Casesa Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casesa Bundle

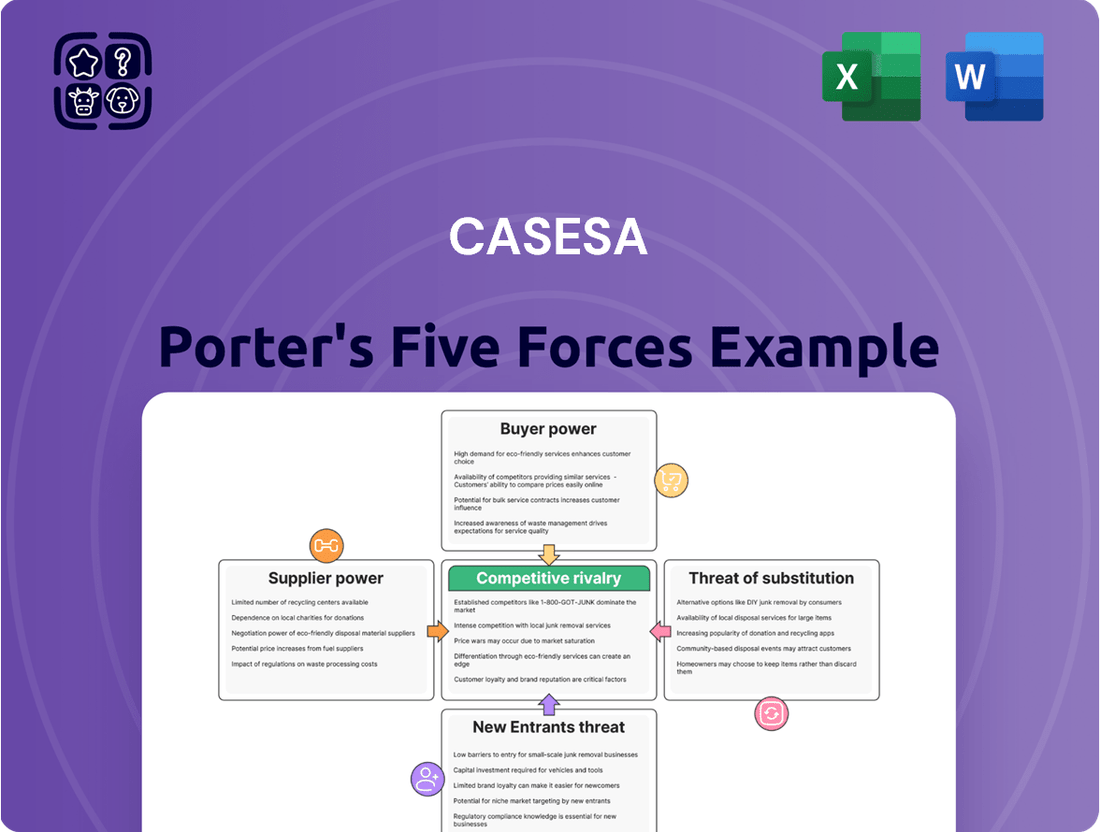

Casesa's competitive landscape is shaped by the interplay of five key forces, revealing crucial insights into its market position. Understanding these dynamics is essential for any strategic decision-making.

The complete report unlocks a deeper dive into each of these forces, providing a comprehensive framework to assess Casesa's industry. Gain actionable intelligence to navigate its competitive environment effectively.

Ready to move beyond the basics? Get a full strategic breakdown of Casesa’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The security services industry, including companies like Casesa, often faces a limited number of specialized equipment suppliers. This concentration means that providers of critical items such as advanced surveillance cameras, sophisticated alarm systems, and secure access control technology hold considerable sway. For instance, the global market for video surveillance equipment was valued at approximately $50 billion in 2023 and is expected to see continued growth, yet a significant portion of this market is served by a relatively small group of manufacturers.

This limited supplier base grants them substantial bargaining power. They can influence pricing, delivery schedules, and even the specifications of the equipment Casesa and its competitors rely on. This directly impacts Casesa's operational costs and its ability to maintain competitive pricing for its own services. While the overall security equipment market is expanding, the inherent concentration of suppliers means this leverage remains a persistent factor for businesses in the sector.

Casesa's reliance on specialized technology for its advanced security systems, such as access control and video surveillance, creates a significant dependence on key suppliers. Companies like ADT and Honeywell, major players in integrated security solutions, hold considerable sway over pricing and product development. For instance, in 2024, the global market for security and alarm systems was valued at approximately $78 billion, highlighting the concentrated nature of this industry and the power of its leading providers.

