Casesa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casesa Bundle

The Casesa BCG Matrix offers a powerful lens to understand product portfolio performance. This glimpse reveals how Casesa's offerings are positioned across Stars, Cash Cows, Dogs, and Question Marks, providing a foundational understanding of market dynamics. To truly unlock strategic advantage and make informed decisions about investment and divestment, dive deeper into the full BCG Matrix.

Gain a comprehensive understanding of Casesa's product portfolio with the full BCG Matrix. This detailed analysis goes beyond simple categorization, offering actionable insights into each quadrant's potential and challenges. Purchase the complete report to equip yourself with the strategic clarity needed to optimize resource allocation and drive future growth.

Stars

AI-Powered Video Surveillance represents a Star in the BCG Matrix for Casesa. The global video surveillance market is booming, expected to reach $79.16 billion in 2025, up from $69.24 billion in 2024, signifying strong market momentum. Casesa's focus on AI integration, enabling features like facial recognition and anomaly detection, taps into this high-growth, high-share segment.

Integrated Security Solutions is likely a Star in Casesa's BCG Matrix. The market for these services is booming, expected to surge from $21.08 billion in 2023 to an impressive $54.73 billion by 2030, reflecting a strong 14.6% compound annual growth rate. Casesa's strategy of merging traditional manned guarding with cutting-edge technology and monitoring perfectly taps into this growing demand for comprehensive, unified security.

Cloud-based access control systems are a significant growth area, with the market valued at $10.76 billion in 2024 and expected to hit $17.30 billion by 2030, growing at an 8.4% CAGR. Casesa's focus on these systems aligns perfectly with the escalating need for flexible, remotely managed security solutions, a trend that will be even more pronounced in 2025.

Cyber-Physical Security Offerings

Casesa's cyber-physical security offerings are positioned as stars within the BCG matrix, reflecting their strong market growth and competitive position. The global cyber-physical systems market is projected to expand significantly, reaching an estimated $255.3 billion by 2029, up from $124.1 billion in 2024, demonstrating a robust compound annual growth rate of 15.5%. This growth underscores the increasing demand for integrated security solutions.

Casesa's strategic advantage lies in its capability to seamlessly integrate physical security measures with advanced cybersecurity protocols. This dual focus is particularly valuable for clients in critical infrastructure sectors and smart building environments, where the convergence of these domains presents unique and complex security challenges. By addressing these needs, Casesa is capitalizing on a high-growth, high-importance market segment.

- Market Growth: The cyber-physical systems market is expected to more than double from $124.1 billion in 2024 to $255.3 billion by 2029.

- CAGR: This expansion represents a compound annual growth rate of 15.5%.

- Casesa's Niche: The company's expertise in bridging physical and cybersecurity is highly relevant to critical infrastructure and smart building clients.

- Strategic Positioning: This focus places Casesa in a prime position to leverage significant market opportunities.

Advanced Threat Detection and Predictive Analytics

Advanced Threat Detection and Predictive Analytics represents a strong potential growth area for Casesa, aligning with the expanding security solutions market. This sector is projected to grow from $408.43 billion in 2024 to $443.12 billion in 2025, demonstrating an 8.5% compound annual growth rate.

Casesa's investment in AI-driven solutions for proactive threat identification and predictive analytics positions it to capitalize on this trend. These capabilities offer significant value by enabling clients to anticipate and mitigate security risks before they materialize.

- Market Growth: The global security solutions market is expanding, indicating strong demand for advanced security technologies.

- AI Integration: Casesa's focus on AI for threat detection and prediction is a key differentiator.

- Client Value: Proactive security measures offer enhanced protection and reduce potential financial and reputational damage for clients.

- Future Potential: This segment represents a significant opportunity for Casesa to capture market share and drive revenue growth.

Casesa's AI-Powered Video Surveillance is a clear Star. The global market is set to grow from $69.24 billion in 2024 to $79.16 billion in 2025, showcasing robust expansion. By integrating AI for advanced features, Casesa is tapping into this high-growth, high-share segment effectively.

