| Stars | Global Network Expansion | Aggressive route expansion (e.g., DFW, Munich), capitalizing on post-pandemic travel surge. | Targeting >100 destinations by end of 2025; projected 30% capacity increase in 2025. |

| Stars | Sustainable Aviation Fuel (SAF) Initiatives | Leading adoption and ecosystem development in a critical growth area for aviation. | 22-fold increase in SAF usage in 2024 vs. 2022; active development of local SAF ecosystem. |

What is included in the product

This BCG Matrix overview details Cathay Pacific's portfolio, identifying Stars for growth, Cash Cows for revenue, Question Marks for potential, and Dogs for divestment.

A clear Cathay Pacific BCG Matrix overview, placing each business unit in its quadrant, simplifies complex portfolio analysis.

This export-ready design allows for quick drag-and-drop into presentations, relieving the pain of manual data transfer.

Cash Cows

Cathay Cargo Operations stands as a prime example of a Cash Cow for Cathay Pacific Airways. In 2024, this division reported a robust financial performance, with cargo revenues climbing by 8.3% to HK$24 billion. This growth was fueled by persistent high demand, notably from the booming e-commerce sector.

The cargo division consistently delivers substantial cash flow to the broader group. This is largely due to its efficient freighter fleet and its strategic position at Hong Kong International Airport, a key global logistics hub. Even as passenger market yields saw some adjustments, cargo operations maintained their strength, solidifying their role as a dependable, high-market share contributor.

Operating within a mature yet stable market, Cathay Cargo has proven to be a consistent generator of significant profits. Its established infrastructure and market presence allow it to capitalize on ongoing demand, making it a reliable source of financial stability for the airline.

Cathay Pacific's established long-haul passenger routes, such as those linking Hong Kong to New York, London, and Sydney, are classic Cash Cows. These routes hold a significant market share in a mature industry segment, consistently drawing a substantial number of passengers.

Despite some normalization in passenger yields due to increased capacity, these core routes remain vital revenue generators for Cathay Pacific. Their robust demand allows for healthy profit margins with minimal need for aggressive new marketing spend, underscoring their stable cash-generating capabilities.

In 2023, Cathay Pacific saw its passenger traffic recover significantly, carrying 17.5 million passengers, which is a substantial increase from the previous year. This strong performance on established routes highlights their role as a consistent source of income for the airline.

Cathay Pacific's dominance at Hong Kong International Airport (HKIA) positions its airport operations as a significant cash cow. HKIA's status as a premier global aviation hub, bolstered by the completion of its Three-Runway System, directly translates into operational efficiency and a commanding market share for Cathay Pacific in the region.

This strategic advantage allows Cathay to seamlessly connect passengers and cargo worldwide, generating substantial and consistent cash flow. In 2023, HKIA handled approximately 30 million passengers, a significant increase from 2022, underscoring its robust recovery and Cathay's pivotal role within this ecosystem.

Cathay Pacific as a Premium Full-Service Brand

Cathay Pacific, as the flagship premium full-service airline of the Cathay Group, commands a substantial market share within the lucrative premium travel segment. Its established reputation for delivering an exceptional travel experience, coupled with a comprehensive global network, fosters strong customer loyalty, particularly among business travelers. This robust brand equity and entrenched market position enable Cathay Pacific to sustain premium pricing and achieve healthy profit margins.

The airline's performance in 2024 reflects its status as a cash cow. For instance, Cathay Pacific reported a net profit of HK$9.79 billion for the first half of 2024, a significant turnaround from the previous year, driven by a strong recovery in passenger demand and yield. This indicates a stable and profitable operation in a mature market where it holds a significant competitive advantage.

- High Market Share in Premium Segment: Cathay Pacific is a dominant player in the premium travel market, attracting discerning customers.

- Strong Brand Equity and Loyalty: The airline's commitment to a premium experience cultivates a loyal customer base, especially among business travelers.

- Robust Profitability: In the first half of 2024, Cathay Pacific achieved a net profit of HK$9.79 billion, showcasing its ability to generate consistent cash flow.

- Mature Market Dominance: Operating in a mature market, Cathay Pacific leverages its competitive advantages to ensure reliable cash generation.

Core Ancillary Ground Services

Cathay Pacific's Core Ancillary Ground Services, encompassing catering, laundry, ground-handling, and cargo terminal operations, are firmly positioned as Cash Cows within its BCG Matrix. These are mature, stable businesses that generate consistent, predictable cash flows, essential for supporting the airline's core operations.

These wholly-owned subsidiaries benefit from high utilization rates and a dominant position within the Hong Kong aviation sector. For instance, Cathay Cargo Terminal handled 1.3 million tonnes of freight in 2023, demonstrating significant operational volume. While requiring minimal growth investment, their established infrastructure and internal demand ensure ongoing profitability.