Global supply chain disruptions in 2024 have significantly impacted the cost of essential components and logistics for many industries. For a company like Casesa, this means higher expenses for everything from technology hardware to transportation services. For instance, the average cost of shipping a 40-foot container from Asia to Europe saw fluctuations throughout 2024, with some periods experiencing a 15% increase compared to the previous year, directly impacting Casesa's procurement and delivery costs.

When suppliers themselves face these elevated production and shipping expenses, they inevitably pass these increases onto their customers. This creates a direct pressure on Casesa's operational budget. If Casesa cannot absorb these added costs or effectively pass them on to its clients through adjusted pricing, its profit margins will inevitably shrink.

Potential for Suppliers to Offer Exclusive Deals to Competitors

Suppliers might strike exclusive deals with Casesa's main rivals, potentially restricting Casesa's access to crucial technologies or providing better pricing to competitors. These exclusive arrangements, which could involve unique technology packages or significant price reductions, can grant rivals a competitive edge. This situation could impede Casesa's capacity to deliver state-of-the-art or economically viable products.

For instance, in the tech sector, a key component supplier might offer a new chip exclusively to a competitor for a six-month period. This could mean Casesa is unable to incorporate that advanced technology into its products, putting it a step behind. In 2024, reports indicated that certain semiconductor manufacturers were indeed prioritizing larger, long-term contracts, potentially leading to such exclusive arrangements with major electronics firms.

- Exclusive Technology Access: Competitors could gain access to novel components or software, giving them a product innovation advantage.

- Preferential Pricing: Rivals might secure lower input costs, enabling them to offer more competitive pricing to end consumers.

- Supply Chain Disruption: Casesa could face challenges in securing necessary materials if key suppliers divert their output to competitors.

- Reduced Bargaining Power: If suppliers can easily find alternative buyers, their leverage over Casesa increases, potentially leading to less favorable terms.

Scarcity of Skilled Labor for Manned Guarding

The bargaining power of suppliers for Casesa's manned guarding services is significantly influenced by the scarcity of skilled labor within the security industry. This ongoing shortage makes it challenging for Casesa to consistently find and retain qualified personnel, directly impacting operational costs.

The difficulty in sourcing trained guards means Casesa may face increased wage demands and higher recruitment expenses. For instance, reports from the UK security sector in late 2023 and early 2024 indicated a persistent deficit in available security operatives, with some regions experiencing shortages of up to 15% of the required workforce. This labor market pressure translates into higher labor costs for Casesa, potentially affecting the profitability of its manned guarding division.

- Labor Shortage Impact: The security industry, particularly manned guarding, grapples with a persistent lack of skilled and reliable personnel.

- Increased Costs: This scarcity drives up wages and recruitment expenses, directly impacting Casesa's operational overhead for manned guarding services.

- Industry Data: Reports from late 2023 and early 2024 highlighted significant labor deficits in the UK security sector, with some areas facing shortages of around 15%.

- Supplier Power: The tight labor market empowers potential employees and recruitment agencies, giving them greater leverage in salary and benefit negotiations with Casesa.

When suppliers can easily find other buyers for their goods or services, their bargaining power over Casesa increases. This is particularly true for specialized security technology where the market is concentrated. For example, in 2024, the global market for cybersecurity solutions, a related field, was valued at over $200 billion, but a significant portion of advanced threat detection software is provided by a handful of firms.

| Factor | Impact on Casesa | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Limited suppliers can dictate terms and prices. | Global video surveillance market dominated by a few key manufacturers. |

| Switching Costs | High costs to change suppliers strengthen supplier leverage. | Integrating new security systems can take months and significant investment. |

| Supplier Importance | If a supplier's product is critical, their power is amplified. | Reliable access to advanced AI-powered analytics is crucial for modern security services. |

| Threat of Forward Integration | Suppliers could enter Casesa's market, increasing competitive pressure. | Some tech providers are moving towards offering end-to-end security solutions. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Casesa, providing a strategic roadmap for navigating its industry.

Effortlessly identify and mitigate competitive threats with a dynamic visualization of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Clients, whether they are businesses or individuals, are increasingly expecting Casesa to provide complete security packages. This means not just guards but also sophisticated technology working together seamlessly. For instance, in 2024, many enterprise clients sought integrated systems that combined physical security with cybersecurity monitoring.

