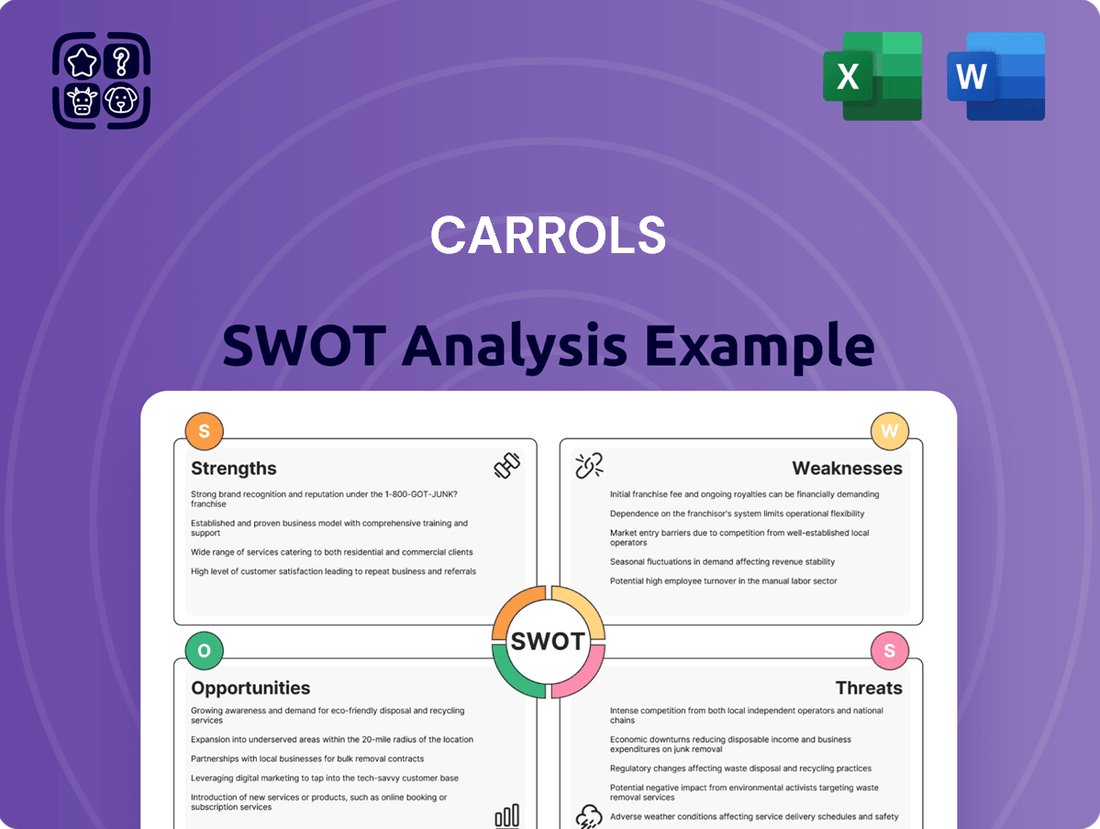

Carrols SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carrols Bundle

Carrols Restaurants, a major franchisee of Burger King and Popeyes, navigates a competitive fast-food landscape. While strong brand recognition and established operational processes are key strengths, the company faces challenges like rising labor costs and evolving consumer preferences.

Want the full story behind Carrols' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Carrols Restaurant Group's position as the largest Burger King franchisee in the United States is a core strength. This extensive network, boasting over 1,000 locations, translates into significant operational scale and market penetration. This broad footprint ensures strong brand visibility and allows for efficient supply chain management and marketing efforts.

Carrols' acquisition by Restaurant Brands International (RBI) in May 2024 for about $1 billion marks a significant strengthening of its position. This move underscores RBI's commitment to revitalizing the Burger King brand through its 'Reclaim the Flame' initiative, with Carrols playing a central role in this strategy.

As a wholly-owned subsidiary of a global powerhouse, Carrols now benefits from enhanced access to capital, operational expertise, and strategic direction. This integration is expected to drive significant improvements in brand performance and market presence, leveraging RBI's extensive resources.

Carrols Restaurant Group (RBI) is making a significant capital investment in remodeling and modernizing its Burger King locations. This includes an additional $500 million earmarked to upgrade over 600 restaurants.

The strategic aim is to have 85-90% of its Burger King restaurants sporting a modern image by 2028. This initiative is already demonstrating positive results, with early remodeled locations experiencing mid-teen sales increases.