Integrated Security Solutions are also Stars for Casesa. This market is projected to jump from $21.08 billion in 2023 to $54.73 billion by 2030, a strong 14.6% CAGR. Casesa's blend of manned guarding with technology meets the demand for comprehensive security.

Cloud-based access control systems are another Star. Valued at $10.76 billion in 2024, this market will reach $17.30 billion by 2030 with an 8.4% CAGR. Casesa's focus here aligns with the increasing need for remote security management.

Casesa's cyber-physical security offerings are Stars due to their strong market growth and competitive positioning. The market is expected to grow from $124.1 billion in 2024 to $255.3 billion by 2029, a 15.5% CAGR. Casesa's integration of physical and cybersecurity is crucial for critical infrastructure and smart buildings.

Advanced Threat Detection and Predictive Analytics are Stars for Casesa. This sector is growing from $408.43 billion in 2024 to $443.12 billion in 2025, an 8.5% CAGR. Casesa's AI-driven solutions for proactive threat identification offer significant client value.

| Casesa's Star Products | Market Size (2024) | Projected Market Size (2025/2029) | CAGR | Casesa's Strategic Advantage |

|---|---|---|---|---|

| AI-Powered Video Surveillance | $69.24 billion | $79.16 billion (2025) | N/A (Implied strong growth) | AI integration for advanced features in a booming market. |

| Integrated Security Solutions | $21.08 billion (2023) | $54.73 billion (2030) | 14.6% | Merging manned guarding with technology for comprehensive security. |

| Cloud-based Access Control | $10.76 billion | $17.30 billion (2030) | 8.4% | Addressing demand for flexible, remote security management. |

| Cyber-Physical Security | $124.1 billion | $255.3 billion (2029) | 15.5% | Bridging physical and cybersecurity for critical infrastructure. |

| Advanced Threat Detection & Predictive Analytics | $408.43 billion | $443.12 billion (2025) | 8.5% | AI-driven proactive threat identification and mitigation. |