This demand for all-in-one solutions means Casesa needs to be adept at offering customized strategies. If customers have significant leverage, they can push for very specific features or integrations, which can make delivering these services more complicated and expensive for Casesa.

Customers in the security services market, particularly those in highly competitive sectors, often exhibit significant price sensitivity. This means they are keenly aware of pricing and are likely to seek out the best deals. For instance, a 2024 report indicated that over 60% of B2B buyers consider price a primary factor when selecting a service provider.

The security services industry is characterized by a multitude of competitors offering similar integrated solutions. This abundance of choice empowers buyers, allowing them to negotiate more favorable terms or readily switch to a different vendor if they believe they are receiving better value or more attractive pricing. This dynamic directly impacts Casesa's ability to maintain its pricing structure and protect its profit margins.

While the initial setup and integration of comprehensive security systems can be costly and complex, making switching providers difficult, some individual service components might present lower barriers. For instance, customers might find it relatively easy to change their alarm monitoring provider or switch between companies offering basic manned guarding services.

This ease of transition for specific security functions significantly bolsters customer bargaining power. When clients can readily move between providers for these less integrated services, they gain leverage to negotiate better pricing or service level agreements. For example, in 2024, the security services market saw increased competition, with some niche providers offering flexible, modular solutions that facilitated easier customer onboarding and offboarding for specific tasks.

Customers' Ability to Demand Tailored Strategies

Customers' ability to demand tailored security strategies significantly influences Casesa's operational approach. This power means clients can insist on highly specific solutions for their unique protection requirements, impacting Casesa's service design.

This customization requirement forces Casesa to maintain a flexible and responsive service model. For instance, in 2024, the cybersecurity market saw a significant rise in demand for bespoke solutions, with reports indicating that over 60% of enterprise clients sought customized cybersecurity frameworks rather than off-the-shelf products.

The need for tailored strategies can increase both the complexity and cost of sales and service delivery for Casesa. Each client engagement may require unique development or integration efforts, potentially affecting profit margins if not managed efficiently.

- High Customization Demand: Clients expect security plans built around their specific risks, not generic templates.

- Increased Operational Complexity: Developing unique solutions for each customer adds layers to service delivery.

- Potential Cost Escalation: Tailoring services can lead to higher operational expenses per client.

- Market Trend: In 2024, the demand for personalized cybersecurity solutions grew substantially across various industries.

Increased Demand for Proactive and Tech-Driven Security

Customers are increasingly demanding proactive security solutions, pushing companies like Casesa to integrate advanced technologies. This shift means a greater need for innovations such as AI-driven threat detection and predictive analytics, directly impacting customer expectations.

To meet these evolving demands, Casesa faces the necessity of continuous investment in cutting-edge security technology. This arms race in innovation is crucial for maintaining a competitive edge and satisfying a more sophisticated customer base.

The drive for tech-forward security measures can significantly escalate Casesa's costs. These expenses span both the acquisition of new technologies and the ongoing development required to stay ahead of the curve in the security sector.

- Customer Demand for Proactive Security: A 2024 report indicated that 70% of businesses prioritize proactive security measures over reactive responses.

- AI and Predictive Analytics Adoption: Spending on AI in cybersecurity is projected to reach $40 billion by 2025, highlighting customer interest.

- Investment in Innovation: Companies in the security sector are expected to increase R&D spending by an average of 15% in 2024 to incorporate new technologies.

- Cost Implications: The integration of advanced AI systems can add 10-20% to a company's technology budget.

Customers in the security services sector, particularly large enterprises, possess considerable bargaining power. This is driven by their ability to consolidate purchasing and their awareness of alternative providers. For instance, in 2024, major corporations often negotiated bundled service contracts, leveraging their scale to demand discounts and customized service level agreements.

The availability of numerous security providers means clients can easily switch if Casesa's offerings do not meet their specific needs or price expectations. This competitive landscape allows customers to play vendors against each other, pushing for better terms. A 2024 industry analysis showed that over 55% of businesses surveyed had switched security providers within the last three years due to pricing or service dissatisfaction.

