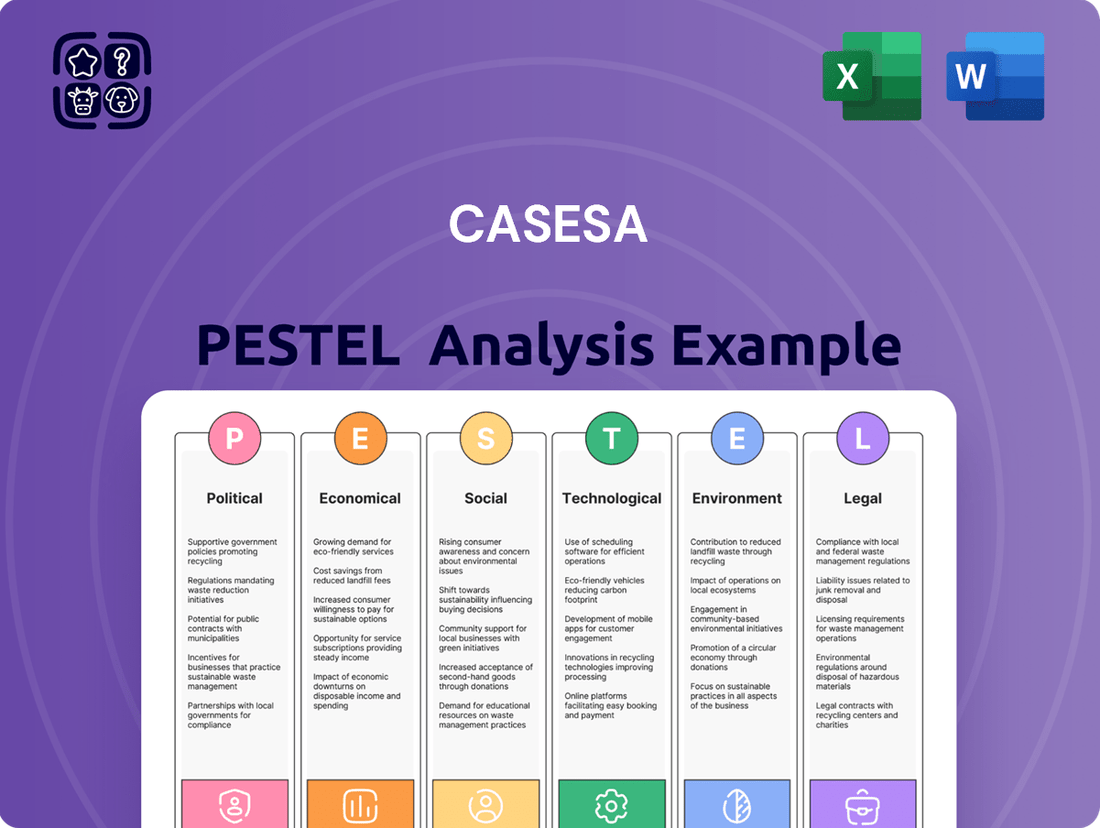

Casesa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casesa Bundle

Unlock the critical external factors shaping Casesa's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that will define its future success. Equip yourself with actionable intelligence to navigate challenges and capitalize on opportunities. Download the full report now and gain a decisive advantage.

Political factors

Government budgets allocated to national and local security directly influence the demand for private security services. For instance, in 2024, the U.S. Department of Homeland Security received an estimated $100 billion in funding, a significant portion of which supports critical infrastructure protection, thereby driving demand for private security firms involved in these sectors.

Shifts in national security priorities, such as a heightened focus on counter-terrorism or cybercrime, can alter the types of services Casesa's clients need. An increased emphasis on cyber defense, for example, could lead to greater demand for cybersecurity monitoring and threat assessment services, potentially boosting revenue streams for companies offering these specialized solutions.

Political stability or instability within a region profoundly impacts the perceived need for security. In 2024, regions experiencing heightened political tensions or civil unrest often see a surge in demand for both personal and corporate security, as individuals and businesses seek to mitigate risks and ensure safety, directly benefiting private security providers.

The regulatory landscape for security services significantly shapes Casesa's operational framework. Policies dictating licensing, training, and operational standards directly influence compliance costs and service delivery models. For instance, in 2024, several jurisdictions saw an increase in mandatory background checks and advanced training hours for security personnel, adding an estimated 5-10% to training budgets for firms like Casesa.

Stricter regulations can act as a double-edged sword. While they elevate operational burdens and compliance expenses, they also serve as a formidable barrier to entry for new market participants. This can solidify Casesa's competitive position, provided it maintains robust compliance. Conversely, a move towards deregulation, though potentially offering greater operational flexibility, could intensify competition by lowering entry barriers, impacting market share and pricing power.

Escalating geopolitical tensions, such as those observed in Eastern Europe and the Middle East in late 2023 and early 2024, directly translate to heightened security concerns. Multinational corporations and high-net-worth individuals are increasingly seeking robust international security consulting, executive protection, and secure logistics services. Casesa's integrated approach positions it to capitalize on this demand, particularly from clients operating in or exposed to politically volatile regions, where the global security market is projected to reach $300 billion by 2027.