What is included in the product

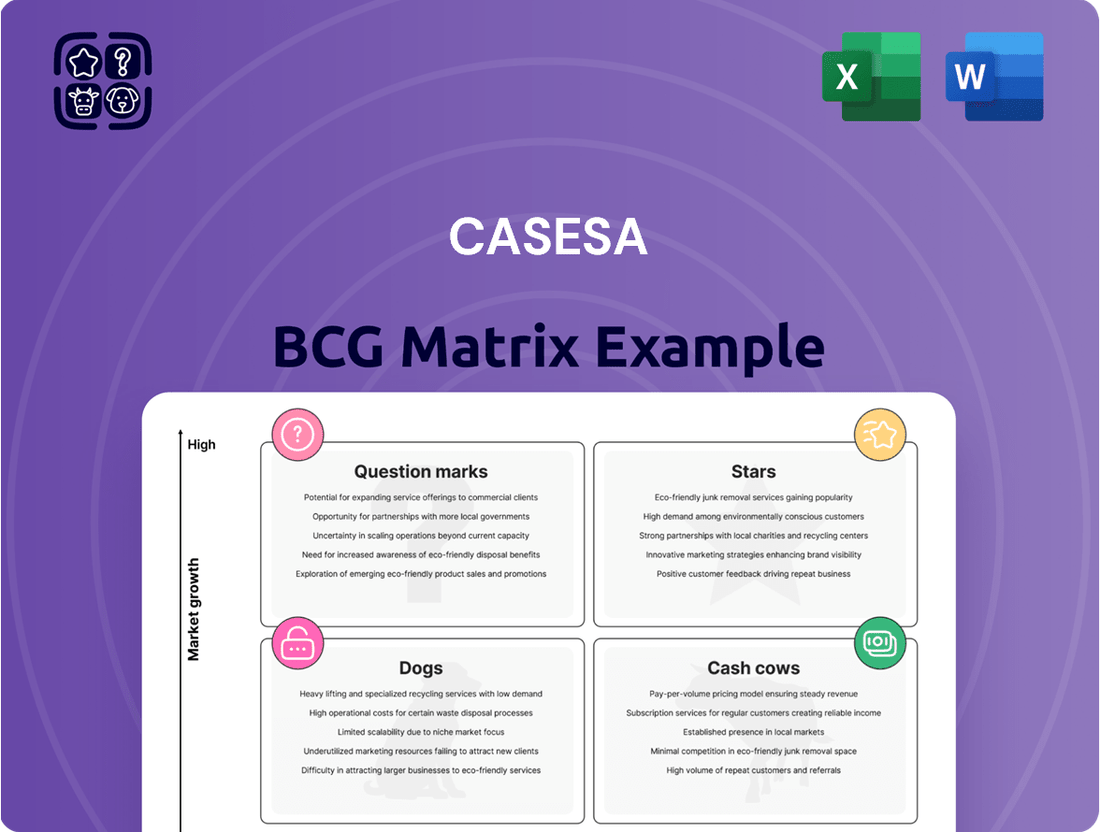

The Casesa BCG Matrix categorizes business units by market share and growth rate, guiding strategic investment decisions.

A clear, visual representation of your portfolio, simplifying complex strategic decisions.

Cash Cows

Traditional manned guarding services represent a significant Cash Cow for Casesa. The global market for these services was valued at $27.25 billion in 2024, demonstrating substantial ongoing demand. This sector is projected to grow to $41.55 billion by 2033, with a compound annual growth rate of 4.8%.

While the growth rate might not match emerging technologies, manned guarding provides a stable and predictable revenue stream. Its enduring relevance stems from the continuous need for physical security presence and deterrence across various industries, making it a reliable foundation for Casesa's business.

Casesa's 24/7 Alarm Monitoring Services represent a classic Cash Cow within the BCG matrix. This segment operates in a mature but steadily growing market, projected to expand from $59.46 billion in 2024 to $62.63 billion in 2025, reflecting a 5.3% compound annual growth rate.

The consistent demand from both residential and commercial clients for reliable security solutions underpins the stable revenue generation of this service. With the market expected to reach $81.58 billion by 2029, Casesa's established position allows it to leverage its existing infrastructure and customer base for significant, low-effort profits.

Standard video surveillance systems, while not the fastest growing segment, remain a significant Cash Cow for Casesa. The global market for these systems was valued at $69.24 billion in 2024, demonstrating a mature yet substantial revenue stream. Casesa's established infrastructure and customer base in this area allow for consistent installation and maintenance revenue.

Basic Access Control Systems

Casesa's basic access control systems, like their established card and keypad solutions, represent a significant cash cow. This segment, though mature, consistently generates substantial revenue due to its deep penetration within a large, loyal customer base. The market for these traditional systems, even as newer technologies emerge, remains a dependable income stream for Casesa.

The enduring demand for reliable, albeit less sophisticated, access control solutions underpins their cash cow status. For instance, the global physical access control systems market was valued at approximately $10.5 billion in 2023 and is projected to reach $17.8 billion by 2030, indicating continued market strength for foundational technologies.

- Stable Revenue: Basic access control systems provide a consistent and predictable income for Casesa.

- Large Install Base: Casesa benefits from a substantial existing customer network for these solutions.

- Market Maturity: While not high-growth, the market for these systems offers reliable demand.

- Foundation for Growth: These cash cows can help fund investment in more innovative product lines.

Customized Security Strategy Consulting

Customized Security Strategy Consulting, while not a tangible product, is a prime example of a Cash Cow for Casesa. This high-margin service capitalizes on their deep expertise in crafting bespoke security solutions for clients.

The consulting engagements are characterized by their steady, high-value nature, reflecting the mature advisory market and Casesa's established client relationships. This translates into consistent revenue streams, a hallmark of a Cash Cow.

Key aspects of this Cash Cow include:

- Leveraging Comprehensive Offerings: The consulting service effectively bundles Casesa's broader product and service portfolio into tailored strategic advice.

- High-Margin Service: Due to the specialized knowledge and expertise involved, these consulting projects typically command significant profit margins.

