Carrols PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carrols Bundle

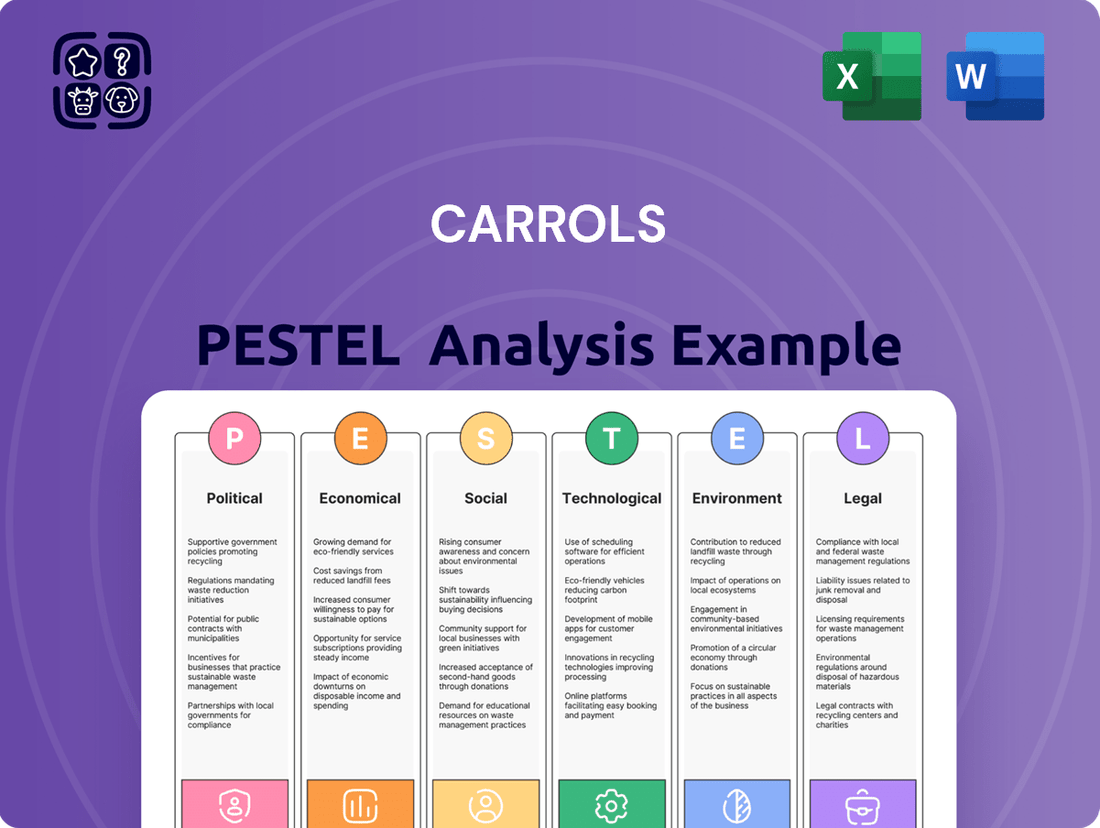

Unlock the strategic advantages Carrols holds by understanding its external environment. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors shaping Carrols's operations and future growth. Gain critical insights to inform your own business strategy and identify potential opportunities and threats. Download the full PESTLE analysis today for actionable intelligence.

Political factors

Government health initiatives, such as those promoting healthier eating or restricting certain ingredients, directly shape Carrols' menu development and marketing. For instance, the U.S. Department of Agriculture's (USDA) Dietary Guidelines for Americans, updated regularly, influence perceptions of healthy food and can lead to regulatory changes affecting the fast-food sector.

Consumer demand for healthier options is rising, partly due to public health campaigns and evolving regulations. In 2024, data from the International Food Information Council indicated that a significant percentage of consumers are actively seeking healthier food choices, a trend that directly impacts fast-food chains like Carrols, which operates numerous Burger King locations.

As a major Burger King franchisee, Carrols must strategically adapt its offerings to align with these health-conscious trends and potential governmental mandates. This includes exploring menu innovations that incorporate more fresh ingredients or offer lighter alternatives to meet consumer preferences and comply with future policy directions.

Changes in labor laws, especially minimum wage increases in states where Carrols operates, directly affect its operational expenses. For instance, by the end of 2024, several states are projected to have minimum wages at or above $15 per hour, a significant jump from previous years.

Continued wage growth in the restaurant sector forces operators like Carrols to carefully manage labor efficiency while preserving service quality. This trend means that labor costs, a substantial portion of operating expenses for quick-service restaurants, will likely remain a key focus area.

These legislative shifts compel Carrols to adapt its strategies, potentially by adjusting staffing models, revising menu prices, or investing in automation to maintain profitability amidst rising labor expenses.