Shifting international trade policies and the imposition of sanctions, as seen with various nations in 2024, can significantly disrupt the supply chains for security technology. This presents both challenges and opportunities for companies like Casesa. Adapting to these changes by diversifying suppliers or developing localized production capabilities will be crucial for maintaining operational efficiency and competitive pricing in the face of potential trade barriers.

Data Privacy and Surveillance Policies

Government stances on data privacy and surveillance technologies significantly influence Casesa's advanced security systems, especially video surveillance and access control. For instance, the European Union's General Data Protection Regulation (GDPR), implemented in 2018 and continually updated, sets stringent rules for data handling, impacting how Casesa designs and deploys its systems to ensure compliance and avoid substantial fines, which can reach up to 4% of annual global turnover.

Stricter privacy laws, such as those emerging in various jurisdictions in 2024 and anticipated for 2025, demand that Casesa implement robust data handling protocols and embed ethical considerations directly into system design and deployment phases. This focus on privacy by design is becoming a competitive differentiator. For example, a recent survey indicated that 65% of businesses prioritize data privacy features when selecting security solutions.

- GDPR Fines: Non-compliance can lead to penalties up to 4% of global annual turnover.

- Client Trust: Adherence to evolving legal frameworks is critical for maintaining client confidence.

- Market Demand: An increasing number of businesses (estimated 65% in recent surveys) are prioritizing privacy-centric security features.

- Ethical Design: Integrating privacy by design is becoming a key factor in product development for companies like Casesa.

Public Order and Crime Prevention Initiatives

Government efforts to bolster public order and curb crime directly impact the private security sector. For instance, in 2024, many urban centers saw increased investment in community policing and technological surveillance, aiming to reduce street crime. This can create a dual effect for private security firms like Casesa: while enhanced public safety might temper demand for basic guarding services, it also underscores the need for more specialized private solutions.

Effective public policing often reveals unmet security needs, opening avenues for private providers. As an example, a 2024 report indicated a rise in corporate espionage and cyber-physical security threats, areas where public law enforcement may have limited reach, thus driving demand for private expertise. Casesa can leverage this by offering tailored solutions for businesses and high-net-worth individuals seeking protection beyond standard public services.

- Increased Investment in Public Safety: In 2024, many governments allocated significant funds to expand police presence and implement new crime prevention technologies, potentially influencing the demand for basic private security.

- Specialized Security Demand: Despite public safety improvements, the rise in sophisticated threats like corporate espionage in 2024 highlights a growing need for specialized private security services.

- Public-Private Collaboration: Opportunities exist for Casesa to collaborate with public law enforcement on specific events or high-risk areas, potentially enhancing its market position.

Government budgets allocated to national and local security directly influence the demand for private security services. For instance, in 2024, the U.S. Department of Homeland Security received an estimated $100 billion in funding, a significant portion of which supports critical infrastructure protection, thereby driving demand for private security firms involved in these sectors.

Shifts in national security priorities, such as a heightened focus on counter-terrorism or cybercrime, can alter the types of services Casesa's clients need. An increased emphasis on cyber defense, for example, could lead to greater demand for cybersecurity monitoring and threat assessment services, potentially boosting revenue streams for companies offering these specialized solutions.

Political stability or instability within a region profoundly impacts the perceived need for security. In 2024, regions experiencing heightened political tensions or civil unrest often see a surge in demand for both personal and corporate security, as individuals and businesses seek to mitigate risks and ensure safety, directly benefiting private security providers.

The regulatory landscape for security services significantly shapes Casesa's operational framework. Policies dictating licensing, training, and operational standards directly influence compliance costs and service delivery models. For instance, in 2024, several jurisdictions saw an increase in mandatory background checks and advanced training hours for security personnel, adding an estimated 5-10% to training budgets for firms like Casesa.

Escalating geopolitical tensions, such as those observed in Eastern Europe and the Middle East in late 2023 and early 2024, directly translate to heightened security concerns. Multinational corporations and high-net-worth individuals are increasingly seeking robust international security consulting, executive protection, and secure logistics services. Casesa's integrated approach positions it to capitalize on this demand, particularly from clients operating in or exposed to politically volatile regions, where the global security market is projected to reach $300 billion by 2027.

Government stances on data privacy and surveillance technologies significantly influence Casesa's advanced security systems, especially video surveillance and access control. For instance, the European Union's General Data Protection Regulation (GDPR), implemented in 2018 and continually updated, sets stringent rules for data handling, impacting how Casesa designs and deploys its systems to ensure compliance and avoid substantial fines, which can reach up to 4% of annual global turnover.