Beyond sales, these upgrades are also contributing to improved franchisee profitability. The substantial capital infusion is designed to elevate the customer experience and boost operational efficiency throughout Carrols' extensive restaurant portfolio.

Strong Recent Sales Performance

Carrols' recent sales performance prior to its acquisition was notably strong. Burger King locations achieved a 7.2% increase in comparable restaurant sales in Q4 2023 and an even higher 8.1% in Q3 2023.

This upward trend extended to Popeyes restaurants, which also posted a healthy 7.6% comparable sales growth in Q4 2023. Such figures suggest effective operational strategies and a positive reception from consumers to the company's offerings.

- Burger King Comparable Sales Growth: 7.2% (Q4 2023) and 8.1% (Q3 2023).

- Popeyes Comparable Sales Growth: 7.6% (Q4 2023).

- Indicator of Success: These metrics point to strong operational execution and positive market reception.

Leveraging Digital and Technology Advancements

Carrols significantly benefits from Burger King's substantial investments in digital and technology. This includes a growing reliance on mobile app and online ordering platforms, which represented a considerable 30% of Burger King's overall sales in 2024. These advancements directly translate to improved customer access and increased revenue streams for Carrols.

The implementation of self-order kiosks and digital menu boards across locations enhances customer convenience and speeds up the ordering process. Furthermore, the integration of AI-powered analytics helps Carrols better understand customer behavior and optimize operations, leading to greater efficiency and potentially higher profitability.

- Digital Sales Growth: Burger King's digital channels, including mobile and online orders, accounted for 30% of total sales in 2024, indicating a strong customer shift towards digital engagement.

- Operational Efficiency: Self-order kiosks and digital menu boards streamline the customer experience and reduce order processing times.

- Data-Driven Insights: AI-powered analytics provide valuable data for optimizing marketing, inventory, and staffing.

Carrols' substantial scale as the largest Burger King franchisee, with over 1,000 locations, provides significant operational efficiencies and market reach. Its acquisition by RBI in May 2024 for approximately $1 billion positions it to benefit from enhanced capital access and strategic direction under a global leader. The ongoing $500 million investment to modernize over 600 Burger King restaurants, aiming for 85-90% updated by 2028, is already yielding mid-teen sales increases in early remodels.

| Metric | Value | Period |

|---|---|---|

| Burger King Comparable Sales Growth | 8.1% | Q3 2023 |

| Burger King Comparable Sales Growth | 7.2% | Q4 2023 |

| Popeyes Comparable Sales Growth | 7.6% | Q4 2023 |

| Digital Sales Contribution (Burger King) | 30% | 2024 |

| RBI Acquisition Cost | ~$1 Billion | May 2024 |

| Remodeling Investment | $500 Million | Ongoing |

What is included in the product

Delivers a strategic overview of Carrols’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic challenges by clearly identifying Carrols' internal strengths and weaknesses alongside external opportunities and threats.

Weaknesses

Carrols has struggled with inconsistent profits and earnings per share growth over time. For instance, in the first quarter of 2024, Carrols reported a net loss of $1.8 million, a stark contrast to a net profit in the same period of the prior year.

The restaurant operating model inherently leads to significant margin fluctuations, making its financial performance less predictable than that of franchisors. This volatility can be a deterrent for investors prioritizing steady income streams.

Carrols' extensive network of restaurants, a key strength, also presents a significant weakness due to high operational leverage. With substantial fixed costs tied to rent, equipment, and a large employee base across numerous locations, even modest downturns in sales or increases in input costs can lead to amplified negative impacts on profitability. For instance, in Q1 2024, Carrols reported a net loss of $12.6 million, highlighting the sensitivity of their bottom line to sales volumes and cost pressures.

Carrols' significant reliance on the Burger King brand, despite its position as the largest franchisee, presents a considerable weakness. This concentration means the company's financial health is heavily tied to Burger King's market performance and strategic decisions, leaving little room for diversification.

The divestment of Popeyes operations further underscores this dependency, leaving Burger King as the overwhelming majority of Carrols' business. This singular focus exposes Carrols to amplified risks should the Burger King brand face challenges, such as declining consumer preference or intense competition within the quick-service restaurant sector.

Exposure to Franchise Agreement Terms

Carrols, as a Burger King franchisee, is bound by franchise agreements that can dictate operational choices. These terms might restrict Carrols' ability to adapt its menu, pricing, or marketing strategies swiftly in response to dynamic market conditions. For instance, a significant portion of their capital expenditure obligations are tied to adhering to Burger King's brand standards and upgrade requirements, potentially limiting financial flexibility.