Franchise regulations significantly shape Carrols' operational landscape and growth potential. These rules, often varying by state and country, govern everything from initial disclosure requirements to ongoing operational standards and termination clauses, directly impacting how Carrols manages its franchisee relationships and brand consistency.

The 2024 acquisition of Carrols Restaurant Group by Restaurant Brands International (RBI) underscores the critical role of political and regulatory approval in large-scale franchise consolidations. Such transactions are scrutinized for antitrust concerns and market concentration, potentially influencing the terms and conditions of future franchise deals and corporate structures.

Legal disputes concerning franchisee agreements or the fallout from major acquisitions can attract political attention and lead to tighter regulatory oversight. For instance, past litigation involving franchisee disputes could prompt legislative reviews of franchise laws, potentially introducing new compliance burdens or operational restrictions for companies like Carrols.

Trade Policies and Supply Chain Stability

Broader trade policies, such as tariffs or shifts in international relations, significantly influence the cost and availability of essential ingredients and supplies for Carrols Restaurant Group. As a major operator, Carrols' profitability is tied to a stable, cost-effective supply chain, making it vulnerable to disruptions.

Geopolitical tensions and evolving trade restrictions can directly translate into higher operational expenses for Carrols, potentially forcing adjustments in menu pricing to maintain margins. For instance, the U.S. imposed tariffs on certain imported goods in recent years, impacting various sectors and indirectly affecting food supply costs.

- Tariff Impact: Increased tariffs on imported agricultural products or packaging materials can raise Carrols' cost of goods sold.

- Supply Chain Vulnerability: Disruptions due to trade disputes can lead to ingredient shortages, affecting operational consistency and customer satisfaction.

- Menu Price Sensitivity: Rising supply costs may necessitate price increases, which could impact consumer demand in a competitive fast-casual market.

Food Safety and Hygiene Standards

Government regulations concerning food safety and hygiene are critically important for fast-food operators like Carrols. These rules are designed to protect public health and are subject to change, necessitating ongoing adaptation. For instance, in 2024, the FDA continued to emphasize enhanced traceability requirements for certain food products, impacting supply chain management for all restaurants.

Carrols' commitment to meeting these evolving standards is crucial for its brand image and operational integrity. Failure to comply can result in significant fines and damage to consumer confidence. In 2024, reports indicated that food safety violations led to an average of $10,000 in fines per incident across the industry, alongside potential temporary closures.

Maintaining compliance involves consistent investment in staff training, updated equipment, and robust quality assurance protocols. These efforts are ongoing, as demonstrated by the 2025 proposed updates to HACCP (Hazard Analysis and Critical Control Points) guidelines, which will require further refinement of internal processes.

- Regulatory Scrutiny: Food safety laws are rigorously enforced by agencies like the FDA and local health departments.

- Brand Reputation: Adherence to hygiene standards directly impacts consumer trust and brand perception.

- Operational Costs: Investments in training and equipment are necessary to meet and exceed compliance requirements.

- Financial Repercussions: Non-compliance can lead to substantial fines, legal action, and lost revenue.

Government health initiatives, such as those promoting healthier eating or restricting certain ingredients, directly shape Carrols' menu development and marketing. For instance, the U.S. Department of Agriculture's (USDA) Dietary Guidelines for Americans, updated regularly, influence perceptions of healthy food and can lead to regulatory changes affecting the fast-food sector.

Consumer demand for healthier options is rising, partly due to public health campaigns and evolving regulations. In 2024, data from the International Food Information Council indicated that a significant percentage of consumers are actively seeking healthier food choices, a trend that directly impacts fast-food chains like Carrols, which operates numerous Burger King locations.

As a major Burger King franchisee, Carrols must strategically adapt its offerings to align with these health-conscious trends and potential governmental mandates. This includes exploring menu innovations that incorporate more fresh ingredients or offer lighter alternatives to meet consumer preferences and comply with future policy directions.

What is included in the product

This Carrols PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic direction.

A clean, summarized version of Carrols' PESTLE analysis provides a quick reference for identifying and addressing external challenges, thereby alleviating pain points related to strategic uncertainty.

Economic factors

Inflationary pressures continue to significantly impact Carrols, particularly through increased costs for essential inputs like food, labor, and energy. For instance, the U.S. Consumer Price Index (CPI) for food away from home saw an increase of 4.4% year-over-year as of April 2024, directly affecting Carrols' cost of goods sold.

These rising operational expenses necessitate careful strategic pricing adjustments. Carrols must balance the need to maintain profitability by passing on some costs with the imperative to offer value to its price-sensitive customer base in the competitive fast-food landscape.