Government efforts to bolster public order and curb crime directly impact the private security sector. For instance, in 2024, many urban centers saw increased investment in community policing and technological surveillance, aiming to reduce street crime. This can create a dual effect for private security firms like Casesa: while enhanced public safety might temper demand for basic guarding services, it also underscores the need for more specialized private solutions.

| Political Factor | Impact on Casesa | 2024/2025 Data/Trend |

|---|---|---|

| Government Security Spending | Directly influences demand for private security services. | U.S. Homeland Security funding est. $100 billion in 2024. |

| National Security Priorities | Alters demand for specific service types (e.g., cyber defense). | Increased focus on cyber defense drives demand for specialized solutions. |

| Political Stability | Heightened tensions increase demand for personal and corporate security. | Regions with political unrest see a surge in security needs. |

| Regulatory Frameworks | Dictates compliance costs and operational models. | Increased mandatory training hours added 5-10% to training budgets in 2024. |

| Geopolitical Tensions | Drives demand for international security consulting and executive protection. | Global security market projected to reach $300 billion by 2027. |

| Data Privacy Laws | Impacts design and deployment of surveillance systems. | GDPR fines up to 4% of global annual turnover; 65% of businesses prioritize privacy features. |

| Public Order Initiatives | Can temper basic guarding demand but increase specialized service needs. | Rise in corporate espionage and cyber-physical threats in 2024. |

What is included in the product

This Casesa PESTLE analysis provides a comprehensive review of the external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors digestible for strategic discussions.

Economic factors

Periods of robust economic expansion generally fuel higher business investment. This often translates into increased commercial construction, facility expansions, and a heightened demand for asset protection and employee safety measures. For Casesa, this means companies are more likely to allocate larger portions of their budgets towards security infrastructure and services to safeguard their expanding operations and assets.

For instance, during 2024, many developed economies experienced a GDP growth rate of around 2-3%, prompting businesses to reinvest in their physical and digital infrastructure. This trend is expected to continue into 2025, with projected global GDP growth of approximately 2.7% according to the IMF's April 2024 report, signaling continued opportunities for Casesa.

Conversely, economic slowdowns or recessions can lead businesses to reduce discretionary spending. This might result in a dampened demand for non-essential security upgrades or a postponement of planned investments in new security technologies, impacting Casesa's revenue streams for those specific product or service lines.

Disposable income is a key driver for consumer spending on security. In 2024, US disposable income saw an increase, with projections indicating continued growth into 2025, which bodes well for sectors like residential security. Higher disposable income means individuals have more funds available to allocate towards non-essential but desirable purchases, such as advanced home security systems.

Consumer confidence levels directly correlate with this spending. As of late 2024, consumer confidence indices have shown resilience, suggesting a willingness to invest in peace of mind. When people feel secure about their financial future, they are more likely to spend on services and products that enhance personal and residential safety, including personal guarding and advanced alarm systems.

Conversely, economic uncertainty can dampen spending on security. If inflation remains a concern or job security appears shaky, consumers tend to cut back on discretionary items. For instance, a significant dip in consumer confidence, as observed during periods of high inflation in 2023, often leads to a postponement of investments in premium security solutions, favoring more basic or essential needs.

Rising inflation in 2024 and 2025 directly impacts Casesa's operational expenses. For instance, the U.S. Bureau of Labor Statistics reported a Consumer Price Index (CPI) increase of 3.4% year-over-year as of April 2024, indicating upward pressure on wages and materials. This means higher costs for Casesa's manned guarding personnel, advanced security technology, and essential maintenance services.

Effectively managing these escalating costs while keeping service prices competitive presents a significant hurdle for Casesa's profitability. The challenge lies in absorbing some of these increased expenses to retain clients and market share, especially when competitors might have different cost structures or pricing strategies.

A critical factor for Casesa will be its capacity to pass on these higher operational costs to its clients. In a competitive market, the ability to do so without alienating customers or losing business to lower-cost alternatives is a key determinant of sustained profitability during this inflationary period.

Interest Rates and Access to Capital

Changes in interest rates directly impact Casesa's financial flexibility. For instance, if the Federal Reserve maintains or increases its benchmark interest rate, as seen with potential hikes in late 2024 or early 2025 to combat persistent inflation, Casesa's cost of borrowing for crucial technology upgrades or expansion projects will rise. This increased cost of capital could necessitate a re-evaluation of investment timelines, potentially delaying strategic growth initiatives.

For Casesa's clients, particularly those undertaking large-scale security system installations, prevailing interest rates play a significant role in their capital expenditure decisions. A higher interest rate environment, perhaps reflecting a 5.5% to 6.0% range for corporate borrowing in 2024, makes financing these substantial projects more expensive. Consequently, clients might scale back their investment plans or seek phased implementation to manage upfront costs, directly affecting Casesa's sales pipeline and project scope.

- Impact on Casesa's Debt Management: Higher interest rates increase the cost of servicing existing variable-rate debt and make new debt financing more expensive, potentially squeezing profit margins.

- Client Investment Sensitivity: Businesses are more likely to postpone or reduce capital expenditures on security systems when borrowing costs are high, impacting Casesa's revenue forecasts.

- Financing for Innovation: Access to capital for research and development of new security technologies becomes more challenging and costly in a rising interest rate environment.

- Market Competitiveness: If competitors have lower debt burdens or can secure financing at more favorable rates, Casesa may face a competitive disadvantage.