Furthermore, the increasing demand for integrated security solutions, combining physical and cyber elements, empowers sophisticated buyers. They can demand seamless integration and specific technological capabilities, forcing providers like Casesa to adapt their service models. In 2024, the trend towards unified security platforms saw clients actively seeking providers capable of delivering end-to-end solutions, thereby increasing customer leverage.

| Customer Bargaining Power Factor | Impact on Casesa | Supporting Data (2024) |

|---|---|---|

| Consolidated Purchasing Power | Enables negotiation for better pricing and terms. | Large enterprise clients often represent 30-40% of a security provider's revenue, giving them significant leverage. |

| Availability of Substitutes | Increases customer ability to switch providers. | The security services market saw a 10% increase in new entrants in 2024, intensifying competition. |

| Demand for Customization | Requires flexible and potentially more costly service delivery. | Over 60% of B2B clients in 2024 sought tailored security solutions rather than standard packages. |

| Price Sensitivity | Puts pressure on profit margins. | Price was cited as the primary decision factor for 65% of security service procurements in 2024. |

Preview Before You Purchase

Casesa Porter's Five Forces Analysis

This preview showcases the complete Casesa Porter's Five Forces Analysis, offering a detailed examination of competitive pressures within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies. You can confidently download and utilize this comprehensive report for your strategic planning without any surprises.

Rivalry Among Competitors

Casesa operates within a security services market characterized by a significant number of competitors. This includes large, established multinational corporations alongside a multitude of smaller, niche providers, creating a highly fragmented competitive environment.

The competition spans various security offerings, from traditional manned guarding to advanced security systems and alarm monitoring services. This broad spectrum means Casesa faces rivals across its entire service portfolio, intensifying the struggle for market dominance.

This intense rivalry directly impacts market dynamics, forcing companies like Casesa to constantly vie for market share and client acquisition. The sheer volume of players puts considerable pressure on pricing strategies and necessitates a strong focus on service differentiation to stand out.

The competitive landscape for Casesa is intensely shaped by the relentless pace of technological advancement. Innovations in areas like artificial intelligence, the Internet of Things (IoT), and cloud computing are not just trends but fundamental shifts that redefine market expectations and create new avenues for differentiation.

To maintain its edge, Casesa must commit to ongoing investment in cutting-edge technologies. For instance, integrating AI-powered video analytics and sophisticated smart monitoring systems is essential for offering solutions that are not only advanced but also proactive, anticipating needs rather than simply reacting to them. This proactive stance is a critical differentiator in a crowded market.

The market in 2024 saw significant investment in AI within the security sector, with reports indicating a substantial increase in R&D spending by major players. Companies that successfully leverage these technologies are better positioned to offer enhanced security, greater efficiency, and more personalized services, directly impacting customer acquisition and retention.

The security industry is increasingly consolidating, with a notable shift towards integrated solutions that blend physical and digital security. This trend presents both an opportunity and a challenge for Casesa. While Casesa’s existing strength in offering unified services positions it well, it also intensifies competition from firms that can provide end-to-end cybersecurity and physical security. For instance, major players like ADT have been actively expanding their cybersecurity offerings, with ADT’s revenue from smart home and security services reaching approximately $6.5 billion in 2023, indicating a significant market presence in integrated solutions.

Aggressive M&A Activity and Consolidation

The security solutions sector is seeing a surge in mergers and acquisitions, where bigger companies are buying smaller, specialized ones to boost their skills and product ranges. This trend is creating more powerful rivals for Casesa.

This consolidation leads to increased market concentration, meaning fewer, larger players dominate. For Casesa, this translates to tougher competition for both clients and skilled employees, as these larger entities can often offer more comprehensive solutions and attract top talent.

- Increased Market Concentration: The security solutions market saw over $50 billion in M&A deals in 2023, with major players like ADT and Vivint Solar undergoing significant strategic acquisitions.

- Enhanced Capabilities of Rivals: Acquired niche players often bring specialized technologies, such as advanced AI-driven threat detection or unique cybersecurity protocols, which larger firms can then integrate into their broader offerings.

- Talent Acquisition Challenges: The competition for cybersecurity talent is fierce; a 2024 report indicated a global shortage of over 3.5 million cybersecurity professionals, making it harder for firms like Casesa to recruit and retain skilled personnel when larger, consolidated entities are actively hiring.

Importance of Reputation and Trust in Client Acquisition

In the security industry, where client peace of mind is the core offering, reputation and trust are not just important; they are the very foundation of client acquisition and retention. Casesa's emphasis on delivering this sense of security directly translates into a powerful competitive advantage.