- Mature Advisory Market: Operating in a well-established market segment allows for predictable demand and consistent revenue generation.

- Reputation for Tailored Solutions: Casesa's proven track record in delivering customized strategies builds client trust and encourages repeat business, solidifying its Cash Cow status.

Casesa's traditional manned guarding services are a strong Cash Cow. The global market for these services was valued at $27.25 billion in 2024 and is expected to reach $41.55 billion by 2033, growing at a 4.8% CAGR. This segment provides stable, predictable revenue due to the ongoing need for physical security across many industries.

The 24/7 Alarm Monitoring Services also represent a classic Cash Cow. This market, projected to grow from $59.46 billion in 2024 to $62.63 billion in 2025, offers consistent demand from both residential and commercial clients. Casesa's established infrastructure and customer base in this mature market ensure reliable, low-effort profits.

Standard video surveillance systems, while not high-growth, remain a significant Cash Cow for Casesa, with the global market valued at $69.24 billion in 2024. Casesa's established presence allows for consistent revenue from installations and maintenance.

Basic access control systems, such as card and keypad solutions, are also Cash Cows. Despite market maturity, these systems generate substantial revenue due to a large, loyal customer base. The physical access control systems market was approximately $10.5 billion in 2023 and is projected to reach $17.8 billion by 2030.

Customized Security Strategy Consulting, a high-margin service, capitalizes on Casesa's expertise and client relationships in the mature advisory market, providing steady, high-value revenue streams.

| Service Segment | Market Value (2024) | Projected Growth (CAGR) | Key Characteristic |

| Manned Guarding | $27.25 billion | 4.8% (to 2033) | Stable, predictable revenue |

| Alarm Monitoring | $59.46 billion | 5.3% (to 2025) | Consistent demand, established base |

| Video Surveillance | $69.24 billion | Mature market | Consistent installation/maintenance revenue |

| Basic Access Control | $10.5 billion (2023) | Projected to $17.8 billion (by 2030) | Large, loyal customer base |

| Consulting Services | Mature advisory market | Steady, high-value engagements | High-margin, leverages expertise |

Full Transparency, Always

Casesa BCG Matrix

The Casesa BCG Matrix document you are previewing is the identical, fully completed report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no incomplete sections—just a professionally designed and thoroughly researched strategic tool ready for your immediate application.

Dogs

Outdated analog security systems are increasingly becoming a relic in the security landscape. These systems, which rely on older coaxial cable technology, are being phased out as newer, more efficient IP-based and smart solutions gain traction. For a company like Casesa, maintaining a strong focus on purely analog offerings without substantial modernization or integration with newer technologies positions them in a segment with declining relevance and limited growth potential.

Offering generic, one-size-fits-all security packages positions Casesa as a potential ‘Dog’ in the BCG matrix. In 2024, the cybersecurity market saw a significant shift towards personalized solutions, with many businesses actively seeking tailored protection against evolving threats. This trend suggests that generic packages may struggle to gain traction, leading to low market share and limited growth opportunities for Casesa in this segment.

Selling security hardware without service contracts, like standalone cameras or access control panels, can lead to lower recurring revenue for Casesa. This model often means less client loyalty as customers can easily switch providers for ongoing support or upgrades.

In 2024, the global cybersecurity market, which includes hardware, saw significant growth, but the trend leans heavily towards integrated solutions and managed services. Companies are increasingly seeking comprehensive security packages rather than just physical devices. For instance, a report from Statista indicated that the managed security services market alone was projected to reach over $60 billion in 2024, highlighting the demand for ongoing support.

This hardware-only approach for Casesa offers minimal long-term value in a market that increasingly prioritizes service-based revenue streams and customer retention through ongoing support and updates.

Niche, Labor-Intensive Manual Reporting

Niche, labor-intensive manual reporting at Casesa fits squarely into the Dogs quadrant of the BCG Matrix. This category represents areas with low market growth and low relative market share, often characterized by inefficiencies and a lack of competitive edge.