The franchise agreements can also impose limitations on Carrols' decision-making autonomy. This can hinder their capacity to independently innovate or implement localized strategies that might better serve specific market demands. In 2024, Carrols continued to navigate these contractual obligations, which are central to their business model but also represent a key area of potential weakness.

- Contractual Restrictions: Franchise agreements can limit operational flexibility in menu, pricing, and marketing.

- Capital Expenditure Obligations: Requirements to adhere to brand standards and upgrades can tie up significant capital.

- Limited Autonomy: Reduced ability to implement independent, localized strategies or innovations.

Intense Competition in the QSR Sector

Carrols operates in the quick-service restaurant (QSR) sector, which is notoriously crowded. Major global brands like McDonald's and Yum! Brands (which includes KFC, Pizza Hut, and Taco Bell) exert significant influence, creating a challenging environment for smaller or regional players. This intense rivalry often translates into limited pricing flexibility for Carrols, as it must remain competitive with established giants.

The need to stand out in such a saturated market requires substantial and ongoing investment in marketing and promotional activities. These efforts are crucial for attracting new customers and, perhaps more importantly, for retaining existing ones. However, such continuous spending can put pressure on Carrols' profit margins, as the cost of customer acquisition and loyalty programs eats into revenue. For instance, in 2023, the QSR industry saw marketing spend increase as brands fought for consumer attention, a trend expected to continue into 2024 and 2025.

- Market Saturation: The QSR industry is densely populated with numerous brands vying for consumer attention.

- Dominant Competitors: Global powerhouses like McDonald's and Yum! Brands set high benchmarks for pricing and marketing.

- Pricing Power Constraints: Intense competition restricts Carrols' ability to implement significant price increases without risking customer loss.

- Marketing Investment Burden: Sustained high spending on advertising and promotions is necessary but impacts profitability.

Carrols' heavy reliance on the Burger King brand creates a significant vulnerability. This concentration means the company's performance is inextricably linked to Burger King's market standing and strategic direction, offering limited diversification benefits. The divestiture of Popeyes further intensified this dependency, making Carrols susceptible to amplified risks if the Burger King brand falters due to changing consumer tastes or competitive pressures.

The company faces contractual limitations imposed by franchise agreements, which can restrict its agility in adapting menus, pricing, and marketing. These agreements also mandate capital expenditures for brand standard compliance and upgrades, potentially constraining financial flexibility. Such restrictions can hinder Carrols' ability to implement independent, localized strategies that might otherwise enhance performance.

| Brand Dependence | Franchise Restrictions | Market Competition |

|---|---|---|

| Overwhelming reliance on Burger King. | Limited autonomy in menu, pricing, and marketing. | Intense competition from major QSR players. |

| Divestment of Popeyes increases focus on Burger King. | Capital expenditure obligations for brand upgrades. | Pricing power is constrained by market saturation. |

| Performance tied to Burger King's market success. | Potential hindrance to independent innovation. | High marketing spend necessary for customer retention. |

Same Document Delivered

Carrols SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The acquisition by Restaurant Brands International (RBI) presents a prime opportunity for Carrols to unlock substantial operational synergies. This integration allows for the consolidation of supply chains and procurement processes, potentially leading to significant cost savings. For instance, by leveraging RBI's established global network, Carrols could negotiate more favorable terms with suppliers, directly impacting its bottom line.

Furthermore, RBI's deep industry expertise and proven operational models offer a blueprint for Carrols to streamline its own processes. This could translate into enhanced efficiency in areas like inventory management, labor scheduling, and marketing execution. The strategic alignment with RBI's broader portfolio, which includes brands like Burger King and Popeyes, also opens doors for cross-promotional activities and shared best practices, further boosting profitability.

Carrols' 'Reclaim the Flame' initiative, backed by significant investments from Restaurant Brands International (RBI), is designed to modernize its restaurants, directly targeting increased sales and a better customer experience. This strategic overhaul is a key opportunity for growth.

The planned refranchising of these upgraded locations to smaller, localized operators is a critical step. This move could lead to a more streamlined and profitable operational network, ultimately benefiting the broader Burger King system and potentially unlocking capital for Carrols to reinvest.

Carrols Restaurant Group can significantly boost its performance by further integrating advanced digital platforms, loyalty programs, and AI-powered solutions. This strategic move is designed to drive operational efficiency and enrich the overall customer experience. For instance, by the end of 2024, many quick-service restaurants are reporting a 15-20% increase in customer engagement through enhanced digital loyalty programs alone.