The fast-food sector, in general, is actively grappling with these economic headwinds. Effective cost management, therefore, remains a paramount strategic focus for Carrols to navigate the current economic climate and sustain its business performance through 2024 and into 2025.

Consumer spending on dining out, especially at fast-food chains like those operated by Carrols, is closely tied to the overall economic climate. When the economy is robust and people have more disposable income, they tend to spend more on conveniences like fast food. For instance, in early 2024, despite some inflationary pressures, consumer spending on services, including dining out, showed resilience, with the U.S. personal consumption expenditures on services increasing.

However, economic slowdowns or periods of reduced consumer confidence can significantly impact Carrols' sales. During such times, consumers often cut back on discretionary spending, leading to fewer visits to restaurants. Carrols needs to remain agile, potentially adjusting its menu pricing and promotions to appeal to a wider range of income levels and maintain customer traffic, especially as economic forecasts for late 2024 and into 2025 suggest continued consumer caution in some sectors.

Interest rate fluctuations directly impact Carrols' cost of capital. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% (as of mid-2024), borrowing for new store development or significant remodels becomes more expensive. This can slow down expansion plans or necessitate more conservative financing strategies.

The recent acquisition of Carrols by Restaurant Business International (RBI) for roughly $1 billion highlights the importance of substantial capital for modernization. This infusion of funds is intended to upgrade Carrols' store portfolio, which is critical for maintaining brand appeal and operational efficiency in a competitive market.

Securing favorable financing terms remains paramount for Carrols' continued growth and competitive positioning. The ability to access capital at reasonable rates allows for strategic investments in technology, store upgrades, and marketing initiatives, all of which are vital for staying ahead in the fast-casual dining sector.

Competitive Landscape and Market Share

The fast-food sector is intensely competitive, with major players like McDonald's, Burger King, and Wendy's constantly vying for consumer dollars. Carrols, as a significant franchisee, must differentiate itself through service, quality, and promotions to capture and maintain its market share. For instance, in 2023, the quick-service restaurant (QSR) segment in the US alone generated over $340 billion in sales, highlighting the sheer scale and competition within the industry.

National restaurant groups, with their substantial marketing budgets and established brand recognition, pose a significant challenge to smaller, independent operators. This dynamic forces Carrols to be agile, adapting its strategies to counter the advantages held by larger entities. The ability to leverage economies of scale and implement national marketing campaigns can quickly shift market dynamics.

- Intense Competition: The fast-food market is saturated with numerous brands, requiring continuous innovation.

- Market Share Battles: Carrols actively competes for consumer attention against established giants.

- National Group Advantage: Larger restaurant groups leverage economic power, increasing pressure on independent operators.

- 2023 QSR Sales: The US quick-service restaurant market exceeded $340 billion in sales in 2023, underscoring the competitive intensity.

Investment and Franchisee Profitability

Franchisee financial health directly impacts Carrols' ability to expand and upgrade its locations. A strong franchisee base willing to invest in modernizing stores and opening new ones is essential for sustained growth. This willingness hinges on their perceived profitability and the overall health of the brand they operate under.

Burger King's strategic initiative, 'Reclaim the Flame,' places significant emphasis on revitalizing the brand, which includes accelerating store remodels and enhancing franchisee profitability. Carrols' acquisition by Burger King is a key component of this plan, aiming to streamline operations and improve the financial outlook for its franchisees.

The success of the Burger King system, and by extension Carrols, is intrinsically linked to the profitability of its franchisees. Investments in store improvements, driven by franchisee confidence in future earnings, are critical for maintaining brand competitiveness and driving overall system-wide sales growth. For instance, in early 2024, Burger King reported that franchisees investing in remodels saw an average increase in sales of approximately 15-20% in the year following the remodel.

- Franchisee Investment Capacity: The financial capacity and willingness of franchisees to fund necessary store modernizations and new unit development are paramount for Carrols' expansion.

- 'Reclaim the Flame' Impact: Burger King's strategic plan is designed to boost franchisee profitability, thereby encouraging reinvestment in the brand through remodels.

- System-Wide Growth: The long-term success of the entire Burger King network, including Carrols' operations, depends on the financial viability and growth-oriented investments made by its franchisees.

- Remodel ROI: Data from early 2024 indicated that Burger King franchisees undertaking remodels experienced an average sales uplift of 15-20% post-renovation, underscoring the importance of such investments.

Economic factors significantly shape Carrols' operational landscape. Inflationary pressures, particularly on food, labor, and energy costs, directly impact profitability. For example, the U.S. CPI for food away from home rose 4.4% year-over-year in April 2024, forcing strategic pricing adjustments to balance costs and consumer value.