Security reporting that heavily relies on manual processes, without automation or integration with modern data analytics, exemplifies this. Such operations are typically low-growth and low-efficiency, consuming valuable resources without yielding significant competitive advantages for Casesa. For instance, if a specific reporting function within Casesa still requires extensive manual data compilation and analysis, it likely falls into this category.

The inefficiency is compounded by the fact that manual reporting is often prone to errors and delays, impacting the speed and accuracy of critical business decisions. In 2024, the average cost of manual data entry across industries can be significantly higher than automated processes, with some reports indicating a cost per entry that is 10 times greater.

- Low Market Growth: The demand for purely manual reporting is declining as industries increasingly adopt automated solutions.

- Low Relative Market Share: Casesa likely holds a small share in this niche, as more efficient competitors dominate.

- High Resource Consumption: Manual processes demand more human hours, increasing operational costs.

- Lack of Competitive Advantage: This area does not contribute to innovation or differentiation for Casesa.

Physical Key-Based Access Solutions

Traditional physical key-based access solutions are rapidly losing ground to more advanced electronic, biometric, and mobile credential systems. This shift is evident in the declining market share of traditional lock manufacturers. For instance, in 2024, the global smart lock market was projected to reach over $4 billion, indicating a significant move away from purely mechanical systems.

Casesa's continued focus on these legacy physical key solutions, without a clear strategy to integrate or transition to newer technologies, positions them in a challenging spot within the BCG matrix. They are likely in the Dogs quadrant, characterized by low market share and low market growth.

This segment of the market is experiencing minimal expansion, with many consumers and businesses opting for the enhanced security and convenience of modern access control. The lack of innovation in Casesa's physical key offerings further solidifies their position in this low-potential category.

- Declining Market Relevance: Physical key systems are becoming obsolete as technology advances.

- Low Growth Potential: The market for traditional key-based access is stagnant or shrinking.

- Lack of Innovation: Casesa's reliance on legacy technology hinders competitiveness.

- Competitive Disadvantage: Competitors offering smart solutions are capturing market share.

Products or services that are in the Dogs quadrant typically have low market share and operate in low-growth industries. For Casesa, this includes offerings like outdated analog security systems and traditional physical key-based access solutions. These segments are characterized by declining demand and minimal potential for expansion, making them a drain on resources without significant return.

The market's clear shift towards IP-based security and smart access control in 2024 further solidifies the Dog status of Casesa's legacy offerings. For instance, while the overall security market grew, the analog segment saw a contraction, with many businesses actively upgrading. This trend means Casesa's investment in these areas yields diminishing returns, as evidenced by the projected $4 billion global smart lock market in 2024, overshadowing traditional locks.

Even niche areas like manual reporting, which are inherently inefficient and prone to errors, fall into the Dog category. In 2024, the cost of manual data entry was significantly higher than automated processes, sometimes up to ten times more. This inefficiency consumes resources that could be better allocated to more profitable and growth-oriented ventures.

Casesa's generic security packages also represent a Dog. The cybersecurity market in 2024 emphasized personalized solutions, with managed security services alone projected to exceed $60 billion. Generic offerings fail to meet this demand, resulting in low market share and limited growth prospects for Casesa.

Question Marks

Integrating AI for predictive maintenance in security systems is a prime example of a Question Mark in the BCG matrix. This area shows immense potential for growth, with the global AI in security market projected to reach $32.9 billion by 2027, growing at a CAGR of 23.5%. Casesa's early investment here could secure a substantial market share in the future, but currently, adoption and market penetration are likely modest.

Casesa's focus on IoT-enabled smart home and business security places it in a rapidly expanding sector, fueled by smart city growth. This segment is experiencing high demand, with the global smart home security market projected to reach approximately $60 billion by 2027, growing at a CAGR of over 15%.

While Casesa's integrated solutions tap into this high-growth potential, its market share in this competitive space remains a question mark. The company faces established specialized smart home providers and a fragmented market, making it a potential 'Question Mark' in the BCG matrix.