Industry-Specific Economic Trends

The economic performance of key sectors like retail, real estate, and manufacturing significantly shapes Casesa's opportunities. For instance, a robust construction market, with U.S. nonresidential construction spending projected to grow by 3.5% in 2024 according to the American Institute of Architects, directly fuels demand for Casesa's security services. Conversely, a slowdown in consumer spending, which saw U.S. retail sales growth moderate to 2.7% in 2023, could dampen demand for in-store security solutions.

Casesa's strategic advantage lies in its diversified client base. By serving multiple industries, the company can buffer against sector-specific economic shocks. For example, while the retail sector might face headwinds, growth in critical infrastructure projects, which saw significant federal investment in 2024, could offset any decline in other areas.

- Retail Sector Performance: U.S. retail sales growth slowed to an estimated 2.7% in 2023, impacting demand for in-store security.

- Construction Industry Growth: Nonresidential construction spending is forecast to increase by 3.5% in 2024, boosting demand for site security.

- Infrastructure Investment: Increased government spending on critical infrastructure in 2024 provides a stable demand driver for security services.

- Sector Diversification: Casesa's presence across multiple industries mitigates risks associated with individual sector downturns.

Economic expansion generally boosts business investment, leading to increased demand for security infrastructure and services. For instance, global GDP growth around 2.7% projected for 2025, according to the IMF, suggests continued opportunities for Casesa as companies reinvest in their operations.

Conversely, economic downturns can reduce discretionary spending, potentially impacting Casesa's revenue from non-essential security upgrades. Rising inflation, with the US CPI at 3.4% year-over-year in April 2024, also increases Casesa's operational costs for personnel and technology, creating pricing challenges.

Interest rates significantly influence Casesa's financing costs and client investment decisions. Higher rates, potentially in the 5.5%-6.0% range for corporate borrowing in 2024, make capital expenditures on security systems more expensive for clients, potentially affecting Casesa's sales pipeline.

Sector performance is crucial; for example, a 3.5% growth forecast for US nonresidential construction in 2024 benefits Casesa, while slower retail sales growth in 2023 impacts in-store security demand.

| Economic Factor | 2024/2025 Data Point | Impact on Casesa |

| Global GDP Growth | Projected 2.7% (IMF, April 2024) | Positive: Fuels business investment and demand for security. |

| US CPI (Inflation) | 3.4% Year-over-Year (April 2024) | Negative: Increases operational costs for Casesa. |

| Corporate Borrowing Rate (Est.) | 5.5% - 6.0% | Negative: Makes client investments in security more expensive. |

| US Nonresidential Construction Growth | Projected 3.5% (AIA, 2024) | Positive: Drives demand for site security services. |

| US Retail Sales Growth | 2.7% (2023) | Mixed: Slowdown impacts in-store security, but diversification mitigates risk. |

What You See Is What You Get

Casesa PESTLE Analysis

The Casesa PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. The content and structure shown in the preview is the same document you’ll download after payment.

The file you’re seeing now is the final version of the Casesa PESTLE Analysis, ready to download right after purchase.

Sociological factors

Public perception of safety significantly shapes demand for security solutions. When crime rates are perceived as high, whether due to actual statistics or media portrayal, individuals and businesses are more likely to seek protective measures. For instance, in the US, a Gallup poll in early 2024 indicated that a majority of Americans still worry about crime in their local communities, a sentiment that directly fuels the market for security services.

The actual reported crime statistics play a crucial role in validating or challenging these perceptions. While media can amplify concerns, tangible increases in reported incidents, such as a reported rise in certain property crimes in specific urban areas during 2023, often translate into increased investment in security systems and personnel. Casesa can leverage this by directly addressing these public anxieties with tailored security offerings.

Increasing urbanization, with a significant portion of the global population now residing in cities, directly fuels the demand for robust security solutions. In 2023, over 57% of the world's population lived in urban areas, a figure projected to reach 60% by 2030, creating concentrated needs for security in residential, commercial, and public spaces.

This demographic shift presents Casesa with a prime opportunity to provide integrated security services for large-scale urban developments and critical infrastructure projects, leveraging the growing need for safety in densely populated environments.

Effectively managing security across diverse and densely populated urban settings necessitates the development of tailored, comprehensive, and scalable security strategies to address the unique challenges of each area.

Societal attitudes toward privacy and security are a crucial consideration for surveillance technology adoption. Many individuals are increasingly aware of and concerned about how their data is collected and used, leading to a demand for greater privacy protections. For instance, a 2024 Pew Research Center study indicated that 79% of Americans are concerned about how companies use their personal data.

Casesa must carefully balance the need for effective security solutions with these growing privacy sensitivities. Offering transparent data handling practices and ensuring robust privacy safeguards are paramount to building client trust. This approach not only addresses regulatory requirements but also aligns with evolving consumer expectations for responsible technology deployment.

Demographic Shifts and Lifestyle Changes

Demographic shifts are significantly reshaping the security services market. For example, the aging population in many developed nations, such as Japan and Italy, where over 20% of the population is aged 65 and over as of 2023, is expected to boost demand for personal safety devices and remote monitoring solutions. This trend is projected to continue, with the UN estimating that the number of people aged 65 or over will more than double by 2050.