Consumer spending habits are sensitive to economic conditions. While dining out showed resilience in early 2024, potential economic slowdowns in late 2024 and into 2025 could reduce discretionary spending, impacting Carrols' sales volume. Interest rate fluctuations also affect the cost of capital, influencing investment in store modernization and expansion, with the federal funds rate target remaining at 5.25%-5.50% as of mid-2024.

The recent $1 billion acquisition by Restaurant Business International (RBI) signifies a capital infusion aimed at upgrading Carrols' store portfolio, crucial for competitiveness. This move underscores the importance of accessing capital at favorable rates for technology, store upgrades, and marketing to maintain market share in the highly competitive fast-food sector, which saw over $340 billion in U.S. QSR sales in 2023.

| Economic Factor | Impact on Carrols | Supporting Data (2024/2025 Focus) |

|---|---|---|

| Inflation | Increased operating costs (food, labor, energy) | U.S. CPI for food away from home: +4.4% (April 2024) |

| Consumer Spending | Sensitivity to economic conditions, disposable income | Potential consumer caution in late 2024/early 2025 |

| Interest Rates | Cost of capital for investment | Federal Funds Rate target: 5.25%-5.50% (mid-2024) |

| Capital Investment | Funding for modernization and expansion | RBI acquisition: approx. $1 billion |

| Market Competition | Need for differentiation and value | U.S. QSR sales: >$340 billion (2023) |

Preview Before You Purchase

Carrols PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Carrols PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed examination crucial for strategic planning and understanding the competitive landscape.

Sociological factors

Consumers are increasingly seeking healthier, more natural, and ethically sourced food, even in fast-food settings. This trend saw a significant uptick in 2024, with surveys indicating over 60% of consumers actively looking for healthier options when dining out.

Carrols needs to adapt by diversifying its menu to include more vegetarian, vegan, and plant-based choices. For instance, the plant-based meat market alone was projected to reach $16 billion globally by 2024, highlighting a substantial opportunity.

Staying relevant means continuous menu innovation and a commitment to transparent ingredient sourcing. Consumers are more informed than ever, with traceability of ingredients becoming a key purchasing factor, especially for younger demographics.

Modern life is increasingly hectic, with busy schedules becoming the norm for many, particularly millennials and the broader working population. This trend fuels a significant demand for meal solutions that are not only quick but also easily consumable while on the move.

Carrols, operating within the fast-food sector, is well-positioned to capitalize on this societal shift towards convenience. The company's business model is intrinsically aligned with providing readily accessible and fast meal options.

To effectively tap into this demand, Carrols must continue to refine its service delivery mechanisms. Innovations in drive-thru efficiency and the expansion of digital ordering platforms are crucial for meeting customer expectations for speed and ease.

Modern consumers increasingly expect to tailor their dining choices to individual tastes, dietary needs, and even allergies. This means Carrols needs to provide flexible menus and ordering platforms that accommodate such personalization. For instance, a 2024 survey indicated that over 65% of fast-casual diners actively seek customization options when ordering.

This desire for personalization isn't limited to just the food itself; it also encompasses the overall dining experience. Consumers are looking for interactive elements and a sense of individuality in their interactions with brands, which Carrols can address through enhanced digital ordering and customer service touchpoints.

Influence of Social Media and Digital Engagement

Social media platforms like TikTok and Instagram, alongside online review sites, significantly shape consumer perceptions and purchasing decisions within the fast-food sector. For Carrols, actively managing its digital footprint, fostering online customer interaction, and utilizing these channels for marketing are essential for brand growth. In 2024, it's estimated that over 4.9 billion people worldwide use social media, highlighting the immense reach of these platforms for influencing consumer behavior.

Maintaining a positive online reputation and offering prompt digital customer service are paramount for Carrols' brand image. Companies that actively respond to customer feedback, both positive and negative, often see improved customer loyalty. For instance, a study by ReviewTrackers in 2023 found that 94% of consumers reported that an online review has convinced them to avoid a business.

- Digital Engagement: Carrols needs to monitor and respond to mentions across platforms like X (formerly Twitter) and Facebook, addressing customer concerns and celebrating positive experiences.

- Online Reputation: Proactive management of platforms like Yelp and Google Reviews is critical, as negative feedback can quickly deter potential customers.

- Marketing Leverage: Utilizing targeted social media advertising and influencer collaborations can drive traffic and sales, especially among younger demographics who rely heavily on digital recommendations.

- Customer Service: Quick and effective resolution of issues raised through social media channels can turn potentially negative situations into opportunities to build trust.

Ethical Consumption and Sustainability Awareness

Consumers are increasingly prioritizing ethical consumption, with a significant portion of individuals factoring sustainability and social responsibility into their purchasing choices. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for products from brands that demonstrate strong environmental and social commitments. This trend directly influences fast-food chains like Carrols, which operates under the Burger King umbrella.