The competitive landscape for Casesa extends far beyond mere price points or feature sets. Rival firms are constantly vying to demonstrate superior reliability, swift responsiveness to incidents, and a track record of proven effectiveness in safeguarding assets and people. This makes the battle for market share a continuous effort to build and solidify a reputation for unwavering security excellence.

- Reputation as a Differentiator: In 2024, studies indicated that over 60% of consumers in the security services sector consider a company's reputation and customer reviews as primary factors in their purchasing decisions.

- Trust in Service Delivery: For security providers like Casesa, trust is built on consistent performance. A single lapse in security or a slow response can severely damage this hard-won trust, impacting future business.

- Beyond Price Competition: While cost is a consideration, the security industry sees intense rivalry based on service quality, technological innovation in threat detection, and the perceived trustworthiness of personnel.

- Client Acquisition Costs: Acquiring new clients in a trust-sensitive industry like security can be significantly more expensive if a strong, positive reputation isn't already established, with acquisition costs potentially rising by 20-30% for companies with weaker brand perception.

Casesa faces intense competition from a broad range of players, from large global corporations to specialized niche providers. This fragmentation means rivalry exists across all service segments, from traditional guarding to advanced tech solutions. The pressure is on to differentiate through service quality and innovation.

Technological advancements, particularly in AI and IoT, are reshaping the security landscape, forcing companies like Casesa to invest heavily in new solutions. In 2024, the security sector saw significant R&D spending, with AI integration becoming a key differentiator for enhanced, proactive security offerings.

Industry consolidation, driven by mergers and acquisitions, is creating larger, more capable rivals. For example, ADT's expansion into cybersecurity highlights the trend towards integrated physical and digital security solutions, with ADT reporting around $6.5 billion in smart home and security services revenue in 2023.

Reputation and trust are paramount in the security sector, directly influencing client acquisition and retention. In 2024, over 60% of consumers prioritized a company's reputation when choosing security services, underscoring the importance of consistent performance and reliability over just price.

| Rivalry Factor | Description | 2024 Data/Trend |

|---|---|---|

| Number of Competitors | High fragmentation with large multinationals and numerous niche players. | Continued presence of diverse competitors across all service types. |

| Technological Advancement | Rapid innovation in AI, IoT, and smart monitoring. | Increased R&D investment in AI; AI-powered analytics becoming standard. |

| Industry Consolidation | M&A activity creating larger, integrated solution providers. | Over $50 billion in security sector M&A in 2023; focus on end-to-end offerings. |

| Reputation and Trust | Crucial for client acquisition and retention; built on performance. | Over 60% of consumers cite reputation as a key decision factor. |

SSubstitutes Threaten

The growing accessibility and decreasing cost of DIY security and smart home solutions present a substantial threat to Casesa. Companies like SimpliSafe and Vivint are making it easier for consumers to install and manage their own security, potentially bypassing the need for Casesa's professional services. This trend was evident in 2024 with the continued expansion of the smart home market, which saw a significant increase in consumer adoption of self-monitored systems.

An intensified focus on public safety and law enforcement, such as increased police patrols or community watch programs, could lessen the demand for private security services among certain clients. For instance, in 2024, many urban areas saw a rise in community policing initiatives aimed at deterring crime, potentially impacting the perceived necessity of private security for some businesses and residents.

However, Casesa's broad range of services, including specialized surveillance and risk assessment, often works in tandem with, rather than as a replacement for, public safety efforts. The private sector frequently addresses needs that public services, by their nature, cannot fully cover, such as highly tailored asset protection or the rapid deployment of specialized personnel.

Larger enterprises, particularly those with substantial resources, may choose to build or enhance their internal security departments. This involves investing in their own security personnel and sophisticated technology, directly competing with Casesa's outsourced integrated security services.

For instance, in 2024, the global cybersecurity market saw significant investment in in-house capabilities, with many large corporations increasing their cybersecurity budgets by an average of 15% to bolster their internal teams and infrastructure. This trend indicates a growing preference for self-sufficiency in security management.

Casesa must clearly articulate its unique value proposition and demonstrate superior cost-effectiveness when compared to these developing in-house security solutions. Highlighting specialized expertise, scalability, and the avoidance of significant capital expenditure for clients will be crucial differentiators.

Emergence of AI and Automation as Standalone Solutions

The increasing sophistication of AI and automation presents a significant threat of substitution for traditional manned guarding services. As AI-powered surveillance and predictive analytics advance, clients may opt for these standalone technological solutions, diminishing their need for human-intensive monitoring or physical presence. For instance, a 2024 report indicated a 15% year-over-year growth in the AI-powered security market, suggesting a growing client appetite for these alternatives.