Biometric and mobile credential access systems represent a burgeoning sector within the security market, fueled by a clear need for heightened security and user-friendly access. Casesa's strategic alignment with this trend positions them to capitalize on a market experiencing significant expansion.

The global biometric system market was valued at approximately $34.5 billion in 2023 and is projected to reach over $115 billion by 2030, indicating a compound annual growth rate (CAGR) of around 18.7%. This robust growth underscores the opportunity for Casesa's advanced solutions.

While Casesa's investment in biometric and mobile credentials aligns with a high-growth area, their current market share in this specific segment might be nascent as they work to solidify their position against established competitors.

Cybersecurity Consulting for Physical Security Systems

Casesa's cybersecurity consulting for physical security systems fits into the Question Marks quadrant of the BCG Matrix. This is because the convergence of physical and cybersecurity is a significant growth trend, driven by increasing cyber threats targeting critical infrastructure. For instance, the global cybersecurity market was projected to reach $232 billion in 2024, with a notable portion dedicated to protecting operational technology (OT) and industrial control systems (ICS), which are integral to physical security.

While this segment offers substantial growth potential, Casesa's market share is likely nascent. The demand for specialized expertise in securing IoT-enabled physical security devices, such as smart cameras and access control systems, is rapidly expanding. Reports from 2024 indicate a surge in investments by companies seeking to mitigate risks associated with interconnected physical security environments, suggesting a market ripe for new entrants and specialized service providers.

- High Growth Potential: The increasing sophistication of cyberattacks on physical infrastructure creates a strong demand for specialized cybersecurity consulting.

- Low Market Share: As a newer offering, Casesa's penetration in this niche cybersecurity segment is likely limited.

- Strategic Investment: Continued investment is crucial to build expertise and capture market share in this evolving field.

- Competitive Landscape: The market is attracting new players, necessitating a focused strategy to differentiate Casesa's offerings.

Drone-Based Surveillance and Monitoring Services

Drone-based surveillance and monitoring services represent a nascent but rapidly expanding segment within the security industry. This innovative field leverages advanced aerial technology to provide enhanced coverage and swifter response capabilities compared to traditional methods.

Casesa's strategic entry into this market, while offering the potential for substantial future returns, places it in a position of low market share within a dynamic and evolving landscape. The global market for commercial drones, a key enabler of these services, was projected to reach approximately $15 billion in 2024, with significant growth anticipated in surveillance and inspection applications.

- High Growth Potential: The drone surveillance market is experiencing rapid expansion, driven by demand across various sectors including public safety, infrastructure inspection, and agriculture.

- Technological Advancement: Continuous improvements in drone capabilities, such as longer flight times, enhanced sensor technology, and AI-powered analytics, are fueling market growth.

- Regulatory Landscape: Evolving regulations for drone operation and data privacy are key factors influencing market adoption and service development.

- Investment Opportunity: Early investment in this sector could position Casesa to capture significant market share as the technology matures and demand solidifies.

Question Marks in Casesa's portfolio represent areas with high growth potential but currently low market share. These are strategic investments that require careful consideration and further development to determine their future success.

Examples include AI-powered predictive maintenance for security systems, IoT-enabled smart home solutions, and cybersecurity consulting for physical infrastructure. These segments are experiencing significant market expansion, driven by technological advancements and evolving security needs.

Casesa's involvement in these areas positions them to capitalize on future market trends, but their current market penetration is still developing. Continued investment and strategic focus are essential to transform these Question Marks into market leaders.

| Business Area | Market Growth Potential | Current Market Share | Key Drivers |

|---|---|---|---|

| AI in Security Systems | High | Low | Increasing cyber threats, demand for automation |

| IoT Smart Home Security | High | Low to Moderate | Smart city initiatives, consumer demand for convenience |

| Biometric Access Systems | High | Low | Enhanced security needs, user experience |

| Cybersecurity Consulting (Physical Security) | High | Low | Convergence of IT/OT, IoT vulnerabilities |

| Drone Surveillance | Very High | Low | Technological advancements, diverse application potential |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.