Carrols, as a franchisee, is expected to align with Burger King's broader sustainability initiatives. This includes commitments to responsible sourcing of ingredients, such as beef and produce, and adopting more eco-friendly packaging solutions to reduce waste. For example, Burger King has set goals to reduce greenhouse gas emissions across its supply chain by 2030.

By actively addressing these consumer concerns, Carrols can foster greater brand loyalty and attract a growing segment of socially conscious customers. Demonstrating tangible progress in areas like waste reduction and ethical sourcing can differentiate the brand in a competitive market. This focus on sustainability isn't just about compliance; it's a strategic imperative for long-term customer engagement and brand reputation.

Key areas of focus for Carrols and the broader Burger King system include:

- Responsible Sourcing: Ensuring ingredients are sourced from suppliers with ethical labor practices and sustainable farming methods.

- Waste Reduction: Implementing strategies to minimize food waste and reduce single-use plastics in packaging.

- Eco-friendly Packaging: Transitioning to recyclable, compostable, or reusable packaging materials.

- Supply Chain Transparency: Providing consumers with more information about the origin and environmental impact of their food.

Consumer preferences are shifting towards health-conscious and ethically produced food, influencing fast-food choices. In 2024, a significant majority of consumers actively sought healthier options when dining out, driving demand for plant-based and sustainable ingredients.

The fast-paced nature of modern life necessitates convenient meal solutions, a trend Carrols is well-positioned to meet through its efficient service and digital ordering capabilities. This aligns with the growing need for on-the-go consumption.

Personalization is a key expectation, with consumers desiring customizable orders to suit dietary needs and preferences. Over 65% of fast-casual diners in 2024 sought customization, highlighting its importance for customer satisfaction.

Social media significantly impacts consumer perception, making online reputation management crucial. With billions of users globally, platforms like TikTok and Instagram are vital for marketing and customer engagement, as evidenced by studies showing negative reviews deterring customers.

Ethical consumption is on the rise, with consumers increasingly factoring sustainability and social responsibility into their decisions. Over 60% of consumers in 2024 were willing to pay more for brands demonstrating strong environmental commitments, pushing companies like Carrols to adopt greener practices.

Technological factors

The widespread adoption of mobile ordering, with a significant portion of quick-service restaurant customers preferring digital channels, directly impacts Carrols' revenue streams. In 2024, mobile orders are projected to account for over 70% of all digital transactions in the fast-food sector, a trend Carrols must leverage through its app and partnerships with platforms like DoorDash and Uber Eats. This digital integration is not just about convenience; it's about capturing a larger market share and improving order accuracy, which was a key focus for Carrols' operational improvements in late 2023.

Technological advancements are significantly reshaping the restaurant industry, with automation playing a key role in boosting operational efficiency. Sophisticated point-of-sale (POS) systems, AI-driven demand forecasting, and upgraded kitchen equipment are becoming crucial for businesses like Carrols to manage costs and improve service. For instance, AI can predict customer traffic with higher accuracy, allowing for better staff scheduling and reduced waste.

Carrols can harness these technologies to streamline operations, from inventory management to order fulfillment. Optimizing staffing levels based on predictive analytics can lower labor expenses, a significant cost for fast-food operators. In 2024, the QSR sector continued to see investments in automation, with companies reporting improved throughput and reduced errors.

The ultimate goal of adopting these technological solutions is to enhance the customer experience through faster service and greater accuracy, which in turn drives increased customer satisfaction and revenue. A focus on efficiency through tech adoption is a critical strategy for maintaining competitiveness in the evolving restaurant landscape.

Carrols can significantly boost its operations by integrating Artificial Intelligence (AI) and machine learning. This technology can transform everything from how they market to customers to how they handle service requests, making interactions more efficient and personalized.

AI-powered tools can analyze vast amounts of customer data to understand individual preferences. This allows Carrols to tailor menu suggestions and promotions, leading to a more engaging customer experience. For instance, in 2024, restaurants leveraging AI for personalized marketing reported an average increase of 15% in customer engagement metrics.

By deeply understanding consumer tastes through data analytics, Carrols can craft highly targeted promotions. This strategic data utilization not only enhances customer satisfaction but also directly contributes to increased profitability and fosters stronger customer loyalty, a critical factor in the competitive fast-food landscape.

Modernization of Store Design and Experience

Burger King's ongoing 'Sizzle' concept and 'Refresh' initiative are transforming restaurant aesthetics and functionality. These upgrades are designed to integrate advanced technology and elevate the overall customer experience, featuring more self-order kiosks and streamlined drive-thru operations. Carrols' strategic adoption of these modernized store designs aims to boost customer traffic and loyalty.