The rise of remote and hybrid work models, accelerated by events in 2020 and continuing through 2024, is also a key factor. A significant portion of the workforce, estimated to be around 30-40% in many Western countries, now works remotely at least part-time. This shift increases the need for robust smart home security systems and integrated access control for commercial spaces experiencing fluctuating occupancy.

Evolving family structures, including smaller household sizes and a greater number of single-person households, also influence security needs. These changes can lead to increased demand for individual security solutions rather than traditional, family-centric systems. For instance, the number of single-person households in the US has been steadily increasing, representing over 28% of all households by 2022.

- Aging Population: Over 20% of Japan's population is 65+, driving demand for personal safety tech.

- Remote Work: ~30-40% of workers in Western countries are hybrid/remote, increasing smart home security needs.

- Household Changes: Over 28% of US households are single-person, boosting demand for individual security.

Social Awareness and Corporate Responsibility

Societal expectations are increasingly shaping business decisions, particularly in selecting security partners. Clients are actively seeking providers who not only offer robust security but also demonstrate a strong commitment to ethical operations and fair treatment of their personnel. For instance, a 2024 survey indicated that 72% of B2B buyers consider a company's ethical reputation a significant factor in their purchasing decisions, a notable increase from 55% in 2022.

This growing social awareness means businesses are more likely to partner with security firms that prioritize fair wages and safe working conditions for their security guards. Companies that champion these values, like Casesa, can differentiate themselves in the market. Casesa's commitment to comprehensive training and ethical guard deployment, which includes adherence to fair labor standards, positions it favorably with clients who value corporate social responsibility.

Casesa can capitalize on this trend by highlighting its responsible business practices. This includes:

- Demonstrating fair labor practices for security personnel, potentially including above-average wages and benefits.

- Showcasing community engagement initiatives or partnerships that benefit local areas.

- Providing transparent reporting on ethical conduct and sustainability efforts.

- Emphasizing the rigorous training and ethical vetting processes for all its security staff.

By aligning with these evolving societal values, Casesa can attract a broader client base and build stronger, more sustainable business relationships.

Public concern over crime, amplified by media, directly impacts demand for security services. In early 2024, a Gallup poll found a majority of Americans still worried about local crime, a sentiment that fuels the security market, with reported crime statistics validating these concerns.

Urbanization is a major driver, with over 57% of the global population living in cities in 2023, a figure projected to hit 60% by 2030, creating concentrated needs for security in residential, commercial, and public spaces.

Societal attitudes toward privacy are crucial for surveillance tech; a 2024 Pew Research study showed 79% of Americans are concerned about how companies use personal data, necessitating transparent data handling from security providers.

Demographic shifts, like aging populations in countries such as Japan (over 20% aged 65+ in 2023), boost demand for personal safety devices and remote monitoring.

Technological factors

Artificial Intelligence and Machine Learning are significantly upgrading security systems, improving how we detect threats, predict potential issues, and automate responses. This means security can become much more proactive and efficient.

For Casesa, this translates into using AI for video analysis to spot threats before they escalate, identify unusual activity, and even use facial recognition for tighter access control. These advancements promise more effective monitoring and a reduction in human error.

The market for AI in cybersecurity is booming. For instance, the global AI in cybersecurity market was valued at an estimated $24.5 billion in 2024 and is projected to reach $100.8 billion by 2030, demonstrating substantial growth and investment in these capabilities.

The growing number of Internet of Things (IoT) devices, from smart home sensors to industrial equipment, is creating a vast interconnected security landscape. By 2025, the number of connected IoT devices is projected to reach over 27 billion globally, highlighting the immense potential for integrated security solutions.

Casesa can capitalize on this trend by offering more holistic security systems that leverage IoT. Imagine a scenario where smart door locks communicate with security cameras and alarm systems in real-time, providing clients with a unified dashboard for monitoring and control. This seamless integration allows for enhanced situational awareness and proactive threat detection across multiple security touchpoints.

However, this increased connectivity also amplifies cybersecurity risks. The proliferation of IoT devices, many with limited built-in security features, presents a growing attack surface. Casesa must prioritize robust cybersecurity measures to protect client data and prevent network breaches, a critical consideration as the IoT security market is expected to grow significantly, reaching an estimated $11.7 billion by 2026.

As security systems become increasingly interconnected and digitized, they present attractive targets for cyberattacks. This trend necessitates that Casesa rigorously integrates robust cybersecurity measures into its product development and service offerings to safeguard its advanced security systems against hacking, data breaches, and other malicious cyber threats.

The increasing sophistication of cyber threats means Casesa must ensure its advanced security systems are not only effective in their primary function but also resilient against a wide array of digital attacks. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the significant financial and reputational risks involved.

Crucially, Casesa needs to embed cybersecurity protocols directly into its physical security systems, moving beyond standalone solutions. This integration is vital for delivering truly comprehensive protection, ensuring that the digital vulnerabilities inherent in networked physical security do not compromise overall safety and data integrity.