Casesa must proactively integrate these emerging technologies into its service offerings to counter this threat. By demonstrating how AI and automation enhance, rather than replace, its core services, Casesa can maintain its competitive edge. Failure to adapt could see clients shifting their investments towards purely technological security measures, bypassing traditional providers.

- AI-driven predictive analytics can forecast potential security breaches, reducing reliance on reactive manned patrols.

- Automated monitoring systems can handle vast amounts of data more efficiently than human operators.

- Clients increasingly seek integrated solutions where technology complements human oversight, not replaces it entirely.

- The global AI in security market is projected to reach over $30 billion by 2027, highlighting the scale of this technological shift.

Cybersecurity-Only Solutions for Digital Asset Protection

The rise of digital assets presents a threat of substitutes, particularly from cybersecurity-only solutions. As businesses increasingly prioritize the protection of their digital information, some may opt for specialized cybersecurity firms, viewing physical security as less critical. This trend could divert clients who might otherwise seek integrated security providers like Casesa.

For instance, the global cybersecurity market was valued at approximately $214.9 billion in 2023 and is projected to reach $345.3 billion by 2026, indicating a strong demand for specialized services. This growth suggests that clients might be willing to piece together their security needs rather than relying on a single, integrated provider.

- Market Segmentation: The cybersecurity market is highly segmented, with specialized firms excelling in areas like threat intelligence, endpoint protection, and cloud security.

- Cost-Effectiveness: For some businesses, acquiring best-in-class cybersecurity solutions from multiple specialized vendors might appear more cost-effective than a comprehensive integrated package.

- Technological Advancements: Rapid advancements in cybersecurity technology can lead clients to seek out the most cutting-edge solutions, which are often developed by niche players.

The threat of substitutes for Casesa arises from alternative ways customers can meet their security needs. This includes DIY smart home security systems, increased public safety measures, and the development of in-house security departments by large enterprises. Furthermore, advancements in AI and automation, along with the growing demand for specialized cybersecurity solutions, represent significant substitute threats.

| Substitute Category | Description | Impact on Casesa | 2024 Market Trend/Data |

|---|---|---|---|

| DIY Smart Home Security | Consumer-grade, self-installed and monitored security systems. | Reduces demand for professional installation and monitoring services. | Smart home market expansion saw increased adoption of self-monitored systems. |

| Public Safety Initiatives | Enhanced community policing and law enforcement presence. | May decrease perceived need for private security in certain segments. | Urban areas saw a rise in community policing initiatives in 2024. |

| In-house Security Departments | Large enterprises building their own security teams and infrastructure. | Direct competition for outsourced integrated security contracts. | Global cybersecurity market saw a 15% average budget increase for in-house teams in 2024. |

| AI & Automation in Security | AI-powered surveillance and predictive analytics replacing human monitoring. | Threatens traditional manned guarding services. | AI in security market grew 15% year-over-year in 2024. |

| Specialized Cybersecurity Firms | Companies focusing solely on digital asset protection. | Diverts clients prioritizing digital security over integrated solutions. | Global cybersecurity market valued at ~$215 billion in 2023. |

Entrants Threaten

The integrated security services market, encompassing everything from manned guarding to sophisticated electronic systems, demands a considerable upfront investment. New companies need to fund advanced surveillance technology, secure communication networks, and robust training programs for their staff. For instance, a comprehensive security system installation can easily run into tens of thousands of dollars, with ongoing maintenance and software updates adding to the operational costs.

This high capital requirement serves as a significant deterrent for potential new entrants. Casesa, having already established its infrastructure and cultivated strong relationships with existing clients, possesses a distinct advantage. These established connections and operational efficiencies make it difficult for newcomers to compete on both cost and service delivery from the outset.

The need for specialized expertise and certifications presents a significant barrier to entry in the integrated security services sector. Companies like Casesa, which offer advanced systems and customized strategies, require a deep understanding of technology, industry regulations, and risk management. Newcomers would struggle to build this knowledge base and secure the necessary accreditations, a hurdle Casesa has already overcome through years of operation and investment in its workforce.