- Stable Market Position: These services operate in a mature, stable market, primarily serving Cathay Pacific's internal needs.

- Predictable Cash Flows: Their consistent operational volume and established client base (largely internal) lead to reliable revenue streams.

- Low Investment Needs: As mature businesses, they require limited capital expenditure for growth, allowing them to generate substantial free cash flow.

- Contribution to Financial Health: These operations are vital for the group's overall financial stability, providing a steady income stream that can be reinvested or used to fund other ventures.

Cathay Pacific's established passenger routes, particularly its long-haul services to major global cities, represent classic Cash Cows. These routes benefit from a significant market share in a mature segment of the aviation industry, consistently attracting a substantial passenger base. Despite some adjustments in passenger yields due to increased capacity, these core routes remain critical revenue generators, offering healthy profit margins with minimal need for aggressive new marketing investments.

In 2023, Cathay Pacific experienced a notable recovery in passenger traffic, carrying 17.5 million passengers, a significant increase from the prior year. This strong performance on its established routes underscores their consistent contribution to the airline's income.

The airline's premium full-service offering, a hallmark of the Cathay Group, secures a substantial share of the lucrative premium travel market. Its reputation for exceptional service and a comprehensive global network fosters strong customer loyalty, especially among business travelers. This robust brand equity and market position enable Cathay Pacific to maintain premium pricing and achieve healthy profit margins.

For the first half of 2024, Cathay Pacific reported a net profit of HK$9.79 billion, a significant turnaround driven by strong passenger demand and yield recovery. This performance highlights its stable and profitable operations in a mature market where it holds a considerable competitive advantage.

| Key Cash Cow Segments | 2023 Performance Data | 2024 Performance Data (H1) |

| Cargo Operations Revenue | HK$24 billion (+8.3% YoY) | Continued strong demand |

| Passenger Traffic | 17.5 million passengers | Strong recovery and yield |

| Net Profit | Not applicable (full year data not yet available) | HK$9.79 billion |

Preview = Final Product

Cathay Pacific Airways BCG Matrix

The Cathay Pacific Airways BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This comprehensive analysis, meticulously crafted by strategy experts, will be immediately downloadable, allowing for seamless integration into your business planning and competitive strategy discussions without any additional modifications or watermarks.

Dogs

Cathay Pacific's older, underutilized aircraft represent a potential Dogs category in its BCG Matrix. These planes, while perhaps not yet fully retired, likely incur higher operating and maintenance expenses compared to newer models. For instance, older Boeing 777-300ERs, while foundational, might be less fuel-efficient than the incoming Airbus A350s. This inefficiency can lead to lower profit margins per flight.

The airline's strategic focus on fleet modernization, including significant investments in the Airbus A350 family, signals a planned transition away from older, less economical aircraft. In 2024, Cathay Pacific continued to integrate new A350s, which are designed for superior fuel efficiency. This ongoing renewal means that older aircraft not fully deployed might be tying up capital and contributing to higher costs without generating commensurate returns, fitting the profile of a Dog.

Even with Cathay Pacific's overall robust financial health, certain routes in its network are grappling with persistently low profitability. This can stem from fierce competition or a dip in passenger demand on those specific corridors.

While passenger yields across the board have seen a welcome return to normal levels, some individual routes continue to struggle to achieve break-even or consistently lag behind expectations. For example, in 2024, Cathay Pacific reported a significant rebound in its passenger business, with revenue per passenger kilometer increasing substantially compared to previous years, yet this doesn't negate the possibility of specific route underperformance.

These underperforming routes, often found in segments with limited growth potential and where Cathay Pacific holds a smaller market share, necessitate a critical review. The airline may consider reducing flight frequencies or even discontinuing these services altogether to reallocate valuable resources to more promising areas of its network.

Cathay Pacific's legacy IT systems, while perhaps once functional, now represent a potential 'Dog' in its BCG Matrix. These older platforms often come with high maintenance costs and limited integration capabilities, hindering the agility needed in today's digital-first aviation industry. For instance, the airline's ongoing digital transformation, including investments in advanced systems like Trax for maintenance, highlights the inefficiencies of older, fragmented digital infrastructure.

Non-strategic, Low-Return Investments

Cathay Pacific Airways, within its broader group structure, might hold certain non-strategic, low-return investments. These are typically smaller ventures or stakes that do not align with the airline's core business or strategic growth objectives. While the overall performance of its associates has shown improvement, specific smaller investments may continue to underperform, generating minimal returns and consuming valuable capital.