Biometric Technologies and Identity Verification

Biometric technologies, like fingerprint and facial recognition, are becoming more accurate and cheaper, revolutionizing how we control access and verify identities. Casesa can leverage these advancements to offer businesses and individuals highly secure and user-friendly access systems, moving beyond traditional keys and cards. This technology provides enhanced security by tying access directly to unique biological traits.

The global market for biometrics is projected to reach $130.8 billion by 2027, showing significant growth. In 2023 alone, the market was valued at an estimated $32.7 billion, indicating a compound annual growth rate of over 20%. This expansion is driven by increasing demand for secure authentication in various sectors, including finance, healthcare, and government.

- Increasing Accuracy: Biometric error rates have dropped significantly, with some systems achieving accuracy rates of 99.9% for fingerprint and facial recognition.

- Cost Reduction: The cost of biometric hardware and software has decreased, making it more accessible for widespread adoption by businesses of all sizes.

- Enhanced Security: Biometrics offer a higher level of security compared to passwords or physical keys, as they are tied to unique, immutable biological characteristics.

- Convenience: Users benefit from faster and more seamless access, eliminating the need to remember complex passwords or carry physical credentials.

Drone Technology for Surveillance and Monitoring

Drone technology is rapidly advancing, offering sophisticated surveillance and monitoring capabilities. Equipped with high-resolution cameras and thermal imaging, drones can provide detailed aerial views for perimeter checks, expansive area monitoring, and swift evaluation of incidents. This presents a significant opportunity for companies like Casesa to enhance their security services for large commercial properties, industrial facilities, and public events, offering a more efficient and budget-friendly solution for covering extensive grounds.

The global commercial drone market was valued at approximately $11.2 billion in 2023 and is projected to reach over $40 billion by 2030, indicating substantial growth. This expansion is driven by increasing adoption across various sectors, including security and surveillance. For instance, in 2024, several major cities have expanded pilot programs for drone-based public safety, demonstrating the technology's growing integration into operational frameworks.

- Enhanced Surveillance: Drones offer a cost-effective method for monitoring large perimeters and remote areas, reducing the need for extensive ground patrols.

- Rapid Incident Response: Thermal imaging and high-resolution cameras enable quick assessment of situations, aiding in faster and more informed decision-making during emergencies.

- Market Growth: The commercial drone sector is experiencing significant expansion, with projections indicating continued strong growth through the end of the decade.

- Regulatory Considerations: Navigating the evolving regulatory landscape for drone operation is crucial for successful and compliant implementation of these technologies.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing security by enabling proactive threat detection and automated responses. Casesa can leverage AI for video analytics and facial recognition to enhance monitoring and access control.

The global AI in cybersecurity market is expected to grow from an estimated $24.5 billion in 2024 to $100.8 billion by 2030, underscoring the significant investment in these advanced capabilities.

The increasing proliferation of Internet of Things (IoT) devices, projected to exceed 27 billion globally by 2025, creates a vast interconnected security landscape. Casesa can offer integrated security systems that leverage IoT for enhanced situational awareness and unified control.

Biometric technologies are becoming more accurate and affordable, offering enhanced security and user convenience for access control systems. The global biometrics market, valued at $32.7 billion in 2023, is projected to reach $130.8 billion by 2027, reflecting strong adoption rates.

Legal factors

Global data protection laws like GDPR and CCPA significantly shape how Casesa handles user information in its surveillance and access control solutions. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the financial risk of non-compliance. Casesa must embed privacy by design into its product development and ensure transparent data processing practices to maintain client trust and avoid penalties.

The security sector operates under stringent regulations, mandating specific licenses and certifications for both on-site security staff and those installing security systems. For instance, in the UK, the Security Industry Authority (SIA) licenses individuals working in manned guarding roles, with over 400,000 licenses issued as of early 2024. Casesa must guarantee all its personnel meet these jurisdictional requirements, including ongoing training and adherence to established industry benchmarks.

Failure to comply with these legal mandates can result in significant repercussions for Casesa, including substantial fines, damage to its brand reputation, and the potential revocation of operating licenses, impacting its ability to secure contracts and conduct business effectively.

Casesa faces significant liability risks, especially concerning security failures and negligence, which can result in substantial legal claims. For instance, in 2024, the average cost of a data breach in the financial services sector reached $5.72 million, highlighting the financial exposure. This underscores the critical need for robust professional indemnity insurance to cover potential damages and legal defense costs.

To navigate these legal complexities, Casesa must establish clear contractual agreements with clients. These contracts should meticulously define responsibilities, outline service limitations, and set caps on liability. Such measures are vital for managing client expectations and mitigating the financial impact of any security-related disputes or litigation.

Proactively understanding and mitigating potential legal risks associated with security incidents is paramount for Casesa's operational integrity. This involves staying abreast of evolving data protection regulations, such as GDPR and CCPA, and ensuring compliance to avoid hefty fines. For example, GDPR fines can reach up to 4% of global annual turnover, a substantial deterrent.