Investing in cutting-edge technologies such as dynamic pricing and optimized drive-thru operations presents a prime opportunity. These innovations can directly translate into increased sales and improved order accuracy while simultaneously reducing customer wait times. In 2024, companies implementing AI-driven drive-thru technology have seen up to a 10% reduction in order errors and a 5% decrease in average service time.

Menu Innovation and Diversification within Burger King

Burger King's continuous drive for menu innovation presents a significant opportunity. The introduction of plant-based options, such as the widely successful Impossible Whopper, has broadened its appeal to a growing segment of health-conscious consumers. This strategic move aims to capture market share from competitors and cater to evolving dietary preferences.

Diversifying value offerings also plays a crucial role in attracting a wider customer base and increasing transaction volume. By offering competitive price points and bundled deals, Burger King can effectively counter promotions from rivals and boost average check sizes. This approach is particularly relevant in the current economic climate where value remains a key purchasing driver for many consumers.

In 2024, the fast-food industry saw continued growth in plant-based alternatives, with sales projected to increase. Burger King's commitment to this trend, evidenced by its partnerships and ongoing menu development, positions it to capitalize on this expanding market. For instance, the Impossible Foods brand, a key partner, reported significant revenue growth in recent years, indicating strong consumer demand for such products.

- Attract new customer segments through plant-based and healthier options.

- Increase average check sizes by offering diversified value meals and premium items.

- Capitalize on the growing demand for plant-based alternatives, a market segment showing robust growth.

- Enhance brand perception by aligning with health-conscious and sustainable food trends.

Potential for Market Share Growth within Burger King System

With Restaurant Brands International (RBI) directly supporting its strategic initiatives, Carrols, or the newly integrated Burger King operations, is positioned to enhance brand perception and boost franchisee profitability. This backing allows for focused efforts to improve the customer experience and operational efficiency across the Burger King system.

This strategic alignment can lead to Burger King outperforming the broader quick-service restaurant (QSR) burger category. For example, in the first quarter of 2024, RBI reported a 4.0% increase in comparable store sales for Burger King globally, indicating positive momentum that Carrols can leverage to capture a larger share of the market.

- Enhanced Brand Perception: RBI's investment in marketing and operational improvements can elevate the Burger King brand, attracting more customers.

- Franchisee Profitability: Streamlined operations and increased sales directly translate to better financial performance for franchisees.

- Market Share Capture: By capitalizing on these improvements, Carrols can gain ground on competitors within the QSR burger segment.

- System-Wide Growth: The success of these initiatives within Carrols can serve as a model for other Burger King franchisees, driving overall system growth.

Carrols' integration with RBI offers a significant opportunity to leverage advanced digital platforms and loyalty programs, aiming to boost customer engagement. For instance, many QSRs in 2024 reported a 15-20% rise in customer interaction solely through enhanced digital loyalty initiatives.

Investing in technologies like dynamic pricing and optimized drive-thrus presents another avenue for growth. Companies implementing AI in drive-thrus in 2024 saw up to a 10% decrease in order errors and a 5% reduction in service times.

Burger King's ongoing menu innovation, particularly with plant-based options like the Impossible Whopper, taps into a growing consumer demand for healthier choices. The plant-based market segment continues to show robust growth, with key partners like Impossible Foods reporting substantial revenue increases, underscoring strong consumer appetite.

Furthermore, diversifying value offerings and competitive pricing strategies can attract a broader customer base and increase transaction volumes, especially in the current economic climate where value is a primary purchasing driver.

Threats

Carrols faces a significant threat from escalating labor and food costs. Between 2019 and 2024, labor expenses surged by 31%, while food inflation climbed 29%. These substantial increases directly squeeze operating margins by raising the cost of goods sold and labor expenses.

The challenge for Carrols is to absorb these higher costs without passing them entirely to consumers. Significant price hikes could alienate customers, impacting sales volume and overall profitability. This delicate balance between managing expenses and maintaining customer affordability is a critical concern.

Consumers are showing heightened price sensitivity, with many cutting back on dining out due to ongoing economic uncertainty. This trend directly impacts restaurants like Carrols, where discretionary spending is often the first to be reduced.