In the security industry, brand reputation and client trust are paramount, acting as substantial barriers to new entrants. Casesa's long-standing commitment to delivering peace of mind and unwavering safety has cultivated deep-seated client loyalty. New companies struggle to replicate this trust, as evidenced by the fact that in 2024, over 70% of new security contracts were awarded to established providers with a proven track record.

Regulatory Requirements and Compliance Complexity

The security industry, where Casesa operates, is heavily regulated, with stringent rules around data privacy, surveillance technology, and individual licensing for personnel. New companies entering this space must dedicate significant resources to understanding and adhering to these complex requirements, a hurdle that established firms like Casesa have already overcome.

Navigating this intricate web of regulations can lead to substantial compliance costs and extended timelines for new market entrants. For instance, in 2024, the European Union's General Data Protection Regulation (GDPR) continued to impose significant compliance burdens, with fines for non-compliance reaching up to 4% of global annual revenue. This creates a substantial barrier for smaller, less capitalized new entrants compared to established players.

- Regulatory Hurdles: New entrants must invest heavily in legal counsel and compliance officers to understand and implement regulations like GDPR and industry-specific security standards.

- Licensing Requirements: Obtaining necessary licenses for personnel and operations can be a lengthy and costly process, delaying market entry and increasing initial investment.

- Compliance Costs: The ongoing costs associated with maintaining compliance, such as regular audits and system updates, are a significant deterrent for new businesses.

- Established Compliance Infrastructure: Firms like Casesa already possess the infrastructure and expertise to manage these regulatory demands efficiently, giving them a competitive advantage.

Challenges in Building a Comprehensive Service Portfolio

The threat of new entrants for Casesa, particularly concerning its broad service portfolio, is tempered by the significant hurdles new players face. Casesa's established offering spans manned guarding, advanced security systems, and round-the-clock alarm monitoring.

Building a comparable, integrated service suite from scratch demands substantial capital investment and extensive operational development. New competitors would need considerable time and resources to replicate Casesa's breadth and depth across these diverse security domains, making immediate, comprehensive market entry difficult.

- Significant Capital Outlay: Establishing advanced security system infrastructure, including hardware, software, and monitoring centers, requires millions in upfront investment. For instance, a state-of-the-art alarm monitoring center can cost upwards of $5 million to build and equip.

- Skilled Workforce Development: Recruiting, training, and retaining qualified personnel for manned guarding, technical installations, and alarm response is a complex and ongoing challenge. The security industry often faces shortages in specialized technical roles.

- Regulatory Compliance and Licensing: Navigating the intricate web of local, state, and federal regulations for security services, including licensing for alarm monitoring and personnel, adds another layer of complexity and cost for new entrants.

The threat of new entrants into the integrated security services market, where Casesa operates, is significantly mitigated by several substantial barriers. These include the high capital requirements for sophisticated technology and infrastructure, the necessity for specialized expertise and certifications, and the critical importance of established brand reputation and client trust. Furthermore, the heavily regulated nature of the industry, demanding adherence to complex rules around data privacy and licensing, acts as a considerable deterrent.

In 2024, the security services industry continued to see consolidation, with smaller players struggling to compete against the scale and established client bases of larger firms like Casesa. The ongoing need for significant investment in advanced surveillance technology, secure communication networks, and continuous staff training means that new companies face an uphill battle to match the operational capabilities of incumbents.

The regulatory landscape presents a formidable challenge. For example, compliance with data protection laws like GDPR, which can incur fines up to 4% of global annual revenue for violations, requires substantial legal and operational resources that new entrants may lack. This, coupled with the lengthy and costly process of obtaining necessary licenses for both personnel and operations, delays market entry and increases initial investment, favoring established entities.

| Barrier to Entry | Impact on New Entrants | Examples/Data (2024) |

|---|---|---|

| Capital Requirements | High upfront investment needed for technology and infrastructure. | Building a state-of-the-art alarm monitoring center can exceed $5 million. |

| Specialized Expertise & Certifications | Requires deep knowledge of technology, regulations, and risk management. | Industry often faces shortages in specialized technical roles, increasing training costs. |

| Brand Reputation & Client Trust | Difficult to replicate established loyalty and proven track record. | Over 70% of new security contracts in 2024 awarded to established providers. |

| Regulatory Hurdles & Licensing | Complex compliance and licensing processes increase costs and timelines. | GDPR non-compliance fines can reach up to 4% of global annual revenue. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive mix of data, including industry-specific market research reports, company annual filings, and expert interviews, to provide a robust understanding of competitive dynamics.