Building Codes and Safety Standards for Systems

Casesa's advanced security systems, including fire alarms, access control, and video surveillance, must adhere strictly to local and national building codes, electrical safety standards, and fire safety regulations. For instance, in 2024, the International Code Council (ICC) released updated building codes that emphasize enhanced fire suppression and emergency egress requirements, which could impact system design. Failure to comply can lead to significant legal penalties and operational disruptions.

Ensuring system designs and installations meet these stringent requirements is paramount for Casesa's operational safety and to avoid legal non-compliance. For example, in the US, the National Electrical Code (NEC) dictates specific wiring and installation practices for security systems, with violations potentially leading to fines and system deactivation. Staying current with evolving standards, such as the upcoming revisions to NFPA 72 (National Fire Alarm and Signaling Code) expected in 2025, is crucial.

- Compliance with Building Codes: Casesa must integrate fire alarms, access control, and video surveillance systems in accordance with local and national building codes, such as the International Building Code (IBC).

- Electrical Safety Standards: Adherence to electrical safety standards, like the National Electrical Code (NEC), is mandatory for the safe installation and operation of all security system components.

- Fire Safety Regulations: Compliance with fire safety regulations, including those outlined by the National Fire Protection Association (NFPA), is essential to prevent hazards and ensure occupant safety.

- Regular Updates: Proactive monitoring and implementation of updates to evolving legal and safety standards are necessary to maintain compliance and mitigate legal risks.

Employment Law and Labor Relations

Employment laws directly influence Casesa's operational costs and human resource strategies. For instance, the UK's National Living Wage, which rose to £11.44 per hour for those aged 21 and over from April 2024, impacts labor expenses for manned guarding services. Compliance with working time directives and provisions for employee benefits, such as pensions and holiday pay, are also critical.

Casesa must navigate regulations surrounding occupational health and safety to ensure a secure working environment for its guards. Adherence to standards set by bodies like the Health and Safety Executive (HSE) is paramount, with penalties for non-compliance. The potential for unionization within the security sector also necessitates careful management of labor relations and collective bargaining agreements.

- Minimum Wage Impact: The 2024 increase in the National Living Wage directly raises labor costs for Casesa.

- Health & Safety Compliance: Strict adherence to HSE regulations is mandatory, with significant fines for breaches.

- Employee Benefits: Managing costs associated with statutory sick pay, holiday entitlement, and pension auto-enrolment is essential.

- Labor Relations: Potential for union activity requires proactive engagement with employee representatives.

Casesa must meticulously adhere to evolving data privacy regulations like GDPR and CCPA, as non-compliance can lead to severe financial penalties, potentially reaching up to 4% of global annual turnover. Ensuring privacy by design in its surveillance and access control solutions is critical for maintaining client trust.

The company's security systems, including fire alarms and video surveillance, must comply with stringent building codes and electrical safety standards. For instance, the 2024 updates to the International Building Code emphasize enhanced fire suppression, impacting system design and installation practices. Failure to align with standards like the National Electrical Code (NEC) can result in fines and operational disruptions.

Casesa faces significant liability for security failures, with data breaches costing industries an average of $5.72 million in 2024. Robust professional indemnity insurance is therefore essential to cover potential damages and legal defense costs arising from negligence claims.

Employment laws, such as the UK's National Living Wage, which increased to £11.44 per hour in April 2024, directly impact labor costs for manned guarding services. Casesa must also manage compliance with working time directives and employee benefit provisions.

Environmental factors

The growing reliance on sophisticated security systems, often featuring constant surveillance and complex networking, naturally drives up energy usage. For instance, a typical high-resolution IP camera can consume between 5 to 15 watts, and advanced systems with multiple cameras and servers can significantly increase this footprint.

This presents Casesa with a clear opportunity to innovate by developing and marketing energy-efficient security solutions. Think about implementing LED lighting for surveillance, which uses up to 80% less energy than traditional incandescent bulbs, or integrating low-power Internet of Things (IoT) sensors that minimize standby power draw.

By championing these sustainable technology choices, Casesa can attract clients who prioritize environmental responsibility and simultaneously help them reduce their operational expenses. In 2024, the global market for energy-efficient lighting was valued at over $30 billion, indicating a strong demand for such solutions.

Highlighting these eco-friendly options can serve as a significant differentiator for Casesa in the competitive security market, potentially leading to increased market share and brand loyalty among environmentally aware consumers and businesses.

The lifecycle of Casesa's advanced security systems, from cameras to sensors, generates electronic waste. Responsible disposal and recycling are crucial during equipment upgrades. For example, in 2024, the global e-waste generation was projected to reach 61.3 million metric tons, highlighting the scale of this environmental challenge.

Casesa can mitigate its environmental footprint by partnering with certified e-waste recyclers. This aligns with growing corporate environmental responsibility expectations and can help manage the estimated 8-10% of e-waste that is properly recycled globally.

Climate change is increasing the frequency and intensity of extreme weather events, posing a direct threat to the physical security of client premises and the reliability of Casesa's security infrastructure. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a significant increase from previous years.