The modernization efforts focus on creating a digital-first environment, which is crucial for attracting younger demographics. For instance, by 2024, it's estimated that over 70% of consumers prefer using kiosks for ordering. Carrols' investment in these upgrades positions them to capitalize on this trend.

- Enhanced Customer Convenience: Kiosks and improved drive-thrus offer faster, more efficient ordering.

- Modernized Ambiance: Updated store designs create a more appealing and contemporary dining space.

- Digital Integration: A digital-first approach caters to evolving consumer preferences for technology-enabled experiences.

Supply Chain Technology and Traceability

Technological advancements are crucial for Carrols' supply chain, enhancing efficiency from ingredient sourcing through to final delivery. This focus includes collaborating with suppliers on recipe enhancements and upgrading restaurant equipment to ensure consistent quality. For instance, in 2024, many quick-service restaurant chains are investing in AI-powered inventory management systems that can predict demand with greater accuracy, potentially reducing waste by up to 15%.

Advanced systems enable Carrols to better manage inventory, minimize stockouts, and react swiftly to disruptions. The integration of real-time tracking and data analytics allows for proactive problem-solving within the supply chain. By late 2024, the adoption of blockchain technology for food traceability is becoming more widespread, offering immutable records of product journeys, which can improve food safety and consumer trust.

- Enhanced Inventory Management: Implementing AI and IoT sensors to monitor stock levels in real-time, reducing manual errors and overstocking.

- Improved Traceability: Utilizing blockchain or similar technologies to track ingredients from farm to table, ensuring quality and safety compliance.

- Supplier Collaboration Tools: Digital platforms for seamless communication and data sharing with suppliers regarding recipe updates and quality standards.

- Restaurant Equipment Upgrades: Investing in modern, efficient kitchen technology that supports consistent food preparation and reduces operational downtime.

Technological advancements are fundamentally altering the quick-service restaurant landscape, driving efficiency and customer engagement. Carrols is leveraging these trends through digital ordering platforms, with mobile orders projected to exceed 70% of digital transactions in the fast-food sector by 2024, a significant increase from previous years.

Automation, including AI-powered demand forecasting and advanced POS systems, is crucial for cost management and service improvement. For instance, AI can optimize staffing and reduce waste by predicting customer traffic with greater accuracy. These technologies are key to enhancing operational throughput and minimizing errors, as seen in industry-wide investments in automation throughout 2024.

Modernized store designs, like Burger King's 'Sizzle' concept, integrate technology such as self-order kiosks and streamlined drive-thrus to enhance customer experience. By 2024, over 70% of consumers prefer kiosk ordering, making Carrols' investment in these upgrades a strategic move to attract younger demographics and boost customer loyalty.

Supply chain efficiency is also being transformed by technology, with AI-driven inventory management systems and real-time tracking. By late 2024, blockchain technology is gaining traction for food traceability, aiming to improve food safety and consumer trust. These advancements help minimize stockouts and react swiftly to disruptions.

Legal factors

Carrols' operations are heavily influenced by its franchise agreements with Burger King's parent company, Restaurant Brands International (RBI). Adherence to these agreements, which dictate everything from store development timelines to menu and operational standards, is paramount for maintaining brand consistency and avoiding penalties. For instance, failure to meet development commitments could lead to significant financial repercussions.

The legal landscape surrounding franchising can be complex, as evidenced by the unsealed lawsuit filed in 2024. This lawsuit, which challenges RBI's 2023 acquisition of Carrols, underscores the potential for legal challenges and disputes within the franchisor-franchisee dynamic. Such litigation can create uncertainty and impact financial performance, as seen in the ongoing legal proceedings.

Carrols operates under a complex web of labor and employment regulations. This includes adhering to federal and state minimum wage laws, which have seen increases in many areas. For instance, as of January 1, 2024, numerous states and cities implemented higher minimum wages. Overtime rules and comprehensive workplace safety standards, such as those enforced by OSHA, are also critical compliance areas.

Anticipated shifts in labor laws, such as potential federal minimum wage hikes or new regulations concerning worker classification, could significantly influence Carrols' staffing models and compensation structures. For example, a substantial increase in the federal minimum wage could directly impact labor costs across its franchise operations. Staying ahead of these legislative changes is vital to manage operational expenses and avoid costly legal repercussions.

Ensuring strict compliance with all labor mandates is not just about avoiding fines; it's fundamental to fostering a stable and productive workforce. In 2023, the U.S. Department of Labor recovered over $300 million in back wages for workers due to minimum wage and overtime violations, highlighting the financial risks of non-compliance. A commitment to fair labor practices contributes to employee morale and retention, which are key competitive advantages.

Carrols must strictly adhere to a complex web of food safety and public health regulations, governing every aspect of its operations from ingredient sourcing to final serving. These legal mandates are critical for maintaining consumer trust and operational continuity.