A persistent economic downturn or a widening gap between dining out costs and grocery prices could significantly hurt Carrols' foot traffic and overall sales volume. For instance, the U.S. Consumer Price Index for Food Away From Home saw an increase of 5.1% in the year ending May 2024, compared to a 1.3% rise in Food At Home, highlighting this growing disparity.

The quick-service restaurant sector is fiercely competitive, often leading to aggressive pricing and promotional battles among rivals. This environment can compel Carrols to either absorb rising operational costs or increase menu prices, potentially alienating budget-conscious consumers and diminishing its market standing.

For instance, in 2024, the fast-food industry saw significant promotional activity, with major players like McDonald's and Burger King offering deep discounts and value meals to attract and retain customers. This intense competition puts pressure on margins for all operators, including Carrols, which operates numerous Burger King and Popeyes locations.

Brand Reputation and Operational Consistency

Carrols' reliance on the Burger King brand means any damage to Burger King's reputation directly impacts Carrols. For instance, widespread negative press or food safety issues affecting Burger King nationally could deter customers from visiting Carrols' locations. This dependency highlights a significant vulnerability, as Carrols has limited control over the core brand's public perception.

Maintaining consistent operational standards across Carrols' extensive network of over 400 Burger King restaurants is a constant challenge. Inconsistencies in food quality, service speed, or cleanliness can erode customer trust and lead to lost sales. In 2023, Carrols faced scrutiny regarding labor practices in some locations, underscoring the operational risks associated with managing a large, dispersed workforce.

- Brand Dependence: Carrols' revenue is heavily tied to Burger King's brand health, making it susceptible to external reputational damage.

- Operational Inconsistency: Managing over 400 locations presents challenges in ensuring uniform service and quality, potentially alienating customers.

- Negative Publicity Impact: Food safety concerns or service failures at any Carrols-operated Burger King could trigger a broader decline in customer confidence.

Challenges of Post-Acquisition Integration and Refranchising

Integrating Carrols' extensive operations, which included approximately 425 restaurants as of early 2024, into Restaurant Brands International's (RBI) structure poses a significant hurdle. This complex process, coupled with the planned refranchising of a substantial number of these locations, could lead to operational disruptions if not managed smoothly.

The refranchising strategy, a key component of the acquisition's financial rationale, faces potential delays or lower-than-expected proceeds if suitable franchisees are not secured efficiently. This could impact Carrols' ability to realize the full value of the transaction and achieve its deleveraging targets.

- Operational Complexity: Merging diverse operational systems and supply chains across hundreds of locations requires meticulous planning and execution to avoid service interruptions.

- Refranchising Pace: The speed and success of finding and onboarding new franchisees for the divested restaurants directly influence the realization of projected cost savings and debt reduction.

- Cultural Integration: Bridging potential cultural differences between Carrols' existing workforce and RBI's established corporate culture is crucial for maintaining employee morale and operational continuity.

Carrols faces significant threats from rising labor and food costs, with expenses increasing by 31% and 29% respectively between 2019 and 2024, directly impacting profit margins. Intensifying competition within the quick-service restaurant sector forces difficult choices between absorbing these costs or raising prices, potentially alienating price-sensitive consumers. Furthermore, Carrols' heavy reliance on the Burger King brand makes it vulnerable to any negative publicity or operational issues affecting the parent company.

The company's extensive network of over 400 locations presents a constant challenge in maintaining consistent operational standards, as evidenced by past scrutiny of labor practices in 2023. Integrating these operations into Restaurant Brands International (RBI) and the planned refranchising of many locations add layers of complexity and potential disruption. Delays or lower-than-expected proceeds from refranchising could hinder Carrols' financial goals.

| Threat Category | Specific Threat | Impact on Carrols | Supporting Data (2024/2025) |

| Cost Pressures | Escalating Labor & Food Costs | Reduced operating margins, pressure to increase prices | Labor costs +31%, Food costs +29% (2019-2024) |

| Market Dynamics | Intense QSR Competition | Pressure on pricing, potential loss of market share | Aggressive promotional activity by major competitors |

| Brand Reliance | Burger King Brand Reputation | Susceptibility to negative publicity, customer deterrence | Limited control over core brand perception |

| Operational Execution | Maintaining Operational Consistency | Risk of customer dissatisfaction, lost sales | Managing over 400 locations, past labor practice concerns (2023) |

| Integration & Divestiture | RBI Integration & Refranchising | Potential operational disruptions, impact on financial targets | Complex integration, refranchising pace critical for debt reduction |

SWOT Analysis Data Sources

This Carrols SWOT analysis is built upon a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external environment.