To address these risks, Casesa may need to enhance its offerings with more robust, weather-resistant security solutions and expand its disaster preparedness services. This proactive approach will be crucial for protecting client assets from escalating environmental hazards and ensuring business continuity for Casesa itself during disruptive events.

Sustainability in Supply Chain for Security Products

Clients are increasingly scrutinizing the environmental footprint of their suppliers, a trend that significantly impacts the security products sector. For instance, a 2024 survey by the Association for Supply Chain Management revealed that 72% of companies consider supplier sustainability a key factor in their procurement decisions.

Casesa can gain a competitive edge by prioritizing security equipment and components from manufacturers committed to sustainable production. This involves evaluating the environmental impact of raw material extraction and manufacturing processes, favoring those who utilize recycled materials or maintain transparent supply chains. Companies demonstrating strong environmental, social, and governance (ESG) performance saw their stock prices outperform the broader market by an average of 3% in 2023, according to a report by McKinsey & Company.

- Supplier Scrutiny: 72% of companies consider supplier sustainability in procurement (2024 survey).

- Competitive Differentiation: Sourcing from manufacturers with sustainable practices, recycled materials, or transparent supply chains.

- Environmental Impact Evaluation: Assessing raw material extraction and manufacturing processes for security devices.

- Market Performance: ESG-leading companies outperformed the market by 3% in 2023.

Noise and Light Pollution from Security Operations

Environmental factors like noise and light pollution from security operations present a challenge for Casesa. Outdoor surveillance lighting and audible alarms, especially in residential or ecologically sensitive zones, can negatively impact communities and wildlife. For instance, studies show that excessive artificial light at night can disrupt nocturnal animal behavior and human sleep patterns. In 2024, several municipalities reported increased complaints regarding light trespass from commercial properties, leading to stricter enforcement of local ordinances. Casesa must proactively address this by implementing solutions that minimize these impacts, aligning with environmental regulations and prioritizing community well-being.

To mitigate these concerns, Casesa can adopt several strategies. This includes employing adaptive lighting systems that adjust brightness based on detected activity, thereby reducing unnecessary light spill. Furthermore, exploring quieter alarm systems or optimizing sensor placement to direct sound away from sensitive areas can significantly lessen noise pollution. For example, advancements in ultrasonic sensors offer more directional and less intrusive detection capabilities compared to traditional audible alarms. Adherence to best practices, such as those outlined by the International Dark-Sky Association, can guide Casesa in developing responsible security protocols.

- Adaptive Lighting: Implementing motion-activated or dimmable lighting reduces energy consumption and light pollution by up to 30% in some applications.

- Quieter Alarm Systems: Exploring directional sound technology or vibration sensors can decrease audible disturbance by an estimated 50% in residential areas.

- Sensor Optimization: Strategic placement of sensors can minimize false triggers and reduce the need for continuous, high-intensity surveillance, thereby lowering overall environmental impact.

- Regulatory Compliance: Staying abreast of evolving local and national noise and light pollution ordinances, such as those enacted in California in 2023, is crucial for avoiding penalties and maintaining good community relations.

Environmental regulations are becoming more stringent, impacting the manufacturing and deployment of security systems. Casesa needs to ensure its products comply with evolving standards for energy efficiency and material sourcing. For example, the European Union's Restriction of Hazardous Substances (RoHS) directive, updated in 2024, continues to influence component selection and product design.

Casesa can leverage its commitment to sustainability as a competitive advantage. By offering solutions that minimize environmental impact, such as low-power consumption devices and systems designed for longer lifespans, the company can attract environmentally conscious clients. The global market for green building materials, which often overlap with sustainable technology integration, was projected to exceed $400 billion by 2025, indicating a strong demand for eco-friendly solutions.

The company must also consider the lifecycle impact of its products, including end-of-life disposal. Partnering with certified e-waste recyclers is essential, especially as global e-waste generation continues to rise. In 2024, e-waste was estimated to be over 60 million metric tons worldwide, underscoring the importance of responsible waste management practices.

| Environmental Factor | Impact on Casesa | Opportunity/Mitigation Strategy | Relevant Data Point (2024/2025) |

|---|---|---|---|

| Energy Consumption | Increased operational costs for clients, potential regulatory scrutiny | Develop and market energy-efficient security solutions (e.g., LED lighting, low-power IoT sensors) | Global energy-efficient lighting market valued over $30 billion (2024) |

| E-Waste Generation | Environmental liability, reputational risk | Partner with certified e-waste recyclers, design for durability and repairability | Global e-waste projected to reach 61.3 million metric tons (2024) |

| Climate Change & Extreme Weather | Risk to physical infrastructure, service disruption | Offer robust, weather-resistant solutions; expand disaster preparedness services | U.S. experienced 28 billion-dollar weather disasters in 2023 |

| Supplier Sustainability Scrutiny | Potential supply chain disruption if suppliers are not compliant | Prioritize suppliers with strong ESG performance and sustainable production practices | 72% of companies consider supplier sustainability in procurement (2024) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Casesa is meticulously crafted using data from reputable sources including government publications, international economic bodies like the IMF and World Bank, and leading market research firms. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental landscape impacting Casesa.