Failure to comply with these stringent rules, which are enforced by bodies like the FDA and local health departments, can result in substantial financial penalties. For instance, in 2024, restaurant chains faced fines averaging tens of thousands of dollars for violations related to improper food handling and sanitation.

Beyond fines, regulatory breaches can trigger temporary or permanent operational shutdowns, severely disrupting revenue streams. Furthermore, such incidents can irreparably damage Carrols' brand reputation, leading to long-term customer attrition and market share loss.

Consumer Protection and Advertising Laws

Carrols' marketing and advertising must strictly adhere to consumer protection regulations, ensuring all claims are truthful and transparent. This means accurate reporting of menu items, clear allergen information, and fair pricing to avoid misleading customers. For example, in 2024, the Federal Trade Commission (FTC) continued its focus on deceptive advertising, with fines levied against businesses for unsubstantiated claims, underscoring the importance of compliance for companies like Carrols.

Failure to comply with these laws, such as misrepresenting nutritional content or allergen information, can lead to significant penalties and damage Carrols' reputation. In 2025, expect ongoing enforcement actions targeting misleading promotions and pricing strategies within the fast-food industry. This legal landscape directly influences how Carrols can craft its promotional campaigns and maintain consumer trust.

- Advertising Transparency: Ensuring all marketing materials accurately reflect product offerings and pricing.

- Allergen Disclosure: Providing clear and accessible information about potential allergens in food products.

- Deceptive Practices: Avoiding any claims or promotions that could mislead consumers about quality, origin, or benefits.

- Regulatory Scrutiny: Anticipating continued enforcement of consumer protection laws by agencies like the FTC.

Environmental Regulations and Reporting

Environmental regulations are becoming more stringent, impacting Carrols' operations. These rules cover areas like waste management, emissions, and the adoption of sustainable practices, creating legal requirements for the company. For instance, in 2024, the EPA continued to emphasize stricter enforcement of air and water quality standards, with potential penalties for non-compliance.

Carrols must ensure proper waste disposal, which includes managing food waste and reducing single-use plastics in its restaurants. This might involve investments in composting programs or sourcing more eco-friendly packaging. By 2025, many jurisdictions are expected to have implemented or expanded bans on certain single-use plastic items, directly affecting restaurant supply chains.

Failure to adhere to these environmental laws can lead to significant financial penalties and damage Carrols' brand image. For example, in 2023, several large restaurant chains faced substantial fines for improper waste management practices.

Key legal considerations for Carrols include:

- Compliance with waste disposal regulations: Ensuring all food and operational waste is handled according to local and federal laws.

- Reduction of single-use plastics: Meeting mandates for phasing out or limiting the use of items like plastic straws, cutlery, and containers.

- Emissions reporting and reduction: Adhering to any requirements for monitoring and potentially lowering greenhouse gas emissions from operations.

- Sustainable sourcing mandates: Complying with laws that may encourage or require the use of sustainably sourced ingredients and materials.

Carrols' franchise agreements with RBI are legally binding, dictating operational standards and development timelines; non-compliance can lead to penalties. A 2024 lawsuit challenging RBI's acquisition of Carrols highlights the potential for legal disputes within the franchisor-franchisee relationship, creating uncertainty.

Labor laws, including minimum wage and workplace safety, are critical. Many states increased minimum wages in 2024, impacting labor costs. Anticipated federal minimum wage hikes in 2025 could further influence staffing and compensation strategies.

Food safety and public health regulations are paramount, with non-compliance leading to fines, operational shutdowns, and reputational damage; restaurant chains faced average fines of tens of thousands of dollars in 2024 for violations.

Marketing and advertising must adhere to consumer protection laws, ensuring transparency. The FTC's continued focus on deceptive advertising in 2024 means potential fines for unsubstantiated claims, affecting Carrols' promotional campaigns.

Environmental factors

Carrols faces increasing pressure to adopt sustainable sourcing and supply chain practices, a trend amplified by consumer demand for ethical and environmentally conscious food options. This means prioritizing local and responsible producers for ingredients.

Key shifts include working with suppliers to phase out practices like gestation crates for sows and moving towards cage-free eggs. For instance, by late 2024, many major fast-food chains aim to have at least 50% of their egg supply from cage-free sources, a benchmark Carrols is likely aligning with.

Environmental concerns are pushing Carrols, as a major restaurant operator, to prioritize packaging waste reduction. This means a shift towards less plastic and more recyclable or compostable materials. Consumers increasingly expect businesses to minimize their environmental footprint, making these changes crucial for brand perception and loyalty.