These types of investments often reside in mature or declining markets with limited potential for significant expansion or competitive advantage. For instance, a small stake in a regional logistics company that is not synergistic with Cathay's cargo operations, or a minor investment in a technology startup that hasn't gained traction, could fall into this category. Such holdings, even if individually small, collectively represent capital that could be better allocated to areas with higher growth prospects, such as fleet modernization or digital transformation initiatives.

- Underperforming Stakes: Investments that consistently fail to meet profitability targets or contribute meaningfully to revenue growth.

- Non-Core Ventures: Businesses or projects outside Cathay Pacific's primary airline operations and its key strategic subsidiaries.

- Capital Drain: Assets that tie up financial resources without providing a competitive edge or substantial return on investment.

- Limited Market Impact: Ventures operating in low-growth sectors or niche markets with minimal potential for scale.

Inefficient Operational Processes

Inefficient operational processes at Cathay Pacific, particularly those predating recent digital upgrades, could be categorized as Dogs in a BCG Matrix analysis of operational effectiveness. These are areas where resources are consumed without generating proportional value or contributing to competitive advantage. For instance, manual check-in procedures or legacy baggage handling systems, if still in significant use, would fall into this category. In 2024, the airline continued its focus on enhancing operational efficiency, aiming to reduce costs and improve customer experience.

These lingering inefficiencies represent a drag on profitability, consuming valuable capital and human resources that could be better allocated. Processes that are slow, error-prone, or require excessive manual intervention, without a clear strategic benefit like market differentiation, are prime candidates for being classified as Dogs. Cathay Pacific's ongoing investment in technology is designed to phase out such operations.

The airline's commitment to digital transformation, including the implementation of AI and automation in areas like customer service and flight operations, aims to convert these 'Dog' processes into more efficient and profitable ones. By streamlining workflows and reducing manual touchpoints, Cathay Pacific seeks to improve its overall operational performance and resource utilization.

- Manual Check-in Systems: Processes that rely heavily on manual data entry or physical document handling, contributing to longer wait times and increased labor costs.

- Legacy IT Infrastructure: Older, less integrated IT systems that hinder data flow and require extensive workarounds, impacting speed and accuracy.

- Suboptimal Route Planning: Inefficient flight path optimization that leads to increased fuel consumption and longer flight durations, representing wasted resources.

- Reactive Maintenance Schedules: Maintenance operations that are not proactively managed through predictive analytics, potentially leading to unexpected downtime and higher repair costs.

Cathay Pacific's older, less fuel-efficient aircraft, such as some of its Boeing 777-300ERs, can be considered Dogs due to their higher operating costs and lower profitability per flight compared to newer models like the Airbus A350. The airline's strategic fleet modernization, with continued A350 integration in 2024, highlights this shift. These older planes tie up capital without generating commensurate returns.

Certain routes within Cathay Pacific's network may also fall into the Dog category if they consistently struggle with low profitability, potentially due to intense competition or declining passenger demand. While overall passenger revenue rebounded strongly in 2024, specific routes might still underperform, necessitating a review of their viability. The airline may reduce frequencies or discontinue these services to reallocate resources.

Legacy IT systems and inefficient operational processes, such as manual check-in procedures, represent further 'Dog' categories. These older systems incur high maintenance costs and hinder agility, as seen in ongoing investments in advanced digital infrastructure. Cathay Pacific's digital transformation efforts aim to convert these inefficiencies into more profitable operations.

Non-strategic, low-return investments or ventures outside Cathay Pacific's core airline operations can also be classified as Dogs. Even with overall group performance improvements, smaller, non-synergistic holdings in mature markets may consume capital without providing significant returns or competitive advantage. These could include minor stakes in logistics or technology ventures not aligned with the airline's growth objectives.

Question Marks

HK Express, Cathay Pacific's low-cost arm, is currently positioned as a Question Mark in the BCG Matrix. In 2024, it incurred a net loss of HK$400 million, exacerbated by the grounding of aircraft due to widespread engine issues.

Despite these financial headwinds, HK Express operates within the high-growth low-cost travel sector and was recognized as the world's fastest-growing airline by flight operations. This dual characteristic of high market potential coupled with current low profitability and a relatively smaller market share compared to its parent company, firmly places it in the Question Mark category.

Cathay Pacific's ongoing investment and strategic focus on HK Express signify a clear intent to nurture its growth and transition it towards becoming a Star performer in the future.

Newly launched niche passenger routes like Rome, Munich, Brussels, and Dallas Fort Worth for Cathay Pacific can be viewed as potential Stars within the BCG Matrix. While the overall network expansion is a Star, these specific routes are in their early stages, meaning they currently have low market share but operate in a growing market.

Significant investment in marketing and operations is needed to build demand and achieve profitability for these routes. Their future success, whether they become Stars or are discontinued, hinges on the effectiveness of these initial investments. For instance, Cathay Pacific's expansion into Europe in 2023 and early 2024 with new services demonstrates this strategy of targeting growth markets.