Restaurant Brands International (RBI), the parent company of Burger King which Carrols operates under, has set a target to reduce virgin plastic in guest-facing packaging by 10% by 2026. This initiative directly impacts Carrols' operations and demonstrates a commitment to addressing packaging waste on a larger scale, aligning with industry-wide sustainability efforts.

Carrols is actively working to shrink its environmental impact by boosting energy efficiency in its dining establishments and cutting down on greenhouse gas (GHG) emissions. This commitment involves testing emissions reduction strategies and adopting updated building codes to support these goals.

As part of its parent company, Restaurant Brands International (RBI), Carrols aligns with science-based targets aimed at lowering Scope 1, 2, and 3 GHG emissions. RBI's 2023 sustainability report highlighted a 2% reduction in Scope 1 and 2 emissions intensity compared to their 2019 baseline, demonstrating progress in this area.

Water Usage and Conservation Efforts

While specific water usage figures for Carrols Restaurant Group aren't publicly detailed, water conservation is a significant environmental factor for any large-scale restaurant operation. Implementing water-saving technologies in kitchens, such as low-flow faucets and efficient dishwashers, along with water-conscious cleaning protocols, are key sustainability practices. The restaurant industry, in general, is seeing increased pressure from consumers and regulators to adopt more environmentally friendly operations, including responsible water management.

For instance, the National Restaurant Association has highlighted water efficiency as a growing concern, with many operators exploring ways to reduce their water footprint. By investing in water-saving fixtures and training staff on conservation techniques, businesses like Carrols can mitigate operational costs and enhance their environmental stewardship. This focus is particularly relevant as water scarcity becomes a more prominent issue in various regions.

- Water-Saving Fixtures: Installation of low-flow aerators on faucets and toilets can reduce water consumption by up to 30%.

- Efficient Cleaning: Optimizing dishwashing cycles and using water-efficient cleaning methods can significantly lower usage.

- Staff Training: Educating employees on water conservation practices, such as turning off taps when not in use, is crucial.

- Industry Trend: Growing consumer demand for sustainable business practices is driving more restaurants to prioritize water conservation.

Climate Change Adaptation and Resilience

Climate change presents significant environmental challenges for Carrols. Extreme weather events, such as hurricanes and droughts, can disrupt agricultural supply chains for key ingredients, leading to increased costs and potential shortages. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a number that has been increasing over time.

Building resilience into Carrols' operations and supply chain is crucial. This involves diversifying suppliers, exploring alternative sourcing locations, and investing in more robust inventory management systems to buffer against disruptions. The company must also consider the long-term operational costs associated with climate change, including potential impacts on energy consumption for cooling or heating, and water availability.

Carrols' commitment to sustainability, such as supporting initiatives like EV charging stations, aligns with adapting to a changing environmental landscape. This not only addresses potential future regulations but also appeals to an increasingly environmentally conscious consumer base. Such investments can contribute to long-term cost savings and brand reputation.

- Supply Chain Vulnerability: Extreme weather events in 2023, like severe droughts impacting crop yields, can directly affect the cost and availability of produce and meats used in Carrols' restaurants.

- Operational Cost Increases: Rising global temperatures may necessitate higher energy expenditures for refrigeration and climate control within restaurant locations.

- Resilience Investment: Carrols needs to allocate capital towards supply chain diversification and operational adjustments to mitigate climate-related risks.

- Sustainable Infrastructure: Supporting EV charging stations is a step towards aligning with a future characterized by reduced carbon emissions and evolving consumer preferences.

Carrols is navigating increasing environmental expectations, focusing on sustainable sourcing and reducing its ecological footprint. This includes a push towards cage-free eggs and phasing out certain animal welfare practices by suppliers, a trend accelerated by consumer demand for ethical food choices.

Packaging waste reduction is another key environmental challenge, with a shift towards less plastic and more recyclable or compostable materials. Restaurant Brands International, Carrols' parent company, aims to cut virgin plastic in packaging by 10% by 2026, directly influencing Carrols' operational strategies.

Energy efficiency and greenhouse gas (GHG) emission reduction are priorities, with Carrols aligning with Restaurant Brands International's science-based targets for Scope 1, 2, and 3 emissions. RBI reported a 2% reduction in Scope 1 and 2 emissions intensity by 2023 compared to their 2019 baseline.

Water conservation is essential, with an industry-wide emphasis on reducing water usage through efficient fixtures and optimized cleaning protocols. Climate change also poses risks, impacting supply chains through extreme weather events, as evidenced by the 28 billion-dollar weather disasters in the U.S. in 2023, necessitating increased resilience investments.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Carrols is built on a robust foundation of data from reputable industry research firms, financial news outlets, and government regulatory bodies. We incorporate insights from economic reports, consumer spending trends, and fast-food industry-specific publications to ensure comprehensive coverage.