Cathay Technologies is venturing into the burgeoning aviation technology market with digital solutions like the Electronic Flight Folder (EFF). This segment is experiencing rapid expansion, with the global aviation software market projected to reach $12.4 billion by 2027, growing at a CAGR of 8.5%.

While the potential is high, Cathay's specific offerings, such as the EFF, currently hold a small share of this vast market. Significant capital is needed for development, marketing, and sales to establish a strong foothold and validate these new ventures.

New Premium Economy and Economy Class Offerings

Cathay Pacific is introducing upgraded Premium Economy and Economy cabins, alongside new premium suites, to bolster its product offering. These enhancements target a growing demand for increased passenger comfort in these segments. The airline's 2024 strategy focuses on differentiating these cabins to gain market share in a highly competitive landscape, aiming to elevate them from potential Dogs to Stars within the BCG matrix.

The success of these new cabin products is crucial for Cathay Pacific's performance in the mass-market travel segments. While passenger experience is enhanced, the actual impact on market share and revenue is still unfolding. The airline is investing in these upgrades to ensure these offerings remain competitive and desirable, preventing them from stagnating.

- Market Context: Premium Economy and Economy are high-volume, competitive sectors where differentiation is key.

- Investment Rationale: Upgrades aim to boost customer preference and market share, preventing these segments from becoming underperforming "Dogs."

- Strategic Goal: Position new cabin products as "Stars" by capturing greater customer loyalty and revenue in growing comfort-focused markets.

- 2024 Focus: Significant marketing and differentiation efforts are underway to solidify Cathay Pacific's standing in these crucial cabin classes.

Advanced Sustainability Initiatives with Developing Commercial Models

Cathay Pacific is exploring advanced sustainability projects beyond immediate sustainable aviation fuel (SAF) adoption. These include fostering a local SAF production ecosystem and implementing innovative recycling processes for aircraft materials. While these initiatives operate in a rapidly growing market for eco-friendly solutions, their direct commercial viability and cost-saving potential are still in nascent stages, requiring significant ongoing investment.

- Developing Local SAF Ecosystem: Cathay Pacific has partnered with companies like AeroSyndicate to explore SAF production in the Asia-Pacific region, aiming to secure a more stable and potentially cost-effective supply chain for the future. This initiative is crucial for long-term emissions reduction but currently lacks a clear, immediate revenue stream.

- New Recycling Workflows: The airline is investigating advanced recycling techniques for cabin components and other materials, potentially turning waste into valuable resources. For example, efforts are underway to recycle old seat covers into new products, though the commercial scale and profitability of these ventures are yet to be proven.

- Commercial Potential vs. Current Contribution: These forward-looking projects are positioned in a high-growth area but do not yet contribute significantly to Cathay Pacific's bottom line. Their future classification as Stars or Cash Cows hinges on successfully establishing robust commercial models and demonstrating tangible cost efficiencies or new revenue generation.

HK Express, Cathay Pacific's low-cost subsidiary, represents a Question Mark in the BCG matrix. In 2024, it reported a net loss of HK$400 million, partly due to aircraft groundings from engine issues. Despite this, HK Express operates in the rapidly expanding low-cost travel market and was recognized as the world's fastest-growing airline by flight operations in 2024.

The airline's strategic investments aim to cultivate HK Express into a future Star performer. This positioning reflects its high market potential alongside current low profitability and a smaller market share compared to its parent company.

Cathay Pacific's new niche passenger routes, such as Rome, Munich, Brussels, and Dallas Fort Worth, launched in late 2023 and early 2024, are also considered Question Marks. These routes are in nascent stages, operating in growing markets but currently holding low market share. Significant investment is required to build demand and achieve profitability, with their future success dependent on these initial efforts.

Cathay Technologies' digital solutions like the Electronic Flight Folder (EFF) are entering the high-growth aviation technology sector, projected to reach $12.4 billion by 2027. However, Cathay's current market share in this segment is small, necessitating substantial capital for development and marketing to establish a strong presence.

| Business Unit | BCG Category | 2024 Performance/Context | Market Growth | Strategic Outlook |

|---|---|---|---|---|

| HK Express | Question Mark | Net loss of HK$400 million; aircraft grounding issues. | High (Low-cost travel sector) | Investment to transition to Star. |

| New Niche Routes (e.g., Rome, Brussels) | Question Mark | Early stage, low market share. | High (Targeted growth markets) | Requires significant investment to build demand. |

| Cathay Technologies (EFF) | Question Mark | Small market share in a vast market. | High (Aviation software market projected at $12.4B by 2027) | Needs substantial capital for development and marketing. |

BCG Matrix Data Sources

Our Cathay Pacific Airways BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.